The global inline filter IV market is experiencing robust growth, driven by rising hospital-acquired infection (HAI) rates, increasing demand for safe intravenous (IV) therapy, and growing emphasis on patient safety in clinical settings. According to Mordor Intelligence, the global IV sets market—of which inline filters are a critical component—was valued at USD 3.8 billion in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2029. Inline filters, particularly those with 0.2 and 1.2-micron pore sizes, are increasingly adopted to remove particulate contaminants and prevent infusion-related complications. This surge in demand has catalyzed innovation and competition among manufacturers, prompting advancements in materials, flow efficiency, and biocompatibility. As healthcare facilities worldwide prioritize precision and safety in infusion therapy, the role of leading inline filter IV manufacturers becomes pivotal. The following list highlights the top eight companies at the forefront of this evolving landscape, recognized for their product quality, R&D investments, regulatory compliance, and global market presence.

Top 8 Inline Filter Iv Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Medical Inline-IV Filter

Domain Est. 1998

Website: directmed.com

Key Highlights: Samples of Medical Inline-IV Filters are available for immediate order. All our OEM components are fully customizable….

#2 Pall Corporation

Domain Est. 1995

Website: pall.com

Key Highlights: Pall offers innovative purification and filtration technologies for new and expanding markets, leading the way with consistent, reliable performance for state- ……

#3 Thru-Link Inline Water Filter For Hydration Systems

Domain Est. 1995

Website: cascadedesigns.com

Key Highlights: In stock Rating 4.9 (12) The MSR Thru-Link inline water filter can be used with any hydration reservoir, turning it into a filtration system for clean water on the go….

