The global refractometer market is experiencing steady growth, driven by increasing demand for precision instrumentation in industries such as food and beverage, pharmaceuticals, and chemicals. According to Grand View Research, the global refractometer market size was valued at USD 281.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2030. This growth is fueled by the rising need for real-time quality control and process optimization in industrial manufacturing—areas where inline refractometers offer significant advantages over portable or handheld models. As automation and Industry 4.0 technologies gain traction, inline refractometers, which enable continuous, non-destructive measurement of refractive index in production lines, are becoming increasingly critical. With demand rising, a select group of manufacturers have emerged as key players in delivering robust, accurate, and hygienic inline solutions. Below is a data-driven look at the top eight inline refractometer manufacturers shaping the market today.

Top 8 Inline Refractometer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Inline Refractometer: L

Domain Est. 1995

Website: anton-paar.com

Key Highlights: Free deliveryDurable, maintenance-free inline refractometer for real-time concentration measurements and production control of raw, intermediate, and final products. ……

#2 Digital Inline and Handheld Refractometers

Domain Est. 1995

Website: misco.com

Key Highlights: The world’s leading digital handheld refractometer. As a result, our refractometer boasts 2-3x the precision of competing refractometers and ruggedness….

#3 Vaisala Polaris™ process refractometer product family

Domain Est. 1995

Website: vaisala.com

Key Highlights: Vaisala’s process refractometer can practically measure any liquid concentration inline, real-time. Processes include evaporation, distillation, fermentation, ……

#4 Process refractometer Inline

Domain Est. 1996

Website: kruess.com

Key Highlights: Process refractometer with inline real-time measurement in the pipeline. Range from nD 1.3200-1.5200 and 0-90 %Brix….

#5 Refractometer

Domain Est. 1998

Website: refractometer.com

Key Highlights: We designed our inline refractometers to be durable and precise, helping industries like food and beverage, chemical processing, and manufacturing maintain ……

#6 Electron Machine Corporation

Domain Est. 1999

Website: electronmachine.com

Key Highlights: Electron Machine Corporation manufactures rugged inline process refractometers for pulp and paper, chemical, and food and beverage industries….

#7 Inline Refractometer

Domain Est. 2023

Website: chuyimc.com

Key Highlights: An online concentration meter with high precision, high efficiency and high adaptability for our lithium battery production line….

#8 Inline Refractometer

Domain Est. 2024

Website: chnspec.net

Key Highlights: Inline refractometer supports real-time continuous monitoring of liquid concentration, refractivity and brix….

Expert Sourcing Insights for Inline Refractometer

H2: 2026 Market Trends for Inline Refractometers

The inline refractometer market is poised for significant growth and transformation by 2026, driven by increasing demands for process automation, quality control, and real-time monitoring across key industries. Several trends are shaping the trajectory of this market, including technological advancements, industry-specific applications, and evolving regulatory standards.

