The global smoking accessories market, which includes premium products like king pipes, has experienced steady growth driven by increasing consumer interest in alternative smoking methods and artisanal craftsmanship. According to Grand View Research, the global cannabis accessories market was valued at USD 5.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 15.6% from 2023 to 2030, fueled by legalization trends and rising demand for high-quality, durable smoking devices. As consumer preferences shift toward premium, handcrafted pieces, king pipes—known for their large size, intricate design, and smooth smoking experience—have emerged as a sought-after segment within this expanding market. This growing demand has elevated a select group of manufacturers known for innovation, material quality, and brand reputation. Based on market presence, product differentiation, and customer reach, the following six manufacturers stand out as industry leaders in the production of king pipes.

Top 6 King Pipes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Plastic Pipe

Domain Est. 1996

Website: lane-enterprises.com

Key Highlights: Plastic Pipe. Lane has a full line of High Density Polyethylene (HDPE) Pipe and Polypropylene Pipe in various diameters to meet the needs of your project….

#2 Manufacturer from Paddhari, India

Domain Est. 2015

Website: kingpipeandfittings.com

Key Highlights: King Polyplast Private Limited, Paddhari, Gujarat – We are Manufacturer of 15mm SDR 13.5 CPVC Water Pipe, 4 Inch PVC Round Pipe, 50mm SCH 40 UPVC Water Pipe ……

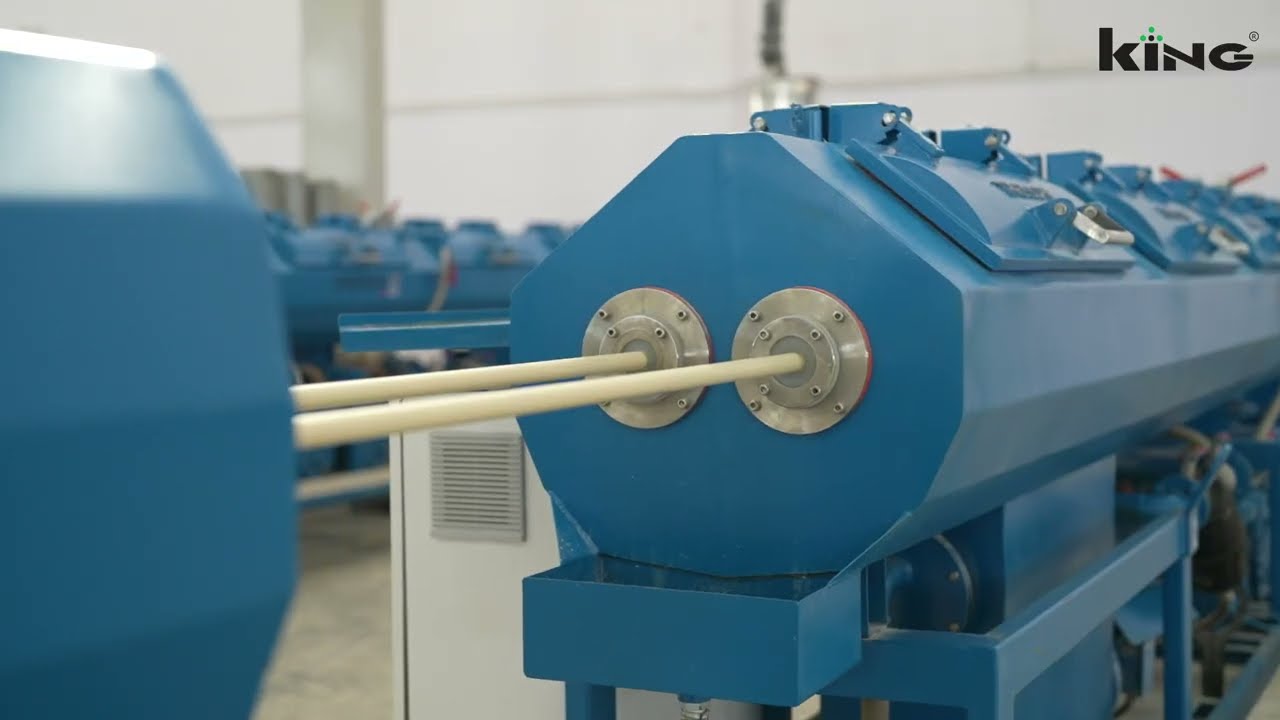

#3 King Pipes

Domain Est. 2021

Website: kingpipe.in

Key Highlights: An ISO 9001:2015 Certified Company Export of high quality CPVC, UPVC, SWR, Agriculture Pipes and fittings as well as Column Pipe, Braided pipe, Garden Pipe….

