The global shaft manufacturing market is experiencing steady expansion, driven by rising demand across automotive, industrial machinery, and renewable energy sectors. According to Grand View Research, the global mechanical power transmission equipment market—of which shafts are a critical component—was valued at USD 39.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. Similarly, Mordor Intelligence forecasts increased activity in the shaft market, citing advancements in electric vehicles and wind turbine technology as key growth accelerators. With industries prioritizing precision engineering and durability, the role of leading shaft manufacturers has become more pivotal than ever. Below are eight key players shaping the market through innovation, scale, and technological expertise.

Top 8 Key Shaft Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 1995

Website: parker.com

Key Highlights: Parker is the global leader in motion and control technologies, providing precision-engineered solutions for a wide variety of mobile, industrial and aerospace ……

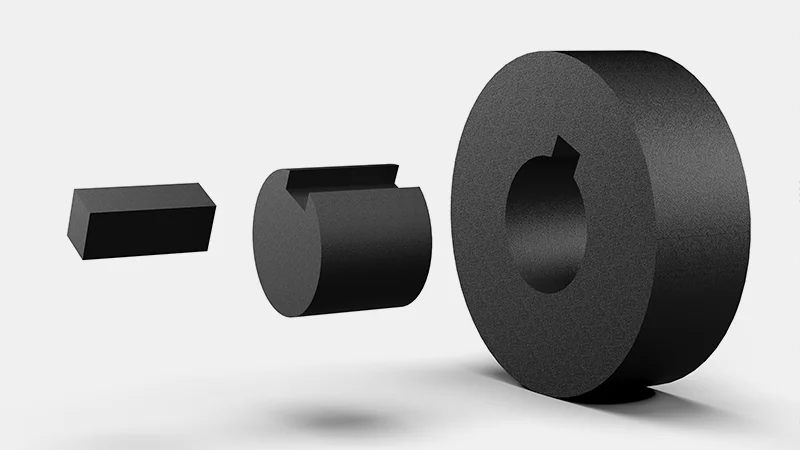

#2 Keyshaft™ Pre-Keyed Shafting

Domain Est. 1999

Website: keyshaft.com

Key Highlights: Welcome to Keyshaft.com. Excalibur Pre-Keyed Shafting, Inc., is the leader in continuous keyed shafting. We manufacture keyshaft to ANSI B17.1-1967, R1973 ……

#3 McMaster

Domain Est. 1994

Website: mcmaster.com

Key Highlights: McMaster-Carr is the complete source for your plant with over 700000 products. 98% of products ordered ship from stock and deliver same or next day….

#4 John Crane

Domain Est. 1996

Website: johncrane.com

Key Highlights: For more than 100 years, John Crane mechanical seals have helped energy and process industries work more effectively, safely, and reliably….

#5 TRW

Domain Est. 1996

Website: aftermarket.zf.com

Key Highlights: TRW solutions save you time and money, inspire customers and function perfectly for longer. TRW is part of ZF company with an amazing heritage that’s shaping ……

#6 Schaff Piano

Domain Est. 1998

Website: schaffpiano.com

Key Highlights: We take pride in being the largest stocked piano supply house in the world. We are the only ALL-SERVICE company remaining in the piano industry today!…

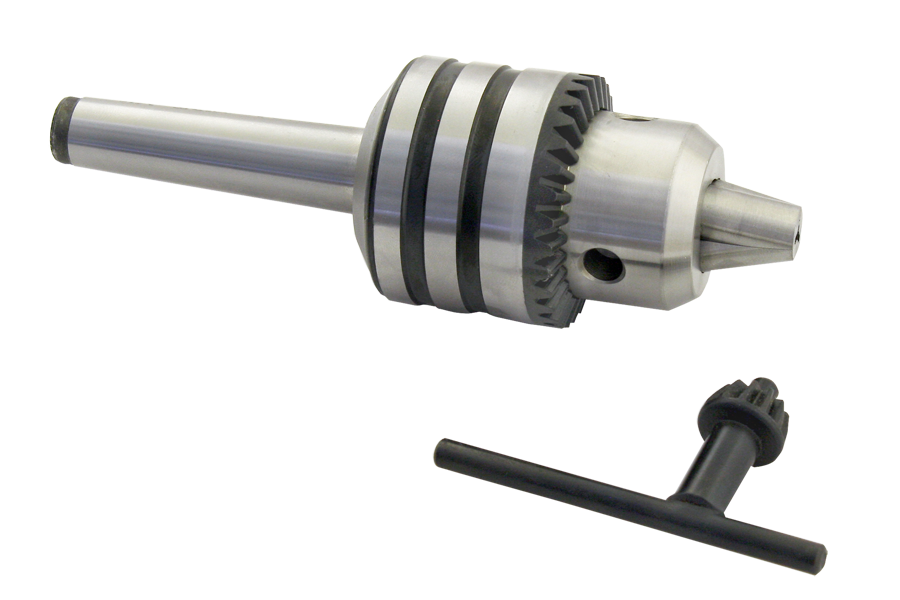

#7 Buy Keyed Shafts

Domain Est. 2004

Website: reidsupply.com

Key Highlights: Free delivery over $100 30-day returnsShop Keyed Shafts at Reid Supply 70+ years of expertise. Download 3D CAD models. Buy online with next day delivery….

