The global suction catheter market is experiencing steady growth, driven by rising demand for critical care devices in hospitals, ambulatory surgical centers, and home healthcare settings. According to Mordor Intelligence, the suction catheter market was valued at USD 490.3 million in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2029. This expansion is fueled by increasing incidences of respiratory disorders, rising geriatric population, and a growing preference for minimally invasive procedures. In-line suction catheters—designed for use with mechanically ventilated patients—offer the advantage of maintaining ventilation during secretion clearance, reducing the risk of contamination and hypoxia. As demand for closed suction systems rises, especially in intensive care units, a select group of manufacturers have emerged as key players in innovation, quality, and global supply. Below are the top 8 in-line suction catheter manufacturers shaping the industry’s future.

Top 8 In Line Suction Catheter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 DAR™ Closed Suction System

Domain Est. 1990

Website: medtronic.com

Key Highlights: The DAR™ closed suction system is designed to expel tracheal secretions and preserve airway clearance for patients with an artificial airway in place. Compared ……

#2 Argyle™ Suction Catheters

Domain Est. 1996

Website: cardinalhealth.com

Key Highlights: The chimney valves and directional valves of Argyle™ suction catheters deliver easy fingertip control with virtually no residual vacuum in the open position….

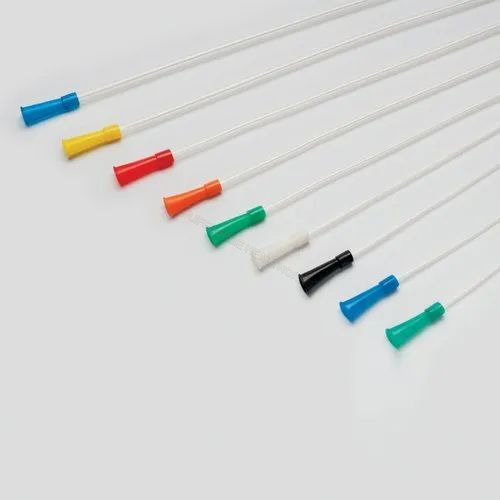

#3 Suction Catheters

Domain Est. 1997

Website: icumed.com

Key Highlights: Maintain airway hygiene with ICU Medical’s Suction Catheters. Effective solutions for clear and healthy air passages….

#4 Suction Catheters

Domain Est. 1997

Website: amsino.com

Key Highlights: AMSure Suction Catheters improve patient care by safely removing respiratory secretions from the upper airway….

#5 SSCOR SDC Catheter

Domain Est. 1998

Website: sscor.com

Key Highlights: The SSCOR SDC Catheter (Formerly the SSCOR DuCanto Catheter®) is a single-use, non-sterile, rigid suction catheter specifically designed to be used by emergency ……

#6 Suction Catheters

Domain Est. 2000

Website: tri-anim.com

Key Highlights: 60-day returnsBALLARD™ Turbo-Cleaning Closed Suction System for Adults. By: AirLife. Your Price: Log in List Price: from $38.00 EA. Log in for availability….

#7 14 fr inline suction catheter

Domain Est. 2003

Website: gcmedica.com

Key Highlights: A 14 Fr Inline Suction Catheter is a high-performance airway clearance device designed to provide safe, efficient secretion removal for adult patients ……

#8 Well Lead Medical

Domain Est. 2017

Website: wellead.com

Key Highlights: Wellead Medical, a leading foley catheter supplier, is devoted to providing superior wholesale catheter supply & medical consumables for global partners….

Expert Sourcing Insights for In Line Suction Catheter

H2: Projected 2026 Market Trends for In-Line Suction Catheters

The global market for in-line suction catheters is poised for significant transformation by 2026, driven by evolving healthcare dynamics, technological innovation, and increasing demand for infection control in critical care settings. These catheters—integrated into ventilator circuits to allow airway clearance without disconnecting patients from mechanical ventilation—are becoming standard in intensive care units (ICUs) due to their clinical and operational benefits.

One of the key trends shaping the 2026 landscape is the rising prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD), pneumonia, and acute respiratory distress syndrome (ARDS), which has been further amplified by the long-term impacts of the COVID-19 pandemic. This has led to prolonged ICU stays and greater reliance on mechanical ventilation, thereby increasing the demand for efficient and safe airway management tools like in-line suction catheters.

Another major trend is the emphasis on reducing healthcare-associated infections (HAIs), particularly ventilator-associated pneumonia (VAP). In 2026, healthcare providers are expected to prioritize closed-system devices that minimize circuit disconnection, with in-line suction catheters playing a crucial role in infection prevention protocols. Regulatory bodies and hospital accreditation organizations are increasingly advocating for the use of closed suction systems, further accelerating market adoption.

