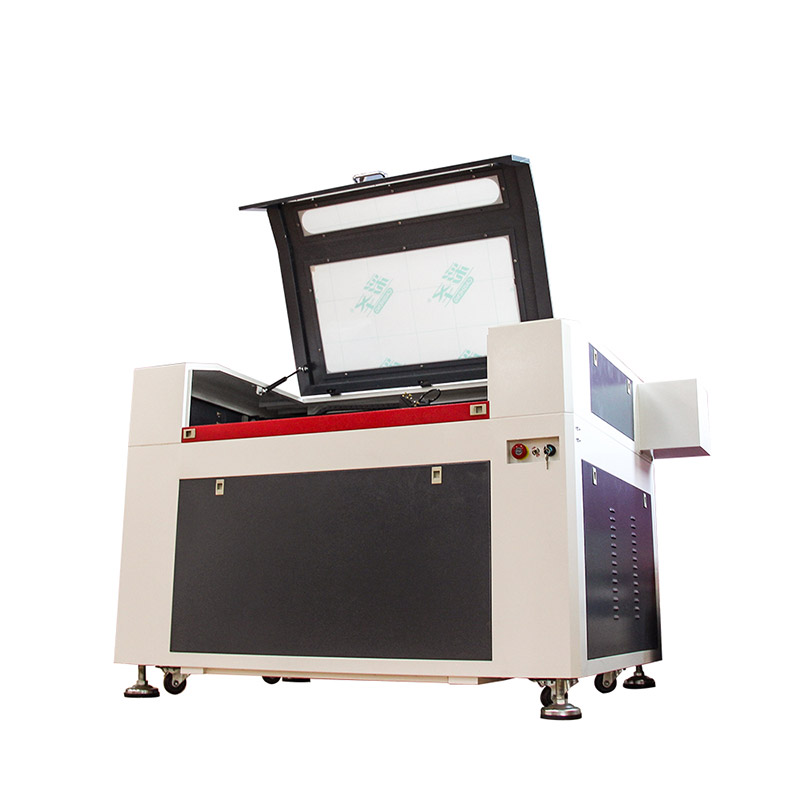

The global industrial laser engraving machine market is experiencing robust expansion, driven by increasing demand for precision marking and customization across industries such as automotive, electronics, medical devices, and aerospace. According to a 2023 report by Mordor Intelligence, the global laser system market was valued at USD 13.6 billion in 2022 and is projected to grow at a CAGR of over 6.8% from 2023 to 2028, with industrial laser engraving systems accounting for a significant share. Similarly, Grand View Research estimates that the global laser marking systems market size reached USD 1.89 billion in 2022 and is expected to expand at a CAGR of 7.4% from 2023 to 2030. This sustained growth is fueled by advancements in fiber and CO₂ laser technologies, rising adoption of automation in manufacturing, and the push for permanent, high-precision product traceability. As industries prioritize efficiency and regulatory compliance, the role of industrial laser engraving machines has become increasingly critical. Against this backdrop, leading manufacturers are innovating rapidly to deliver high-speed, durable, and intelligent engraving solutions. The following list highlights the top 10 industrial laser engraving machine manufacturers shaping the future of industrial marking and customization.

Top 10 Industrial Laser Engraving Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Laser Markers

Domain Est. 1996

Website: telesis.com

Key Highlights: Industrial Laser Marking Machines … Telesis Technologies, Inc. offers efficient, high-performing laser marking systems engineered for industrial applications….

#2 Marking machine manufacturer, Laser marking, Traceability …

Domain Est. 2000

Website: sic-marking.com

Key Highlights: For more than 30 years, SIC Marking has been designing a range of reliable, robust industrial marking machines that can be customized to suit your needs….

#3 Laser Etching & Engraving Applications and Machines

Domain Est. 1996

Website: mecco.com

Key Highlights: Explore our laser etching and laser engraving machines MECCO provides to help manufacturers improve part traceability and increase efficiency….

#4 Large Format Laser Cutting Systems and Laser Engravers

Domain Est. 1998

Website: kernlasers.com

Key Highlights: USA manufacturer of large format laser cutting systems and laser engraver equipment. Specializing in metal and acrylic cutting machines….

#5 Laser engravers & laser cutters

Domain Est. 2007

Website: gravotech.us

Key Highlights: Our laser engravers come in several sizes, powers and technologies: from a compact CO2 laser machine (LS100) to industrial laser engraver (LS900XP)….

