The global automotive oil filter market is experiencing steady growth, driven by increasing vehicle production, rising after-sales maintenance demand, and stricter emission regulations. According to Mordor Intelligence, the oil filter market was valued at USD 6.83 billion in 2023 and is projected to reach USD 8.93 billion by 2029, growing at a CAGR of 4.6% during the forecast period. Hyundai, as one of the world’s leading automotive manufacturers, contributes significantly to this demand, requiring a robust supply chain of high-quality oil filters that meet original equipment (OE) standards. This has catalyzed the growth of specialized manufacturers capable of delivering performance-driven, compatible filtration solutions. In response, a select group of eight manufacturers have emerged as top suppliers, combining advanced filtration technology, scale of production, and strong OEM partnerships to support Hyundai vehicles worldwide. These companies are not only meeting current market needs but are also investing in R&D to align with evolving engine technologies and sustainability goals in the automotive sector.

Top 8 Hyundai Oil Filter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Who makes Hyundai oil filters?

Domain Est. 2013

Website: rickcasehyundairoswell.com

Key Highlights: Manufactured by the parts and service arm of the Hyundai Motor Company, Hyundai Mobis, OEM Hyundai oil filters are made in-house by the Hyundai brand….

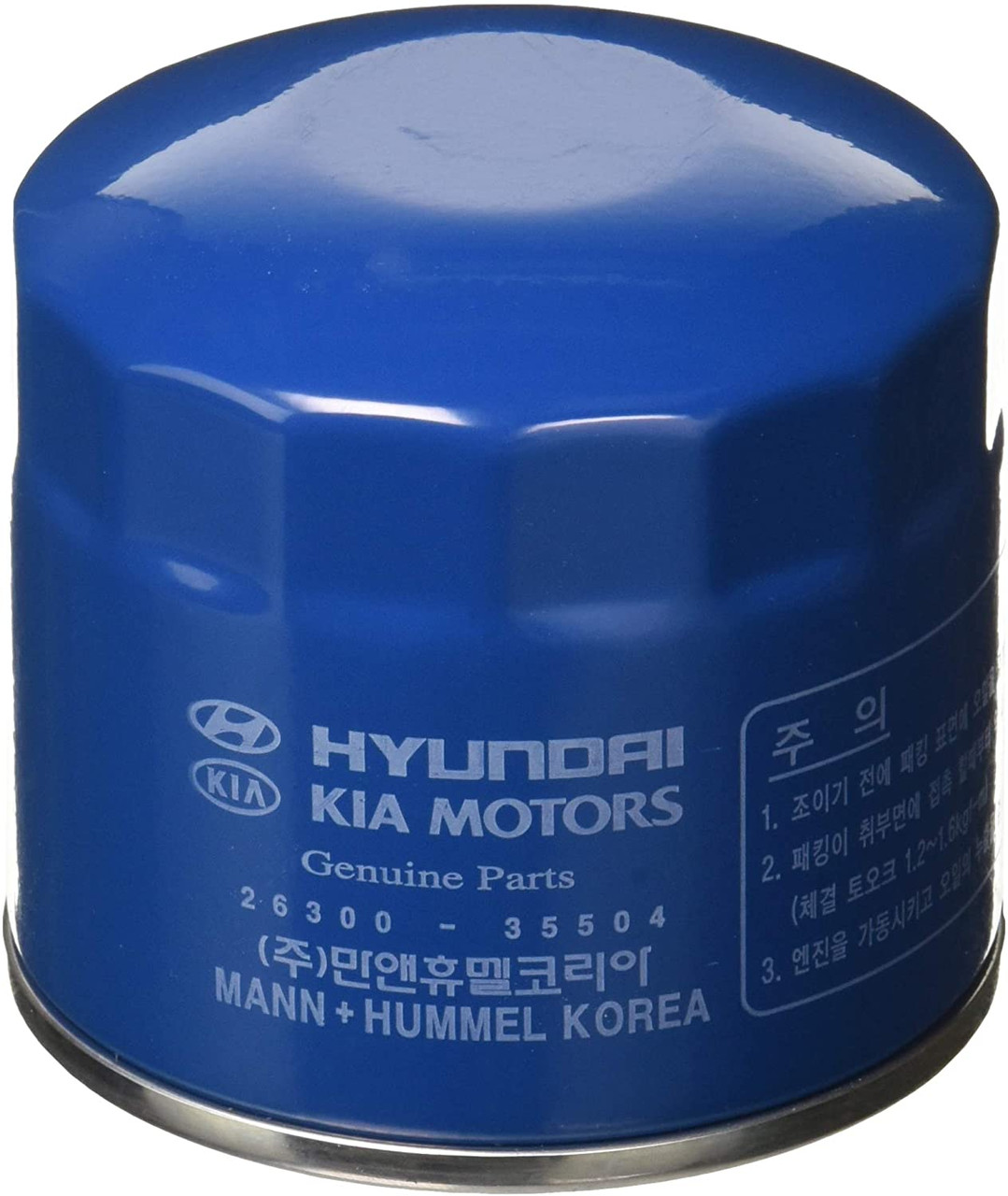

#2 1986-2025 Hyundai Oil Filter 26300-35505

Domain Est. 2015

Website: hyundai.oempartsonline.com

Key Highlights: Rating 4.5 (37) · 3–6 day deliveryThis OEM Hyundai engine oil filter, part number 26300-35505, captures and contains impurities and other contaminants in motor oil….

#3 Recommended Maintenance Schedules

Domain Est. 1997

Website: hyundaiusa.com

Key Highlights: Hyundai Motor America provides the Maintenance Menu for all 2000 and later model year vehicles….

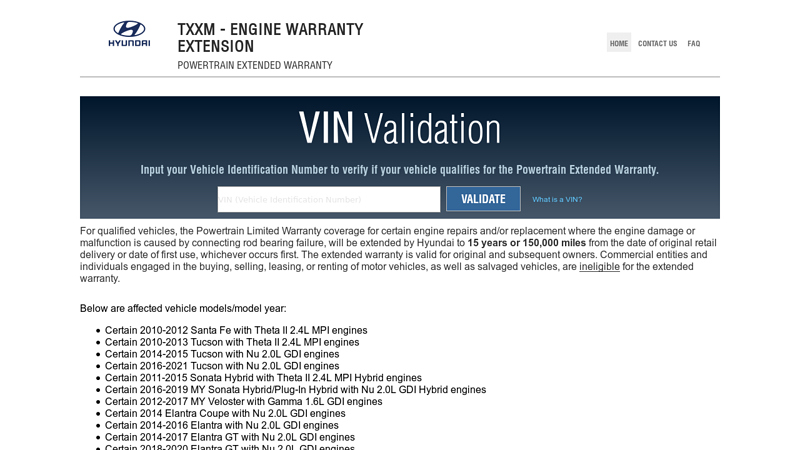

#4 powertrain extended warranty

