The global iron sponge market, particularly in the context of direct reduced iron (DRI) production, has witnessed steady growth driven by rising demand for high-purity iron in electric arc furnace (EAF) steelmaking. According to Grand View Research, the global DRI market was valued at USD 50.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, fueled by the shift toward sustainable steel production and increased EAF adoption in emerging economies. Similarly, Mordor Intelligence projects a CAGR of over 6% during the forecast period 2024–2029, citing growing investments in gas-based and coal-based reduction plants, especially in India, Iran, and the Middle East. As production scales to meet expanding steel industry needs, a select group of manufacturers have emerged as leaders in innovation, output volume, and technological efficiency. Here’s a data-driven look at the top 9 iron sponge manufacturers shaping the industry’s future.

Top 9 Iron Sponge Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High-Quality Sponge Iron Manufacturer

Domain Est. 2007

Website: sunviksteels.com

Key Highlights: Premium sponge iron manufacturer Sunvik Steels. Our high-quality sponge iron offers superior performance and durability for your industrial needs….

#2 Iron Sponge

Domain Est. 2002

Website: connellygpm.com

Key Highlights: Connelly-GPM, Inc. Iron Sponge is now used around the world to treat natural gas, sewer gas, landfill gas, methane manufactured from biogas digesters….

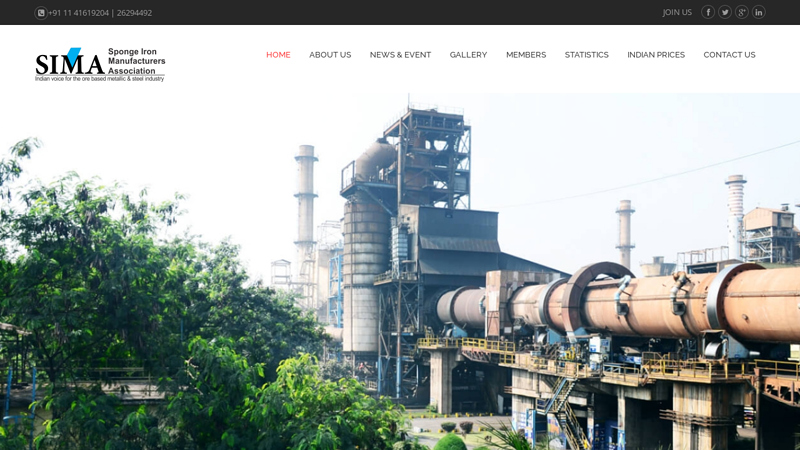

#3 Sponge Iron Manufacturer India

Domain Est. 2019 | Founded: 1992

Website: spongeironindia.com

Key Highlights: The Sponge Iron Manufacturers Association (SIMA) established in 1992 is an all India apex body of Indian sponge iron industry….

#4 Calstar Sponge Ltd

Domain Est. 2023

Website: calstarsponge.com

Key Highlights: Calstar Sponge Ltd. is developing everyday as we are prepearing ourselves to achive the position of one of the best sponge iron manufacturer of the world….

#5 Sponge Iron

Domain Est. 1997

Website: prakash.com

Key Highlights: Sponge iron is a highly processed form of iron ore which contains metallic iron in the range of 83-88% obtained by direct reduction without melting it….

#6 ORISSA SPONGE IRON AND STEEL LTD.

Domain Est. 2003

Website: orissasponge.com

Key Highlights: Orissa Sponge Iron & Steel Ltd is engaged in manufacturing and marketing of iron and steel. The products include sponge iron and MS billets….

#7 Tata Sponge Iron Ltd.

Domain Est. 2007

Website: spongeiron.in

Key Highlights: Tata Sponge, which has its manufacturing facility at Bilaipada (in Joda Block of Keonjhar District in Orissa), was initially set up as a joint venture company ……

#8 SHRI HARE KRISHNA SPONGE IRON LIMITED

Domain Est. 2020

Website: shkraipur.com

Key Highlights: We introduce ourselves as M/S SHRI HARE KRISHNA SPONGE IRON LTD, state of the art leading integrated steel plant located approximately 22 km from Raipur….

