The global industrial warehouse shelving market is experiencing robust growth, driven by rising demand for efficient storage solutions in logistics, e-commerce, and manufacturing sectors. According to Grand View Research, the global warehouse automation market—of which industrial shelving is a critical component—was valued at USD 17.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.8% from 2023 to 2030. Similarly, Mordor Intelligence projects the material handling equipment market, encompassing industrial storage systems, to grow at a CAGR of over 6.5% during the forecast period 2023–2028. This surge is fueled by the rapid expansion of omnichannel retail, increasing warehouse digitization, and the need for optimized space utilization in distribution centers. As demand intensifies, manufacturers are innovating with durable, modular, and smart shelving solutions tailored for high-density storage and integration with automated systems, making the selection of reliable industrial shelving partners more critical than ever.

Top 10 Industrial Warehouse Shelving Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

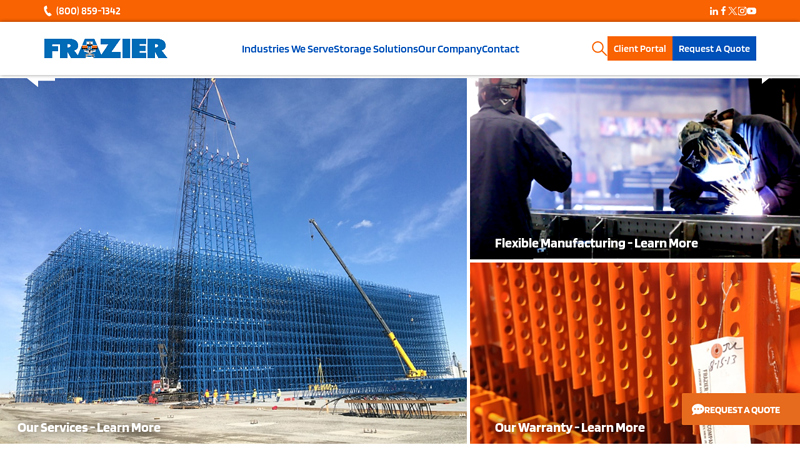

#1 Storage Racking System, Industrial Pallet Racks, Pallet Racking …

Domain Est. 1995

Website: frazier.com

Key Highlights: Frazier is the leading manufacturer of industrial storage racks in North America, with ten manufacturing facilities across the United States, Canada and Mexico….

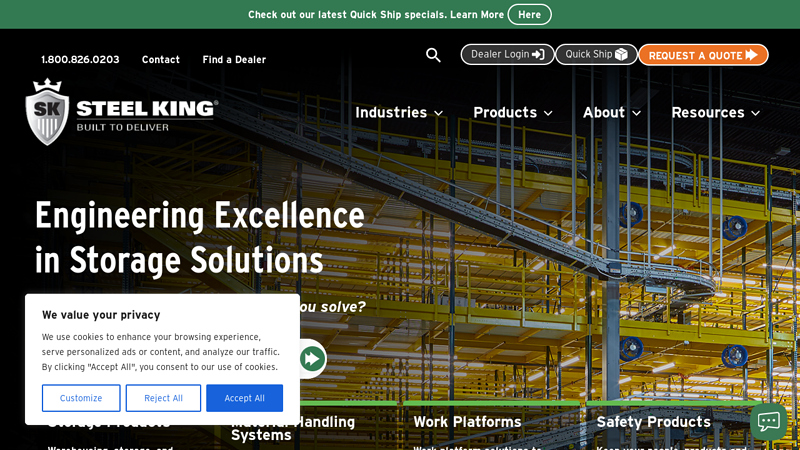

#2 Steel King

Domain Est. 1998

Website: steelking.com

Key Highlights: Steel King is the nation’s single-source industrial rack manufacturer. We are a qualified industrial rack supplier that provides efficient material handling ……

#3 Republic Storage Products

Domain Est. 1999 | Founded: 1930

Website: republicstorage.com

Key Highlights: Republic Has Been a Leading Manufacturer of Storage Products Including Metal Lockers and Industrial Metal Shelving since 1930….