#4 Fast Fittings 1 in. x Swing Pipe Barb End of Line (25

Domain Est. 2002

Website: kinginnovation.com

Key Highlights: The Blazing Fast Fittings 1 in. x Swing Pipe Barb End of Line is the easiest way to connect Polyethylene pipe for irrigation systems….

#5 KING’s Pipe Shop

Domain Est. 2014

Website: kings-pipe.com

Key Highlights: We sell a wide variety of quality smoking gear from top US brands, including vaporizers, dab rigs, vape pens, dab pens, 510 batteries, glass pipes, and bongs….

#6 Kings Pipes

Domain Est. 2017

Website: kingspipes.com

Key Highlights: Explore Kings Pipes, the premier USA online head shop. Find high-quality glass bongs, smoking pipes, dab rigs, and vaporizers at the lowest prices….

Expert Sourcing Insights for King Pipes

H2: 2026 Market Trends for King Pipes

While specific forward-looking data for a private company like King Pipes is limited, we can project key 2026 market trends based on broader industry dynamics, technological advancements, regulatory shifts, and macroeconomic factors. King Pipes, as a manufacturer of steel pipes (likely serving oil & gas, construction, water infrastructure, and industrial sectors), will be significantly influenced by the following H2 2026 trends:

1. Accelerated Shift Towards Green Infrastructure & Sustainability:

* Renewable Energy & Hydrogen Pipelines: Demand for specialized pipes for hydrogen transportation (requiring higher-grade steels resistant to embrittlement) and geothermal energy projects will rise significantly. King Pipes may need to invest in R&D or new production lines to meet these specifications.

* Water Infrastructure Renewal: Aging water systems globally will drive substantial investment in pipe replacement and expansion, favoring durable, corrosion-resistant solutions like high-quality steel pipes. King Pipes is well-positioned to benefit, especially if emphasizing longevity and leak prevention.

* ESG Pressures: Investors and customers will demand lower carbon footprints. King Pipes will face pressure to decarbonize manufacturing (e.g., using DRI/EAF steel, renewable energy) and provide transparent carbon accounting for its products. “Green steel” pipes could become a premium offering.

2. Geopolitical & Supply Chain Resilience:

* “Nearshoring” & “Friend-shoring”: Ongoing geopolitical tensions and lessons from recent disruptions will push customers (especially in North America and Europe) towards suppliers with regional manufacturing. King Pipes’ geographic footprint will be crucial. Expanding regional production or forming strategic local partnerships could be key.

* Raw Material Volatility: Fluctuations in scrap steel, iron ore, and energy prices will persist. King Pipes will need robust hedging strategies and potentially vertical integration (e.g., securing scrap sources) to manage costs and ensure supply stability.

* Trade Policy Impact: Tariffs, quotas (like US Section 232), and local content requirements will remain significant factors. King Pipes must navigate complex trade landscapes, potentially adjusting sourcing or production locations.

3. Technological Advancements & Digitalization:

* Smart Pipes & IoT Integration: Increased demand for pipes with embedded sensors for real-time monitoring (pressure, temperature, corrosion, location) in critical infrastructure (water, oil/gas). King Pipes could offer value-added “smart pipe” solutions.

* Advanced Manufacturing (Industry 4.0): Adoption of AI for predictive maintenance in mills, automated quality control (vision systems), and digital twins for process optimization will improve efficiency, yield, and product consistency, becoming a competitive necessity.

