The global cutlery market is experiencing steady growth, driven by rising demand in the culinary, healthcare, and outdoor sectors. According to Grand View Research, the global cutlery market size was valued at USD 18.3 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A significant portion of this growth is attributed to the increasing preference for high-performance, corrosion-resistant materials such as stainless steel (inox), particularly in professional kitchens and industrial applications. With durability, hygiene, and edge retention being key purchasing factors, manufacturers specializing in inox knives are well-positioned to capitalize on this upward trend. As competition intensifies and quality standards rise, identifying the top-performing knife inox manufacturers becomes crucial for B2B buyers and industry stakeholders. Based on production capacity, innovation, global reach, and market reputation, the following seven manufacturers stand out in the current landscape.

Top 7 Knife Inox Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 DITAI INOX

Domain Est. 2024

Website: ditaiinoxfactory.com

Key Highlights: Ditai Inox (Xiamen Ditai Stainless Steel Cutlery Company) is a high-quality manufacturer of stainless steel kitchen knives, flatware (table fork, ……

#2 Forged steak knife

Domain Est. 1997

Website: inoxriv.it

Key Highlights: Monobloc stainless steel forged knife with steak cutting blade tempered and serrated. Adatto a lavastoviglie dishwasher No microonde microwave…

#3 Swiss Army Knives from Victorinox

Domain Est. 1998

Website: victorinox.com

Key Highlights: Our Swiss Army Knife™ & Tools range is divided into four categories: Everyday, Outdoor and Sports, Trades and Crafts, and Accessories. Each category has ……

#4 Made in Italy since 1972.

Domain Est. 2000

Website: inoxbonomi.com

Key Highlights: Inoxbonomi is a company which highly specializes in manufacturing stainless steel cutlery. In the post war period Bernardo Bonomi starts the activity of ……

#5 Germany Solingen

Domain Est. 2000

Website: germanysolingen.com

Key Highlights: High-quality knives, scissors, manicure and pedicure items ✓ Made in the blade city of Solingen ✓ FREE SHIPPING for orders over 70€ ✓ Purchase on account….

#6 Steel cutlery, pots and knives for the professional and …

Domain Est. 2002

Website: pintinox.com

Key Highlights: Stainless steel for the professional kitchen and for your table. Discover all the quality of Pinti Inox, the most loved Made in Italy in the world….

#7 Authentic INOX Knives

Domain Est. 2019

Website: hasuseizo.com

Key Highlights: Free delivery over $150 10-day returnsHasu-Seizo’s Authentic INOX Knives combine premium craftsmanship, lasting sharpness, and reliability for chefs seeking dependable performance….

Expert Sourcing Insights for Knife Inox

H2: 2026 Market Trends Analysis for Knife Inox

The global market for stainless steel (inox) knives is poised for significant evolution by 2026, driven by shifting consumer preferences, technological advancements, and sustainability imperatives. Here is a comprehensive analysis of key trends shaping the Knife Inox landscape for 2026:

1. Sustainability & Circular Economy Dominance:

* Material Sourcing: Intense focus on traceability and ethical sourcing of stainless steel. Brands will increasingly adopt recycled stainless steel (especially high-grade 300 series like 304/316) and promote closed-loop manufacturing. Certifications (e.g., Cradle to Cradle, B Corp) will become differentiators.

* Durability as Sustainability: The inherent longevity of high-quality inox knives will be a major marketing pillar. “Buy Once, Buy Well” messaging will resonate strongly, countering fast fashion trends. Repairability (e.g., replaceable blades, sharpening services) will gain prominence.

* Packaging & End-of-Life: Minimalist, plastic-free, and recyclable packaging will be standard. Take-back programs for worn-out knives to facilitate recycling will emerge as a competitive advantage.

2. Hyper-Personalization & Customization:

* Beyond Engraving: Consumers will demand deeper customization – choice of specific steel grade (e.g., Sandvik 14C28N, CPM-S35VN), handle materials (sustainable woods, recycled composites, unique polymers), blade geometry (grind, edge angle), and even weight balance.

* Digital Configurators: Advanced online tools allowing real-time visualization of custom knife builds will become essential for direct-to-consumer (DTC) brands.

* Niche Specialization: Growth in ultra-specialized knives (e.g., for specific cuisines, dietary needs like vegan prep, or professional tasks like filleting exotic fish) will accelerate.

