The global refractometer market is experiencing steady expansion, driven by increasing demand for precision measurement tools across industries such as food and beverage, pharmaceuticals, automotive, and chemical processing. According to a 2023 report by Mordor Intelligence, the market was valued at USD 446.7 million in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% through 2028. Similarly, Grand View Research notes heightened adoption of inline process analytical technology (PAT) to ensure real-time quality control, particularly in highly regulated sectors. Inline refractometers, known for their ability to provide continuous, accurate refractive index measurements during production, are at the forefront of this trend. As industries prioritize automation, efficiency, and compliance, leading manufacturers are innovating to deliver robust, digitally integrated solutions. This growing demand has elevated the prominence of key players specializing in inline refractometry, setting the stage for the following overview of the top nine manufacturers shaping the market.

Top 9 In Line Refractometer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Rudolph Research Analytical

Domain Est. 1997

Website: rudolphresearch.com

Key Highlights: Laboratory Instrument Manufacturer for over 50 years – Refractometer, Density Meter, Polarimeter, and Saccharimeter by Rudolph Research….

#2 ATAGO USA

Domain Est. 2002

Website: atago-usa.com

Key Highlights: ATAGO is the leading manufacturer of refractometers and polarimeters as well as salt meters, acidity, ph meter and saccharimeter….

#3 Digital Handheld Refractometers

Domain Est. 1993

Website: mt.com

Key Highlights: A digital handheld refractometer is an instrument that automatically measures the refractive index (or Brix) of a sample by measuring the total reflection….

#4 Inline Refractometer: L

Domain Est. 1995

Website: anton-paar.com

Key Highlights: Free deliveryInline refractometer L-Rix 5100/5200 fulfills NAMUR NE 107, is designed according to EHEDG, and is ready for measuring concentration….

#5 Vaisala Polaris™ process refractometer product family

Domain Est. 1995

Website: vaisala.com

Key Highlights: Discover the pioneering optical in-line process refractometry for liquid concentration measurements with Vaisala Polaris™ product family refractometers….

#6 MISCO Refractometer

Domain Est. 1995

Website: misco.com

Key Highlights: The world’s leading digital handheld refractometer. As a result, our refractometer boasts 2-3x the precision of competing refractometers and ruggedness….

#7 Maselli Misure

Domain Est. 1997 | Founded: 1948

Website: maselli.com

Key Highlights: Since 1948, Maselli Misure provides high quality in-line and laboratory analyzer for several application fields, with a focus on the Food&Beverage sector….

#8 Electron Machine Corporation

Domain Est. 1999

Website: electronmachine.com

Key Highlights: Electron Machine Corporation manufactures rugged inline process refractometers for pulp and paper, chemical, and food and beverage industries….

#9 Inline Refractometer

Domain Est. 2023

Website: chuyimc.com

Key Highlights: An online concentration meter with high precision, high efficiency and high adaptability for our lithium battery production line….

Expert Sourcing Insights for In Line Refractometer

2026 Market Trends for In-Line Refractometers

The in-line refractometer market is poised for significant evolution by 2026, driven by technological advancements, increasing industrial automation, and stringent quality control demands across key sectors. Here’s an analysis of the key trends shaping the market:

1. Accelerated Adoption Driven by Industry 4.0 and Process Intensification

* Seamless Integration: In-line refractometers will become increasingly integral to Industrial Internet of Things (IIoT) ecosystems. Expect widespread adoption of devices with native support for IIoT protocols (MQTT, OPC UA) and cloud connectivity, enabling real-time data flow to central control systems (SCADA, MES, ERP) for holistic process optimization.

* Predictive Analytics & AI: Data from in-line refractometers will feed into advanced analytics platforms and AI algorithms. This will shift focus from simple monitoring to predictive maintenance (identifying sensor fouling or drift before failure) and predictive process control (anticipating quality deviations and automatically adjusting parameters).

* Demand for Continuous Processing: Industries like pharmaceuticals (continuous manufacturing) and food & beverage (continuous cooking, fermentation) will drive demand for in-line refractometers as essential tools for real-time concentration control, replacing slower, less accurate offline methods.

2. Technological Advancements Enhancing Performance and Reliability

* Improved Sensor Durability & Self-Cleaning: Expect significant R&D focus on materials (e.g., enhanced sapphire optics, corrosion-resistant alloys) and integrated self-cleaning mechanisms (ultrasonic, air-purge, chemical flush cycles) to combat fouling in challenging applications (e.g., viscous foods, pulp & paper, wastewater). This reduces maintenance downtime and improves measurement reliability.

* Miniaturization & Ruggedization: Smaller, more robust sensor designs will facilitate installation in space-constrained areas and harsh environments (high pressure, temperature, vibration), expanding application possibilities in compact skids and mobile units.

