The global commercial vehicle parts market is experiencing robust growth, driven by rising freight demand, fleet modernization, and increasing vehicle production across emerging economies. According to Grand View Research, the global truck parts market was valued at USD 333.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. With Navistar International Corporation maintaining a significant presence in medium- and heavy-duty truck manufacturing, the demand for high-quality, compatible parts has surged worldwide. This growth has catalyzed the expansion of a competitive international supply base, comprising OEMs and Tier-1 suppliers specializing in Navistar-compatible components. As fleet operators prioritize uptime, cost-efficiency, and OEM equivalency, sourcing from reliable international manufacturers has become a strategic imperative. Below is a data-driven overview of the top six international manufacturers excelling in the production of Navistar parts, selected based on market reach, quality certifications, innovation, and supply chain resilience.

Top 6 International Navistar Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Investor Relations

Domain Est. 1993

Website: ir.navistar.com

Key Highlights: Navistar International Corporation is a holding company whose subsidiaries and affiliates produce International® brand commercial trucks….

#2 Navistar International Parts for Trucks, Buses, and more

Domain Est. 2019

Website: s1partscenter.com

Key Highlights: Discover our vast selection of Navistar International truck parts, designed for optimal performance and reliability. Shop genuine OEM parts for your Navistar ……

#3 Navistar, Inc.

Website: navistarsupplier.com

Key Highlights: The purpose of this website is to provide a responsive, secure environment within which Navistar and the Supply Chain can partner in innovation ……

#4 Parts

Domain Est. 1998

Website: international.com

Key Highlights: International® offers a vast inventory of quality parts so your fleet has the right parts at the right time to get the job done….

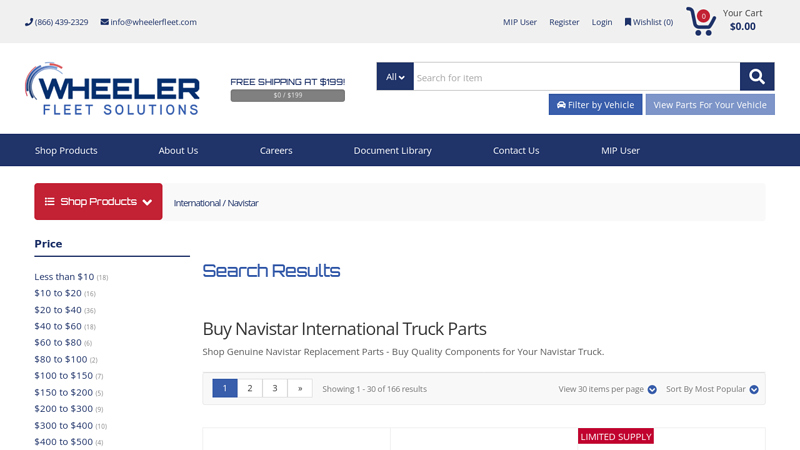

#5 International / Navistar

Domain Est. 2014

Website: wheelerfleet.com

Key Highlights: Free delivery over $199 · 30-day returnsBuy Navistar International Truck Parts. Shop Genuine Navistar Replacement Parts – Buy Quality Components for Your Navistar Truck. Filter Op…

#6 International Truck Parts For Sale with Catalog Online Lookup

Domain Est. 2020

Website: beltwaytruckparts.com

Key Highlights: 8-day delivery 30-day returnsExplore International truck parts at Beltway Truck Parts. Shop our wide selection, enjoy competitive pricing, fast shipping, and expert support….

Expert Sourcing Insights for International Navistar Parts

H2: 2026 Market Trends for International Navistar Parts

As the global commercial transportation and heavy-duty vehicle sector advances toward 2026, International Navistar Parts—key components of vehicles manufactured by International Trucks, a division of Navistar International (now part of Traton Group, a subsidiary of Volkswagen)—are expected to experience significant transformations driven by technological innovation, regulatory pressures, and shifting market dynamics. Below are the major market trends shaping the demand, distribution, and strategic positioning of International Navistar Parts in 2026.

1. Electrification and Alternative Fuel Transition

By 2026, electrification will be a dominant force in the heavy-duty vehicle market. Navistar has already launched the International eMV™ and eRH™ electric vehicle platforms, signaling a strategic shift away from traditional diesel engines. Consequently, the demand for conventional diesel-related parts—such as diesel particulate filters, exhaust gas recirculation (EGR) systems, and high-pressure fuel pumps—is projected to decline. In contrast, demand for electric drivetrain components—including electric motors, battery management systems, power inverters, and thermal management parts—will rise sharply. Navistar’s parts division will need to scale up production and distribution networks for these new components, particularly in North America where the company maintains a strong service footprint.

