The industrial and commercial heating sector is undergoing rapid transformation, driven by rising energy efficiency standards and growing demand across manufacturing, food processing, and petrochemical industries. According to a 2023 report by Mordor Intelligence, the global electric immersion heater market was valued at USD 1.85 billion and is projected to grow at a CAGR of 5.2% from 2024 to 2029. This expansion is fueled by increasing industrial automation, stricter environmental regulations, and the shift toward reliable, low-maintenance heating solutions. Immersion (imm) heaters, known for their direct heating capability and compact design, have become critical components in process heating applications worldwide. As demand surges, manufacturers are focusing on advanced materials, smart integration, and improved thermal efficiency to capture market share. Based on production scale, technological innovation, global reach, and customer reviews, here are the top 10 immersion heater manufacturers shaping the future of industrial heating.

Top 10 Imm Heater Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Immersion Heaters

Domain Est. 1994

Website: thermon.com

Key Highlights: Heating Systems · Caloritech™ – Engineered Electric Heat · Immersion Heaters · Heat Trace · Controls & Monitoring · Design Technology · Transportation Heating….

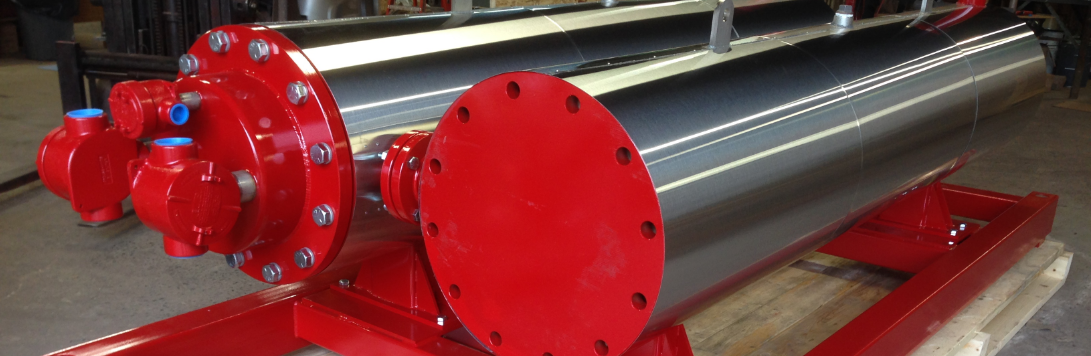

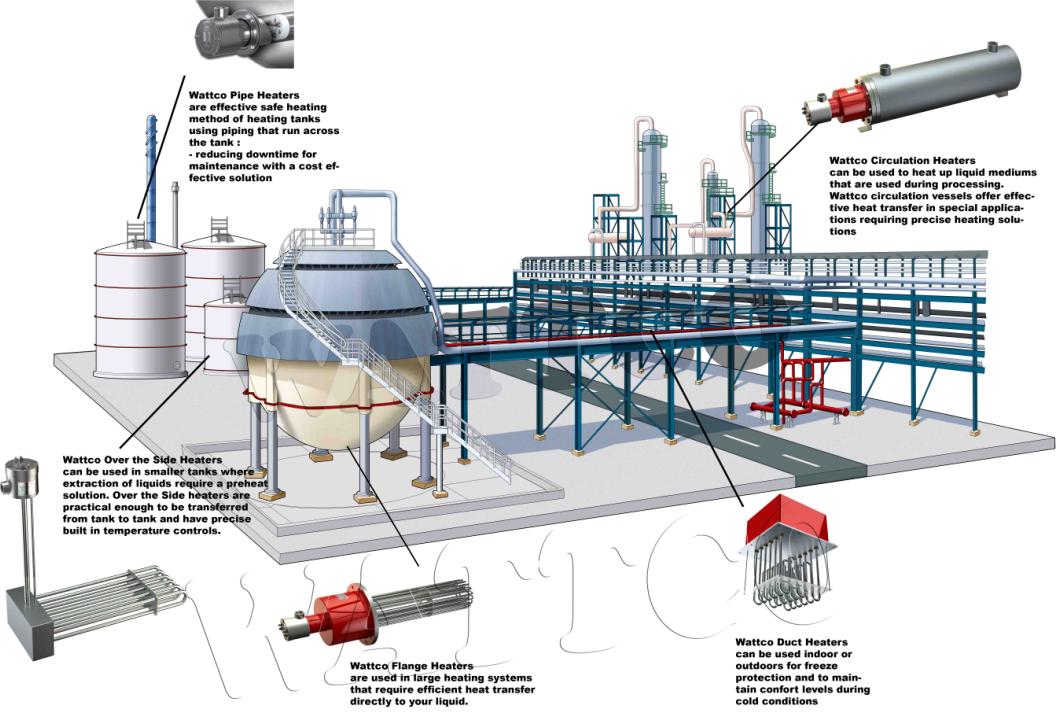

#2 Wattco

Domain Est. 1999

Website: wattco.com