3. Smart Integration & Connected Kitchen Tools:

* Embedded Technology: While not ubiquitous, premium segments will see knives with subtle tech integration: embedded RFID/NFC for origin/usage tracking, smart handles with grip sensors (for ergonomics training or safety), or integrated temperature probes (e.g., in chef’s knives for meat).

* App Ecosystems: Companion apps offering personalized sharpening guides, usage analytics, recipe pairing, and maintenance reminders will enhance customer loyalty for tech-enabled brands.

4. Premiumization & Material Innovation:

* Performance Steels: Wider adoption of advanced powdered metallurgy (PM) stainless steels (e.g., CPM series, ZDP-189) offering superior edge retention, toughness, and corrosion resistance, even in mid-tier markets.

* Exotic & Composite Handles: Increased use of premium, sustainable, or visually striking handle materials: stabilized burls, recycled ocean plastics, titanium, advanced composites (G10, Micarta with unique infills), and bio-resins.

* Artisan & Craft Revival: Strong demand for hand-forged, small-batch inox knives from master cutlers, emphasizing craftsmanship, unique patterns (e.g., damascus-inspired with modern steels), and heritage.

5. E-commerce & Direct-to-Consumer (DTC) Acceleration:

* Omnichannel Dominance: Seamless integration between online platforms (brand websites, marketplaces) and physical touchpoints (pop-ups, experiential stores) will be crucial. Virtual try-ons using AR will enhance online confidence.

* Content-Driven Marketing: Brands will invest heavily in educational content (sharpening tutorials, knife skills, material science) to build trust and authority, driving DTC sales.

* Subscription Models: Growth in knife care subscriptions (sharpening stones, maintenance tools, replacement blades for specific models) and curated “knife discovery” boxes.

6. Geopolitical & Supply Chain Resilience:

* Regionalization: To mitigate risks (trade tensions, logistics disruptions), manufacturers will increasingly regionalize production and sourcing (e.g., EU brands focusing on European steel suppliers, US brands on North American sources).

* Transparency: Consumers and B2B buyers will demand greater visibility into the entire supply chain, from ore to finished product, driven by ESG concerns.

7. Health, Hygiene & Material Purity:

* Antimicrobial Properties: Marketing will emphasize the inherent hygienic properties of stainless steel (non-porous, easy to clean). Some brands may explore surface treatments with proven antimicrobial efficacy (e.g., copper-infused coatings), though regulatory approval and consumer acceptance will be key hurdles.

* Food-Grade Certification: Clear labeling of food-grade stainless steel standards (e.g., 18/10, 18/8) and compliance with FDA/EFSA regulations will be non-negotiable.

Conclusion for Knife Inox in 2026:

Success in the 2026 market will hinge on authentic sustainability, embracing technological enablement without sacrificing core function, offering meaningful customization, and building deep consumer trust through transparency and education. Brands that innovate in materials (sustainable steels, advanced composites), leverage DTC channels effectively, and position their inox knives as durable, personalized, and responsibly made tools will capture significant market share. The focus will shift decisively from mere utility to value-driven, experience-led ownership of high-quality stainless steel cutlery.

Common Pitfalls When Sourcing Knife Inox (Quality, IP)

Sourcing stainless steel (Inox) knives, especially for commercial or high-volume applications, involves several potential pitfalls related to quality control, intellectual property (IP), and supplier reliability. Being aware of these challenges can help procurement teams and businesses avoid costly mistakes.

Poor Material Quality and Mislabeling

One of the most frequent issues is the use of substandard or misrepresented stainless steel. Some suppliers may advertise high-grade Inox (e.g., 304 or 420) but deliver lower-quality alloys with higher carbon content or insufficient chromium, leading to corrosion and reduced durability. This is especially common in low-cost manufacturing regions where oversight is limited.