* Advanced Optics & Signal Processing: Development of more sophisticated optical designs (e.g., multi-wavelength measurement) and signal processing algorithms will improve accuracy, especially for complex or colored fluids, and reduce sensitivity to air bubbles or particulates.

* Wireless & Battery-Powered Options: Growth in wireless (e.g., LoRaWAN, NB-IoT) and battery-powered in-line refractometers will simplify installation in remote locations or rotating equipment, enabling monitoring in previously inaccessible points.

3. Expanding Application Scope Across Key Verticals

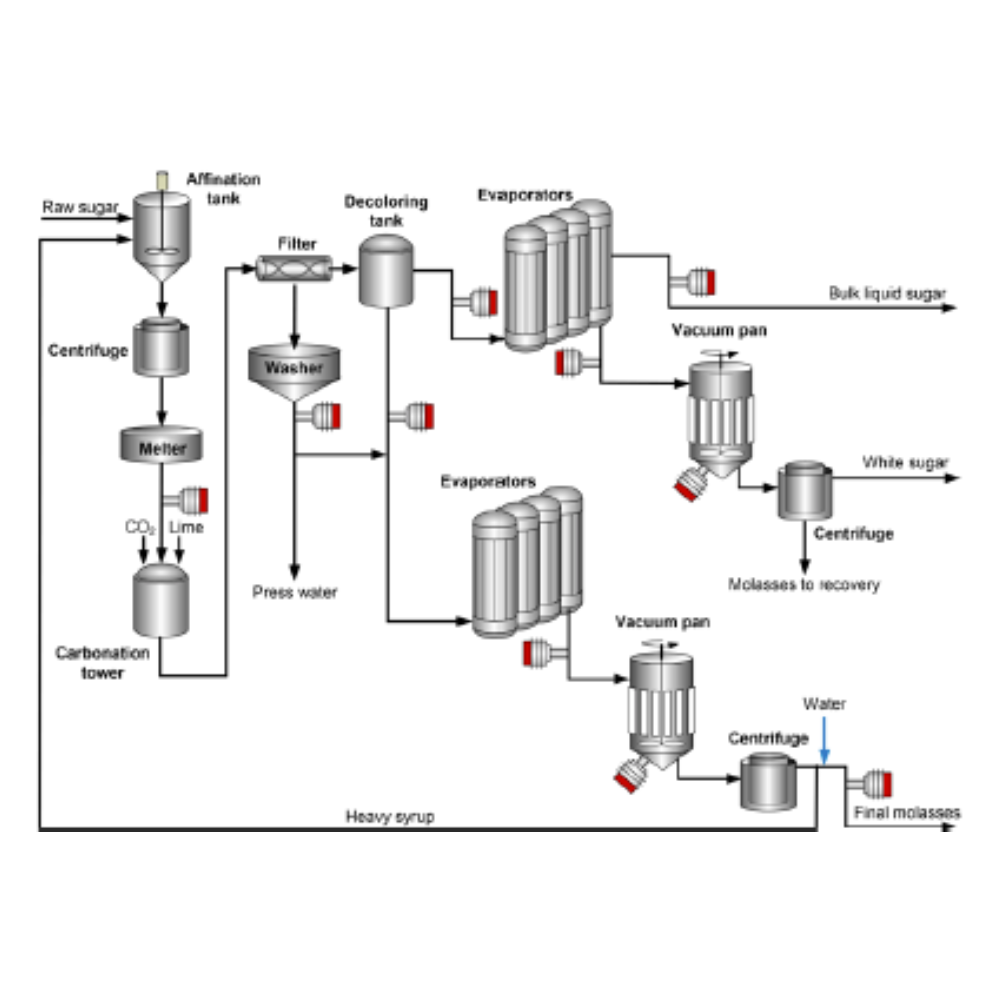

* Food & Beverage: Dominant growth segment. Demand will surge for real-time control in juice concentration, sugar syrup production, dairy processing (cheese, yogurt), beverage mixing, and alcohol production. Focus on natural ingredients and clean labels will heighten the need for precise, consistent quality control.

* Pharmaceuticals & Biotechnology: Critical for monitoring cell culture media, buffer preparation, purification steps (ultrafiltration/diafiltration), and final product concentration. Stringent regulatory requirements (FDA, EMA) will drive adoption of highly accurate, validated, and data-integrity-compliant systems.

* Chemicals & Petrochemicals: Essential for monitoring reaction progress, solvent concentration, and final product specifications in processes like polymerization, solvent recovery, and acid/base concentration. Focus on safety and efficiency will boost demand.

* Pulp & Paper: Continued importance for monitoring black liquor concentration (Kraft process) and chemical recovery, directly impacting energy efficiency and process economics.

