The global automotive engine import market has seen steady expansion, driven by rising demand for fuel-efficient, high-performance powertrains and increasing vehicle production in emerging economies. According to Mordor Intelligence, the automotive engine market is projected to grow at a CAGR of over 4.2% from 2023 to 2028, with Asia-Pacific—particularly Japan—remaining a pivotal hub for engine manufacturing and export. Japan’s reputation for precision engineering, reliability, and technological innovation positions its engine manufacturers as key players in international supply chains. Fueled by advancements in hybrid and clean diesel technologies, Japanese engine exports continue to command significant market share globally, especially in North America, Europe, and Southeast Asia. As demand for durable, efficient engines rises, these top 10 Japanese manufacturers stand out for their production volume, technological leadership, and export performance—backed by consistent growth trends highlighted in industry reports from Grand View Research and Mordor Intelligence.

Top 10 Japanese Engine Import Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

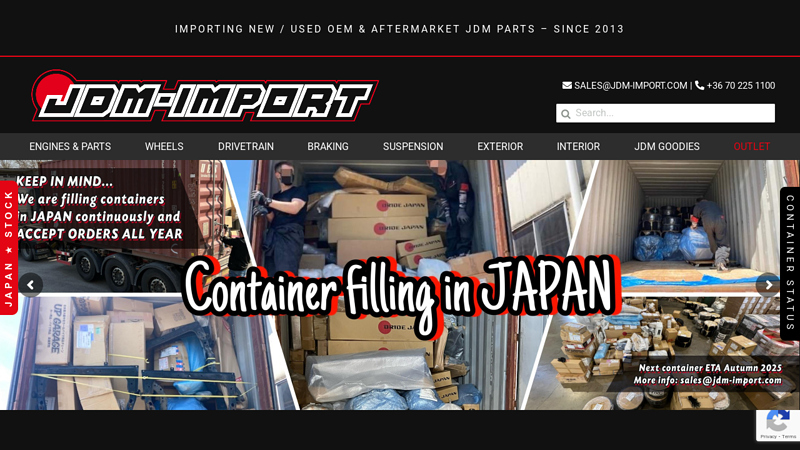

#1 JDM

Domain Est. 2013

Website: jdm-import.com

Key Highlights: WELCOME TO The home of No.1 European JDM car parts seller JDM Performance and racing parts from all Japanese brands and manufacturers ……

#2 Japanese Classics

Domain Est. 2002

Website: japaneseclassics.com

Key Highlights: Japanese Classics is the premier US dealer of Japanese Domestic Market (JDM) vehicles. We select only the best right-hand drive (RHD) cars, SUVs, vans, and ……

#3 Toprank Importers

Domain Est. 2011

Website: importavehicle.com

Key Highlights: JDM imports for sale in California — R34 GT-R, S15 Silvia, and more. Toprank Importers is your trusted source for rare and legal Japanese cars….

#4 JDM of California

Domain Est. 2014

Website: jdmcalifornia.com

Key Highlights: All our products are directly imported from Japan, ensuring high-quality, low-mileage JDM engines and parts. Each item is carefully sourced and inspected to ……

#5 JDM Engines Imports

Domain Est. 2015

Website: jdmenginesimport.com

Key Highlights: JDM Engines Imports · 1 Select Brand. ACURA; AUDI; FORD; HONDA; INFINITI; MAZDA; MINI; MITSUBISHI; NISSAN; SCION; SUBARU; TOYOTA; LEXUS · 2 Select Model · 3 Select ……

#6 Jdm Motor Import

Domain Est. 2015

Website: jdmmotorimport.com

Key Highlights: Looking for that reliable engine or transmission? We have it here at JDM Motor Import. Onto of our wide variety of Japanese parts, we offer our support….

#7 JDM Westcoast

Domain Est. 2015

Website: jdmwestcoast.com

Key Highlights: $200 deliveryThe premiere supplier of Japanese Domestic Market Motors, JDM West Coast strives to provide you with the absolute best in JDM engines and auto parts….

