The U.S. jewelry manufacturing industry is experiencing steady growth, fueled by rising consumer demand for fine and fashion jewelry, increasing e-commerce adoption, and a resurgence in luxury spending. According to Grand View Research, the U.S. jewelry market was valued at USD 83.5 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. This growth is supported by evolving consumer preferences toward personalized and ethically sourced pieces, as well as innovations in manufacturing technologies like CAD design and 3D printing. As competition intensifies, a select group of domestic manufacturers are leading the way in quality, craftsmanship, and scalability. Based on production capacity, industry reputation, and market reach, here are the top 10 jewelry manufacturers in the United States shaping the future of the industry.

Top 10 Jewelry In Usa Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

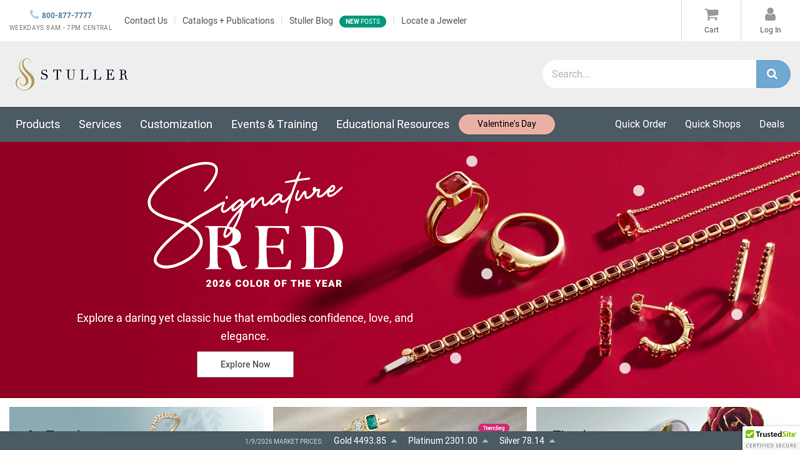

#1 Stuller: Fine Jewelry Manufacturer

Domain Est. 1996

Website: stuller.com

Key Highlights: Stuller, Inc. is the #1 supplier of fine jewelry, findings, mountings, tools, packaging, diamonds & gemstones for today’s retail jeweler….

#2 Custom Wedding Rings Handcrafted and Designed • Jewelry …

Domain Est. 2000

Website: jewelryinnovations.com

Key Highlights: As a manufacturer and wholesale supplier to retail jewelry stores, Jewelry Innovations only sells to authorized retailers and jewelry industry professionals….

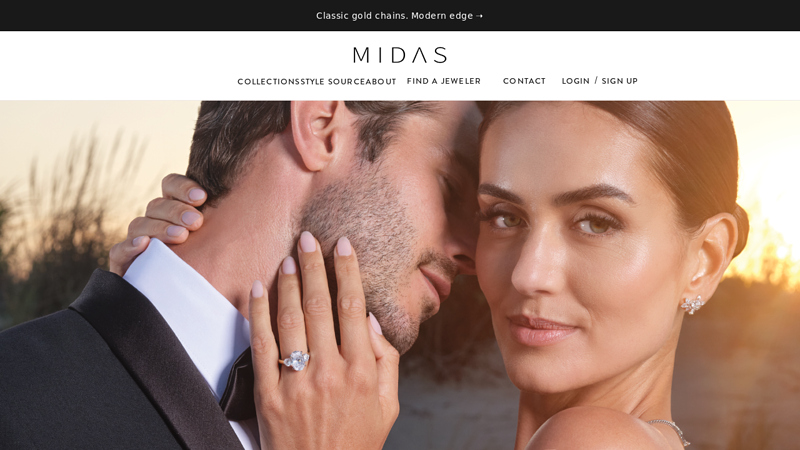

#3 Midas Chain

Domain Est. 2001

Website: midaschain.com

Key Highlights: Midas Chain, known as the premier jewelry manufacturer in the U.S. and worldwide, sells exclusively to the jewelry trade. Midas began as a family business ……

