The global irrigation water pump market is experiencing robust growth, driven by rising agricultural intensification, water scarcity concerns, and increasing adoption of efficient irrigation systems. According to a report by Mordor Intelligence, the irrigation pumps market was valued at USD 11.5 billion in 2023 and is projected to grow at a CAGR of over 7.5% from 2024 to 2029. Similarly, Grand View Research estimates that the market size surpassed USD 12.8 billion in 2022 and is expected to expand at a CAGR of 7.3% through 2030, fueled by advancements in energy-efficient pumping technologies and supportive government initiatives promoting sustainable agriculture. With solar-powered and submersible pumps gaining traction across both developed and emerging markets, demand for reliable and high-performance irrigation solutions continues to rise. Amid this growth trajectory, key manufacturers are innovating to meet evolving agricultural needs, making it essential to identify the leading players shaping the industry.

Top 10 Irrigation Water Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Pumps Manufacturer

Domain Est. 1997

Website: gouldspumps.com

Key Highlights: Industrial Pumps Manufacturer for a wide range of markets — including chemical, mining, oil & gas, power generation, pulp and paper, and general industry….

#2 Grundfos USA

Domain Est. 1995

Website: grundfos.com

Key Highlights: The full range supplier of pumps and pump solutions. As a renowned pump manufacturer, Grundfos delivers efficient, reliable, and sustainable solutions all ……

#3 Goulds Water Technology

Domain Est. 1995

Website: goulds.com

Key Highlights: Gould purchased a pump making business. Today, Goulds Water Technology brand is a leader of residential, commercial and agricultural products globally….

#4 Wilo USA

Domain Est. 1996

Website: wilo.com

Key Highlights: Wilo is one of the world’s leading manufacturers of pumps and pump systems for building services, water management, and groundwater applications….

#5 Cornell Pump Company

Domain Est. 1997

Website: cornellpump.com

Key Highlights: Cornell Pump Company in Clackamas, Oregon, is a trusted manufacturer of high-quality pumps that have been designed in the USA, manufactured in the US with ……

