The global iron pipe fittings market is experiencing robust growth, driven by rising infrastructure development, expansion of water and wastewater treatment systems, and increasing demand from industries such as oil & gas, construction, and manufacturing. According to Grand View Research, the global pipe fittings market size was valued at USD 34.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 5.6% during the forecast period (2024–2029), fueled by urbanization and government investments in pipeline infrastructure across emerging economies. With cast iron and ductile iron fittings remaining preferred for their durability, corrosion resistance, and high-pressure tolerance, manufacturers are scaling production and adopting advanced manufacturing techniques to meet global demand. In this competitive landscape, nine leading iron pipe fittings manufacturers have distinguished themselves through innovation, quality, and global reach—shaping the future of fluid transport systems worldwide.

Top 9 Iron Pipe Fittings Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Tyler Pipe

Domain Est. 1997

Website: tylerpipe.com

Key Highlights: We are a manufacturer of cast iron soil pipe & fittings for DWV plumbing systems. Our products are sustainable and environmentally safe that are made from more ……

#2

Domain Est. 2008 | Founded: 1905

Website: american-usa.com

Key Highlights: Founded in 1905 in Birmingham, Alabama, AMERICAN is a manufacturer of fire hydrants, valves, ductile iron pipe and spiral-welded steel pipe for the waterworks ……

#3 U.S. Pipe

Domain Est. 1995

Website: uspipe.com

Key Highlights: US Pipe, a Quikrete company, offers a complete range of Ductile Iron Pipe, Restrained Joint Pipe, Fabrication, Gaskets, and Fittings….

#4 Cast Iron Pipe & Fittings

Domain Est. 1997

Website: charlottepipe.com

Key Highlights: We produce a full line of service and extra-heavy cast iron soil pipe and fittings from 2 to 15 inches and double-hub pipe from 2 to 6 inches….

#5 American Piping Products

Domain Est. 1997

Website: amerpipe.com

Key Highlights: American Piping Products is the largest supplier of steel pipe, tube, fittings & flanges in the United States. View our product catalog & request a quote….

#6 Star Pipe Products

Domain Est. 1998

Website: starpipeproducts.com

Key Highlights: Star Pipe Products has manufactured ductile iron pipe fittings, joint restraints, and castings for the waterworks industry for over 40 years….

#7 MSI

Domain Est. 2000

Website: msi-products.com

Key Highlights: Founded by experienced professionals in the piping industry, we offer a comprehensive range of products including malleable iron, stainless steel, forged carbon ……

#8 McWane Ductile

Domain Est. 2013 | Founded: 1921

Website: mcwaneductile.com

Key Highlights: With three US foundries, McWane Ductile has been an industry leader in the manufacture of water distribution and infrastructure products since 1921….

#9 Pipe Fittings

Domain Est. 2020

Website: asc-es.com

Key Highlights: ASC offers the broadest line of malleable iron fitting sizes in both black and galvanized finishes. Every fitting is manufactured and tested to ……

Expert Sourcing Insights for Iron Pipe Fittings

H2: 2026 Market Trends for Iron Pipe Fittings

The global iron pipe fittings market is expected to experience steady growth and transformation by 2026, driven by infrastructure development, industrial modernization, and evolving material preferences. Despite increasing competition from alternative materials such as plastic (PVC, HDPE) and stainless steel, iron pipe fittings—particularly ductile iron and cast iron—remain vital in water supply, wastewater management, oil & gas, and HVAC systems due to their durability, pressure resistance, and cost-effectiveness.

-

Infrastructure Investment Driving Demand

Governments worldwide, especially in emerging economies across Asia-Pacific, Africa, and Latin America, are prioritizing urbanization and water infrastructure projects. Increased public and private funding for water treatment plants, sewage systems, and district heating networks is expected to boost demand for iron pipe fittings. In North America and Europe, aging infrastructure is driving replacement cycles, further supporting market growth. -