#9 SHAH SPONGE AND POWER LTD.

Domain Est. 2021

Website: shahsponge.com

Key Highlights: Shah Sponge & Power Ltd. was incorporated in the year 2005 with main object to establish blast furnace, sponge iron plant, power plant, steel melting shop and ……

Expert Sourcing Insights for Iron Sponge

H2: Market Trends for Iron Sponge in 2026

The Iron Sponge market, primarily driven by its use in hydrogen sulfide (H₂S) removal across natural gas processing, biogas upgrading, and industrial air treatment, is poised for significant evolution by 2026. As global environmental regulations tighten and the clean energy transition accelerates, demand for efficient, low-cost gas purification technologies like Iron Sponge is expected to grow—albeit with notable shifts in technology adoption and market dynamics.

1. Increased Demand in Biogas and Renewable Natural Gas (RNG) Sectors

By 2026, the biogas and renewable natural gas (RNG) industries are expected to be key growth drivers for Iron Sponge. With governments worldwide setting aggressive net-zero targets, investment in waste-to-energy projects—including landfill gas, anaerobic digestion, and agricultural biogas—is expanding. Iron Sponge, due to its low capital cost and simplicity, remains a preferred solution for small-to-medium-scale biogas upgrading facilities, particularly in developing markets and rural applications.

Trend: Iron Sponge adoption will grow in decentralized biogas systems where advanced technologies (e.g., amine scrubbing, PSA) are economically unfeasible.

2. Regulatory Pressure Driving H₂S Abatement

Environmental regulations, particularly in the U.S. (EPA), EU (Industrial Emissions Directive), and emerging markets in Asia and Latin America, are tightening permissible H₂S emissions. This regulatory push is increasing compliance requirements for oil & gas operations, wastewater treatment plants, and landfills—all major users of Iron Sponge.

Trend: Compliance mandates will sustain baseline demand for Iron Sponge, especially in regions with aging infrastructure seeking cost-effective retrofits.

3. Competition from Advanced and Regenerable Technologies

Despite its advantages, Iron Sponge faces growing competition from regenerable H₂S removal systems (e.g., solid-bed regenerable media, liquid redox, and biological desulfurization). These technologies offer lower waste generation and reduced lifecycle costs, appealing to larger operators focused on sustainability and operational efficiency.

Trend: By 2026, Iron Sponge will increasingly be viewed as a “first-tier” or temporary solution, with larger facilities migrating to regenerable systems. However, its niche in low-volume, intermittent, or remote applications will remain secure.

4. Sustainability and Waste Management Challenges

A major constraint for Iron Sponge is the disposal of spent media, which is classified as hazardous waste due to iron sulfide content. Rising landfill costs and environmental scrutiny are prompting operators to seek alternatives or improved disposal/recycling methods.

Trend: Innovations in spent media recycling—such as conversion to elemental sulfur or iron oxide byproducts—could emerge by 2026, improving the environmental profile and cost-effectiveness of Iron Sponge systems.

5. Regional Market Diversification

While North America remains a core market (especially in associated gas and rural biogas), growth in Southeast Asia, India, and Africa is accelerating. These regions benefit from abundant organic waste streams and expanding off-grid energy needs, where Iron Sponge’s simplicity and low maintenance are highly valued.

Trend: Regional suppliers and localized production of Iron Sponge media (e.g., iron oxide pellets) will rise to reduce import dependence and logistics costs.

6. Integration with Digital Monitoring and IoT

By 2026, even simple gas treatment systems like Iron Sponge are beginning to integrate with IoT sensors for remote monitoring of breakthrough, bed life, and H₂S levels. This digital augmentation enhances operational efficiency and predictive maintenance.

Trend: Smart Iron Sponge systems with cloud-connected sensors will gain traction in mid-tier operations, improving uptime and reducing manual oversight.