* Emerging Applications: Growing use in water/wastewater treatment (monitoring brine concentration in desalination, sludge thickening), battery electrolyte manufacturing, and specialty chemical synthesis.

4. Increasing Focus on Sustainability and Efficiency

* Energy & Resource Optimization: By enabling precise control of concentration, in-line refractometers directly contribute to reducing energy consumption (e.g., minimizing evaporation time), minimizing raw material waste (over/under-concentration), and optimizing water usage, aligning with corporate sustainability goals.

* Reduced Chemical Consumption: Accurate monitoring in cleaning-in-place (CIP) systems allows for precise control of cleaning agent concentration, minimizing chemical usage and reducing environmental impact of CIP effluent.

* Water Reclamation: In desalination and industrial water treatment, refractometers are crucial for monitoring process efficiency and product quality, supporting water conservation efforts.

5. Market Consolidation and Competitive Dynamics

* Integration into Broader Solutions: Leading players will increasingly offer in-line refractometers as part of integrated process analytics packages, bundling sensors with transmitters, software platforms, and services (calibration, maintenance contracts).

* Focus on Service & Support: As systems become more complex, value will shift towards comprehensive service offerings, including remote diagnostics, predictive maintenance support, and application expertise.

* Regional Growth Variations: Strong growth expected in Asia-Pacific (driven by manufacturing expansion, especially in food, pharma, and chemicals) and emerging markets. Mature markets (North America, Europe) will see steady growth driven by automation upgrades and sustainability initiatives.

Conclusion

By 2026, the in-line refractometer market will be characterized by smarter, more robust, and deeply integrated sensors. The convergence of IIoT, AI, and advanced materials will transform them from simple measurement devices into intelligent nodes within autonomous control systems. Driven by the imperatives of quality, efficiency, sustainability, and regulatory compliance across food & beverage, pharma, chemicals, and other industries, in-line refractometers will become indispensable tools for modern process manufacturing. Success will depend on manufacturers’ ability to deliver reliable, connected, and data-rich solutions that demonstrably improve operational outcomes.

Common Pitfalls Sourcing In-Line Refractometers (Quality, IP)

Sourcing in-line refractometers requires careful consideration beyond basic specifications, especially regarding long-term quality and Ingress Protection (IP) ratings critical for industrial environments. Overlooking these factors can lead to premature failure, inaccurate measurements, safety hazards, and costly downtime. Below are key pitfalls to avoid:

1. Underestimating Environmental and Process Demands

Many buyers select a refractometer based on nominal specifications without fully analyzing the actual operating environment. High-pressure washdowns, exposure to corrosive chemicals, extreme temperatures, or high vibration can quickly degrade a unit not robustly designed. Assuming a standard IP65 rating is sufficient for outdoor or high-humidity areas may result in moisture ingress and sensor failure. Always verify that both the sensor housing and cable connections meet or exceed the environmental IP requirements (e.g., IP66, IP67, or IP69K for washdown applications).

2. Overlooking Material Compatibility and Build Quality

The quality of wetted parts—especially the prism and housing—is paramount. Low-cost refractometers may use inferior materials (e.g., standard stainless steel or non-sapphire prisms) that degrade when exposed to aggressive process fluids or frequent cleaning agents. This leads to inaccurate readings and frequent maintenance. Always confirm material certifications (e.g., 316L stainless steel, sapphire prism) and demand proof of compatibility with your specific process media.

3. Misinterpreting IP Ratings and Sealing Integrity

IP ratings are often listed without context. A device may claim IP65, but if the cable gland or connector does not match that rating, the overall protection is compromised. Poorly sealed electrical connections are a common point of failure. Ensure the full assembly—including junction boxes, connectors, and cable entries—maintains the stated IP rating under real-world conditions. Request third-party certification or test reports when possible.

4. Sacrificing Calibration and Long-Term Stability for Cost

Cheaper refractometers may lack proper factory calibration traceability or drift significantly over time due to substandard optics and electronics. This results in unreliable process control and increased validation effort. Prioritize suppliers that provide NIST-traceable calibration certificates and demonstrate long-term stability data. Field recalibration capability should also be considered to minimize process interruptions.

5. Ignoring Installation and Maintenance Requirements

Poor installation—such as incorrect mounting orientation, inadequate back-pressure, or insufficient straight pipe runs—can affect measurement accuracy and sensor lifespan. Some suppliers do not provide clear installation guidelines or support. Additionally, maintenance access and cleanability are often overlooked. Ensure the refractometer design allows for easy inspection and cleaning without disassembly, especially in sanitary or food-grade applications.

