The global Inconel pipe market is experiencing robust expansion, driven by escalating demand across high-performance industries such as aerospace, power generation, oil & gas, and chemical processing. According to a report by Mordor Intelligence, the global Inconel market was valued at approximately $6.5 billion in 2023 and is projected to grow at a CAGR of over 6.5% from 2024 to 2029. This growth is fueled by the material’s exceptional resistance to extreme temperatures, corrosion, and mechanical stress—making Inconel pipes critical in mission-critical applications where reliability is non-negotiable. Additionally, increasing investments in clean energy infrastructure and the modernization of aging industrial systems are further accelerating demand. As the industry expands, a select group of manufacturers has emerged as leaders in producing high-quality, technically advanced Inconel piping solutions. Here are the top 10 Inconel pipe manufacturers shaping the future of industrial performance and reliability.

Top 10 Inconel Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hastelloy and Inconel pipe for harsh industrial applications

Domain Est. 1996

Website: highpurity.com

Key Highlights: Nickel-based piping ideal for persistent high-heat, high-stress service in industrial applications such as power generation, oil & gas extraction, pulp & paper….

#2 Inconel Manufacturers

Domain Est. 2005

Website: nickelsuppliers.com

Key Highlights: Find the leading inconel manufacturers and suppliers across the United States who offer 24/7 customer support and unique products at competitive prices….

#3 Inconel Alloy Pipes/Tubes Manufacturer

Domain Est. 2017

Website: tescosteel.com

Key Highlights: Tesco Steel & Engineering is a leading supplier of Inconel Pipes/ Tubes. We are producing Tubes as well as Pipes in various dimensions and specifications….

#4 Inconel Pipes Manufacturer

Domain Est. 2018

Website: newzelindustries.com

Key Highlights: Newzel Industries is a Manufacturer & Supplier of Inconel Pipes, Buy ASME SB725 Sch 40 Inconel Alloy Welded Pipe in India, View its schedule/weight chart, ……

#5 Inconel 625 Seamless Pipes Manufacturer, Supplier in Mumbai, India

Domain Est. 2019

Website: jayhindmetal.com

Key Highlights: Jayhind Metals and Tubes is leading manufacturer of Inconel 625 Pipes, ASTM B167 alloy 625 seamless, welded pipes in India, visit the page ……

#6 Inconel Pipe Manufacturer

Domain Est. 2022

Website: xtd-ss.com

Key Highlights: Inconel Pipe Manufacturer. We at Xintongda Special Steel (XTD) are a leading supplier and manufacturer of inconel seamless pipes in Songyang, China….

#7 Special Metals

Domain Est. 1995

Website: specialmetals.com

Key Highlights: The Alloys You Trust. Special Metals has invented over 80 percent of nickel alloys including INCONEL®, INCOLOY®, NIMONIC®, MONEL®, and UDIMET®….

#8 INCONEL® Pipe Fittings

Domain Est. 1996

Website: usmetals.com

Key Highlights: U.S. Metals offers a full range of Inconel pipe, valves, fittings & flanges for high temperature environments that require retained strength, ……

#9 Inconel ® Alloy Supplier

Domain Est. 1998

Website: continentalsteel.com

Key Highlights: Continental Steel is your trusted supplier of Inconel® alloys: 600, 601, 617, 625, 718, 925, and X750. Available in various forms. Get a quote today!…

#10 Tenaris

Domain Est. 2000

Website: tenaris.com

Key Highlights: We supply the most extensive portfolio of high-quality casing and tubing, drill pipe, premium connections, and pipe accessories, for all types of oil and gas ……