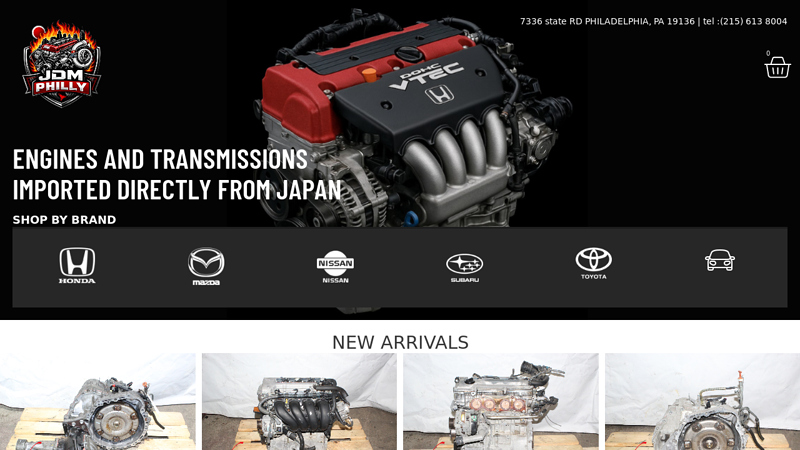

#8 JDM Engine PA

Domain Est. 2016

Website: jdmenginepa.com

Key Highlights: Shop low-mileage, high-quality JDM engines & transmissions from Japan. U.S. shipping. Top brands like Nissan, Subaru, Toyota, Mazda….

#9 Japan Motor

Domain Est. 2019

Website: japan-motor.com

Key Highlights: Company exports Japanese used vehicles, car. We buy the best quality JDM used cars from dealership and Japanese car auctions which meets your requirements….

#10 JDM Sport Classics – Japanese Classics

Domain Est. 2019

Website: jdmsportclassics.com

Key Highlights: We work tirelessly, scouring the Japanese Domestic Market for the highest quality vintage, premium, and classic right hand drive JDM cars over 25 years old….

Expert Sourcing Insights for Japanese Engine Import

2026 Market Trends for Japanese Engine Imports: A Hydrogen Horizon (H2) Perspective

The global shift toward decarbonization is fundamentally reshaping the automotive and industrial engine landscape. By 2026, the import market for Japanese engines will be profoundly influenced by this transition, with hydrogen (H2) emerging as a critical, albeit complex, factor. While traditional internal combustion engine (ICE) imports will persist, the trajectory is increasingly defined by hydrogen-powered technology and related components. Here’s a breakdown of key trends shaping the 2026 Japanese engine import market through the H2 lens:

1. Rising Demand for Hydrogen Fuel Cell Systems & Components:

* Core Trend: The most significant H2-driven trend will be the surge in imports of Japanese hydrogen fuel cell (FC) stacks, systems, and key components (e.g., compressors, humidifiers, control units). Japan (led by Toyota, Honda, and suppliers like Denso) remains a global leader in FC technology.

* Drivers:

* Regulatory Pressure: Stricter global emissions standards (e.g., Euro 7, China 6b, US EPA rules) and net-zero targets are pushing heavy-duty transport (trucks, buses, potentially trains/ships) and industrial applications towards zero-emission solutions where batteries are less viable. H2 FC is a primary alternative.

* Infrastructure Development: While still nascent, significant investments in H2 refueling infrastructure (especially in Europe, China, and parts of North America) will create demand for FC vehicles and their engines, driving imports of Japanese FC systems known for reliability and efficiency.

* Heavy-Duty Focus: Japanese FC technology is particularly advanced for commercial vehicles. Imports of FC-powered truck and bus powertrains will be a major growth segment.

* 2026 Outlook: Expect a substantial increase in the volume and value of imported Japanese FC systems, particularly targeting the commercial vehicle sector in key export markets like Europe, China, Southeast Asia, and potentially North America.

2. Evolution of “Hybrid” ICE Engines (H2-ICE & e-Fuels):

* Core Trend: While pure battery electric vehicles (BEVs) dominate light-duty, Japan is investing heavily in alternative pathways for existing ICE platforms. This includes:

* Hydrogen Internal Combustion Engines (H2-ICE): Engines modified to burn gaseous hydrogen (e.g., Toyota’s GR Corolla H2 concept). These leverage existing manufacturing but produce near-zero tailpipe emissions (mainly NOx, manageable).

* Synthetic Fuels (e-Fuels): Engines optimized to run on carbon-neutral synthetic fuels, potentially produced using green H2. Japan sees this as a way to preserve ICE heritage and performance.

* Drivers:

* Preserving ICE Ecosystem: Allows automakers and suppliers to extend the life of ICE technology and manufacturing investments.

* Performance & Range: H2-ICE and e-Fuels offer potential advantages in refueling speed and range compared to batteries for certain applications.

* Niche Markets & Enthusiasts: Appeal to markets or segments resistant to full electrification or valuing traditional driving characteristics.

* 2026 Outlook: Exports of H2-ICE prototypes, demonstration units, and potentially limited-production engines (e.g., for motorsport or specific industrial uses) will begin. Imports of engines designed for e-Fuels will likely be minimal by 2026 due to e-Fuel scarcity and cost, but represent a future-looking segment. H2-ICE faces challenges (storage, efficiency, NOx) limiting widespread adoption soon.

