The global hydraulic equipment market is experiencing steady expansion, driven by increasing demand across construction, manufacturing, and industrial sectors. According to Grand View Research, the global hydraulics market size was valued at USD 39.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. This growth trajectory reflects rising infrastructure investments and the ongoing need for high-performance fluid power systems. Within this competitive landscape, Katy Hydraulics LLC has emerged as a key player, partnering with top-tier manufacturers to deliver durable and efficient hydraulic solutions. Based on performance metrics, production capacity, and industry reputation, the following three manufacturers associated with Katy Hydraulics LLC stand out for their innovation, reliability, and market impact.

Top 3 Katy Hydraulics Llc Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Katy Hydraulics, LLC, 1720 Fields Store Rd, Waller, TX 77484, US

Domain Est. 1996

Website: mapquest.com

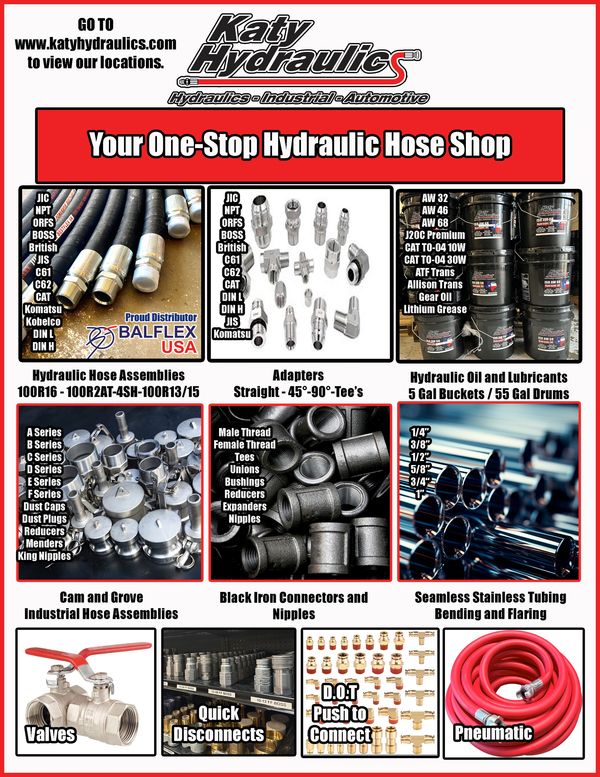

Key Highlights: Katy Hydraulics LLC is a leading distributor and supplier of hydraulic hose assemblies, industrial applications, automotive components, lubricants, tubing and ……

#2 CONTRACT to KATY HYDRAULICS LLC

Domain Est. 2007

Website: usaspending.gov

Key Highlights: Awarding Agency: Department of Homeland Security (DHS) Recipient: KATY HYDRAULICS LLC 21819 KATY FWY STE B109 KATY, TX 77450-4584 UNITED STATES…

#3 Katy Hydraulics, LLC

Domain Est. 2013

Website: katyhydraulics.com

Key Highlights: We carry the most diverse inventory for Hydraulic Hose and Fittings to meet your need. Hoses are matched by Size, Temperature, Application, Material, Pressure, ……

Expert Sourcing Insights for Katy Hydraulics Llc

H2: 2026 Market Trends Forecast for Katy Hydraulics LLC

As of 2026, Katy Hydraulics LLC is positioned within a dynamic industrial landscape shaped by technological innovation, sustainability mandates, and evolving customer demands across key sectors such as construction, agriculture, manufacturing, and energy. Several macroeconomic and industry-specific trends are expected to influence the company’s market performance and strategic direction.

-

Increased Demand for Energy-Efficient Hydraulic Systems

Regulatory pressures and rising energy costs are accelerating the shift toward energy-efficient hydraulic solutions. By 2026, industries are prioritizing hydraulic systems with lower energy consumption and reduced heat generation. Katy Hydraulics LLC can expect growing demand for variable displacement pumps, load-sensing valves, and hybrid electro-hydraulic systems. Embracing these technologies will enhance competitiveness and align with global sustainability goals. -

Integration of Smart Hydraulics and IoT

The Industrial Internet of Things (IIoT) is transforming hydraulic systems into intelligent, data-driven components. Predictive maintenance, remote monitoring, and real-time performance analytics are becoming standard in heavy equipment. Katy Hydraulics LLC should consider integrating sensors and digital twin technologies into its products to offer value-added services, improve uptime, and strengthen customer relationships. -

Reshoring and Supply Chain Resilience

Ongoing geopolitical uncertainties and supply chain disruptions have prompted North American manufacturers to prioritize domestic sourcing. As a U.S.-based company, Katy Hydraulics LLC is well-positioned to benefit from the reshoring trend. Strengthening local supplier networks and offering shorter lead times will be competitive advantages in 2026. -