#8 Keyed Shaft

Domain Est. 2018

Website: empowermfg.com

Key Highlights: Empower Manufacturing stands at the forefront of the industry, offering the straightest and most meticulously crafted custom pre-keyed shafts made to your ……

Expert Sourcing Insights for Key Shaft

H2: Market Trends for Key Shaft in 2026

As we approach 2026, the global market for key shafts—mechanical components used to transmit torque between shafts and hubs in machinery—is undergoing significant transformation driven by evolving industrial demands, technological innovation, and shifts in manufacturing practices. Key shafts, traditionally used in automotive, aerospace, industrial equipment, and power transmission systems, are being re-evaluated in the context of advanced materials, smart manufacturing, and sustainability imperatives.

-

Increased Demand from Electrification and EV Manufacturing

The rapid expansion of the electric vehicle (EV) market is one of the most influential trends shaping the key shaft industry. While EVs use fewer traditional transmission components than internal combustion engine (ICE) vehicles, key shafts remain relevant in auxiliary systems such as cooling pumps, compressors, and power take-off units. As EV production scales through 2026, demand for precision-engineered, lightweight key shafts with high fatigue resistance is expected to grow, particularly in hybrid drivetrain applications. -

Adoption of Advanced Materials and Coatings

To meet performance demands under higher loads and temperatures, manufacturers are increasingly turning to advanced materials such as high-strength alloy steels, stainless steels, and composite materials. Additionally, surface treatments like nitriding, carburizing, and PVD (Physical Vapor Deposition) coatings enhance wear resistance and corrosion protection. By 2026, these material innovations are projected to become standard in high-performance sectors like aerospace and renewable energy equipment. -

Integration with Smart Manufacturing and Industry 4.0

The rise of Industry 4.0 is enabling predictive maintenance and condition monitoring in rotating machinery. Key shafts are being designed with embedded sensors or compatibility with monitoring systems to detect misalignment, wear, or torque overloads. This trend supports reliability-centered maintenance strategies in industries such as wind energy and heavy manufacturing, where unplanned downtime is costly. -

Growth in Renewable Energy Applications

The wind and hydropower sectors are significant contributors to demand for robust key shafts used in gearboxes and generator couplings. With global investments in renewable infrastructure accelerating, especially in Asia-Pacific and Europe, the need for durable, high-precision shafts capable of withstanding variable loads and harsh environments is rising. By 2026, this sector is expected to account for a growing share of key shaft applications. -

Regional Manufacturing Shifts and Supply Chain Localization

Geopolitical factors and supply chain resilience concerns are pushing companies to localize production. In 2026, we are seeing increased key shaft manufacturing in emerging markets such as India, Mexico, and Southeast Asia, supported by government incentives and proximity to end-user industries. This trend is reducing lead times and logistics costs while increasing responsiveness to regional demand fluctuations. -

Focus on Sustainability and Circular Economy

Environmental regulations and corporate sustainability goals are influencing material selection and production processes. By 2026, key shaft manufacturers are adopting cleaner production methods, using recycled steels, and designing for remanufacturability. End-of-life recovery and reconditioning of key shafts are gaining traction, especially in the mining and construction equipment sectors. -

Standardization and Customization Balance

While international standards (e.g., ISO, DIN) ensure compatibility and safety, there is a growing need for customized key shaft designs tailored to specific applications—especially in robotics, medical devices, and high-precision automation. The market is moving toward modular designs that combine standardization with configurable features, enabling faster prototyping and reduced costs.

Conclusion

By 2026, the key shaft market is poised for steady growth, underpinned by technological innovation and expanding applications in high-growth industries. Success will depend on manufacturers’ ability to adapt to electrification trends, embrace smart technologies, and deliver sustainable, high-performance solutions. Companies investing in R&D, digital integration, and supply chain agility are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls Sourcing Key Shafts (Quality, IP)

Sourcing key shafts—critical mechanical components used to transmit torque between shafts and hubs—can present several challenges, particularly concerning quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to performance failures, legal disputes, and supply chain disruptions.

Poor Material Quality and Inadequate Specifications

One of the most frequent pitfalls is receiving key shafts made from substandard materials or failing to meet exact dimensional and tolerance requirements. Suppliers may use inferior alloys or skip essential heat treatment processes to cut costs, compromising strength, wear resistance, and fatigue life. Without clearly defined material specifications (e.g., AISI 1045 steel, hardness HRC 35–40) and inspection criteria in procurement contracts, buyers risk integrating underperforming components into their assemblies.

