The global personal watercraft (PWC) market—driven by rising recreational water sports participation and increasing disposable incomes—was valued at USD 3.87 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% through 2030, according to Grand View Research. This sustained expansion is fueling demand for high-performance jetski parts, from engine components to hull systems and electronic controls. As OEMs and aftermarket suppliers scale production to meet evolving consumer expectations for speed, durability, and efficiency, the supply chain has seen consolidation among key manufacturers with advanced R&D capabilities and global distribution networks. Based on market presence, product innovation, and technical expertise, here are the top 9 jetski parts manufacturers shaping the future of the PWC industry.

Top 9 Jetski Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

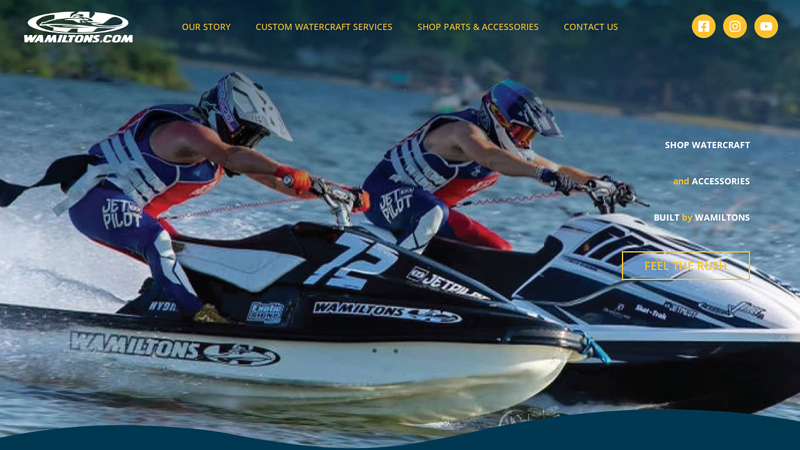

#1 PWC Custom Parts Manufacturer, Distributor & Jet Ski Repair

Domain Est. 1997

Website: wamiltons.com

Key Highlights: Wamiltons Customs is a personal watercraft parts manufacturer & distributor. We also specialize jet ski & yacht tender repair & service ….

#2 Sea Doo Parts Finder

Domain Est. 1999

Website: factoryrecreation.com

Key Highlights: Factory Recreation is a powersports dealer for new and used motorcycles, atvs, snowmobiles, jetskis, boats and more, as well as parts and services in ……

#3 About Partzilla.com

Domain Est. 2003

Website: partzilla.com

Key Highlights: Partzilla.com is the premier OEM parts dealer and distributor. Our goal is to get you up and running whether you need genuine parts, an aftermarket upgrade….

#4 Kawasaki OEM Parts Free Shipping in US Motorcycle

Domain Est. 2012

Website: kawasakioemparts.com

Key Highlights: Kawasaki OEM parts, where America goes for motorcycle, ATV, Jetski Kawasaki OEM Parts and Accessories with Free Shipping on orders of $100 or more in the ……

#5 Mikuni American Corporation

Domain Est. 1994

Website: mikuni.com

Key Highlights: The Mikuni Group manufactures superior products for a wide range of industries, including automotive, commercial vehicles, powersports, general purpose, ……

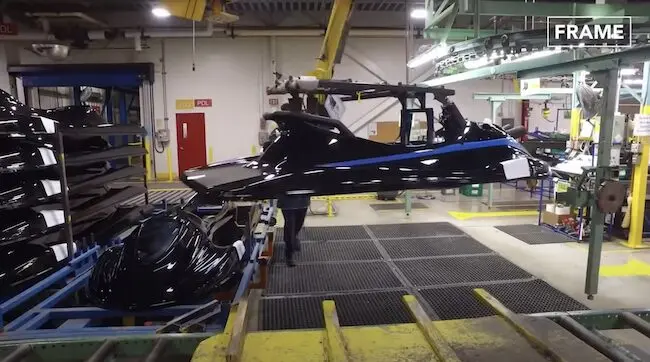

#6 BRP

Domain Est. 1995

Website: brp.com

Key Highlights: Discover BRP, the world leader in the snowmobile, all-terrain & side-by-side vehicle, 3-wheel motorcycle and personal watercraft industries….