Shift Toward Ductile Iron Fittings

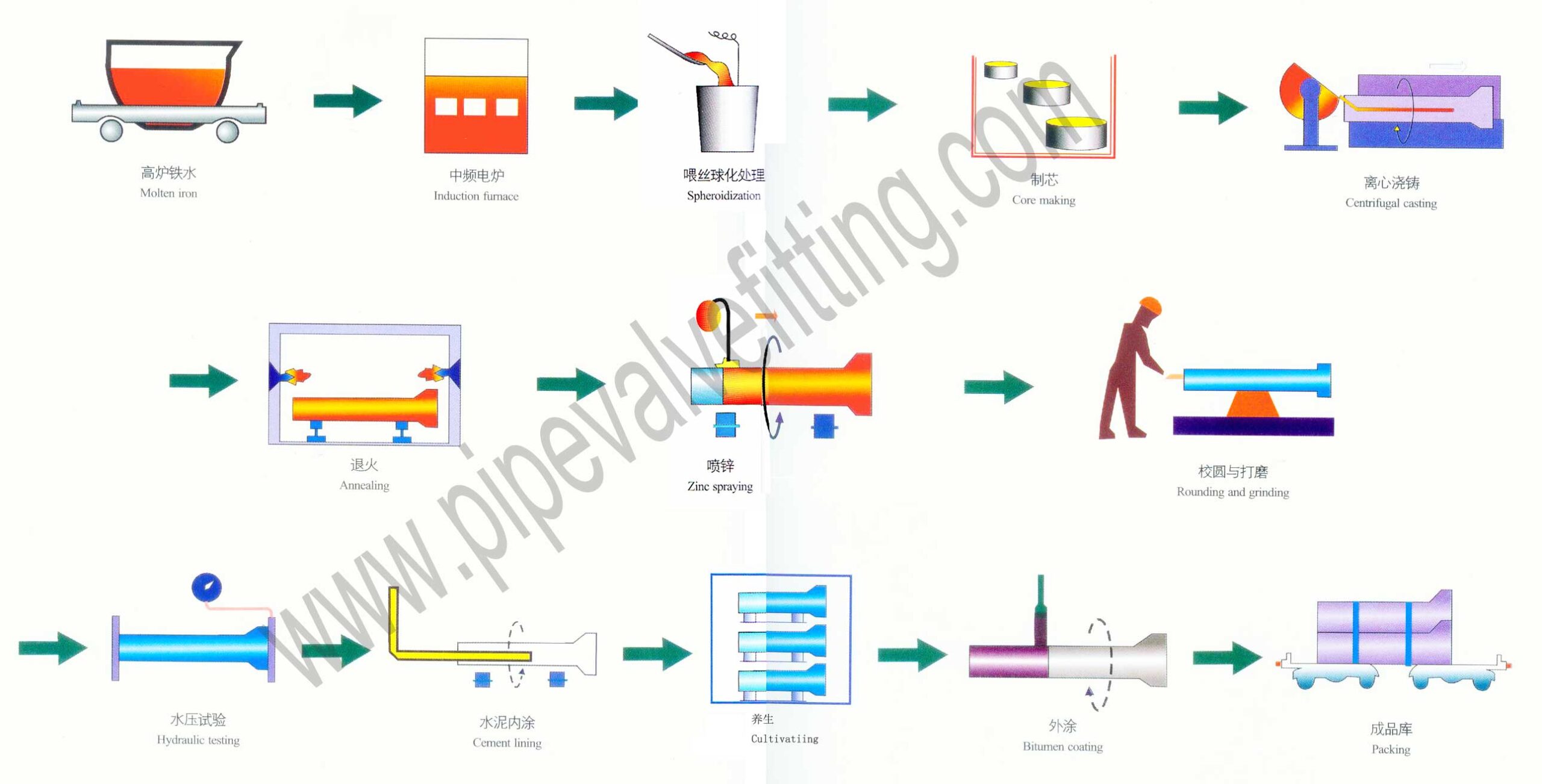

Ductile iron fittings are gaining preference over traditional cast iron due to their superior tensile strength, impact resistance, and flexibility. By 2026, the market share of ductile iron is projected to expand significantly, particularly in municipal water distribution and underground applications. Manufacturers are investing in advanced coating technologies (e.g., cement mortar, epoxy, zinc) to enhance corrosion resistance and extend service life. -

Regional Market Dynamics

- Asia-Pacific: Expected to dominate the market, with China, India, and Southeast Asian nations leading in construction and industrial growth.

- North America: Steady demand fueled by infrastructure renewal programs, such as the U.S. Bipartisan Infrastructure Law.

- Europe: Growth driven by environmental regulations and sustainable water management initiatives.

-

Middle East & Africa: Rising investments in desalination and oil & gas pipelines support demand, particularly in GCC countries.

-

Sustainability and Regulatory Pressures

Environmental regulations are pushing manufacturers to adopt energy-efficient production methods and recyclable materials. Iron fittings, being highly recyclable, benefit from green building certifications and sustainability mandates. However, stricter emission norms may increase production costs, prompting innovation in foundry technologies. -

Supply Chain and Raw Material Volatility

Fluctuations in iron ore and scrap metal prices, influenced by geopolitical tensions and energy costs, may impact profitability. Companies are increasingly diversifying supply chains and exploring localized production to mitigate risks. -

Technological Advancements and Smart Integration

While iron pipe fittings are traditionally passive components, integration with smart monitoring systems (e.g., IoT-enabled sensors for leak detection) is emerging. By 2026, hybrid solutions combining robust iron infrastructure with digital monitoring could gain traction in smart city projects. -

Competition from Alternative Materials

Plastic and composite fittings continue to challenge iron in residential and low-pressure applications due to lighter weight and easier installation. However, iron maintains a stronghold in high-pressure, high-temperature, and critical infrastructure applications where long-term reliability is paramount.

