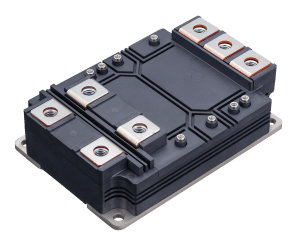

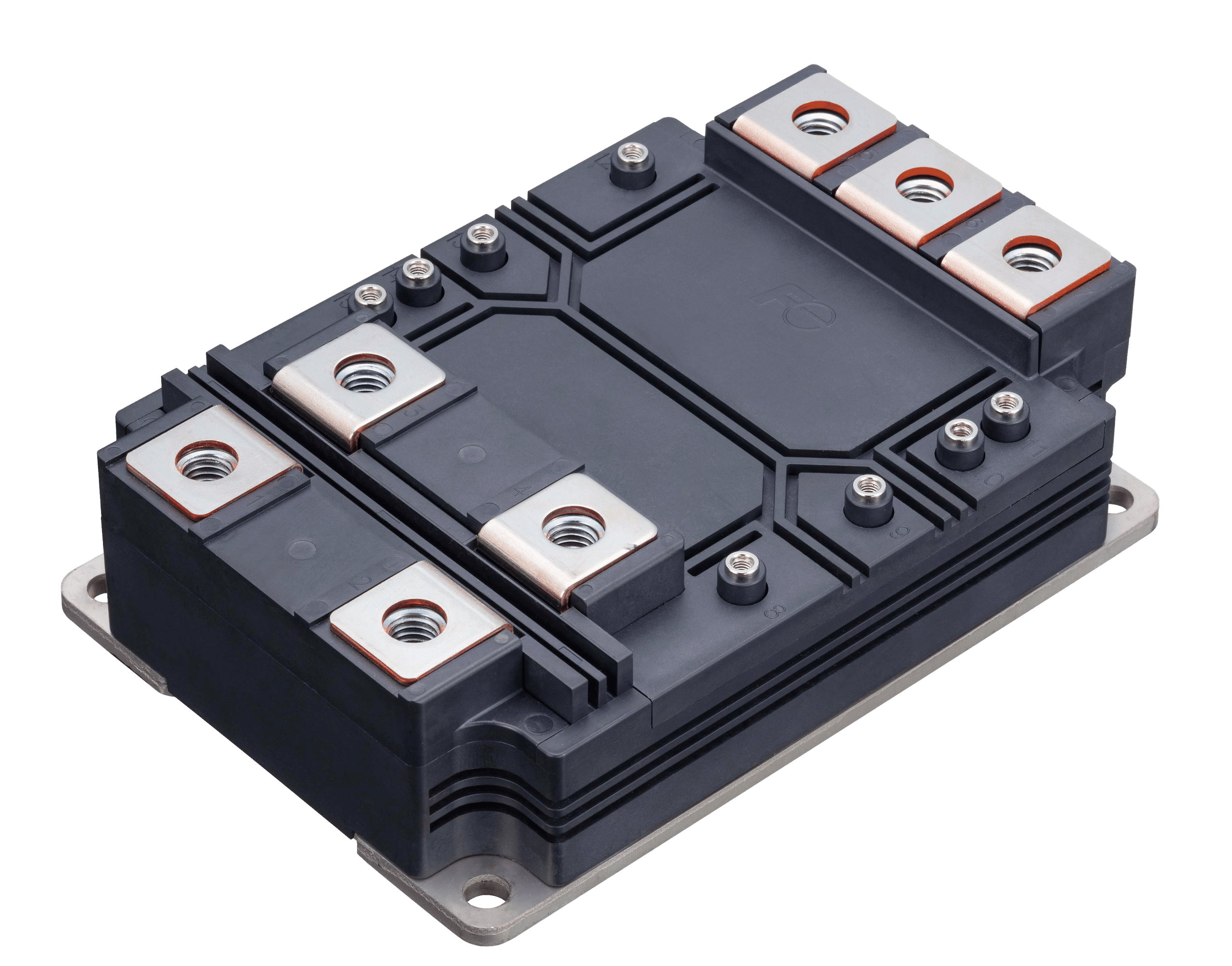

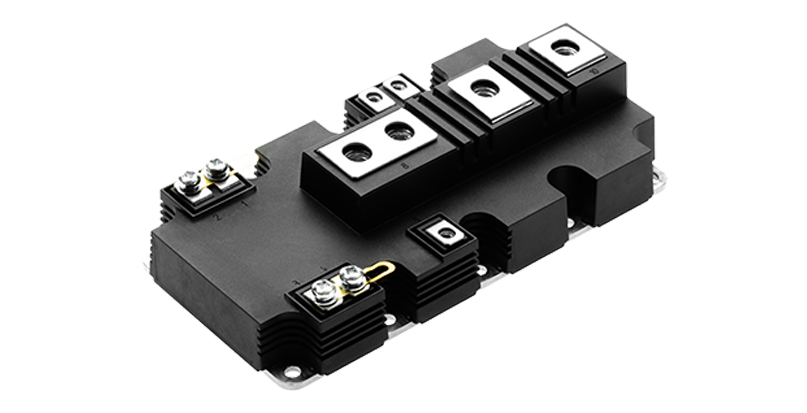

The global IGBT (Insulated Gate Bipolar Transistor) module market is experiencing robust expansion, driven by rising demand in electric vehicles, renewable energy systems, and industrial automation. According to a 2023 report by Mordor Intelligence, the IGBT market was valued at USD 7.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of over 9.5% from 2023 to 2028. This growth is fueled by the increasing adoption of electric vehicles—where IGBTs are critical components in powertrain systems—as well as the global push toward solar and wind energy integration, which relies heavily on efficient power conversion. Additionally, Grand View Research highlights that advancements in voltage handling capacity and thermal performance are accelerating innovation in industrial motor drives and consumer electronics. As demand surges, a select group of manufacturers have emerged as leaders in technology, scale, and reliability, shaping the competitive landscape of the IGBT module industry. Here are the top 9 IGBT module manufacturers driving this transformation.

Top 9 Igbt Module Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 IGBTs – Insulated gate bipolar transistors

Domain Est. 1999

Website: infineon.com

Key Highlights: Infineon’s industrial and power control IGBTs are designed with superior current capability and higher pulse load capacity for enhanced robustness….