Key Highlights: Wattco manufactures a complete line of flange heaters, circulation heaters, tubular heaters, and immersion heaters. Browse our product catalogue….

#3 Heatmax Heaters

Domain Est. 2017

Website: heatmaxheaters.com

Key Highlights: We design industrial immersion heaters for the metal plating, process heat, and OEM industries, from infrared and flanged heaters to heat transfer systems….

#4 Industrial Heaters & Systems

Domain Est. 1997

Website: chromalox.com

Key Highlights: Chromalox manufactures a wide range of industrial heaters and systems to meet the thermal energy requirements of your process. Our product range covers air ……

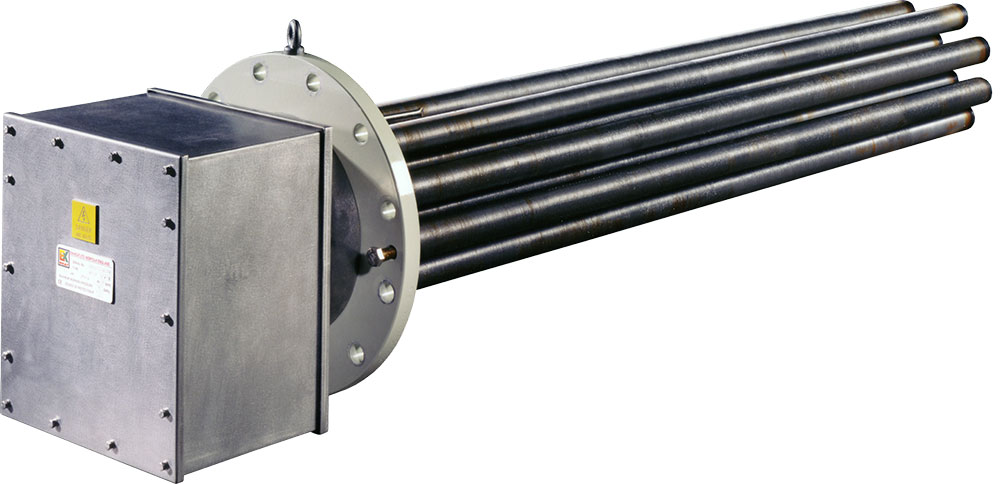

#5 Immersion Heaters

Domain Est. 1997

Website: belilove.com

Key Highlights: BCE’s immersion heaters provide efficient and durable heat transfer in liquids and gases, designed for extreme industrial environments….

#6 Electric Immersion Heaters

Domain Est. 1998

Website: durexindustries.com

Key Highlights: Electric immersion heaters used to directly heat liquids in a variety of tanks & reservoirs for any industrial or process heating applications….

#7 Immersion Heaters

Domain Est. 1995

Website: watlow.com

Key Highlights: Watlow manufactures a complete line of immersion heaters, designed primarily for direct immersion in water, oils, solvents and process solutions as well as ……

#8 Immersion Heaters

Domain Est. 1996

Website: imscompany.com

Key Highlights: Heating Element, Immersion, 12kW, 230/460 VAC, for IMS Hydra Model RQE Pressurized Mold Temperature Controllers. Catalog Page 741. $510.00 ea. Add….

