The global iron powder market is experiencing steady expansion, driven by rising demand from automotive, industrial machinery, and additive manufacturing sectors. According to a 2023 report by Mordor Intelligence, the market was valued at approximately USD 780 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2028. This growth is fueled by the increasing adoption of powder metallurgy in lightweight component production and the surge in metal 3D printing applications. Additionally, Grand View Research highlights that advancements in production technologies and the development of high-purity, specialized iron powders are further accelerating market expansion, particularly in emerging economies. As demand intensifies, a select group of manufacturers has emerged as leaders in innovation, scale, and product diversification—shaping the future of this critical materials industry.

Top 10 Iron Powders Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 U.S. Metal Powders, Inc.

Domain Est. 2008 | Founded: 1918

Website: usmetalpowders.com

Key Highlights: Global Producers of Metal Powders since 1918. Our products are used in over 180 countries. aluminum powders Products Advanced engineered aluminum powders….

#2 Höganäs

Domain Est. 1996

Website: hoganas.com

Key Highlights: Höganäs is the world’s leading manufacturer of metal powders for powder metallurgy. By harnessing the vast potential of our metal powders, we drive positive ……

#3 Iron Powder Manufacturers and Distributors

Domain Est. 2008

Website: iron-powder.com

Key Highlights: Iron powder products are classified by purity, production method, grain and density. Following are some of the most widely used iron powder products….

#4 Metal Powder Suppliers

Domain Est. 2009

Website: cnpcpowder.com

Key Highlights: CNPC is a large producer of Nickel, Steel, Iron, Copper powder and other Ultrafine alloys, electrolytic or atomized powders….

#5 SAGWELL

Domain Est. 2017

Website: sagwellusa.com

Key Highlights: SAGWELL is a metal powder supplier, the supply of micro superfine iron powder, copper powder and pre-alloyed powder is the core business of SAGWELL….

#6 Powdered Metals

Domain Est. 1997

Website: belmontmetals.com

Key Highlights: Belmont Powdered Metals featuring Holtite Alsil Grit, Iron Powder, High Grade Zinc, Tin, and Copper-Aluminum Applications….

#7 Ferrous metallics

Domain Est. 1997

Website: riotinto.com

Key Highlights: Ferrous metals are any metal that contains iron. Because of their strength, you can find ferrous metals in everyday items from skyscrapers to cars. They’re also ……

#8 IRON POWDERS

Domain Est. 2008

Website: ironpowders.com

Key Highlights: High purity fine iron powders are used to manufacture sintered components, soft magnetic components, brazing, iron fortification, friction products, printing, ……

#9 GKN Powder Metallurgy

Domain Est. 2018

Website: gknpm.com

Key Highlights: We manufacture high-precision metal components for consumer products, from electronic housings to mechanical parts. Our expertise in sintering and injection ……

#10 Iron Powders

Website: jfe-steel.co.jp

Key Highlights: As a total iron powder maker, JFE Steel Corporation is the only company in Japan which produces and sells both reduced iron powder and atomized iron powder….

Expert Sourcing Insights for Iron Powders

H2: 2026 Market Trends for Iron Powders

The global iron powders market is poised for significant transformation by 2026, driven by evolving industrial demands, technological advancements, and shifting regional dynamics. As a critical component in powder metallurgy, additive manufacturing (AM), and various industrial applications, iron powders are witnessing renewed growth momentum. The following analysis outlines key market trends expected to shape the iron powders landscape in 2026 under the H2 framework—highlighting Hydrogen-based Production and High-Performance Applications as pivotal drivers.

1. Hydrogen-Based Production (First H): Green Iron Powder Manufacturing

A defining trend in 2026 is the increasing adoption of hydrogen-based reduction processes for sustainable iron powder production. With global decarbonization targets intensifying, traditional carbon-intensive methods (using coal or natural gas) are being phased out in favor of cleaner alternatives.

- Green Hydrogen Reduction: Several European and North American producers are scaling up pilot projects using hydrogen gas (H₂) to reduce iron ore into sponge iron, which is then atomized into high-purity iron powder. This method eliminates CO₂ emissions, aligning with EU Green Deal objectives and U.S. Inflation Reduction Act incentives.

- Cost Competitiveness Improving: By 2026, falling renewable energy prices and advances in electrolyzer technology are reducing the cost of green hydrogen, making hydrogen-based iron powder production more economically viable.

- Regulatory Push: Carbon pricing mechanisms and environmental regulations are incentivizing manufacturers to transition to low-carbon processes. Companies like H2 Green Steel and Rio Tinto are leading the charge, with partnerships forming across the value chain to supply green iron powders.

