The global ductile iron pipe market is experiencing steady growth, driven by increasing urbanization, rising infrastructure investments, and the need for durable water and wastewater management systems. According to a report by Mordor Intelligence, the global ductile iron pipe market was valued at USD 23.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2029. Similarly, Grand View Research estimates that the market will expand at a CAGR of 5.4% during the forecast period of 2023 to 2030, citing robust demand from municipal water supply networks and industrial applications. As aging infrastructure is replaced and new smart cities are developed—particularly across Asia-Pacific, North America, and the Middle East—the demand for high-performance, corrosion-resistant piping solutions continues to rise. This growth trajectory has intensified competition among manufacturers, with innovation in coatings, jointing technology, and sustainability practices becoming key differentiators. In this evolving landscape, the following seven companies have emerged as leading producers of ductile iron pipes, combining production scale, technological advancement, and global reach to meet the rising demands of modern infrastructure projects.

Top 7 Iron Ductile Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 DIPRA

Domain Est. 1998

Website: dipra.org

Key Highlights: DIPRA is a non-profit association supported by all of the Ductile iron pressure pipe manufacturers in North America….

#2 AMERICAN Ductile Iron Pipe

Domain Est. 2008

Website: american-usa.com

Key Highlights: AMERICAN Ductile Iron Pipe, a division of AMERICAN Cast Iron Pipe Company, is a manufacturer of ductile iron pipe and fittings for the waterworks industry….

#3 U.S. Pipe

Domain Est. 1995

Website: uspipe.com

Key Highlights: US Pipe, a Quikrete company, offers a complete range of Ductile Iron Pipe, Restrained Joint Pipe, Fabrication, Gaskets, and Fittings….

#4 Ductile Iron Pipes

Domain Est. 1997

Website: kubota.com

Key Highlights: Kubota’s ductile iron pipes are known for its excellent strength and high durability. Their strength and ductility offer high level safety against internal and ……

#5 Star Pipe Products

Domain Est. 1998

Website: starpipeproducts.com

Key Highlights: Star Pipe Products has manufactured ductile iron pipe fittings, joint restraints, and castings for the waterworks industry for over 40 years….

#6 Ductile Iron Pipe

Domain Est. 2008

Website: electrosteelusa.com

Key Highlights: Electrosteel USA is your source for PushTite ductile iron pipe that meets all American Water Works Association and American National Standards Institute ……

#7 McWane Ductile

Domain Est. 2013 | Founded: 1921

Website: mcwaneductile.com

Key Highlights: With three US foundries, McWane Ductile has been an industry leader in the manufacture of water distribution and infrastructure products since 1921….

Expert Sourcing Insights for Iron Ductile Pipe

H2: Projected Market Trends for Ductile Iron Pipe in 2026

The global ductile iron pipe (DIP) market is expected to experience steady growth by 2026, driven by increasing urbanization, aging water infrastructure, and growing demand for durable and corrosion-resistant water and wastewater conveyance systems. Key market trends shaping the industry include:

-

Infrastructure Modernization Initiatives

Governments worldwide are prioritizing the replacement of aging water pipelines, particularly in North America and Europe. In the United States, the Bipartisan Infrastructure Law continues to allocate significant funding toward water system upgrades, favoring ductile iron pipe due to its longevity, strength, and resistance to external loads. This trend is expected to accelerate DIP demand through 2026. -

Sustainability and Long-Term Cost Efficiency

Ductile iron pipe is gaining favor over alternative materials like PVC and concrete due to its superior lifespan (often exceeding 100 years) and lower lifecycle costs. Utilities and municipalities are increasingly adopting life-cycle cost analysis (LCCA) in procurement decisions, bolstering DIP’s competitive position in large-scale projects. -

Growth in Emerging Markets

Rapid urbanization in Asia-Pacific (particularly India and Southeast Asia), the Middle East, and Africa is fueling demand for new water transmission and distribution networks. Countries investing in smart city development and improved sanitation are turning to ductile iron pipe for its reliability in varying soil and load conditions. -

Technological Advancements and Coatings

Manufacturers are investing in improved internal and external coatings (e.g., polyurethane, cement mortar linings, and zinc-aluminum alloys) to enhance corrosion resistance and hydraulic efficiency. These innovations are expanding DIP applications in aggressive environments and saline conditions. -

Environmental and Regulatory Pressures

Stricter environmental regulations related to water loss and leakage are pushing governments to adopt materials that minimize pipe bursts and water wastage. Ductile iron’s high pressure-bearing capacity and joint flexibility make it a preferred choice for leak-prone areas. -