In conclusion, the iron pipe fittings market in 2026 will be shaped by resilient demand in core sectors, technological enhancements, and regional infrastructure momentum. While facing material substitution pressures, iron fittings—especially ductile iron—will remain essential in global fluid transport systems, supported by durability, recyclability, and ongoing innovation.

Common Pitfalls When Sourcing Iron Pipe Fittings (Quality & Intellectual Property)

Sourcing iron pipe fittings involves navigating several critical challenges, particularly concerning quality consistency and intellectual property risks. Failing to address these pitfalls can lead to project delays, safety hazards, financial losses, and legal complications.

Poor Material Quality and Non-Compliance

One of the most prevalent issues is receiving fittings made from substandard materials or that fail to meet required industry standards (e.g., ASTM, ANSI, ISO). Suppliers may use inferior-grade cast or ductile iron, leading to reduced strength, corrosion resistance, and lifespan. Buyers must verify material certifications and conduct third-party inspections to ensure compliance.

Inaccurate Dimensional Tolerances

Fittings that do not adhere to precise dimensional specifications can cause leaks, improper alignment, and installation failures. Poor manufacturing processes or lack of quality control often result in variations in thread pitch, diameter, or flange alignment. Always request sample testing and dimensional inspection reports before bulk orders.

Inadequate Coating and Corrosion Protection

Many iron pipe fittings require protective coatings (e.g., zinc galvanizing, epoxy) to prevent rust and extend service life. A common pitfall is receiving fittings with uneven, too thin, or missing coatings. This compromises durability, especially in harsh environments. Ensure coating specifications are clearly defined in contracts and verified upon delivery.

Misrepresentation of Fitting Type or Grade

Suppliers may mislabel ductile iron as cast iron, or vice versa, due to significant cost differences. Ductile iron offers superior strength and flexibility, and substituting it without disclosure can compromise system integrity. Require mill test reports and perform material verification testing to confirm the actual grade.

Intellectual Property (IP) Infringement

Sourcing from manufacturers that replicate patented designs or registered trademarks exposes buyers to legal liability. Some suppliers produce “look-alike” fittings that mimic proprietary designs of well-known brands without authorization. Conduct due diligence on suppliers, request IP compliance documentation, and avoid vendors offering suspiciously low prices on branded-looking products.

Lack of Traceability and Documentation

Reliable suppliers provide full traceability, including heat numbers, batch codes, and test reports. A major pitfall is receiving undocumented or traceability-lacking fittings, making quality audits and compliance verification impossible. Insist on complete documentation packages with every shipment.

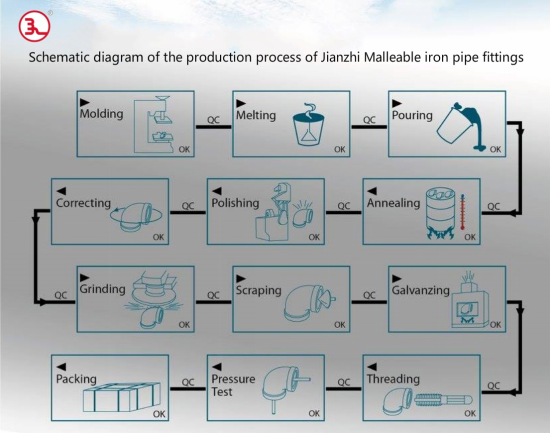

Inconsistent Manufacturing Processes

Variability in casting, machining, and finishing processes can lead to inconsistent quality across batches. This is common with suppliers lacking robust quality management systems (e.g., ISO 9001). Audit supplier facilities or work only with certified manufacturers to mitigate this risk.

Hidden Costs from Rework or Rejection

Low initial pricing often comes at the expense of quality, leading to higher total costs due to rejections, rework, or system failures. Factor in the total cost of ownership, including inspection, potential downtime, and safety risks, rather than focusing solely on purchase price.

Logistics & Compliance Guide for Iron Pipe Fittings

This guide outlines essential logistics and compliance considerations for the handling, transportation, and regulatory adherence related to iron pipe fittings, including cast iron and ductile iron components commonly used in plumbing, industrial, and infrastructure applications.

Regulatory Classification and Documentation

Iron pipe fittings are subject to international and national regulations based on material composition, intended use, and destination. Key documentation includes:

- Harmonized System (HS) Codes: Typically classified under HS Code 7307 (Pipes and tubes and tube fittings, of iron or steel). Accurate classification is vital for customs clearance and duty assessment.