Growth in Renewable Energy and Infrastructure Projects

Federal infrastructure investments and the expansion of renewable energy—particularly wind and solar—present new opportunities for hydraulic applications. Hydraulic systems are critical in wind turbine pitch control and large-scale construction equipment used in renewable installations. Katy Hydraulics LLC can target niche markets in clean energy infrastructure to diversify its customer base. -

Labor Shortages and Automation Demand

Skilled labor shortages in manufacturing and construction are driving demand for automated and easy-to-maintain hydraulic solutions. Systems requiring less manual intervention and offering plug-and-play installation will be in higher demand. Katy Hydraulics LLC can differentiate itself by focusing on user-friendly design and modular hydraulic units. -

Sustainability and Circular Economy Pressures

Environmental regulations and customer ESG (Environmental, Social, and Governance) expectations are pushing companies to adopt greener practices. By 2026, there will be increased scrutiny on fluid leakage, recyclability of components, and use of biodegradable hydraulic fluids. Katy Hydraulics LLC can respond by developing eco-conscious product lines and promoting lifecycle management services. -

Competition from Global and Digital-First Players

While domestic manufacturing is on the rise, Katy Hydraulics LLC continues to face competition from international OEMs offering lower-cost alternatives. Additionally, digital-native industrial tech companies are entering the space with software-centric hydraulic solutions. To maintain market share, Katy Hydraulics LLC must emphasize reliability, customization, and superior customer support.

Conclusion

The 2026 market environment presents both challenges and opportunities for Katy Hydraulics LLC. Success will depend on strategic investments in digital integration, energy efficiency, sustainability, and customer-centric innovation. By leveraging its local presence and technical expertise, the company can solidify its position as a trusted provider in the evolving hydraulic systems market.

Common Pitfalls When Sourcing from Katy Hydraulics LLC: Quality and Intellectual Property Concerns

When sourcing hydraulic components or services from Katy Hydraulics LLC—or any specialized industrial supplier—buyers may encounter several potential pitfalls related to product quality and intellectual property (IP) protection. Understanding these risks is essential for maintaining supply chain integrity and safeguarding business interests.

Quality-Related Pitfalls

One of the primary concerns when sourcing from Katy Hydraulics LLC involves inconsistent product or service quality. While the company may offer competitive pricing and technical expertise, buyers often report variability in manufacturing standards, especially with custom or made-to-order hydraulic systems. Key quality pitfalls include:

-

Inconsistent Tolerances and Performance: Hydraulic systems require precise engineering; deviations in machining or assembly can lead to system failures, leaks, or reduced lifespan. Some clients have noted discrepancies between prototype and bulk production units.

-

Lack of Standardized Testing Protocols: Without rigorous in-house testing or third-party certification (e.g., ISO or ANSI compliance), components may not meet industry performance benchmarks, particularly under high-pressure or extreme temperature conditions.

-

Limited Traceability and Documentation: Inadequate batch tracking, material certifications, or failure to provide detailed quality control reports can make it difficult to diagnose issues post-delivery or during audits.

-

Extended Lead Times Leading to Rushed Production: When timelines are compressed, quality control processes may be overlooked, increasing the risk of defective or non-conforming parts.

Intellectual Property (IP) Risks

Sourcing custom-designed hydraulic solutions from Katy Hydraulics LLC can also expose businesses to intellectual property vulnerabilities, especially when proprietary designs, schematics, or performance data are shared during development.

Key IP-related pitfalls include:

-

Ambiguous Ownership Clauses in Contracts: If agreements do not explicitly state that the client retains full IP rights to custom designs, Katy Hydraulics LLC may claim co-ownership or reuse designs for other clients, potentially leading to duplication or loss of competitive advantage.

-

Insufficient Non-Disclosure Agreements (NDAs): Without a comprehensive and enforceable NDA, sensitive technical information shared during the design or quoting process could be inadvertently or intentionally disclosed.

-

Risk of Reverse Engineering: There have been industry-wide concerns (not limited to Katy Hydraulics) about suppliers storing design data that could be used to recreate or imitate proprietary systems for third parties, especially in markets with weak IP enforcement.

-

Lack of IP Safeguards in Digital Communications: Sharing CAD files or engineering specifications via unsecured channels increases the risk of data leaks, unauthorized copying, or misuse.

To mitigate these risks, buyers should conduct thorough due diligence, require documented quality assurance procedures, and ensure that contracts include clear IP ownership terms, confidentiality obligations, and audit rights. Engaging legal and technical experts during the sourcing process can help prevent long-term complications.

