The global industrial laser welding market is experiencing robust expansion, driven by rising demand for precision manufacturing across automotive, aerospace, and electronics sectors. According to Mordor Intelligence, the industrial laser market was valued at USD 12.7 billion in 2023 and is projected to grow at a CAGR of over 8.5% through 2029, with laser welding representing a significant segment. This growth is fueled by advancements in high-power laser technologies, increasing automation in production lines, and the shift toward lightweight, energy-efficient materials requiring high-integrity joins. Among the latest innovations, internally heated laser welders—designed to improve weld penetration, reduce thermal distortion, and enhance joint quality—are gaining traction in high-volume manufacturing environments. As adoption accelerates, a select group of manufacturers has emerged at the forefront of integrating thermal control with high-precision laser delivery. Below are the top eight manufacturers leading innovation in internally heated industrial laser welding systems.

Top 8 Internally Heated Industrial Laser Welder Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Internally Heated Industrial Laser Welding Tools

Website: happinook.com

Key Highlights: The internal ceramic heating technology allows the 60W soldering iron to heat up rapidly.Non-slip handle of soldering gun conforms to ergonomics….

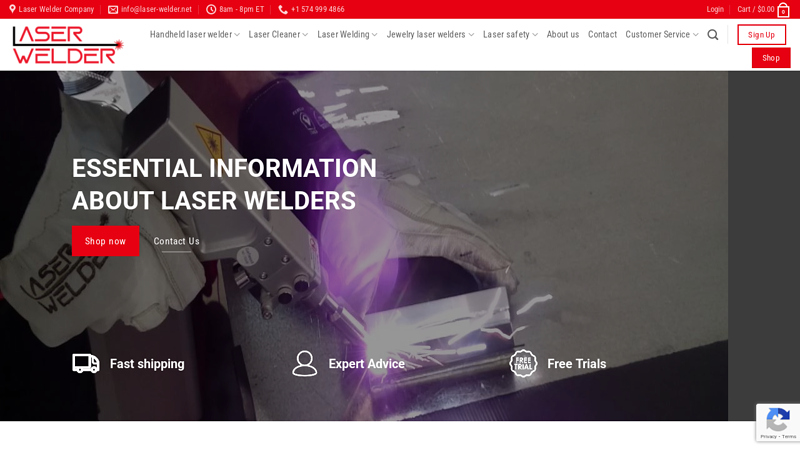

#2 Laser Welder

Website: laser-welder.net

Key Highlights: Laser welders are incredibly versatile and essential in any fabrication shop or factory welding parts from sheet metal….

#3 Laser Welding Machines|Handheld Laser Welder Manufacturer

Website: hantencnc.com

Key Highlights: As a professional laser welding machine manufacturer in China, HANTENCNC has 20 years of experience in designing and manufacturing handheld laser welders….

#4 Laser Welder

Website: triumphlaser.com

Key Highlights: Laser welder and handheld laser cleaner in one system. Up to 4X faster than TIG, able to weld a wide range of materials up to ¼” thick….

#5 Xlaserlab X1 Handheld Laser Welder for Metal

#6 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#7 3000 Watt Handheld Fiber Laser Welding Machine

Website: peslaser.com

Key Highlights: Handheld laser welder speed is 4-10 times faster than the traditional TIG/MIG welding · Easy to operate, no need welding work license, unskilled operator can ……

#8 The 15 Best Laser Welding Machine Manufacturers in the US

Website: kuntailaser.com

Key Highlights: The majority of the most prominent laser welding machine manufacturers operate in the US. Below, we aim to introduce the top 15 manufacturers of these machines ……

Expert Sourcing Insights for Internally Heated Industrial Laser Welder

H2: 2026 Market Trends for Internally Heated Industrial Laser Welders

By 2026, the market for internally heated industrial laser welders is poised for significant transformation, driven by advancements in manufacturing technologies, rising demand for precision welding, and the integration of smart industry systems. Internally heated laser welding—a hybrid technique combining laser beam welding with localized resistive or induction heating—offers enhanced weld quality, reduced residual stress, and improved performance on high-strength and dissimilar materials. The following trends are expected to shape the market through 2026:

1. Rising Adoption in Automotive and EV Manufacturing

The automotive industry, particularly electric vehicle (EV) production, will be a primary growth driver. As manufacturers shift toward lightweight materials like aluminum, high-strength steel, and multi-material joints, internally heated laser welding ensures stronger, more reliable seams with minimal distortion. The technology’s ability to manage thermal stress is crucial for battery enclosures, motor housings, and structural components, where precision and durability are paramount.

