The global industrial earring jewelry manufacturing market is experiencing robust expansion, driven by rising consumer demand for personalized accessories, growth in disposable incomes, and the increasing influence of e-commerce platforms. According to Grand View Research, the global jewelry market size was valued at USD 303.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.8% from 2023 to 2030. A significant portion of this growth is attributed to the manufacturing of industrially produced earrings, which benefit from scalable production techniques, cost-efficiency, and consistent quality control. Additionally, Mordor Intelligence projects the jewelry market to grow at a CAGR of over 6% during the forecast period 2023–2028, citing rising urbanization and evolving fashion trends as key drivers. Against this backdrop, a select group of manufacturers has emerged as leaders in innovation, volume production, and global distribution—shaping the future of industrial earring jewelry.

Top 10 Industrial Earring Jewelry Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wholesale Industrial Barbells

Domain Est. 2001

Website: piercebody.com

Key Highlights: Rating 4.8 (142) · Free deliveryGrab wholesale industrial barbells in G23 Titanium, and 316L steel for your shop. Strong, high-quality designs with bulk options and worldwide s…

#2 About Salamander Piercing Jewelry

Domain Est. 1999

Website: body-piercing.com

Key Highlights: We are a wholesale body jewelry manufacturer and supplier with customers on every continent. Our goal is to provide the most diverse collection of wholesale ……

#3 Steel and Silver

Domain Est. 1999

Website: steelandsilver.com

Key Highlights: Steel and Silver is a Manufacturer and Wholesaler of the most unique and innovative body jewelry on the market. If you are looking for something original ……

#4 SRK

Domain Est. 2017

Website: srk.one

Key Highlights: SRK is a technologically advanced diamond crafting company in the world. It has embraced science and technology to further its quest to blend quality and scale….

#5 Implant Grade

Domain Est. 2018

Website: implantgrade.com

Key Highlights: Official shop Implant Grade – piercing jewelry manufacturer. High quality titanium ASTM F-136. Free shipping available….

#6 Feebee Jewelry

Domain Est. 2023

Website: feebeejewelry.com

Key Highlights: Looking for a custom stainless steel jewelry manufacturers? We can create any kind of fashion elements you need. Charms, pendants, any kind of settings you ……

#7 ISC Body Jewelry

Domain Est. 1997

#8 W.R. Cobb Company

Domain Est. 1998

Website: wrcobb.com

Key Highlights: WR Cobb Company has been the cornerstone of the jewelry industry since 1877. It is through innovation, reliability, and dedication to servicing our customers…

#9 Metal Mafia

Domain Est. 2002

Website: metalmafia.com

Key Highlights: We manufacture the highest quality wholesale piercing jewelry, including 316L Stainless Steel, ASTM F-136 Titanium, Solid Gold and Glass body jewelry….

