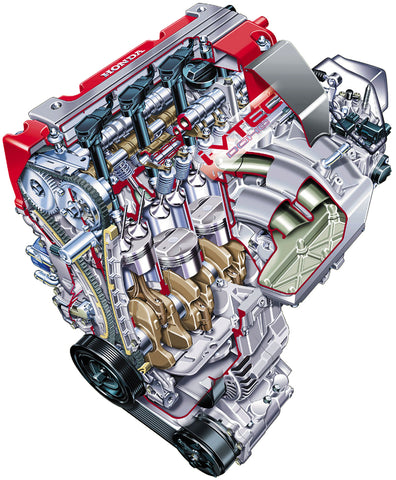

The high-performance automotive parts market is experiencing robust expansion, driven by rising consumer demand for enhanced vehicle dynamics, increased adoption of aftermarket modifications, and advancements in materials engineering. According to Grand View Research, the global automotive aftermarket parts market was valued at USD 405.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Within this segment, performance-oriented components—particularly those compatible with tuning platforms like the Honda K24 engine—have gained significant traction among enthusiasts and professional tuners alike. Mordor Intelligence forecasts similar momentum, highlighting a growing preference for OEM-adjacent quality with improved output, durability, and thermal efficiency. As the demand for reliable, high-output components climbs, a select group of manufacturers has emerged as leaders in innovation, quality control, and market share within the K24 performance ecosystem. These top nine manufacturers are shaping the future of performance tuning through data-optimized design, rigorous testing protocols, and consistent product advancements.

Top 9 K24 Performance Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

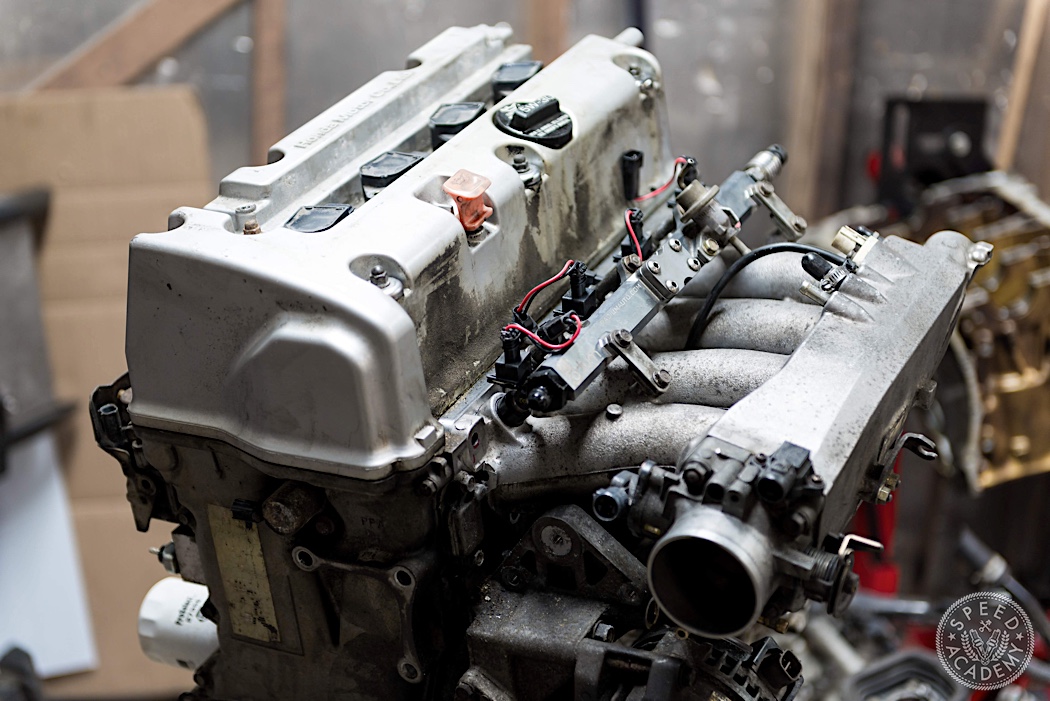

#1 K Series Engines

Domain Est. 2006

Website: speedfactoryracing.net

Key Highlights: 8-day deliveryWiseco Acura/HondaK24 andK24 withK20 Cylinder Head Complete Piston Set $683.99 Select options Wiseco Acura/HondaK20 2002-06 RSX-S Complete Piston Set…

