The global market for electric vehicles, renewable energy, and advanced technology solutions is expanding at an unprecedented pace, driven by innovation and growing demand for sustainable infrastructure. According to Mordor Intelligence, the global electric vehicle market was valued at USD 645.17 billion in 2023 and is projected to grow at a CAGR of over 14.1% from 2024 to 2029. Similarly, Grand View Research reports that the global energy storage market is expected to reach USD 209.5 billion by 2030, fueled by advancements in battery technology and increasing grid modernization efforts. At the center of this transformation are companies backed by Elon Musk—visionary enterprises like Tesla, SpaceX, SolarEdge (formerly SolarCity), and Neuralink—that are not only shaping their respective industries but also redefining the future of technology and energy. As investment pours into high-growth sectors such as EVs, space exploration, AI, and sustainable energy, the manufacturers and suppliers aligned with Musk’s ecosystem are emerging as key players in the next wave of industrial innovation.

Top 8 Invest In Elon Musk Companies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Elon Musk

Domain Est. 1992

Website: tesla.com

Key Highlights: As the co-founder and CEO of Tesla, Elon leads all product design, engineering and global manufacturing of the company’s electric vehicles, battery products ……

#2 Invest in SpaceX? How to Invest in a Private Company

Domain Est. 1993

Website: nasdaq.com

Key Highlights: SpaceX is privately held rather than publicly traded, so you can’t buy shares of the rocket and satellite maker on the stock exchanges….

#3 How to Invest in Starlink

Domain Est. 2003

Website: smartasset.com

Key Highlights: Starlink is not available for public investment. No shares trade on public exchanges and the company has not announced any official plans for a public offering….

