The global industrial motor market continues to gain momentum, driven by rising demand for energy-efficient machinery, automation across manufacturing sectors, and stringent energy regulations. According to a 2023 report by Mordor Intelligence, the industrial motor market was valued at USD 122.4 billion in 2022 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029. This growth is further corroborated by Grand View Research, which highlights the expanding adoption of electric motors in industries such as automotive, oil & gas, and food & beverage, alongside increasing investments in smart manufacturing and Industry 4.0 technologies. As operational efficiency and sustainability become top priorities, leading manufacturers are innovating with IE4 and IE5 premium efficiency motors, integrated IoT capabilities, and predictive maintenance features. In this evolving landscape, a select group of industrial motor manufacturers are setting the benchmark for performance, reliability, and technological advancement—shaping the future of industrial automation and energy optimization.

Top 10 Industrial Motor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Baldor.com

Domain Est. 1995

Website: baldor.com

Key Highlights: ABB is the world’s number-one manufacturer of NEMA motors, and we’re proud to support you locally with the Baldor-Reliance product brand….

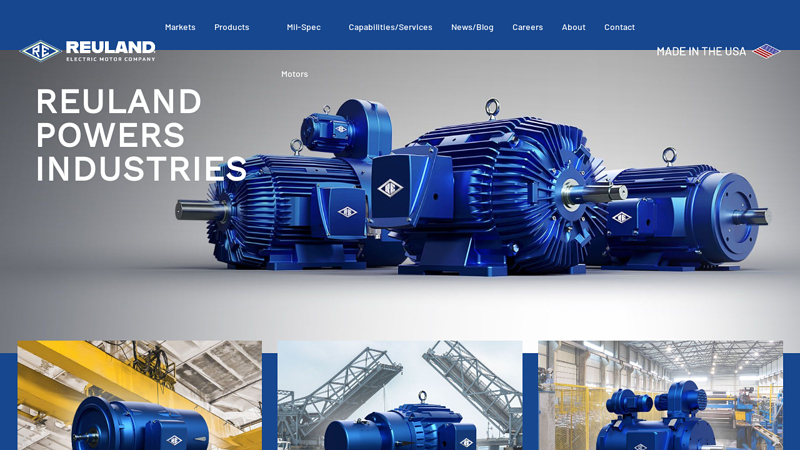

#2 Reuland Electric Motors

Domain Est. 1996

Website: reuland.com

Key Highlights: Reuland Electric Motor Company | Leading manufacturer of custom electric motors. Over 85 years of experience. American-made motors for various applications….

#3 Nidec Motors

Domain Est. 1997

Website: acim.nidec.com

Key Highlights: Nidec is the world’s leading motor manufacturer. Our team is passionate about everything that spins and moves, from the tiniest motors to the largest….

#4 Bodine Electric Company: Gearmotors

Domain Est. 1997

Website: bodine-electric.com

Key Highlights: Bodine Electric Company is a leading manufacturer of fractional horsepower gearmotors, motors, parallel shaft gearmotors, and motor speed controls….

#5 WorldWide Electric Corporation

Domain Est. 1999

Website: worldwideelectric.com

Key Highlights: WorldWide Electric manufactures electric motors, gear reducers, controls, & generators – backed by our reliable service and fast shipping….

#6 ABB Motors and Generators

Domain Est. 1990

Website: new.abb.com

Key Highlights: Welcome to ABB’s Motors and Generators, your ultimate destination for high-efficiency motors and dependable power generators….

#7 Hansen Corporation

Domain Est. 1996

Website: hansen-motor.com

Key Highlights: Hansen Corporation can design and build the motors you need. Our precision electric motors are shipped to clients all over the world….

#8 TECO-Westinghouse

Domain Est. 1999

Website: tecowestinghouse.com

Key Highlights: Browse Our Products & Services · Green Energy · Stock Motors · Custom Motors · Drives & Controls · Service and Repair….

#9 WEG

Domain Est. 2004

Website: weg.net

Key Highlights: WEG provides global solutions for electric motors, variable frequency drives, soft starters, controls, panels, transformers, and generators….

