The global industrial machinery repair market is experiencing robust growth, driven by increasing demand for predictive maintenance, rising equipment complexity, and the need to minimize downtime across manufacturing and heavy industries. According to Mordor Intelligence, the industrial machinery market is projected to grow at a CAGR of over 5.8% from 2023 to 2028, with repair and aftermarket services accounting for a significant share of revenue. Similarly, Grand View Research estimates that the global industrial maintenance market size was valued at USD 533.6 billion in 2022 and is expected to expand at a CAGR of 8.3% through 2030. As companies prioritize operational efficiency and asset longevity, the reliance on specialized repair manufacturers has intensified. In this evolving landscape, a select group of industrial machine repair manufacturers are leading innovation through data-driven diagnostics, remanufacturing capabilities, and IoT-enabled service platforms—setting new standards for performance, sustainability, and cost-effectiveness. The following list highlights the top 10 manufacturers shaping the future of industrial repair solutions.

Top 10 Industrial Machine Repair Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Repair Services

Domain Est. 1996

Website: k-and-s.com

Key Highlights: For over 40 years, K+S Services has provided industrial repair services from electronics and machining to motors and mechanical……

#2 Marshall Industrial Tech

Domain Est. 1996

Website: marshallindtech.com

Key Highlights: Marshall Industrial Technologies offers a single source for your plant maintenance, emergency repairs and capital project installations….

#3 Grand Rapids Machine Repair

Domain Est. 1997

Website: grmr.com

Key Highlights: We repair all types of machinery. From press inspections to clutch conversions, complete rebuilds and any other industrial machinery repairs, we have you ……

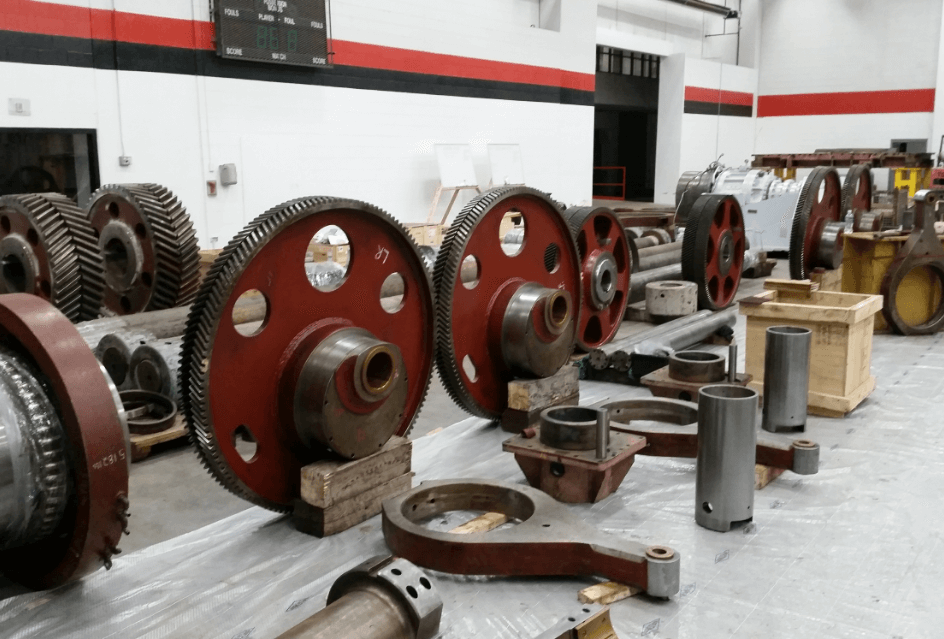

#4 L&H Industrial

Domain Est. 1998

Website: lnh.net

Key Highlights: L&H Industrial specialized teams transform the biggest heavy industry machines with expert design, engineering, and precision manufacturing….

#5 U.S. Industrial Machinery

Domain Est. 1999

Website: usindustrial.com

Key Highlights: U.S. Industrial Machinery in Memphis, TN is an independently owned supplier of industrial-grade and reliable metal-working machine tools for professionals….

#6 Universal Plant Services

Domain Est. 2002

Website: universalplant.com

Key Highlights: Universal Plant Services is North America’s leading provider of maintenance, repair, and installation services for industrial and energy equipment….

