The global injector pen market is experiencing robust growth, driven by the rising prevalence of chronic diseases such as diabetes and autoimmune disorders, increased demand for self-administered drug delivery systems, and ongoing innovations in wearable and connected injection devices. According to Grand View Research, the global auto-injector market size was valued at USD 7.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.4% from 2023 to 2030. This surge is mirrored in the insulin pen segment, where patient preference for convenient, discreet, and accurate dosing continues to fuel adoption. As pharmaceutical and biotech companies increasingly favor prefilled and reusable injector pens, manufacturing expertise has become a critical differentiator. Against this backdrop, a select group of manufacturers has risen to prominence, combining engineering precision, regulatory compliance, and scalable production capacity to support leading drug developers worldwide. Here, we examine the top 9 injector pen manufacturers shaping the future of subcutaneous drug delivery.

Top 9 Injector Pen Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Pen Injector Manufacturer

Domain Est. 2011

Website: phillipsmedisize.com

Key Highlights: Trusted pen injector manufacturer. We provide high-quality, reliable pen injectors for a range of pharmaceutical applications….

#2 BD Vystra™ disposable pen

Domain Est. 1990

Website: bd.com

Key Highlights: The BD Vystra™ disposable pen is an intuitive, high-quality and customizable disposable pen injector designed to support therapies that require frequent, low- ……

#3 Auto Injector / Insulin Pen

Domain Est. 1994

Website: murata.com

Key Highlights: Murata’s abundant product lineup provides the optimal solution for each function of the auto injector and insulin pen….

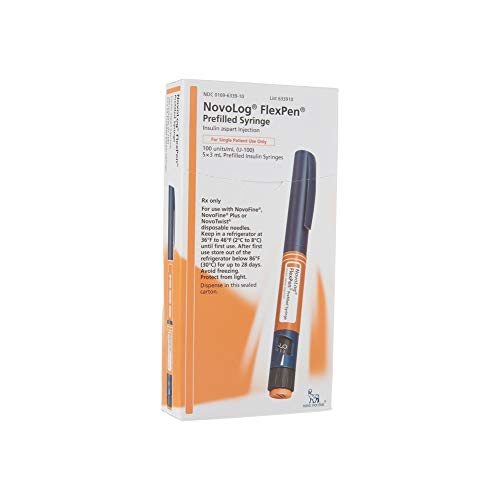

#4 NovoLog® (insulin aspart) injection 100 U/mL

Domain Est. 1997

Website: novolog.com

Key Highlights: NovoLog® offers multiple options for insulin delivery to manage mealtime blood sugar including insulin pumps, insulin pens, and vials….

#5 FlexPen®

Domain Est. 1998

Website: novonordisk.com

Key Highlights: For over a decade, FlexPen® has helped millions of patients with diabetes worldwide to inject their insulin. See what FlexPen® can offer you….

#6 Haselmeier

Domain Est. 2000

Website: haselmeier.com

Key Highlights: Welcome to Haselmeier, the drug delivery device business of medmix and your trusted partner for subcutaneous self-injection devices….

#7 SHL Medical

Domain Est. 2003

Website: shl-medical.com

Key Highlights: SHL Medical is the world leader in designing, developing, and manufacturing advanced drug delivery devices like autoinjectors and pen injectors. Read on….

#8 Drug Delivery Device Contract Manufacturing

Domain Est. 2013

Website: mgsmfg.com

Key Highlights: MGS is your expert partner for drug delivery device contract manufacturing. We develop autoinjectors, insulin delivery disposables, wearable injectors ……

#9 Pen Injector Device

Domain Est. 2018

Website: solteam-medical.com

Key Highlights: Discover our large range of self-injector pens such as reusable and disposable injection pens customizable for use in diabetes treatment and other therapies….

Expert Sourcing Insights for Injector Pen

H2: Market Trends Shaping the Injector Pen Industry in 2026

By 2026, the injector pen market is poised for significant transformation, driven by converging forces in healthcare, technology, and patient expectations. Key trends shaping this evolution include:

1. Dominance of Chronic Disease Management: The escalating global prevalence of diabetes, obesity, autoimmune disorders (like rheumatoid arthritis, psoriasis), and growth hormone deficiencies will remain the primary market driver. The convenience, accuracy, and portability of injector pens make them indispensable for long-term self-administration, fueling sustained demand, particularly for insulin and GLP-1 receptor agonists (e.g., semaglutide, tirzepatide).

2. Rise of Smart and Connected Pens: H2 will see accelerated adoption of digital health integration. Smart pens with embedded sensors, Bluetooth connectivity, and companion apps will transition from niche offerings to mainstream. These devices track dosage, timing, adherence, and provide reminders, enabling better disease management, remote patient monitoring for clinicians, and valuable real-world data for pharmaceutical companies and payers. Data security and interoperability with electronic health records (EHRs) will be critical focus areas.