#7 Karavan Trailers

Domain Est. 2000

Website: karavantrailers.com

Key Highlights: Karavan Trailer has a selection of boat, jetski, ATV, and utility trailers are built to last & there when you need them….

#8 PWC, Marine, ATV, UTV & Dirt Bike Parts

Domain Est. 2003

Website: wsmparts.com

Key Highlights: We supply some of the top engine and drive parts for the Powersports markets and the Marine Industry throughout the world….

#9 Jetski Parts

Domain Est. 2014

Website: jspmanufacturing.com

Key Highlights: Free deliveryWe have a large selection of new aftermarket parts available for your jet ski. Many of our new jet ski parts fit Kawasaki, SeaDoo, Tigershark, Polaris, Honda ……

Expert Sourcing Insights for Jetski Parts

H2: 2026 Market Trends for Jet Ski Parts

The global jet ski parts market is poised for significant transformation by 2026, driven by technological innovation, shifting consumer behavior, and growing participation in water sports. As personal watercraft (PWC) continue to gain popularity among recreational users and performance enthusiasts, the demand for high-quality, durable, and technologically advanced parts is accelerating. Below are key trends expected to shape the jet ski parts market in 2026:

1. Rising Demand for Performance and Aftermarket Upgrades

Enthusiasts are increasingly investing in aftermarket jet ski parts to enhance speed, handling, and fuel efficiency. Performance components such as upgraded impellers, high-flow intake grates, and performance exhaust systems are in high demand. Customization options and modular part designs are becoming more prevalent, allowing riders to tailor their PWCs to specific riding styles—ranging from freestyle to long-distance touring.

2. Growth in E-Commerce and Direct-to-Consumer Sales

Online marketplaces and specialized e-commerce platforms are dominating the distribution of jet ski parts. By 2026, a majority of consumers are expected to purchase parts through digital channels due to convenience, competitive pricing, and access to customer reviews. Major brands are investing in direct-to-consumer (DTC) sales models, offering subscription services for maintenance parts and bundled accessory kits.

3. Advancements in Material Science and Durability

Manufacturers are increasingly using lightweight, corrosion-resistant materials such as reinforced polymers, marine-grade aluminum, and composite alloys. These materials extend the lifespan of critical components like hulls, wear rings, and intake systems, particularly in saltwater environments. Sustainability is also influencing material choices, with some companies exploring recycled and bio-based composites.

4. Integration of Smart Technology and IoT

Jet ski parts are becoming smarter, with sensors and IoT-enabled components allowing real-time monitoring of engine performance, fuel consumption, and part wear. By 2026, smart gauges, GPS-integrated control modules, and predictive maintenance systems are expected to become standard in high-end models and available as aftermarket upgrades. This shift supports proactive servicing and reduces downtime.

5. Expansion of the Used and Refurbished Parts Market

With the rising cost of new PWCs and parts, there is growing interest in reconditioned and recycled components. Certified refurbished parts—especially engines, electronics, and superchargers—are gaining consumer trust. Third-party certification programs and warranties are helping legitimize this segment, making it a cost-effective alternative for budget-conscious riders.

6. Regional Market Growth and Emerging Economies

While North America and Europe remain dominant markets, regions like Southeast Asia, the Middle East, and Latin America are witnessing rapid growth in water sports tourism and PWC ownership. This expansion is fueling demand for replacement parts and servicing infrastructure. Local distributors and regional manufacturing hubs are emerging to support this growth.

7. Emphasis on Sustainability and Regulatory Compliance

Environmental regulations are pushing manufacturers to develop eco-friendly jet ski parts that reduce emissions and noise pollution. Parts compatible with alternative fuel systems (e.g., hybrid-electric conversions) are under development. Additionally, end-of-life part recycling programs are becoming more common, aligning with global sustainability goals.