3. Strategic Export of Advanced ICE & Hybrid Components (Leveraging H2 Tech):

* Core Trend: Japanese manufacturers will continue exporting high-efficiency, low-emission conventional and hybrid (HEV/PHEV) engines and components. Crucially, the R&D and manufacturing expertise gained from H2 projects (e.g., high-pressure systems, advanced materials, thermal management, control systems) will enhance the performance and efficiency of all engine types they export.

* Drivers:

* Market Demand: Significant global demand for efficient ICEs and hybrids will persist, especially in emerging markets and for specific vehicle types (SUVs, trucks) where BEV adoption is slower.

* Technology Spillover: H2 development drives innovation in materials (for H2 compatibility), sensors, and control algorithms that benefit conventional engine efficiency and durability.

* Profitability: HEVs and efficient ICEs remain highly profitable and fund R&D for future H2 and BEV technologies.

* 2026 Outlook: Robust exports of advanced Japanese ICE and hybrid engines will continue, forming the bulk of engine import volumes in many regions. The “H2 effect” will be indirect but significant, making these engines more competitive.

4. Infrastructure & Support Equipment Imports:

* Core Trend: The growth of H2 adoption will drive demand for supporting Japanese technology beyond the engine itself. This includes:

* High-pressure hydrogen storage tanks (Type IV).

* Advanced hydrogen sensors and safety systems.

* Specialized materials and coatings resistant to hydrogen embrittlement.

* Diagnostic and service equipment for H2 systems.

* Drivers: The need for safe, reliable, and efficient H2 handling in vehicles and potentially for industrial H2 engine applications.

* 2026 Outlook: Increasing, though smaller volume, imports of these specialized Japanese components will support the deployment of both FC and H2-ICE vehicles.

5. Challenges & Uncertainties Impacting H2-Driven Imports:

* H2 Cost & Availability: Green hydrogen remains expensive. Widespread H2-ICE or even FC adoption hinges on drastically reducing H2 production (via electrolysis powered by renewables) and distribution costs. This is a major bottleneck for 2026.

* Infrastructure Gap: The lack of widespread H2 refueling infrastructure severely limits the practicality of H2-powered vehicles, constraining demand for the engines.

* Efficiency Debate: H2-ICE is significantly less energy-efficient than BEVs or even FCVs. This makes it a less compelling long-term solution for many.

* Competition: Intense competition from rapidly improving BEV technology and falling battery costs.

* Regulatory Clarity: Global standards for H2 safety, emissions (especially NOx for H2-ICE), and “green” hydrogen certification are still evolving.

Conclusion for 2026:

By 2026, the Japanese engine import market will be characterized by a dual-track evolution heavily influenced by H2:

- The Primary H2 Impact: A significant and growing stream of imports focused on Japanese Hydrogen Fuel Cell systems, primarily for heavy-duty commercial vehicles, driven by decarbonization mandates and infrastructure development. This will be the most direct and impactful H2 trend.

- The Secondary H2 Impact: The continued export of highly refined conventional, hybrid, and emerging H2-ICE engines, where H2 R&D indirectly enhances overall engine technology. H2-ICE exports will be niche but visible.

- The Foundation: Strong ongoing imports of advanced traditional ICE and hybrid engines, still dominant in volume but increasingly developed with H2-related technological advancements.

Success for Japanese exporters by 2026 will depend on overcoming H2 cost and infrastructure hurdles, particularly for FCs, while leveraging their technological leadership and efficiency gains across all powertrain types. The “H2” factor will be less about mass-market H2-ICE cars and more about establishing FC dominance in commercial transport and advancing core engine technology through H2-related innovation.

Common Pitfalls When Sourcing Japanese Engine Imports (Quality, IP)

Sourcing Japanese engines for import can offer performance and reliability benefits, but it comes with significant risks related to quality and intellectual property (IP). Being aware of these pitfalls is crucial to avoid costly mistakes and legal complications.

Quality-Related Pitfalls

Unclear Maintenance and Usage History

Many imported Japanese engines originate from used vehicles with limited or falsified service records. Buyers may not know if the engine was regularly maintained, subjected to harsh driving conditions, or involved in accidents, leading to premature failure.

Hidden Damage or Wear

Engines may appear functional but harbor internal damage such as worn bearings, cylinder wall scoring, or turbocharger issues. Without a full tear-down inspection or compression test, these problems often go undetected until after installation.