2. Growth in Connected Vehicle and Predictive Maintenance

Navistar’s OnCommand® Connection telematics platform is expected to be more deeply integrated into fleet operations by 2026. As fleets adopt data-driven maintenance models, there will be increased demand for smart parts that support remote diagnostics and predictive maintenance. For example, sensors embedded in brake systems, transmissions, and cooling units will provide real-time data, reducing unplanned downtime and enabling just-in-time part replacements. This shift will elevate the value of software-enabled parts and aftermarket services, pushing Navistar Parts to develop or partner with tech providers to offer integrated hardware-software solutions.

3. Expansion of Aftermarket and Remanufactured Parts

With rising vehicle acquisition costs and pressure to reduce total cost of ownership (TCO), fleet operators are increasingly turning to remanufactured and certified pre-owned parts. Navistar’s existing remanufacturing programs for engines, transmissions, and axles are expected to grow in 2026. The company is likely to expand its “ReNew” and “ReMan” branded parts offerings, leveraging Traton’s global remanufacturing capabilities. Additionally, digital marketplaces and e-commerce platforms for Navistar parts are projected to mature, offering customers transparent pricing, faster delivery, and enhanced inventory tracking—further boosting aftermarket revenues.

4. Regulatory Compliance Driving Emissions-Related Part Demand

Despite the move toward electrification, diesel and natural gas-powered International trucks will remain on the road through 2026, especially in long-haul and vocational applications. Stricter emissions regulations—such as the U.S. Environmental Protection Agency’s (EPA) 2027 greenhouse gas standards and California Air Resources Board (CARB) requirements—will necessitate ongoing maintenance and replacement of emissions control components. This includes diesel oxidation catalysts (DOC), selective catalytic reduction (SCR) systems, and advanced aftertreatment sensors. Navistar Parts will continue to see sustained demand for these components, particularly in retrofit and compliance upgrade programs.

5. Supply Chain Resilience and Localization

The global supply chain disruptions experienced in the early 2020s have prompted Navistar and its parent Traton to localize key parts production and diversify suppliers. By 2026, Navistar Parts are expected to benefit from regionalized manufacturing hubs in North America, particularly in the U.S. and Mexico, to reduce dependency on overseas logistics. This localization will improve lead times, reduce costs, and support faster response to market demand—especially for high-usage wear items like brakes, filters, and lighting systems.

6. Increased Competition and Third-Party Part Proliferation

While Navistar Parts maintain an advantage through OEM certification and warranty alignment, third-party and independent aftermarket suppliers are improving quality and gaining market share. By 2026, Navistar will need to emphasize the value proposition of genuine parts—such as compatibility, durability, and integration with telematics—through targeted marketing and fleet partnerships. Additionally, cybersecurity concerns around connected parts may drive customers toward OEM-sourced components to ensure system integrity.

Conclusion

The 2026 market for International Navistar Parts will be shaped by a dual transition: from internal combustion to electrification, and from reactive to predictive maintenance. While traditional diesel parts will remain relevant in the near term, the future lies in electric drivetrains, connected systems, and remanufactured solutions. To maintain leadership, Navistar Parts must innovate rapidly, strengthen digital distribution channels, and align with Traton’s global sustainability and technology roadmap. Fleet operators seeking reliability, compliance, and cost efficiency will increasingly rely on a hybrid ecosystem of genuine OEM parts and advanced service solutions—positioning Navistar Parts at the forefront of the evolving commercial vehicle aftermarket.

Common Pitfalls Sourcing International Navistar Parts (Quality, IP)

Poor Quality Control and Counterfeit Parts

Sourcing Navistar parts internationally often exposes buyers to inconsistent quality standards. Many overseas suppliers lack rigorous manufacturing oversight, leading to parts that fail to meet OEM specifications. A major risk is counterfeit or “gray market” components falsely labeled as genuine Navistar. These parts may use inferior materials or incorrect tolerances, resulting in premature failure, reduced vehicle performance, and potential safety hazards.

Intellectual Property (IP) Infringement Risks

Navistar holds trademarks, patents, and design rights on its genuine parts. When sourcing from international suppliers, especially in regions with weak IP enforcement, there’s a high risk of purchasing pirated or reverse-engineered components. Using such parts not only violates intellectual property laws but can also void vehicle warranties and expose fleets or repair shops to legal liability. Authenticity documentation is often missing or falsified, making verification difficult.

Lack of Traceability and Certification

Internationally sourced parts may not come with proper traceability documentation, such as certificates of conformance, batch numbers, or compliance with ISO or EPA standards. Without these, it’s challenging to verify that a part meets original equipment performance or emissions requirements. This lack of transparency increases the risk of non-compliance, particularly in regulated markets.

Inconsistent After-Sales Support and Warranty Coverage

Genuine Navistar parts come with manufacturer-backed warranties and technical support. International alternatives often offer limited or no warranty, and service support may be unavailable outside the supplier’s home country. If a part fails, resolving claims or obtaining replacements can be time-consuming and costly, disrupting fleet operations.

Supply Chain and Logistics Delays

While cost may be a motivating factor in sourcing internationally, extended lead times, customs delays, and unreliable shipping partners can negate savings. Poor logistics planning may result in inventory shortages, downtime, and increased operational costs—especially when urgent repairs are needed.