Avoiding these pitfalls requires due diligence in supplier evaluation, demanding technical documentation, and aligning specifications with real-world operating conditions. Investing in a high-quality, properly specified in-line refractometer ensures reliable performance, reduces lifecycle costs, and supports consistent product quality.

Logistics & Compliance Guide for In-Line Refractometer

General Handling and Storage

Prior to installation and use, the in-line refractometer must be stored in a clean, dry environment with temperatures between 5°C and 40°C (41°F to 104°F). Avoid exposure to direct sunlight, moisture, dust, and corrosive atmospheres. Keep the device in its original packaging until ready for deployment. If stored for extended periods (over 6 months), inspect for physical damage and verify calibration before commissioning.

Transportation Requirements

When shipping the in-line refractometer, ensure it is securely packed using the original manufacturer-approved packaging materials. Use shock-absorbing cushioning to protect the sensor optics and housing. Clearly label packages with “Fragile,” “This Side Up,” and “Protect from Moisture” indicators. For international shipments, comply with IATA/ICAO regulations for electronic instruments if transported by air. Maintain ambient temperatures during transit between -10°C and 50°C (14°F to 122°F) to prevent damage to internal components.

Installation and Integration

Installation must be performed by qualified personnel in accordance with the manufacturer’s technical manual. Ensure the process line is depressurized and drained before mounting. The refractometer must be installed in a location free from excessive vibration and thermal gradients. Proper orientation (typically with the sensor facing downward to avoid air bubble accumulation) is critical for accurate readings. Verify that all wetted materials (e.g., sapphire window, body material such as 316L stainless steel) are compatible with the process media. Follow local electrical codes for wiring and grounding; use shielded cables to minimize electromagnetic interference.

Regulatory Compliance

The in-line refractometer must comply with relevant regional and international standards applicable to the installation site. Typical certifications include:

– CE Marking: Conformity with EU directives (e.g., EMC Directive 2014/30/EU, RoHS 2011/65/EU, and ATEX for hazardous areas if applicable).

– ATEX/IECEx: Required for use in explosive atmospheres; ensure the device model is rated for the designated zone (e.g., Zone 1 or 2 for gases).

– cULus: For compliance with North American safety standards (UL 61010-1).

– Pressure Equipment Directive (PED) 2014/68/EU: If the device is part of a pressurized system above specified thresholds.

– FDA Compliance: Required for food, beverage, and pharmaceutical applications; confirm wetted parts are FDA 21 CFR 177.2600 compliant.

Calibration and Documentation

Maintain a documented calibration schedule according to process requirements and quality standards (e.g., ISO 9001, GMP). Initial and periodic calibrations must be traceable to national standards (NIST, DAkkS, etc.). Calibration records should include date, technician, reference standards used, and as-found/as-left data. Store calibration certificates with the instrument history file. For regulated industries (pharma, food), electronic records must comply with 21 CFR Part 11 if using digital data logging.

Environmental and Disposal Compliance

At end-of-life, dispose of the in-line refractometer in accordance with local, national, and international environmental regulations. The device contains electronic components and potentially hazardous materials (e.g., lead solder, batteries) and must not be discarded in general waste. Follow WEEE (Waste Electrical and Electronic Equipment) Directive 2012/19/EU in Europe or equivalent programs (e.g., EPA regulations in the U.S.). Return to the manufacturer or an authorized e-waste recycler for proper dismantling and material recovery.

Export Controls

Certain high-precision refractometer models may be subject to export control regulations due to their measurement accuracy or dual-use potential. Verify compliance with:

– EAR (Export Administration Regulations) in the U.S. (check Commerce Control List, ECCN).

– EU Dual-Use Regulation (EU) 2021/821 for shipments outside the European Union.

Obtain necessary export licenses or authorizations when shipping to restricted destinations or end-users.

Conclusion:

In summary, sourcing an in-line refractometer is a strategic investment for industries requiring continuous, real-time monitoring of concentration or purity in liquid processes—such as food and beverage, pharmaceuticals, chemical production, and pulp and paper. By selecting the right in-line refractometer based on accuracy, durability, ease of integration, and compatibility with process conditions (temperature, pressure, chemical exposure), companies can significantly enhance product consistency, reduce waste, and improve process efficiency.

Key considerations during sourcing include sensor material (e.g., sapphire prism for abrasion resistance), output signal compatibility (4–20 mA, Modbus, etc.), required certifications (e.g., ATEX, 3-A, IP67), and the level of support provided by the supplier, including calibration and installation services. Additionally, evaluating total cost of ownership—beyond initial price—ensures long-term reliability and minimized downtime.

Ultimately, a well-sourced in-line refractometer not only supports quality control and regulatory compliance but also contributes to smarter, data-driven manufacturing, paving the way for improved operational excellence and sustainable production practices.