The global industrial compressor market is experiencing robust expansion, driven by rising demand across oil & gas, manufacturing, and power generation sectors. According to a report by Mordor Intelligence, the market was valued at USD 35.13 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. Similarly, Grand View Research estimates the market to reach USD 92.8 billion by 2030, with a CAGR of 5.5% during the forecast period. This sustained growth is fueled by increasing industrial automation, energy efficiency regulations, and the need for reliable compressed air systems in critical applications. As the market evolves, innovation in energy-saving technologies and digital integration is becoming a key differentiator among leading manufacturers. In this competitive landscape, the top 10 industrial compressor manufacturers stand out through technological leadership, global reach, and strategic investments in sustainable solutions.

Top 10 Industrial Compressor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Chicago Pneumatic Homepage

Domain Est. 1994

Website: cp.com

Key Highlights: We are a global manufacturer of high-performance power tools, air compressors, generators, light towers, and hydraulic equipment for professional and industrial ……

#2 ELGi Industrial Air Compressors

Domain Est. 1997

Website: elgi.com

Key Highlights: ELGi Compressor in USA offers a wide range of portable air compressors that are environmentally friendly and adhere to most of the international standards….

#3 Bauer Compressors: High

Domain Est. 1997

Website: bauercomp.com

Key Highlights: Bauer Compressors manufactures a broad range of compressor systems for various breathing-air and industrial applications….

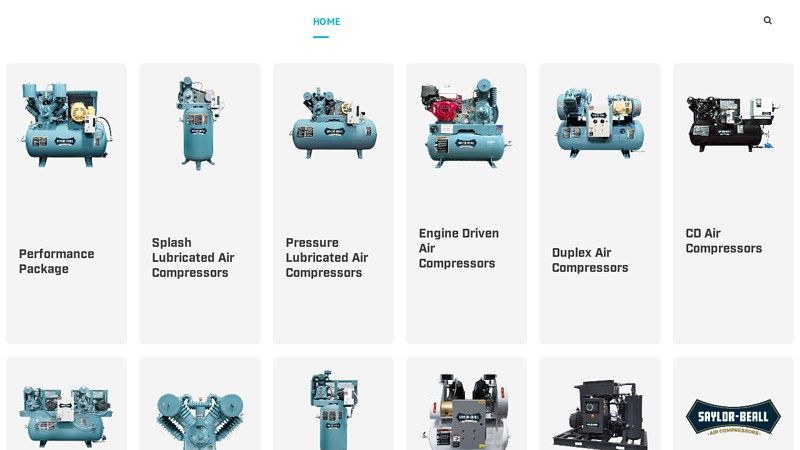

#4 Saylor

Domain Est. 1997 | Founded: 1915

Website: saylor-beall.com

Key Highlights: Since 1915, Saylor-Beall has been a trusted name in the manufacturing of industrial-quality, two-stage air compressors….

#5 Ingersoll Rand Air Compressors, Power Tools, Lifting and Fluid …

Domain Est. 2001

Website: ingersollrand.com

Key Highlights: Air Compressors & Systems Ingersoll Rand is a worldwide manufacturer and distributor of unrivalled compressed air solutions, parts and accessories and services ……

#6 Kaishan USA

Domain Est. 2018

Website: kaishanusa.com

Key Highlights: Kaishan USA offers a variety of air compressors for industrial and commercial use. Contact our team for expert customer service and support….

#7 TCCI Manufacturing

Domain Est. 2005

Website: tccimfg.com

Key Highlights: A global leader in high-efficiency compressors and next-generation thermal management solutions. Low Voltage 4kw | 24V High Voltage 30kw | 400V and 850V…

#8 FS

Domain Est. 2008

Website: us.fscurtis.com

Key Highlights: Since 1854, we have manufactured rugged rotary screw and reciprocating air compressors in the USA, built for long-lasting power and reliability….

#9 Emax Compressor

Domain Est. 2009

Website: emaxcompressor.com

Key Highlights: Air compressors by EMAX Compressor. Check out our air compressors, tools, and compressor accessories online at emaxcompressor.com….

#10

Domain Est. 2021

Website: kobelco-compressors.com

Key Highlights: KOBELCO COMPRESSORS is a global compressed air solution provider from Japan, having over 100 years history. Introducing corporate philosophy, history, locations ……

Expert Sourcing Insights for Industrial Compressor

H2: Projected Market Trends for Industrial Compressors in 2026

The industrial compressor market is poised for significant transformation by 2026, driven by technological innovation, evolving regulatory landscapes, and shifting industrial demands. This analysis outlines key trends expected to shape the market in the coming years.

1. Energy Efficiency and Sustainability Driving Innovation

As global decarbonization targets intensify, industrial compressor manufacturers are prioritizing energy-efficient designs. By 2026, compressors with variable speed drives (VSD), heat recovery systems, and low-emission components are expected to dominate new installations. Regulatory mandates in the EU, North America, and parts of Asia are pushing industries to adopt ISO 1217 and ISO 5389 certified compressors, boosting demand for high-efficiency models. Additionally, the integration of digital energy monitoring systems will enable real-time optimization, minimizing energy waste.