Regulatory and Compliance Issues

Navistar vehicles must comply with specific regional emissions and safety standards (e.g., EPA, CARB, EU directives). Parts sourced from outside regulated markets may not meet these requirements, leading to failed inspections, fines, or non-roadworthiness. Importing non-compliant parts can also trigger customs seizures or penalties.

Mitigation Strategies

To avoid these pitfalls, prioritize authorized distributors, verify supplier credentials, demand authenticity documentation (e.g., Navistar’s Genuine Parts certification), and consider total cost of ownership—not just upfront price. Using Navistar’s global parts network or certified partners ensures quality, compliance, and protection against IP violations.

Logistics & Compliance Guide for International Navistar Parts

This guide outlines key logistics and compliance considerations for the international shipment of Navistar parts, ensuring efficient operations and adherence to global trade regulations.

Understanding International Shipping Requirements

Each country has distinct import regulations, including documentation, labeling, and product standards. Prior to shipping, verify destination-specific requirements such as import licenses, customs duties, and restrictions on certain parts (e.g., emissions-related components). Utilize Navistar’s global trade compliance resources and consult with certified customs brokers to ensure shipments meet local laws.

Proper Documentation and Export Controls

Accurate and complete documentation is essential for smooth customs clearance. Required documents typically include commercial invoices, packing lists, bills of lading, and certificates of origin. For parts subject to export controls (e.g., technology-containing components), ensure compliance with U.S. Department of Commerce regulations under the Export Administration Regulations (EAR). Classify parts using the appropriate Export Control Classification Number (ECCN) and obtain necessary licenses when required.

Packaging and Labeling Standards

Use durable, export-grade packaging to protect parts during transit. Clearly label each package with the consignee’s details, purchase order number, part numbers, quantities, and handling instructions (e.g., “Fragile,” “This Side Up”). Include Navistar’s part-specific labeling requirements and any country-specific language or barcode specifications. Proper labeling reduces delays and ensures traceability.

Incoterms and Responsibility Allocation

Clearly define shipping terms using internationally recognized Incoterms (e.g., FOB, DAP, DDP) in all sales contracts. This establishes responsibilities for costs, risks, and customs clearance between Navistar and the international buyer. Selecting the appropriate Incoterm helps manage logistics expectations and avoids disputes.

Carrier Selection and Freight Management

Partner with experienced freight forwarders and carriers experienced in automotive parts logistics and global trade compliance. Ensure they provide tracking capabilities, customs brokerage services, and contingency planning for delays. Evaluate carriers based on reliability, transit times, and adherence to regulatory standards.

Sanctions and Restricted Party Screening

Navistar must comply with U.S. and international sanctions programs administered by OFAC, BIS, and other authorities. Conduct regular screenings of customers, suppliers, and intermediaries against government-maintained restricted party lists (e.g., SDN, BIS Entity List) before initiating shipments. Deny transactions involving sanctioned entities or embargoed destinations.

Environmental and Safety Compliance

Ensure international shipments comply with environmental regulations such as those governing the transport of batteries, fluids, or hazardous materials (if applicable). Adhere to International Air Transport Association (IATA) and International Maritime Dangerous Goods (IMDG) codes when shipping regulated items. Document any special handling requirements clearly.

Recordkeeping and Audit Readiness

Maintain comprehensive records of all international shipments for at least five years, including export filings, licenses, correspondence, and compliance certifications. These records support internal audits and regulatory reviews, demonstrating Navistar’s commitment to lawful trade practices.

Training and Continuous Improvement

Provide regular training for logistics and sales teams on export compliance, documentation updates, and global trade developments. Encourage reporting of compliance concerns and continuously refine logistics processes based on feedback and regulatory changes.

Adhering to this guide ensures efficient delivery of Navistar parts worldwide while minimizing compliance risks and enhancing customer satisfaction.

Conclusion: Sourcing International Navistar Parts

Sourcing international Navistar parts presents both significant opportunities and notable challenges. On one hand, accessing a global supply chain can lead to cost savings, increased availability of hard-to-find components, and improved operational efficiency for fleet maintenance and repair operations. Partnering with authorized distributors, leveraging OEM specifications, and utilizing Navistar’s global support network help ensure part authenticity, reliability, and compatibility.

However, buyers must remain vigilant about potential risks such as counterfeit parts, import regulations, shipping delays, and varying quality standards across suppliers. Establishing strong relationships with reputable international vendors, conducting due diligence, and maintaining compliance with local and international trade laws are essential for mitigating these risks.

In conclusion, with a strategic and informed approach—emphasizing quality assurance, supply chain transparency, and technical compatibility—sourcing international Navistar parts can be a viable and advantageous option for maintaining fleet uptime and reducing long-term maintenance costs. As global logistics continue to evolve, integrating trusted international suppliers into a comprehensive parts procurement strategy will be key to maximizing performance and serviceability for Navistar-powered vehicles and equipment.