- Certificates of Conformance (CoC): Required to verify that fittings meet standards such as ASTM A74 (for cast iron soil pipe fittings), ASTM A536 (for ductile iron), or ISO 65 (for general-purpose cast iron pipe fittings).

- Mill Test Certificates (MTC): Provide traceability and chemical/mechanical properties of the base material, often required in industrial and municipal contracts.

- REACH and RoHS Compliance: For shipments to the EU, confirm that fittings do not contain restricted hazardous substances, especially in coatings or surface treatments.

Packaging and Handling Requirements

Proper packaging ensures product integrity during transit and storage:

- Protective Packaging: Use wooden crates, pallets with corner boards, or shrink-wrapped bundles to prevent mechanical damage. Threaded ends should be protected with plastic or metal caps.

- Corrosion Protection: Apply temporary anti-rust coatings (e.g., vapor corrosion inhibitors – VCI) for long-term storage or ocean freight. Avoid exposure to moisture and salt environments.

- Labeling: Clearly mark packages with product specifications, size, material grade, heat number, manufacturer name, and handling instructions (e.g., “Fragile,” “This Side Up”).

Transportation and Freight Considerations

Iron pipe fittings are heavy and bulky, affecting shipping methods and costs:

- Mode of Transport:

- Maritime: Most common for international shipments. Ensure proper container loading and weight distribution.

- Rail and Truck: Suitable for domestic or regional transport. Use flatbeds or enclosed trailers with secure strapping.

- Weight and Dimensions: Account for density of iron (approx. 7.2 g/cm³); plan load limits and forklift capacity accordingly.

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., FOB, CIF, DDP) to allocate costs and risks between buyer and seller.

Import/Export Compliance

Adherence to destination country regulations is essential:

- Customs Declarations: Submit accurate commercial invoices, packing lists, and bills of lading. Include unit weight, total weight, and material composition.

- Import Duties and Taxes: Research tariff rates and preferential trade agreements (e.g., USMCA, ASEAN) that may reduce duties.

- Product Standards and Approvals: Some countries require third-party certification (e.g., WRAS approval in the UK for water supply fittings, NSF/ANSI 61 for potable water contact in the U.S.).

Environmental and Safety Regulations

Ensure compliance with environmental and workplace safety standards:

- Hazard Communication: Provide Safety Data Sheets (SDS) if coatings or treatments involve chemicals (e.g., zinc galvanizing).

- Waste Disposal: Follow local regulations for scrap iron and packaging materials. Iron fittings are recyclable; promote circular economy practices.

- OSHA and Workplace Safety: Enforce safe handling procedures to prevent injuries due to weight and sharp edges during loading/unloading.

Quality Assurance and Traceability

Maintain robust quality control throughout the supply chain:

- Batch Traceability: Assign batch/lot numbers linked to heat analysis and production records.

- Inspection Protocols: Conduct pre-shipment inspections for dimensional accuracy, surface defects, and compliance with purchase specifications.

- Non-Conformance Management: Establish procedures for handling rejected shipments, including return, replacement, or repair.

Special Considerations for Ductile Iron Fittings

Ductile iron fittings require additional attention due to their use in high-pressure systems:

- Pressure Testing: Verify compliance with AWWA C110 or ISO 2531 standards for mechanical strength and leakage.

- Coating Specifications: Internal cement-mortar lining or external polyethylene sleeving may be required for corrosion resistance in water infrastructure applications.

Conclusion

Effective logistics and compliance for iron pipe fittings demand meticulous attention to classification, packaging, regulatory standards, and transportation planning. By adhering to this guide, stakeholders can mitigate risks, ensure timely delivery, and maintain regulatory compliance across global markets.

Conclusion for Sourcing Iron Pipe Fittings:

Sourcing iron pipe fittings requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. After evaluating suppliers, material specifications, manufacturing processes, and logistical considerations, it is clear that choosing the right source involves more than just competitive pricing. Quality assurance, adherence to standards such as ASTM, ISO, or ANSI, and consistent product performance under varying conditions are critical factors that impact long-term project success and operational safety.

Establishing relationships with reputable suppliers—whether domestic or international—ensures access to durable, corrosion-resistant fittings that meet technical requirements. Additionally, considering lead times, supply chain resilience, and sustainability practices contributes to a more reliable and responsible sourcing strategy.

In conclusion, effective sourcing of iron pipe fittings hinges on comprehensive supplier evaluation, clear technical specifications, and ongoing quality control. By prioritizing these elements, organizations can secure reliable, cost-efficient materials that support the integrity and longevity of piping systems across industrial, commercial, and infrastructure applications.