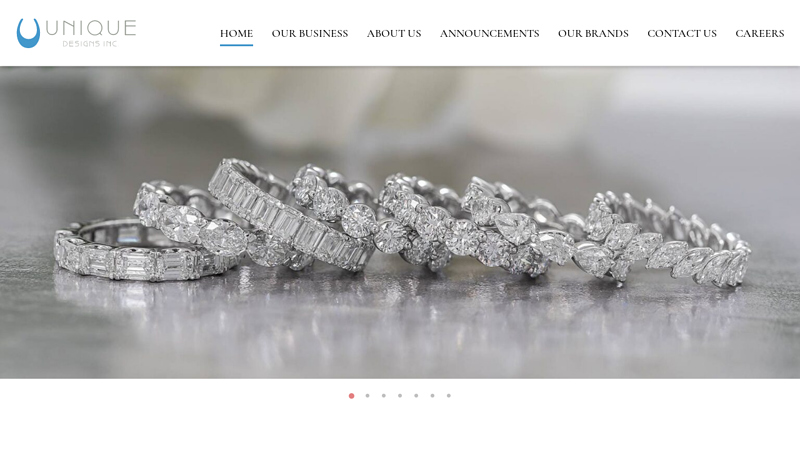

#4 Unique Designs, Inc.

Domain Est. 2008

Website: ud-ny.com

Key Highlights: With decades of experience, we offer an extensive range of exquisite diamond jewelry designs, including diamonds, gemstones, gold, silver and platinum pieces….

#5 Custom Fashion Jewels

Domain Est. 2014

Website: customfashionjewels.com

Key Highlights: Custom Fashion Jewels – Wholesale Custom Jewelry Manufacturing Company in USA · Charms · Necklaces · Bracelets · Lapel Pins · Apparel and Handbag Accessories ……

#6 Empire Casting House: Jewelry Manufacturing

Domain Est. 2017

Website: empirecastinghouse.com

Key Highlights: All in One Jewelry Manufacturing. Empire Casting House offers custom jewelry to jewelers based in New York, where we serve as your #1 wholesale manufacturer….

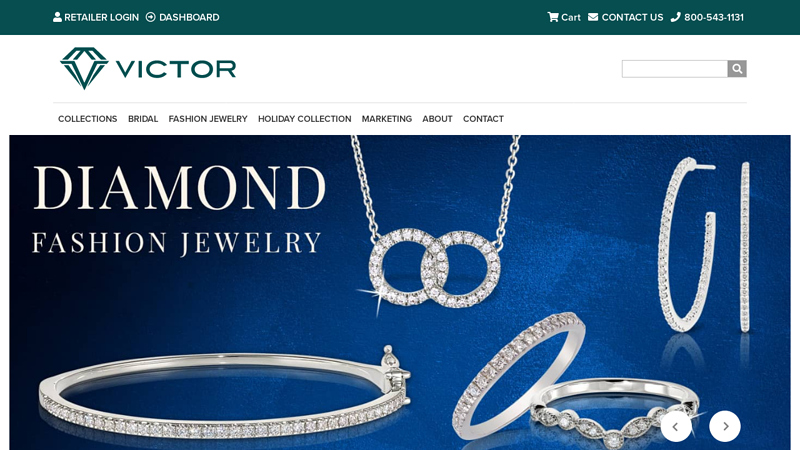

#7 Victor Corporation

Domain Est. 1998

Website: victorcorporation.com

Key Highlights: Victor Corporation specializes in unique and attractive bridal and fashion styles that appeal broadly to the American consumer….

#8 Kamal Trading: Wholesale jewelry Findings

Domain Est. 2000

Website: kamaltrading.com

Key Highlights: Kamal Trading provide wholesale jewelry supplies to the jewelry industry for more than 30 years. Jewelry findings, Jewelry making chains and accessories ……