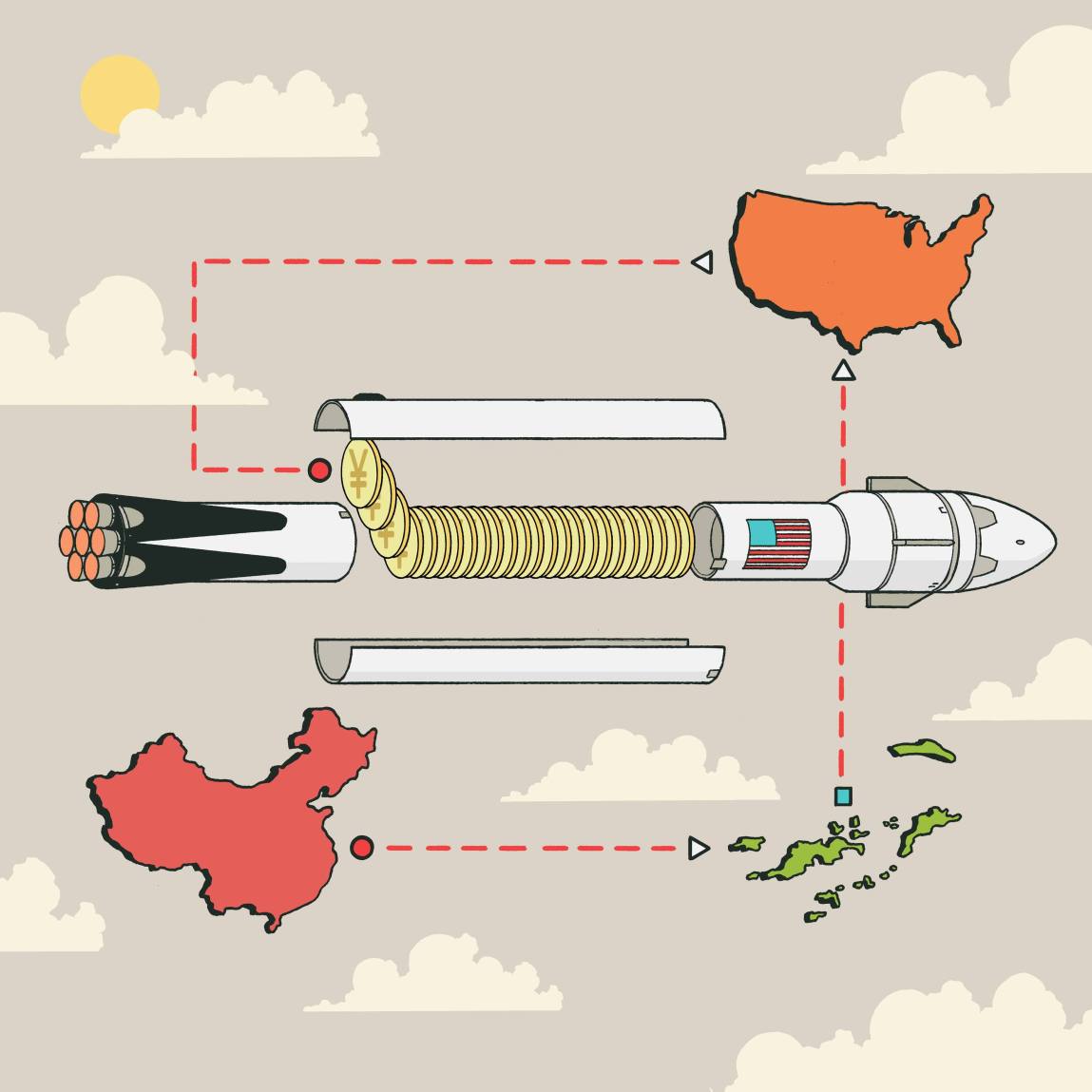

#4 How Elon Musk’s SpaceX Secretly Allows Investment From China

Domain Est. 2007

Website: propublica.org

Key Highlights: Elon Musk’s aerospace giant SpaceX allows investors from China to buy stakes in the company as long as the funds are routed through the Cayman Islands or other ……

#5 Beware Elon Musk Investment Scam Using Deepfake Videos

Domain Est. 2012

Website: africacheck.org

Key Highlights: The videos announce Elon Musk’s supposed “new secret investment” project using the likeness of TV news anchors. Musk is the founder of the ……

#6 Invest In SpaceX Stock

Domain Est. 2013

Website: equityzen.com

Key Highlights: Sign Up Today and Learn More About SpaceX Stock. Invest in or calculate the value of your shares in SpaceX or other pre-IPO companies through EquityZen’s ……

#7 Elon Musk

Domain Est. 2023

Website: investinmusk.com

Key Highlights: Elon Musk is an entrepreneur, founder of SpaceX and Tesla, aiming to change the world through innovations in space, energy, and AI, inspiring millions….

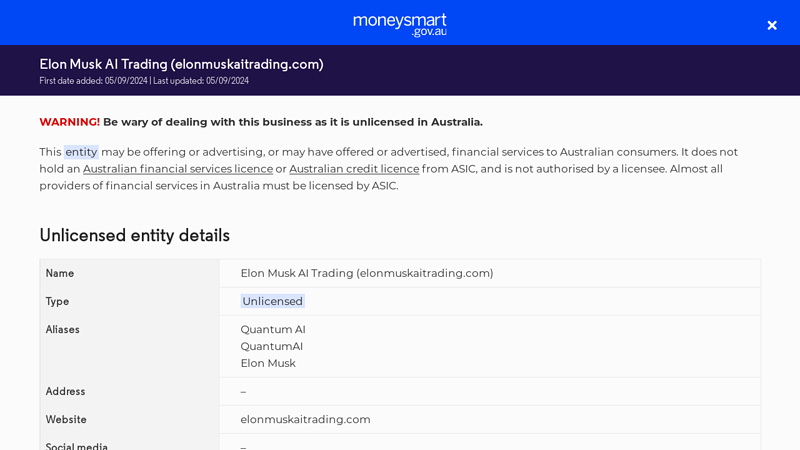

#8 Investor warning

Website: moneysmart.gov.au

Key Highlights: ASIC warns consumers about Elon Musk AI Trading (elonmuskaitrading.com). Be wary of dealing with this business as it is unlicensed in Australia and may be ……

Expert Sourcing Insights for Invest In Elon Musk Companies

2026 Market Trends for Investing in Elon Musk Companies

As we approach 2026, investing in Elon Musk-led companies—primarily Tesla, SpaceX, and emerging ventures like xAI and Neuralink—remains both highly attractive and inherently volatile. The investment landscape will be shaped by macroeconomic forces, technological breakthroughs, regulatory developments, and Musk’s increasingly unpredictable leadership style. Here’s a breakdown of key market trends likely to influence investor decisions:

Accelerated AI and Robotics Integration

By 2026, artificial intelligence will be central to the valuation of Musk’s ventures. Tesla’s Full Self-Driving (FSD) and Optimus robot initiatives are expected to reach inflection points, with potential commercial rollouts of humanoid robots in logistics and manufacturing. Meanwhile, xAI aims to challenge industry leaders with its Grok AI model, positioning itself in enterprise and consumer markets. Investors will closely monitor milestones in AI safety, scalability, and monetization, as success could dramatically increase xAI’s valuation and catalyze cross-company synergies.