#2 NoShitPerformance.com

Domain Est. 2015

Website: noshitperformance.com

Key Highlights: OEM Honda K24A JDM Engine Complete · OHA-ENG-K24A-JDM. OEM Honda K24A JDM Engine Complete · €1,497.00 Ex Tax:€1,497.00 ; NSP Honda K-swap K20 K24 – Package Builder….

#3 OEM Honda Parts

#4 Skunk2 Racing

Domain Est. 1999

#5 Hybrid Racing

Domain Est. 2003

Website: hybrid-racing.com

Key Highlights: 30-day returnsHybrid Racing designs and manufactures performance automotive parts for Hondas and Acuras….

#6 K

Domain Est. 2007

Website: k-tuned.com

Key Highlights: Honda performance specialist. Everything from coilovers and brakes to shifters and throttle bodies….

#7 Honda / Acura K Series (K20 & K24) Engine Block Internals

Domain Est. 2007

Website: ipgparts.com

Key Highlights: 30-day returnsHonda / Acura K Series (K20 & K24) Engine Block Internals. K Series Bearings · K Series Connecting Rods · K Series Gaskets and Hardware · K Series Pistons…

#8 K

Domain Est. 2008

Website: kseriesparts.com

Key Highlights: Free delivery over $300 · 30-day returnsK-Tuned is a renowned brand specializing in manufacturing and distributing high-performance parts and accessories primarily for Honda and A…

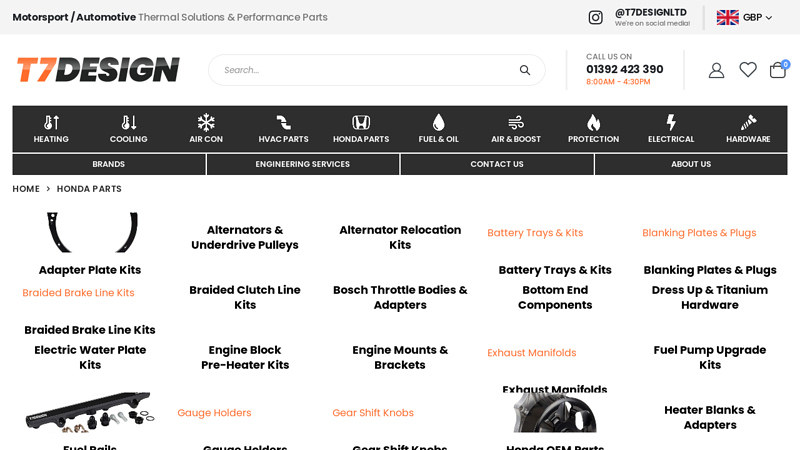

#9 T7Design Develop and Manufacture Honda K20 & K24 Performance …

Domain Est. 2010 | Founded: 2016

Website: t7design.co.uk

Key Highlights: T7Design have been developing performance parts for Honda’s since 2016, predominantly parts for the Honda K-Series (K20 & K24) engine which can be seen as ……

Expert Sourcing Insights for K24 Performance Parts

H2: 2026 Market Trends Analysis for K24 Performance Parts

Based on current industry trajectories, technological advancements, and macroeconomic factors, the performance aftermarket sector – particularly for popular platforms like the Honda K24 engine family – is poised for significant evolution by 2026. Here’s a strategic analysis of key trends impacting K24 Performance Parts (K24PP):

1. Continued High Demand for K-Swap Compatibility

- Trend: The K-series engine swap (especially K24) into older Civics, Integras, S2000s, and even non-Honda platforms (Miata, trucks) remains a dominant enthusiast activity. The K24’s balance of displacement, strength, and tunability ensures sustained demand.