#4 Industrial Shelving Systems

Domain Est. 1996

Website: industrialshelving.com

Key Highlights: Industrial Shelving Systems provides the best in storage equipment solutions from material handling to heavy duty shelving. We offer reliability & fast ……

#5 Metro

Domain Est. 1997

Website: metro.com

Key Highlights: Metro is the global manufacturer for original Super Erecta wire shelving and a vast array of storage & productivity products including advanced polymer shelving ……

#6 Industrial Storage

Domain Est. 1997

Website: unicor.gov

Key Highlights: We manufacture heavy duty pallet racking and cantilevered storage for warehousing needs, and more lightweight shelving, lockers, and cabinets….

#7 Industrial Racking Systems

Domain Est. 2022

Website: bhdstorage.us

Key Highlights: Industrial warehouse storage solutions. High-quality racking systems. 30+ years of expertise. Fast delivery & competitive pricing. Reach out to us today….

#8 Warehouse Shelving Systems

Domain Est. 1995

Website: ssi-schaefer.com

Key Highlights: We offer a large selection of high-quality shelving systems suitable for your storage processes. Our shelves are suitable for storing small parts, spare parts, ……

#9 Warehouse Rack & Shelf LLC

Domain Est. 1998

Website: rackandshelf.com

Key Highlights: From pallet racks to custom bins, Warehouse Rack & Shelf LLC delivers durable shelving solutions backed by decades of expertise. Upgrade your storage now!…

#10 Warehouse Optimizers Inc Full

Domain Est. 2021

Website: warehouseoptimizers.com

Key Highlights: We specialize in pallet racking, mezzanines, modular buildings, prefabricated structures, storage solutions, and conveyors across the Southeast….

Expert Sourcing Insights for Industrial Warehouse Shelving

H2: 2026 Market Trends for Industrial Warehouse Shelving

The industrial warehouse shelving market in 2026 is poised for dynamic transformation, driven by evolving supply chain demands, technological integration, and sustainability imperatives. Key trends shaping the sector include:

H2: Automation and Smart Storage Integration

By 2026, warehouses will increasingly adopt automated storage and retrieval systems (AS/RS) integrated with intelligent shelving solutions. Growth in e-commerce fulfillment centers is driving demand for modular shelving compatible with robotics, such as shuttle systems and autonomous mobile robots (AMRs). IoT-enabled shelving—embedded with sensors for real-time inventory tracking, load monitoring, and predictive maintenance—will become mainstream, enhancing operational efficiency and reducing downtime.

H2: Demand for Customization and Flexibility

As warehouse operations diversify, there is a rising need for customizable shelving systems that adapt to varying product sizes, weights, and turnover rates. Modular, reconfigurable shelving allows businesses to quickly modify storage layouts in response to seasonal demand or changing product lines. This flexibility supports omnichannel fulfillment strategies, where space optimization is critical in multi-purpose distribution centers.

H2: Sustainability and Green Materials

Environmental regulations and corporate ESG (Environmental, Social, Governance) goals will drive the use of sustainable materials in shelving manufacturing. By 2026, recyclable steel, low-carbon production processes, and shelving made from recycled or bio-based composites will gain traction. Energy-efficient manufacturing and longer product lifecycles will be key selling points, appealing to eco-conscious logistics providers.

H2: Growth in Emerging Markets and Last-Mile Warehousing

Expanding e-commerce penetration in Asia-Pacific, Latin America, and Africa will fuel demand for industrial shelving in new logistics hubs. Additionally, the proliferation of micro-fulfillment centers (MFCs) in urban areas will drive demand for compact, high-density shelving solutions optimized for small-footprint warehouses. These systems must maximize vertical space while ensuring rapid order picking.

H2: Labor Shortages Driving Efficiency Solutions

Persistent labor shortages in warehousing will accelerate investment in space-efficient shelving that reduces manual handling and improves pick accuracy. High-density systems like push-back, pallet flow, and drive-in racks will see increased adoption to minimize aisle space and boost storage capacity per square foot.