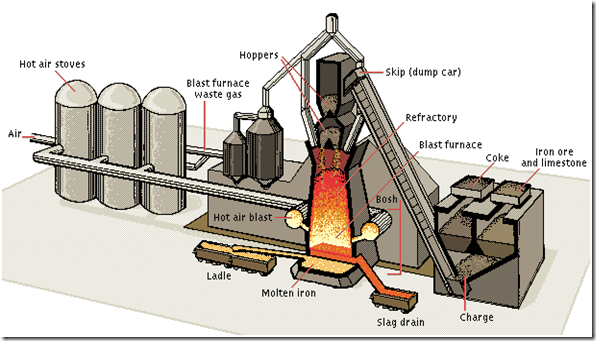

Supply Chain and Raw Material Dynamics

The availability and pricing of scrap iron and pig iron—key inputs in DIP manufacturing—will influence production costs. By 2026, industry players are expected to adopt more circular economy models, including increased scrap recycling, to mitigate raw material volatility. -

Competition from Alternative Materials

Despite its advantages, DIP faces competition from HDPE and PVC pipes, especially in smaller-diameter applications and regions with lower installation budgets. However, DIP maintains a strong foothold in large-diameter, high-pressure, and critical infrastructure projects.

In conclusion, the ductile iron pipe market is poised for moderate but consistent growth by 2026, supported by infrastructure investment, sustainability goals, and technological innovation. Market expansion will be most pronounced in regions undergoing significant water infrastructure development, with North America and Asia-Pacific leading demand.

Common Pitfalls When Sourcing Ductile Iron Pipe (Quality & Intellectual Property)

Sourcing ductile iron pipe involves navigating several critical challenges that can significantly impact project performance, longevity, and compliance. Below are the most common pitfalls related to quality assurance and intellectual property concerns:

Inadequate Quality Control and Non-Compliance with Standards

One of the most frequent issues is procuring ductile iron pipe that fails to meet recognized international standards such as ISO 2531, EN 545, or AWWA C151. Suppliers may claim compliance without providing verifiable test reports or third-party certifications. Inconsistent chemical composition, insufficient wall thickness, poor cement lining, or substandard external coatings can lead to premature failure, leaks, or contamination in water distribution systems. Buyers often overlook the importance of independent quality audits or factory inspections, resulting in acceptance of non-conforming products.

Counterfeit or Misrepresented Products

The ductile iron pipe market is vulnerable to counterfeit goods and mislabeled products. Some suppliers may rebrand lower-grade cast iron or recycled materials as ductile iron to cut costs. These products often lack the tensile strength, elongation, and impact resistance required for high-pressure applications. Without proper material test certificates (MTCs) or traceability documentation, it becomes difficult to verify the authenticity of the pipe, exposing projects to safety and regulatory risks.

Intellectual Property Infringement

Reputable manufacturers invest heavily in proprietary production processes, coating technologies, and jointing systems (e.g., push-on or mechanical joints). A key pitfall arises when sourcing from suppliers who replicate patented designs or use branded components without authorization. This not only violates intellectual property rights but may also result in inferior performance, as knock-off components are rarely tested to the same rigorous standards. Buyers risk legal liability and project delays if IP-infringing materials are discovered during or after installation.

Lack of Traceability and Documentation

Proper traceability—from raw material sourcing to final inspection—is essential for quality assurance and accountability. Many suppliers fail to provide batch-specific documentation, heat numbers, or inspection records. This absence complicates root cause analysis in case of failures and undermines compliance with regulatory or client requirements, especially in public infrastructure projects.

Choosing Suppliers Based Solely on Price

Opting for the lowest bid often leads to compromised quality. Low-cost suppliers may use inferior raw materials, reduce production oversight, or skip critical quality tests. While initial savings are attractive, the long-term costs of maintenance, repairs, and system downtime far outweigh the upfront discount. A total cost of ownership analysis should guide procurement decisions, not just initial price.

Insufficient Verification of Coatings and Linings

Internal cement-mortar linings and external polyethylene sleeving or zinc coatings are critical for corrosion resistance and water quality. Poor application—such as uneven coating thickness, curing defects, or inadequate adhesion—can drastically reduce pipe lifespan. Buyers often assume specifications are met without demanding on-site or lab testing, leading to early degradation in the field.

Overlooking Supplier Capability and Track Record

Engaging new or unproven suppliers without evaluating their production capacity, quality management systems (e.g., ISO 9001), or project references increases risk. Suppliers with limited experience may struggle with large-volume orders or fail to meet delivery timelines, disrupting project schedules and increasing logistical costs.

Avoiding these pitfalls requires due diligence: conducting supplier audits, requiring full certification packages, insisting on third-party inspections, and protecting against IP risks through clear contractual terms and brand verification.

Logistics & Compliance Guide for Ductile Iron Pipe

Overview and Handling Requirements

Ductile iron pipe is a durable and widely used material in water and wastewater infrastructure due to its strength, flexibility, and long service life. Proper logistics and compliance practices are essential to ensure safe transportation, handling, storage, and regulatory adherence throughout the supply chain. This guide outlines key considerations for managing ductile iron pipe from manufacturing to installation.