Expert Sourcing Insights for Inconel Pipe

H2: Projected 2026 Market Trends for Inconel Pipes

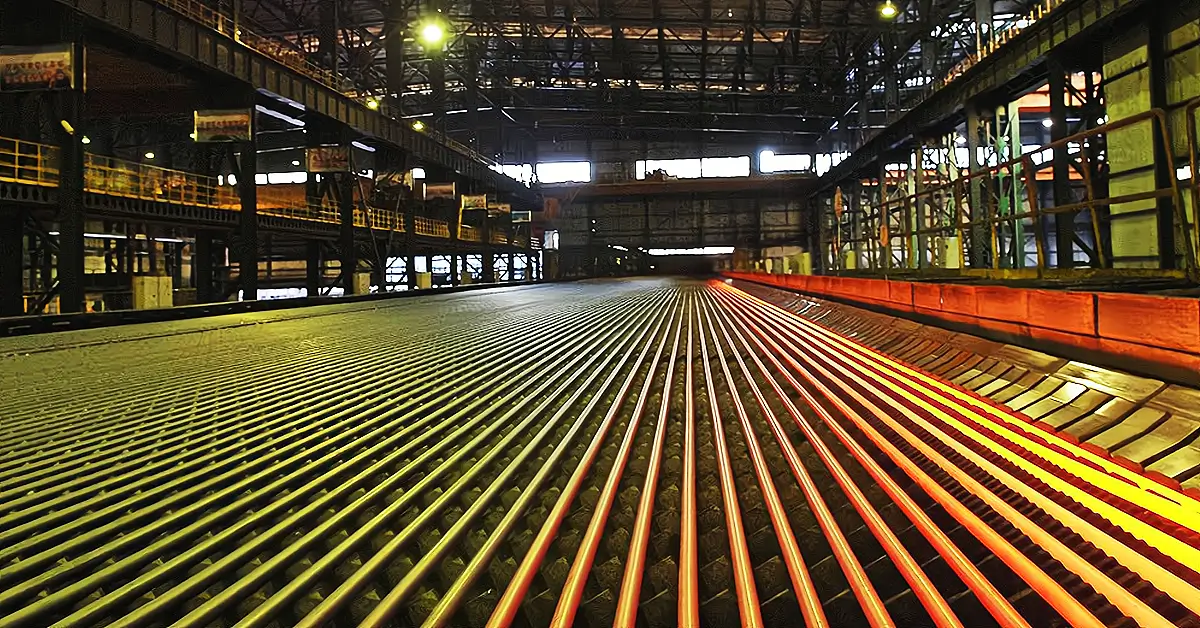

The global Inconel pipe market is poised for steady growth by 2026, driven by rising demand across high-performance industrial sectors and technological advancements in material engineering. Inconel, a family of nickel-chromium-based superalloys known for exceptional resistance to extreme temperatures, corrosion, and oxidation, remains a critical material in environments where standard alloys fail.

-

Expanding Demand from Energy Sectors

The oil & gas, nuclear, and renewable energy industries are expected to be primary growth drivers. Inconel pipes are essential in sour service environments, offshore drilling, and high-temperature processing units. With increased exploration in harsh environments and the global push toward cleaner energy, demand for Inconel in geothermal systems and next-generation nuclear reactors is anticipated to rise significantly by 2026. -

Growth in Aerospace and Defense Applications

The aerospace industry continues to favor Inconel for jet engines, rocket components, and auxiliary power units due to its strength at elevated temperatures. As commercial air travel rebounds and defense modernization programs expand globally, especially in Asia-Pacific and North America, the need for high-integrity Inconel piping systems will grow. -

Chemical Processing Industry Expansion

Inconel pipes are widely used in chemical processing plants due to their resistance to corrosive substances like acids and chlorides. The ongoing expansion of chemical manufacturing capacity in emerging economies such as India, Vietnam, and the Middle East is expected to boost Inconel pipe consumption through 2026. -

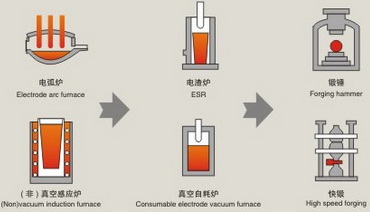

Technological Advancements and Manufacturing Efficiency

Improvements in manufacturing processes such as precision welding, additive manufacturing (3D printing) of complex Inconel components, and better quality control are reducing production costs and lead times. These advances are making Inconel pipes more accessible for critical applications, supporting broader market adoption. -

Supply Chain and Raw Material Challenges

Despite demand growth, the market may face constraints due to the volatility of nickel and chromium prices, which are key components of Inconel. Geopolitical factors affecting mining and refining, especially in Russia and Indonesia, could impact supply stability. As a result, companies are increasingly investing in recycling technologies and alternative sourcing strategies. -

Regional Market Dynamics

North America and Europe will remain significant markets due to stringent safety and performance standards in energy and aerospace sectors. However, the Asia-Pacific region is expected to witness the highest CAGR, fueled by industrialization, infrastructure development, and investments in power generation. -

Sustainability and Regulatory Influence

Environmental regulations are pushing industries to adopt longer-lasting, more durable materials. Inconel’s longevity reduces maintenance and replacement cycles, aligning with sustainability goals. Regulatory support for high-efficiency and low-emission technologies will further encourage Inconel use.

In conclusion, by 2026, the Inconel pipe market is projected to grow at a CAGR of approximately 5–7%, reaching an estimated market value of USD 3.8–4.2 billion. Success will depend on innovation in production, strategic raw material sourcing, and alignment with evolving industrial and environmental standards.

