The global industrial freezer market is experiencing robust expansion, driven by rising demand for cold chain infrastructure across food processing, pharmaceuticals, and logistics sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 4.5 billion in 2022 and is projected to grow at a CAGR of 5.8% from 2023 to 2028. This growth is fueled by increasing regulatory standards for food safety, the expansion of frozen food consumption, and advancements in energy-efficient refrigeration technologies. Additionally, Grand View Research highlights that innovations in smart freezing systems and the integration of IoT for remote monitoring are reshaping the competitive landscape. As industries prioritize reliability, scalability, and sustainability, the role of leading industrial freezer manufacturers becomes increasingly critical. Here’s a data-driven look at the top 10 companies shaping the future of industrial freezing solutions worldwide.

Top 10 Industrial Freezer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 2000 | Founded: 1986

Website: advancedfreezer.com

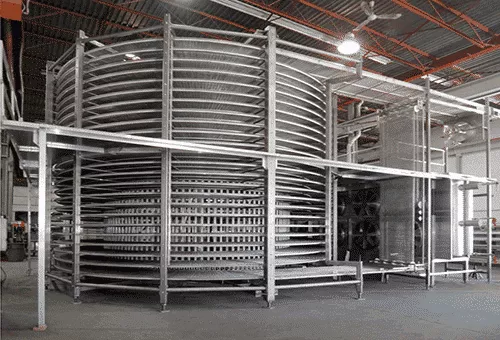

Key Highlights: Advanced Equipment Inc. has been designing and manufacturing both tunnel freezer and spiral freezer systems since 1986….

#2 Beverage

Domain Est. 1996

Website: beverage-air.com

Key Highlights: Your complete refrigeration source. Beverage-Air is a leading domestic manufacturer committed to producing American made equipment for the foodservice ……

#3 Polar King

Domain Est. 1996

Website: polarking.com

Key Highlights: Polar King commercial walk in cooler, freezer and combo units are custom-made to your specs and built to last. Start saving energy now!…

#4 True Manufacturing

Domain Est. 1997

Website: truemfg.com

Key Highlights: True, the most trusted name in commercial refrigeration. Best-in-class refrigerators and freezers, made in the USA and distributed worldwide….

#5 So

Domain Est. 1997

Website: so-low.com

Key Highlights: For over 65 years So-Low Environmental has been manufacturing Ultra Low freezers and medical-grade refrigeration equipment in Cincinnati, OH, USA….

#6 Bally Walk

Domain Est. 1998

Website: ballyrefboxes.com

Key Highlights: Manufacturing Walk-In Coolers, Freezers, and Refrigerated Warehouses for over 75 years. We provide a full line of Refrigeration Equipment and Service Parts, ……

#7 Blue Air FSE LLC

Domain Est. 2001

Website: blueairinc.com

Key Highlights: Blue Air provides the longest standard warranty in the commercial refrigeration and restaurant equipment supply industry….

#8 Kelvinator Commercial

Domain Est. 2009

Website: kelvinatorcommercial.com

Key Highlights: The Kelvinator Commercial refrigeration line includes stainless steel door refrigerators and upright freezers, high-performance chest freezers, and glass top ……

#9 Walk-In Cooler & Freezers

Domain Est. 2014

Website: kpsglobal.com

Key Highlights: KPS Global offers Walk-Ins coolers & freezers, EPS IMPs, Replacement Walk-in Doors or Parts and other Custom solutions for controlled environments….

#10 Habco Manufacturing

Domain Est. 2015

Website: habcomfg.com

Key Highlights: HABCO’s top-of-the-line commercial refrigerators and refrigeration equipment are made with four key elements: value, innovation, quality, and sustainability….

Expert Sourcing Insights for Industrial Freezer

H2: 2026 Market Trends for Industrial Freezers

As we approach 2026, the industrial freezer market is poised for significant transformation driven by technological innovation, evolving regulatory standards, and increasing demand across key end-use sectors. Several critical trends are shaping the industry landscape:

1. Rising Demand from Food & Beverage and Pharmaceutical Sectors

The food processing and cold chain logistics industries continue to expand globally, particularly in emerging markets where urbanization and changing consumer habits fuel demand for frozen and perishable goods. Simultaneously, the pharmaceutical and biotechnology sectors require ultra-low temperature storage for vaccines and biologics—accelerating the need for advanced industrial freezers capable of maintaining precise, consistent temperatures. This dual demand is expected to be a primary growth driver through 2026.