#2 IGBT Module

Domain Est. 2013

Website: en.lonten.com

Key Highlights: LONTEN offers a comprehensive range of IGBT modules spanning voltage ratings from 600V to 1700V and covering various current levels, tailored to meet diverse ……

#3 Modules, IGBT

Domain Est. 1995

Website: vishay.com

Key Highlights: Vishay’s IGBT modules are available with several different configurations, including half-bridge, full-bridge, chopper, and 6PAK inverter….

#4 Powerex

Domain Est. 1996

Website: pwrx.com

Key Highlights: Leading provider of IGBTs and other high power semiconductor products- Our IGBT (Insulated Gate Bipolar Transistor) and HVIGBT (High Voltage Insulated Gate ……

#5 Introduction to IGBT (Power Modules)

Domain Est. 1997

Website: fujielectric.com

Key Highlights: Fuji Electric offers a lineup of high-quality, highly reliable power modules suitable for various applications. Product List. Features of the IGBT Module X ……

#6 Dynex IGBT modules range from 1.2kV to 6.5kV

Domain Est. 1999

Website: dynexsemi.com

Key Highlights: Dynex high and low power IGBT modules 500A to 3600A at 1.2kV to 6.5kV are durable and work with high reliability at any temperature condition from -40/-50°C ……

#7 StarPower

Domain Est. 2007 | Founded: 2005

Website: powersemi.cc

Key Highlights: is a leading power module company located in Jiaxing China about 59 miles southeast of Shanghai. Founded in 2005, StarPower designs and manufactures IGBT ……