3. Focus on Enhanced User Experience and Ergonomics: Competition will intensify around patient-centric design. Expect innovations in pen ergonomics (lighter weight, improved grip, easier dialing), quieter injection mechanisms, reduced injection force, and intuitive visual/tactile feedback. Addressing needle phobia and injection anxiety through features like hidden needles and faster injection times will be paramount.

4. Expansion Beyond Diabetes: While diabetes remains the largest segment, H2 anticipates significant growth in non-diabetes applications. The success of biologics for conditions like osteoporosis (e.g., teriparatide), fertility, migraine prevention (CGRP inhibitors), and increasingly, obesity therapeutics, will drive demand for specialized pens. Pen platforms will be increasingly tailored to specific drug viscosities, volumes, and dosing regimens.

5. Sustainability and Environmental Concerns: Pressure to reduce medical waste will push manufacturers towards sustainable solutions. This includes developing pens with higher drug capacity (reducing device count), using recyclable materials, and exploring reusable platforms with disposable cartridges. Regulatory bodies and healthcare systems will likely incentivize or mandate greener design.

6. Biosimilars and Market Access: The increasing availability of biosimilar versions of key biologic drugs (e.g., insulin, anti-TNFs) will expand the patient base and drive competition. Pen manufacturers will partner with biosimilar developers, and cost-effectiveness will become an even more crucial factor in formulary decisions and payer negotiations.

7. Regulatory Scrutiny and Human Factors Engineering (HFE): Regulatory agencies (FDA, EMA) will maintain a strong focus on patient safety and usability. Rigorous HFE studies will be mandatory to demonstrate that pens are safe and effective for the intended user population, including elderly and visually impaired patients. Post-market surveillance for usability issues will intensify.

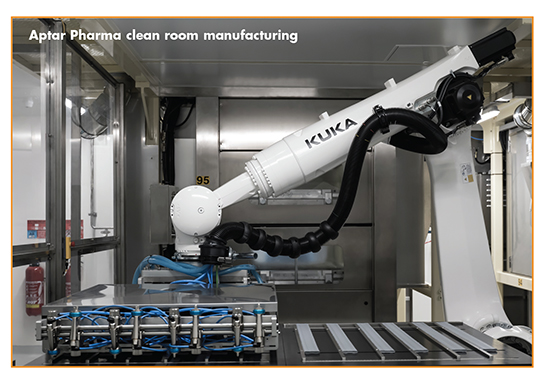

8. Supply Chain Resilience and Localization: Lessons from recent global disruptions will lead to efforts to diversify and strengthen supply chains. There may be a trend towards regional manufacturing hubs to mitigate risks and ensure consistent product availability, particularly for critical therapies.

In conclusion, the 2026 injector pen market, as analyzed by H2, will be characterized by technological sophistication, a deep focus on the patient journey, expansion into new therapeutic areas, and increasing pressure for sustainability and cost-effectiveness. Success will belong to companies that seamlessly integrate advanced functionality with exceptional usability while navigating complex regulatory and market access landscapes.

Common Pitfalls Sourcing Injector Pens: Quality and Intellectual Property Risks

Sourcing injector pens—especially for pharmaceuticals or medical devices—can be fraught with challenges. Two major areas of concern are product quality and intellectual property (IP) risks. Avoiding these pitfalls is critical for regulatory compliance, patient safety, and business integrity.

Quality-Related Pitfalls

-

Inconsistent Manufacturing Standards

Many suppliers, particularly in low-cost regions, may not adhere to ISO 13485 or other medical device quality management standards. This can result in variability in pen performance, such as inaccurate dosing, unreliable spring mechanisms, or inconsistent needle deployment. -

Substandard Materials

Low-quality plastics, elastomers, or metals can lead to device failure, drug incompatibility, or leaching of harmful substances. For example, using non-medical-grade silicone in seals may contaminate the drug formulation. -

Lack of Regulatory Compliance

Sourcing from manufacturers without FDA 510(k), CE marking, or other regulatory approvals exposes buyers to legal and market access risks. Devices may not meet biocompatibility (ISO 10993) or sterility requirements. -

Inadequate Testing and Validation

Reputable suppliers conduct rigorous usability, reliability, and stability testing. Many third-party or unverified manufacturers skip these steps, increasing the risk of device malfunction in real-world use. -

Poor Documentation and Traceability

A lack of Design History Files (DHF), Device Master Records (DMR), or batch traceability makes it difficult to respond to audits, recalls, or adverse event investigations.

