The industrial laser cleaning market is experiencing robust expansion, driven by increasing demand for eco-friendly, non-abrasive surface treatment solutions across manufacturing, automotive, and aerospace sectors. According to Grand View Research, the global laser cleaning market was valued at USD 422 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 17.6% from 2023 to 2030. This surge is fueled by tighter environmental regulations, the phase-out of chemical and abrasive cleaning methods, and rising adoption of automated production systems. Mordor Intelligence further supports this outlook, forecasting continued momentum with favorable industry tailwinds in North America, Europe, and Asia-Pacific. As adoption climbs, a select group of manufacturers has emerged as leaders in innovation, reliability, and application versatility. Below are the top 9 industrial cleaning laser manufacturers shaping the future of precision surface decontamination.

Top 9 Industrial Cleaning Laser Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Laserax

Website: laserax.com

Key Highlights: Laserax works with the world’s leading manufacturers to implement laser cleaning, welding, texturing, and marking solutions….

#2 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: we engineer and manufacture the most advanced—and most powerful—pulsed industrial laser cleaning systems on the market, built for both manual and automated ……

#3 Clean Laser Systems

Website: cleanlaser.de

Key Highlights: IPG | cleanLASER has been developing and producing high-precision laser systems for cleaning and industrial surface treatment for more than 20 years….

#4 Laser Photonics

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

#5 SFX Laser

Website: sfxlaser.com

Key Highlights: SFX Laser is a 20+ years professional laser equipment manufacturer including laser cleaning machine, laser welding machine, fiber laser engraver, fiber laser…

#6 SHARK P CL Industrial Laser Cleaning Machines (100

Website: pulsar-laser.com

Key Highlights: SHARK P CL is an industrial pulsed laser cleaning machine series by PULSAR Laser with outputs from 100 W to 1000 W, air-cooled up to 500 W….

#7 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#8 Netalux

Website: netalux.com

Key Highlights: Discover our award-winning Laser Cleaning Solutions for the world’s most demanding industries. Discover our products and global service now….

#9 Vytek Laser Systems

Website: vytek.com

Key Highlights: Vytek designs, builds, and sells a complete line of laser solutions for cleaning, engraving, marking, cutting, and welding, built to exacting standards….

Expert Sourcing Insights for Industrial Cleaning Laser

H2: 2026 Market Trends for Industrial Cleaning Lasers

The industrial cleaning laser market is poised for transformative growth and technological advancement by 2026, driven by increasing demand for eco-friendly, precision-based cleaning solutions across key manufacturing and maintenance sectors. Several macro and microeconomic trends are shaping the trajectory of this niche but rapidly expanding market.

1. Rising Adoption in Manufacturing and Automotive Industries

By 2026, the automotive and heavy manufacturing sectors are expected to be the largest adopters of industrial laser cleaning systems. These industries are leveraging laser technology for rust removal, paint stripping, mold cleaning, and weld preparation due to its non-abrasive and highly precise nature. As global automotive production shifts toward electric vehicles (EVs), demand for high-precision surface preparation in battery and motor manufacturing will further accelerate laser cleaning adoption.

2. Environmental and Regulatory Drivers

Stringent environmental regulations on chemical solvents and abrasive blasting methods are pushing industries toward cleaner alternatives. Laser cleaning produces no secondary waste, eliminates the need for chemical detergents, and reduces water consumption — aligning with global ESG (Environmental, Social, and Governance) goals. Regulatory support in North America and the European Union is expected to mandate or incentivize the use of green cleaning technologies by 2026, boosting market penetration.