2. Integration with Industry 4.0 and Smart Manufacturing

By 2026, internally heated laser welding systems will increasingly feature IoT connectivity, real-time process monitoring, and AI-driven adaptive control. Predictive maintenance, closed-loop feedback systems, and digital twin integration will enhance process consistency and reduce downtime. Smart sensors will monitor temperature profiles and weld integrity in real time, enabling autonomous adjustments to heating and laser parameters.

3. Technological Advancements in Hybrid Heating Methods

Innovations in combining laser sources with internal resistive or induction heating will improve energy efficiency and process speed. New designs will allow dynamic adjustment of heating zones, enabling optimized thermal profiles for complex joint geometries. Fiber and disk lasers with higher beam quality, paired with modular heating units, will expand application flexibility across industries.

4. Expansion into Aerospace and Defense

The aerospace sector will adopt internally heated laser welding for critical components such as turbine blades, fuselage sections, and fuel systems. The technique’s ability to weld heat-sensitive alloys like titanium and nickel-based superalloys without compromising material integrity will support next-generation aircraft and space vehicle development.

5. Regional Market Growth in Asia-Pacific

China, Japan, South Korea, and India will lead market expansion due to booming EV production, government investments in advanced manufacturing, and growing automation in industrial sectors. Localized production of laser systems and supportive industrial policies will further accelerate adoption.

6. Sustainability and Energy Efficiency Focus

As industries prioritize carbon reduction, internally heated laser welding will gain favor for its lower energy consumption compared to traditional welding methods. The process reduces post-weld machining and rework, contributing to leaner, more sustainable production lines.

7. Increased Competition and Consolidation

The market will see intensified competition among laser technology providers, with key players investing in R&D to differentiate through software integration, modular designs, and service ecosystems. Strategic partnerships between laser manufacturers and automation integrators will become common to offer turnkey solutions.

8. Regulatory and Safety Standards Evolution

With wider deployment, international standards for laser safety, emissions, and operational protocols will evolve. Compliance with ISO and IEC regulations will be critical, especially in high-risk environments like automotive and aerospace facilities.

In summary, by 2026, the internally heated industrial laser welder market will be characterized by technological convergence, broader industrial adoption, and deeper integration into digital manufacturing ecosystems. Companies that innovate in hybrid heating control, scalability, and smart functionality will lead this next phase of industrial welding evolution.

H2: Common Pitfalls When Sourcing Internally Heated Industrial Laser Welders (Quality & IP)

Sourcing internally heated industrial laser welders—a niche technology often used for specialized applications like hermetic sealing or deep-penetration welding—presents unique challenges. Focusing on quality and intellectual property (IP) risks is critical to avoid costly failures, legal disputes, and operational inefficiencies.

H3: Quality-Related Pitfalls

-

Overlooking True “Internal Heating” Mechanism & Validation:

- Pitfall: Suppliers may misuse the term “internally heated,” implying a specific technology (e.g., hybrid laser-arc, tailored beam profiles inducing internal thermal gradients) when they offer standard laser welding with external pre/post-heat. This leads to unsuitable equipment for the core process requirement.

- Risk: The welder fails to achieve the necessary internal temperature profile, resulting in poor weld quality (cracking, porosity, lack of fusion) and process instability.

- Mitigation: Demand detailed technical documentation, peer-reviewed publications, or independent test reports specifically validating the internal heating mechanism and its performance metrics under conditions matching your application.

-

Inadequate Power Source Stability & Beam Quality:

- Pitfall: Assuming all high-power lasers are equivalent. Internal heating processes often demand exceptional beam stability (low power fluctuation, consistent mode) and high beam quality (M² close to 1) for precise, deep, and consistent energy deposition.