2. Growth in Oil & Gas and Manufacturing Sectors

Despite the global energy transition, the oil and gas industry will remain a major consumer of industrial compressors, particularly in LNG processing and gas reinjection applications. Simultaneously, manufacturing and automotive sectors—especially in emerging economies—will drive demand for compressed air systems in automation and assembly lines. Asia-Pacific, led by China and India, is projected to account for over 40% of global market growth by 2026.

3. Digitalization and Industry 4.0 Integration

Smart compressors equipped with IoT sensors, predictive maintenance algorithms, and cloud-based monitoring platforms will become standard. By 2026, over 60% of new industrial compressor installations are expected to include connectivity features. These systems enable remote diagnostics, reduce downtime, and improve lifecycle management, appealing to industries focused on operational efficiency and predictive analytics.

4. Shift Toward Oil-Free and Portable Compressors

With stricter air quality standards in pharmaceuticals, food & beverage, and electronics manufacturing, demand for oil-free rotary screw and centrifugal compressors will rise. Additionally, portable and mobile compressors will gain traction in construction, mining, and emergency response sectors, particularly in regions with expanding infrastructure projects.

5. Supply Chain Localization and Resilience

Post-pandemic supply chain disruptions have prompted manufacturers to localize production and diversify sourcing. By 2026, North American and European companies are expected to increase regional manufacturing capacity to reduce dependency on global suppliers, especially for critical components like motors and control systems.

6. Rising Adoption of Hydrogen and CO₂ Compression Technologies

The expanding hydrogen economy and carbon capture, utilization, and storage (CCUS) initiatives will create new demand for specialized compressors. Hydrogen refueling stations and green hydrogen production plants require high-pressure, leak-proof compressors, while CO₂ transport and sequestration projects will need robust compression systems capable of handling supercritical fluids.

Conclusion

By 2026, the industrial compressor market will be defined by sustainability, digital intelligence, and sector-specific innovation. Companies that invest in energy-efficient, smart, and adaptable compression solutions are likely to gain competitive advantage. With a projected CAGR of 5.2% from 2023 to 2026, the market is expected to reach approximately USD 45 billion, reflecting both recovery and transformation across global industrial ecosystems.

Common Pitfalls When Sourcing Industrial Compressors: Quality and Intellectual Property (IP) Risks

Sourcing industrial compressors involves complex technical, financial, and legal considerations. Overlooking critical aspects related to quality and intellectual property (IP) can result in operational failures, safety hazards, legal disputes, and reputational damage. Below are the most common pitfalls organizations encounter in these two vital areas.

Quality-Related Pitfalls

1. Selecting Vendors Based Solely on Price

One of the most frequent mistakes is prioritizing low initial cost over long-term reliability. Compressors from low-cost suppliers may use inferior materials, substandard components, and lack rigorous testing. This often leads to frequent breakdowns, higher maintenance costs, and shorter equipment lifespan—ultimately increasing total cost of ownership.

2. Insufficient Verification of Manufacturing Standards

Failing to confirm that a compressor meets recognized international standards (e.g., ISO 1217, ASME, CE) can result in non-compliant equipment. Buyers must verify certifications and conduct third-party audits of manufacturing facilities to ensure adherence to quality management systems such as ISO 9001.

3. Inadequate Performance Testing and Documentation

Some suppliers provide incomplete or falsified performance test reports. Relying on unverified data may result in compressors that fail to deliver promised capacity, efficiency, or pressure levels. Buyers should require witnessed factory acceptance tests (FATs) and detailed performance documentation under standardized conditions.

4. Poor After-Sales Support and Spare Parts Availability

Even high-quality compressors can underperform without proper maintenance. Sourcing from vendors with weak global service networks or limited spare parts availability can lead to extended downtime. Assessing the supplier’s service infrastructure and parts logistics is crucial before procurement.

5. Overlooking Environmental and Operational Suitability

Not all compressors are suitable for every environment. Buyers may fail to account for factors like ambient temperature, humidity, dust levels, or corrosive atmospheres. Selecting a unit not engineered for the specific operating environment accelerates wear and increases failure risk.

Intellectual Property (IP)-Related Pitfalls

1. Procuring Counterfeit or Clone Equipment

Some suppliers offer “compatible” or “OEM-equivalent” compressors that infringe on patented designs or trademarks. These clones often mimic reputable brands but lack the engineering integrity and IP licenses. Purchasing such units exposes buyers to legal liability, warranty voidance, and performance risks.

2. Lack of IP Due Diligence on Suppliers

Failing to investigate a supplier’s IP portfolio—such as design patents, technical innovations, or licensing agreements—can result in unknowingly supporting IP theft. Buyers should request evidence of legitimate IP ownership or authorized manufacturing rights, especially when sourcing from emerging markets.

3. Ambiguous Ownership of Customized Designs

When compressors are custom-engineered for a specific application, unclear contractual terms can lead to disputes over IP ownership. Without explicit agreements, the supplier may retain rights to design improvements, limiting the buyer’s ability to replicate or modify the equipment.