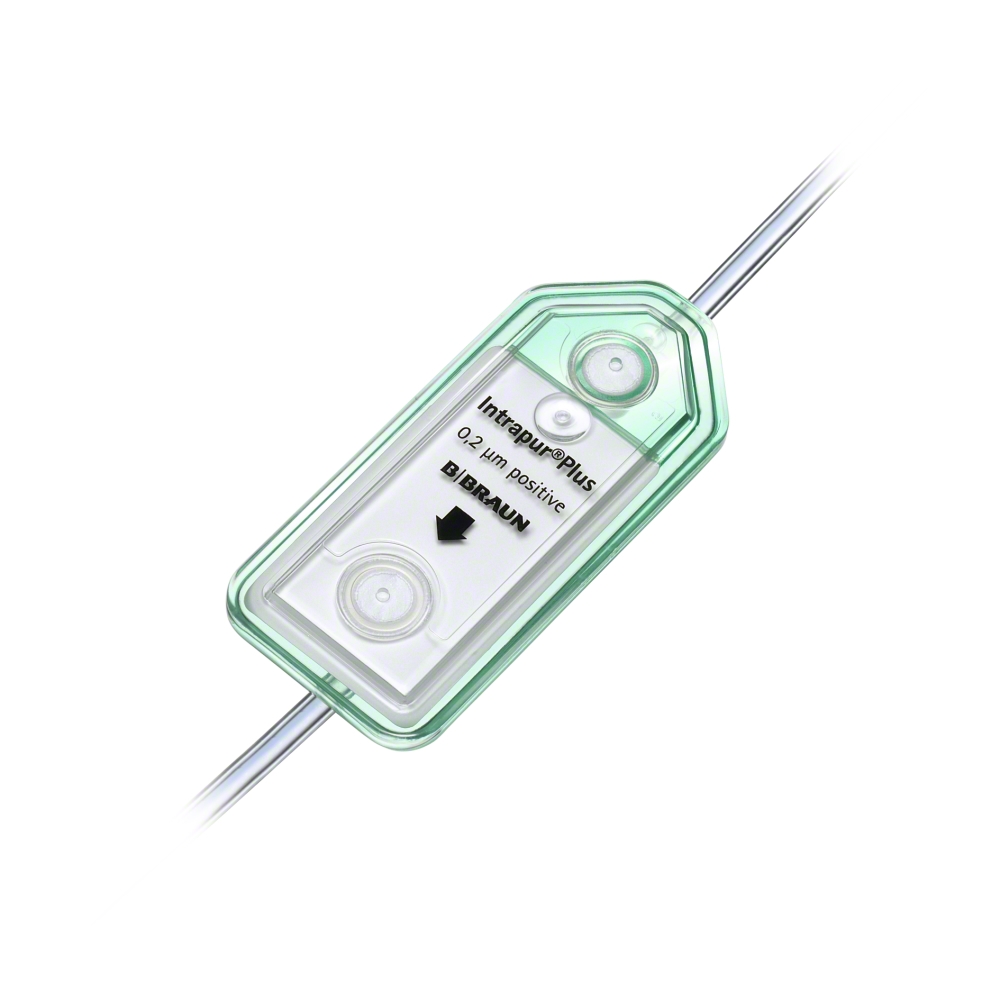

#4 Intrapur® Inline

Domain Est. 1996

Website: catalogs.bbraun.com

Key Highlights: Ready-to-use IV Administration set (type Intrafix® Primeline) serially equipped with 0.2μm inline IV filter to retain particles, bacteria and fungi and to ……

#5 Check Valves & Inline Filters

Domain Est. 2017

#6 IV inline filter selection for mAb therapeutics

Domain Est. 2019

Website: cytivalifesciences.com

Key Highlights: The use of an IV in-line filter is either required or strongly recommended for all three COVID-19 mAb therapeutics….