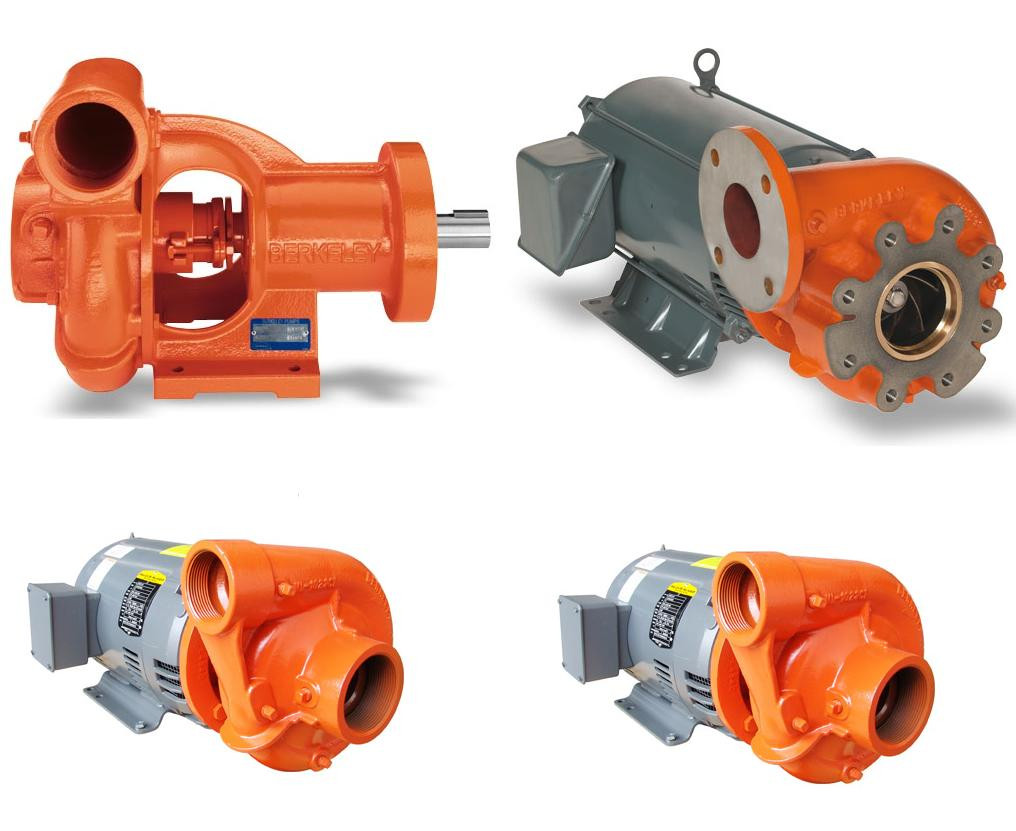

#6 Berkeley

Domain Est. 1996

Website: pentair.com

Key Highlights: Discover efficient water management with Berkeley pumps, From irrigation pumps to residential water pumps, experience quality & performance with Pentair today….

#7 Watertronics

Domain Est. 1997

Website: watertronics.com

Key Highlights: We offer a comprehensive line of pumping solutions for golf courses, commercial landscaping, agriculture, and municipal applications….

#8 Flint & Walling

Domain Est. 2000

Website: flintandwalling.com

Key Highlights: Flint & Walling offers innovative water management solutions and high-quality pumps. Discover reliable products for residential and commercial applications….

#9 Gorman

Domain Est. 2000 | Founded: 1933

Website: grpumps.com

Key Highlights: Since 1933, Gorman-Rupp has manufactured the high-performance, high-quality pumps and pumping systems required for lasting service….

#10 Franklin Water

Domain Est. 2009

Website: franklinwater.com

Key Highlights: Headquartered in Fort Wayne, Indiana, USA, Franklin Electric makes choosing the right products for your water system needs easy….

Expert Sourcing Insights for Irrigation Water Pump

H2: 2026 Market Trends for Irrigation Water Pumps

The global irrigation water pump market is poised for significant transformation by 2026, driven by technological innovation, increasing water scarcity, and the rising demand for sustainable agriculture. Key market trends shaping the industry include the integration of smart technologies, a shift toward energy-efficient systems, regional expansion in developing economies, and growing government support for modern irrigation infrastructure.

Smart Irrigation and IoT Integration

One of the most prominent trends is the adoption of smart irrigation water pumps powered by the Internet of Things (IoT). By 2026, an increasing number of farms are expected to deploy IoT-enabled pumps that monitor soil moisture, weather conditions, and water usage in real time. These systems optimize water distribution, reduce waste, and enhance crop yields. Cloud-based platforms and mobile applications allow farmers to remotely control and monitor pump operations, improving efficiency and reducing labor costs.

Energy Efficiency and Renewable Energy Adoption

Energy costs and environmental concerns are pushing the market toward solar-powered irrigation pumps. The decline in solar panel prices and advancements in photovoltaic technology make solar pumps a cost-effective and sustainable solution, especially in off-grid and rural areas. By 2026, solar-powered pumps are projected to account for a growing share of the market, particularly in regions like Sub-Saharan Africa, South Asia, and parts of Latin America. Governments and international organizations are supporting this trend through subsidies and financing schemes.

Water Scarcity and Precision Agriculture

With climate change exacerbating drought conditions and depleting freshwater resources, efficient water management has become critical. Precision agriculture—utilizing drip and sprinkler irrigation systems paired with high-efficiency pumps—is gaining traction. These systems minimize water loss and ensure targeted delivery, aligning with global efforts to conserve water. As a result, demand for variable-speed and high-efficiency centrifugal and submersible pumps is expected to rise significantly.

Regional Market Expansion

Emerging economies in Asia-Pacific, Africa, and South America are key growth drivers for the irrigation pump market. Countries such as India, China, Nigeria, and Brazil are investing heavily in agricultural modernization and irrigation infrastructure. Government initiatives like India’s Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) are accelerating the adoption of efficient pumping systems. Additionally, increasing farm mechanization and rising farmer awareness about advanced irrigation practices are fueling market growth in these regions.

Consolidation and Innovation Among Manufacturers

The competitive landscape is evolving, with leading manufacturers focusing on product innovation, energy efficiency, and after-sales services. Companies are investing in R&D to develop durable, low-maintenance pumps with enhanced performance. Strategic partnerships, mergers, and acquisitions are also on the rise as firms aim to expand their global footprint and offer integrated irrigation solutions.