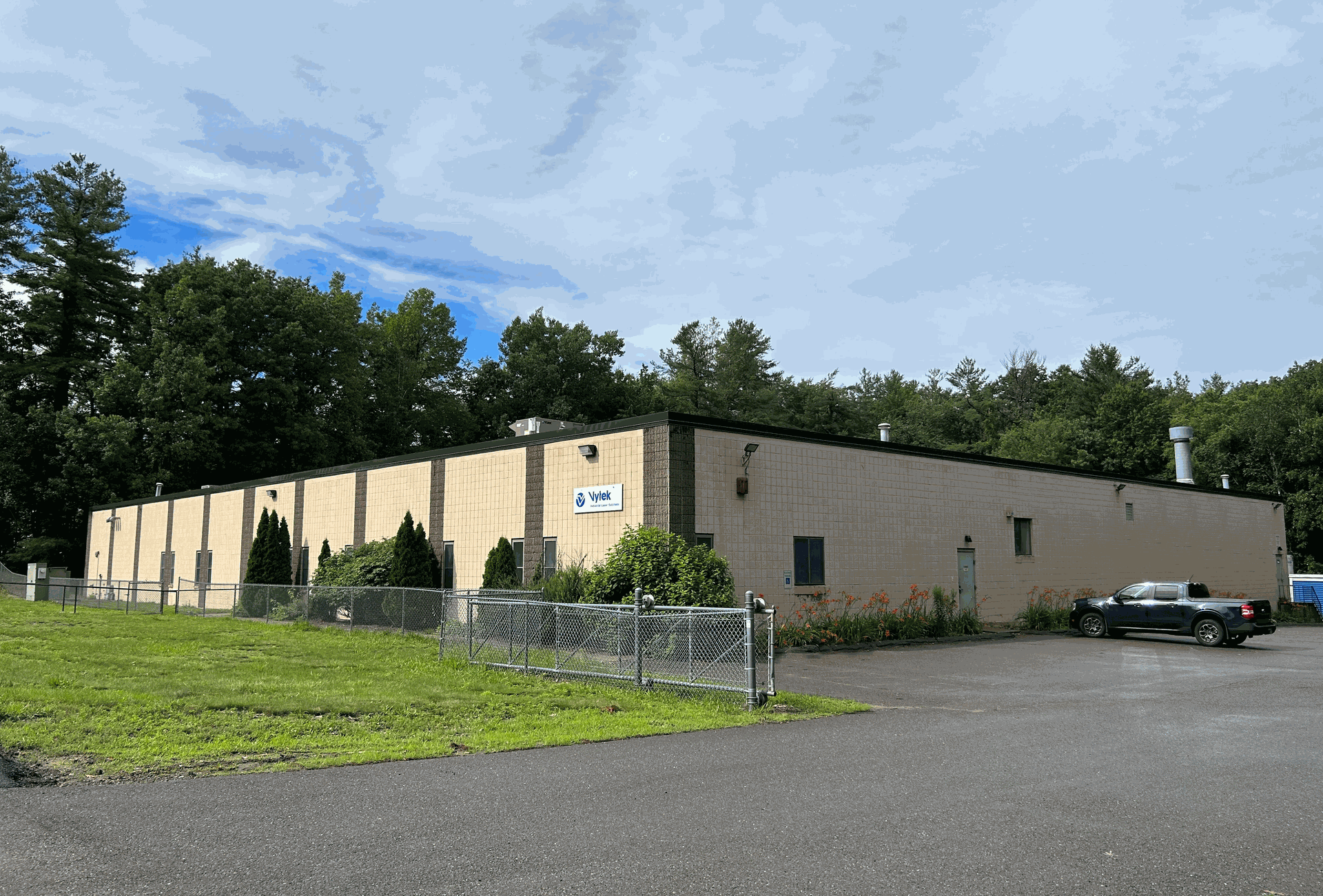

#6 Vytek Laser Systems

Domain Est. 1997

Website: vytek.com

Key Highlights: Vytek designs, builds, and sells a complete line of laser solutions for cleaning, engraving, marking, cutting, and welding, built to exacting standards….

#7 Laser Engraving and Engraver Machines

Domain Est. 1997

Website: epiloglaser.com

Key Highlights: Learn how a laser engraver machine can provide fast, precise, repeatable laser engraving on wood, acrylic, fabric, glass, stone, paper, and more….