#7 Under Sink Water Filter System

Domain Est. 2023

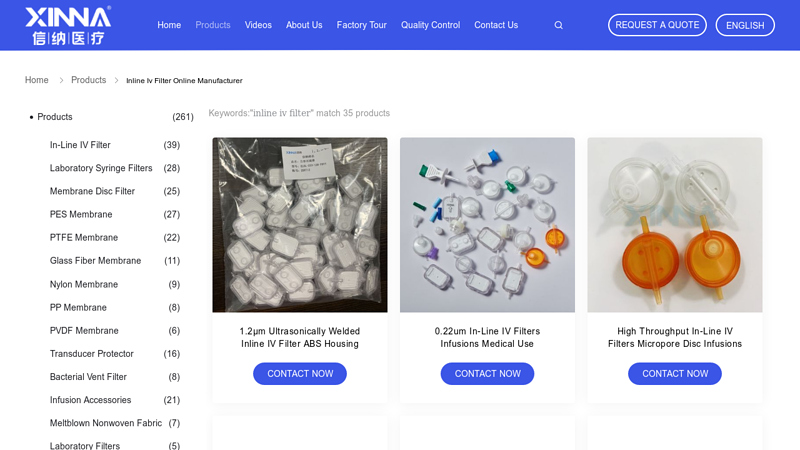

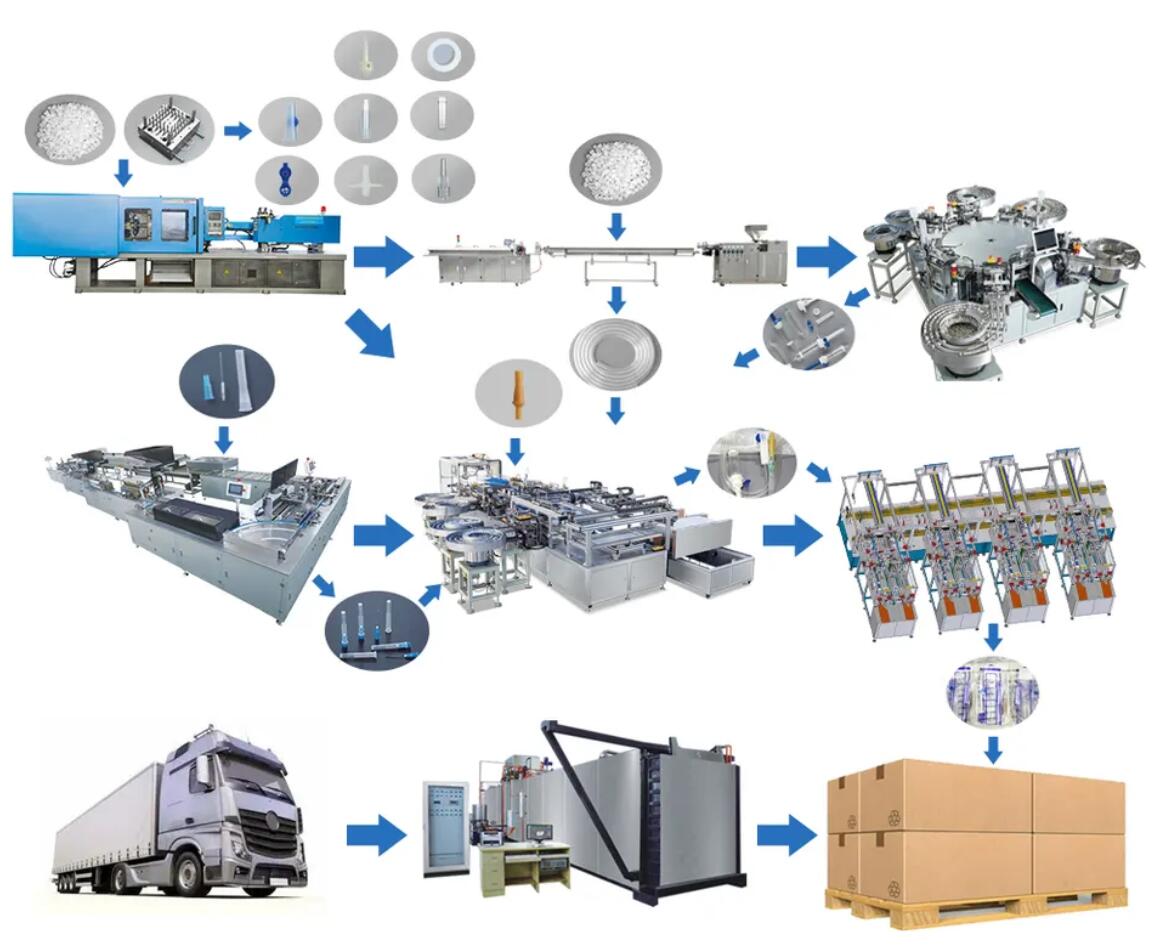

#8 Inline IV Filter

Domain Est. 2023

Website: filter-membranes.com

Key Highlights: 0.22um In-Line IV Filters Infusions Medical Use Maximizes Drug Delivery Of Critical Pharmaceuticals · Price:$0.10 – $0.25 per piece · MOQ:12000 Pcs · Chat Now….

Expert Sourcing Insights for Inline Filter Iv

2026 Market Trends for Inline Filter IV

The global Inline Filter IV market is poised for significant transformation by 2026, driven by advancements in medical technology, rising healthcare demands, and increased focus on patient safety. As healthcare systems worldwide prioritize infection control and fluid administration efficacy, Inline Filter IV devices—critical components in intravenous (IV) therapy—are gaining prominence. This analysis explores key trends shaping the Inline Filter IV market in 2026.

Growing Emphasis on Patient Safety and Infection Control

A major driver of the Inline Filter IV market in 2026 is the intensified focus on minimizing healthcare-associated infections (HAIs). Inline filters play a vital role in removing particulate matter, microorganisms, and air emboli from IV lines, thereby reducing complications. Regulatory bodies such as the FDA and WHO continue to advocate for best practices in IV medication administration, encouraging hospitals and clinics to adopt high-efficiency inline filtration systems. This regulatory push, coupled with rising awareness among healthcare professionals, is expected to boost adoption rates significantly.

Technological Advancements and Smart Filtration Systems

By 2026, technological innovation is set to redefine the Inline Filter IV landscape. Manufacturers are investing heavily in smart filtration systems equipped with sensors and connectivity features that allow real-time monitoring of flow rates, particle capture, and filter integrity. These intelligent filters integrate with hospital information systems (HIS) and electronic medical records (EMR), enabling proactive maintenance and reducing the risk of filter failure. Additionally, advancements in membrane materials—such as hydrophilic PTFE and polyethersulfone—are improving filtration efficiency while maintaining high flow rates.