#7 Industrial Machine Service

Domain Est. 2005

Website: ims-s.com

Key Highlights: Industrial Machine Service offers plant maintenance, hydraulic pump repair, CNC lathe work, CNC millwork, welding and fabrication. Learn more!…

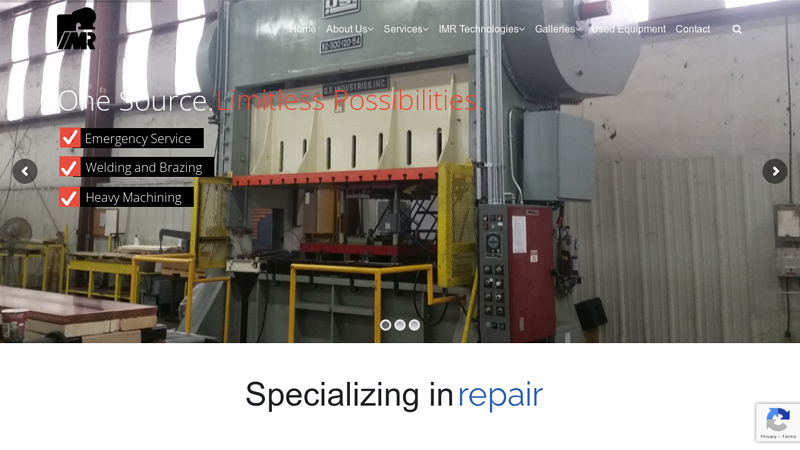

#8 IMR Inc.

Domain Est. 2009

Website: imrinc.net

Key Highlights: IMR specializes in the repair, rebuild, retrofit and remanufacture of stamping presses. Additionally, service is provided for mechanical press brakes and shears ……

#9 Machine Ethics

Domain Est. 2010

Website: machineethicsllc.com

Key Highlights: CNC machine repair, preventive maintenance & industrial equipment service. Any make or model. Fast response across MI, OH, IN, WI & beyond….

#10 Advanced Machine and Equipment Services

Domain Est. 2022

Website: advancedmachinefl.com

Key Highlights: We offer Repair and Maintenance on industrial tools such as shears, ironworks, sanders, lathes, mills, grinders, air compressors, CNC tools, manual tools, metal ……

Expert Sourcing Insights for Industrial Machine Repair

H2: 2026 Market Trends for Industrial Machine Repair

The industrial machine repair market is poised for significant transformation by 2026, driven by technological advancements, evolving manufacturing demands, and a growing emphasis on operational efficiency. Key trends shaping the sector include the integration of predictive maintenance powered by artificial intelligence (AI), the expansion of Industrial Internet of Things (IIoT), and the increasing adoption of robotics and automation. Companies are shifting from reactive or scheduled maintenance to condition-based and predictive models, reducing downtime and extending equipment lifespan.

Another major trend is the rising demand for skilled technicians equipped with digital competencies. As machinery becomes more complex, repair services increasingly require expertise in data analytics, software diagnostics, and remote monitoring tools. This skills gap is prompting investment in training programs and partnerships between original equipment manufacturers (OEMs) and third-party service providers.

Geopolitical factors and supply chain resilience are also influencing the market. The push for localized manufacturing and nearshoring, especially in North America and Europe, is boosting demand for reliable, fast-response repair services. Additionally, sustainability initiatives are encouraging companies to repair and refurbish machinery rather than replace, supporting a circular economy and reducing waste.

By 2026, the industrial machine repair market is expected to see increased consolidation, with service providers expanding their digital platforms and service portfolios to offer end-to-end solutions. Cloud-based maintenance management systems and augmented reality (AR) for remote assistance will become standard tools, enhancing repair accuracy and speed.

Overall, the 2026 landscape will favor agile, technology-driven repair service providers who can deliver predictive insights, reduce operational costs, and support the digital transformation of industrial operations.

Common Pitfalls in Sourcing Industrial Machine Repair: Quality and Intellectual Property Risks

Sourcing industrial machine repair services presents significant challenges, particularly concerning quality assurance and intellectual property (IP) protection. Overlooking these areas can lead to operational downtime, safety hazards, and long-term competitive disadvantages.

Poor Quality Control and Inconsistent Workmanship

One of the most frequent pitfalls is engaging repair providers without robust quality control processes. This can result in substandard repairs using incorrect materials, improper calibration, or inadequate testing. Inconsistent workmanship not only compromises machine performance and lifespan but can also lead to repeated breakdowns, increasing total cost of ownership and unplanned downtime.

Use of Non-OEM or Counterfeit Parts

Many third-party repair vendors use non-original equipment manufacturer (OEM) or even counterfeit parts to reduce costs. While this may offer short-term savings, these components often fail to meet the original specifications, leading to reduced machine efficiency, safety risks, and potential voiding of equipment warranties. This undermines reliability and can introduce long-term maintenance liabilities.

Lack of Skilled Technicians and Certification

Industrial machinery often requires specialized knowledge and certified technicians for proper diagnosis and repair. Choosing a vendor without adequately trained personnel increases the risk of misdiagnosis, improper repairs, and further damage. The absence of recognized certifications (e.g., ISO standards, OEM authorizations) is a red flag indicating potential capability gaps.

Inadequate Documentation and Traceability

Reputable repair services provide detailed work logs, component replacements, and performance test results. A common pitfall is partnering with vendors who offer little or no documentation, making it difficult to verify repair quality, track maintenance history, or comply with regulatory requirements. Poor traceability also complicates root cause analysis during future failures.