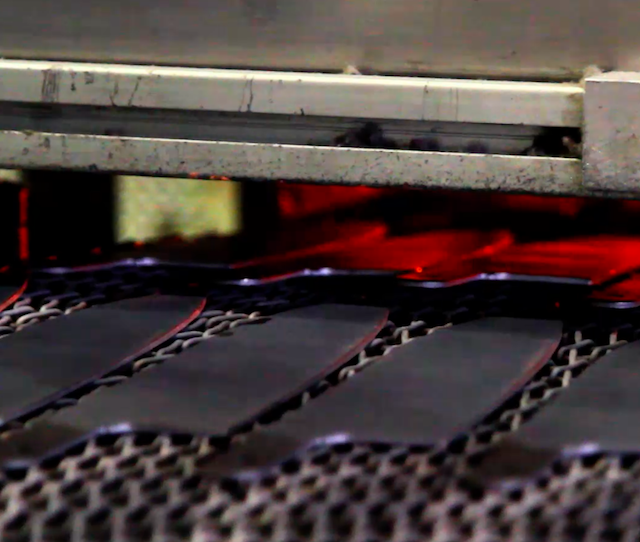

Inadequate Heat Treatment

Even with proper steel grade, poor heat treatment compromises knife performance. Knives may be too soft (leading to dulling) or too brittle (leading to chipping). Many suppliers outsource heat treatment, making it difficult to ensure consistency and traceability in the production process.

Lack of Quality Control and Certification

Many suppliers, particularly smaller or uncertified manufacturers, may lack proper quality assurance systems. This results in inconsistent edge retention, finish, balance, and overall craftsmanship. Absence of certifications such as ISO 9001, FDA compliance, or food-grade material validation increases the risk of receiving non-compliant products.

Intellectual Property (IP) Infringement

Sourcing knives that resemble patented or branded designs (e.g., Swiss Army knives, Wüsthof, Victorinox) can lead to IP violations. Some manufacturers produce look-alike products that mimic protected designs or logos, exposing importers to legal action, customs seizures, or reputational damage.

Inconsistent Manufacturing Standards

Variations in blade thickness, handle alignment, or sharpness between batches indicate weak process control. This inconsistency can affect user safety and product reliability, especially in professional environments like kitchens or industrial settings.

Hidden Costs and Minimum Order Quantities (MOQs)

Suppliers may offer attractive unit prices but impose high MOQs or hidden costs for tooling, packaging, or shipping. These can inflate the total cost of ownership and reduce flexibility, especially for small or growing businesses.

Language and Communication Barriers

Miscommunication due to language differences can result in incorrect specifications, delayed timelines, or misunderstood quality expectations. This is particularly risky when technical details like Rockwell hardness or blade geometry are involved.

Counterfeit or Gray Market Products

Some suppliers may offer “branded” Inox knives at suspiciously low prices, which are often counterfeit or diverted from authorized distribution channels. These products lack warranty support, authenticity, and may fail to meet safety standards.

Final Inspection and Testing Gaps

Failing to conduct third-party inspections or performance testing before shipment increases the risk of receiving defective goods. Without on-site or post-production checks, issues like dull edges, rough welds, or non-compliant materials may only be discovered upon arrival.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Request material test reports (MTRs) and verify steel grades.

– Conduct factory audits or use third-party inspection services.

– Ensure designs are original or properly licensed.

– Specify clear quality standards and include them in contracts.

– Work with reputable suppliers who have verifiable certifications and traceable production processes.

By proactively addressing these common issues, businesses can ensure they source high-quality, legally compliant Inox knives that meet performance and safety expectations.

Logistics & Compliance Guide for Knife Inox

This guide outlines the key logistics and compliance considerations for the import, export, storage, and distribution of Knife Inox products. Adherence to these guidelines ensures legal compliance, operational efficiency, and product integrity.

Product Classification & Regulatory Framework

Knife Inox products, typically stainless steel knives, may be subject to multiple regulatory regimes depending on their design, intended use, and destination. Key classifications include:

- HS Code (Harmonized System): Most knives fall under chapter 82 of the HS code, specifically 8211 (knives with cutting blades). Confirm the exact subcategory (e.g., 8211.10 for table knives, 8211.92 for other knives with stainless steel blades) based on product specifications.

- Customs Duties & Tariffs: Duty rates vary significantly by country. For example, the U.S. may apply MFN rates under HTS 8211.92.00, while the EU applies specific rates under CN code 8211 92 00. Verify using up-to-date tariff databases.

- Export Controls: Certain knife types (e.g., combat, tactical, or gravity knives) may be restricted or require export licenses under national arms embargoes or dual-use regulations. Check with national export control authorities (e.g., BIS in the U.S., SPIRE in the UK).