Expansion in Emerging Markets

The Asia-Pacific and Latin American regions are emerging as high-growth areas for the Inline Filter IV market. Increasing healthcare infrastructure investments, rising geriatric populations, and growing incidence of chronic diseases are fueling demand for advanced IV therapy solutions. Countries like India, China, and Brazil are witnessing a surge in hospital upgrades and adoption of international safety standards, creating lucrative opportunities for inline filter manufacturers. Local production and partnerships with global players are expected to accelerate market penetration.

Shift Toward Single-Use and Disposable Filters

In 2026, the preference for single-use, sterile inline filters is expected to dominate the market. Reusable filters pose contamination risks and require stringent sterilization protocols, making disposables a safer and more cost-effective choice in most clinical settings. The trend is further supported by hospital infection control protocols and regulatory guidelines promoting single-use devices. Innovations in eco-friendly materials and packaging are also addressing environmental concerns related to medical waste.

Impact of Pandemics and Global Health Crises

The lessons learned from recent global health crises, including the COVID-19 pandemic, continue to influence the Inline Filter IV market. Increased ICU admissions and widespread use of IV medications during outbreaks have underscored the importance of reliable filtration. As healthcare systems build resilience against future pandemics, stockpiling of critical IV accessories, including inline filters, is becoming standard practice, ensuring sustained market demand.

Conclusion

By 2026, the Inline Filter IV market will be shaped by technological innovation, regulatory support, and evolving clinical needs. With patient safety at the forefront, smart, efficient, and disposable inline filtration systems are set to become standard in modern healthcare delivery. Stakeholders who invest in R&D, expand into emerging regions, and align with global safety standards will be best positioned to capitalize on these trends.

Common Pitfalls Sourcing Inline Filter IV (Quality, IP)

When procuring inline filter IV (intravenous) devices, overlooking critical quality and intellectual property (IP) considerations can lead to regulatory setbacks, patient safety risks, and legal complications. Below are common pitfalls to avoid:

1. Prioritizing Cost Over Quality Standards

Choosing suppliers based solely on low pricing often results in substandard materials or manufacturing processes. Inferior filters may fail to remove particulates effectively, increasing the risk of embolism or infection. Always verify compliance with ISO 13485, FDA 21 CFR Part 820, and other relevant quality management standards.

2. Inadequate Supplier Qualification

Failing to conduct thorough audits or request evidence of cleanroom manufacturing, batch traceability, and sterility validation can expose your organization to unreliable supply chains. Ensure suppliers have a proven track record in medical device production.

3. Overlooking Regulatory Compliance

Not confirming that the inline filter meets regional regulatory requirements (e.g., FDA 510(k), CE Marking under MDR, or NMPA approval) can delay market entry. Differences in filter pore size, biocompatibility, and labeling must align with target market regulations.

4. Ignoring Intellectual Property Risks

Sourcing from manufacturers using patented technologies without proper licensing exposes buyers to infringement claims. Conduct due diligence to confirm that the design, materials, or functionality of the filter do not violate existing IP rights, especially for proprietary filtration media or connector designs.

5. Assuming Interchangeability Without Verification

Even if a filter appears similar to an existing product, differences in flow rate, priming volume, or compatibility with specific IV sets or drugs can impact clinical performance. Always perform functional and compatibility testing before switching suppliers.

6. Incomplete Documentation and Traceability

Lack of proper device history records (DHR), certificates of conformance (CoC), or UDI (Unique Device Identification) data compromises quality assurance and recall readiness. Ensure full documentation is provided with each batch.

7. Underestimating Post-Market Surveillance Needs

Failing to establish a system for monitoring field performance and adverse events can delay response to quality issues. Include service level agreements (SLAs) with suppliers for timely reporting and corrective actions.

Avoiding these pitfalls requires a proactive approach to supplier evaluation, regulatory alignment, and IP diligence—ensuring both patient safety and commercial viability.