Incompatibility with Local Fuel and Emissions Standards

Japanese domestic market (JDM) engines are calibrated for Japan’s fuel quality and emissions regulations. When imported into countries with lower octane fuel or stricter emission laws, performance may degrade, and the engine could fail emissions testing or cause long-term damage.

Lack of Warranty and After-Sales Support

Most imported engines are sold “as-is” without manufacturer warranty. If a defect emerges post-installation, repair costs fall entirely on the buyer, with few authorized service centers available for support.

Intellectual Property (IP)-Related Pitfalls

Unauthorized Use of Branding and Trademarks

Some suppliers affix OEM logos or model names (e.g., Toyota TRD, Nissan NISMO) to engines or parts without licensing. Importing or reselling these items may constitute trademark infringement, leading to customs seizures or legal action.

Replica or Counterfeit Components

Engines may include aftermarket parts falsely labeled as genuine OEM. These replicas not only compromise performance and safety but also expose importers to IP liability if they knowingly distribute misbranded goods.

Patented Technologies and Licensing Issues

Advanced engine technologies (e.g., variable valve timing, direct injection systems) are often protected by patents. Modifying or reverse-engineering imported engines for resale may infringe on these patents, especially in jurisdictions with strong IP enforcement.

Grey Market and Distribution Rights Violations

Importing engines outside official distribution channels may breach territorial licensing agreements. OEMs can challenge such imports under IP or competition laws, resulting in fines, injunctions, or forced recalls.

Avoiding these pitfalls requires due diligence, including verification of engine history, pre-shipment inspections, legal review of branding and components, and consultation with IP and customs experts before importing.

Logistics & Compliance Guide for Importing Japanese Engines into [Your Target Country]

Note: Replace [Your Target Country] with the actual destination country (e.g., USA, Australia, Canada, EU Country), as regulations vary significantly. This guide provides a general framework based on common requirements, but country-specific rules are paramount.

Understanding the Engine Type and Classification

- Identify the Engine: Determine the exact type (e.g., gasoline, diesel, hybrid, rotary), displacement, model (e.g., 2JZ-GTE, SR20DET), year of manufacture, and original vehicle application. This is crucial for classification and regulations.

- HS Code Classification: Obtain the correct Harmonized System (HS) code for the engine. This 6-10 digit code determines import tariffs, taxes, and regulatory oversight. Common starting points might be 8407 (Spark-ignition engines) or 8408 (Compression-ignition engines), but the full code depends on specifics. Consult your target country’s customs authority or a licensed customs broker for the definitive code.

Pre-Shipment Requirements in Japan

- Export Documentation:

- Commercial Invoice: Detailed invoice from the Japanese seller/exporter, including seller/buyer info, engine description (make, model, serial number, year), value (FOB – Free On Board port), currency, and Incoterms (e.g., FOB Yokohama).

- Packing List: Itemizes contents, weight, dimensions of the shipping package(s).

- Certificate of Origin (Japan): Often required, confirming the engine was manufactured in Japan. May need certification by a Japanese Chamber of Commerce.

- Bill of Lading (B/L) or Air Waybill (AWB): Issued by the freight forwarder/carrier, serving as the contract of carriage and title document. Choose between “Straight” (non-negotiable) or “To Order” (negotiable).

- Japanese Export Procedures:

- Dismantling & Preparation: Engines are typically removed from vehicles by Japanese dismantlers (“Yan” or “Recycling Shops”). Ensure the engine is properly drained of all fluids (oil, coolant, fuel).

- De-registration: The original Japanese vehicle is de-registered upon export. The engine itself doesn’t require separate de-registration.

- Export License (Check): Verify if Japan requires an export license for engines. Generally, standard automotive parts do not, but confirm with the exporter or Japanese customs.

- Packing & Marking: Engines must be securely crated or palletized to withstand ocean/air transit. Crates should be marked with buyer info, engine details, HS code, and handling instructions (e.g., “Fragile,” “This Side Up”). ISPM 15 compliant wooden crates (heat-treated/sterilized) are often required to prevent pest spread.

International Shipping & Logistics

- Choose Freight Mode:

- Ocean Freight (FCL/LCL): Most common and cost-effective for heavy engines. Full Container Load (FCL) offers security; Less than Container Load (LCL) is cheaper for single engines but shares space.

- Air Freight: Significantly faster but much more expensive, rarely used for standard engine imports unless urgent.

- Select a Freight Forwarder: Use a reliable forwarder experienced in Japan-to-[Target Country] automotive parts shipments. They handle booking, documentation, inland transport in Japan, and coordination with the carrier.