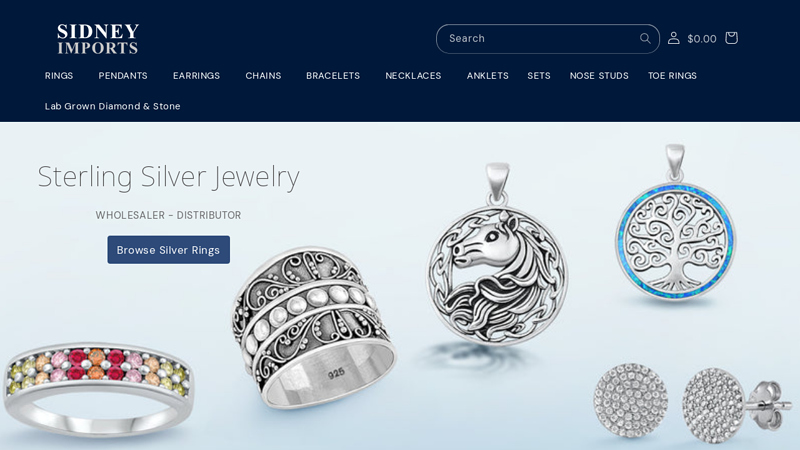

#9 Sidney Imports

Domain Est. 2004

Website: sidneyimports.com

Key Highlights: We offer one of the largest in-stock selections in the industry, featuring over 30,000 unique sterling silver designs ready for fast, immediate delivery….

#10 Wholesale Jewelry Website

Domain Est. 2009

Website: wholesalejewelrywebsite.com

Key Highlights: Wholesale Jewelry Website (WJW) is a leading wholesale jewelry supplier in the USA, proudly ranked #1 on Google for wholesale jewelry. We offer a massive ……

Expert Sourcing Insights for Jewelry In Usa

Jewelry Market Trends in the USA for 2026

The U.S. jewelry market is poised for dynamic shifts in 2026, driven by evolving consumer preferences, technological advancements, and broader socioeconomic trends. As the industry continues to recover and adapt post-pandemic, several key trends are shaping the future of jewelry retail, design, and sustainability in the United States.

Growing Demand for Lab-Grown Diamonds and Sustainable Materials

One of the most significant forces shaping the 2026 jewelry market is the rising consumer preference for lab-grown diamonds and ethically sourced materials. With increased awareness of environmental and social issues linked to traditional mining, millennials and Gen Z buyers are gravitating toward sustainable alternatives. Lab-grown diamonds, which offer the same physical and chemical properties as mined diamonds at a lower price point, are projected to capture over 20% of the diamond jewelry market by 2026. Brands emphasizing transparency, carbon neutrality, and recyclable packaging are gaining competitive advantage.

Personalization and Customization as Key Differentiators

Personalized jewelry continues to gain momentum, with consumers seeking unique pieces that reflect individual identity and sentiment. Advances in 3D printing and computer-aided design (CAD) are enabling faster and more affordable customization. In 2026, major retailers and independent designers alike are expected to offer enhanced online tools that allow customers to co-create designs—from engraving names and dates to selecting gemstones and settings. This trend is especially strong in engagement rings, anniversary gifts, and milestone celebrations.

E-Commerce and Omnichannel Retail Dominance

The shift toward digital shopping, accelerated during the pandemic, has become permanent. By 2026, e-commerce is expected to account for nearly 40% of all jewelry sales in the U.S. Virtual try-on technologies, augmented reality (AR) apps, and AI-powered styling assistants are enhancing the online buying experience. At the same time, successful brands are adopting omnichannel strategies—offering seamless integration between online browsing and in-store pickup, virtual consultations, and local events—to build trust and convenience.

Rise of Inclusive and Gender-Neutral Designs

The jewelry market is increasingly embracing inclusivity. Gender-fluid and non-binary fashion trends are influencing design, with more brands launching unisex collections that break traditional gender norms. This shift reflects broader cultural movements and appeals to younger consumers who value self-expression and diversity. In 2026, inclusivity will extend beyond design to marketing and branding, with campaigns featuring diverse models and stories.

Investment in Precious Metals Amid Economic Uncertainty

With ongoing inflation concerns and fluctuating stock markets, many U.S. consumers are turning to precious metals like gold and silver as safe-haven assets. Jewelry made from high-karat gold is not only viewed as a fashion statement but also as a form of wealth preservation. In 2026, we anticipate increased interest in heirloom-quality pieces and investment-grade jewelry, particularly among affluent buyers and first-time investors.

Influence of Social Media and Influencer Marketing

Social media platforms—especially Instagram, TikTok, and Pinterest—remain powerful drivers of jewelry trends. Micro-influencers and niche content creators play a crucial role in shaping consumer tastes and driving viral product launches. By 2026, brands that effectively leverage user-generated content, limited-edition collaborations, and short-form video marketing are expected to outperform competitors in customer acquisition and retention.