Domain Est. 1997

Website: autoservice.hyundaiusa.com

Key Highlights: For the vehicles listed above, the engine oil and oil filter should be replaced at least every 7,500 miles and every 12 months under normal usage. Owners ……

#5 The benefits of getting oil changes on time.

Domain Est. 1997

Website: service.hyundaiusa.com

Key Highlights: Here you will find Hyundai oil change services, with Hyundai Genuine parts, Hyundai oil filter replacement as part of the Hyundai USA service & maintenance ……

#6 Is oil filter special?

Domain Est. 2004

Website: hyundai-forums.com

Key Highlights: The Hyundai filters are good quality and inexpensive (if you buy online) so I would at least run one until the car was out of the warranty period….

#7 Hyundai Oil Filter

Domain Est. 2009

Website: hyundaishop.com

Key Highlights: In stock Rating 5.0 (2) Constructed from high-quality materials, the Hyundai Oil Filter features a durable housing and a filtration media that effectively traps dirt, metal parti…

#8 The Best Hyundai Oil Filters For Sale

Domain Est. 2017

Expert Sourcing Insights for Hyundai Oil Filter

H2: Analysis of 2026 Market Trends for Hyundai Oil Filters

As the global automotive industry evolves toward electrification, sustainability, and advanced maintenance technologies, the market for automotive aftermarket components such as oil filters is undergoing significant transformation. Hyundai, a major player in both vehicle manufacturing and parts distribution, is well-positioned to adapt its oil filter business to meet emerging demands by 2026. Below is an analysis of key market trends influencing Hyundai oil filters in 2026, with a focus on technological innovation, market dynamics, regulatory changes, and consumer behavior.

1. Decline in Internal Combustion Engine (ICE) Vehicles and Impact on Oil Filter Demand

- Trend: Global adoption of electric vehicles (EVs) continues to accelerate, driven by government mandates (e.g., EU ICE phase-out by 2035), consumer demand, and automaker electrification strategies.