Common Pitfalls When Sourcing Inconel Pipe (Quality, IP)

Sourcing Inconel pipe—especially for critical applications in high-temperature, corrosive, or high-pressure environments—requires careful attention to material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to performance failures, safety hazards, and legal risks. Below are key pitfalls to avoid:

1. Compromised Material Quality Due to Substandard Manufacturing

One of the most significant risks is receiving Inconel pipe that does not meet required chemical or mechanical specifications. Common issues include:

– Off-spec chemical composition: Substituting or imprecise alloying (e.g., incorrect Ni, Cr, Mo levels) affects corrosion resistance and high-temperature strength.

– Inadequate heat treatment: Improper solution annealing or aging can result in poor mechanical properties or susceptibility to stress corrosion cracking.

– Poor welding practices: For welded pipe, inconsistent weld quality or lack of post-weld heat treatment (PWHT) can create weak points.

Prevention: Require full Material Test Reports (MTRs) traceable to each heat number and conduct third-party testing when necessary. Ensure suppliers adhere to ASTM, ASME, or NACE standards (e.g., ASTM B167, ASME SB-167).

2. Inadequate or Falsified Certification and Traceability

Lack of proper documentation is a major red flag. Some suppliers provide forged or generic mill test reports that do not match the delivered product.

- Missing heat traceability: Inability to link the pipe to its original melt and production batch.

- Non-compliant certifications: Certifications that don’t align with project specifications (e.g., missing NACE MR0175 for sour service).

Prevention: Insist on certified 3.1 or 3.2 EN 10204 documentation. Perform independent verification through PMI (Positive Material Identification) testing upon receipt.

3. Counterfeit or Misrepresented Material (IP and Brand Infringement)

Inconel is a registered trademark of Special Metals Corporation (now owned by PCC). Unauthorized use of the “Inconel” name by suppliers offering inferior or non-certified alloys is a growing concern.

- Mislabeling: Selling low-nickel alloys as Inconel (e.g., passing off 316L as Inconel 600).

- Trademark infringement: Using “Inconel-like” or unauthorized brand references to imply equivalency without proper licensing.

Prevention: Source only from licensed producers or authorized distributors. Verify trademark usage and request proof of licensing where applicable. Beware of unusually low prices, which may indicate counterfeit material.

4. Lack of Compliance with Industry-Specific Standards

Different industries (oil & gas, chemical processing, aerospace) require specific performance criteria. Using pipe that meets generic standards but not application-specific ones can lead to premature failure.

- Non-compliance with NACE MR0175/ISO 15156: Critical in sour (H₂S) environments.

- Missing ASME BPVC certification: Required for pressure-containing components.

Prevention: Clearly define required standards in procurement contracts and verify compliance through audits and documentation reviews.

5. Insufficient Quality Assurance and Supplier Vetting

Relying on suppliers without rigorous QA processes increases the risk of receiving defective or non-conforming pipe.

- Unqualified or uncertified mills: Sourcing from manufacturers without ISO 9001 or API Q1 certification.

- No on-site audits: Failing to audit supplier facilities to verify production controls and quality systems.

Prevention: Conduct supplier qualification audits. Prioritize vendors with a proven track record in high-performance alloys and transparent quality management systems.

6. Intellectual Property Risks in Custom or Proprietary Alloys

Some high-performance Inconel variants (e.g., Inconel 718, 625, 935) involve proprietary processing techniques protected by patents or trade secrets.

- Unauthorized production: Mills may replicate compositions without licensed processing know-how, leading to inconsistent performance.

- IP infringement claims: Using non-licensed sources may expose end-users to legal liability, especially in regulated industries.

Prevention: Source proprietary alloys only through authorized channels. Include IP indemnification clauses in supplier contracts.

By addressing these pitfalls proactively—through stringent specifications, supplier vetting, independent verification, and IP compliance—buyers can ensure the integrity, performance, and legal safety of Inconel pipe in critical applications.

Logistics & Compliance Guide for Inconel Pipe

Overview of Inconel Pipe

Inconel pipe, part of the nickel-chromium superalloy family, is designed to withstand extreme environments involving high temperatures, corrosive chemicals, and mechanical stress. Common grades include Inconel 600, 625, 718, and 825. Due to its specialized use in aerospace, chemical processing, oil & gas, and power generation, transporting and handling Inconel pipe requires strict attention to logistics and regulatory compliance.

Packaging & Handling Requirements

Proper packaging is essential to prevent surface damage, contamination, and corrosion during transit.