Logistics & Compliance Guide for Inline Filter IV

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence of Inline Filter IV devices. These filters are typically used in medical or industrial applications to remove particulates from fluid or gas streams. Proper management ensures patient safety, product efficacy, and regulatory compliance.

Regulatory Classification and Documentation

Determine the regulatory classification of the Inline Filter IV based on its intended use. In medical applications, it may be classified as a Class I, II, or III medical device under FDA (U.S.) or MDR (EU) regulations. Ensure all required technical documentation, including design files, risk assessments, and labeling, is complete and up to date. Maintain a Device Master Record (DMR) and comply with ISO 13485 for quality management systems.

Labeling and Packaging Requirements

Label all units with essential information, including product name, model number, lot number, expiration date (if applicable), manufacturer details, and regulatory symbols (e.g., CE mark, UDI). Packaging must be sterile if intended for medical use and should protect against contamination and physical damage during transit. Use validated packaging methods that meet ISTA or ASTM standards for distribution.

Storage Conditions

Store Inline Filter IV devices in a controlled environment as specified by the manufacturer. Typically, this includes protection from direct sunlight, moisture, and extreme temperatures (e.g., 15°C to 30°C). Maintain clean, dry storage areas with limited dust and proper ventilation. Implement a first-in, first-out (FIFO) inventory system to prevent expiration.

Transportation and Distribution

Use certified logistics partners experienced in handling medical or sensitive industrial devices. Ensure temperature-controlled shipping if required, and use real-time monitoring devices (e.g., data loggers) for critical shipments. All transport containers must be sealed and labeled appropriately with handling instructions (e.g., “Fragile,” “Do Not Freeze”). Comply with IATA, IMDG, or other relevant transport regulations if shipping hazardous or regulated goods.

Import/Export Compliance

Verify import and export requirements based on destination country. Obtain necessary permits, licenses, and certifications (e.g., FDA export certificates, CE certificates of conformity). Ensure Harmonized System (HS) codes are correctly assigned for customs declarations. Monitor changes in international trade regulations and sanctions that may impact shipment routes or destinations.

Quality Control and Traceability

Implement robust quality control procedures at all stages of the supply chain. Conduct incoming inspections and periodic audits of storage and distribution facilities. Maintain full traceability through batch/lot tracking and UDI (Unique Device Identifier) systems. Report any non-conformances or adverse events per regulatory requirements (e.g., FDA MedWatch, EU Vigilance reporting).

Training and Personnel Compliance

Ensure all personnel involved in logistics and handling are trained in GMP (Good Manufacturing Practice), GDP (Good Distribution Practice), and relevant safety protocols. Training records must be maintained and updated regularly. Personnel handling sterile devices should follow aseptic techniques where applicable.

Environmental and Disposal Compliance

Dispose of expired or non-conforming Inline Filter IV units according to local, national, and international environmental regulations. For medical devices, follow biohazard or medical waste protocols if contaminated. Partner with certified waste management providers and maintain disposal records for audit purposes.

Audit and Continuous Improvement

Schedule regular internal and external audits of logistics and compliance processes. Use findings to drive continuous improvement in supply chain efficiency and regulatory adherence. Stay informed about evolving standards (e.g., updates to MDR, FDA guidance) and adjust procedures accordingly.

Conclusion for Sourcing Inline IV Filters:

In conclusion, sourcing inline IV filters is a critical step in ensuring patient safety, maintaining the integrity of intravenous therapies, and reducing the risk of complications such as particulate embolism, microbial contamination, and phlebitis. Selecting high-quality, clinically appropriate filters involves evaluating factors such as pore size (typically 0.22 µm for bacterial retention or 1.2 µm for particulate filtration), biocompatibility, compliance with regulatory standards (e.g., ISO 13485, FDA approval), and compatibility with specific IV solutions and administration sets.

Effective sourcing also requires collaboration with reputable suppliers, consideration of cost-efficiency without compromising quality, and ongoing evaluation of clinical feedback and product performance. By implementing a structured procurement strategy that prioritizes safety, efficacy, and regulatory compliance, healthcare facilities can enhance patient outcomes and ensure reliable, consistent delivery of intravenous treatments.