- Risk: Process drift, inconsistent weld penetration, spatter, and inability to maintain the required internal thermal profile, leading to high scrap rates and rework.

- Mitigation: Specify stringent requirements for power stability (<1-2% fluctuation), beam parameter product (BPP), and M² value. Require factory acceptance testing (FAT) with real-time monitoring of beam characteristics.

-

Insufficient Process Monitoring & Control Integration:

- Pitfall: Focusing only on the laser source and neglecting integrated sensors (e.g., high-speed pyrometry, plasma monitoring, seam tracking, photodiodes) and closed-loop control systems essential for maintaining the internal heating effect consistently.

- Risk: Inability to detect and correct process deviations in real-time, leading to undetected defects and inconsistent quality, especially on complex or variable parts.

- Mitigation: Require a comprehensive monitoring and control package as part of the core system specification. Demand validation data showing closed-loop correction of key parameters affecting internal heating.

-

Underestimating Cooling & Thermal Management:

- Pitfall: The intense, localized heating (even if “internal”) generates significant heat in the workpiece and surrounding tooling. Inadequate cooling design for the workpiece or fixture can distort the thermal profile.

- Risk: Thermal distortion, warping, changes in material properties near the weld, and ultimately, failure to achieve the desired internal heating result or part geometry.

- Mitigation: Require detailed thermal modeling or FEA analysis from the supplier showing predicted workpiece temperature distribution and cooling strategies. Specify fixture material (e.g., high thermal conductivity copper alloys) and active cooling requirements.

-

Lack of Application-Specific Process Development & Support:

- Pitfall: Suppliers may provide the machine but offer limited support for developing the specific internal heating process parameters (laser power, speed, beam oscillation, shielding gas, pre/post-heat settings) for your unique material and geometry.

- Risk: Long, expensive, and potentially unsuccessful internal process development phase, delaying production and increasing costs.

- Mitigation: Contractually bind the supplier to provide extensive application engineering support, including on-site process development and optimization using your actual parts and materials.

H3: Intellectual Property (IP) Pitfalls

-

Unclear Ownership of Process IP:

- Pitfall: Assuming that because you bought the machine, any novel welding process developed using it (especially the specific parameters enabling the “internal heating” effect) automatically belongs to you. The supplier might claim ownership or have restrictive licensing.

- Risk: Legal challenges if you try to use the optimized process on other equipment, scale up, or if a competitor uses a similar process. Loss of a key competitive advantage.

- Mitigation: Explicitly define IP ownership in the contract before development starts. State that all process know-how, recipes, and parameters developed using the equipment on your materials belong solely to you. Get legal review.

-

Supplier’s Use of Proprietary/Copycat Technology:

- Pitfall: The supplier’s “internally heated” technology might itself infringe on patents held by a third party (e.g., original developers of hybrid laser-arc, specific beam shaping techniques).

- Risk: You could be drawn into a patent infringement lawsuit as the end-user, face injunctions stopping production, or be forced to pay royalties. Equipment might become unusable.

- Mitigation: Require the supplier to provide a warranty of non-infringement and indemnification against third-party IP claims. Conduct independent patent landscape analysis on the core technology.

-

Reverse Engineering Risks & Lack of Trade Secret Protection:

- Pitfall: The supplier’s unique control algorithms, sensor fusion techniques, or specific hardware designs enabling the internal heating are trade secrets. Poor contractual clauses or physical access could allow competitors (or even your own personnel) to reverse-engineer the system.

- Risk: Loss of competitive differentiation for the supplier, potentially leading to lawsuits against you or your employees. Erosion of the technology’s value.

- Mitigation: Ensure contracts include strong confidentiality clauses covering both your process data and the supplier’s technology. Limit physical access to sensitive control units or software. Use secure, locked enclosures for proprietary hardware/software modules.

-

Restrictive Licensing of Control Software:

- Pitfall: The sophisticated software controlling the internal heating process (e.g., dynamic parameter adjustment based on sensor feedback) may be licensed, not sold. Licenses might restrict modifications, backups, or use on future equipment.