#9 Aluminium immersion heating

Domain Est. 1998

Website: atherm.com

Key Highlights: Immersion heaters for light metals. Access the most efficient and environmentally friendly heating solutions for aluminum alloys and zinc alloys….

#10 aluminum immersion heaters

Domain Est. 1999

Website: lethiguel.com

Key Highlights: By heating your aluminum effectively with our immersion heaters, overheating is avoided and we can ensure you that your metal quality will be in its best form….

Expert Sourcing Insights for Imm Heater

H2: Market Trends for Immersion Heaters in 2026

As we approach 2026, the global immersion heater (Imm Heater) market is poised for significant transformation driven by technological innovation, regulatory shifts, and evolving industrial and consumer demands. Below is a comprehensive analysis of key market trends expected to shape the immersion heater industry in 2026:

-

Increased Demand from Renewable Energy and Green Technologies

With global decarbonization goals intensifying, industries are integrating immersion heaters into renewable energy systems—particularly in solar thermal, geothermal, and green hydrogen production. Immersion heaters are being utilized for temperature regulation in electrolyzers and thermal energy storage systems. Governments offering incentives for clean energy infrastructure are accelerating adoption, especially in Europe and North America. -

Growth in Industrial Automation and Smart Manufacturing

The rise of Industry 4.0 is driving demand for intelligent immersion heaters equipped with IoT connectivity, real-time monitoring, and predictive maintenance features. By 2026, smart immersion heaters with integrated sensors and remote control via mobile or cloud platforms are expected to capture over 35% of the industrial segment. These heaters offer improved energy efficiency, process stability, and reduced downtime. -

Expansion in the Electric Vehicle (EV) and Battery Manufacturing Sector

Immersion heaters are increasingly used in battery thermal management systems and EV coolant loop testing. As EV production scales globally—particularly in China, the U.S., and Germany—the need for precision heating in battery formation and testing processes is boosting demand. Custom-designed, corrosion-resistant immersion heaters with high thermal response times are becoming critical components. -

Shift Toward Energy-Efficient and High-Performance Materials

Manufacturers are adopting advanced materials such as Incoloy, titanium, and ceramic coatings to improve heater durability and efficiency in aggressive environments (e.g., chemical processing, desalination). In 2026, over 50% of new immersion heaters are expected to feature energy-saving designs with low watt density and improved heat transfer properties, aligning with global energy efficiency standards. -

Stringent Environmental Regulations and Compliance Standards

Regulatory bodies such as the EU Ecodesign Directive and U.S. DOE efficiency standards are pushing for reduced emissions and higher efficiency in heating equipment. This is prompting OEMs to phase out outdated models and invest in eco-designs. Immersion heaters with reduced thermal losses, lower standby power, and recyclable components will gain market share. -

Growth in Asia-Pacific Driven by Industrialization and Urbanization

Countries like India, Vietnam, and Indonesia are witnessing rapid industrial growth in chemicals, textiles, and food processing—all key users of immersion heaters. Urban infrastructure development is also increasing demand in residential water heating. The Asia-Pacific region is projected to be the fastest-growing market, with a CAGR exceeding 6.5% through 2026. -

Consolidation and Innovation Among Key Players

Major manufacturers (e.g., Watlow, Chromalox, Schneider Electric) are focusing on R&D and strategic partnerships to develop modular, scalable heating solutions. Mergers and acquisitions are expected to increase as companies aim to expand their global footprint and technological capabilities, particularly in smart and sustainable heating systems. -

Rising Adoption in HVAC and Residential Applications

In residential markets, tankless and hybrid water heaters incorporating immersion heating elements are gaining popularity due to space-saving designs and on-demand heating. With rising energy costs, consumers are opting for high-efficiency models, supported by government rebates in markets like Japan and Germany.

Conclusion:

By 2026, the immersion heater market will be characterized by a strong shift toward sustainability, digitalization, and application-specific solutions. Companies that innovate in smart controls, energy efficiency, and integration with renewable systems will lead the market. As global electrification and industrial modernization continue, the immersion heater industry is set for robust, technology-driven growth.