This shift not only reduces the environmental footprint but also enhances powder quality—lower oxygen content and fewer impurities improve performance in high-end applications.

2. High-Performance Applications (Second H): Expansion in Additive Manufacturing and EVs

The second major trend involves the rising demand for high-performance iron-based powders in advanced manufacturing sectors, particularly additive manufacturing and electric vehicles (EVs).

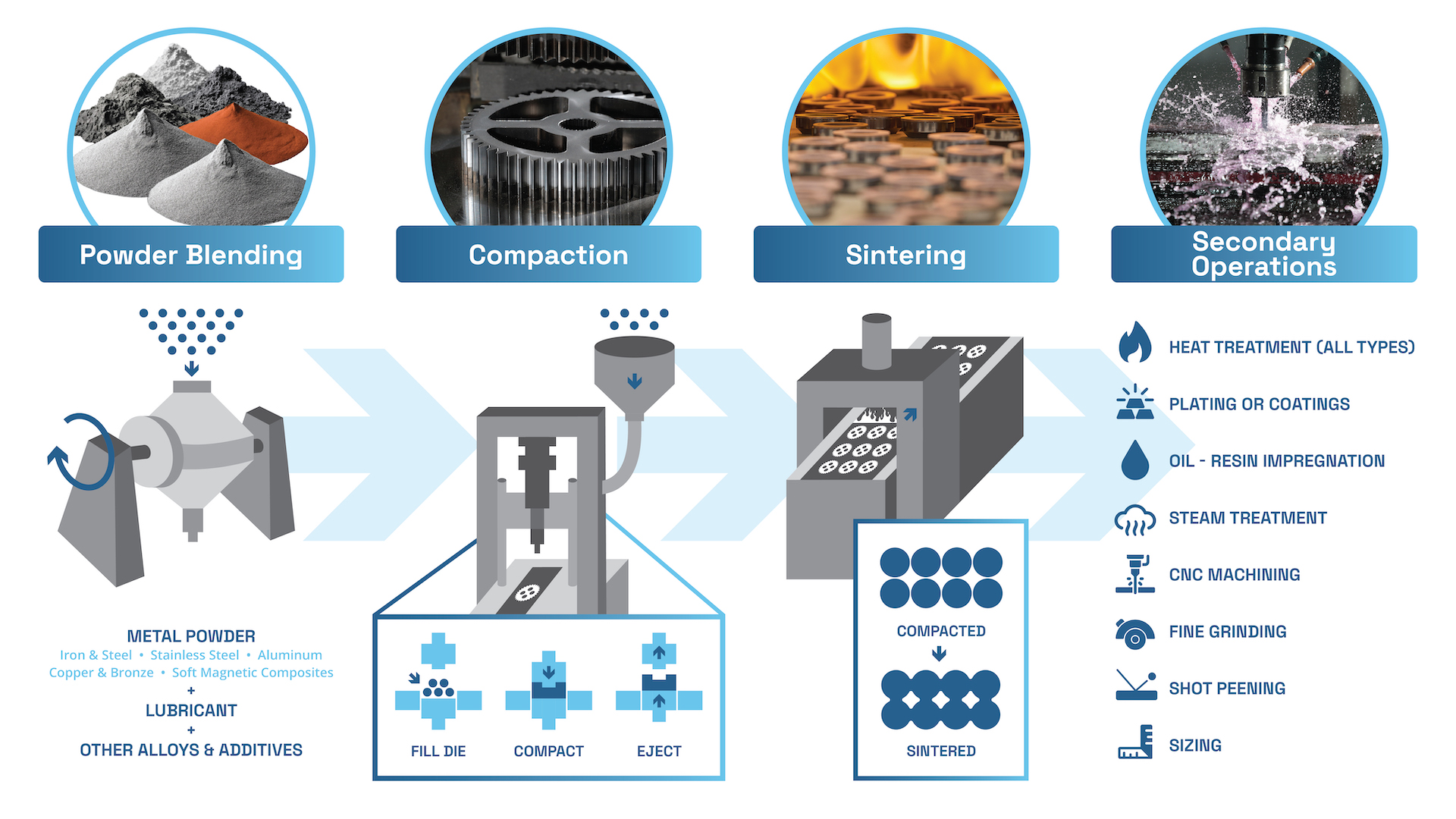

- Additive Manufacturing (3D Printing): By 2026, iron and low-alloy steel powders are gaining traction in industrial 3D printing for automotive, aerospace, and tooling sectors. Improved atomization techniques (e.g., plasma and gas atomization) are enabling finer, spherical powders with consistent flowability and density—key parameters for successful printing.