#8 IGBT MODULE

Domain Est. 2020

Website: x-ipm.com

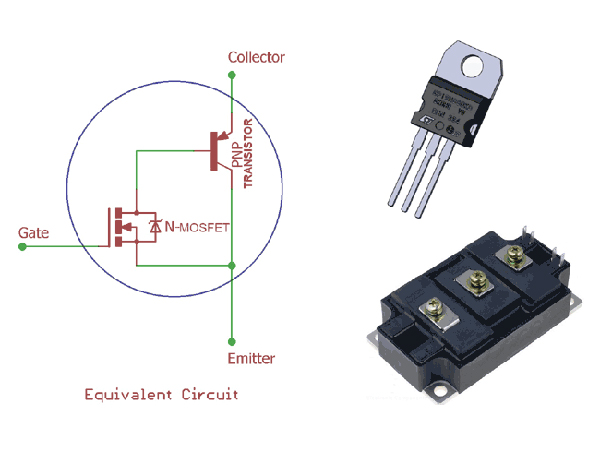

Key Highlights: IGBT modules combine the fast-switching characteristics of a MOSFET with the high current capability of a bipolar transistor (GTR)….

#9 Insulated Gate Bipolar Transistor (IGBT) and diode modules with …

Domain Est. 2021

Website: hitachienergy.com

Key Highlights: Hitachi Energy’s IGBT power modules are available from 1700 to 6500 volt as single, dual / phase-leg, chopper IGBT and dual diode modules….

Expert Sourcing Insights for Igbt Module

H2: 2026 Market Trends for IGBT Modules

The Insulated Gate Bipolar Transistor (IGBT) module market is poised for significant transformation by 2026, driven by converging megatrends in electrification, renewable energy, and industrial automation. Key developments shaping the market include:

1. Accelerated Electrification of Transportation:

The electric vehicle (EV) and hybrid electric vehicle (HEV) sector remains the dominant growth engine. By 2026, increasing global EV adoption, stricter emissions regulations (e.g., Euro 7, China 6b), and the expansion of charging infrastructure will drive demand for high-efficiency, high-power-density IGBT modules. 800V architectures will gain traction, boosting demand for 750V and 1200V IGBTs capable of handling higher voltages and switching frequencies. Additionally, growth in electric buses, trucks, and rail systems will expand industrial transportation applications.

2. Expansion in Renewable Energy Systems:

IGBT modules are critical in solar inverters and wind turbine converters. By 2026, with global renewable energy capacity additions continuing to rise (especially solar PV), demand for robust, efficient IGBTs in utility-scale and distributed energy systems will grow. Trends toward higher system voltages and improved power conversion efficiency will favor advanced IGBT modules with lower conduction and switching losses.

3. Industrial Automation and Motor Drives:

The ongoing industrial digitalization and energy efficiency mandates will sustain demand for IGBTs in variable frequency drives (VFDs), robotics, and high-performance motor control. Modules offering enhanced reliability, thermal management, and integration capabilities will be favored in smart manufacturing environments.