- End Protection: Use plastic or metal caps on pipe ends to prevent dents and protect threading.

- Bundling: Secure pipes with non-metallic strapping or coated steel bands to avoid scratching. Place wooden or plastic spacers between layers.

- Wrapping: Wrap bundles in waterproof, anti-corrosive VCI (Vapor Corrosion Inhibitor) paper or plastic film.

- Palletization: Mount bundles on wooden or composite pallets suitable for forklift handling. Ensure load stability for stacking.

- Labeling: Clearly mark each bundle with grade, dimensions, heat number, weight, and handling instructions (e.g., “Fragile,” “This Side Up”).

Storage Conditions

Store Inconel pipes in controlled environments to maintain material integrity.

- Indoor Storage: Preferable; protect from moisture, salt spray, and direct sunlight.

- Ventilation: Ensure dry, well-ventilated areas to prevent condensation.

- Elevation: Store pipes off the ground on racks or pallets to avoid contact with dirt and moisture.

- Segregation: Keep separate from carbon steel or other metals to prevent galvanic corrosion or contamination.

Transportation Guidelines

Choose transport modes and methods that minimize risk of damage and ensure compliance.

- Land Transport: Use flatbed or enclosed trailers. Secure loads with straps and padding. Avoid dragging or rolling pipes directly on surfaces.

- Marine Shipping: Use containers or flat racks. Comply with IMDG Code for sea freight. Include desiccants in containers to control humidity.

- Air Freight: Suitable for urgent or high-value shipments. Ensure packaging meets IATA standards for weight and dimensions.

- Customs Documentation: Prepare commercial invoice, packing list, bill of lading/air waybill, and material test reports (MTRs).

Regulatory Compliance

Adherence to international and industry-specific standards is mandatory.

- Material Certification: Provide Mill Test Certificates (MTC) per EN 10204 Type 3.1 or 3.2, confirming chemical and mechanical properties.

- Export Controls: Check ITAR (International Traffic in Arms Regulations) and EAR (Export Administration Regulations) if used in defense or aerospace. Some Inconel grades may be subject to licensing.

- REACH & RoHS: Confirm compliance with EU chemical regulations, especially regarding nickel content and restricted substances.

- Country-Specific Imports: Verify destination country requirements (e.g., INMETRO for Brazil, GOST for Russia, PVoC for Kenya).

- Hazardous Materials: While Inconel is not classified as hazardous, dust from machining may be regulated—provide SDS (Safety Data Sheet) if requested.

Quality & Traceability

Maintain full traceability throughout the supply chain.

- Heat Number Tracking: Each pipe must be traceable to its heat number for quality verification.

- Inspection Reports: Include NDE (Non-Destructive Examination) reports such as hydrotesting, eddy current, or ultrasonic testing as required.

- ASME & ASTM Compliance: Ensure pipes meet relevant standards (e.g., ASTM B167, B444, ASME SB-167) and are certified accordingly.

Special Considerations for International Shipments

- Incoterms: Clearly define responsibilities using Incoterms 2020 (e.g., FOB, CIF, DDP).

- Insurance: Insure shipments against loss, damage, or delay, especially for high-value Inconel grades.

- Lead Times: Account for export licensing, customs clearance, and potential inspections that may delay delivery.

Conclusion

Transporting and managing Inconel pipe requires meticulous planning to preserve material quality and meet global compliance standards. By following proper packaging, handling, documentation, and regulatory protocols, suppliers and buyers can ensure safe, efficient, and compliant logistics operations. Always consult with metallurgical and regulatory experts when shipping to restricted or highly regulated markets.

Conclusion for Sourcing Inconel Pipes

Sourcing Inconel pipes requires a strategic approach due to their specialized use in high-temperature, high-pressure, and corrosive environments across industries such as aerospace, chemical processing, oil & gas, and power generation. These nickel-chromium-based superalloys offer exceptional strength, oxidation resistance, and performance under extreme conditions, making material authenticity, quality certification, and supplier reliability critical considerations.

A successful sourcing strategy involves selecting reputable suppliers with proven expertise in high-performance alloys, ensuring compliance with international standards (e.g., ASTM, ASME, NACE), and verifying material test reports (MTRs) for traceability. Additionally, evaluating lead times, cost-efficiency, and technical support capabilities helps mitigate project risks and ensures on-time delivery without compromising quality.

In conclusion, sourcing Inconel pipes is not merely a procurement decision but a vital component of project integrity and operational safety. Partnering with certified, experienced suppliers and maintaining strict quality control throughout the supply chain ensures long-term reliability, performance, and cost-effectiveness in critical applications.