Technological advancements are also influencing the market. By 2026, manufacturers are anticipated to launch next-generation catheters featuring antimicrobial coatings, improved tip designs for better secretion clearance, and integration with smart monitoring systems. These innovations aim to enhance patient safety, ease of use, and clinical outcomes, thus differentiating products in a competitive marketplace.

Regionally, North America is expected to maintain its dominant position due to advanced healthcare infrastructure and high ICU bed capacity. However, the Asia-Pacific region is projected to witness the fastest growth, fueled by increasing healthcare spending, rising awareness of critical care standards, and expanding hospital networks in countries like China and India.

In addition, the shift toward value-based care is prompting hospitals to evaluate cost-effectiveness alongside clinical performance. While in-line suction catheters carry a higher upfront cost than open systems, their role in reducing VAP rates and shortening ICU stays is increasingly recognized, making them a cost-efficient solution in the long term.

In summary, the 2026 market for in-line suction catheters will be shaped by growing clinical demand, stringent infection control standards, technological innovation, and regional healthcare development. Stakeholders—including manufacturers, healthcare providers, and policymakers—will need to align with these trends to optimize patient outcomes and capitalize on expanding market opportunities.

Common Pitfalls Sourcing In-Line Suction Catheters (Quality, IP)

Sourcing in-line suction catheters requires careful attention to both quality and intellectual property (IP) considerations. Overlooking these aspects can lead to compromised patient safety, regulatory non-compliance, and legal risks. Below are key pitfalls to avoid:

Inadequate Quality Control and Regulatory Compliance

One of the most significant risks when sourcing in-line suction catheters is partnering with suppliers who lack rigorous quality management systems. Many low-cost manufacturers, especially in regions with less stringent oversight, may not adhere to international standards such as ISO 13485 (Quality Management for Medical Devices) or FDA 21 CFR Part 820. This can result in inconsistent product performance, material defects, or non-sterile packaging—directly endangering patients in critical care environments. Buyers must verify certifications, conduct on-site audits, and request documentation for biocompatibility (ISO 10993) and sterilization validation (ISO 11135 or ISO 11137).

Counterfeit or Non-Original Products

The market for in-line suction catheters is vulnerable to counterfeit or imitation products that mimic branded designs but fail to meet performance and safety benchmarks. These products often emerge from unauthorized manufacturers who reverse-engineer patented devices. Sourcing such items not only risks patient outcomes but also exposes the buyer to liability. It is essential to work directly with authorized distributors or the original equipment manufacturer (OEM) and verify product authenticity through batch traceability, holograms, or digital verification systems.

Intellectual Property Infringement

Using or sourcing in-line suction catheters that infringe on existing patents, trademarks, or design rights can lead to severe legal consequences, including injunctions, fines, and reputational damage. Many leading catheter designs are protected under utility patents (e.g., specific valve mechanisms or anti-reflux features) or design patents (e.g., unique housing shapes). Buyers must conduct thorough IP due diligence, including freedom-to-operate (FTO) analyses, and ensure that suppliers warrant non-infringement in contracts. Sourcing from manufacturers without proper IP clearance increases exposure to litigation from patent holders.

Lack of Traceability and Documentation

Inadequate documentation—such as missing Certificates of Conformance, material declarations, or sterilization records—compromises traceability and regulatory compliance. In the event of a product recall or adverse event, the absence of lot-level tracking can delay responses and escalate risks. Suppliers should provide full documentation aligned with regulatory requirements in target markets (e.g., EU MDR, FDA). Relying on vendors who cannot supply complete technical files is a critical oversight.

Substandard Materials and Design Flaws

Some sourced catheters use inferior materials that degrade under clinical conditions, such as non-medical-grade plastics that leach chemicals or become brittle. Design flaws—like poor valve sealing or inconsistent suction control—can lead to cross-contamination or ineffective airway management. These issues often stem from cost-cutting measures and insufficient design validation. Buyers should demand data from performance testing (e.g., kink resistance, suction efficiency) and insist on prototypes for evaluation before bulk procurement.

Insufficient Post-Market Support and Recall Preparedness

Low-cost suppliers may lack robust post-market surveillance systems, making it difficult to address field complaints or initiate timely recalls. When sourcing, assess the supplier’s capability to support corrective actions, provide updates, and comply with adverse event reporting requirements. A supplier without a structured quality feedback loop poses ongoing operational and compliance risks.

Avoiding these pitfalls requires a strategic sourcing approach centered on verified quality systems, IP integrity, and transparent supplier relationships—prioritizing patient safety and regulatory alignment over short-term cost savings.