4. Reverse Engineering and Technology Leakage

In joint development or OEM arrangements, inadequate contract safeguards may allow suppliers to reverse-engineer proprietary technologies. This compromises competitive advantage and opens doors for unauthorized replication. Robust non-disclosure agreements (NDAs) and IP clauses are essential.

5. Infringement Risks in Spare Parts and Upgrades

Aftermarket parts or retrofit kits from third parties may violate original equipment manufacturer (OEM) patents. Using such components can expose the end-user to infringement claims, especially in jurisdictions with strong IP enforcement. Always verify the IP compliance of replacement components.

Conclusion

To mitigate risks in sourcing industrial compressors, organizations must adopt a holistic approach that balances cost with quality assurance and IP integrity. Conducting thorough supplier audits, demanding verifiable performance data, and securing clear IP rights in contracts are essential steps toward reliable, legally compliant procurement.

Logistics & Compliance Guide for Industrial Compressor

Overview

Transporting industrial compressors involves managing complex logistics and stringent regulatory requirements due to their size, weight, and potential environmental and safety impacts. This guide outlines key considerations for safe, efficient, and compliant shipping, handling, and installation.

Classification and Regulatory Framework

Industrial compressors are classified as heavy industrial equipment and may contain pressurized components, hazardous materials (e.g., lubricants), or controlled substances (e.g., refrigerants). Key regulations include:

– International Maritime Dangerous Goods (IMDG) Code (for sea freight)

– International Air Transport Association (IATA) Dangerous Goods Regulations (for air freight)

– U.S. Department of Transportation (DOT) 49 CFR (for domestic U.S. transport)

– ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road)

– ASME and ISO standards for pressure equipment safety

Ensure classification based on compressor type (e.g., reciprocating, rotary screw, centrifugal) and components.

Packaging and Securing

- Use custom crated packaging with skids or pallets to support weight and prevent shifting.

- Protect inlet/outlet ports with caps or blank flanges to prevent contamination.

- Secure internal components (e.g., rotors) to avoid movement during transit.

- Apply moisture-resistant wrapping and desiccants to prevent corrosion.

- Clearly label packages with handling instructions: “Fragile,” “This Side Up,” “Do Not Stack.”

Transportation Modes and Requirements

- Road: Use flatbed or step-deck trailers for oversized units; confirm weight and dimension compliance with local axle load and height/width restrictions. Obtain special permits if required.

- Sea: Containerized or break-bulk shipping; ensure moisture protection and secure lashing per CTU (Cargo Transport Unit) Code.

- Air: Rare due to size/weight; if applicable, comply with IATA size/weight limits and pre-clear hazardous components.

Always verify carrier certifications for heavy or specialized cargo.

Export and Import Compliance

- Export Controls: Check if compressor contains dual-use technology subject to EAR (Export Administration Regulations) or ITAR (International Traffic in Arms Regulations).

- Customs Documentation: Prepare commercial invoice, packing list, bill of lading, certificate of origin, and export declaration. Include HS code (e.g., 8414.80 for air or vacuum pumps).

- Import Requirements: Verify local standards (e.g., CE marking in EU, CRN in Canada, PESO in India). Some countries require pre-shipment inspection (PSI) or conformity assessment.

Environmental and Safety Compliance

- Refrigerant-containing compressors must comply with Montreal Protocol and local regulations (e.g., EPA Section 608 in the U.S.). Ensure proper recovery and certification during servicing.

- Oil-lubricated units must prevent leaks; package absorbent materials and seal oil reservoirs.

- Provide Safety Data Sheets (SDS) for any hazardous materials onboard.

Installation and On-Site Compliance

- Confirm site readiness (foundation, ventilation, clearance).

- Follow manufacturer’s installation manual and local electrical, mechanical, and fire codes.

- Perform pressure testing and safety valve calibration per ASME BPVC or equivalent standards.

- Register equipment with local authorities if required (e.g., pressure vessel registration).

Documentation and Recordkeeping

Maintain records including:

– Transport compliance certificates

– Export/import filings

– Inspection and test reports (e.g., hydrostatic test)

– Maintenance and refrigerant handling logs

– Conformity declarations (CE, UL, etc.)

Retain for a minimum of 5–10 years depending on jurisdiction.

Best Practices

- Partner with freight forwarders experienced in heavy industrial equipment.

- Conduct pre-shipment inspections and route surveys.

- Insure cargo for full replacement value.

- Train personnel on handling, spill response, and regulatory compliance.

Adhering to this guide ensures safe delivery, avoids penalties, and supports smooth commissioning of industrial compressors.

In conclusion, sourcing industrial compressor manufacturers requires a strategic approach that balances quality, cost, reliability, and long-term support. Key factors to consider include the manufacturer’s reputation, product range, technological capabilities, energy efficiency standards, compliance with industry regulations, and after-sales service. Conducting thorough due diligence—such as evaluating certifications, visiting production facilities, reviewing customer feedback, and comparing quotes—ensures informed decision-making. Partnering with a reputable manufacturer not only guarantees performance and durability of the equipment but also contributes to operational efficiency and reduced lifecycle costs. Ultimately, selecting the right industrial compressor supplier is a critical investment in the reliability and productivity of industrial operations.