#10 Piercing China

Domain Est. 2023

Website: piercingchina.com

Key Highlights: Free delivery over $299 15-day returns…

Expert Sourcing Insights for Industrial Earring Jewelry

H2: 2026 Market Trends for Industrial Earring Jewelry

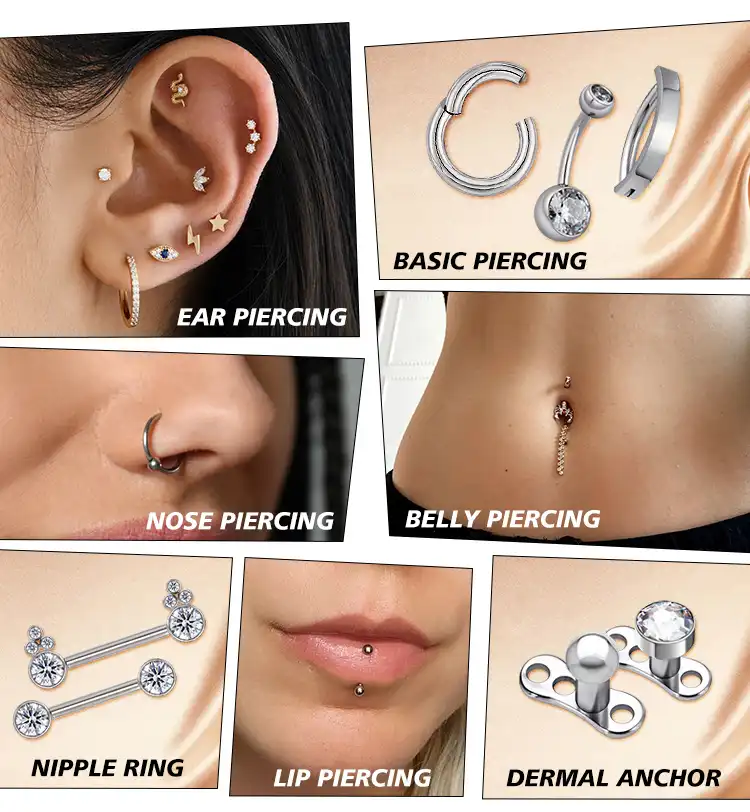

The industrial earring jewelry market is poised for dynamic evolution by 2026, driven by shifting consumer preferences, technological advancements, and sustainability imperatives. As part of the broader contemporary and alternative fashion movements, industrial earrings—characterized by their use of metals like titanium, stainless steel, and surgical-grade alloys, and often associated with body modification and edgy aesthetics—are gaining mainstream traction while retaining their subcultural roots.

-

Mainstream Adoption with Subcultural Authenticity

By 2026, industrial earrings are expected to see increased adoption in mainstream fashion, influenced by celebrity endorsements, fashion runways, and social media influencers. However, consumers continue to value authenticity, favoring designs that honor the original industrial piercing culture. Brands that successfully balance commercial appeal with underground credibility will likely dominate the market. -

Rise of Sustainable and Ethical Materials

Sustainability is becoming a key purchasing factor. Consumers are demanding transparency in sourcing and manufacturing. By 2026, expect a surge in industrial earrings made from recycled metals, ethically mined titanium, and eco-conscious packaging. Brands emphasizing carbon-neutral production or partnerships with ethical suppliers will gain a competitive edge. -

Customization and Personalization

Advances in 3D printing and CAD design are enabling hyper-personalized jewelry. In 2026, the ability to customize industrial earrings—through unique shapes, engravings, or modular designs—will be a major trend. Consumers seek pieces that reflect individual identity, and digital platforms allowing virtual try-ons and design input will enhance the buying experience. -

Integration of Smart Technology

Emerging trends include the incorporation of wearable tech into jewelry. While still niche, industrial earrings with embedded features—such as biometric sensors or NFC chips for digital identity—may begin to appear by 2026. These innovations will appeal primarily to tech-savvy urban consumers, especially in developed markets. -

Expansion of Gender-Neutral and Inclusive Designs

The market is moving toward fluid, gender-neutral aesthetics. Industrial earrings, traditionally unisex, are being further reimagined to appeal across gender identities. In 2026, inclusive marketing campaigns and diverse representation will be essential for brands aiming to resonate with younger, socially conscious demographics. -

Growth in E-Commerce and Direct-to-Consumer Models

Online sales channels will continue to expand, with social commerce (especially via Instagram and TikTok) playing a pivotal role. Direct-to-consumer (DTC) brands offering limited-edition drops, subscription models, and community engagement will outperform traditional retail outlets. -

Regional Market Diversification

While North America and Western Europe remain strong markets, Asia-Pacific—particularly South Korea, Japan, and urban centers in China—is witnessing rising demand for alternative jewelry. By 2026, localized designs that blend industrial elements with regional aesthetics will emerge as a growth opportunity.

In conclusion, the 2026 industrial earring jewelry market will be defined by innovation, inclusivity, and sustainability. Brands that embrace technological tools, ethical practices, and cultural authenticity will be best positioned to capture evolving consumer interest.

Common Pitfalls When Sourcing Industrial Earring Jewelry (Quality & Intellectual Property)

Sourcing industrial earring jewelry—characterized by bold designs, geometric shapes, and often made from stainless steel, titanium, or other durable metals—presents unique challenges. While attractive for its edgy aesthetic and durability, buyers must navigate several critical pitfalls, particularly concerning quality and intellectual property (IP). Overlooking these can lead to product failures, customer dissatisfaction, and legal risks.

Quality Inconsistencies in Materials and Craftsmanship

One of the most frequent issues in sourcing industrial earrings is inconsistent material quality. Suppliers, especially in competitive manufacturing regions, may use substandard metals that appear similar but lack the hypoallergenic properties or corrosion resistance expected of surgical-grade stainless steel or titanium. Buyers may receive earrings that tarnish quickly, cause skin irritation, or break under normal wear. Additionally, poor craftsmanship—such as uneven polishing, rough edges, weak post attachments, or misaligned components—can compromise both safety and aesthetics. Without rigorous quality control protocols and third-party inspections, these defects may go unnoticed until after shipment.