3. Technological Advancements and Cost Reduction

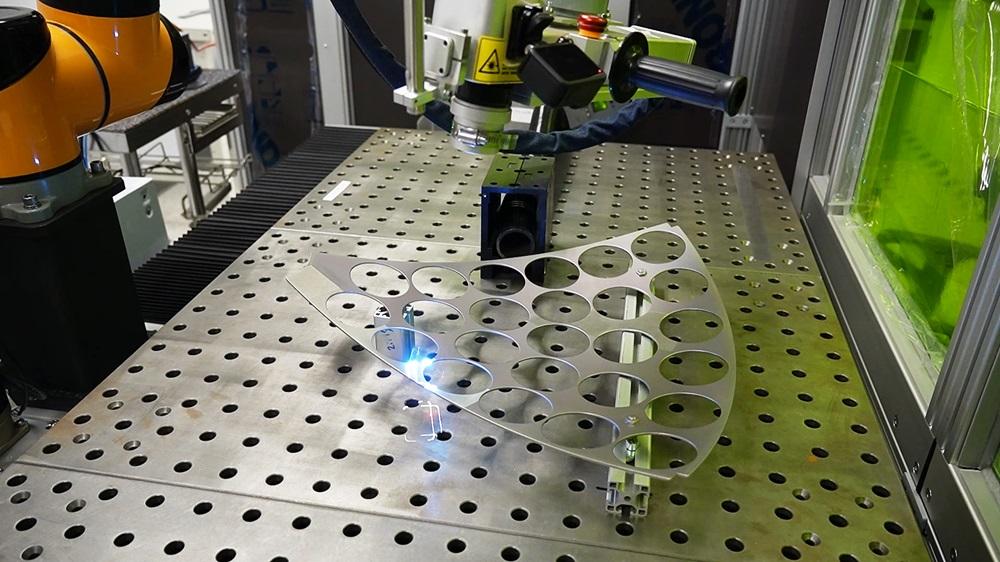

Ongoing improvements in fiber laser efficiency, portability, and automation integration are making laser cleaning systems more accessible. By 2026, modular, handheld, and robot-integrated laser cleaners are expected to dominate, offering scalable solutions for both large-scale industrial facilities and small workshops. Concurrently, declining costs of laser components — particularly high-power fiber lasers — are reducing initial investment barriers, improving ROI timelines.

4. Expansion in Aerospace and Energy Sectors

The aerospace industry is increasingly utilizing laser cleaning for turbine blade refurbishment and composite material maintenance, where precision and material integrity are critical. Similarly, in the energy sector — especially nuclear and renewable infrastructure — laser cleaning is being adopted for decontamination and maintenance of sensitive equipment. Offshore wind farms, in particular, are expected to drive demand due to the challenges of corrosion in harsh marine environments.

5. Regional Market Growth and Competitive Landscape

Asia-Pacific, led by China, Japan, and South Korea, will remain the fastest-growing regional market due to rapid industrialization and government support for smart manufacturing. Europe maintains a strong foothold through innovation and strict environmental policies, while North America sees growth fueled by defense, aerospace, and automotive R&D. Key players such as IPG Photonics, Laser Photonics Corp., and CleanLASER are expected to intensify competition through product innovation and strategic partnerships.

6. Integration with Industry 4.0 and Smart Manufacturing

By 2026, industrial cleaning lasers will increasingly be integrated with IoT-enabled monitoring systems, AI-driven process optimization, and predictive maintenance platforms. This convergence with Industry 4.0 enhances process control, data analytics, and operational efficiency, making laser cleaning a key component of smart factory ecosystems.

In conclusion, the 2026 industrial cleaning laser market will be defined by sustainability mandates, technological maturity, and broader industry adoption. As companies seek cleaner, safer, and more efficient alternatives to traditional cleaning methods, laser-based solutions are set to transition from a premium option to a standard industrial practice.

Common Pitfalls When Sourcing Industrial Cleaning Lasers (Quality & IP)

Sourcing industrial cleaning lasers presents significant opportunities, but also critical risks related to quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to performance failures, legal disputes, and financial losses. Below are key pitfalls to avoid:

1. Overlooking Build Quality and Component Reliability

Many suppliers, particularly those from emerging markets, offer lower-cost lasers that may use substandard components such as inferior optics, unstable power supplies, or poorly calibrated cooling systems. These can result in inconsistent cleaning performance, short operational lifespans, and frequent maintenance downtime. Always verify material specifications, request third-party test reports, and conduct on-site facility audits if possible.

2. Inadequate Verification of Laser Specifications

Suppliers may exaggerate key performance metrics like average power, pulse energy, beam quality (M²), or cleaning speed. Without independent validation or standardized testing protocols, buyers risk acquiring underperforming systems. Demand access to certified performance data under real-world conditions and consider third-party benchmark testing before finalizing procurement.

3. Insufficient Due Diligence on IP Ownership and Licensing

Industrial laser systems often incorporate proprietary technologies—ranging from beam delivery mechanisms to control software and safety interlocks. Sourcing from manufacturers who lack clear IP rights or use unlicensed technology exposes buyers to infringement claims. Always request proof of IP ownership, patent documentation, and freedom-to-operate (FTO) analyses, especially when importing across jurisdictions.

