The infrared heater market has experienced robust growth, driven by rising demand for energy-efficient heating solutions across residential, commercial, and industrial sectors. According to a report by Mordor Intelligence, the global infrared heater market was valued at USD 2.87 billion in 2023 and is projected to reach USD 4.13 billion by 2029, growing at a CAGR of approximately 6.3% during the forecast period. This expansion is fueled by increasing awareness of energy conservation, the adoption of eco-friendly heating technologies, and advancements in electric heating systems. With infrastructure development and cold-climate heating needs on the rise, especially in North America and Europe, manufacturers are innovating to deliver high-performance, low-emission infrared heating solutions. As competition intensifies, a select group of companies has emerged as leaders in technology, scalability, and global reach—shaping the future of efficient thermal comfort. The following are eight of the top infrared heater manufacturers leading this transformation.

Top 8 Infra Ray Heaters Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Portable Infrared Heaters

Domain Est. 2004

Website: val6.com

Key Highlights: VAL6 is an original industrial infrared heater line with decades of manufacturing experience, and this page clarifies how its radiant technology compares to the ……

#2 Oklahoma Infra

Domain Est. 2021

Website: okinfrared.com

Key Highlights: Oklahoma Infra-Red, Inc. specializes in outdoor heaters for commercial and industrial use, barns, garages, patios, restaurants, and more in Oklahoma City, ……

#3 Infrared Radiant Heaters

Domain Est. 1997

Website: spaceray.com

Key Highlights: Space-Ray manufactures high efficiency infrared radiant heaters and forced air heaters for industrial, commercial, patio, agricultural, and leisure uses….

#4 Roberts

Domain Est. 1998

Website: robertsgordon.com

Key Highlights: Roberts Gordon Infrared Heating manufactures high quality, efficient radiant tube heaters for industrial and commercial applications….

#5 Ducoterra

Domain Est. 2011

Website: ducoterra.com

Key Highlights: Discover the most affordable, comfortable and efficient heating for your home – Infrared Heating Panels can save 35% or more on your home heating bill….