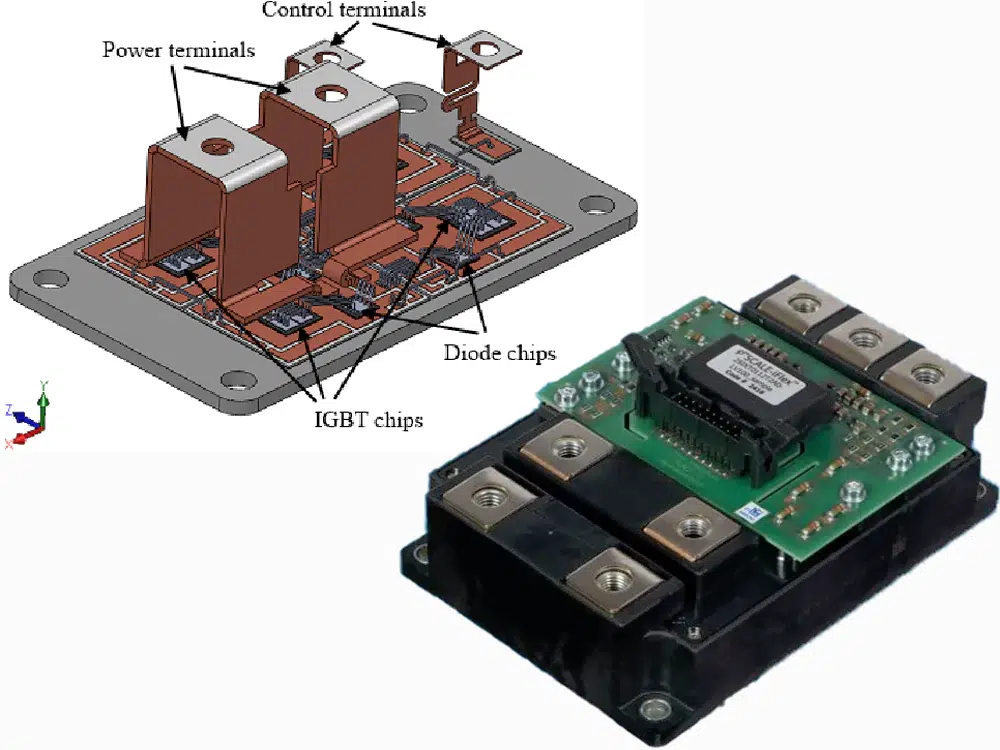

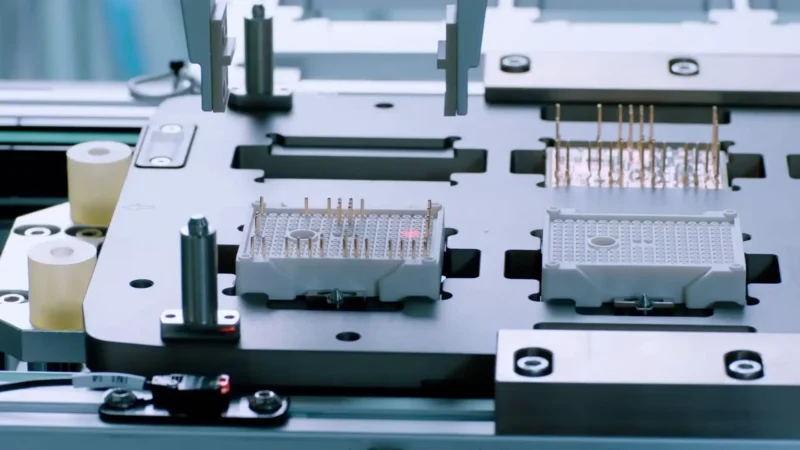

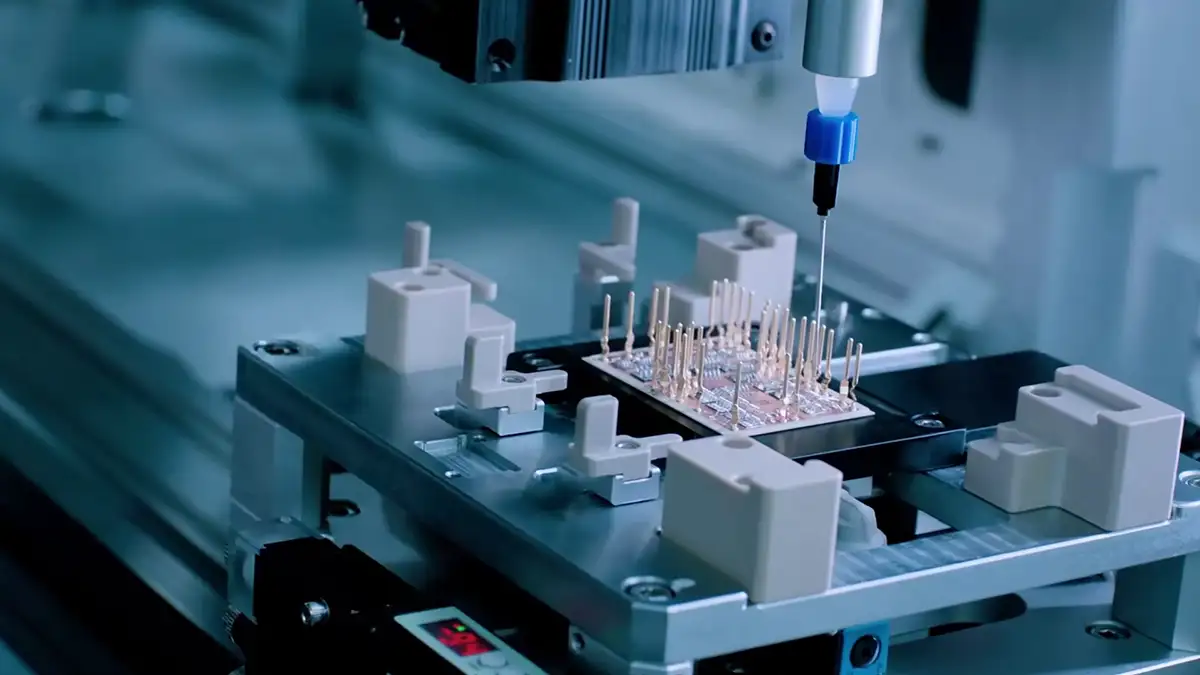

4. Advancements in Packaging and Integration:

To meet performance and cost targets, IGBT module packaging technologies will evolve. By 2026, widespread adoption of advanced packaging such as sintered silver die-attach, double-sided cooling, and molded modules will enhance thermal performance and reliability. Increased integration with gate drivers and sensors (IPM-like designs) will simplify system design and improve robustness.

5. Competitive Pressure from Wide Bandgap (WBG) Technologies:

While SiC and GaN devices will continue to penetrate high-end EV and industrial applications, IGBTs will retain strong market share in cost-sensitive and mid-power segments. By 2026, IGBT technology will see incremental improvements (e.g., trench-gate field-stop designs, thinner wafers) to close the performance gap with WBG, ensuring competitiveness in applications where cost and maturity are decisive.

6. Supply Chain Resilience and Regionalization:

Geopolitical factors and past supply disruptions will drive efforts to diversify IGBT manufacturing. By 2026, increased investment in regional production (e.g., in Europe, North America, and Southeast Asia) and vertical integration by key players will aim to enhance supply chain security and reduce dependency on single sources.

7. Focus on Sustainability and Lifecycle Management:

Environmental regulations and corporate ESG goals will push for greener manufacturing processes and recyclable module designs. IGBT manufacturers will increasingly emphasize lifecycle analysis, reduced use of hazardous materials, and end-of-life recyclability.

Conclusion:

By 2026, the IGBT module market will remain robust and strategically vital, particularly in transportation and energy sectors. While facing competition from WBG semiconductors, continuous innovation in silicon-based IGBTs—combined with cost-effectiveness and mature supply chains—will secure its position in a broad range of high-power applications. Market growth will be underpinned by global decarbonization efforts and the relentless demand for efficient power conversion.

Common Pitfalls When Sourcing IGBT Modules (Quality, IP)

Sourcing Insulated Gate Bipolar Transistor (IGBT) modules involves significant technical and legal considerations, particularly concerning quality assurance and intellectual property (IP) protection. Falling into common pitfalls can lead to performance failures, supply chain disruptions, or legal liabilities. Below are key risks to avoid:

Quality-Related Pitfalls

1. Selecting Non-Certified or Counterfeit Modules

One of the most critical risks is sourcing from suppliers offering uncertified or counterfeit IGBT modules. These may appear identical to genuine parts but fail under operational stress due to substandard materials or manufacturing. Always verify certifications such as ISO 9001, IATF 16949 (for automotive), and compliance with standards like UL, CE, or AEC-Q101.

2. Inadequate Thermal and Electrical Performance Validation

IGBT modules must meet specific thermal resistance, current rating, and switching speed requirements. Sourcing without thorough validation—such as reviewing datasheets, test reports, or conducting sample testing—can result in premature failure or system inefficiency. Ensure supplier data matches your application’s operating conditions.

3. Poor Packaging and Handling Leading to Damage

IGBTs are sensitive to electrostatic discharge (ESD) and mechanical stress. Modules shipped without proper ESD-safe packaging or mishandled during transit may suffer latent damage, reducing reliability. Confirm the supplier adheres to industry-standard handling and packaging protocols.