- Electric Vehicle Components: The EV boom is driving demand for soft magnetic composites (SMCs) made from insulated iron powders. These materials are used in motor cores, stators, and inductors due to their high magnetic permeability and low eddy current losses. With EV production projected to exceed 40 million units annually by 2026, demand for high-purity, insulation-coated iron powders is surging.

- Custom Alloys and Nanopowders: Market players are investing in R&D to develop specialty iron powders with enhanced properties—such as corrosion resistance, high temperature stability, and mechanical strength—for niche applications in defense, medical devices, and energy systems.

Supporting Trends in 2026:

- Geopolitical Shifts in Supply Chains: Asia-Pacific (particularly China and India) remains the largest producer and consumer of conventional iron powders. However, in 2026, Europe and North America are emerging as hubs for high-value, green iron powders, reducing reliance on imported materials.

- Consolidation and Partnerships: Major players like Höganäs AB, GKN Powder Metallurgy, and Rio Tinto are forming strategic alliances with hydrogen producers and AM companies to secure supply chains and co-develop next-generation powders.

- Recycling and Circular Economy: Closed-loop recycling of iron powder scrap from AM and machining processes is becoming standard practice, improving sustainability and lowering production costs.

Conclusion:

By 2026, the iron powders market is undergoing a dual transformation anchored in Hydrogen-based Production and High-Performance Applications. These H2-driven trends are not only redefining manufacturing sustainability but also expanding the functional capabilities of iron powders across high-tech industries. Companies that invest early in green production technologies and advanced material engineering are likely to capture significant market share in this evolving landscape.

Sourcing iron powders for applications involving hydrogen (H₂), particularly in sectors like hydrogen storage, catalysis, fuel cells, or metal additive manufacturing in H₂ atmospheres, requires careful attention to both quality specifications and intellectual property (IP) considerations. Here are the common pitfalls to avoid:

🔹 1. Quality-Related Pitfalls

1.1. Inadequate Purity & Contamination

- Pitfall: Iron powders with high levels of impurities (e.g., O₂, C, S, Si, or residual process metals like Ni, Cr from milling equipment) can degrade performance in H₂ environments.

- Impact: Contaminants may:

- Poison catalysts in hydrogenation reactions.

- Reduce hydrogen absorption capacity in storage alloys.

- Promote embrittlement or corrosion under H₂ exposure.

- Mitigation: Specify high-purity Fe (>99.5% or higher), with strict limits on interstitials (O < 1000 ppm, C < 500 ppm). Request full elemental analysis (ICP-MS/OES) and surface analysis (XPS).

1.2. Poor Particle Size Distribution (PSD) & Morphology

- Pitfall: Inconsistent or unsuitable particle size or shape affects reactivity, flowability, and packing density.

- Impact: In hydrogen storage or catalysis, fine powders may agglomerate or oxidize rapidly; coarse powders may react too slowly.

- Mitigation: Define tight PSD (e.g., D10, D50, D90) via laser diffraction. Use SEM to verify spherical vs. irregular morphology, especially for AM applications.

1.3. Surface Oxidation & Passivation

- Pitfall: Iron powders readily oxidize in air, forming Fe₂O₃/Fe₃O₄ surface layers.

- Impact: Oxide layers hinder H₂ adsorption/dissociation, reduce effective surface area, and may spall under thermal cycling.

- Mitigation: Source powders with controlled passivation (thin, stable oxide) or under inert atmosphere (Ar/N₂). Prefer suppliers offering glovebox packaging or H₂-reducible surface treatments.

1.4. Moisture & Residual Solvents

- Pitfall: Hygroscopic powders or solvent residues (from chemical synthesis routes) introduce H₂O, which can oxidize Fe or generate steam in high-temp H₂ systems.

- Impact: Accelerated degradation, safety risks (pressure buildup), side reactions.

- Mitigation: Require low moisture content (<100 ppm, via Karl Fischer titration) and specify drying protocols (e.g., vacuum bake before use).

1.5. Inconsistent Batch-to-Batch Quality

- Pitfall: Suppliers using variable synthesis methods (e.g., reduced iron, atomization, chemical reduction) may lack process control.

- Impact: Unpredictable H₂ interaction (kinetics, capacity), failed reproducibility in R&D or production.