Logistics & Compliance Guide for In-Line Suction Catheter

Regulatory Classification and Approvals

In-Line Suction Catheters are classified as medical devices and are subject to stringent regulatory requirements. In the United States, they are typically classified under FDA Class II (21 CFR 870.1820 – Suction Catheter) and require 510(k) premarket notification to demonstrate substantial equivalence to a legally marketed predicate device. In the European Union, they fall under the Medical Device Regulation (MDR) (EU) 2017/745 and are generally classified as Class IIa or IIb, depending on duration of use and invasiveness. CE marking is mandatory, requiring conformity assessment by a Notified Body. Manufacturers must maintain a Technical File, Implement a Quality Management System (QMS) per ISO 13485, and comply with Unique Device Identification (UDI) requirements.

Labeling and Packaging Requirements

Labeling must comply with both FDA and MDR regulations, including device name, manufacturer details, lot number, expiration date, sterile status, single-use designation, and UDI. Labels must be legible, durable, and affixed directly to the packaging. Primary packaging must ensure sterility and protect the device during transport. All labeling must be in the official language(s) of the destination country. Instructions for Use (IFU) must be included, providing clear guidance on indications, contraindications, warnings, precautions, and step-by-step usage procedures. Packaging must also indicate storage conditions (e.g., room temperature, avoid direct sunlight) and any special handling instructions.

Supply Chain and Distribution Logistics

Distribution of In-Line Suction Catheters requires a controlled supply chain to maintain product integrity. Products must be stored and transported under recommended environmental conditions (typically 15°C–30°C, low humidity) to prevent degradation. Temperature excursions must be monitored and documented using validated data loggers when necessary. Logistics partners must be qualified and compliant with Good Distribution Practice (GDP) for medical devices. Serialization and traceability systems must be in place to support UDI implementation and facilitate recalls if needed. Distribution agreements should include compliance clauses and audit rights to ensure adherence to regulatory standards.

Import and Export Compliance

Exporting In-Line Suction Catheters requires compliance with the regulations of both the exporting and importing countries. In the U.S., export of medical devices must comply with FDA export provisions (21 CFR Part 801, Subpart H), including submission of an Export Certificate when required. Importing countries may require local regulatory authorization (e.g., Health Canada license, ANVISA registration in Brazil, TGA approval in Australia). Customs documentation must include accurate Harmonized System (HS) codes, product classification, and certificates of free sale or manufacturing. Documentation must be verified for accuracy to avoid delays or seizure at customs.

Post-Market Surveillance and Vigilance Reporting

Manufacturers are responsible for implementing a robust post-market surveillance (PMS) system in accordance with FDA and MDR requirements. This includes monitoring adverse events, customer complaints, and field safety corrective actions (FSCAs). Under MDR, manufacturers must report serious incidents and field safety notices through EUDAMED within defined timelines. In the U.S., adverse events must be reported to the FDA via the MedWatch system (Form FDA 3500A) when they meet reporting criteria. Periodic Summary Reporting and Post-Market Surveillance Plans may be required, especially for higher-risk devices.

Quality Management System and Audits

A certified Quality Management System (QMS) per ISO 13485 is mandatory for design, manufacturing, and distribution of In-Line Suction Catheters. The QMS must cover document control, risk management (per ISO 14971), supplier controls, corrective and preventive actions (CAPA), and internal audits. Regular internal and external audits (including Notified Body audits under MDR) must be conducted to ensure ongoing compliance. Audit trails and records must be maintained for regulatory inspections and certification renewals. Any non-conformances must be documented, investigated, and resolved promptly.

Conclusion for Sourcing In-Line Suction Catheters

In conclusion, sourcing in-line suction catheters requires a strategic approach that balances clinical efficacy, patient safety, cost-efficiency, and supply chain reliability. These critical devices play a vital role in maintaining airway patency in ventilated patients, reducing the risk of ventilator-associated pneumonia (VAP) and minimizing oxygen desaturation during suctioning. When selecting suppliers, healthcare facilities must prioritize products that meet rigorous regulatory standards (such as FDA, CE, or ISO certifications), demonstrate compatibility with existing ventilation systems, and offer features that enhance patient comfort and infection control.

Engaging with reputable manufacturers, conducting thorough evaluations of product quality and performance, and considering total cost of ownership—rather than unit price alone—are essential steps in the sourcing process. Long-term partnerships with suppliers who provide consistent product availability, responsive customer support, and training resources can further ensure uninterrupted patient care.

Ultimately, effective sourcing of in-line suction catheters supports improved clinical outcomes, enhances operational efficiency, and contributes to higher standards of patient care in critical and intensive care settings. Continued evaluation and adaptation to emerging technologies and market trends will remain key to maintaining a resilient and responsive procurement strategy.