In conclusion, by 2026, the irrigation water pump market will be defined by digitalization, sustainability, and regional growth. Stakeholders who embrace smart technologies, renewable energy integration, and precision irrigation will be best positioned to capitalize on these evolving trends.

Common Pitfalls Sourcing Irrigation Water Pumps (Quality, IP Rating)

Sourcing irrigation water pumps requires careful attention to both quality and Ingress Protection (IP) ratings to ensure long-term reliability and performance in demanding agricultural environments. Overlooking these factors can lead to premature failures, increased maintenance costs, and operational downtime. Below are key pitfalls to avoid:

Overlooking Build Quality and Material Durability

Many low-cost pumps use substandard materials like brittle plastics, thin-gauge metals, or low-grade seals and bearings. These components degrade quickly when exposed to continuous operation, abrasive water (with sand or silt), and outdoor weather conditions. Always verify that the pump housing, impeller, and shaft are made from corrosion-resistant materials such as cast iron, stainless steel, or high-quality thermoplastics suitable for prolonged water exposure.

Ignoring the Importance of IP Rating

The IP (Ingress Protection) rating indicates how well the pump’s electrical components are protected against solids (like dust) and liquids (like water). A common mistake is selecting a pump with insufficient IP protection for outdoor or wet environments. For irrigation systems, especially those exposed to rain, sprinkler overspray, or humid conditions, an IP65 or higher rating is recommended. Choosing a pump with only IP44 or lower increases the risk of water ingress, leading to motor failure and electrical hazards.

Assuming All Pumps Are Suitable for Continuous Duty

Some pumps are designed only for intermittent use and overheat or fail under continuous operation typical in irrigation cycles. Ensure the pump is rated for continuous duty (often labeled S1 duty cycle) and has adequate thermal protection. Poor quality pumps may lack proper insulation or cooling mechanisms, leading to shortened motor life.

Failing to Verify Certification and Compliance

Low-quality pumps may lack proper certification (e.g., CE, ISO, or local electrical safety standards), indicating non-compliance with safety and performance benchmarks. Always request certification documentation and verify authenticity. Non-compliant pumps pose safety risks and may not be covered under warranty.

Underestimating the Impact of Poor Sealing and Gasket Quality

Even with a high IP rating, poor manufacturing—such as misaligned housings or low-quality O-rings—can compromise protection. Inspect reviews or request samples to evaluate seal integrity. Failed seals allow moisture into the motor, causing short circuits or corrosion.

Prioritizing Price Over Total Cost of Ownership

The cheapest pump often has the highest lifetime cost due to frequent repairs, energy inefficiency, and early replacement. Investing in a high-quality, properly rated pump reduces downtime and maintenance, offering better value over time.

By addressing these pitfalls—focusing on durable materials, appropriate IP ratings, duty cycle suitability, and verified certifications—you can source a reliable irrigation water pump that performs efficiently and safely throughout its service life.

Logistics & Compliance Guide for Irrigation Water Pumps

Overview

This guide outlines the key logistics considerations and compliance requirements for the international shipment and deployment of irrigation water pumps. Proper planning ensures timely delivery, regulatory adherence, cost efficiency, and operational readiness.

Classification & Documentation

Harmonized System (HS) Code

Identify the correct HS code for customs declaration. Typical codes include:

– 8413.70: Pumps for liquids, whether or not fitted with a measuring device.

– 8501.31 or 8501.32: If the pump is electric motor-driven (AC/DC).

Note: Exact codes vary by country and pump specifications; consult local customs authorities or a licensed customs broker.

Required Documentation

Ensure the following documents are prepared and accurate:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin

– Product Conformity Certificate (e.g., CE, UL, or local standard)

– Technical Data Sheet and User Manual

– Import/Export License (if required)

Packaging & Handling

Packaging Standards

- Use moisture-resistant, durable packaging to protect against environmental exposure during transit.

- Secure pumps with anti-vibration materials to prevent internal damage.