- Mitigation: Audit supplier QC processes. Require certificates of analysis (CoA) for every batch, including BET surface area, tap density, and H₂ reactivity tests.

🔹 2. Intellectual Property (IP) Pitfalls

2.1. Use of Patented Synthesis Methods

- Pitfall: Certain iron powder production techniques (e.g., plasma atomization, chemical vapor condensation, nanostructured Fe via borohydride reduction) may be protected.

- Impact: Infringement risk if you scale up a process unknowingly using patented methods.

- Mitigation: Conduct freedom-to-operate (FTO) analysis before scaling. Review patents (e.g., USPTO, WIPO) related to Fe powder synthesis, especially those citing H₂ applications.

2.2. Proprietary Surface Treatments or Coatings

- Pitfall: Suppliers may apply proprietary coatings (e.g., carbon, polymers, oxides) to stabilize powders, protected by trade secrets or IP.

- Impact: Using such powders in your product may limit freedom to modify or disclose formulations.

- Mitigation: Clarify if surface treatments are patented. Negotiate IP rights or licensing if integrating into your product.

2.3. Reverse Engineering Risks

- Pitfall: Attempting to replicate a high-performance iron powder (e.g., nano-Fe for H₂ storage) without understanding IP landscape.

- Impact: Legal challenges even if independently developed, if process overlaps with existing patents.

- Mitigation: Document R&D thoroughly. File provisional patents early if novel synthesis or application is developed.

2.4. Data Rights & Supplier Lock-In

- Pitfall: Custom-synthesized powders may be co-developed with suppliers who retain IP or data rights.

- Impact: Inability to switch suppliers or disclose material specs to partners.

- Mitigation: Define IP ownership in supply agreements. Ensure data (e.g., PSD, reactivity in H₂) is transferable.

🔹 Best Practices When Sourcing Iron Powders for H₂ Applications

- Define Clear Specs: Include purity, PSD, surface area (BET), oxygen content, moisture, and H₂ reactivity metrics.

- Prefer H₂-Compatible Suppliers: Choose vendors experienced in materials for hydrogen environments (e.g., those serving fuel cell or hydride industries).

- Request Testing Data: Ask for H₂ uptake isotherms, TPR (temperature-programmed reduction), or in-situ XRD under H₂ flow.

- Conduct FTO Analysis: Before scaling, ensure your use case doesn’t infringe on existing IP.

- Use NDAs with Clear IP Clauses: When collaborating on custom powders.

- Audit Supply Chain: Ensure traceability and consistency, especially for critical applications.

✅ Summary

| Pitfall Category | Key Risk | Solution |

|——————|——–|———-|

| Low Purity | Contamination in H₂ systems | Specify >99.5% Fe, low O/C |

| Surface Oxide | Poor H₂ activation | Request inert packaging, H₂-reducible surfaces |

| Variable Quality | Irreproducible results | Demand batch CoA, audit supplier |

| Patented Methods | IP infringement | Perform FTO search |

| Coatings/IP Rights | Limited freedom to operate | Clarify IP ownership in contracts |

By proactively addressing both material quality and IP risks, you can ensure reliable, scalable, and legally sound sourcing of iron powders for hydrogen-related technologies.

H2: Logistics & Compliance Guide for Iron Powders

Transporting and handling iron powders requires strict adherence to logistical protocols and regulatory compliance due to their physical properties, potential reactivity, and classification under international shipping regulations. This guide outlines key considerations for the safe and compliant logistics of iron powders.

H2: Classification & Regulatory Compliance

Iron powders are classified based on particle size, purity, and potential hazards. Key regulatory frameworks include:

- UN Number: Iron powder is typically assigned UN 3089 (Environmentally hazardous substance, solid, n.o.s.) when in fine particulate form and may be subject to additional classifications if pyrophoric.

- GHS Classification: Depending on particle size and manufacturing process, iron powder may be classified as:

- Flammable Solid (Category 2) – if fine particles can ignite spontaneously in air (pyrophoric iron powder).

- Hazardous to the Aquatic Environment (Acute, Category 1).

- OSHA & REACH: In the U.S., OSHA’s Hazard Communication Standard (HCS) requires proper labeling and Safety Data Sheets (SDS). In the EU, REACH regulations apply, requiring registration and communication of substance properties.

- DOT (49 CFR): Regulates domestic U.S. transport; iron powder may require placarding if classified as hazardous.

H2: Packaging Requirements

Proper packaging prevents oxidation, contamination, and ignition risks:

- Moisture Protection: Use moisture-resistant packaging (e.g., sealed plastic liners inside fiber drums or steel containers).