#10 Wolong Electric America

Domain Est. 2023

Website: wolongamerica.com

Key Highlights: Wolong Electric America manufactures GE branded AC motors, DC motors, and NEMA low voltage and medium voltage electric motors. We serve heavy industries ……

Expert Sourcing Insights for Industrial Motor

H2: Market Trends for the Industrial Motor Industry in 2026

As the global industrial sector continues its transformation driven by digitalization, sustainability imperatives, and evolving regulatory landscapes, the industrial motor market is poised for significant shifts by 2026. In the second half of 2026, several key trends will define the trajectory of this critical component of industrial automation and energy systems.

1. Accelerated Adoption of Energy-Efficient and IE4/IE5 Motors

Regulatory pressures and rising energy costs are pushing manufacturers to adopt motors that meet or exceed the International Electrotechnical Commission (IEC) IE4 (Super Premium Efficiency) and emerging IE5 standards. The European Union’s Ecodesign Directive and similar regulations in North America and parts of Asia are mandating higher efficiency classes, compelling OEMs and end-users to phase out IE1 and IE2 motors. By H2 2026, IE4 motors are expected to constitute over 35% of new installations in key industrial markets, with IE5 adoption beginning to scale in high-value applications such as HVAC, pumps, and compressors.

2. Growth of Smart and Connected Motors

Integration of IoT-enabled sensors, predictive maintenance algorithms, and digital twins is transforming traditional industrial motors into smart systems. In H2 2026, an increasing number of industrial facilities are deploying connected motors equipped with real-time monitoring capabilities. These systems provide insights into temperature, vibration, load, and energy consumption, enabling proactive maintenance and reducing unplanned downtime. Major motor manufacturers are partnering with industrial IoT platforms to offer bundled solutions, enhancing value beyond the physical motor.

3. Expansion of Motor Demand in Renewable Energy and EV Infrastructure

The global push for decarbonization is driving investments in renewable energy and electric vehicle (EV) charging networks—both of which rely heavily on industrial motors. In wind turbines, large-scale generators and pitch control systems require high-performance motors. Similarly, EV charging stations and battery manufacturing plants are creating new demand for precision motors in automated production lines. By H2 2026, the clean energy sector is projected to account for nearly 20% of incremental industrial motor demand, particularly in North America and China.

4. Regional Shifts and Supply Chain Resilience

Geopolitical tensions and supply chain disruptions have prompted a reevaluation of manufacturing footprints. In H2 2026, there is a noticeable shift toward regionalization, with increased motor production in North America and Eastern Europe to serve local markets and reduce dependency on Asian imports. Companies are investing in nearshoring and automation of motor assembly to improve resilience and responsiveness. This trend is supported by government incentives, such as those under the U.S. Inflation Reduction Act (IRA) and the EU’s Green Deal Industrial Plan.

5. Rise of Integrated Motor-Drive Systems

System-level efficiency is gaining priority over component-level performance. As a result, integrated motor-drive systems—where variable frequency drives (VFDs) are pre-matched and optimized with motors—are becoming the standard in new installations. These systems reduce energy losses, simplify commissioning, and enhance control precision. By late 2026, over 50% of new medium-voltage motor installations in process industries are expected to feature factory-integrated drives.

6. Focus on Sustainability and Circular Economy

Environmental, social, and governance (ESG) reporting requirements are prompting motor manufacturers to adopt greener practices. This includes using recyclable materials, reducing rare earth content in permanent magnet motors, and offering remanufacturing and recycling programs. In H2 2026, leading players are launching take-back schemes and carbon footprint labeling for motors, appealing to sustainability-conscious industrial buyers.

Conclusion

The industrial motor market in H2 2026 reflects a convergence of technological innovation, regulatory compliance, and sustainability goals. As industries move toward smarter, greener, and more resilient operations, the role of the industrial motor is evolving from a basic mechanical component to a central node in the intelligent factory ecosystem. Companies that embrace these trends—through product innovation, digital integration, and sustainable practices—are well-positioned to lead in the next phase of industrial development.