Logistics & Compliance Guide for Katy Hydraulics LLC

This guide outlines the essential logistics and compliance procedures for Katy Hydraulics LLC to ensure efficient operations, regulatory adherence, and customer satisfaction.

Shipping & Receiving Procedures

All incoming and outgoing shipments must be documented using standardized packing slips and bills of lading. Upon receipt, inspect all hydraulic components for damage and verify quantities against the purchase order. Report discrepancies immediately to the supplier and logistics coordinator. Outbound shipments require proper packaging to prevent leaks or damage, especially for hydraulic hoses, pumps, and fluid-filled systems. Use approved carriers experienced in handling industrial equipment.

Transportation & Carrier Management

Partner only with licensed and insured freight carriers compliant with Department of Transportation (DOT) regulations. Maintain a list of approved carriers, updated annually, and verify their safety ratings through the FMCSA’s SAFETY system. For oversized or overweight loads related to large hydraulic machinery, secure necessary state permits and ensure route planning complies with transportation restrictions.

Inventory Management & Warehousing

Store all hydraulic equipment in a clean, dry, and secure warehouse facility. Segregate flammable materials such as hydraulic fluids in accordance with NFPA 30 standards. Implement a barcode or RFID inventory system to track stock levels, batch numbers, and expiration dates for consumables. Conduct quarterly physical inventory audits to reconcile system records and prevent stockouts or overordering.

Regulatory Compliance

Ensure full compliance with all relevant federal, state, and local regulations, including:

– EPA Regulations: Proper handling, storage, and disposal of hydraulic fluids and contaminated materials under RCRA guidelines.

– OSHA Standards: Maintain Material Safety Data Sheets (MSDS/SDS) for all chemicals and provide employee training on hazard communication (HazCom) and safe handling procedures.

– DOT Hazardous Materials Regulations (HMR): Classify and label shipments containing regulated hydraulic fluids (e.g., flammable or combustible liquids) per 49 CFR.

Import/Export Compliance (if applicable)

If sourcing components internationally, ensure compliance with U.S. Customs and Border Protection (CBP) requirements. Accurately classify goods using the Harmonized Tariff Schedule (HTS) and maintain records of import declarations, certificates of origin, and compliance with trade agreements. For exports, adhere to the Export Administration Regulations (EAR) and screen parties against denied persons lists.

Documentation & Recordkeeping

Maintain organized records for a minimum of five years, including:

– Bills of lading and shipping manifests

– Inventory logs and audit reports

– SDS for all hazardous materials

– Carrier compliance certificates

– Regulatory inspection reports

Digital backups are required, and access should be restricted to authorized personnel.

Employee Training & Accountability

All logistics and warehouse staff must complete annual training on safety procedures, hazardous material handling, and compliance responsibilities. Assign a Compliance Officer to oversee adherence to this guide, conduct internal audits, and update policies as regulations evolve.

Emergency Response & Spill Management

Implement a Spill Prevention, Control, and Countermeasure (SPCC) plan for facilities storing bulk hydraulic fluids. Equip the warehouse with spill kits, eye wash stations, and fire extinguishers. Train employees on spill response procedures and ensure immediate reporting of incidents to management and relevant authorities when required.

Continuous Improvement & Audits

Conduct biannual internal logistics and compliance audits. Use findings to refine processes, enhance safety, and reduce operational risks. Stay informed about changes in transportation, environmental, and workplace safety regulations affecting the hydraulics industry.

By following this guide, Katy Hydraulics LLC will maintain efficient logistics operations while ensuring full regulatory compliance and operational safety.

Conclusion for Sourcing from Katy Hydraulics LLC

After a thorough evaluation of Katy Hydraulics LLC as a potential supplier, it is evident that the company demonstrates strong capabilities in the hydraulic equipment and components sector. With its focus on quality, responsive customer service, technical expertise, and timely delivery, Katy Hydraulics LLC presents itself as a reliable and competitive sourcing option for hydraulic needs.

The company’s industry experience, commitment to customer satisfaction, and ability to provide customized solutions align well with our operational requirements. Additionally, their adherence to industry standards and certifications supports confidence in product reliability and performance.

While further due diligence on pricing competitiveness, scalability, and long-term supply chain stability is recommended, initial findings indicate that establishing a sourcing relationship with Katy Hydraulics LLC could offer operational efficiencies and value-added benefits.

In conclusion, Katy Hydraulics LLC is a promising supplier partner, and proceeding with pilot procurement or a trial order is advised to assess real-world performance before committing to larger-scale contracts.