Import & Export Compliance

Ensure full compliance with both origin and destination country regulations:

- Documentation Requirements:

- Commercial Invoice

- Packing List

- Bill of Lading or Air Waybill

- Certificate of Origin (required for preferential tariff treatment under trade agreements)

- Export Declaration (when required by exporting country)

-

Import License (if applicable—e.g., certain countries regulate blade length or type)

-

Restricted Destinations: Some countries (e.g., Australia, Canada, UAE) impose strict rules on knife imports. Prohibited items may include switchblades, daggers, or knives exceeding a specific blade length (often 7–10 cm). Research destination-specific laws prior to shipment.

-

Prohibited Items: Clearly identify and exclude any knife models that may be classified as weapons or prohibited instruments under local laws.

Transportation & Handling

Safe and compliant transportation is critical for product integrity and regulatory adherence:

- Packaging Standards:

- Use secure, tamper-evident packaging to prevent blade exposure.

- Clearly label packages as containing sharp objects.

-

Avoid public display of knives in transit; use neutral outer packaging.

-

Carrier Restrictions:

- Airlines and couriers (e.g., FedEx, UPS, DHL) have specific rules for shipping knives.

- Knives are generally allowed in checked baggage but prohibited in carry-on under IATA guidelines.

- Ground shipments may require declaration of sharp objects.

-

Verify carrier policies and ensure proper labeling.

-

Storage & Warehousing:

- Store in locked, secure areas with controlled access.

- Segregate from food-grade or high-risk compliance items if applicable.

- Maintain dry, temperature-stable conditions to prevent corrosion.

Labeling & Product Safety

Compliance with consumer safety and labeling laws is mandatory:

- Mandatory Markings:

- Manufacturer name and address

- Country of origin

- Material composition (e.g., “Blade: Stainless Steel 420”)

- Blade length (in cm or inches)

-

Safety warnings (e.g., “Sharp Blade—Handle with Care”)

-

Safety Standards:

- Comply with regional safety standards such as:

- EU: General Product Safety Directive (GPSD), REACH (chemical compliance)

- U.S.: CPSA (Consumer Product Safety Act), OSHA handling guidelines

- Canada: Canada Consumer Product Safety Act (CCPSA)

- Ensure blades meet mechanical and material durability requirements.

Legal & Ethical Considerations

- Age Restrictions: Some jurisdictions prohibit sale of knives to minors. Implement age verification in e-commerce and retail settings.

- Anti-Terrorism & Crime Prevention: Avoid distribution channels associated with illegal activities. Maintain records of business customers in high-risk sectors.

- Corporate Compliance Programs: Establish internal audits, employee training, and documentation systems to ensure adherence to all applicable regulations.

Record Keeping & Traceability

Maintain comprehensive records for a minimum of 5–7 years (or as required by jurisdiction):

- Shipping and customs documentation

- Supplier certifications (e.g., material origin, manufacturing compliance)

- Product testing reports (if applicable)

- Import/export licenses and declarations

- Customer transaction logs (for B2B traceability)

Conclusion

Compliance in the logistics of Knife Inox products demands attention to international trade regulations, transportation safety, and consumer protection laws. Regular monitoring of regulatory updates and proactive risk assessment are essential to ensure smooth global operations and avoid legal penalties. Always consult with legal and customs experts when entering new markets.

Conclusion for Sourcing Stainless Steel Knives:

Sourcing stainless steel knives requires a careful balance between quality, cost, supplier reliability, and compliance with industry standards. Stainless steel knives are widely preferred for their durability, corrosion resistance, and ease of maintenance, making them ideal for culinary, industrial, and household applications. When sourcing, it is essential to evaluate material composition (e.g., high-grade austenitic steels like 304 or 420), manufacturing processes, and certifications to ensure performance and longevity.

Key considerations include identifying reputable suppliers—whether domestic or international—assessing minimum order quantities, lead times, and ensuring adherence to food safety or industry-specific regulations (e.g., FDA, LFGB, or CE). Building strong supplier relationships, conducting factory audits, and performing product sampling can significantly mitigate risks related to quality inconsistency or supply chain disruptions.

In conclusion, a strategic sourcing approach that emphasizes quality assurance, cost-efficiency, and long-term supplier partnerships will ensure a reliable supply of high-performing stainless steel knives that meet both business and customer expectations. Continuous market evaluation and staying informed on material and manufacturing advancements will further enhance sourcing effectiveness.