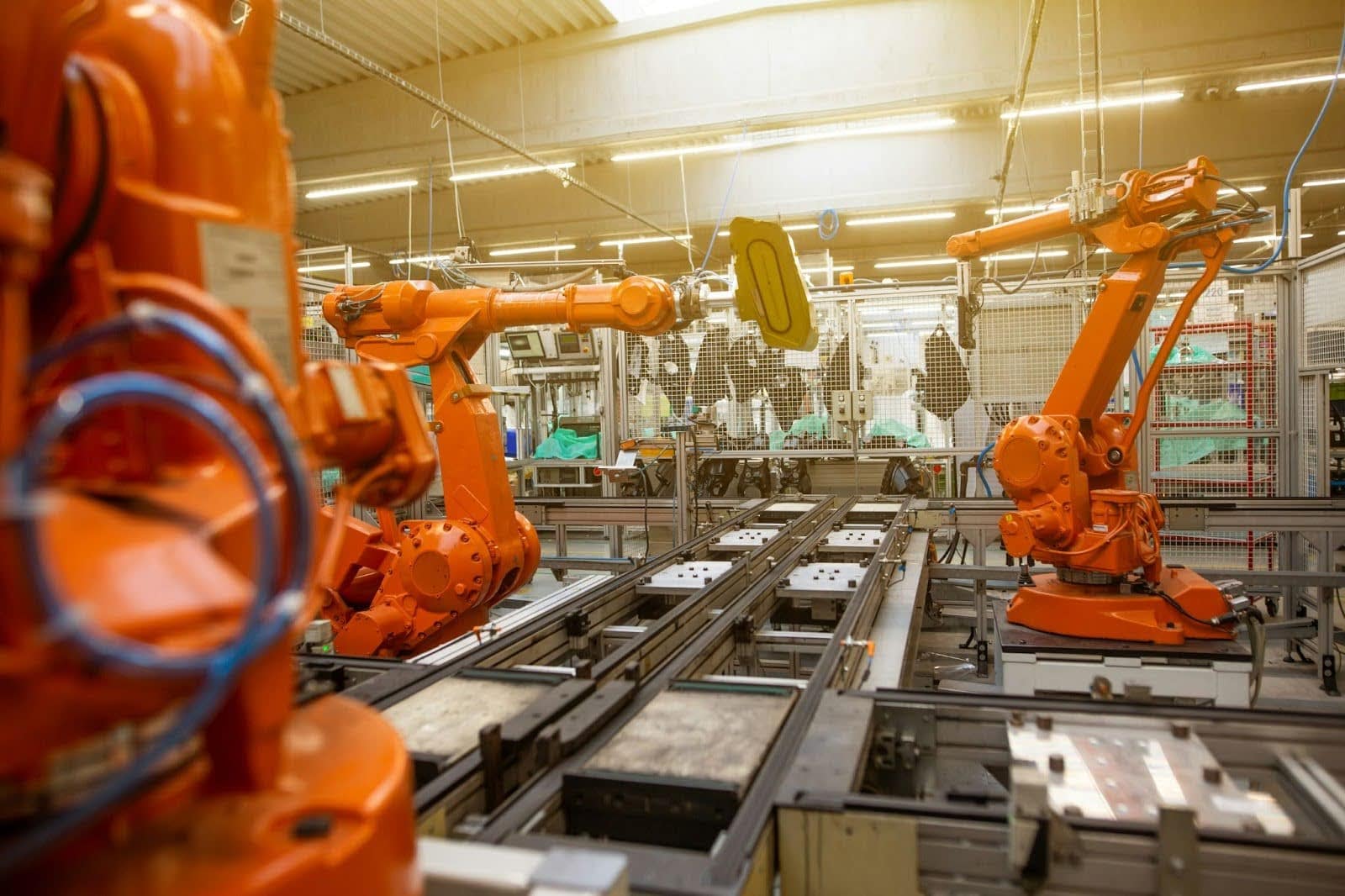

The global industrial machinery market continues its robust expansion, driven by rising automation, advancements in smart manufacturing, and growing demand across sectors such as automotive, aerospace, and construction. According to Mordor Intelligence, the industrial machinery market was valued at USD 642.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2029. Similarly, Grand View Research reports steady momentum, citing increasing adoption of Industry 4.0 technologies and government initiatives to modernize industrial infrastructure as key growth catalysts. In this evolving landscape, leading manufacturers are differentiating themselves through innovation in precision engineering, energy efficiency, and digital integration. As competition intensifies and global capacity expands, identifying the top players becomes critical for stakeholders navigating procurement, partnership, and investment decisions. The following list highlights the ten most influential industrial machine manufacturers shaping the future of global manufacturing.

Top 10 Industrial Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Caterpillar

Domain Est. 1995

Website: caterpillar.com

Key Highlights: Caterpillar is the world’s leading manufacturer of construction and mining equipment, diesel and natural gas engines, industrial turbines and ……

#2 Industrial Machine Tool, Inc

Domain Est. 1998 | Founded: 1979

Website: industrialmachinetools.com

Key Highlights: Industrial Machine Tool, Inc has specialized in providing first class used machinery and services to manufacturers worldwide since 1979….

#3 Metalworking CNC Machine Tools Supplier & Equipment Distributor …

Domain Est. 1991

Website: productivity.com

Key Highlights: We are a single source machine tool distributor of metalworking machines, tooling and industrial supplies, robots and related manufacturing products and ……

#4 Makino

Domain Est. 1996

Website: makino.com

Key Highlights: Achieve superior results with Makino’s CNC machining. Makino machines and engineering services provide precision and reliability across applications….

#5 Haas Automation Inc.

Domain Est. 1996

Website: haascnc.com

Key Highlights: Haas Automation is the largest machine tool builder in the western world, manufacturing a complete line of CNC vertical machining centers, ……