Common Pitfalls When Sourcing Immersion Heaters (Quality and Intellectual Property)

Sourcing immersion heaters (Imm Heaters) involves more than just finding a low-cost supplier. Overlooking quality and intellectual property (IP) considerations can lead to significant operational, legal, and financial risks. Below are common pitfalls to avoid:

Poor Quality Control and Material Standards

One of the most frequent issues in sourcing immersion heaters is inadequate quality assurance. Suppliers—especially those in low-cost regions—may use substandard materials such as inferior-grade stainless steel, undersized heating elements, or poor insulation. This can result in premature failure, safety hazards (e.g., leaks, overheating, or electrical faults), and increased maintenance costs. Always verify that suppliers adhere to recognized standards (e.g., ASTM, ASME, or ISO) and conduct third-party testing or audits.

Lack of Certifications and Compliance

Many suppliers may claim compliance with industry standards but fail to provide valid certifications (e.g., CE, UL, ATEX, or RoHS). Using non-compliant immersion heaters in regulated environments (such as food processing, pharmaceuticals, or hazardous areas) can lead to equipment rejection, regulatory fines, or safety incidents. Ensure that all heaters are tested and certified by accredited bodies relevant to your application and region.

Inadequate Design for Application Requirements

Off-the-shelf immersion heaters may not meet specific operational needs, such as temperature range, pressure rating, fluid compatibility, or watt density. Sourcing without detailed technical specifications often leads to mismatched products, resulting in inefficient heating, material degradation, or system damage. Always provide clear technical requirements and confirm design validation with the supplier.

Intellectual Property Infringement Risks

Sourcing from unverified suppliers increases the risk of receiving counterfeit or IP-infringing products. Some manufacturers replicate patented designs, branding, or proprietary technology without authorization. Using such heaters not only exposes your company to legal liability but may also compromise performance and reliability. Conduct due diligence on supplier legitimacy, request proof of IP ownership or licensing, and avoid suppliers offering well-known branded products at suspiciously low prices.

Hidden Costs from Poor Reliability

While initial purchase price is a key factor, low-cost heaters often have higher total cost of ownership due to frequent replacements, downtime, and energy inefficiency. Poorly built heaters may consume more power or fail prematurely, leading to unplanned maintenance and operational disruption. Evaluate total lifecycle costs, not just upfront pricing.

Insufficient Documentation and Traceability

Reliable suppliers provide comprehensive documentation, including material test reports (MTRs), performance data, wiring diagrams, and traceability records. Lack of documentation makes it difficult to validate quality, troubleshoot issues, or meet audit requirements. Insist on full technical dossiers and batch traceability, especially in regulated industries.

Conclusion

Avoiding these pitfalls requires thorough supplier vetting, clear technical specifications, and attention to both quality assurance and IP integrity. Investing time in due diligence upfront can prevent costly failures, legal issues, and operational disruptions down the line.

Logistics & Compliance Guide for Imm Heater

Product Overview

The Imm Heater is a smart, energy-efficient heating device designed for residential and commercial use. It integrates IoT capabilities for remote temperature control and monitoring. This guide outlines the logistics and compliance requirements for the manufacturing, transportation, import/export, and distribution of the Imm Heater.

Regulatory Compliance Requirements

Electrical Safety Standards

The Imm Heater must comply with international electrical safety standards to ensure user safety and market access:

– IEC 60335-1: General safety requirements for household electrical appliances.

– IEC 60335-2-30: Particular safety requirements for room heaters.

– UL 1278: Standard for Movable Electric Room Heaters (for U.S. market).

– EN 60335-1 & EN 60335-2-30: European standards for electrical safety.

– Certification: CE (Europe), UKCA (UK), FCC Part 15 (EMI/EMC), and ETL or UL (North America).

Electromagnetic Compatibility (EMC)

- Must comply with FCC Part 15 (Class B) in the U.S. and CISPR 14-1 in Europe.

- Testing required for radio frequency emissions and immunity.

Energy Efficiency Regulations

- EU Ecodesign Directive 2009/125/EC and Energy Labeling Regulation (EU) 2017/1369: Mandate minimum energy performance and consumer labeling.