-

Growth in Process Automation and Industry 4.0 Integration

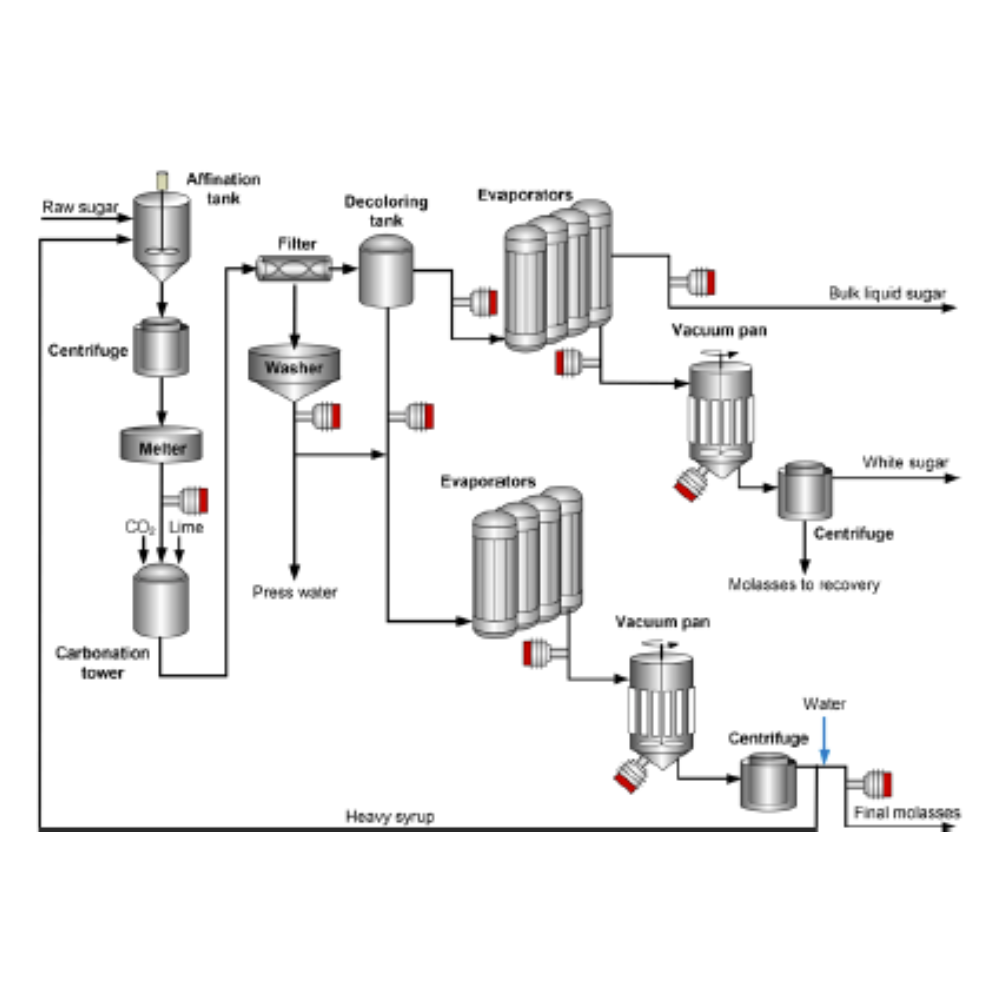

By 2026, the integration of inline refractometers into smart manufacturing ecosystems is expected to accelerate. With the widespread adoption of Industry 4.0 principles, manufacturers are prioritizing real-time data acquisition and process optimization. Inline refractometers, equipped with IoT connectivity and digital communication protocols (e.g., Modbus, Profibus, and Ethernet/IP), are increasingly being embedded into control systems for continuous monitoring of concentration, density, and purity in liquids. This trend is particularly strong in food and beverage, chemical, and pharmaceutical sectors. -

Expansion in Food and Beverage Industry Applications

The food and beverage industry remains a dominant end-user of inline refractometers, with growing emphasis on product consistency and safety. By 2026, demand is expected to rise for monitoring sugar content (Brix) in juices, dairy products, and confectionery. Manufacturers are also adopting inline refractometers for energy efficiency and waste reduction, aligning with sustainability goals. Regulatory pressures to maintain consistent quality and label accuracy further support market growth. -

Pharmaceutical and Biotech Sector Adoption

In the pharmaceutical and biotech industries, inline refractometers are gaining traction for monitoring critical process parameters during fermentation, purification, and formulation stages. The shift toward continuous manufacturing processes and single-use technologies is increasing the need for real-time analytics. By 2026, advanced refractometers with high precision, cleanability (e.g., CIP/SIP compatibility), and compliance with FDA and GMP standards will be in higher demand. -

Technological Advancements and Miniaturization

Ongoing innovations in sensor technology are leading to more compact, robust, and accurate inline refractometers. Advances in digital signal processing, automatic temperature compensation (ATC), and sapphire prism durability are enhancing measurement reliability in harsh environments. Additionally, AI-powered analytics and predictive maintenance features are expected to be integrated into refractometer systems, improving process efficiency and reducing downtime. -

Sustainability and Energy Efficiency Initiatives

As industries focus on reducing water and energy consumption, inline refractometers are being used to optimize concentration control in evaporation and crystallization processes. This not only improves product quality but also supports environmental sustainability targets. The pulp and paper industry, for instance, uses inline refractometers to monitor black liquor concentration, directly impacting energy recovery efficiency. -