#6 Industrial Machinery

Domain Est. 1998

Website: mhi.com

Key Highlights: Industrial Machinery · Engines (Diesel & Gas) · Engine Output Range Chart · Chemical Plants · CO2 Recovery Plants · Printing Presses · Paper Converting Machinery….

#7 Bartell Machinery

Domain Est. 1999

Website: bartellmachinery.com

Key Highlights: Bartell Machinery delivers the most advanced and proven machinery systems and industrial equipment solutions for the production of a wide array of products….

#8

Domain Est. 2015

Website: hitachicm.com

Key Highlights: We are now a leading global manufacturer of mining machinery. We will continuously work on resolving issues which our customers face in the mining sites….

#9 Gleason Corporation

Domain Est. 1991

Website: gleason.com

Key Highlights: We are a leader in the development and manufacture of production systems for all types of gears including gear and transmission design software, machines, ……

#10 DN Solutions

Domain Est. 2017

Website: dn-solutions.com

Key Highlights: Welcome to official website of DN Solutions! Here you can view our wide range of products from the very latest machines to our most popular models….

Expert Sourcing Insights for Industrial Machine

H2: 2026 Market Trends for Industrial Machinery – Resilience, Digitization, and Sustainability Drive Transformation

The global industrial machinery market in 2026 is poised for robust growth, driven by a confluence of technological advancements, shifting economic priorities, and transformative global trends. While navigating persistent challenges like supply chain volatility and geopolitical uncertainty, the sector is fundamentally reshaping towards smarter, greener, and more resilient operations. Here’s an analysis of the key trends defining the market in 2026:

1. Accelerated Adoption of Industry 4.0 & AI Integration:

* Deepening Digitalization: Integration of IoT sensors, cloud platforms, and advanced data analytics is no longer optional but standard. Machines generate vast operational data, enabling predictive maintenance (reducing downtime by 20-50%), optimized production scheduling, and real-time performance monitoring.

* AI & Machine Learning Maturity: AI moves beyond pilot projects. Expect widespread use for:

* Predictive Quality: Identifying potential defects before they occur.