Conclusion

The U.S. jewelry market in 2026 will be defined by innovation, sustainability, and personal connection. As consumer values evolve, brands that prioritize ethical sourcing, digital engagement, and inclusive design will lead the industry forward. With technology enabling greater customization and accessibility, the future of jewelry is not just about adornment—it’s about meaning, identity, and responsibility.

Common Pitfalls Sourcing Jewelry in the USA (Quality, IP)

Sourcing jewelry in the USA offers advantages like proximity, regulatory oversight, and strong consumer protection laws. However, businesses—especially those new to the industry—can encounter significant challenges related to quality control and intellectual property (IP). Being aware of these pitfalls is crucial to protecting your brand, ensuring customer satisfaction, and avoiding legal complications.

Quality Inconsistencies and Material Misrepresentation

One of the most common issues when sourcing jewelry domestically is inconsistent quality. While the U.S. has strict regulations, not all manufacturers adhere to high standards uniformly. Buyers may encounter:

- Inaccurate Metal Purity: Some suppliers may misrepresent karat gold or silver content. Even with hallmarking laws, not all pieces are independently tested, leading to discrepancies in fineness.

- Use of Plating Instead of Solid Metal: Items marketed as “gold” or “silver” may only be plated over base metals. Without clear specifications, buyers risk receiving lower-value goods.

- Poor Craftsmanship: Inadequate attention to detail—such as uneven soldering, weak clasps, or rough finishes—can affect product durability and brand reputation.

- Inconsistent Gemstone Quality: Diamonds and gemstones may lack proper grading or certification. Color, clarity, and cut can vary widely between batches if not strictly controlled.

To mitigate these risks, always request third-party assay reports, insist on detailed material specifications, and conduct regular quality audits—even with domestic suppliers.

Intellectual Property Infringement and Design Theft

The U.S. jewelry market is highly competitive and design-driven, making intellectual property a critical concern:

- Unintentional Infringement: Sourcing designs from third-party manufacturers without verifying originality may lead to copying protected designs. Even subtle similarities to patented or trademarked pieces can result in legal action.

- Lack of IP Ownership Clarity: Contracts often fail to specify who owns the rights to custom designs. Without a written agreement, the manufacturer may retain design rights, limiting your ability to reproduce or modify the piece.

- Design Theft by Suppliers: Domestic manufacturers may replicate your unique designs and sell them to competitors or under their own brand, especially if non-disclosure agreements (NDAs) or IP clauses are absent.

- Trademark and Hallmark Confusion: Unauthorized use of brand names, logos, or registered hallmarks can result in cease-and-desist letters or lawsuits.

To protect your business, always execute comprehensive contracts that assign IP rights to your company, use NDAs during development, and conduct IP searches before launching new products.

Conclusion

Sourcing jewelry in the USA can streamline operations and improve time-to-market, but it requires diligence in vetting suppliers and safeguarding your designs. Prioritize transparency in materials, enforce strict quality controls, and establish clear legal protections for intellectual property to avoid costly setbacks and maintain brand integrity.

Logistics & Compliance Guide for Jewelry in the USA

Import Regulations and Customs Compliance

When importing jewelry into the United States, businesses must comply with regulations set by U.S. Customs and Border Protection (CBP). All shipments must be declared, and accurate documentation—including commercial invoices, packing lists, and bills of lading—is required. Jewelry items are classified under the Harmonized Tariff Schedule (HTS) codes, typically ranging from 7113 (articles of precious metals) to 7117 (imitation jewelry). Proper classification ensures correct duty assessment and avoids delays or penalties.

Importers must also comply with country of origin marking requirements. Each piece of jewelry must be clearly labeled with the country where it was manufactured. This marking must be permanent and legible.