Space Economy Expansion and Starlink Monetization

SpaceX is poised to dominate the commercial space sector through Starlink and Starship. By 2026, Starlink is projected to achieve global broadband coverage and profitability, driven by enterprise contracts, aviation, maritime, and government deals. The successful deployment of Starship will unlock new markets in satellite mega-constellations, space tourism, and lunar missions under NASA’s Artemis program. These developments could position SpaceX for a potential IPO or major secondary offering, making it a rare private-market unicorn with tangible revenue.

Tesla’s Transition Beyond Electric Vehicles

While Tesla remains the EV market leader, 2026 will test its ability to diversify. Energy storage (Megapack), solar, and the Tesla Bot ecosystem will play larger roles in revenue generation. However, increasing competition from legacy automakers and Chinese EV manufacturers may pressure margins. Investors will scrutinize Tesla’s ability to innovate in battery technology (e.g., 4680 cells) and maintain pricing power amid saturated EV markets in North America and Europe.

Regulatory and Governance Challenges

Elon Musk’s dual roles across multiple companies raise governance concerns. Regulatory scrutiny—especially from the SEC regarding disclosures and stock sales—is expected to intensify. Additionally, labor practices at Tesla, environmental compliance, and AI ethics pose reputational and legal risks. Investors will demand greater transparency and risk mitigation strategies, potentially affecting stock volatility.

Macroeconomic and Geopolitical Influences

High interest rates, inflation, and supply chain disruptions could impact capital-intensive ventures like SpaceX and Tesla. Geopolitical tensions may affect Tesla’s operations in China and Starlink’s global expansion. Conversely, government incentives for clean energy and space exploration could provide tailwinds.

Conclusion: High Risk, High Reward

Investing in Elon Musk companies in 2026 offers exposure to transformative technologies but requires tolerance for volatility and leadership risk. Success will hinge on execution, regulatory navigation, and sustained innovation. Diversified investors may find strategic value in selective exposure, particularly in SpaceX’s space infrastructure and Tesla’s AI-driven mobility ecosystem.

Common Pitfalls When Sourcing Investments in Elon Musk Companies (Quality, IP)

Investing in companies associated with Elon Musk—such as Tesla, SpaceX, Neuralink, and The Boring Company—can be highly rewarding, but it also comes with unique risks, particularly concerning quality control and intellectual property (IP). Below are common pitfalls investors should be aware of:

1. Overreliance on Elon Musk’s Personal Brand

Many investors are drawn to Musk’s visionary image, often overlooking fundamental business metrics. This emotional bias can lead to undervaluing risks related to product quality, scalability, or long-term sustainability. When Musk’s attention shifts between companies, operational focus may wane, impacting product consistency and delivery timelines.

2. Quality Control and Production Scalability Issues

Tesla, in particular, has faced recurring challenges with manufacturing quality during rapid scaling (e.g., early Model 3 production). Similarly, SpaceX and other ventures push technological boundaries, increasing the risk of defects, delays, or safety concerns. Investors may underestimate how these quality issues can affect brand reputation, regulatory compliance, and profitability.

3. Intellectual Property Leaks and Protection Gaps

Innovative companies like Neuralink and SpaceX develop cutting-edge technologies that are prime targets for IP theft. While these firms pursue patents, much of their IP is protected as trade secrets—especially in software and proprietary processes. However, rapid hiring, contractor involvement, and public demonstrations increase the risk of unintentional disclosure or reverse engineering.

4. Aggressive IP Filings with Uncertain Enforcement

Elon Musk companies often file broad patents, but not all translate into enforceable or commercially viable IP. Some patents are strategic—intended to block competitors—rather than reflective of imminent products. Investors may misinterpret patent volume as a sign of strong IP moats, when in reality, many filings never result in marketable technology.

5. Open-Source Claims vs. Actual IP Strategy

Tesla’s 2014 pledge to open-source its patents created confusion among investors about the company’s true IP protection strategy. While the move was framed as promoting EV adoption, critical battery and software IP remains closely guarded. Misunderstanding this nuance can lead to incorrect assumptions about competitive advantages or barriers to entry.

6. Supply Chain and Third-Party Dependencies

High reliance on external suppliers for components (e.g., semiconductors, specialized materials) exposes Musk-affiliated companies to quality inconsistencies and IP risks. If third parties gain access to proprietary designs or processes, there’s potential for IP leakage, especially in jurisdictions with weak IP enforcement.

7. Rapid Innovation at the Expense of Documentation and IP Management

The fast-paced development culture in Musk’s companies sometimes leads to inadequate documentation of inventions or delayed patent filings. This can weaken IP positions and make it harder to defend against infringement or attract strategic partners who require clear IP ownership.