Conclusion

By 2026, the jet ski parts market will be characterized by innovation, digitalization, and customization. Companies that invest in R&D, embrace e-commerce, and align with environmental standards will be best positioned to capture market share. As the line between recreational equipment and smart marine vehicles blurs, the role of high-performance, intelligent, and sustainable parts will be central to the future of the industry.

Common Pitfalls When Sourcing Jet Ski Parts (Quality, IP)

Sourcing jet ski (personal watercraft) parts can be a complex process, especially when balancing cost, quality, and legal considerations. Two major pitfalls—compromised quality and intellectual property (IP) issues—can lead to performance problems, safety risks, and even legal liability. Being aware of these challenges is essential for dealers, repair shops, and enthusiasts alike.

Poor Quality and Counterfeit Components

One of the most frequent issues when sourcing jet ski parts is encountering substandard or counterfeit components, particularly from non-OEM (original equipment manufacturer) suppliers or overseas markets. These parts may appear identical to genuine ones but often fail to meet the rigorous performance and safety standards required for marine environments.

- Material Deficiencies: Low-quality plastics, metals, or seals may degrade quickly when exposed to saltwater, UV radiation, or high engine temperatures, leading to premature failure.

- Performance Issues: Non-OEM parts may not fit precisely or function as intended, resulting in reduced engine efficiency, handling problems, or increased wear on other components.

- Safety Risks: Critical parts like impellers, fuel lines, or electrical connectors that fail under stress can cause accidents or leave riders stranded.

- Lack of Testing: Counterfeit or imitation parts are rarely subjected to the same durability and safety testing as OEM parts, increasing the likelihood of defects.

To mitigate this, buyers should verify supplier credentials, request product certifications, and prioritize parts with traceable manufacturing origins.

Intellectual Property (IP) Infringement

Another significant risk when sourcing jet ski parts—especially aftermarket or replica components—is the potential for intellectual property violations. Major manufacturers like Yamaha (WaveRunner), Sea-Doo (BRP), and Kawasaki (Jet Ski) hold trademarks, patents, and copyrights on their designs and branding.

- Trademark Violations: Using branded logos, model names, or distinctive design elements without authorization can lead to legal action. Even if a part is functionally identical, using a trademarked name (e.g., “GTX-style” or “copy of Yamaha OEM”) may constitute infringement.

- Patented Designs: Functional components such as hull shapes, intake systems, or engine configurations may be protected by utility or design patents. Manufacturing or selling replicas without a license can result in lawsuits.

- Gray Market Goods: Parts imported without the brand owner’s consent may violate IP rights and void warranties. Distributors and retailers can be held liable for selling such items.

- Reputational and Legal Risk: Businesses caught sourcing or selling IP-infringing parts may face fines, product seizures, or damage to their reputation.

To avoid IP pitfalls, purchasers should ensure suppliers provide legal documentation, avoid parts that mimic branded designs too closely, and confirm that aftermarket components are designed to be compliant with IP laws (e.g., reverse-engineered within legal limits).

In summary, while cost savings may tempt buyers to opt for non-OEM or international suppliers, the risks associated with poor quality and IP infringement can far outweigh short-term benefits. Due diligence, supplier vetting, and a focus on compliance are critical for safe, legal, and reliable jet ski part sourcing.

Logistics & Compliance Guide for Jet Ski Parts

Navigating the logistics and compliance landscape is essential when importing, exporting, or distributing jet ski parts. This guide outlines key considerations to ensure smooth operations, avoid delays, and remain compliant with international and domestic regulations.

Understanding Product Classification

Accurately classifying jet ski parts is the foundation of compliant logistics. Most components fall under the Harmonized System (HS) codes within Chapter 89 (Ships, Boats, and Floating Structures). Common classifications include:

- 8908.00 – Parts and accessories for pleasure or sporting boats

- 8407.33 – Outboard motors and parts (if applicable)

- 8536.69 – Electrical control systems and switches

Always verify the correct HS code with your country’s customs authority, as misclassification can lead to fines or shipment delays.