- Impact on K24PP: Demand for comprehensive swap kits (engine mounts, transmission adapters, wiring harnesses, exhaust manifolds) will remain strong. K24PP must ensure compatibility across the widest possible range of popular swap vehicles and offer application-specific solutions. Bundling components will be key.

2. Rise of Hybrid & EV Integration Challenges & Niche Opportunities

- Trend: As electrification accelerates, some enthusiasts will seek to preserve internal combustion (ICE) performance, potentially fueling demand for “last of the ICE” projects. Simultaneously, a niche but growing segment will explore hybridizing traditional platforms (e.g., adding small EV motors to K-swapped cars).

- Impact on K24PP: While core K24 parts demand persists, K24PP should monitor this space. Opportunities may arise in supporting hybrid conversions (e.g., custom mounting solutions, integration brackets, cooling for additional components) or marketing K-swaps as a “pure ICE experience.” Avoid over-investing in EV-specific K24 parts unless a clear niche emerges.

3. Advanced Materials & Manufacturing Dominance

- Trend: Expect wider adoption of advanced materials (lighter, stronger alloys, high-temp composites) and manufacturing techniques (3D printing for prototyping, complex manifolds, or custom brackets; improved CNC precision).

- Impact on K24PP: Competitive advantage will lie in leveraging these technologies. Key areas:

- Intake/Exhaust Manifolds: 3D-printed or CNC’d complex runners for optimized flow.

- Intercoolers: More efficient, compact designs using advanced fin/tube tech.

- Brackets & Mounts: Lightweight, high-strength custom solutions.

- Differentiation: Offer parts with demonstrable performance gains (CFD data, dyno proof) and superior durability claims backed by material science.

4. Turbocharging Optimization & Electrification Synergy

- Trend: Turbocharging the K24 remains the primary path to significant power. Expect focus on:

- Smaller, Faster-Spooling Turbos: Catering to street/track balance and daily drivability.

- Improved Turbo Kits: Easier installation, better integration (oil/coolant lines, wastegate control).

- Turbo + Mild Hybrid Concepts: Exploring electric compressor/turbo assist (e.g., BorgWarner EVC) to eliminate lag – a potential high-end niche.

- Impact on K24PP: Core business remains strong. Invest in R&D for next-gen turbo manifolds, downpipes, and complete, reliable turbo kits. Explore partnerships or development for electric turbo assist compatibility as a premium offering, though volume will likely be low initially.

5. Data-Driven Tuning & Connectivity Integration

- Trend: ECU tuning is becoming more sophisticated and accessible. Expect deeper integration with:

- Real-time Data Logging & Telemetry: Via smartphones/tablets.

- Cloud-Based Tuning Platforms: Remote tuning, data sharing for optimization.

- Enhanced Sensors: More widespread use of wideband O2, knock detection, oil temp/pressure monitoring.

- Impact on K24PP: Parts must support this ecosystem:

- Sensor Bungs: Ensure all relevant bungs (especially multiple wideband locations, oil pressure/temp) are standard on critical parts (manifolds, oil pans).

- Harness Adapters: Facilitate clean integration of aftermarket sensors and ECUs.

- Marketing: Highlight compatibility with popular tuning platforms (Hondata, AEM, Haltech) and data logging capabilities. Consider developing simple data-focused accessories.

6. Sustainability & Circular Economy Pressures

- Trend: Growing consumer and regulatory focus on sustainability. This includes material sourcing, manufacturing processes, and end-of-life.

- Impact on K24PP:

- Material Sourcing: Explore recycled aluminum content in castings/machining.

- Packaging: Shift to recyclable/eco-friendly materials.

- Longevity & Repairability: Design parts for durability and repair (e.g., replaceable flanges on exhaust manifolds). Offer robust core exchange programs for turbochargers or ECUs.

- Marketing: Transparency about sustainable practices will become a differentiator, even in performance segments.