Regional Market Dynamics

Asia-Pacific is projected to be the fastest-growing market for inline refractometers by 2026, driven by industrial expansion in countries like China, India, and South Korea. Increasing investments in food processing, chemical production, and pharmaceutical manufacturing are fueling demand. Meanwhile, North America and Europe continue to lead in technology adoption, supported by stringent regulatory frameworks and mature automation infrastructure. -

Competitive Landscape and Strategic Partnerships

The market is witnessing increased competition among key players such as Schmidt + Haensch, METTLER TOLEDO, Bronkhorst, and ABB. Companies are focusing on product differentiation through enhanced software integration, remote monitoring capabilities, and application-specific solutions. Strategic collaborations with system integrators and OEMs are expected to expand market reach and accelerate deployment in niche applications.

In conclusion, the inline refractometer market in 2026 will be characterized by deeper integration into digital industrial systems, broader application across regulated industries, and a strong emphasis on precision, reliability, and sustainability. As process industries continue to evolve, inline refractometers will play a crucial role in ensuring quality, efficiency, and compliance in real time.

Common Pitfalls When Sourcing Inline Refractometers (Quality, IP)

Sourcing an inline refractometer requires careful evaluation beyond basic specifications. Overlooking critical factors related to quality and ingress protection (IP) can lead to unreliable measurements, frequent maintenance, and premature failure. Below are key pitfalls to avoid:

Selecting Based on Price Alone Without Assessing Build Quality

Focusing solely on the lowest price often results in choosing instruments made with inferior materials (e.g., non-316L stainless steel, low-grade optics, or poor seals). These units may corrode quickly, suffer from optical degradation, or fail under thermal cycling. Always evaluate the manufacturer’s reputation, material certifications, and construction details to ensure long-term reliability in your process environment.

Ignoring Ingress Protection (IP) Rating Suitability

Choosing a refractometer with an inadequate IP rating for the installation environment is a common mistake. For instance, using an IP65-rated unit in a washdown area requiring IP68/IP69K protection can lead to water and chemical ingress, damaging internal electronics. Always match the IP rating to your application’s exposure—consider high-pressure washdown, dust, humidity, and outdoor conditions.

Overlooking Process Compatibility and Sealing Integrity

Even with a high IP rating, poor sealing design or incompatible wetted materials can compromise performance. Check that O-rings, gaskets, and seals are chemically resistant to your process media and cleaning agents (e.g., avoid EPDM with certain solvents). A mismatch can result in swelling, leaks, and contamination.

Assuming All “Industrial” Models Are Rugged Enough

Not all industrial-rated refractometers are equally robust. Some may lack shock resistance, vibration dampening, or thermal stability. Verify that the unit is designed for your specific mechanical and thermal conditions—especially in harsh environments like food processing or chemical manufacturing.

Neglecting Calibration and Service Support

A high-quality refractometer is only as good as its calibration and ongoing support. Sourcing from suppliers without local technical support or traceable calibration services can lead to extended downtime and process inconsistencies. Ensure the vendor offers accessible service, spare parts, and recalibration options.

Failing to Validate Performance Claims with References

Manufacturers may overstate accuracy, stability, or durability. Always request customer references or case studies in similar applications. Independent validation or third-party testing reports can help confirm performance claims before procurement.

Avoiding these pitfalls ensures you select an inline refractometer that delivers accurate, reliable, and durable performance, protecting your process quality and minimizing lifecycle costs.

Logistics & Compliance Guide for Inline Refractometer

Product Overview

The Inline Refractometer is a precision instrument designed for real-time measurement of refractive index in industrial process streams. It enables continuous monitoring of concentration levels in liquids for quality control in industries such as food & beverage, pharmaceuticals, chemicals, and pulp & paper. This guide outlines the logistics procedures and compliance requirements for the safe and legal handling, transportation, and operation of the device.

Packaging and Handling

Ensure the inline refractometer is shipped in its original protective packaging, including foam inserts and sealed enclosure to prevent mechanical damage. Handle packages with care—avoid drops, impacts, and exposure to extreme temperatures during transit. Use appropriate lifting equipment for heavier models. Store in a dry, temperature-controlled environment (5°C to 40°C) prior to installation.