In summary, the 2026 industrial warehouse shelving market will be defined by intelligence, adaptability, and sustainability, with technology and evolving logistics models reshaping product design and deployment strategies.

Common Pitfalls When Sourcing Industrial Warehouse Shelving (Quality & Intellectual Property)

Sourcing industrial warehouse shelving involves more than just comparing prices—overlooking quality and intellectual property (IP) concerns can lead to safety hazards, legal issues, and long-term cost overruns. Below are key pitfalls to avoid:

Overlooking Material Quality and Load Capacity Verification

Many suppliers advertise high load capacities, but not all shelving units meet stated specifications. Common issues include using substandard steel gauges, inadequate welding, or poor corrosion resistance. Always request independent test certifications (e.g., from RMI or FEM) and verify that materials comply with regional safety standards (e.g., OSHA in the U.S. or EN standards in Europe).

Ignoring Structural Design and Engineering Compliance

Improperly engineered shelving can collapse under load, especially in dynamic warehouse environments. A major pitfall is selecting systems without certified engineering drawings or load tables. Ensure the supplier provides stamped structural calculations and complies with recognized design standards like the Rack Manufacturers Institute (RMI) guidelines.

Failing to Assess Manufacturing Consistency and Finish Quality

Inconsistent manufacturing processes—such as uneven powder coating, misaligned components, or poor bolt tolerances—can hinder assembly and reduce system longevity. Inspect samples or conduct factory audits to evaluate production controls. Poor finishes may lead to premature rust and structural degradation, especially in humid or corrosive environments.

Assuming All “Heavy-Duty” Shelving Is Interchangeable

Not all industrial shelving is created equal. Some suppliers rebrand generic systems with misleading specifications. Avoid assuming compatibility with existing systems or industry norms. Confirm that components are truly interchangeable and meet your operational needs in terms of adjustability, durability, and safety features.

Neglecting Intellectual Property (IP) Infringement Risks

Sourcing from low-cost manufacturers increases the risk of IP violations. Some suppliers replicate patented designs (e.g., unique beam connectors, upright frames, or bracing systems) without authorization. Using infringing products can expose your company to legal liability, shipment seizures, or forced removal of installed systems. Always require proof of IP compliance or original design rights from suppliers.

Skipping Supplier Due Diligence and References

Choosing suppliers based solely on price or lead time often leads to quality issues. Verify the supplier’s track record, certifications (ISO 9001), and customer references. A reliable supplier should openly share test reports, engineering documentation, and IP ownership details.

Underestimating Installation and Maintenance Requirements

Poorly designed or non-standard shelving may require specialized tools or training for assembly and ongoing maintenance. Systems that deviate from common designs can increase labor costs and safety risks. Confirm that installation manuals, replacement parts, and maintenance support are readily available.

By proactively addressing these quality and IP-related pitfalls, businesses can ensure safe, compliant, and cost-effective warehousing solutions that support long-term operational efficiency.

Logistics & Compliance Guide for Industrial Warehouse Shelving

Understanding Industrial Warehouse Shelving

Industrial warehouse shelving is a critical component of efficient storage and inventory management. Designed to support heavy loads, these systems maximize vertical space utilization, improve accessibility, and enhance overall warehouse safety. Common types include selective pallet racking, drive-in racking, push-back racking, and cantilever shelving. Each type serves specific storage needs and operational workflows.

Regulatory Compliance Standards

Compliance with industry regulations ensures the safety and structural integrity of shelving systems. Key standards include:

- OSHA (Occupational Safety and Health Administration): Requires that all storage racks be designed to support the maximum intended load and be maintained in good repair. OSHA 29 CFR 1910.176 governs materials handling and storage.

- RMI (Rack Manufacturers Institute): Sets engineering specifications for pallet racking systems. RMI guidelines cover load capacity, column protection, and seismic considerations.

- ANSI MH16.1: The American National Standard for the design, testing, and utilization of industrial steel storage racks. Compliance with ANSI ensures structural reliability under various conditions.