Intellectual Property (IP) Risks

-

Infringement of Patented Technologies

Injector pens often incorporate patented mechanisms (e.g., dose-setting, safety features, or auto-injection systems). Sourcing from suppliers using unlicensed designs can expose your company to costly litigation from patent holders like Novo Nordisk, Eli Lilly, or Sanofi. -

Counterfeit or Copycat Devices

Some suppliers offer “compatible” or “generic” pens that closely mimic branded products. These may violate design patents or trademarks, leading to seizures by customs or legal action. -

Unclear IP Ownership in Custom Designs

When working with contract manufacturers on custom pen development, failure to define IP ownership in contracts may result in disputes. Suppliers may claim rights to improvements or tooling, limiting your freedom to operate. -

Use of Open-Source or Publicly Available Designs Without Protection

Even if a design appears generic, underlying components might still be protected. Assuming a design is free to use without thorough freedom-to-operate (FTO) analysis is a common and dangerous oversight. -

Lack of Non-Disclosure Agreements (NDAs)

Sharing specifications or development plans without proper NDAs can lead to IP theft or reverse engineering by the supplier, especially in regions with weaker IP enforcement.

Mitigation Strategies

- Conduct thorough due diligence on suppliers, including on-site audits.

- Require ISO 13485 certification and regulatory documentation.

- Perform IP landscape and FTO analysis before finalizing designs.

- Secure written agreements clarifying IP ownership and confidentiality.

- Work with legal and regulatory experts familiar with medical device sourcing.

Avoiding these pitfalls ensures safer, compliant, and legally sound sourcing of injector pens.

Logistics & Compliance Guide for Injector Pen

Regulatory Classification and Approval

Injector pens are typically classified as medical devices and may be regulated as combination products depending on the jurisdiction. In the United States, the FDA regulates injector pens under 21 CFR Part 880 (General Hospital and Personal Use Devices) or as combination products if they include a drug. In the European Union, they fall under the Medical Devices Regulation (MDR) (EU) 2017/745. Manufacturers must ensure the device has the appropriate CE marking or FDA clearance/approval before market entry.

Labeling and Packaging Requirements

Labeling must comply with regional regulations including product identification, intended use, contraindications, warnings, and usage instructions. Labels should be legible, durable, and available in the local language(s) of the destination market. Packaging must protect the device during transit, prevent contamination, and incorporate tamper-evident features. Unique Device Identification (UDI) is required in the U.S. (FDA) and EU (MDR), including a barcode or RFID tag for traceability.

Storage and Transportation Conditions

Injector pens must be stored and transported within specified temperature ranges, typically between 2°C and 8°C for pre-filled drug-device combinations, unless otherwise validated. Use of validated cold chain logistics with real-time temperature monitoring (e.g., data loggers) is essential. Packaging should include insulated containers and refrigerants (e.g., gel packs or dry ice) as appropriate. Transport vehicles must be qualified and capable of maintaining required conditions.

Import and Export Documentation

Ensure all import/export documentation is accurate and complete, including commercial invoices, packing lists, Certificate of Origin, and regulatory permits. For medical devices, an FDA Form 2877 (Notice of Arrival) may be required for U.S. entry. In the EU, importers must appoint an Authorized Representative and maintain a Declaration of Conformity. Export controls may apply depending on destination country regulations.

Customs Clearance and Duties

Work with licensed customs brokers to ensure compliant classification under the Harmonized System (HS Code), typically under heading 9018 (medical instruments). Provide accurate valuation and regulatory certifications to avoid delays. Be aware of preferential trade agreements that may reduce or eliminate import duties. Some countries may require prior approval from health authorities before customs release.

Distribution and Last-Mile Delivery

Partner with distributors or 3PL providers experienced in handling temperature-sensitive medical devices. Ensure last-mile delivery includes validated packaging and time-definite shipping. Patient delivery programs (e.g., direct-to-patient) must comply with local pharmacy and healthcare regulations, including secure handling and patient verification protocols.

Post-Market Surveillance and Recalls

Implement a robust post-market surveillance system to monitor adverse events and device malfunctions. Comply with mandatory reporting timelines (e.g., FDA MedWatch, EU Vigilance reporting). Maintain a recall plan that includes logistics for rapid retrieval, communication with stakeholders, and regulatory notifications. Track all devices via UDI to facilitate efficient recalls.

Environmental and Disposal Compliance

Provide patients and healthcare providers with instructions for proper disposal of injector pens, especially if they contain sharps or hazardous materials. Comply with local regulations such as EU WEEE or national take-back programs. Consider designing for sustainability and minimizing packaging waste in accordance with environmental directives.

Conclusion for Sourcing an Injector Pen:

Sourcing an injector pen requires a comprehensive evaluation of quality, regulatory compliance, cost, reliability, and supplier reputation. It is essential to select a supplier that adheres to international standards such as ISO 13485 and complies with regulatory requirements from agencies like the FDA or EMA, especially given the critical nature of drug delivery devices. Consideration should be given to the pen’s compatibility with the intended drug formulation, ease of patient use, and potential for customization. Additionally, evaluating total cost of ownership—factoring in unit price, tooling, minimum order quantities, and long-term supply agreements—ensures sustainable procurement. By prioritizing safety, performance, and scalability, organizations can successfully source an injector pen that meets clinical, commercial, and regulatory objectives while supporting patient adherence and therapeutic outcomes.