* Digital Sales & Customer Platforms: B2B customers will expect seamless digital ordering, real-time logistics tracking, and access to technical specifications/COAs online. King Pipes needs a robust digital customer experience.

4. Sector-Specific Demand Shifts:

* Oil & Gas (O&G): While long-term energy transition pressures continue, near-term demand for pipes (especially OCTG – Oil Country Tubular Goods) may remain resilient due to disciplined spending and energy security concerns. Focus will be on high-spec, deepwater, and sour service applications. King Pipes serving this segment needs to maintain premium quality.

* Construction & Industrial: Growth in non-residential construction and industrial projects (e.g., data centers, manufacturing) will drive demand for structural and mechanical tubing. Sustainability requirements within these projects will influence material choices.

* Emerging Markets Infrastructure: Significant growth potential exists in developing regions (Asia, Africa, Latin America) investing in power, water, and transportation. King Pipes may explore export opportunities or JVs, facing competition from local producers.

5. Intensifying Competition & Consolidation:

* Pressure on Margins: Competition from both large integrated mills and lower-cost producers will keep price pressure high. Differentiation through quality, reliability, service, and sustainability credentials will be critical.

* Industry Consolidation: The steel pipe sector may see further mergers and acquisitions as companies seek scale, geographic reach, and technological capabilities to survive. King Pipes could be a potential target or acquirer.

Conclusion for King Pipes (H2 2026 Outlook):

The 2026 environment for King Pipes will be defined by the twin imperatives of sustainability and resilience. Success will hinge on:

- Embracing Green Transformation: Investing in low-carbon production, developing products for hydrogen/water infrastructure, and meeting stringent ESG standards.

- Optimizing for Resilience: Securing stable raw material supplies, potentially regionalizing production, and building flexible supply chains.

- Leveraging Technology: Implementing digitalization for efficiency, quality, and offering smart solutions.

- Strategic Differentiation: Moving beyond commodity pricing by focusing on high-spec applications, reliability, service, and sustainability.

Failure to adapt to these H2 2026 trends, particularly the energy transition and digitalization, risks commoditization and margin erosion. Proactive adaptation positions King Pipes to capture growth in emerging green infrastructure markets while maintaining strength in traditional sectors.

Common Pitfalls Sourcing King Pipes (Quality, IP)

Sourcing King Pipes—particularly in industries like oil and gas, plumbing, or industrial manufacturing—can present several critical challenges, especially concerning product quality and intellectual property (IP) rights. Failing to address these pitfalls can lead to safety risks, regulatory non-compliance, financial loss, and legal liabilities. Below are key issues to watch for:

Poor Quality Control and Substandard Materials

Many suppliers, especially those in less-regulated markets, may offer King Pipes made from inferior materials or with inconsistent manufacturing processes. This can result in pipes that fail under pressure, corrode prematurely, or do not meet industry standards (e.g., ASTM, API, ISO). Without proper certifications or third-party testing, buyers risk system failures, leaks, or environmental hazards.

Misrepresentation of Specifications and Compliance

Suppliers may falsely claim that King Pipes meet certain pressure ratings, temperature tolerances, or corrosion resistance standards. This misrepresentation can lead to the use of incompatible components in critical applications. Always verify compliance through documentation, mill test reports, and independent quality inspections.

Counterfeit or Imitation Products

King Pipes, especially branded or patented designs, are frequently counterfeited. These imitation products may look identical but lack the engineering and materials integrity of genuine items. Counterfeits can compromise system performance and void warranties or insurance coverage.

Intellectual Property Infringement

Sourcing King Pipes from unauthorized manufacturers or suppliers may involve IP violations, including unauthorized use of patented designs, trademarks, or proprietary technology. Purchasing such products—even unknowingly—can expose your company to legal action, seizure of goods, or reputational damage, particularly in regulated markets.

Lack of Traceability and Documentation

Reliable sourcing requires full traceability, including material origin, manufacturing batch, and quality assurance records. Suppliers that cannot provide comprehensive documentation may be hiding gaps in their supply chain or non-compliant practices, increasing liability and complicating recalls or audits.