Conclusion:

In 2026, the Iron Sponge market will remain relevant but increasingly specialized. While facing displacement in large-scale applications by more advanced technologies, Iron Sponge will thrive in decentralized, cost-sensitive, and emerging markets where reliability and low upfront investment are paramount. Success will depend on innovation in waste valorization, regional supply chain development, and integration with digital tools to extend its lifecycle and sustainability.

Common Pitfalls When Sourcing Iron Sponge (Quality, IP)

Sourcing iron sponge—an absorbent iron-based material used primarily for hydrogen sulfide (H₂S) removal in gas treatment—can present several challenges, particularly concerning product quality and intellectual property (IP) considerations. Being aware of these pitfalls helps ensure reliable performance and legal compliance.

Quality-Related Pitfalls

1. Inconsistent Chemical Composition

Iron sponge formulations vary significantly between suppliers, often based on proprietary blends of iron oxide, wood shavings, and moisture. Sourcing from manufacturers without stringent quality controls can result in inconsistent H₂S scavenging efficiency, reduced service life, and potential operational failures.

2. Poor Moisture Content Management

Optimal performance requires precise moisture levels (typically 30–50%). Iron sponge that is too dry loses reactivity; too wet promotes clumping, channeling, and microbial growth. Suppliers lacking controlled packaging or storage may deliver product with degraded performance.

3. Contaminants and Impurities

Low-grade iron sponge may contain undesirable impurities such as chlorides, heavy metals, or excessive fines. These contaminants can corrode downstream equipment, poison catalysts in subsequent processing stages, or complicate disposal due to hazardous waste classification.

4. Lack of Performance Testing Data

Some suppliers provide insufficient or unreliable performance data (e.g., H₂S capacity, breakthrough time, bulk density). Without verified test results under relevant operating conditions (pressure, temperature, gas composition), end-users risk under-sizing units or experiencing early breakthrough.

5. Inadequate Shelf Life and Packaging

Iron sponge degrades upon prolonged exposure to air and moisture. Poor packaging (e.g., non-sealed bags) or extended storage can diminish reactivity before use. Suppliers without proper shelf-life guarantees or FIFO (first-in, first-out) inventory practices increase this risk.

Intellectual Property (IP)-Related Pitfalls

1. Use of Proprietary Formulations Without Licensing

Many high-performance iron sponge products are protected by patents or trade secrets. Sourcing generic versions that replicate patented compositions or manufacturing processes may expose the buyer to IP infringement claims, especially in regulated industries or export markets.

2. Misrepresentation of “Equivalent” Products

Suppliers may claim their iron sponge is “equivalent” to a branded product (e.g., Drizo® or SulfaTreat®) without authorization. These claims can be misleading and legally risky, particularly if the substitute product uses protected technology or branding.

3. Lack of Traceability and Documentation

Reputable suppliers provide certificates of conformance, material safety data sheets (MSDS), and formulation disclosures where appropriate. Absence of documentation may indicate IP ambiguity or non-compliance with regulatory standards, complicating audits or liability assessments.

4. Reverse Engineering Risks

In attempts to develop in-house alternatives, companies may inadvertently infringe on existing patents. Without thorough freedom-to-operate (FTO) analysis, reverse engineering iron sponge formulations can lead to costly litigation.

5. Gray Market and Unauthorized Distributors

Purchasing from unauthorized resellers may result in counterfeit or diverted goods. These products may not meet original specifications and could breach IP agreements, voiding warranties and exposing the buyer to legal or safety issues.

Mitigation Strategies

- Qualify suppliers through audits, performance testing, and reference checks.

- Demand technical documentation including batch-specific test reports and compliance certificates.

- Verify IP status of formulations, especially when sourcing near-identical substitutes.

- Use contracts that include warranties on quality, performance, and IP indemnification.

- Consult legal counsel when developing or sourcing alternative formulations to ensure IP compliance.

Avoiding these pitfalls ensures reliable gas treatment performance and protects against legal and operational risks in iron sponge procurement.