#8 Trotec Laser

Domain Est. 2002

Website: troteclaser.com

Key Highlights: High-end laser machines for precise engraving, marking and cutting. Trotec lasers for printers, manufacturing industry, engravers and schools. Based on over 25 ……

#9 Laser Cutting, Engraving & Marking Machines

Domain Est. 2010

Website: thunderlaser.com

Key Highlights: Laser Engraver The best RF laser engraving machine. Integrated camera with a speed of up to 2000 mm/s. Laser engraving photo to precise detail is so easy….

#10 SA Laser

Domain Est. 2022

Website: salasers.com

Key Highlights: Explore opportunities in laser engraving with SA Laser’s top-quality fiber & CO2 laser engraving machines, Spark Laser Training, engraving services, ……

Expert Sourcing Insights for Industrial Laser Engraving Machine

2026 Market Trends for Industrial Laser Engraving Machines

The industrial laser engraving machine market is poised for significant transformation by 2026, driven by technological innovation, expanding industrial automation, and rising demand across diverse manufacturing sectors. As industries prioritize precision, efficiency, and customization, laser engraving technologies are evolving to meet these needs. This analysis explores key market trends expected to shape the industrial laser engraving landscape through 2026.

Rising Adoption in Advanced Manufacturing

One of the most prominent trends in the 2026 outlook is the increasing integration of industrial laser engraving machines in advanced manufacturing environments. Industries such as aerospace, automotive, and electronics are leveraging laser engraving for permanent part marking (PPM), serialization, and traceability—requirements driven by regulatory standards and supply chain transparency. The ability of laser systems to mark complex codes (e.g., Data Matrix, QR codes) on metal, plastic, and composite materials with high accuracy ensures compliance with industry regulations like AS9100 and ISO 26262.

Growth in Fiber Laser Dominance

By 2026, fiber laser technology is expected to maintain its dominance in the industrial laser engraving market. Fiber lasers offer superior beam quality, higher energy efficiency, lower maintenance, and longer operational lifespans compared to CO2 and lamp-pumped lasers. These advantages make fiber lasers ideal for high-speed engraving on metals and engineered plastics, particularly in high-volume production lines. Continued advancements in diode pumping and cooling systems are further reducing operational costs, making fiber lasers more accessible to small and medium enterprises (SMEs).