2. Adoption of Energy-Efficient and Sustainable Technologies

Environmental regulations and corporate sustainability goals are pushing manufacturers to develop energy-efficient industrial freezers. The phase-down of high-GWP (Global Warming Potential) refrigerants under the Kigali Amendment to the Montreal Protocol is driving a shift toward natural refrigerants such as ammonia (NH₃), carbon dioxide (CO₂), and hydrocarbons. By 2026, systems utilizing these low-GWP alternatives are projected to gain significant market share, supported by government incentives and stricter emissions standards.

3. Integration of Smart Technology and IoT

The industrial freezer market is increasingly embracing digitalization. Smart freezers equipped with IoT sensors, remote monitoring, predictive maintenance, and real-time data analytics are becoming standard in modern cold storage facilities. These technologies enhance operational efficiency, reduce downtime, and improve temperature compliance—especially critical in regulated industries. By 2026, connectivity and automation are expected to be key differentiators among leading suppliers.

4. Growth in Modular and Prefabricated Cold Storage Solutions

To meet the need for rapid deployment and scalability, especially in logistics hubs and e-commerce fulfillment centers, modular industrial freezer units are gaining traction. These prefabricated solutions offer faster installation, lower construction costs, and flexibility in facility layout. This trend is particularly evident in regions with expanding cold chain infrastructure, such as Southeast Asia, Africa, and Latin America.

5. Regional Market Expansion and Infrastructure Investment

Asia-Pacific is expected to lead market growth by 2026 due to rising investments in cold chain infrastructure, particularly in India and China. Government initiatives to reduce food waste and improve food safety are accelerating the adoption of industrial freezing solutions. Meanwhile, North America and Europe remain strong markets, driven by modernization of aging cold storage facilities and stringent food safety regulations.

6. Supply Chain Resilience and Onshoring Trends

Post-pandemic supply chain disruptions have prompted industries to reevaluate their cold storage strategies. Companies are investing in localized freezing and storage capabilities to ensure resilience. This trend supports increased deployment of industrial freezers within domestic manufacturing and distribution networks, especially in North America and Western Europe.

Conclusion

By 2026, the industrial freezer market will be defined by sustainability, digital integration, and increased capacity demands. Manufacturers who innovate in energy efficiency, smart functionality, and modular design will be best positioned to capitalize on these trends. As global cold chain infrastructure matures, industrial freezers will play a pivotal role in ensuring food security, advancing healthcare logistics, and supporting sustainable industrial practices.

Common Pitfalls When Sourcing Industrial Freezers (Quality and IP)

Sourcing industrial freezers involves significant investment and long-term operational impact. Overlooking key quality and intellectual property (IP) considerations can lead to performance issues, safety risks, legal complications, and financial losses. Below are common pitfalls to avoid:

Poor Quality Construction and Materials

Many suppliers offer industrial freezers at competitive prices, but compromise on build quality. Thin insulation, substandard refrigeration components, or inadequate corrosion protection can lead to poor energy efficiency, temperature instability, and shortened equipment lifespan. Always verify material specifications, insulation R-values, and component brands before purchase.

Lack of Compliance with Industry Standards

Industrial freezers must meet stringent safety and performance standards (e.g., CE, UL, ISO, or NSF). Sourcing units that do not comply can result in failed inspections, operational shutdowns, or liability in case of accidents. Ensure the supplier provides full documentation and certifications relevant to your region and application.

Inadequate Temperature Uniformity and Control

Low-quality freezers may have inconsistent temperature distribution, especially in larger units. This can compromise product integrity—critical in food processing or pharmaceutical storage. Verify that the unit includes features like proper airflow design, accurate sensors, and reliable control systems.

Insufficient After-Sales Support and Warranty

Some suppliers offer attractive upfront pricing but provide limited technical support, spare parts availability, or warranty coverage. This can result in extended downtime and high maintenance costs. Evaluate the supplier’s service network, response time, and warranty terms before committing.

Ignoring Energy Efficiency

Energy consumption is a major operational cost. Freezers with outdated compressors, poor insulation, or inefficient defrost cycles can significantly increase electricity bills. Always request energy performance data and compare units using standardized metrics like kWh/year.

Overlooking Intellectual Property (IP) Risks

When sourcing from manufacturers—especially overseas—there is a risk of purchasing freezers that infringe on patented designs, control systems, or refrigeration technologies. Using such equipment can expose your business to legal action or forced equipment removal. Conduct due diligence by asking suppliers to confirm that their products do not violate third-party IP rights.

Copycat or Counterfeit Equipment

Some suppliers produce “look-alike” models of well-known brands, replicating design and branding without authorization. These units often lack quality assurance and may pose safety hazards. Verify the authenticity of the equipment and supplier through official channels or third-party audits.

Incomplete or Ambiguous Technical Documentation

Poorly translated or missing documentation (e.g., manuals, schematics, IP ratings) can complicate installation, maintenance, and regulatory compliance. Ensure all technical documents are comprehensive, accurate, and available in your required language.