Common Pitfalls When Sourcing Industrial Motors (Quality and IP)

Sourcing industrial motors involves navigating complex technical, commercial, and legal considerations. Overlooking key aspects can lead to poor performance, safety risks, intellectual property (IP) exposure, and long-term cost overruns. Below are common pitfalls to avoid, particularly concerning quality and intellectual property.

Inadequate Quality Verification

One of the most frequent issues in sourcing industrial motors is assuming supplier claims without rigorous validation. Buyers may rely solely on datasheets or certifications without conducting independent assessments. This can result in receiving motors that fail prematurely under real-world conditions, leading to unplanned downtime and repair costs. To mitigate this, implement a structured quality assurance process including factory audits, sample testing, and review of the supplier’s quality management system (e.g., ISO 9001 certification).

Overlooking IP Protection in Custom Designs

When sourcing custom-designed motors, companies risk exposing proprietary technology if proper IP agreements are not in place. Suppliers may gain access to sensitive design specifications, control algorithms, or integration details that could be reverse-engineered or shared with competitors. Always use Non-Disclosure Agreements (NDAs) and clearly define IP ownership in contracts. Ensure that design rights, patents, and trade secrets are legally protected before sharing any technical documentation.

Relying on Non-Standard or Counterfeit Components

Some suppliers, especially in low-cost regions, may use substandard or counterfeit components to reduce costs. These components can compromise motor efficiency, reliability, and safety. Poor insulation, inferior bearings, or fake nameplate ratings are red flags. Conduct material traceability checks and insist on component-level certifications (e.g., UL, CE, or IEC standards). Third-party inspections and batch testing can help detect counterfeit parts.

Insufficient Due Diligence on Supplier Capabilities

Not all motor manufacturers have the engineering expertise or production capacity to meet industrial-grade requirements. Choosing a supplier based solely on price without evaluating their technical competence can result in inadequate thermal management, vibration control, or electromagnetic compatibility. Perform technical due diligence by reviewing the supplier’s product history, engineering team qualifications, and past performance in similar applications.

Failure to Specify IP Ratings Correctly

The Ingress Protection (IP) rating defines a motor’s resistance to dust and moisture, which is critical in harsh environments. Misunderstanding or misapplying IP codes (e.g., specifying IP54 instead of IP65 for outdoor or washdown applications) can lead to premature motor failure. Clearly define environmental conditions and ensure the supplier provides motors with appropriate IP ratings, verified through testing reports.

Assuming Global Compliance Without Verification

Industrial motors must comply with regional regulations such as the EU’s Ecodesign Directive, NEMA standards in North America, or CCC in China. Assuming a motor meets all relevant standards without documentation can result in shipment delays, fines, or safety hazards. Require compliance certificates and test reports for each target market and confirm that labeling and documentation are region-specific.

Neglecting Long-Term Support and Spare Parts Availability

Even a high-quality motor becomes a liability if the supplier cannot provide technical support, spare parts, or repair services over its lifecycle. This is especially critical for custom or specialized motors. Evaluate the supplier’s service network, spare parts inventory, and commitment to long-term support before finalizing procurement.

By proactively addressing these pitfalls—particularly those related to quality assurance and IP protection—companies can ensure reliable motor performance, safeguard proprietary technology, and reduce total cost of ownership.

Logistics & Compliance Guide for Industrial Motors

Overview

Industrial motors are critical components in manufacturing, energy, and infrastructure systems. Their transportation, storage, and regulatory compliance require careful planning to ensure safety, efficiency, and legal adherence. This guide outlines key logistics and compliance considerations for the global movement of industrial motors.

Classification and Harmonized System (HS) Codes

Industrial motors are typically classified under the Harmonized System (HS) for international trade. Common HS codes include:

– 8501: Electric motors and generators (excluding generating sets)

– 8501.31 – AC motors, single-phase, output ≤ 750 W

– 8501.32 – AC motors, multi-phase, output ≤ 750 W

– 8501.33 – AC motors, output > 750 W but ≤ 75 kW

– 8501.34 – AC motors, output > 75 kW

Accurate classification ensures correct tariff application and customs clearance.