7. E-commerce & Direct-to-Consumer (D2C) Intensification

- Trend: The shift to online purchasing accelerates. Consumers expect seamless D2C experiences, detailed technical content, video reviews, and fast global shipping.

- Impact on K24PP:

- Website & UX: Invest heavily in a user-friendly, mobile-optimized e-commerce platform with detailed product pages (specs, fitment guides, installation videos, CAD drawings).

- Content Marketing: Produce high-quality technical articles, build guides, and video content (dyno tests, installations).

- Global Logistics: Optimize warehousing and shipping partners for faster, more reliable international delivery.

- Community Engagement: Foster active social media presence and forums.

8. Supply Chain Resilience & Localization

- Trend: Geopolitical instability and past disruptions necessitate more resilient, diversified, and potentially regionalized supply chains.

- Impact on K24PP:

- Diversify Suppliers: Avoid over-reliance on single-source manufacturers, especially in volatile regions.

- Strategic Stockpiling: Maintain critical safety stock for high-demand components.

- Nearshoring/Reshoring: Evaluate feasibility of shifting some manufacturing or final assembly closer to key markets (e.g., US, EU) to reduce lead times and risks, even at higher cost.

Strategic Recommendations for K24 Performance Parts

- Double Down on Core Swaps: Be the undisputed leader in K-swap solutions. Expand fitment guides and application-specific kits.

- Embrace Advanced Manufacturing: Utilize CNC and 3D printing for performance-optimized, differentiated parts (manifolds, intercoolers, custom solutions).

- Integrate with the Data Ecosystem: Ensure all parts are sensor-ready and market compatibility with tuning/data platforms.

- Invest in D2C & Content: Make the online experience exceptional. Become a content hub for K24 builders.

- Prepare for Sustainability: Implement eco-friendly practices and communicate them authentically.

- Build Supply Chain Resilience: Diversify sources and consider strategic localization.

- Monitor the Niche: Keep an eye on hybrid/electric performance trends for potential future opportunities without diverting core focus.

Conclusion: The 2026 landscape for K24 Performance Parts is one of strong underlying demand for core products, driven by the enduring popularity of the K24 platform and engine swaps. Success will depend on leveraging technological advancements (materials, manufacturing, data), mastering the D2C model, ensuring supply chain stability, and adapting to evolving consumer expectations around sustainability and integration – all while maintaining a laser focus on performance and reliability for the enthusiast community.

Common Pitfalls Sourcing K24 Performance Parts (Quality, IP)

Sourcing K24 performance parts—especially for Honda’s popular K24 engine platform—can be a minefield if not approached carefully. Buyers and tuners often encounter issues related to part quality and intellectual property (IP) infringement. Being aware of these pitfalls can help avoid costly mistakes, engine failures, and legal complications.

Inconsistent or Substandard Quality

One of the biggest risks when sourcing K24 performance parts is encountering inconsistent or substandard manufacturing quality. Many aftermarket suppliers—particularly those based overseas—produce components that appear identical to OEM or reputable aftermarket parts but fail under real-world conditions.

- Material Deficiencies: Some intake manifolds, camshafts, or pistons are made from inferior alloys or composites that degrade quickly under high heat and pressure.

- Poor Tolerances: Machining inaccuracies can lead to improper sealing, oil leaks, or timing issues, especially with cylinder heads and gaskets.

- Lack of Testing: Unlike OEM or premium aftermarket brands, many budget parts are not subjected to rigorous dyno or durability testing, increasing the risk of premature failure.

Counterfeit or Replica Parts

The performance automotive market is rife with counterfeit or replica components that mimic well-known brands such as Skunk2, DC Sports, or AEM.

- Fake Branding: Components may carry logos or part numbers of reputable manufacturers but are unauthorized copies produced without quality control.

- Misleading Listings: Online marketplaces often feature parts labeled as “compatible with K24” or “OEM-style,” which may imply authenticity but are actually low-quality replicas.