Underestimating Environmental and IP Rating Needs

Industrial environments often require freezers with specific Ingress Protection (IP) ratings to withstand dust, moisture, or washdown conditions. Selecting a unit with insufficient IP protection can lead to premature failure. Confirm the IP rating (e.g., IP54 or higher) matches your operating environment.

Failure to Audit the Supplier

Especially when sourcing from new or low-cost suppliers, skipping factory audits or quality inspections increases the risk of receiving substandard goods. Consider third-party inspections during production or before shipment to verify quality and specifications.

Logistics & Compliance Guide for Industrial Freezer

Product Classification and Regulatory Overview

Industrial freezers are subject to international and regional regulations due to their energy consumption, refrigerant types, and electrical safety standards. Before shipping, confirm product classification under the Harmonized System (HS) Code, typically falling under 8418.40 (refrigerators, freezers, and other refrigerating or freezing equipment). Accurate classification ensures correct customs duties and compliance with import/export controls.

Refrigerant Regulations and Environmental Compliance

Most industrial freezers use fluorinated greenhouse gases (F-gases) such as HFCs (e.g., R-404A, R-134a). Compliance with the EU F-Gas Regulation (No 517/2014) or the U.S. EPA’s SNAP Program is mandatory. Ensure all units have proper refrigerant leak checks, documentation of charge quantity, and certified handling procedures. For international shipments, verify that refrigerants are allowed in the destination country and that recovery/recycling systems are in place.

Electrical Safety and Certification Requirements

Industrial freezers must meet electrical safety standards in the destination market. In the U.S., compliance with UL 471 (Standard for Commercial Refrigerators and Freezers) is required. In the EU, CE marking under the Low Voltage Directive (2014/35/EU) and EMC Directive (2014/30/EU) is mandatory. Other regions may require certifications such as CCC (China), PSE (Japan), or RCM (Australia/NZ). Always include certified test reports and technical documentation with shipments.

Packaging and Transportation Guidelines

Use robust, climate-resistant packaging designed to protect against moisture, shock, and vibration. Industrial freezers should be secured on pallets with corner boards and stretch-wrapping. If shipped by sea, ensure compliance with the International Maritime Dangerous Goods (IMDG) Code if refrigerants are pre-charged. For air freight, adhere to IATA Dangerous Goods Regulations. Clearly label units with handling instructions (e.g., “This Side Up”, “Do Not Stack”).

Import/Export Documentation

Prepare a complete set of shipping documents, including:

– Commercial Invoice (with HS code, value, and refrigerant details)

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Conformity (e.g., CE, UL)

– F-Gas Certificate (if applicable)

– Export Declaration (as required by origin country)

Verify destination-specific requirements—some countries require pre-shipment inspections or import permits.

Energy Efficiency and Labeling Compliance

Many markets require energy labeling for commercial refrigeration equipment. The EU Energy Label (EU 2019/2013) and U.S. ENERGY STAR or DOE efficiency standards apply. Ensure units meet minimum energy performance standards (MEPS) and include required labels affixed before import. Non-compliance may result in shipment rejection or fines.

Installation and On-Site Compliance

Provide installation manuals that comply with local electrical, plumbing, and ventilation codes. Technicians must be certified to handle refrigerants (e.g., Section 608 certification in the U.S.). Confirm that the end-user’s facility meets safety clearances, floor load capacity, and ambient temperature requirements for optimal freezer operation.

Maintenance and Record-Keeping

Maintain logs for refrigerant handling, service, and decommissioning per local environmental laws. In the EU, F-gas leak checks must be recorded and retained for at least five years. Provide end-users with compliance documentation and training materials to support ongoing regulatory adherence.

Conclusion for Sourcing an Industrial Freezer

After a thorough evaluation of requirements, market options, and supplier capabilities, sourcing an industrial freezer requires a strategic approach that balances performance, reliability, energy efficiency, and long-term cost-effectiveness. The chosen freezer must align with the specific operational needs—such as capacity, temperature range, usage frequency, and available space—while complying with relevant health, safety, and environmental standards.

Key considerations in the selection process include energy consumption, maintenance requirements, build quality, warranty, and the supplier’s reputation for service and support. Prioritizing energy-efficient models not only reduces operational costs but also supports sustainability goals. Additionally, engaging with reliable suppliers who offer comprehensive after-sales service ensures minimal downtime and prolonged equipment life.

In conclusion, successful sourcing of an industrial freezer involves a well-structured procurement process that integrates technical specifications with financial and operational priorities. By selecting a freezer that meets current demands and allows for future scalability, businesses can enhance productivity, preserve product quality, and achieve long-term operational efficiency.