Import & Export Regulations

Compliance with customs regulations is mandatory for cross-border trade:

- Export Controls: Certain high-performance or electronic components (e.g., GPS modules, throttle controls) may be subject to export restrictions under regulations like the Export Administration Regulations (EAR) in the U.S. Check if parts require licenses based on destination and technology.

- Import Duties & Taxes: Duties vary by country and HS code. Use binding tariff information (BTI) rulings where available to ensure predictable costs.

- Documentation: Ensure accurate commercial invoices, packing lists, certificates of origin, and bills of lading. Include detailed part descriptions, quantities, values, and HS codes.

Shipping & Transportation

Efficient and compliant shipping ensures timely delivery:

- Packaging: Use durable, moisture-resistant packaging. Clearly label parts with item numbers, barcodes, and handling instructions (e.g., “Fragile,” “Do Not Stack”).

- Mode of Transport: Choose between air (fast, expensive), ocean (cost-effective, slower), or ground (for regional distribution). Hazardous components (e.g., batteries) require special handling and labeling.

- Carrier Requirements: Confirm carrier-specific rules for dimensions, weight, and hazardous materials. Use freight forwarders experienced in marine equipment logistics.

Regulatory Compliance

Ensure parts meet safety and environmental standards in target markets:

- U.S. (EPA & Coast Guard): Parts affecting emissions (e.g., carburetors, exhaust systems) must comply with EPA marine engine regulations. Safety-related parts (e.g., kill switches, lanyards) must meet U.S. Coast Guard standards.

- European Union (CE Marking): Parts must comply with directives such as the Recreational Craft Directive (RCD), Electromagnetic Compatibility (EMC), and RoHS (Restriction of Hazardous Substances).

- Other Markets: Check local requirements (e.g., Transport Canada, Australian Design Rules).

Aftermarket & OEM Compliance

Distinguish between original equipment manufacturer (OEM) and aftermarket parts:

- OEM Parts: Must match specifications and carry manufacturer authorization. Counterfeit OEM parts risk legal action and safety issues.

- Aftermarket Parts: Must not infringe on patents or trademarks. Clearly label as “aftermarket” and ensure compatibility and safety.

Recordkeeping & Traceability

Maintain detailed records for compliance audits and recalls:

- Track batch numbers, suppliers, shipment dates, and customer deliveries.

- Implement a traceability system (e.g., barcode/QR code) for high-risk or safety-critical components.

Environmental & Disposal Regulations

Address environmental responsibilities:

- Batteries & Oils: Classify and ship under ADR/IATA/IMDG rules if transporting hazardous materials.

- End-of-Life Parts: Comply with local waste disposal and recycling regulations (e.g., WEEE in the EU).

Best Practices Summary

- Verify HS codes and regulatory requirements before shipping.

- Partner with experienced customs brokers and freight forwarders.

- Maintain up-to-date compliance documentation.

- Train staff on international shipping procedures and product regulations.

- Monitor regulatory changes in key markets.

By adhering to these logistics and compliance guidelines, businesses can minimize risks, reduce delays, and build trust with customers and regulators in the jet ski parts industry.

In conclusion, sourcing Jet Ski parts requires careful consideration of several key factors to ensure performance, reliability, and cost-effectiveness. It is essential to identify genuine OEM (Original Equipment Manufacturer) parts versus compatible aftermarket options, balancing quality and budget. Reliable suppliers, whether online or local, should be evaluated based on reputation, warranty offerings, and customer service. Additionally, understanding the specific model and year of your Jet Ski is crucial for compatibility. Proper research, verification of part numbers, and timely ordering can prevent prolonged downtime. Ultimately, a strategic sourcing approach—prioritizing quality, authenticity, and support—will lead to longer-lasting performance and a safer, more enjoyable riding experience.