- Reduced Performance and Reliability: Counterfeit parts often underperform and can cause catastrophic engine damage due to design flaws or poor materials.

Intellectual Property (IP) Infringement

Many aftermarket K24 parts are reverse-engineered or copied from original designs, leading to potential IP violations.

- Patent and Design Violations: Some manufacturers produce parts that closely replicate patented designs (e.g., intake manifold runner configurations or cam profiles), exposing buyers and resellers to legal risk.

- Trademark Infringement: Using brand names or logos without authorization in product listings—even if unintentional—can lead to takedown notices or legal action.

- Ethical and Legal Concerns: Supporting companies that infringe on IP can harm innovation and discourage investment in R&D by legitimate performance brands.

Lack of Technical Support and Warranty

Lower-tier or unbranded K24 parts often come without reliable technical support or enforceable warranties.

- No Installation Guidance: Unlike reputable brands, many generic parts lack detailed fitment guides or compatibility information, increasing the risk of improper installation.

- Voided Warranties: If a counterfeit or off-brand part fails and causes engine damage, manufacturers may void warranties on other components or the entire engine.

How to Avoid These Pitfalls

- Buy from authorized distributors or directly from reputable brands.

- Verify seller authenticity on marketplaces like eBay or Amazon.

- Check for certifications, material specifications, and customer reviews.

- Be wary of prices that seem too good to be true—extremely low-cost parts are often compromised in quality or legality.

By understanding these common sourcing pitfalls, enthusiasts and professionals can make safer, more informed decisions when upgrading their K24-powered vehicles.

Logistics & Compliance Guide for K24 Performance Parts

This guide outlines the essential logistics and compliance procedures for handling K24 Performance Parts. Adherence ensures timely delivery, regulatory compliance, and customer satisfaction.

Order Fulfillment Process

All K24 Performance Parts orders must be processed within 24 hours of receipt. Verify part compatibility with the customer’s vehicle make, model, and engine code (e.g., K24A2, K24Z3) before shipping. Use internal part numbering and cross-reference with OEM and aftermarket databases to prevent fulfillment errors.

Inventory Management

Maintain real-time inventory tracking using barcode scanning. Conduct monthly cycle counts and full physical audits quarterly. Store K24-specific components such as camshafts, intake manifolds, and performance crankshafts in designated climate-controlled zones to prevent corrosion and damage.

Shipping & Carrier Compliance

Ship via approved carriers (FedEx, UPS, DHL) with tracking and insurance. Clearly label packages with “Performance Automotive Parts – Handle with Care” and include a packing slip with part numbers, engine compatibility notes, and compliance certifications. International shipments require accurate HS codes (e.g., 8708.29 for engine components) and export documentation.

Import/Export Regulations

For cross-border shipments, ensure compliance with destination country regulations. Provide EPA and DOT compliance statements where applicable, especially for emissions-related parts. Complete customs forms accurately, declaring value, origin, and technical specifications of K24 components.

Regulatory Compliance

All K24 Performance Parts must meet relevant standards:

– Emissions: CARB EO number required for sale in California; include certification on website and packaging.

– Safety: Parts affecting vehicle safety (e.g., connecting rods, pistons) must meet SAE or equivalent standards.

– Labeling: Include manufacturer name, part number, manufacturing date, and compliance marks on all units.

Returns & Warranty Handling

Accept returns within 30 days if parts are unused and in original packaging. Issue Return Merchandise Authorizations (RMAs) with clear instructions. Warranty claims require proof of purchase and installation documentation. Track failure data to identify recurring part issues.

Recordkeeping & Audits

Retain all transaction records, compliance certificates, and shipping documents for a minimum of five years. Prepare for annual internal audits to verify adherence to logistics protocols and regulatory requirements.

Training & Responsibilities

All warehouse and logistics staff must complete biannual training on K24 part specifications, handling procedures, and compliance updates. Designate a Compliance Officer to oversee audits and regulatory communications.