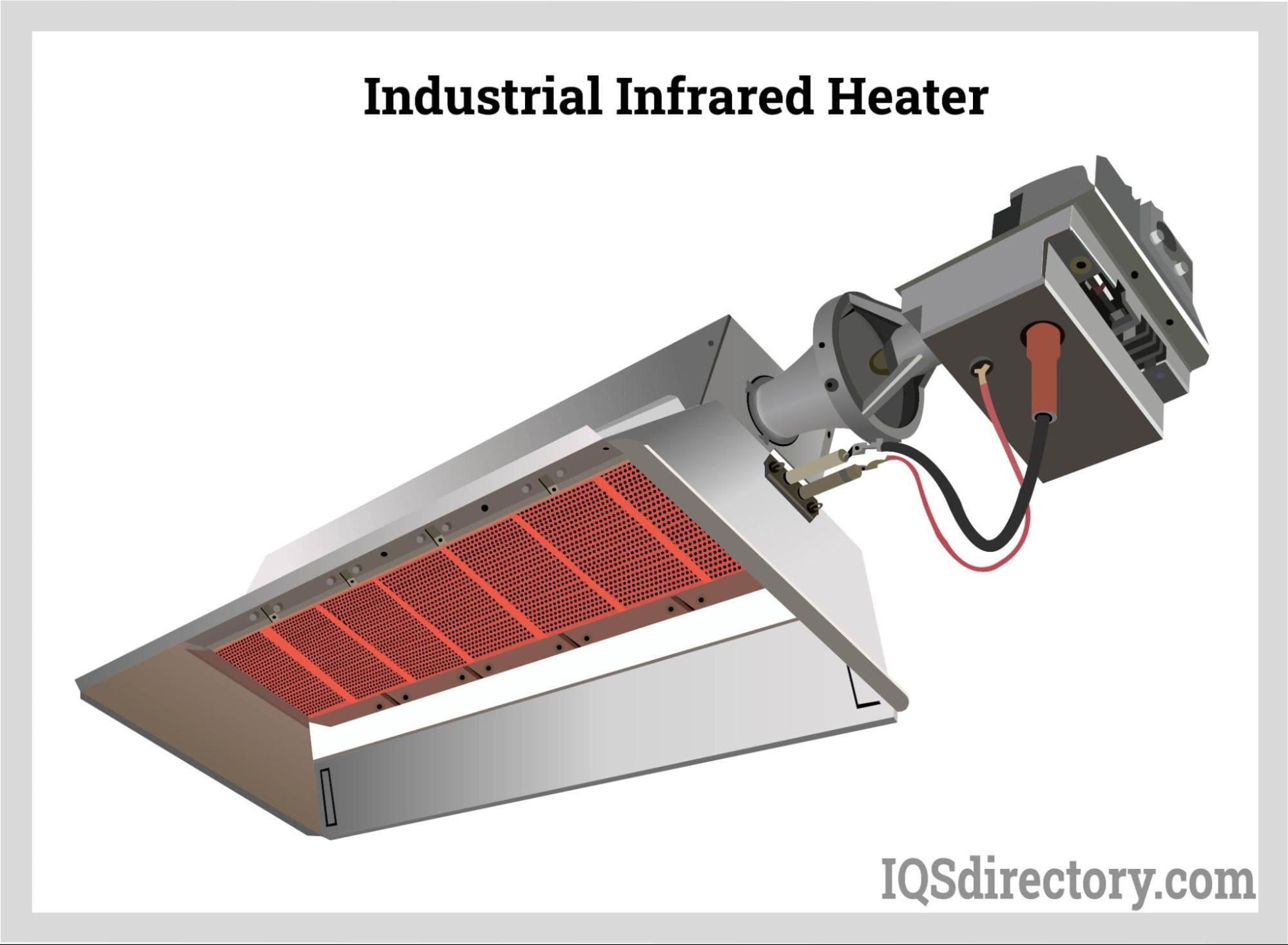

#6 Industrial Infrared Heaters

Domain Est. 2016

Website: infra-heater.com

Key Highlights: If you are looking for high-performance heating for your production processes, Industrial infrared heater systems by EUROLINIA are the excellent choice for you!…

#7 Heat Cleanly with Electric Infrared Heaters

Domain Est. 1996

Website: reverberray.com

Key Highlights: Electric Infrared Heaters – Our line of high-intensity infrared tube heaters are the answer when gas and ventilation is not available or practical….

#8 Combustion Research

Domain Est. 1997

Website: combustionresearch.com

Key Highlights: Combustion Research Corporation has been in the Low Intensity infrared heating manufacturing business for over 50 years….

Expert Sourcing Insights for Infra Ray Heaters

2026 Market Trends for Infrared Heaters

The infrared heater market is poised for significant transformation by 2026, driven by technological innovation, shifting consumer preferences, and global sustainability imperatives. Key trends shaping the industry include:

Growing Demand for Energy Efficiency and Sustainability

As energy costs remain volatile and environmental regulations tighten worldwide, consumers and businesses are prioritizing energy-efficient heating solutions. Infrared heaters, which directly warm objects and people rather than the air, offer superior energy efficiency compared to conventional convection systems—often achieving 30–50% energy savings. By 2026, this efficiency advantage will be a primary driver of adoption, particularly in regions with high electricity costs or cold climates. Additionally, the integration of infrared heating with renewable energy sources like solar power will accelerate, aligning with global net-zero goals and appealing to eco-conscious consumers.

Smart Technology Integration and IoT Advancements

The convergence of infrared heating with smart home ecosystems will be a defining trend by 2026. Manufacturers are increasingly incorporating Wi-Fi connectivity, mobile app control, voice assistant compatibility (e.g., Alexa, Google Assistant), and AI-driven temperature optimization. These features allow users to remotely manage heating schedules, monitor energy usage, and personalize comfort settings. Advanced models may use occupancy sensors and machine learning to adjust output based on room usage patterns, enhancing convenience and further reducing energy waste. This shift toward intelligent, responsive systems will differentiate premium brands in a competitive marketplace.

Expansion in Commercial and Industrial Applications

Beyond residential use, infrared heaters are gaining traction in commercial and industrial sectors. By 2026, demand is expected to rise in warehouses, manufacturing plants, agricultural facilities, and outdoor hospitality areas due to their ability to provide targeted, instant heat with minimal heat loss. High-wattage infrared systems efficiently heat large, poorly insulated spaces, reducing operational costs. Innovations in mounting systems, durability, and safety features will support broader adoption in demanding environments, particularly where spot heating or zone control is needed.

Design Innovation and Aesthetic Appeal

Infrared heaters are evolving from functional appliances into design elements. By 2026, sleek, minimalist designs—including mirror, picture, and wall-panel formats—will dominate the premium segment. These units blend seamlessly into modern interiors, appealing to design-conscious homeowners and architects. Transparent or customizable front panels and integration with smart home aesthetics will further enhance their appeal, positioning infrared heaters as both practical and stylish solutions.