Inadequate Supplier Vetting

Relying solely on price or convenience without conducting due diligence on suppliers increases the risk of encountering the above issues. Proper vetting should include site audits, evaluation of certifications, and verification of business legitimacy.

Avoiding these pitfalls requires a proactive sourcing strategy that prioritizes verified suppliers, rigorous quality assurance, and legal compliance to ensure both operational safety and IP integrity.

Logistics & Compliance Guide for King Pipes

This guide outlines the essential logistics and compliance procedures for King Pipes to ensure efficient operations, regulatory adherence, and customer satisfaction. All departments, including shipping, warehousing, procurement, and sales, must follow these standards.

Shipping & Transportation

All shipments must comply with domestic and international transportation regulations, including those set by the Department of Transportation (DOT) and International Air Transport Association (IATA) where applicable. Use only approved carriers with proven track records in handling industrial pipe materials. Package all products securely to prevent damage during transit, using moisture-resistant wrapping and reinforced pallets. Clearly label shipments with product specifications, batch numbers, and handling instructions.

Warehousing & Inventory Management

Maintain a clean, organized, and climate-controlled warehouse environment to prevent corrosion and material degradation. Implement a barcode or RFID inventory system to track stock levels, batch numbers, and expiration dates (if applicable). Conduct monthly cycle counts and annual physical inventories. Store hazardous materials (e.g., coatings, adhesives) separately in designated, ventilated areas with proper signage and spill containment.

Regulatory Compliance

King Pipes must adhere to all relevant industry standards, including ASTM, ASME, and API specifications for pipe manufacturing and testing. Certifications for each production batch must be retained for a minimum of seven years. Ensure compliance with OSHA workplace safety standards, including proper employee training and use of personal protective equipment (PPE). Monitor changes in environmental regulations (e.g., EPA) related to emissions and waste disposal.

Import/Export Documentation

For international shipments, prepare accurate and complete documentation, including commercial invoices, packing lists, certificates of origin, and bill of lading. Verify export control classifications (e.g., ECCN) and obtain necessary licenses for restricted destinations. Maintain records of all import/export transactions in accordance with U.S. Customs and Border Protection (CBP) and foreign regulatory body requirements.

Quality Assurance & Traceability

Implement a documented quality control process at every stage of production and distribution. Conduct routine inspections and pressure testing as required. Ensure full traceability of raw materials to finished products using batch and heat numbers. Report and investigate non-conforming products promptly, initiating corrective and preventive actions (CAPA) when necessary.

Sustainability & Environmental Responsibility

Adopt eco-friendly logistics practices, such as optimizing delivery routes to reduce fuel consumption and partnering with recyclers for scrap metal and packaging materials. Comply with all local and federal environmental laws regarding waste management, emissions, and resource usage. Report sustainability metrics annually as part of corporate compliance reporting.

Training & Audits

Provide regular compliance and safety training for all employees involved in logistics and operations. Conduct internal audits quarterly and prepare for external audits by regulatory bodies or certification agencies. Update policies and procedures based on audit findings and evolving regulations.

By following this guide, King Pipes ensures reliable delivery, regulatory adherence, and continued trust from customers and partners.

Conclusion for Sourcing King Pipes:

After a comprehensive evaluation of suppliers, product quality, pricing, lead times, and overall reliability, sourcing King Pipes presents a viable and strategic option for securing high-quality piping solutions. King Pipes demonstrates strong manufacturing capabilities, adherence to international standards (such as ASTM, API, and ISO), and a proven track record in delivering durable and consistent products across various industries, including oil and gas, construction, and infrastructure.

Their competitive pricing, scalability, and responsive customer service further enhance their value proposition. However, considerations such as logistics, delivery timelines, and potential import regulations should be factored into the final decision, especially for international procurement.

In conclusion, King Pipes stands out as a reliable and cost-effective supplier. With proper due diligence and long-term partnership planning, sourcing from King Pipes can contribute to improved project efficiency, reduced material costs, and enhanced supply chain resilience. It is recommended to move forward with a pilot order to validate performance before scaling up procurement.