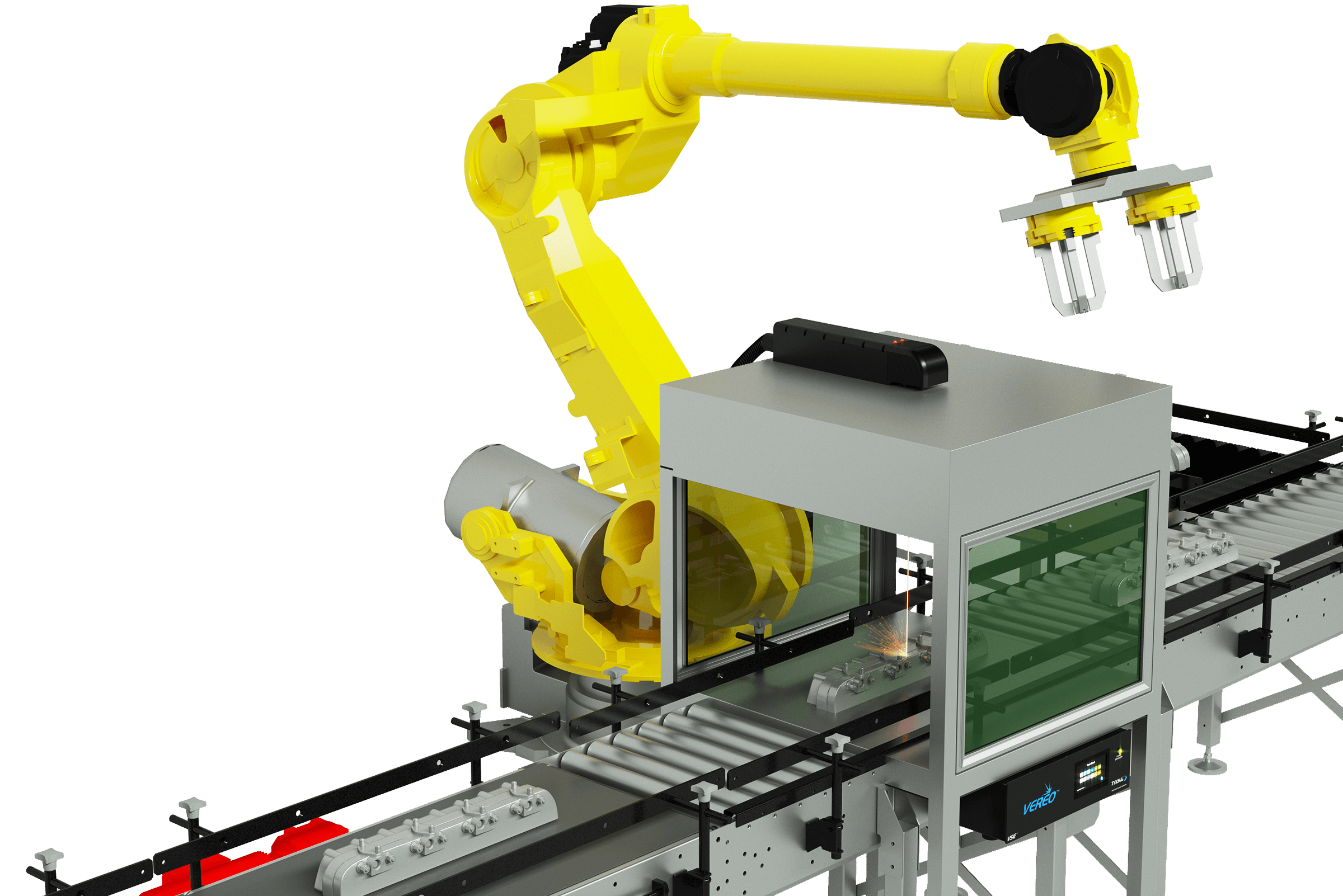

Expansion of Smart and Connected Systems

The integration of Industry 4.0 principles is transforming laser engraving systems into intelligent, networked devices. By 2026, a growing number of industrial laser engravers are expected to feature IoT connectivity, real-time monitoring, predictive maintenance, and cloud-based control systems. These smart capabilities enable seamless integration with manufacturing execution systems (MES) and enterprise resource planning (ERP) platforms, improving production traceability, reducing downtime, and enabling remote diagnostics. This trend supports the broader move toward digital twin technology and smart factories.

Demand for Customization and Personalization

Consumer and industrial demand for product customization is accelerating the adoption of laser engraving in mass production environments. From personalized consumer electronics and medical devices to branded industrial components, laser engraving offers a scalable solution for adding unique identifiers, logos, or decorative elements. By 2026, manufacturers are likely to invest in modular and reconfigurable laser systems capable of rapid job changeovers and integration with automated handling systems to support flexible production lines.

Sustainability and Energy Efficiency Focus

Environmental concerns and corporate sustainability goals are influencing purchasing decisions in the industrial sector. Laser engraving machines with lower power consumption, reduced emissions, and minimal consumables (unlike ink-based marking systems) are gaining favor. By 2026, original equipment manufacturers (OEMs) are expected to emphasize eco-design principles, offering energy-efficient models and recyclable components. Additionally, regulatory pressures in regions like the EU and North America are likely to accelerate the shift away from chemical marking processes toward cleaner laser alternatives.

Regional Market Dynamics

Asia-Pacific is projected to remain the fastest-growing market for industrial laser engraving machines through 2026, led by China, India, and Southeast Asian nations. This growth is fueled by expanding electronics manufacturing, government initiatives promoting smart manufacturing (e.g., “Make in India” and “China Manufacturing 2025”), and rising investments in automation. Meanwhile, North America and Europe will see steady growth driven by aerospace, defense, and medical device industries requiring high-precision marking solutions.

Competitive Landscape and Innovation

The competitive landscape is becoming increasingly dynamic, with key players such as Trumpf, IPG Photonics, Han’s Laser, and Universal Laser Systems investing heavily in R&D. Innovations include ultrafast lasers (picosecond and femtosecond) for cold ablation processes, multi-axis engraving systems for complex 3D surfaces, and AI-driven software for optimizing engraving parameters. By 2026, differentiation will increasingly depend on software capabilities, system integration services, and total cost of ownership rather than hardware alone.

Conclusion

The 2026 industrial laser engraving machine market will be characterized by technological sophistication, digital integration, and expanded applications across critical industries. As manufacturers strive for greater efficiency, traceability, and sustainability, laser engraving systems will play a central role in modern production ecosystems. Companies that embrace innovation, connectivity, and customization will be best positioned to capitalize on the evolving market landscape.