- Oxygen Barrier: For pyrophoric grades, packaging must exclude oxygen—often achieved using vacuum sealing or inert gas (e.g., nitrogen) flushing.

- Container Types: Common packaging includes:

- 25–50 kg multi-wall paper bags with PE lining

- 500 kg–1 MT super sacks (with anti-static properties if required)

- Steel drums for sensitive or reactive grades

- UN Certification: If classified as hazardous, packaging must meet UN performance standards (e.g., UN 11F for flexible containers).

H2: Handling & Storage

Safe handling minimizes fire, health, and environmental risks:

- Storage Conditions:

- Store in a cool, dry, well-ventilated area away from oxidizers, acids, and moisture.

- Keep containers tightly closed to prevent oxidation and moisture absorption.

- Avoid dust accumulation—use dust control measures (e.g., ventilation, HEPA filters).

- Fire Prevention:

- Iron powder, especially fine or pyrophoric types, can ignite spontaneously in air.

- Prohibit open flames, sparks, and static discharge in handling areas.

- Use grounding and bonding procedures during transfer.

- PPE Requirements:

- Wear nitrile gloves, safety goggles, and dust masks (or respirators for high-exposure areas).

- Use flame-resistant clothing when handling pyrophoric grades.

H2: Transportation Guidelines

Transport modal requirements vary by region and hazard class:

- Road (ADR – Europe / DOT – USA):

- Vehicles must be marked with appropriate hazard labels (e.g., Class 4.1 Flammable Solid).

- Segregate from strong oxidizers and acids.

- Ensure packages are secured to prevent movement and damage.

- 海运 (IMDG Code):

- Declare iron powder according to UN 3089 or UN 1365 (if flammable).

- Stow away from heat sources and living quarters.

- Documented stowage plan required for hazardous shipments.

- Air (IATA DGR):

- Iron powder may be restricted or prohibited if classified as flammable solid (UN 1365).

- Requires shipper’s declaration and package testing if offered for air transport.

- Often classified as “Dangerous Goods” with specific quantity limits.

H2: Documentation & Labeling

Ensure full regulatory traceability:

- Safety Data Sheet (SDS): Must be up to date (per GHS standards) and include:

- Hazard identification

- First-aid and firefighting measures

- Handling and storage instructions

- Transport Documents: Include proper shipping name, UN number, hazard class, packing group, and emergency contact.

- Labels & Markings:

- GHS pictograms (e.g., flame, exclamation mark, environment)

- UN number and proper shipping name on each package

- Orientation arrows and “Keep Dry” markings if applicable

H2: Environmental & Disposal Compliance

- Spill Response:

- Do not use water on fine iron powder spills (may generate hydrogen gas).

- Use dry sand or inert absorbents; collect material in sealed containers.

- Report large spills to local environmental authorities if near waterways.

- Waste Disposal:

- Dispose of waste iron powder as hazardous waste if classified.

- Follow local regulations (e.g., RCRA in the U.S., Waste Framework Directive in EU).

- Recycle when possible through metal reprocessing facilities.

H2: Special Considerations for Pyrophoric Iron Powder

- Definition: Finely divided iron that ignites spontaneously in air (common in catalyst residues or certain manufacturing byproducts).

- Handling: Must be handled under inert atmosphere (e.g., nitrogen or argon).

- Packaging: Double-contained, inert gas-purged, and sealed.

- Transport: Often classified as UN 1365, Iron powder, wetted with not less than 25% water to suppress ignition.

Adhering to this logistics and compliance guide ensures the safe, legal, and environmentally responsible handling of iron powders across the supply chain. Always consult the latest version of regulatory texts (e.g., IATA, IMDG, ADR, GHS) and conduct a hazard assessment for your specific iron powder formulation.

In conclusion, sourcing iron powders requires a comprehensive evaluation of several key factors to ensure optimal performance, cost-efficiency, and suitability for specific applications. The selection should be based on the required powder characteristics—such as purity, particle size distribution, morphology, and flowability—aligned with the end-use, whether in metallurgy, additive manufacturing, electronics, or chemical applications. Suppliers must be assessed not only on product quality and consistency but also on their ability to meet regulatory standards, provide technical support, and maintain reliable supply chains. Additionally, considerations around pricing, scalability, and sustainability are increasingly important in today’s market. By adopting a strategic sourcing approach that balances technical requirements with economic and logistical factors, organizations can secure high-quality iron powders that support innovation, efficiency, and long-term success.