* Autonomous Optimization: Self-adjusting machines for optimal efficiency and resource use.

* Enhanced Human-Machine Collaboration: AI-powered cobots (collaborative robots) performing complex tasks alongside humans safely and efficiently.

* Digital Twins Proliferation: Virtual replicas of physical machinery and production lines become essential for simulation, optimization, remote monitoring, and training, reducing physical prototyping costs and accelerating innovation.

2. Sustainability and Energy Efficiency as Core Drivers:

* Regulatory & Customer Pressure: Stricter global emissions regulations (e.g., EU Green Deal, US climate initiatives) and corporate ESG commitments are forcing manufacturers to prioritize low-carbon solutions.

* Demand for “Green Machines”: Significant growth in machinery designed for:

* Energy Efficiency: Motors, drives, and processes consuming significantly less power (e.g., high-efficiency electric motors, regenerative braking systems).

* Renewable Energy Integration: Machinery optimized for use with solar, wind, or green hydrogen power sources.

* Circular Economy: Equipment designed for easier disassembly, remanufacturing, and recycling. Increased demand for machinery enabling recycling processes (e.g., advanced sorting, shredding).

* Lifecycle Cost Focus: Buyers increasingly evaluate Total Cost of Ownership (TCO), where lower energy consumption and reduced environmental impact significantly improve long-term economics.

3. Resilience and Supply Chain Reconfiguration:

* Nearshoring & Friendshoring: Geopolitical tensions and pandemic-era disruptions accelerate the shift of manufacturing closer to end markets (e.g., US, EU, Mexico, Vietnam, India). This drives demand for machinery in these new/relocated production hubs.

* Supply Chain Digitization: Machinery OEMs and users invest heavily in digital supply chain platforms for greater visibility, risk mitigation, and agility. Blockchain for provenance tracking gains traction.

* Local Sourcing & Inventory Optimization: Increased focus on securing critical components locally and utilizing data analytics for smarter inventory management of spare parts.

4. Automation Beyond the Factory Floor:

* Logistics & Warehousing Boom: Continued explosive growth in e-commerce and omnichannel retail fuels massive demand for automated guided vehicles (AGVs), autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS), and robotic picking/packing solutions.

* Construction Automation: Adoption of robotic bricklaying, 3D concrete printing, and autonomous site equipment increases to address labor shortages and improve safety/efficiency.

* Agricultural Automation: Precision farming machinery (autonomous tractors, AI-powered harvesters, drone-based monitoring) sees significant uptake for sustainable food production.

5. Workforce Evolution and Skills Gap:

* Demand for New Skills: The shift towards connected, automated systems creates high demand for workers skilled in data science, AI/ML, cybersecurity, robotics programming, and digital maintenance.

* Upskilling Imperative: Companies invest heavily in training programs to bridge the skills gap. OEMs increasingly offer integrated training and support services.

* Human-Centric Design: Machinery design focuses on intuitive interfaces, augmented reality (AR) for maintenance guidance, and enhanced safety features to support the hybrid human-machine workforce.

6. Cybersecurity as a Critical Concern:

* Increased Attack Surface: As machinery becomes more connected, the risk of cyberattacks disrupting production or stealing intellectual property grows exponentially.

* Embedded Security: Cybersecurity is no longer an afterthought but integrated into machinery design (secure-by-design principles), software updates, and network architecture. Demand for industrial cybersecurity solutions and services surges.

Regional Dynamics:

* Asia-Pacific: Remains the largest and fastest-growing market, driven by China’s “Made in China 2025,” robust manufacturing in Southeast Asia, and India’s industrial expansion.

* North America & Europe: Focus on modernization, automation, and sustainability drives demand, particularly in reshoring initiatives. Strong regulatory push for green technologies.

* Emerging Markets: Significant growth potential in regions like Latin America and Africa, driven by infrastructure development and industrialization, albeit with varying levels of digital maturity.

Challenges Persist:

* Economic Volatility: Inflation, interest rates, and potential recessions could impact capital expenditure decisions.