Common Pitfalls When Sourcing Industrial Laser Engraving Machines

Quality-Related Pitfalls

Inadequate Build Quality and Materials

One of the most frequent issues when sourcing industrial laser engraving machines is encountering units made with substandard components. Low-cost manufacturers may use inferior metals, weak structural frames, or low-grade optics, leading to reduced accuracy, misalignment, and shortened machine lifespan. Always verify the materials used in the machine’s construction and prioritize suppliers who provide detailed specifications.

Poor Laser Source Quality

The laser source (e.g., CO2, fiber, or diode) is the core of the system. Sourcing machines with underperforming or counterfeit laser modules can lead to inconsistent engraving depth, reduced power output, and frequent failures. Beware of vague specifications—confirm the brand and model of the laser source and request performance data or third-party certifications.

Lack of Proper Cooling Systems

High-power industrial lasers generate significant heat. Machines without adequate cooling (e.g., chiller units for CO2 lasers or proper heat dissipation for fiber lasers) risk overheating, which degrades performance and shortens component life. Ensure the cooling system is appropriately sized and reliable for continuous operation.

Insufficient After-Sales Support and Calibration

Even high-quality machines require maintenance and recalibration. Many suppliers, especially from less regulated markets, lack local technical support or fail to provide comprehensive training. This can result in prolonged downtime. Verify the supplier’s service network, availability of spare parts, and technical documentation.

Intellectual Property (IP) and Compliance Risks

Use of Counterfeit or Unlicensed Components

Some manufacturers use cloned or pirated control systems (e.g., fake Ruida or Trocen controllers) or software to cut costs. These systems often lack updates, have security vulnerabilities, and may infringe on IP rights, exposing the buyer to legal risks. Always confirm the authenticity of critical components and ensure software licenses are legitimate.

Non-Compliance with International Safety and Emission Standards

Industrial laser machines must comply with regulations such as FDA (U.S.), CE (Europe), or IEC 60825 for laser safety. Machines sourced from unreliable vendors may lack proper safety interlocks, labeling, or certification documentation. Using non-compliant equipment can lead to legal liability, workplace accidents, and import restrictions.

Lack of IP Protection in Contracts

When customizing machines or developing proprietary engraving processes, failing to secure IP rights in supplier contracts is a major oversight. Ensure that agreements clearly define ownership of designs, software modifications, and process innovations developed during integration or use.

Risk of Technology Theft or Reverse Engineering

Working with overseas suppliers, especially in regions with weak IP enforcement, increases the risk of design or process theft. Avoid sharing sensitive technical details without NDAs and consider staging technology transfer to minimize exposure.

By addressing these quality and IP-related pitfalls early in the sourcing process, businesses can mitigate risks and ensure reliable, legally compliant operation of their industrial laser engraving systems.

Logistics & Compliance Guide for Industrial Laser Engraving Machine

Overview

This guide outlines the essential logistics and compliance considerations for the international shipment, import, and operation of industrial laser engraving machines. Adhering to these standards ensures safe transport, regulatory compliance, and smooth customs clearance.

Classification & Documentation

Harmonized System (HS) Code

Identify the correct HS code for customs declaration. Industrial laser engraving machines typically fall under:

– 8456.11 or 8456.12 – Machines for drilling or milling; laser-operated

– Confirm with local customs authorities, as classification may vary by country and machine specifications.

Required Documentation

Ensure the following documents are prepared and accurate:

– Commercial Invoice (with full technical specifications)

– Packing List

– Bill of Lading (BOL) or Air Waybill (AWB)

– Certificate of Origin

– Technical Manuals and User Guides

– CE, FCC, or other relevant certifications (see Compliance section)

– Laser Safety Certification (e.g., IEC 60825-1)

Packaging & Handling

Secure Packaging

– Use sturdy, export-grade wooden crates with internal shock-absorbing materials (e.g., foam, corner protectors).

– Protect optical components and laser heads with dust covers and anti-static materials.

– Clearly label “Fragile,” “This Side Up,” and “Do Not Stack” on all sides.

Weight & Dimensions

– Accurately measure and declare gross/net weight and external dimensions.

– Confirm compliance with carrier size and weight limits for air, sea, or ground transport.