- Impact on Hyundai Oil Filters: As EVs require no traditional oil changes, the long-term demand for oil filters is expected to decline in regions with high EV penetration (e.g., Western Europe, China).

- Outlook: However, ICE vehicles will still dominate parts of the global fleet through 2026, especially in emerging markets (Southeast Asia, Africa, Latin America), sustaining a robust aftermarket for oil filters. Hyundai can leverage its strong presence in these regions to maintain market share.

2. Growth in the Automotive Aftermarket and OEM Trust

- Trend: The global automotive aftermarket is projected to grow at a CAGR of ~4.5% through 2026, driven by aging vehicle fleets and increased vehicle longevity.

- Impact on Hyundai Oil Filters: Hyundai OEM oil filters benefit from consumer trust in brand reliability and compatibility. Many vehicle owners prefer genuine parts for performance and warranty reasons.

- Opportunity: Hyundai can strengthen its aftermarket distribution through partnerships with auto parts retailers, e-commerce platforms (e.g., Amazon, CarParts.com), and service networks to capture a larger share of the $500+ billion global aftermarket.

3. Advancements in Filter Technology and Material Science

- Trend: Increasing demand for high-efficiency, long-life oil filters due to extended oil change intervals (up to 15,000–20,000 miles in modern ICE vehicles).

- Impact on Hyundai Oil Filters: Hyundai is investing in synthetic media, multi-layer filtration, and anti-drain back valves to improve performance. By 2026, smart filters with embedded sensors (to monitor oil condition) may begin to emerge.

- Strategic Move: Hyundai can differentiate its filters through superior filtration efficiency, durability, and compatibility with low-viscosity synthetic oils used in turbocharged and hybrid engines.

4. Sustainability and Circular Economy Pressures

- Trend: Regulatory and consumer pressure is rising for environmentally responsible manufacturing and disposal practices.

- Impact on Hyundai Oil Filters: Traditional oil filters contribute to metal waste and oil contamination. By 2026, recyclable or biodegradable filter materials may gain traction.

- Opportunity: Hyundai can introduce eco-friendly oil filters using recyclable steel casings and bio-based filter media, aligning with its broader sustainability goals and appealing to environmentally conscious consumers.

5. Rise of Hybrid Vehicles and Mixed Powertrains

- Trend: Hybrid vehicles (e.g., Hyundai’s own Sonata Hybrid, Tucson Hybrid) are expected to grow faster than pure EVs in some markets through 2026, particularly where charging infrastructure is limited.

- Impact on Hyundai Oil Filters: Hybrids still require oil changes (albeit less frequently), creating ongoing demand for high-quality filters optimized for stop-start engine cycles and thermal stress.

- Strategic Advantage: Hyundai can offer hybrid-specific oil filters engineered for durability under frequent thermal cycling, enhancing brand loyalty among hybrid vehicle owners.

6. Digitalization and Predictive Maintenance Integration

- Trend: Connected vehicles and AI-driven maintenance platforms are enabling predictive servicing.

- Impact on Hyundai Oil Filters: While oil filters themselves are passive components, integration with Hyundai’s vehicle health monitoring systems (e.g., Hyundai Mobility App) can prompt timely filter replacements.

- Future Outlook: Hyundai could develop “smart” service kits bundled with oil and filters, triggered by real-time engine data, improving customer retention and aftermarket revenue.

Conclusion

By 2026, the market for Hyundai oil filters will be shaped by the tension between declining ICE vehicle sales and sustained demand in the global aftermarket. While long-term challenges from electrification loom, Hyundai can maintain relevance by:

- Targeting high-growth emerging markets with ICE vehicles.

- Innovating in filter technology and sustainability.

- Leveraging its OEM reputation and hybrid vehicle leadership.

- Expanding digital and e-commerce distribution channels.

Hyundai’s integrated approach—balancing legacy ICE support with forward-looking sustainability and digital strategies—will be critical to sustaining its oil filter business through 2026 and beyond.

Common Pitfalls Sourcing Hyundai Oil Filters (Quality, IP)

Sourcing genuine or high-quality Hyundai oil filters requires vigilance to avoid several common pitfalls related to product quality and intellectual property (IP) concerns. Being aware of these risks helps ensure vehicle performance, longevity, and legal compliance.