Transportation Requirements

- Domestic Shipments: Comply with carrier-specific regulations (e.g., FedEx, UPS). Mark packages as “Fragile” and “This Side Up.” Use climate-controlled transport if ambient conditions exceed storage limits.

- International Shipments: Adhere to IATA/IMDG regulations if shipping by air or sea. Include proper export documentation such as commercial invoice, packing list, and certificate of origin. Confirm export classification; the device may fall under HS Code 9027.50 (optical instruments).

- Battery Considerations: If the unit contains onboard batteries, comply with UN 38.3 testing requirements for lithium batteries and mark accordingly.

Import and Customs Compliance

Verify country-specific import regulations. The inline refractometer may require conformity assessment under local standards (e.g., CE in the EU, UKCA in the UK, or EAC in Russia). Provide technical documentation, Declaration of Conformity, and, if applicable, proof of RoHS, REACH, and WEEE compliance. Some jurisdictions may require pre-shipment inspections or local representative registration.

Regulatory Certifications

Ensure the device carries relevant certifications for target markets:

– CE Marking: Complies with EU directives including Machinery Directive 2006/42/EC, EMC Directive 2014/30/EU, and RoHS 2011/65/EU.

– UKCA Marking: Required for sale in Great Britain; meets UK regulatory standards.

– NEMA/UL Certification: Required for operation in hazardous locations in North America (e.g., UL 61010-1).

– ATEX/IECEx Certification: Mandatory for use in explosive atmospheres in Europe and international zones.

Installation and Operational Compliance

Install the refractometer in accordance with manufacturer guidelines and local electrical and process safety codes. Ensure grounding, ingress protection (e.g., IP65/IP68), and compatibility with process media. Calibration must be performed using traceable standards (NIST or equivalent). Maintain records for audit purposes under ISO 9001, ISO 22000, or FDA 21 CFR Part 11 for electronic records.

Environmental and Disposal Regulations

At end-of-life, dispose of the refractometer in compliance with WEEE (Waste Electrical and Electronic Equipment) directives in applicable regions. Recycle components through authorized e-waste handlers. Avoid landfill disposal. Process wetted parts may require cleaning prior to disposal to prevent contamination.

Documentation and Record Keeping

Retain the following for compliance audits:

– Certificate of Conformity

– Calibration certificates

– Risk assessment reports

– Installation and maintenance logs

– Safety data sheets (SDS) for any consumables or cleaning agents used

Ensure all documentation is accessible to regulatory authorities and updated per device servicing or relocation.

Contact and Support

For compliance inquiries or technical support, contact the manufacturer’s regulatory affairs department at [email protected] or +1-800-XXX-XXXX. Access product-specific documentation via the customer portal at www.example.com/support.

Conclusion for Sourcing an Inline Refractometer

After a thorough evaluation of technical requirements, operational needs, and supplier capabilities, sourcing an inline refractometer is a strategic decision that enhances process efficiency, product quality, and automation in industrial applications. Inline refractometers provide real-time, continuous measurement of refractive index, enabling precise monitoring and control of concentration in liquids—critical in industries such as food & beverage, chemical processing, pharmaceuticals, and pulp & paper.

Key factors considered in the sourcing process—such as measurement accuracy, chemical compatibility, temperature and pressure resistance, ease of integration, maintenance requirements, and data connectivity—have led to the identification of suitable suppliers offering reliable and robust solutions. Selecting a refractometer with appropriate materials of construction, sanitary design (if required), and advanced digital communication protocols ensures seamless integration into existing control systems and long-term operational reliability.

Furthermore, vendor support, calibration services, and total cost of ownership played a significant role in the decision-making process. Investing in a high-quality inline refractometer not only reduces downtime and waste but also contributes to consistent product standards and regulatory compliance.

In conclusion, procuring an inline refractometer from a reputable supplier aligns with our goals of process optimization, quality assurance, and operational excellence. The implementation of this technology will deliver measurable improvements in process control and overall productivity, justifying the investment and supporting sustainable manufacturing practices.