Regional Market Growth and Policy Influence

Europe and North America are expected to lead market growth due to stringent building efficiency standards and government incentives for low-carbon heating. Meanwhile, the Asia-Pacific region will experience rapid expansion fueled by urbanization, rising disposable incomes, and increased awareness of indoor air quality. Government subsidies for energy-efficient appliances and phasing out of fossil fuel-based heating will play a critical role in accelerating infrared heater adoption globally by 2026.

In summary, the 2026 infrared heater market will be characterized by smarter, greener, and more versatile products, driven by technological advancement and sustainability demands across residential, commercial, and industrial sectors.

Common Pitfalls When Sourcing Infrared Heaters (Quality and IP)

Sourcing infrared heaters involves navigating several critical quality and Ingress Protection (IP) rating challenges. Overlooking these can lead to safety risks, performance issues, premature failure, and non-compliance. Below are the most common pitfalls to avoid:

Inadequate IP Rating for Environment

Choosing an infrared heater with an insufficient IP rating for its intended environment is a frequent and costly mistake. For example, installing a heater with only IP20 protection in a dusty workshop or damp bathroom can lead to electrical faults, corrosion, or short circuits. Always match the IP rating to the operational conditions—such as IP54 or higher for outdoor, industrial, or washdown areas—to ensure durability and safety.

Misleading or Unverified IP Claims

Some suppliers may exaggerate or falsely claim high IP ratings without proper certification. Relying on marketing materials alone can result in substandard products. Always request test reports from accredited laboratories and verify compliance with international standards like IEC 60529. Avoid products that lack third-party certification or provide vague documentation.

Poor Build Quality and Material Selection

Low-cost infrared heaters often use inferior materials such as thin-gauge steel, low-grade heating elements, or substandard insulation. These compromise efficiency, longevity, and safety. For instance, ceramic emitters made with inconsistent formulations may crack under thermal stress. Insist on detailed material specifications and conduct sample testing to assess construction quality.

Inconsistent Heating Performance

Inferior heaters may exhibit uneven heat distribution or fluctuating output due to poor emitter alignment or inadequate thermal design. This reduces efficiency and can create safety hazards. Evaluate performance data such as watt density, emission spectrum, and thermal response time, and prioritize suppliers with proven design and quality control processes.

Lack of Safety Certifications

Skipping verification of essential safety certifications (e.g., CE, UKCA, ETL, or UL) is a major risk. Heaters without proper certification may not meet electrical safety, fire resistance, or EMC requirements. Always confirm that the product carries valid, up-to-date certifications relevant to your target market.

Overlooking Thermal and Electrical Safety Features

Cheap models may lack critical safety mechanisms like overheat protection, tip-over switches, or thermal fuses. These omissions increase fire and injury risks, especially in commercial or residential settings. Ensure the heater includes appropriate safety features and that they are independently tested.

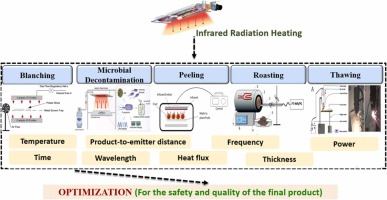

Incorrect Wavelength for Application

Infrared heaters emit in different wavelengths (near, medium, far). Using the wrong type—for example, a short-wave heater where gentle, even heating is needed—can reduce efficiency and damage sensitive materials. Understand your application requirements and select the appropriate emitter technology accordingly.

Poor Supplier Transparency and Traceability

Working with suppliers who do not provide clear documentation, origin information, or quality assurance processes increases the risk of counterfeit or non-compliant products. Prioritize suppliers with transparent supply chains, clear labeling, and accessible technical support.

By proactively addressing these pitfalls—particularly around verified IP ratings and consistent quality—you can source reliable, safe, and effective infrared heating solutions tailored to your needs.

Logistics & Compliance Guide for Infra Ray Heaters

This guide outlines essential logistics and compliance considerations for the safe, efficient, and legal handling, transportation, import/export, and sale of Infra Ray Heaters. Adherence to these guidelines ensures product integrity, regulatory compliance, and customer safety.

Product Classification & Documentation

Accurately classifying Infra Ray Heaters is critical for customs clearance, regulatory compliance, and appropriate handling. These products typically fall under specific HS (Harmonized System) codes related to electric space heaters. Common classifications include 8516.79 (other electro-thermic appliances) or similar codes depending on design and power. Maintain comprehensive technical documentation, including detailed specifications (voltage, wattage, materials), user manuals, safety certifications, and test reports (e.g., from accredited labs like UL, TÜV, SGS). This documentation is essential for customs authorities, regulatory bodies, and end-users.