Lack of Standardization in Plating and Coatings

Many industrial earrings feature IP (Ion Plating) or PVD (Physical Vapor Deposition) coatings for color and durability. However, the thickness and adhesion of these coatings vary widely among suppliers. Thin or improperly applied plating can chip, fade, or wear off after minimal use, undermining the product’s premium appearance. Buyers often assume “IP-coated” implies long-lasting durability, but without clear specifications and testing (e.g., salt spray tests or adhesion tests), the actual performance may fall short. Sourcing from vendors without verifiable plating standards increases the risk of receiving inferior finishes.

Misrepresentation of Material Specifications

Suppliers may falsely claim their products are made from “surgical-grade stainless steel” (e.g., 316L) or “titanium” without providing material certifications. In reality, lower-grade alloys or mixed-metal components may be used to cut costs. This misrepresentation not only affects quality and safety but can also lead to compliance issues, especially when selling in markets with strict consumer safety regulations (e.g., EU REACH or U.S. CPSIA). Buyers must demand mill test reports (MTRs) and conduct material verification through independent labs to avoid this pitfall.

Intellectual Property Infringement Risks

Industrial earring designs often feature distinctive, architectural aesthetics that may be protected by design patents, trademarks, or copyrights. Sourcing from manufacturers who replicate popular designs—especially those inspired by high-end or designer pieces—can expose buyers to IP infringement claims. Some suppliers offer “similar to” or “inspired by” versions of trending styles, but these can still violate existing IP rights. Buyers who import or sell such items risk legal action, seized shipments, or forced product recalls. Conducting thorough IP due diligence and obtaining written assurance of original design from suppliers is essential.

Inadequate Testing for Safety and Durability

Industrial earrings, particularly those with barbells, captive beads, or threaded posts, must meet basic safety and durability standards. However, many sourced products fail simple stress tests—such as repeated insertion/removal or impact resistance. Poor thread quality, weak welds, or brittle materials can result in injuries or lost jewelry. Buyers often overlook the need for standardized testing protocols before mass production. Implementing pre-shipment testing for mechanical strength, biocompatibility, and wear resistance helps mitigate these risks.

Hidden Costs from Re-Work and Returns

When quality issues are discovered post-delivery, the costs can escalate quickly. Defective batches may require rework, replacements, or full refunds, eroding profit margins. High return rates due to tarnishing, breakage, or allergic reactions damage brand reputation. These hidden costs are often underestimated during initial sourcing decisions. Partnering with reliable suppliers who adhere to clear quality agreements and offer warranties can reduce long-term financial exposure.

Conclusion

Successfully sourcing industrial earring jewelry requires more than competitive pricing and appealing designs. Buyers must proactively address quality control gaps and IP vulnerabilities through detailed specifications, third-party verification, and legal diligence. By anticipating these common pitfalls, businesses can ensure they deliver safe, durable, and legally compliant products that meet consumer expectations.

Logistics & Compliance Guide for Industrial Earring Jewelry

Product Classification and HS Codes

Industrial earring jewelry is typically classified under Harmonized System (HS) codes related to precious metal articles or costume jewelry. For items made of precious metals (e.g., surgical steel, titanium, gold, silver), the common HS code is 7113.19 (Articles of jewelry and parts thereof, of base metal clad with precious metal, NESOI). For non-precious metals or fashion-grade materials, 7117.90 (Imitation jewelry) may apply. Accurate classification is critical for import/export duties, tariffs, and customs clearance. Always confirm the correct HS code with your local customs authority based on material composition and value.

Material Compliance and Safety Standards

Industrial earrings must comply with regional safety and material regulations. In the EU, compliance with REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) is mandatory, restricting the use of nickel, lead, cadmium, and other harmful substances. Nickel release must not exceed 0.2 µg/cm²/week under the Nickel Directive (2004/96/EC). In the U.S., the CPSIA (Consumer Product Safety Improvement Act) limits lead and phthalates in children’s products. Even for adult-use jewelry, best practices include testing for heavy metals. Use certified hypoallergenic materials such as ASTM F138 surgical stainless steel or ASTM F67 titanium to ensure biocompatibility.