Packaging and Load Securing

Ductile iron pipes are typically shipped in bundles or individually, depending on size and project requirements. Pipes must be securely bundled using steel strapping or chains and placed on wooden skids to prevent direct contact with the ground or transport surface. During transport, loads must be properly blocked and braced to prevent shifting. Use cradles or padded supports to protect pipe ends and coatings, especially for lined and coated pipes. Ensure all securing methods comply with local and international freight regulations (e.g., AAR, FMCSA, or IATA standards, where applicable).

Transportation and Routing

Due to the weight and length of ductile iron pipe, specialized transport vehicles such as flatbed trailers or lowboy trailers are required. Route planning must consider bridge weight limits, road restrictions, and overhead clearance. Oversize/overweight permits may be necessary; ensure compliance with Department of Transportation (DOT) regulations. Coordinate with local authorities for access to urban or restricted areas. Avoid sharp turns and rough terrain to reduce stress on pipe bundles and transport equipment.

Storage and Site Management

Store ductile iron pipes on level, well-drained ground, preferably on timber stringers to elevate them off the ground and prevent corrosion. Stack pipes no higher than three layers to avoid deformation and ensure stability. Protect lined or coated pipes from direct sunlight, moisture, and physical damage. Cover with waterproof tarpaulins if stored outdoors for extended periods. Clearly mark stored materials with identification tags indicating size, class, coating type, and project specifications. Implement a first-in, first-out (FIFO) inventory system to prevent aging-related degradation.

Compliance with Industry Standards

Ductile iron pipe must meet recognized standards for quality and performance. Key compliance standards include:

– ASTM A536: Standard specification for ductile iron castings.

– AWWA C151/A21.51: Standard for ductile iron pipe, centrifugally cast, for water and other liquids.

– AWWA C111/A21.11: Standard for rubber gaskets for ductile iron pipe.

– ISO 2531: International standard for ductile iron pipes, fittings, accessories, and their joints for water pipelines.

Ensure all materials are certified and accompanied by mill test reports (MTRs) and compliance documentation. Verify third-party inspection reports when required by project specifications.

Environmental and Safety Regulations

Adhere to environmental regulations regarding coating materials (e.g., epoxy, cement mortar lining) and handling of waste during installation. Use secondary containment when storing coating materials. Comply with OSHA standards for worker safety during handling, including proper use of lifting equipment, personal protective equipment (PPE), and fall protection when working on elevated loads. Train personnel on safe rigging practices and emergency procedures.

Import/Export and Customs Compliance

For international shipments, ensure proper classification under the Harmonized System (HS Code), typically 7303.00 for cast iron pipes. Prepare accurate commercial invoices, packing lists, and certificates of origin. Comply with destination country regulations, including import duties, phytosanitary requirements for wooden skids (ISPM 15), and product conformity assessments. Retain documentation for audit and traceability purposes.

Quality Assurance and Documentation

Maintain a comprehensive quality management system throughout logistics operations. Document inspections at each stage: pre-shipment, during transit, and upon delivery. Record any damages, deviations, or non-conformances. Retain shipping logs, inspection reports, compliance certificates, and delivery receipts for a minimum of five years or as required by contract. Implement traceability systems using barcodes or RFID tags where feasible.

Conclusion

Effective logistics and compliance management for ductile iron pipe ensures product integrity, regulatory adherence, and project success. By following industry standards, safety protocols, and proper handling procedures, stakeholders can minimize risks, reduce costs, and support sustainable infrastructure development. Regular training, audits, and continuous improvement are recommended to maintain high operational standards.

Conclusion for Sourcing Ductile Iron Pipe

Sourcing ductile iron pipe remains a strategic and reliable choice for water, wastewater, and other fluid transmission infrastructure projects due to its superior strength, durability, and resilience. Its combination of high tensile strength, flexibility, and resistance to corrosion and external loading makes it a cost-effective long-term solution compared to alternative materials. When sourcing ductile iron pipe, it is essential to partner with reputable suppliers and manufacturers that adhere to international standards such as ISO 2531, EN 545, or ASTM A536 to ensure product quality and performance.

Key considerations include evaluating supplier reliability, ensuring compliance with project specifications, assessing delivery timelines, and factoring in total lifecycle costs rather than initial procurement price. Additionally, sustainability aspects—such as recyclability and reduced maintenance needs—further enhance the environmental and economic value of ductile iron pipe.

In conclusion, a well-structured sourcing strategy focused on quality, compliance, and long-term value will ensure the successful implementation of durable and efficient pipeline systems, supporting resilient infrastructure for decades to come.