Hazardous Components

– While the laser itself is not classified as hazardous, high-voltage components and cooling systems (if containing refrigerants) may require special handling.

– Declare any batteries (e.g., for backup systems) according to IATA/IMDG regulations if applicable.

Shipping & Transportation

Mode of Transport

– Air Freight: Faster but more expensive; ideal for urgent deliveries. Ensure compliance with IATA regulations.

– Ocean Freight: Cost-effective for heavy machinery; requires proper containerization (20′ or 40′ container).

– Ground Transport: Suitable for regional delivery; verify road clearance and weight limits.

Insurance

– Obtain comprehensive cargo insurance covering damage, loss, and delays during transit.

– Include coverage for high-value components such as laser tubes and control systems.

Customs Clearance

– Assign a licensed customs broker in the destination country.

– Pre-clear documentation to avoid delays.

– Be prepared for possible inspections or requests for additional technical data.

Regulatory Compliance

Laser Safety Standards

– Comply with IEC 60825-1 (international standard for laser product safety).

– Ensure proper labeling: laser class (typically Class 1 or Class 4), wavelength, power output, and warning symbols.

– Provide a Laser Safety Officer (LSO) manual if required by local regulations.

Electromagnetic Compatibility (EMC)

– Meet EMC Directive 2014/30/EU (for EU markets) or FCC Part 15 (for USA).

– Include test reports and Declaration of Conformity (DoC).

Electrical Safety

– Comply with IEC 61010-1 (safety requirements for electrical equipment).

– Confirm voltage compatibility (e.g., 220–240V, 50/60 Hz) with the destination country.

Regional Certifications

– CE Marking: Required for European Economic Area (EEA).

– UKCA Marking: Required for Great Britain (UK).

– FCC ID: Required for U.S. market.

– PSE Mark: Required for Japan.

– RCM Mark: Required for Australia and New Zealand.

Import Duties & Taxes

Duty Rates

– Vary by country. Check the destination’s tariff schedule using the HS code.

– Some countries offer reduced or zero duty under trade agreements (e.g., USMCA, ASEAN).

Value-Added Tax (VAT) or Goods and Services Tax (GST)

– Importer is typically liable for VAT/GST upon entry. Rate depends on destination country.

– Provide accurate declared value to avoid penalties.

Import Permits

– Some countries require import licenses for industrial machinery or laser equipment.

– Verify with local trade authorities (e.g., Ministry of Commerce).

Installation & Operational Compliance

Site Preparation

– Ensure adequate ventilation, stable power supply, and grounding.

– Install in a controlled environment free from dust and moisture.

Operator Training

– Provide training on safe operation, emergency shutdown, and maintenance.

– Maintain training records for compliance audits.

Environmental & Waste Regulations

– Laser engraving may produce fumes and particulate matter.

– Use certified fume extraction systems compliant with OSHA (USA) or REACH/CLP (EU).

– Dispose of consumables (e.g., filters, lenses) according to local environmental laws.

After-Sales & Warranty

Spare Parts Logistics

– Maintain inventory of critical spare parts (e.g., lenses, nozzles, laser tubes) in key regions.

– Ship spares with appropriate documentation and customs classification.

Service & Maintenance Compliance

– Service personnel must follow local safety and technical standards.

– Keep records of maintenance and safety inspections.

Summary

Proper logistics planning and adherence to global compliance standards are critical for the successful delivery and operation of industrial laser engraving machines. Always verify regulations with local authorities and work with experienced freight forwarders and compliance consultants.

Conclusion: Sourcing an Industrial Laser Engraving Machine

Sourcing an industrial laser engraving machine is a strategic investment that can significantly enhance manufacturing precision, production efficiency, and product customization capabilities. After evaluating key factors such as laser type (fiber, CO2, or UV), power requirements, software compatibility, build quality, maintenance support, and total cost of ownership, it becomes clear that selecting the right machine requires aligning technical specifications with specific industrial applications—be it in aerospace, automotive, electronics, or medical device manufacturing.

It is essential to partner with reputable suppliers offering robust after-sales support, warranty coverage, and technical training to ensure long-term reliability and operational success. Additionally, considering scalability and future production needs will help avoid premature obsolescence and support business growth.

In conclusion, a well-researched procurement process that balances performance, durability, and cost-effectiveness will result in the acquisition of a high-quality industrial laser engraving system—delivering lasting value, improving competitiveness, and enabling innovation in manufacturing processes.