* Component Shortages: While improving, supply chain bottlenecks for semiconductors and specialized materials can still disrupt production.

* High Implementation Costs: Significant upfront investment for advanced automation and digitalization remains a barrier for SMEs.

* Regulatory Complexity: Navigating diverse and evolving environmental and safety regulations across regions.

Conclusion:

The 2026 industrial machinery market is characterized by transformation driven by intelligence, sustainability, and resilience. Success will belong to OEMs and users who embrace digitalization (AI, IIoT, Digital Twins), prioritize energy efficiency and circularity, build agile supply chains, invest in workforce upskilling, and embed cybersecurity. While challenges remain, the fundamental trends point towards a market that is smarter, greener, and more adaptable than ever before, playing a pivotal role in the future of global manufacturing and infrastructure.

Common Pitfalls in Sourcing Industrial Machines: Quality and Intellectual Property Risks

Sourcing industrial machinery involves significant investment and long-term operational impact. While cost and delivery timelines are often primary concerns, overlooking quality assurance and intellectual property (IP) protection can lead to severe consequences. Below are key pitfalls to avoid in these critical areas.

Quality-Related Pitfalls

Inadequate Supplier Vetting

Failing to conduct thorough due diligence on suppliers can result in substandard machinery. Red flags include lack of certifications (e.g., ISO 9001), inconsistent production processes, and poor customer references. Always verify a supplier’s track record, manufacturing capabilities, and quality control systems before committing.

Insufficient On-Site Inspections

Relying solely on supplier-provided documentation or remote video tours increases the risk of receiving defective equipment. Conducting third-party pre-shipment inspections or factory acceptance tests (FATs) helps identify manufacturing flaws, non-compliance with specifications, or incorrect configurations.

Ambiguous Technical Specifications

Vague or incomplete technical requirements can lead to machines that don’t meet performance expectations. Ensure specifications explicitly define materials, tolerances, safety standards, automation interfaces, and expected output. Use detailed engineering drawings and require formal sign-off before production.

Neglecting After-Sales Support and Spare Parts Availability

Even high-quality machines degrade over time. Sourcing from suppliers without reliable technical support, maintenance training, or accessible spare parts can result in prolonged downtime and inflated lifecycle costs. Evaluate service networks and support agreements as part of the procurement decision.

Intellectual Property-Related Pitfalls

Lack of IP Clauses in Contracts

Failing to define IP ownership in sourcing agreements can lead to disputes, especially for custom-designed or modified machinery. Clearly specify whether the buyer, seller, or both hold rights to designs, software, and technical documentation. Include clauses on usage rights, modifications, and reverse engineering prohibitions.

Risk of Infringement from Supplier

Suppliers may unknowingly (or knowingly) incorporate third-party patented components or software into the machinery. If your company uses such equipment, you could face infringement claims. Require suppliers to warrant that their products do not violate existing IP rights and to assume liability for any claims.

Exposure of Sensitive Operational Data

Modern industrial machines often include IoT sensors and proprietary control software. If not properly secured, these systems can expose sensitive production data. Ensure contracts mandate data protection standards, restrict unauthorized data collection, and clarify data ownership.

Unauthorized Replication or Resale

In some regions, especially where IP enforcement is weak, suppliers may replicate your custom machine designs for resale to competitors. Use non-disclosure agreements (NDAs), limit access to technical data, and consider patenting or registering unique design elements where feasible.

By proactively addressing these quality and IP risks during the sourcing process, companies can safeguard their operations, protect innovation, and ensure long-term return on investment.

Logistics & Compliance Guide for Industrial Machines

Overview

This guide outlines the essential logistics and compliance considerations for the safe, legal, and efficient transportation, import/export, and operation of industrial machines. Adherence to these guidelines ensures regulatory compliance, minimizes risks, and supports smooth supply chain operations.