Logistics & Compliance Guide for Iron Sponge

Overview of Iron Sponge

Iron Sponge is a specialized filtration media used primarily for hydrogen sulfide (H₂S) removal in natural gas, biogas, and other gas streams. Due to its chemical composition—typically wood-based substrates impregnated with ferric oxide—it requires careful handling, transportation, and regulatory compliance to ensure safety and effectiveness.

Regulatory Classification

Iron Sponge is generally classified as a non-hazardous material under most international transport regulations when in its unused form. However, once spent (i.e., after reacting with H₂S), it may contain sulfides that could generate hydrogen sulfide gas under acidic conditions, potentially classifying it as hazardous waste under regulations such as RCRA (40 CFR 261) in the United States. Always verify local, national, and international regulations before transport or disposal.

Packaging Requirements

Unused Iron Sponge should be stored and shipped in sealed, moisture-resistant packaging, typically in poly-lined fiber drums or bulk totes. Packaging must prevent exposure to moisture and atmospheric contaminants, which can prematurely degrade the media. Drums should be clearly labeled with contents, batch number, and manufacturer information.

Transportation Guidelines

Transport Iron Sponge via ground, sea, or air in accordance with applicable regulations (e.g., IMDG for maritime, IATA for air, and 49 CFR for U.S. ground transport). While unused Iron Sponge is typically non-hazardous, shippers must provide a Safety Data Sheet (SDS) and ensure compliance with carrier-specific requirements. For international shipments, include proper customs documentation and export controls if applicable.

Storage Conditions

Store Iron Sponge in a dry, well-ventilated area away from direct sunlight, moisture, and incompatible materials such as strong acids or oxidizers. Keep containers sealed when not in use. Avoid prolonged storage in high-humidity environments to prevent clumping and reduced effectiveness.

Handling Procedures

Use appropriate personal protective equipment (PPE), including gloves and safety glasses, when handling Iron Sponge. Minimize dust generation during transfer. If dust is produced, use local exhaust ventilation. Avoid inhalation of dust and contact with skin or eyes.

Spent Media Disposal

Spent Iron Sponge must be treated as potentially hazardous waste due to sulfur content. Conduct a waste characterization test (e.g., TCLP) to determine disposal classification. Dispose of through licensed hazardous waste handlers in compliance with local environmental regulations. Never dispose of in regular landfill without proper testing and approval.

Environmental & Safety Compliance

Adhere to OSHA, EPA, and equivalent regional safety and environmental standards. Maintain records of SDS, waste manifests, and regulatory filings. Implement spill response procedures: in case of large spills, contain material, avoid wetting, and consult environmental professionals for cleanup.

Documentation & Recordkeeping

Maintain accurate records including batch certifications, SDS, shipping manifests, waste disposal receipts, and compliance reports. Documentation should be retained for a minimum of three to five years, depending on jurisdiction.

Training & Personnel Awareness

Ensure all personnel involved in handling, transporting, or disposing of Iron Sponge are trained in safety procedures, emergency response, and regulatory compliance. Conduct periodic refresher training to maintain awareness and preparedness.

Conclusion on Sourcing Iron Sponge:

Sourcing iron sponge (also known as direct reduced iron or DRI) requires a strategic approach that balances cost, quality, reliability, and logistical efficiency. It is a critical raw material for steelmaking, particularly for electric arc furnaces, offering advantages such as high metallicity, low impurities, and environmental benefits over traditional pig iron. When sourcing iron sponge, key considerations include the reputation and production standards of suppliers, consistency in chemical composition, transportation infrastructure, and compliance with environmental and regulatory standards.

Emerging suppliers in regions like the Middle East, Latin America, and India provide competitive options due to abundant natural gas resources and established DRI production facilities. However, buyers must conduct thorough due diligence to mitigate risks related to supply chain disruptions, fluctuating energy prices, and quality variability.

Long-term contracts, partnerships with reliable producers, and continuous market monitoring can enhance supply security and cost stability. In conclusion, successful sourcing of iron sponge hinges on a well-informed, flexible procurement strategy that aligns with operational needs and sustainability goals in the evolving global steel industry.