- Risk: Inability to adapt the software for future needs, high renewal costs, or loss of functionality if the supplier goes out of business or changes licensing terms.

- Mitigation: Negotiate for a perpetual license or source-code escrow agreement. Ensure the license allows necessary modifications and backups. Understand all limitations upfront.

-

Co-Development Ambiguity:

- Pitfall: If the supplier and your team co-develop the specific internal heating process or even modify the equipment, ownership of the resulting IP becomes murky without clear agreements.

- Risk: Disputes over who owns the improved process or hardware modifications, hindering future use or commercialization.

- Mitigation: Establish a clear Joint Development Agreement (JDA) before collaborative work begins, outlining contributions, ownership splits (e.g., background vs. foreground IP), and usage rights.

By proactively addressing these quality and IP pitfalls through rigorous technical evaluation, detailed specifications, and robust legal contracts, you can significantly de-risk the sourcing of internally heated industrial laser welders and protect your investment and competitive position.

H2: Logistics & Compliance Guide for Internally Heated Industrial Laser Welder

This guide outlines the key logistics and compliance considerations for the safe, legal, and efficient handling, transport, installation, operation, and maintenance of an Internally Heated Industrial Laser Welder (IHILW). Adherence is critical for safety, regulatory compliance, and operational continuity.

H2: 1. Pre-Shipment & Transportation Logistics

- Packaging & Crating:

- Use manufacturer-supplied or certified, heavy-duty, shock-absorbent packaging designed specifically for laser equipment.

- Ensure internal components (especially the laser source, optics, sensors) are secured against movement and vibration.

- Clearly label crates with “Fragile,” “This Side Up,” “Do Not Stack,” and “Protect from Moisture.”

- Include desiccants within sealed compartments to prevent condensation during transit, especially if crossing climates.

- Transportation Mode & Handling:

- Mode: Typically shipped via specialized freight (flatbed truck, container ship, air freight for urgent needs). Coordinate with a freight forwarder experienced in sensitive industrial equipment.

- Lifting: Use only designated lifting points (forklift pockets, crane eyes) specified in the manual. Never lift by enclosures, hoses, or cables. Use spreader bars for large units.

- Handling: Avoid drops, sharp impacts, or excessive tilting. Maintain the unit in its designated shipping orientation unless explicitly stated otherwise by the manufacturer.

- Documentation:

- Ensure all commercial invoices, packing lists, and bills of lading are accurate and complete.

- Obtain and verify any required export/import licenses or permits, especially for high-power lasers (check ITAR/EAR regulations if applicable).

- Include the equipment’s CE Marking Declaration of Conformity (or equivalent for destination market) and safety certifications (e.g., IEC 60825-1, IEC 61400 for laser safety).

- Environmental Controls:

- Specify temperature and humidity ranges during transit (e.g., 5°C to 40°C, 10% to 80% non-condensing RH) to the carrier.

- Avoid exposure to direct sunlight, rain, snow, or extreme temperature fluctuations.

H2: 2. Import/Export Compliance

- Regulatory Classification:

- Laser Safety (Key): Classify the laser according to IEC 60825-1 (or ANSI Z136.1 in the US). IHILWs typically fall into Class 4 (Highest Hazard). This classification drives most safety and regulatory requirements.

- Harmonized System (HS) Code: Obtain the correct HS code (e.g., 8456.20 for laser welding machines) for customs clearance and duty calculation.

- Country-Specific Regulations:

- USA: Comply with FDA/CDRH (Center for Devices and Radiological Health) regulations (21 CFR 1040.10 & 1040.11) for laser products. Registration and variance may be required for Class 4 manufacturers/importers.

- EU/UK: Ensure CE Marking per the Machinery Directive (2006/42/EC) and potentially the Low Voltage Directive (2014/35/EU). Full Technical File and EC Declaration of Conformity are mandatory. UKCA marking for Great Britain.

- Canada: Comply with Health Canada’s Radiation Emitting Devices Act (REDA) and associated regulations. Registration required.

- Other Regions: Research local radiation safety, electrical safety, and industrial equipment regulations (e.g., China CCC, South Korea KC, Australia RCM).