Classification and Documentation

Accurate classification of industrial machines is vital for customs and regulatory purposes. Use the appropriate Harmonized System (HS) code to determine duties, restrictions, and required documentation. Required documentation typically includes:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of origin

– Technical specifications and user manuals

– Export license (if applicable)

Ensure all documents are complete, consistent, and compliant with destination country requirements.

Export and Import Regulations

Compliance with international trade regulations is mandatory. Key considerations include:

– Export Controls: Verify if the machine or its components are subject to export restrictions (e.g., dual-use items under EAR or ITAR). Obtain necessary export licenses.

– Import Restrictions: Research destination country tariffs, import permits, and technical standards. Some countries require pre-shipment inspections or certifications.

– Sanctions and Embargoes: Confirm that the destination country, end-user, or end-use is not restricted under international sanctions.

Packaging and Handling

Industrial machines require specialized packaging to prevent damage during transport:

– Use robust crating with moisture barriers and shock-absorbing materials.

– Secure all moving parts and sensitive components.

– Label packages with handling instructions (e.g., “Fragile,” “This Side Up,” lifting points).

– Include internal documentation and spare parts in waterproof containers.

Transportation Modes and Requirements

Select the appropriate mode of transport based on machine size, weight, and destination:

– Road: Ensure vehicles meet weight and dimension regulations; use pilot/escort vehicles for oversized loads.

– Rail: Confirm compatibility with railcar dimensions and loading procedures.

– Sea: Use containerized or break-bulk shipping; secure cargo with lashing and blocking. Comply with IMDG Code if hazardous materials are present.

– Air: Follow IATA regulations; ensure machine dimensions and weight comply with aircraft limitations.

Customs Clearance

Prepare for timely customs clearance by:

– Submitting accurate customs declarations.

– Paying applicable duties, taxes, and fees promptly.

– Providing certificates of conformity, safety approvals, or test reports when required.

– Appointing a licensed customs broker in the destination country if necessary.

Regulatory Compliance and Certifications

Industrial machines must meet safety and environmental standards in the target market:

– CE Marking: Required for machines sold in the European Economic Area (per Machinery Directive 2006/42/EC).

– UL/CSA Certification: Required in the U.S. and Canada for electrical safety.

– RoHS and REACH Compliance: Restrict hazardous substances in electrical and electronic components.

– Local Approvals: Some countries require specific approvals (e.g., GOST in Russia, KC in South Korea).

Installation, Commissioning, and Training

Ensure compliance during setup:

– Follow manufacturer’s installation guidelines and local building/electrical codes.

– Conduct safety inspections and performance testing before operation.

– Provide operator and maintenance training as required by regulations (e.g., OSHA in the U.S.).

Recordkeeping and Audit Readiness

Maintain comprehensive records for:

– Shipping and customs documentation

– Certifications and test reports

– Maintenance logs and safety inspections

– Export license applications and approvals

Records should be retained for a minimum of 5 years (or as required by jurisdiction) to support audits and compliance reviews.

Risk Management and Insurance

Protect against logistical and compliance risks:

– Obtain cargo insurance covering damage, loss, or theft during transit.

– Evaluate liability insurance for compliance-related incidents.

– Conduct regular compliance training for logistics and operations staff.

Conclusion

Successful logistics and compliance for industrial machines require proactive planning, detailed documentation, and adherence to international and local regulations. Partnering with experienced freight forwarders, customs brokers, and regulatory consultants can help ensure seamless operations across borders.

In conclusion, sourcing industrial machine manufacturers requires a strategic and well-informed approach that balances cost, quality, reliability, and long-term operational needs. It is essential to conduct thorough due diligence, evaluating potential suppliers based on technical capabilities, production capacity, certifications, reputation, and after-sales support. Engaging with manufacturers that align with your specific industry requirements and regulatory standards ensures optimal performance and return on investment. Leveraging global supply chains offers opportunities for cost savings and access to innovative technologies, but also necessitates careful risk management, including considerations around logistics, lead times, and intellectual property protection. Ultimately, building strong, transparent relationships with reputable manufacturers fosters collaboration, scalability, and resilience in an increasingly competitive industrial landscape.