4. Inconsistent Batch Quality from Low-Cost Suppliers

Some suppliers, particularly in less-regulated markets, may offer attractive pricing but lack consistent quality control. Variability between production batches can lead to field failures. Request batch test reports and consider third-party audits or incoming inspections.

Intellectual Property (IP)-Related Pitfalls

1. Sourcing from Suppliers with Unclear IP Ownership

Using IGBT modules manufactured by companies with questionable IP origins—such as clones or reverse-engineered designs—exposes your business to legal risk. Infringing on patented semiconductor technologies can lead to lawsuits, product recalls, or import bans. Always source from reputable manufacturers with transparent IP portfolios (e.g., Infineon, Mitsubishi, Fuji, Semikron).

2. Lack of Traceability and Documentation

Reputable suppliers provide full traceability, including lot numbers, manufacturing dates, and compliance documentation. Absence of such records may indicate gray-market or stolen goods, increasing IP and compliance risks. Demand complete documentation as part of procurement agreements.

3. Unauthorized Distribution Channels

Purchasing from unauthorized distributors increases the risk of counterfeit or re-marked parts. These suppliers may not have legal rights to distribute the modules, potentially violating the original manufacturer’s IP. Always buy through authorized channels or certified franchise distributors.

4. Insufficient Legal Protections in Contracts

Procurement contracts that lack IP indemnification clauses leave buyers exposed. Ensure agreements include warranties that the products do not infringe third-party IP and that the supplier assumes liability for IP violations.

Conclusion

To mitigate these pitfalls, perform due diligence on suppliers, prioritize certified and authorized partners, and implement technical validation and legal safeguards. Investing time upfront in vetting IGBT module sources protects product reliability, brand reputation, and intellectual property integrity.

Logistics & Compliance Guide for IGBT Modules

IGBT (Insulated Gate Bipolar Transistor) modules are critical components in power electronics, used in applications such as electric vehicles, renewable energy systems, industrial motor drives, and rail traction. Due to their high value, sensitivity, and potential regulatory implications, proper logistics and compliance procedures are essential throughout the supply chain.

Packaging and Handling

IGBT modules are sensitive to electrostatic discharge (ESD), mechanical stress, moisture, and temperature extremes. Proper packaging and handling are critical to prevent damage.

- ESD Protection: Always use ESD-safe packaging (e.g., conductive foam, shielding bags) and handle modules in ESD-protected areas with grounding straps.

- Mechanical Protection: Use rigid packaging with cushioning materials to prevent shock and vibration during transit.

- Moisture Sensitivity: Many IGBT modules are moisture-sensitive devices (MSD). Follow the manufacturer’s Moisture Sensitivity Level (MSL) guidelines, including use of desiccant and humidity indicator cards. Seal in dry bags with appropriate labeling if required.

- Labeling: Clearly mark packages as “ESD Sensitive,” “Fragile,” and include handling instructions (e.g., “Do Not Drop,” “Keep Dry”).

Storage Conditions

IGBT modules must be stored under controlled environmental conditions to preserve performance and reliability.

- Temperature: Store between 5°C and 35°C unless otherwise specified by the manufacturer. Avoid condensation.

- Humidity: Maintain relative humidity below 60%. For moisture-sensitive devices, storage in dry cabinets or nitrogen-purged environments is recommended.

- Shelf Life: Observe manufacturer-recommended shelf life. For MSD-labeled devices, track floor life and re-bake if exposed beyond MSL limits.

Transportation Requirements

Ensure safe and compliant transit through all modes (air, sea, road).

- Climate-Controlled Transport: Use temperature- and humidity-controlled vehicles or containers when possible, especially for long-distance or international shipments.

- Shock and Vibration Mitigation: Use pallets with secure strapping and shock-monitoring devices for high-value shipments.

- Documentation: Include packing lists, commercial invoices, and material safety data sheets (MSDS/SDS) as needed.