Packaging and Handling Requirements

Proper packaging is essential to prevent damage during transit:

– Use wooden crates or heavy-duty cardboard with internal bracing to protect terminals, shafts, and housings.

– Apply anti-corrosion coatings or VCI (Vapor Corrosion Inhibitor) paper for long-term storage or humid environments.

– Secure motors to prevent movement inside containers; use dunnage and straps.

– Clearly label packages with orientation arrows, “Fragile,” and handling instructions.

Transportation Modes and Considerations

Choose transportation method based on motor size, weight, and delivery urgency:

– Road: Suitable for regional distribution; ensure vehicles have adequate suspension and load capacity.

– Rail: Cost-effective for heavy motors over long distances; confirm platform compatibility.

– Sea: Preferred for international shipments; use ISO containers and consider container desiccants to control moisture.

– Air: For urgent or high-value deliveries; verify weight and dimensional restrictions.

Import/Export Documentation

Ensure compliance with international trade regulations through accurate documentation:

– Commercial Invoice

– Packing List

– Bill of Lading (or Air Waybill)

– Certificate of Origin

– Import/Export Licenses (if applicable)

– Test Reports (e.g., efficiency, safety certifications)

Regulatory Compliance

Industrial motors are subject to multiple regulatory standards:

– Energy Efficiency: Comply with regional standards such as:

– IEC 60034-30 (International Efficiency Classes: IE1, IE2, IE3, IE4, IE5)

– DOE Rule 10 CFR 431 (USA)

– EU Ecodesign Directive (EU) 2019/1781

– Safety Standards:

– IEC 60034-1 (General requirements for rotating electrical machines)

– UL 1004 (USA)

– CSA C22.2 No. 100 (Canada)

– EMC and RoHS:

– IEC 61800-3 (EMC for adjustable speed electrical power drive systems)

– RoHS Directive 2011/65/EU (Restriction of Hazardous Substances in EU)

Country-Specific Requirements

Be aware of local regulations:

– USA: Motors may require NEMA labeling and DOE efficiency compliance.

– EU: CE marking is mandatory; declare conformity with applicable directives.

– China: Requires CCC (China Compulsory Certification) for certain motor types.

– India: BIS (Bureau of Indian Standards) certification may be needed.

Storage Guidelines

Store motors properly before installation:

– Keep in dry, clean, temperature-controlled environments (ideally 10–30°C, <60% RH).

– Store vertically if designed for it; otherwise, keep horizontal with shaft supported.

– Rotate shafts periodically (e.g., monthly) for motors in long-term storage to prevent brinelling.

– Inspect insulation resistance before commissioning after storage.

Environmental and Sustainability Considerations

- Recycle packaging materials and encourage returnable/reusable crates.

- Optimize transport routes to reduce carbon footprint.

- Choose high-efficiency motors (IE3/IE4) to support sustainability goals.

Risk Management and Insurance

- Insure motors for full replacement value during transit.

- Conduct pre-shipment inspections and quality audits.

- Use logistics providers with experience in heavy industrial equipment.

Conclusion

Successful logistics and compliance for industrial motors require attention to classification, packaging, transportation, documentation, and regulatory standards. Proactive planning ensures timely delivery, avoids customs delays, and maintains product integrity across the supply chain. Always consult local regulations and engage certified compliance experts when entering new markets.

Conclusion for Sourcing Industrial Motors

In conclusion, sourcing industrial motors requires a comprehensive evaluation of technical specifications, operational requirements, supplier reliability, and total cost of ownership. Selecting the right motor involves balancing performance, energy efficiency, durability, and compatibility with existing systems. Partnering with reputable suppliers who provide quality certifications, technical support, and after-sales service is crucial to ensuring long-term reliability and minimizing downtime. Additionally, considering energy-efficient models not only reduces operational costs but also supports sustainability goals. By following a structured sourcing strategy—incorporating market research, supplier assessments, and lifecycle analysis—organizations can make informed decisions that enhance productivity, reduce maintenance expenses, and contribute to overall operational excellence.