- Documentation for Customs:

- Provide technical specifications (laser wavelength, power output, pulse characteristics), safety certifications, and compliance declarations.

- Be prepared for potential customs inspections focusing on safety features and labeling.

H2: 3. Site Preparation & Installation Logistics

- Facility Requirements:

- Space & Layout: Ensure adequate floor space (including clearances for maintenance, safety interlocks, and exhaust). Plan for material flow (in/out of weld zone).

- Flooring: Verify floor load capacity meets equipment specifications. Ensure level surface.

- Utilities:

- Power: Dedicated, stable electrical supply meeting voltage, phase, frequency, and amperage requirements. Proper grounding is non-negotiable. Consider backup power (UPS) for control systems.

- Cooling: Reliable supply of clean, deionized water (or compatible coolant) at specified flow rate, pressure, temperature, and quality. Include filtration and water treatment if needed. Plan for drainage.

- Compressed Air: Clean, dry air at required pressure and flow rate (for sensors, purging, actuators).

- Exhaust/Ventilation: Dedicated fume extraction system capable of handling metal particulates and potential ozone/NOx gases generated by the laser process. Ductwork must meet specifications.

- Environmental Conditions:

- Maintain ambient temperature and humidity within the manufacturer’s specified operating range.

- Minimize dust, vibration, and electromagnetic interference (EMI).

- Safety Infrastructure:

- Laser Controlled Area: Designate and demarcate a permanent Laser Controlled Area (LCA) using physical barriers (walls, interlocked doors) or curtains (laser-resistant, rated for the wavelength and power). Post appropriate warning signs (Mandatory “Laser Radiation” signs per IEC 60825-1).

- Access Control: Implement interlocks on entry points to the LCA that disable the laser when breached. Use key switches or access codes.

- Emergency Stop (E-Stop): Install clearly marked, easily accessible E-Stop buttons at strategic locations around the LCA and control panel. Ensure they are hardwired to cut power.

- Fire Safety: Have appropriate fire extinguishers (e.g., Class D for metal fires) readily available within the LCA. Consider automatic fire suppression systems.

H2: 4. Operational Compliance & Safety

- Laser Safety Program (Mandatory for Class 4):

- Appoint a designated Laser Safety Officer (LSO) responsible for program implementation.

- Develop and maintain a site-specific Laser Safety Program compliant with ANSI Z136.1 (US) or equivalent (e.g., IEC 60825 series, national standards).

- Conduct a Laser Hazard Analysis for the specific installation and processes.

- Personal Protective Equipment (PPE):

- Laser Protective Eyewear (LPE): Mandatory for all personnel within the Nominal Hazard Zone (NHZ). Eyewear must be:

- Specific to the laser’s wavelength(s) (e.g., 1064nm for Nd:YAG/fiber, 10.6µm for CO2).

- Have an adequate Optical Density (OD) rating for the maximum accessible emission.

- Be comfortable and worn correctly. Regular inspection for damage is required.

- Other PPE: Flame-resistant clothing, safety glasses (under LPE if needed for impact), hearing protection (if process noise is high), gloves (for handling hot parts, not for laser protection).

- Laser Protective Eyewear (LPE): Mandatory for all personnel within the Nominal Hazard Zone (NHZ). Eyewear must be:

- Training & Authorization:

- Provide comprehensive, documented training for all operators, maintenance personnel, and the LSO on:

- Laser hazards (direct, reflected beams, fumes, electrical, fire, noise).

- Equipment operation and safety systems (interlocks, E-Stops).

- Emergency procedures (laser exposure, fire, fume release).

- Proper use and limitations of PPE.

- Site-specific rules and procedures.

- Only authorized, trained personnel should operate or service the equipment.

- Provide comprehensive, documented training for all operators, maintenance personnel, and the LSO on:

- Engineering Controls:

- Enclosure: Operate the laser within a fully interlocked, light-tight enclosure whenever possible. This is the primary safety control.

- Beam Path: Ensure all beam paths within the machine are enclosed. Use beam stops.

- Fume Extraction: Ensure the exhaust system is operational and maintained. Monitor filter status.