- Clearly label packages with:

- Product name and model

- Weight, dimensions, and handling instructions (e.g., “Fragile,” “This Side Up”)

- HS code and country of origin

Handling Requirements

- Avoid stacking heavy items on pump crates.

- Use appropriate lifting equipment (e.g., forklifts, pallet jacks).

- Store in dry, covered areas before and after transport.

Transportation & Shipping

Mode of Transport

Select based on destination, volume, and urgency:

– Sea Freight: Cost-effective for large shipments; use FCL (Full Container Load) or LCL (Less than Container Load).

– Air Freight: Faster but more expensive; suitable for urgent or lightweight orders.

– Land Freight: Ideal for regional distribution; ensure compliance with cross-border trucking regulations.

Incoterms®

Define responsibilities using appropriate Incoterms® (e.g., FOB, CIF, DDP) to clarify:

– Who arranges transport and insurance

– Where risk transfers from seller to buyer

– Who handles customs clearance

Import & Export Compliance

Export Controls

- Verify if pumps (especially diesel or high-power electric models) are subject to export restrictions in the originating country.

- Check dual-use regulations if components have potential military applications.

Import Regulations

- Confirm tariff rates and import duties in the destination country.

- Be aware of anti-dumping measures or safeguard tariffs on machinery imports.

- Some countries require pre-shipment inspections (e.g., SPS, SONCAP, COC).

Product Standards & Certification

Safety & Performance Standards

Ensure pumps meet destination-market requirements:

– European Union: CE marking per Machinery Directive, EMC Directive, and RoHS.

– United States: EPA and DOE efficiency standards; UL/ETL certification for electric models.

– Canada: CSA certification; compliance with Energy Efficiency Regulations.

– Australia/NZ: MEPS (Minimum Energy Performance Standards) and RCM mark.

– India: BIS certification under IS 4314 or IS 12975.

Environmental Compliance

- Adhere to restrictions on hazardous substances (e.g., lead, cadmium) per RoHS or similar laws.

- Include disposal instructions for end-of-life equipment in user manuals.

Customs Clearance & Duties

Duty Calculation

- Duties vary by country; typical rates range from 0% to 15% depending on trade agreements and local policies.

- Leverage free trade agreements (e.g., USMCA, RCEP) where applicable to reduce tariffs.

Customs Clearance Process

- Engage a licensed customs broker in the destination country.

- Provide accurate product descriptions and valuation to avoid delays or penalties.

- Be prepared for inspections or documentation audits.

After-Sales & Warranty Logistics

Spare Parts & Service Support

- Establish local or regional distribution of common spare parts (seals, impellers, motors).

- Provide multilingual service manuals and training materials.

Warranty & Returns

- Define return shipping procedures and responsibilities.

- Include compliance with local consumer protection laws (e.g., right to repair, warranty duration).

Sustainability & End-of-Life

Recycling & Disposal

- Design for disassembly where possible.

- Support compliance with WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions.

- Partner with certified e-waste recyclers in target markets.

Conclusion

Successful logistics and compliance for irrigation water pumps require proactive planning, accurate documentation, and adherence to international and local regulations. Partnering with experienced freight forwarders, customs brokers, and certification bodies ensures smooth operations and market access. Regularly review regulatory updates to maintain compliance across all supply chain stages.

Conclusion for Sourcing an Irrigation Water Pump

Selecting the right irrigation water pump is a critical decision that directly impacts the efficiency, sustainability, and productivity of agricultural operations. After evaluating key factors such as water source, required flow rate, total dynamic head, power source availability, pump type (e.g., centrifugal, submersible, or solar), and long-term operational costs, it becomes evident that a tailored approach is essential.

A thorough assessment of site-specific conditions—combined with consideration of energy efficiency, durability, maintenance requirements, and initial investment—ensures the selection of a pump that meets both current and future irrigation needs. Additionally, exploring sustainable options like solar-powered pumps can offer long-term economic and environmental benefits, especially in off-grid or energy-constrained areas.

In conclusion, sourcing an irrigation water pump should be a strategic process grounded in technical analysis, cost-benefit evaluation, and long-term planning. By choosing the appropriate pump system, farmers and agricultural planners can enhance water use efficiency, reduce operational costs, and support sustainable crop production, ultimately contributing to improved food security and agricultural resilience.