Packaging and Labeling Requirements

Proper packaging protects products during shipping and ensures compliance. All industrial earring packaging must include:

– Manufacturer or importer name and address

– Country of origin

– Material composition (e.g., “Surgical Stainless Steel 316L”)

– Conformity markings (CE mark in the EU, FCC/CPSC if applicable in the U.S.)

– Care instructions and allergy warnings (e.g., “May contain traces of nickel”)

Blister cards, sterile pouches, or sealed boxes are recommended to maintain hygiene and prevent tampering. Eco-friendly packaging may be required in regions with strict environmental regulations, such as the EU Packaging Waste Directive.

Import/Export Documentation

Complete and accurate documentation is essential for international shipments. Required documents typically include:

– Commercial invoice (detailing product description, value, quantity, HS code)

– Packing list

– Bill of lading or air waybill

– Certificate of Origin (to claim preferential tariffs under trade agreements)

– Test reports or compliance certificates (e.g., REACH, RoHS, CPSIA)

For high-value shipments, consider obtaining a Carnet (ATA Carnet) for temporary export/import without paying duties. Always verify documentation requirements with your freight forwarder and destination country’s customs authority.

Shipping and Handling Considerations

Industrial earrings are small, high-value items vulnerable to loss or damage. Use secure, trackable shipping methods (e.g., DHL, FedEx, UPS) with insurance. Clearly label packages as “Fragile” and “Jewelry – High Value.” For B2B or bulk logistics, implement inventory tracking using barcodes or RFID. Temperature and humidity control are generally not required, but avoid extreme conditions that could degrade packaging or adhesives. Consider fulfillment centers near target markets to reduce delivery times and import costs.

Regulatory Compliance by Region

- European Union: CE marking not required for jewelry, but REACH and the EU Medical Device Regulation (if marketed for post-piercing use) may apply. Compliance with the Packaging and Packaging Waste Directive (94/62/EC) is mandatory.

- United States: No federal jewelry labeling law, but FTC guidelines require accurate metal content disclosure (e.g., “Surgical Steel” only if compliant with ASTM standards). State laws (e.g., California Prop 65) require warnings for listed chemicals.

- Canada: Must comply with the Consumer Chemicals and Containers Regulations (CCCR) and Textile Labelling Act if applicable. Nickel release limits align with EU standards.

- UK: Post-Brexit, UKCA marking is required for goods placed on the UK market, though CE marking is still accepted until 2025. UK REACH applies.

Intellectual Property and Brand Protection

Ensure designs do not infringe on registered trademarks or patents. Register your brand and designs with IP offices (e.g., USPTO, EUIPO). Include anti-counterfeiting measures such as holographic labels or serialized packaging. When shipping internationally, file a Recordal of Intellectual Property Rights with customs authorities to help prevent counterfeit imports.

Returns, Recalls, and Reverse Logistics

Establish a clear return policy compliant with local consumer laws (e.g., 14-day right of withdrawal in the EU). For hygiene reasons, pierced earrings are often non-returnable unless defective. In case of non-compliance or safety issues, initiate a product recall following jurisdiction-specific procedures (e.g., RAPEX in the EU, CPSC in the U.S.). Maintain records of all incidents and corrective actions for compliance audits.

Conclusion for Sourcing Industrial Ear Piercing Jewelry

Sourcing industrial earring jewelry requires a strategic approach that balances quality, design, compliance, and cost-effectiveness. As industrial piercings—typically involving two piercings connected by a single barbell—are gaining popularity, the demand for durable, hypoallergenic, and aesthetically diverse options continues to rise. To successfully source this type of jewelry, buyers must prioritize materials such as surgical-grade stainless steel, titanium, or biocompatible gold, ensuring safety and minimizing the risk of irritation or allergic reactions.

Establishing relationships with reputable suppliers, whether domestic or international, is essential to guarantee consistent quality and adherence to health and safety standards. Additionally, factors such as design innovation, customization capabilities, ethical sourcing practices, and efficient logistics play a crucial role in maintaining a competitive edge in the market.

Ultimately, a well-structured sourcing strategy—backed by thorough supplier vetting, product testing, and market trend awareness—will not only meet consumer expectations but also support long-term brand credibility and growth in the evolving body jewelry industry.