Precious Metals and Gemstone Regulations

The use of precious metals such as gold, silver, and platinum is regulated by the Federal Trade Commission (FTC) through the Guides for the Jewelry, Precious Metals, and Ophthalmic Goods. These guidelines require accurate disclosure of:

- Metal type (e.g., 14K gold, sterling silver)

- Fineness or purity (e.g., “925” for sterling silver)

- Use of terms like “gold-filled,” “gold-plated,” or “vermeil” must meet FTC standards and not mislead consumers

Gemstones must also be truthfully represented. Disclosure is required for treatments (e.g., clarity enhancement in diamonds) and synthetic or lab-grown stones. Misrepresentation can lead to enforcement actions, fines, or recalls.

Labeling and Advertising Requirements

All jewelry sold in the U.S. must adhere to FTC labeling guidelines. Mandatory disclosures include:

- Metal content (e.g., “14K,” “.925,” “Plat”)

- Presence of gemstones (natural, synthetic, or treated)

- Country of origin (if applicable)

- Manufacturer or dealer identification (e.g., hallmark or registered trademark)

Advertising must not be deceptive. Claims such as “conflict-free diamonds” or “eco-friendly materials” require substantiation. The FTC monitors marketing claims to ensure transparency and consumer protection.

Importing Diamonds and the Kimberley Process

The U.S. enforces the Kimberley Process Certification Scheme (KPCS) to prevent the trade of conflict diamonds. Importers of rough diamonds must:

- Source diamonds only from Kimberley Process participant countries

- Provide a Kimberley Process certificate with each shipment

- Maintain detailed records for at least five years

Polished diamonds and jewelry containing diamonds are not subject to KPCS requirements but must still comply with general import and labeling rules.

State-Level Sales Tax and Nexus Rules

Jewelry retailers must comply with state sales tax regulations. With the 2018 South Dakota v. Wayfair Supreme Court ruling, economic nexus now applies: businesses exceeding a state’s sales threshold (e.g., $100,000 in sales or 200 transactions) must collect and remit sales tax in that state.

Maintaining compliance requires:

– Determining nexus in each state

– Registering with state tax authorities

– Collecting appropriate sales tax at point of sale

– Filing regular tax returns

Product Safety and Consumer Protection

Although jewelry is not typically regulated by the Consumer Product Safety Commission (CPSC) as a children’s product unless intended for use by children under 12, certain items (e.g., children’s jewelry) must comply with lead and phthalates limits under the Consumer Product Safety Improvement Act (CPSIA).

Additionally, jewelry containing hazardous materials (e.g., cadmium or excessive lead in metal components) may be subject to recall. Regular third-party testing is recommended to ensure compliance.

Anti-Counterfeiting and Intellectual Property

Importing or selling counterfeit jewelry violates U.S. trademark laws. Brand names, logos, and distinctive designs are protected under federal law. Registering trademarks with the U.S. Patent and Trademark Office (USPTO) helps protect intellectual property.

CBP can detain shipments suspected of trademark infringement. Rights holders can record their trademarks with CBP to enhance enforcement.

Recordkeeping and Audit Preparedness

Businesses must maintain records of imports, sales, compliance testing, and disclosures for a minimum of five years. These include:

– Import documentation (invoices, entry filings)

– Kimberley Process certificates (for rough diamonds)

– Lab reports for metal and gemstone authenticity

– Advertising and marketing materials

Proper recordkeeping is essential for audits and regulatory inquiries.

Conclusion

Successfully navigating the logistics and compliance landscape for jewelry in the U.S. requires attention to federal regulations, accurate labeling, ethical sourcing, and tax compliance. Staying informed and working with legal and customs experts ensures long-term business viability and consumer trust in the competitive U.S. jewelry market.

In conclusion, sourcing jewelry suppliers in the USA offers numerous advantages, including access to high-quality materials, adherence to ethical and sustainable practices, shorter lead times, and strong legal protections for intellectual property. Domestic suppliers often provide greater transparency, reliable communication, and the ability to build personalized, long-term partnerships. While costs may be higher compared to overseas alternatives, the benefits of supporting local businesses, ensuring product integrity, and maintaining supply chain control can far outweigh the initial investment. By carefully vetting suppliers through trade shows, industry directories, certifications, and direct engagement, businesses can establish reliable sourcing networks that align with their values and quality standards. Ultimately, sourcing jewelry suppliers within the USA supports not only economic growth and craftsmanship but also fosters responsible and sustainable practices in the jewelry industry.