- Interlocks: Never bypass safety interlocks. Test them regularly as per the maintenance schedule. Document any bypasses (only for qualified maintenance under strict procedures).

- Procedural Controls:

- Implement a Permit-to-Work system for maintenance, alignment, or any work requiring entry into the LCA while the laser could be energized.

- Establish clear Alignment Procedures using the lowest possible power and appropriate viewing aids (IR/UV cards, cameras).

- Post clear Operating Procedures near the machine.

- Conduct regular safety audits and management reviews of the Laser Safety Program.

H2: 5. Maintenance & Servicing Compliance

- Scheduled Maintenance:

- Follow the manufacturer’s preventative maintenance (PM) schedule rigorously. Document all PM activities.

- Focus on critical systems: laser source cooling, optics cleaning/alignment, beam delivery components, electrical connections, safety interlocks, exhaust filters, sensors.

- Spare Parts:

- Stock critical spare parts (e.g., protective windows, fuses, specific sensors) as recommended by the manufacturer.

- Use only manufacturer-approved or certified equivalent parts.

- Service Personnel:

- Only trained, authorized technicians (either in-house or qualified OEM/specialist service engineers) should perform maintenance.

- Strict adherence to the Permit-to-Work system and Lockout/Tagout (LOTO) procedures is mandatory before any internal work.

- Calibration & Testing:

- Periodically calibrate critical sensors (temperature, pressure, position) and power meters.

- Regularly test safety systems (interlocks, E-Stops, warning lights/signals).

- Record Keeping:

- Maintain a comprehensive logbook for the IHILW, including:

- Installation dates.

- All maintenance, repairs, and part replacements.

- Calibration records.

- Safety system test results.

- Operator training records.

- Incident reports (even near misses).

- Laser Safety Program reviews.

- Maintain a comprehensive logbook for the IHILW, including:

H2: 6. End-of-Life & Decommissioning

- Planning: Plan for decommissioning early in the equipment lifecycle.

- Safe Shutdown: Follow manufacturer procedures for permanent shutdown. Ensure all stored energy (capacitors, hydraulic) is safely discharged.

- Laser Source Disposal: The laser source (especially solid-state rods, fiber lasers, or gas mixtures) may contain hazardous materials or be classified as hazardous waste. Consult the manufacturer and local environmental regulations (e.g., EPA, local hazardous waste authority) for proper disposal procedures. DO NOT dispose of in regular trash. This is critical compliance.

- Recycling: Recycle metals, electronics, and other components through certified e-waste or scrap metal recyclers.

- Documentation: Update site records and the Laser Safety Program to reflect the equipment’s removal.

Disclaimer: This guide provides a general framework. Always consult the specific manufacturer’s documentation (User Manual, Safety Manual, Installation Manual) and comply with all applicable local, national, and international regulations. Requirements can vary significantly based on the exact laser specifications, application, and jurisdiction. Engage qualified professionals (safety officers, industrial hygienists, electrical engineers) as needed.

Conclusion:

Sourcing an internally heated industrial laser welder internally presents both strategic advantages and notable challenges. While internal development offers greater control over design specifications, intellectual property, and long-term cost savings, it requires significant investment in R&D, specialized expertise, and rigorous quality assurance protocols. The technical complexity of integrating heating mechanisms with high-power laser systems demands cross-functional collaboration and advanced engineering capabilities.

However, successful internal sourcing can enhance operational autonomy, accelerate innovation cycles, and improve customization for specific manufacturing needs. It also aligns with long-term sustainability and supply chain resilience goals by reducing dependency on external vendors.

Before proceeding, a comprehensive evaluation of in-house technical capacity, timeline constraints, and total cost of ownership is essential. If the organization possesses—or is prepared to develop—the necessary expertise and infrastructure, internal sourcing of an internally heated industrial laser welder can yield a competitive edge in precision manufacturing and process efficiency. Otherwise, a hybrid approach involving strategic partnerships or phased internal development may offer a more balanced path forward.

Ultimately, the decision should be guided by strategic alignment with core business objectives, production scalability, and long-term technological roadmap.