Regulatory Compliance & Safety Standards

Infra Ray Heaters must comply with electrical safety, electromagnetic compatibility (EMC), and energy efficiency regulations in every target market. Key standards include:

* North America: UL 1278 (Movable Electric Heaters), CSA C22.2 No. 46 (Canada), FCC Part 15 (EMC).

* European Union: CE marking requiring compliance with the Low Voltage Directive (LVD 2014/35/EU), Electromagnetic Compatibility Directive (EMCD 2014/30/EU), and potentially the Ecodesign Directive (ErP).

* United Kingdom: UKCA marking (post-Brexit equivalent to CE, with specific requirements).

* Other Regions: KC Mark (South Korea), CCC Mark (China), RCM (Australia/New Zealand). Verify specific national requirements. Ensure all heaters have required safety labels (voltage, wattage, warnings) in the local language(s).

Packaging & Handling Requirements

Robust packaging is vital to prevent damage during transit. Use double-walled corrugated cardboard boxes with sufficient internal cushioning (e.g., molded pulp, foam inserts) to protect the heater, reflector, and controls. Clearly label all packages with standard shipping marks (product name, model, quantity, weight, dimensions), handling instructions (“Fragile,” “This Side Up”), and any required hazard symbols. Implement secure stacking practices in warehouses and containers to prevent crushing. Train personnel on proper lifting techniques to avoid strain.

Transportation & Shipping

Select appropriate transportation modes (air, sea, road) based on urgency, cost, and destination. For ocean freight, ensure containers are weather-tight, well-ventilated if necessary, and secured to prevent shifting. When shipping by air, verify compliance with IATA Dangerous Goods Regulations; while standard heaters are usually non-hazardous, batteries (if included) or specific components may have restrictions. Always provide accurate shipping documentation, including commercial invoices, packing lists, and bills of lading/air waybills, detailing product description, value, and HS codes.

Import/Export Controls & Customs Clearance

Navigate import/export regulations meticulously. Obtain any necessary export licenses, especially for shipments to restricted countries. Provide complete and accurate customs declarations to avoid delays, fines, or seizures. Be aware of potential import duties, taxes (like VAT or GST), and anti-dumping measures applicable to heating appliances in the destination country. Utilize Harmonized System codes correctly to determine duty rates. Consider engaging a licensed customs broker for complex shipments.

Environmental & Sustainability Regulations

Comply with environmental directives governing the use of restricted substances and end-of-life management. Key regulations include:

* RoHS (EU/UK/China): Restricts hazardous substances (lead, mercury, cadmium, etc.) in electrical equipment.

* REACH (EU): Addresses the registration, evaluation, authorization, and restriction of chemicals.

* WEEE (EU/UK): Requires producers to finance the collection and recycling of waste electrical equipment. Ensure heaters are designed for disassembly and use RoHS-compliant components. Participate in relevant producer compliance schemes.

Quality Control & Inspection

Implement rigorous quality control (QC) checks at manufacturing and before shipment. Inspect for defects in heating elements, wiring, housing, and controls. Verify that safety features (tip-over switches, overheat protection) function correctly. Conduct sample testing according to relevant standards. Maintain QC records. Consider third-party pre-shipment inspections (PSI) for large orders to verify compliance with specifications and detect potential issues early.

Warranty, Returns & After-Sales Compliance

Establish clear procedures for handling warranty claims and product returns. Ensure returned units are processed according to environmental regulations (e.g., WEEE). Maintain records of returns and failures for quality improvement and potential regulatory reporting (e.g., product safety incidents). Provide customer support in local languages, including access to manuals and safety information.

Conclusion for Sourcing Infrared Heaters:

Sourcing infrared heaters requires a strategic approach that balances cost, quality, energy efficiency, and application-specific requirements. After evaluating various suppliers, product types (such as short-wave, medium-wave, and far-infrared), and key performance factors—including heating efficiency, durability, safety certifications, and ease of installation—it is clear that selecting the right infrared heating solution significantly impacts operational effectiveness and long-term savings.

Prioritizing reputable manufacturers with proven track records ensures reliable performance and compliance with international standards. Additionally, considering factors like scalability, warranty, technical support, and energy consumption helps optimize total cost of ownership. For specialized applications—such as industrial drying, commercial space heating, or outdoor use—customization and expert consultation may be essential.

In conclusion, successful sourcing of infrared heaters hinges on thorough due diligence, clear understanding of end-use requirements, and building strong partnerships with suppliers who offer both high-quality products and responsive service. With the right selection and sourcing strategy, infrared heaters can deliver efficient, targeted, and sustainable heating solutions across diverse environments.