Export Compliance

IGBT modules may be subject to export control regulations due to their use in defense, aerospace, or advanced technology applications.

- Export Classification: Determine the Export Control Classification Number (ECCN) based on technical specifications. Common classifications may fall under ECCN 3A001 or 3A002 (related to electronic assemblies and power semiconductors).

- Licensing Requirements: Check if export licenses are required based on destination country, end-user, and end-use. Countries under U.S. or EU sanctions may require special authorization.

- EAR and ITAR Compliance: Confirm whether modules fall under the U.S. Export Administration Regulations (EAR) or International Traffic in Arms Regulations (ITAR). Most commercial IGBTs are EAR-controlled.

- Deemed Exports: Be aware that sharing technical data with foreign nationals within your country may constitute a “deemed export” and require a license.

Import Regulations

Importing IGBT modules may involve customs duties, import licenses, and conformity assessments.

- HS Code Classification: Use the correct Harmonized System (HS) code. IGBT modules typically fall under 8541.40 or 8542.31 depending on configuration.

- Duties and Taxes: Verify applicable tariffs, VAT, and import fees based on destination country.

- Conformity Marking: Ensure modules comply with local standards (e.g., CE in Europe, CCC in China, KC in South Korea). Retain certificates of conformity (CoC) and test reports.

- Restricted Substances: Confirm compliance with RoHS, REACH (EU), and China RoHS. Provide necessary declarations.

Safety and Environmental Compliance

IGBT modules must meet environmental and safety standards globally.

- RoHS Compliance: Ensure modules are free of restricted substances (e.g., lead, cadmium, mercury) unless exempted.

- REACH: Declare substances of very high concern (SVHC) if present above thresholds.

- WEEE: For products placed on the EU market, ensure compliance with Waste Electrical and Electronic Equipment directives, including proper labeling and take-back obligations.

Quality and Traceability

Maintain full traceability and quality assurance throughout logistics.

- Lot/Batch Tracking: Record and track lot numbers, manufacturing dates, and supplier information for each module.

- Documentation Retention: Retain compliance documents (CoC, test reports, ECCN classification) for at least 5 years or as required by regulation.

- Audits and Inspections: Be prepared for customs inspections, quality audits, or compliance reviews by regulatory bodies.

Emergency Procedures

- Damage or Loss: Report any damage, loss, or theft immediately to carrier and insurer. Document condition upon receipt.

- Non-Compliance Discovery: If a compliance issue is identified (e.g., incorrect export classification), cease shipment and consult legal or compliance officers.

Adhering to this logistics and compliance guide ensures the safe, legal, and efficient movement of IGBT modules across global supply chains while minimizing risks and regulatory penalties. Always consult the manufacturer’s datasheets and your organization’s compliance team for specific product and jurisdictional requirements.

Conclusion for Sourcing IGBT Modules

Sourcing IGBT (Insulated Gate Bipolar Transistor) modules requires a strategic approach that balances technical specifications, supplier reliability, cost efficiency, and long-term supply chain stability. After thorough evaluation, it is evident that selecting the right IGBT module involves more than just comparing datasheets—key factors such as voltage and current ratings, thermal performance, switching speed, packaging, and application suitability must align with the system requirements.

Working with reputable manufacturers such as Infineon, Mitsubishi Electric, Fuji Electric, and SEMIKRON ensures high-quality, reliable components with strong technical support. However, cost-effective alternatives from emerging suppliers can be viable, provided they meet rigorous qualification and testing standards.

Additionally, establishing long-term partnerships with trusted distributors or direct suppliers helps mitigate risks related to lead times, counterfeit parts, and supply disruptions. Evaluating total cost of ownership—not just initial purchase price—enables better decision-making, especially in high-volume or mission-critical applications such as electric vehicles, renewable energy systems, and industrial motor drives.

In conclusion, a successful IGBT module sourcing strategy combines technical diligence, supplier vetting, and supply chain resilience to ensure optimal performance, reliability, and cost-effectiveness across the product lifecycle. Regular market reviews and staying updated on technological advancements will further enhance sourcing efficiency and competitiveness.