4. Risk of Counterfeit or Clone Systems

The growing demand for laser cleaning has led to an increase in counterfeit or reverse-engineered systems that mimic reputable brands. These clones frequently fail to meet safety standards (e.g., IEC 60825) and lack proper technical support. Verify authenticity through official distributor networks, check for unique serial numbers, and perform background checks on suppliers.

5. Neglecting Software and Firmware IP Compliance

Modern industrial lasers rely heavily on proprietary software for automation, monitoring, and user interface. Sourcing systems with pirated, unlicensed, or open-source software used in violation of licensing terms can lead to legal liability. Ensure software compliance by reviewing license agreements and confirming OEM authorization.

6. Poor After-Sales Support and Spare Parts Availability

Low-cost suppliers may lack global service networks or stock critical spare parts, leading to extended downtimes. Poor quality control also increases the likelihood of recurring failures. Evaluate the supplier’s service infrastructure, warranty terms, and documented history of customer support before procurement.

7. Incomplete or Misleading Safety and Certification Documentation

Industrial lasers must comply with regional safety regulations (e.g., CE, FDA, RoHS). Some suppliers provide forged or incomplete certifications. Always validate certification authenticity with issuing bodies and confirm that the system meets the safety standards of the target operating region.

By proactively addressing these quality and IP-related pitfalls, businesses can mitigate risks and ensure reliable, legally compliant integration of industrial cleaning laser systems into their operations.

Logistics & Compliance Guide for Industrial Cleaning Lasers

Regulatory Compliance Overview

Industrial cleaning lasers are subject to a range of international, national, and regional regulations due to their classification as laser products, industrial machinery, and potentially hazardous equipment. Compliance ensures safe operation, legal distribution, and avoids penalties. Key regulatory frameworks include:

- IEC 60825-1: International standard for laser product safety, defining classification (typically Class 4 for industrial cleaning lasers) and required safety measures.

- ANSI Z136.1: U.S. standard for safe use of lasers, often adopted by OSHA for workplace enforcement.

- CE Marking (EU): Requires compliance with the Machinery Directive (2006/42/EC), Electromagnetic Compatibility (EMC) Directive (2014/30/EU), and Laser Product Safety under the Low Voltage Directive (2014/35/EU) and relevant EN standards (e.g., EN 60825-1).

- FDA/CDRH (USA): U.S. Food and Drug Administration’s Center for Devices and Radiological Health regulates laser products under 21 CFR 1040.10 and 1040.11, requiring product reporting, labeling, and safety features.

- RoHS & REACH (EU): Restriction of Hazardous Substances and Registration, Evaluation, Authorization of Chemicals apply to electronic components and materials used in laser systems.

- Local Workplace Safety Regulations: OSHA (U.S.), HSE (UK), or equivalent bodies require risk assessments, protective measures, and training for laser use.

Manufacturers and operators must verify compliance with all applicable standards in target markets before deployment.

Transportation and Handling

Transporting industrial cleaning lasers involves specific logistical considerations due to their size, weight, delicate optics, and laser classification:

- Packaging Requirements: Lasers must be shipped in robust, shock-resistant packaging with internal supports to prevent movement. Anti-static and moisture-resistant materials are recommended. Include cushioning for optical components and electronic modules.

- Hazard Classification: Class 4 lasers are not classified as hazardous goods under IATA/IMDG for transport per se, but accompanying power supplies or batteries may require special handling (e.g., UN3480 for lithium batteries).

- Labeling: Packages must display appropriate labels, including:

- “Fragile” and “This Side Up”

- Laser radiation warning symbol (IEC 60825)

- Handling instructions (e.g., “Do Not Stack”)

- Proper shipping name and technical contact if required

- Carrier Coordination: Notify carriers in advance, especially for air freight, due to potential screening concerns with high-power optical equipment. Provide technical specifications upon request.

- Climate Control: Avoid extreme temperatures and humidity during transit to protect sensitive electronics and optics. Use climate-controlled transport if necessary.

Import/Export Documentation

Cross-border movement of industrial lasers requires accurate documentation to ensure customs clearance and regulatory compliance:

- Commercial Invoice: Must include detailed description, Harmonized System (HS) code, value, country of origin, and seller/buyer information. HS codes vary by region (e.g., 8515.31 for laser soldering machines in EU; verify locally).