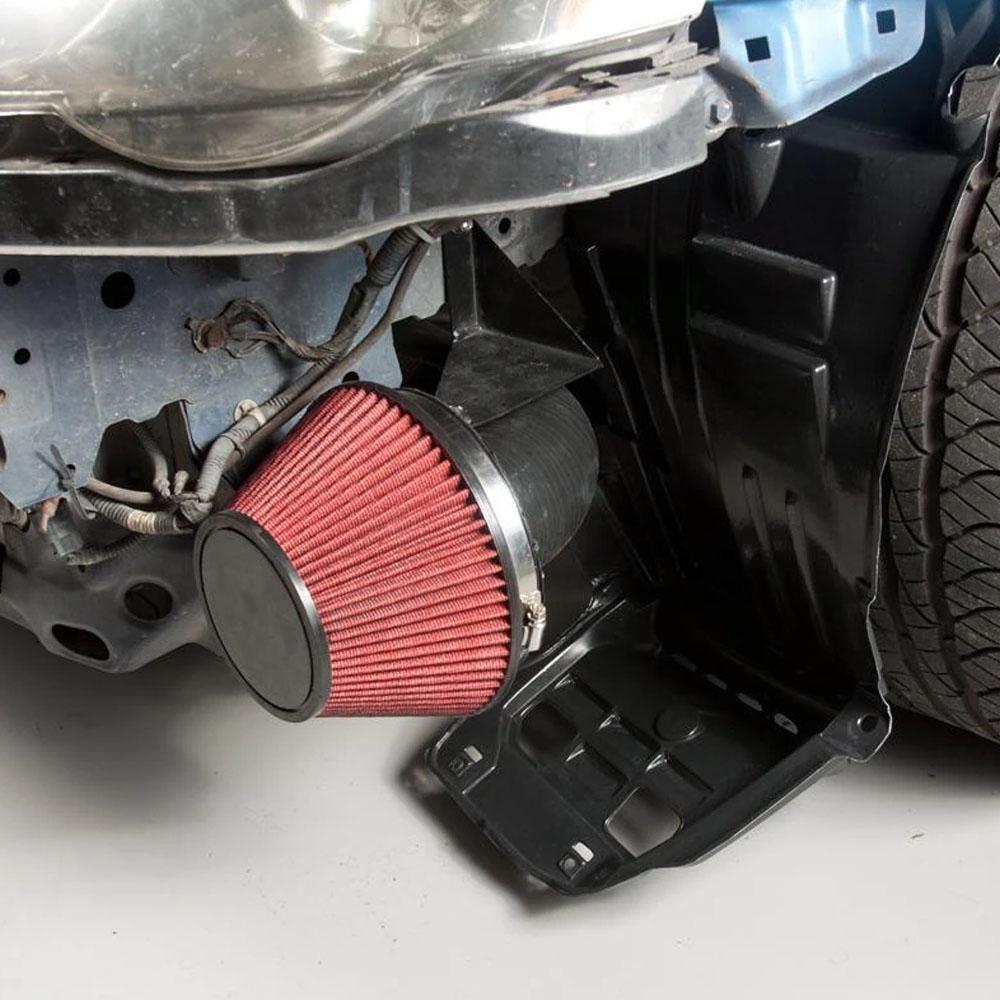

In conclusion, sourcing K24 performance parts requires careful consideration of quality, compatibility, and intended use. Whether building a high-revving naturally aspirated motor, a turbocharged powerhouse, or a reliable daily driver with enhanced performance, selecting the right components—such as performance camshafts, pistons, connecting rods, headers, intake systems, and engine management—is crucial. Prioritizing reputable manufacturers, ensuring proper fitment with your specific K24 variant (K24A, K24A2, K24A4, K24Z, etc.), and investing in supporting modifications will maximize both power and reliability. Additionally, professional tuning and installation play a vital role in unlocking the engine’s full potential. With the right approach, the K24 engine remains a versatile and potent platform for performance enthusiasts seeking a balance of horsepower, efficiency, and Honda’s renowned engineering heritage.