Inconsistent Manufacturing Precision

Key shafts require tight tolerances to ensure proper fit and function within keyways. Sourcing from manufacturers with inconsistent machining capabilities—especially in countries with variable quality control standards—can result in dimensional deviations, surface finish issues, or geometric inaccuracies. These inconsistencies may lead to misalignment, excessive play, or premature failure in rotating equipment. Lack of proper metrology reports or third-party certifications exacerbates the risk.

Lack of Traceability and Certification

Many suppliers, particularly in less-regulated markets, fail to provide full material traceability, heat treatment records, or test certifications. This absence makes it difficult to verify compliance with industry standards (e.g., ISO, DIN, or ANSI) and impairs root cause analysis in the event of field failures. Without proper documentation, organizations expose themselves to reliability and liability risks.

Intellectual Property Infringement Risks

Sourcing custom-designed key shafts from overseas manufacturers increases the risk of IP theft. Designs, proprietary geometries, or performance specifications shared with suppliers may be replicated and sold to competitors without authorization. Jurisdictional differences in IP enforcement, especially in regions with weak legal protections, make it difficult to pursue remedies. Using non-disclosure agreements (NDAs) and limiting design data disclosure are essential but often overlooked safeguards.

Supply Chain Transparency and Counterfeit Components

Unverified supply chains can introduce counterfeit or reconditioned key shafts falsely labeled as new or high-grade. These components may have been salvaged, improperly refurbished, or manufactured using scrap materials. Without rigorous supplier vetting and incoming inspection protocols, such parts can infiltrate critical systems, leading to unexpected downtime or safety hazards.

Failure to Audit Supplier Capabilities

Organizations often select suppliers based solely on cost, neglecting on-site audits of manufacturing facilities, quality management systems (e.g., ISO 9001), and process controls. Without direct oversight, it’s difficult to ensure consistent production quality or verify claims about capabilities and compliance.

Avoiding these pitfalls requires a strategic sourcing approach that emphasizes supplier qualification, detailed technical specifications, robust quality assurance protocols, and proactive IP protection measures.

Logistics & Compliance Guide for Key Shaft

Overview

This guide outlines the essential logistics procedures and compliance requirements for the transportation, handling, and documentation of key shaft components. Adherence ensures operational efficiency, regulatory compliance, and product integrity throughout the supply chain.

Regulatory Compliance

Ensure all key shaft shipments meet international and local regulations, including:

– ITAR/EAR: If applicable, verify export control classification numbers (ECCNs) and secure necessary licenses for cross-border shipments.

– REACH & RoHS: Confirm material composition complies with EU environmental standards for restricted substances.

– Customs Declarations: Provide accurate HS codes (e.g., 8483.40 for transmission shafts) and commercial invoices to avoid delays.

Packaging & Handling

Proper packaging protects key shafts during transit:

– Use anti-corrosion wraps or VCI (Vapor Corrosion Inhibitor) paper for metal components.

– Secure shafts in rigid containers with foam or custom inserts to prevent movement.

– Label packages with orientation arrows, “Fragile,” and handling instructions.

Transportation Requirements

Choose transportation methods based on urgency, destination, and shaft specifications:

– Domestic Shipping: Use freight carriers with lift-gate service for heavy loads.

– International Shipping: Engage freight forwarders experienced in industrial parts; provide detailed packing lists and export documentation.

– Temperature & Humidity Control: For precision shafts, consider climate-controlled transport to maintain tolerances.

Documentation Standards

Maintain accurate records for traceability and audits:

– Bill of Lading (BOL)

– Certificate of Conformance (COC)

– Material Test Reports (MTRs)

– Export Packing List

– Dangerous Goods Declaration (if applicable)

Quality & Inspection Protocols

Conduct pre-shipment inspections to ensure compliance with technical specifications:

– Verify dimensions, surface finish, and keyway alignment per engineering drawings.

– Perform visual and dimensional checks before packaging.

– Retain inspection records for minimum 7 years.

Risk Mitigation

Minimize supply chain disruptions by:

– Diversifying logistics partners.

– Implementing tracking systems for real-time shipment visibility.

– Carrying appropriate cargo insurance for high-value shipments.

Training & Accountability

Ensure all personnel involved in logistics are trained on:

– Proper handling techniques to avoid damage.

– Compliance responsibilities per regional regulations.

– Incident reporting procedures for non-conformances.

Continuous Improvement

Regularly review logistics performance through KPIs such as on-time delivery rate, damage incidence, and customs clearance times. Update procedures based on audit findings and regulatory changes.

Conclusion for Sourcing Key Shaft:

In conclusion, sourcing a key shaft requires a careful evaluation of material specifications, dimensional accuracy, mechanical properties, and compliance with industry standards to ensure optimal performance and reliability in its intended application. By assessing potential suppliers based on quality certifications, manufacturing capabilities, cost-efficiency, and delivery timelines, organizations can secure a consistent and dependable supply chain. Additionally, considering alternatives such as in-house production versus external procurement, along with long-term partnerships, can lead to improved cost control and supply continuity. Ultimately, a strategic sourcing approach for key shafts supports enhanced product durability, reduced maintenance, and overall operational efficiency.