Conclusion

While Elon Musk’s ventures offer groundbreaking potential, investors must look beyond the hype. Assessing real-world quality control practices, understanding the depth and enforceability of IP portfolios, and recognizing operational vulnerabilities are critical to making informed investment decisions. Due diligence should focus on sustainable innovation, not just charismatic leadership.

Logistics & Compliance Guide for Investing in Elon Musk Companies

Investing in companies associated with Elon Musk—such as Tesla, Inc. (TSLA), SpaceX (privately held), Neuralink, and The Boring Company—requires careful attention to logistics and regulatory compliance. This guide outlines key steps and considerations for individuals and institutions interested in investing legally and efficiently.

Understanding the Investment Landscape

Before investing, determine which Elon Musk-affiliated companies are publicly traded versus private. Tesla (TSLA) is publicly listed on the NASDAQ, making it accessible through standard brokerage accounts. In contrast, SpaceX, Neuralink, and The Boring Company are private entities, limiting investment opportunities primarily to accredited investors via private placements or secondary markets.

Opening a Brokerage Account (For Public Companies)

To invest in Tesla, open an account with a registered brokerage firm regulated by the U.S. Securities and Exchange Commission (SEC) or your country’s equivalent financial authority. Ensure the platform supports trading of U.S.-listed stocks. Complete required Know Your Customer (KYC) and Anti-Money Laundering (AML) verification processes, which typically include providing government-issued ID, proof of address, and financial information.

Conducting Due Diligence

Perform thorough research on the company’s financial health, market position, regulatory filings (e.g., 10-K, 10-Q), and governance practices. Review Tesla’s investor relations website and SEC filings for accurate, up-to-date information. Be cautious of misinformation or speculative claims often associated with high-profile figures like Elon Musk.

Navigating Compliance Requirements

All investments must comply with federal securities laws. In the U.S., this includes adherence to regulations enforced by the SEC. Private investments in companies like SpaceX require compliance with Regulation D (Rule 506(c)), which mandates that investors be accredited—defined as individuals with an annual income over $200,000 (or $300,000 jointly) or a net worth exceeding $1 million, excluding primary residence.

Managing International Investment Logistics

Non-U.S. investors must consider currency exchange, cross-border transaction fees, and tax implications. Confirm that your brokerage supports international trading and complies with local financial regulations, such as MiFID II in the European Union or IIROC in Canada. Report foreign investments to your national tax authority as required.

Monitoring Regulatory Communications

Elon Musk’s public statements, particularly on social media, can significantly affect stock prices. The SEC has previously taken enforcement action related to Musk’s tweets about Tesla. Investors should remain aware of how executive communications may influence market behavior and regulatory scrutiny.

Maintaining Accurate Records

Keep detailed records of all transactions, including purchase/sale dates, prices, fees, and communications with brokers. These records are essential for tax reporting, audits, and demonstrating compliance with securities regulations.

Consulting Professional Advisors

Given the complexity of investing in high-volatility, innovation-driven companies, consult with a licensed financial advisor and tax professional. They can help align investments with your risk profile, ensure regulatory compliance, and optimize tax outcomes.

Staying Informed on Policy Changes

Monitor changes in securities laws, tax codes, and international investment treaties that could impact your holdings. Regulatory developments related to electric vehicles, space technology, or AI may directly affect the valuation and compliance obligations of Musk-affiliated companies.

By following this logistics and compliance guide, investors can responsibly engage with opportunities tied to Elon Musk’s ventures while minimizing legal and financial risk.

Investing in Elon Musk’s companies can offer significant long-term growth potential due to their focus on disruptive innovation in high-impact sectors such as electric vehicles (Tesla), space exploration (SpaceX), renewable energy, artificial intelligence, and infrastructure (The Boring Company, Neuralink). Musk’s visionary leadership and track record of turning ambitious ideas into scalable technologies have created substantial shareholder value in the past.

However, investing in these companies comes with notable risks. The businesses operate in capital-intensive, highly competitive, and often regulatory-sensitive industries. Additionally, their performance can be heavily influenced by Musk’s personal decisions, public statements, and his involvement in multiple ventures simultaneously.

Therefore, while sourcing an investment in Elon Musk-related companies may be compelling for those with a higher risk tolerance and a belief in transformative technologies, it is crucial to conduct thorough due diligence, diversify risk, and consider the volatile nature of both the industries and Musk’s leadership style. A balanced approach—recognizing both the innovation potential and the inherent uncertainties—is key to making an informed investment decision.