- Packing List: Itemizes contents, weights, dimensions, and packaging types.

- Certificate of Conformity (CoC): Issued by manufacturer, confirming compliance with applicable standards (e.g., CE, FCC, IEC).

- Bill of Lading/Air Waybill: Legal contract between shipper and carrier.

- Export Licenses: Required in certain jurisdictions for high-power laser systems (e.g., U.S. Department of Commerce may require an export license under EAR for certain laser power levels or applications).

- Import Permits: Some countries require prior approval for laser equipment (e.g., India, China). Check local import regulations.

- RoHS/REACH Declarations: May be requested by customs or customers in the EU.

Maintain digital and physical copies of all documents for audit and traceability.

Installation and Site Compliance

Prior to operation, ensure the installation site meets safety and regulatory requirements:

- Laser Controlled Area: Designate a restricted access zone with interlocks, warning signs (e.g., “Laser Radiation – Avoid Eye or Skin Exposure”), and beam enclosures per ANSI Z136.1 or EN 60825.

- Ventilation and Fume Extraction: Industrial laser cleaning produces particulates and fumes. Install appropriate HEPA or industrial filtration systems compliant with OSHA PELs or EU Directive 2004/37/EC (carcinogens).

- Electrical Compliance: Ensure power supply meets voltage, grounding, and circuit protection standards (e.g., NEC Article 700 in U.S., IEC 60364 internationally).

- Emergency Stops and Safety Interlocks: Install accessible emergency shutoffs and interlocks on access points.

- Permits and Notifications: Some jurisdictions require notification or permits for Class 4 laser use. Consult local authorities.

Training and Operational Documentation

Compliance extends to safe usage. Operators must be trained and documentation maintained:

- Laser Safety Officer (LSO): Appoint an LSO (per ANSI Z136.1) to oversee safety procedures, audits, and training.

- Operator Training: Mandatory training on laser hazards, PPE use (e.g., wavelength-specific laser safety goggles), emergency procedures, and equipment operation.

- Standard Operating Procedures (SOPs): Document safe startup, operation, shutdown, and maintenance.

- Maintenance Logs: Record all service activities, component replacements, and laser alignment checks.

- Incident Reporting: Establish a protocol for reporting exposure incidents or equipment malfunctions per local regulations.

Disposal and End-of-Life Management

End-of-life handling must comply with environmental regulations:

- Waste Electrical and Electronic Equipment (WEEE): In the EU, lasers fall under WEEE Directive (2012/19/EU) and must be recycled through approved facilities.

- Hazardous Components: Batteries, capacitors, and certain optical materials may require special disposal.

- Data Security: If the laser includes programmable controllers or network connectivity, perform data wiping before disposal.

- Manufacturer Take-Back Programs: Utilize OEM recycling or return programs where available.

Ensure all disposal activities are documented and performed by licensed waste handlers.

Conclusion: Sourcing Industrial Cleaning Lasers

Sourcing industrial cleaning lasers represents a strategic investment in advanced, sustainable, and efficient surface preparation and maintenance technology. As industries increasingly prioritize precision, environmental compliance, and operational productivity, laser cleaning stands out as a chemical-free, non-abrasive, and highly effective alternative to traditional methods such as sandblasting, chemical solvents, and steam cleaning.

When sourcing industrial laser cleaning systems, key considerations include laser power, pulse duration, beam quality, automation compatibility, and total cost of ownership. Evaluating suppliers based on technical expertise, after-sales support, safety certifications, and real-world performance data is essential to ensuring reliability and long-term value.

Additionally, while the initial investment may be higher than conventional cleaning methods, the reduction in consumables, waste disposal costs, labor requirements, and downtime often leads to a favorable return on investment over time. Furthermore, the versatility of laser cleaning—applicable to rust, paint, oxides, and contaminants on metals, composites, and delicate surfaces—enhances its adaptability across sectors such as automotive, aerospace, energy, and heritage restoration.

In conclusion, sourcing industrial cleaning lasers should be approached with a thorough understanding of operational needs, regulatory standards, and future scalability. With the right partner and well-matched system, businesses can achieve cleaner, safer, and more sustainable operations, positioning themselves at the forefront of industrial innovation.