- IBC (International Building Code): Addresses seismic design requirements for rack structures in earthquake-prone regions.

Adherence to these standards is mandatory to avoid fines, ensure worker safety, and maintain insurance coverage.

Load Capacity and Weight Distribution

Proper load management is essential for safety and compliance. Key considerations include:

- Verify the load capacity of each shelving unit and clearly label it.

- Distribute weight evenly across beams and avoid overloading.

- Account for dynamic loads during forklift operations.

- Regularly inspect for signs of deformation, bending, or stress.

Exceeding load limits can lead to rack collapse, workplace injuries, and regulatory penalties.

Installation and Anchoring Requirements

Correct installation ensures stability and safety:

- Use manufacturer-approved hardware and follow installation manuals.

- Anchor racks securely to the warehouse floor using appropriate fasteners.

- Ensure proper alignment and plumb of upright frames.

- Conduct post-installation inspections before loading.

Improper anchoring increases the risk of rack tipping, especially during seismic events or accidental impacts.

Inspection and Maintenance Protocols

Regular inspections are required by OSHA and RMI:

- Perform daily visual checks for damage by warehouse staff.

- Schedule quarterly professional inspections by qualified personnel.

- Document all inspections and repairs.

- Repair or replace damaged components immediately—do not use compromised racks.

Common issues include bent beams, damaged base plates, and missing safety pins.

Safety Clearance and Aisle Management

Maintain clear access and safe operation:

- Ensure adequate clearance between racks and sprinkler systems (per NFPA 13).

- Keep aisles free of obstructions and debris.

- Mark safe operating zones for forklifts and personnel.

- Install rack guards and column protectors in high-traffic areas.

Poor aisle management increases accident risks and can violate fire code regulations.

Training and Personnel Compliance

Employee training is a compliance cornerstone:

- Train all warehouse staff on safe loading practices and rack inspection basics.

- Educate forklift operators on clearance zones and impact avoidance.

- Maintain training records and update programs annually or after incidents.

Well-trained personnel contribute to a safer, more compliant warehouse environment.

Documentation and Record Keeping

Maintain comprehensive records to demonstrate compliance:

- Keep copies of rack design specifications and load capacity charts.

- Archive inspection reports, maintenance logs, and repair records.

- Store installation certificates and compliance certifications.

These documents may be required during OSHA audits or insurance claims.

Emergency Preparedness and Risk Mitigation

Prepare for potential failures:

- Develop a response plan for rack collapse or structural damage.

- Conduct periodic drills involving evacuation and reporting procedures.

- Install seismic restraints where applicable.

- Use monitoring systems (e.g., rack sensors) in high-risk environments.

Proactive risk mitigation protects personnel, inventory, and operational continuity.

Conclusion

Compliance with logistics and safety standards for industrial warehouse shelving is not optional—it is a legal and operational necessity. By adhering to OSHA, RMI, and ANSI guidelines, conducting regular inspections, and training personnel, warehouse operators can ensure a safe, efficient, and compliant storage environment. Proper shelving management supports productivity, protects workers, and safeguards your investment.

Conclusion for Sourcing Industrial Warehouse Shelves:

Sourcing industrial warehouse shelving is a critical step in optimizing storage efficiency, enhancing operational productivity, and ensuring long-term cost-effectiveness. After evaluating various suppliers, materials, load capacities, configurations, and budget considerations, it is clear that selecting the right shelving solution requires a balance between durability, flexibility, and value.

Investing in high-quality, customizable shelving systems tailored to the specific needs of the warehouse—such as pallet racking, cantilever, or adjustable boltless shelving—not only maximizes space utilization but also supports inventory organization and worker safety. Additionally, partnering with reputable suppliers who offer reliable installation support and warranties ensures long-term performance and reduces maintenance costs.

In conclusion, a strategic and well-researched approach to sourcing industrial shelving will result in a scalable, efficient storage infrastructure that supports current operations and adapts to future growth. Prioritizing quality, safety, and supplier reliability ultimately leads to a smarter, more sustainable warehouse environment.