- Incoterms: Clearly agree on Incoterms with the seller (e.g., FOB, CIF, DAP). FOB is common, meaning you (buyer) take responsibility (and cost) once the engine is loaded onto the vessel at the Japanese port.

- Shipping Route: Typical departure ports in Japan include Yokohama, Osaka, Nagoya, or Kobe. Destination port depends on the target country.

Import Clearance in [Your Target Country]

- Engage a Licensed Customs Broker: Essential. A broker navigates complex customs procedures, submits documentation electronically, calculates duties/taxes, and ensures compliance.

- Submit Import Documentation: The broker files the entry with customs, including:

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Certificate of Origin

- Importer Security Filing (ISF – for sea shipments to USA, for example)

- Any permits or licenses required by regulators.

- Pay Duties, Taxes, and Fees:

- Import Duty: Calculated based on the engine’s HS code and declared value (usually CIF value: Cost + Insurance + Freight). Rates vary significantly by country and engine type.

- Value Added Tax (VAT) / Goods and Services Tax (GST) / Sales Tax: Applied to the CIF value plus the import duty.

- Customs Processing Fees: Charged by the broker and/or customs authority.

- Port/Airport Handling Fees, Terminal Charges: Paid to the terminal operator.

- Customs Inspection: Customs may physically examine the shipment. Ensure the engine is easily accessible and matches documentation. Be prepared for potential delays.

Key Compliance & Regulatory Considerations

- Emissions & Environmental Regulations:

- [Critical – Target Country Specific]: This is often the biggest hurdle. Most countries have strict emissions standards (e.g., EPA in USA, ADR in Australia, Euro standards in EU). Engines manufactured for the Japanese domestic market (JDM) frequently do not meet the emissions requirements of other countries. Importing a non-compliant engine may be illegal or require costly and complex modifications to certify. Research the specific regulations thoroughly before purchasing.

- Vehicle Safety Standards:

- If the engine is intended for use in a vehicle, ensure it can be integrated in a way that allows the entire vehicle to meet the target country’s safety standards (e.g., FMVSS in USA, CMVSS in Canada, ADR in Australia). Modifications might be necessary.

- Age Restrictions:

- Some countries have “25-year rule” (USA) or similar regulations allowing easier import of vehicles/engines over a certain age without needing to meet current emissions/safety standards. Verify if this applies and the specific age cutoff.

- Homologation/Certification:

- Certain countries may require the engine (or the vehicle it’s going into) to undergo homologation or obtain specific certification before registration. This can be complex and expensive.

- DOT Regulations (USA Specific): If importing parts into the USA, be aware of Department of Transportation (DOT) regulations, though engines themselves are less commonly subject to DOT than safety-critical components.

Post-Clearance

- Delivery: Arrange for trucking from the port/airport to your final destination (warehouse, workshop). The broker or forwarder usually arranges this.

- Record Keeping: Maintain all import documentation (invoices, B/L, duty/tax receipts) for the required period (often 5-7 years) as required by customs.

- Registration (If Applicable): If installing the engine in a vehicle, follow the target country’s vehicle registration process, which may require inspection to verify compliance.

Disclaimer: This guide provides general information. Import regulations, duties, and compliance requirements are highly specific to the destination country and subject to change. ALWAYS consult with a licensed customs broker and relevant government agencies (Customs, Environmental Protection, Transportation Department) in your target country before proceeding with an import. Failure to comply can result in shipment seizure, fines, and penalties.

Conclusion: Sourcing Japanese Engine Imports

Sourcing Japanese engines for import presents a strategic opportunity for businesses and individuals seeking high-quality, reliable, and cost-effective powertrain solutions. Japanese engines are widely recognized for their durability, fuel efficiency, advanced engineering, and low maintenance requirements, making them a preferred choice in both mature and emerging markets.

The well-established export infrastructure in Japan, combined with stringent quality control standards and transparent auction grading systems, ensures that imported engines are generally in excellent condition and thoroughly inspected before sale. Additionally, Japan’s large domestic market and early vehicle replacement cycle result in a consistent and plentiful supply of low-mileage used and reconditioned engines, offering excellent value compared to new units.

However, successful sourcing requires due diligence. Importers must navigate regulatory compliance (such as emissions standards and import duties), verify engine specifications and compatibility, and partner with reputable suppliers or auction channels. Logistics, customs clearance, and potential reconditioning costs should also be factored into the total investment.

In conclusion, with proper research, reliable supply chain partners, and compliance with local regulations, importing Japanese engines can be a highly advantageous solution for automotive repair, restoration, and commercial vehicle operations. It offers a sustainable and economical alternative to new engine manufacturing, supporting both business efficiency and environmental goals through the reuse of high-quality components.