Intellectual Property Exposure and Misuse

Industrial machines may contain proprietary designs, control software, or custom configurations that constitute valuable IP. When outsourced repairs involve third parties—especially offshore or unvetted providers—there is a risk of unauthorized copying, reverse engineering, or misuse of sensitive technical information. Contracts often lack sufficient IP protection clauses, leaving companies vulnerable.

Insufficient Legal Protections and Confidentiality Agreements

Many organizations fail to implement strong legal safeguards before sharing equipment for repair. Without comprehensive confidentiality agreements (NDAs) and clear IP ownership terms, companies risk losing control over proprietary technology. This is especially critical when repairs involve software, firmware, or custom-engineered components.

Overreliance on Cost as the Primary Selection Criterion

Focusing solely on the lowest repair quote often leads to compromised quality and heightened IP risks. Vendors offering unusually low prices may cut corners on parts, labor quality, or security protocols. A total cost of ownership approach—factoring in reliability, longevity, and IP protection—is essential for sustainable sourcing decisions.

Failure to Audit or Qualify Repair Vendors

Skipping due diligence in vendor qualification is a critical oversight. Without on-site audits, reference checks, or performance evaluations, companies cannot verify a repair provider’s capabilities, quality systems, or security practices. This increases exposure to both operational and IP-related risks.

By recognizing and addressing these pitfalls, organizations can make more informed sourcing decisions that balance cost, quality, and intellectual property protection in industrial machine repair.

Logistics & Compliance Guide for Industrial Machine Repair

Proper logistics and compliance management are essential to ensure timely, safe, and legally compliant repair operations for industrial machinery. This guide outlines key considerations and best practices.

Equipment Handling and Transportation

Ensure safe and efficient movement of industrial machinery to and from repair facilities. Use specialized rigging, cranes, and heavy-duty transport vehicles based on equipment size and weight. Secure all components to prevent damage during transit. Develop detailed handling plans, including lift points and weight distribution, and conduct route assessments for oversized loads.

Regulatory Compliance

Adhere to all applicable local, national, and international regulations. This includes compliance with OSHA (Occupational Safety and Health Administration) standards for workplace safety, EPA (Environmental Protection Agency) rules for hazardous material handling, and DOT (Department of Transportation) regulations for machinery transport. Maintain up-to-date permits for oversized loads and environmental discharges.

Hazardous Materials Management

Identify and properly manage any hazardous substances encountered during repairs, such as oils, coolants, or cleaning solvents. Store, label, and dispose of materials according to RCRA (Resource Conservation and Recovery Act) guidelines. Provide proper training for personnel handling hazardous waste and maintain manifests for disposal tracking.

Documentation and Recordkeeping

Maintain comprehensive records for all repair activities, including work orders, inspection reports, parts replaced, and technician certifications. Keep logs of equipment maintenance history, safety inspections, and compliance audits. Documentation must be accurate, accessible, and retained per regulatory requirements (typically 3–7 years).

Safety Protocols and Training

Implement strict safety procedures for lockout/tagout (LOTO), confined space entry, and working at heights. Ensure all technicians are certified and trained in relevant safety standards. Conduct regular safety audits and provide ongoing training to reinforce compliance and reduce accident risks.

Customs and Cross-Border Considerations

For international repairs, comply with customs regulations, import/export controls, and tariff classifications. Prepare accurate commercial invoices, packing lists, and certificates of origin. Be aware of restrictions on dual-use equipment and ensure all necessary licenses are obtained prior to shipment.

Environmental and Sustainability Practices

Adopt eco-friendly practices such as recycling metal and electronic components, reducing energy consumption in repair operations, and minimizing waste. Comply with WEEE (Waste Electrical and Electronic Equipment) directives where applicable and explore remanufacturing options to extend equipment life.

Vendor and Contractor Management

Ensure third-party repair vendors and logistics partners meet your compliance and safety standards. Conduct due diligence, require certifications (e.g., ISO 9001, ISO 14001), and include compliance clauses in service agreements. Monitor performance and audit suppliers regularly.

Emergency Response and Contingency Planning

Develop contingency plans for transport delays, equipment damage, or regulatory violations. Establish protocols for spill response, fire emergencies, and workplace injuries. Maintain contact lists for emergency services, regulatory agencies, and alternate logistics providers.

Quality Assurance and Audits

Implement a quality management system to verify repair standards and compliance. Conduct internal audits regularly and prepare for external regulatory inspections. Use audit findings to improve processes and ensure sustained compliance.

In conclusion, sourcing industrial machine repair services requires a strategic approach that balances cost, quality, speed, and reliability. Selecting qualified providers with proven expertise in specific machinery types ensures minimal downtime and extends equipment lifespan. Factors such as preventive maintenance capabilities, response time, availability of spare parts, and compliance with industry standards should be carefully evaluated. Additionally, building long-term partnerships with trusted service providers can lead to improved efficiency, proactive maintenance, and better overall operational performance. Ultimately, effective sourcing of industrial machine repair contributes significantly to maximizing uptime, reducing total cost of ownership, and supporting continuous production in industrial environments.