- ENERGY STAR® certification (voluntary in U.S. and Canada) enhances marketability.

- Test reports using standardized methods (e.g., IEC 62301) for standby power and efficiency.

Environmental & Chemical Compliance

- RoHS (EU Directive 2011/65/EU): Restricts hazardous substances (Pb, Cd, Hg, etc.).

- REACH (EC 1907/2006): Requires declaration of Substances of Very High Concern (SVHC).

- Proposition 65 (California): Requires warning labels if containing listed chemicals.

- WEEE (EU Directive 2012/19/EU): Mandates end-of-life collection and recycling; registration with national WEEE authorities required.

Wireless & IoT Compliance

- FCC ID Certification (U.S.) for integrated Wi-Fi/Bluetooth modules.

- ISED Certification (Canada) for radio frequency devices.

- CE RED (Radio Equipment Directive 2014/53/EU) for EU market.

- Data privacy compliance: GDPR (EU), CCPA (California), and local data protection laws.

Logistics & Supply Chain Considerations

Packaging & Labeling

- Packaging must meet ISTA 3A or equivalent for durability during transport.

- Labels must include:

- Product name, model, and serial number

- Voltage, power rating, and input specifications

- CE, UKCA, FCC, and other applicable marks

- QR code linking to user manual and safety information

- Language-specific warnings and instructions (per destination market)

Shipping & Transportation

- Mode of Transport: Sea freight (FCL/LCL) for bulk shipments; air freight for urgent or low-volume deliveries.

- HS Code: 8516.79 (Electric instantaneous or storage water heaters) – verify per country.

- Temperature & Humidity Control: Avoid exposure to extreme conditions during transit.

- Battery Handling: If applicable (e.g., backup battery), comply with IATA/IMDG regulations for lithium batteries.

Import & Customs Clearance

- Required Documentation:

- Commercial invoice

- Packing list

- Bill of lading/air waybill

- Certificate of Conformity (CoC)

- Test reports (safety, EMC, energy)

- FCC ID/ISED/CE Declaration of Conformity

- Duties & Tariffs: Check local tariff schedules; consider using bonded warehouses or free trade agreements (e.g., USMCA, RCEP) to reduce costs.

Warehousing & Distribution

- Store in dry, temperature-controlled environments.

- Implement FIFO (First In, First Out) inventory management.

- Ensure compliance with local fire safety regulations for stacked storage of electrical goods.

Post-Market Obligations

Product Registration

- Register with national product safety authorities (e.g., RAPEX in EU, CPSC in U.S.).

- Maintain a technical file and DoC for minimum 10 years post-production.

Recall & Incident Reporting

- Establish a product incident reporting system.

- Comply with mandatory reporting timelines (e.g., 10 days under EU GPSD, 24 hours for serious risks).

Customer Support & Warranty

- Provide multilingual support and clear warranty terms.

- Track warranty claims for potential compliance or design issues.

Conclusion

Successful global distribution of the Imm Heater requires strict adherence to electrical, environmental, and logistics regulations. Proactive compliance planning, accurate documentation, and robust supply chain management are essential to ensure safe, legal, and efficient delivery to all target markets. Regular audits and updates to this guide are recommended to reflect regulatory changes.

Conclusion for Sourcing an Immersion Heater:

After evaluating technical requirements, operational needs, supplier capabilities, and cost considerations, sourcing an immersion heater requires a balanced approach that prioritizes reliability, efficiency, and long-term performance. It is essential to select a heater that matches the specific application—considering factors such as tank size, fluid type, temperature requirements, material compatibility, and power supply. Engaging with reputable suppliers who offer certified products, proper documentation, and technical support ensures quality and compliance with safety and industry standards.

Additionally, evaluating total cost of ownership—factoring in energy efficiency, maintenance needs, and expected lifespan—can lead to more sustainable and cost-effective outcomes. By conducting thorough market research, obtaining multiple quotations, and verifying product specifications, organizations can make informed procurement decisions that enhance system performance and minimize downtime. Ultimately, a well-sourced immersion heater contributes to improved operational efficiency, safety, and process reliability.