Counterfeit and Substandard Products

One of the most significant risks when sourcing Hyundai oil filters is encountering counterfeit or substandard parts. These filters often mimic genuine Hyundai packaging and branding but fail to meet original equipment (OE) specifications. Using such filters can lead to inadequate oil flow, poor contaminant capture, and premature engine wear. Common indicators include unusually low prices, inconsistent labeling, and poor packaging quality. These filters may lack proper filtration media, anti-drain back valves, or pressure relief mechanisms, compromising engine protection.

Intellectual Property Infringement

Sourcing non-OEM filters marketed as “compatible” or “direct replacement” for Hyundai vehicles can inadvertently involve intellectual property risks. While functional equivalents are generally permissible under patent law after expiration, some third-party manufacturers may copy protected design elements, logos, or trademarks associated with genuine Hyundai parts. Distributors or resellers using Hyundai’s branding without authorization may face legal challenges for trademark infringement, even if the product itself is not counterfeit.

Inconsistent Quality from Aftermarket Suppliers

Even legitimate aftermarket suppliers vary widely in quality control. Some brands may claim OEM-equivalent performance but lack certification or testing data. Filters from unverified manufacturers may use inferior materials that degrade quickly or fail under high temperatures and pressures. Without certifications such as ISO 9001 or compliance with industry standards (e.g., SAE or ISO 4548), there is no reliable assurance of performance or durability.

Lack of Traceability and Documentation

Reputable sourcing requires full traceability, including batch numbers, manufacturing dates, and supplier credentials. Many low-cost suppliers, especially through online marketplaces, provide little to no documentation. This lack of transparency makes it difficult to verify authenticity, confirm quality standards, or respond to recalls. For fleet operators or repair shops, this also poses liability risks in case of engine damage linked to faulty filters.

Misleading Marketing and Compatibility Claims

Some suppliers exaggerate compatibility or performance claims, advertising filters as “OEM-grade” or “factory-approved” without evidence. Genuine Hyundai oil filters are produced under strict quality controls, and only parts distributed through authorized channels can be guaranteed as authentic. Third-party claims of equivalence should be scrutinized and supported by independent testing or certification.

Supply Chain Vulnerabilities

Global supply chains increase exposure to gray market goods—filters manufactured legally but sold outside authorized distribution networks. These products may have been diverted, stored improperly, or expired, affecting performance. Sourcing through unauthorized distributors heightens the risk of receiving outdated or damaged inventory, especially in regions with weak regulatory oversight.

Conclusion

To mitigate these pitfalls, buyers should source Hyundai oil filters through authorized dealers, certified distributors, or reputable suppliers with verifiable credentials. Always request product documentation, verify certifications, and avoid offers that seem too good to be true. Protecting against IP risks and ensuring quality safeguards both engine integrity and legal compliance.

Logistics & Compliance Guide for Hyundai Oil Filter

This guide outlines the essential logistics and compliance considerations for the handling, transportation, storage, and regulatory adherence related to Hyundai Oil Filters. It is designed to ensure product integrity, timely delivery, and full compliance with applicable laws and standards.

Product Specifications and Handling

Hyundai Oil Filters are precision-engineered components designed to meet strict OEM specifications. Proper handling is critical to maintain performance and avoid contamination.

- Packaging: Filters are shipped in sealed, protective packaging to prevent exposure to dust, moisture, and physical damage. Packaging is designed to meet ISO and ISTA standards for transit safety.

- Handling Instructions: Avoid dropping or crushing packages. Use appropriate lifting equipment for bulk shipments. Always handle with clean gloves to prevent oil or debris transfer to sealing surfaces.

- Storage Conditions: Store in a dry, temperature-controlled environment (10°C to 35°C). Keep away from direct sunlight, extreme heat, or freezing conditions. Stack pallets no higher than recommended (typically 3–4 layers) to avoid crushing.

Transportation and Distribution

Efficient and secure transportation ensures filters arrive in optimal condition.

- Mode of Transport: Suitable for road, sea, and air freight. Choose non-hazardous classification (UN3082, Environmentally Hazardous Substance, liquid, n.o.s., Class 9 – if applicable due to residual oil).

- Labeling Requirements: Packages must display:

- Product name and part number

- Batch/lot number

- “Fragile” and “This Way Up” indicators

- Hyundai OEM branding and barcode

- Compliance marks (e.g., ISO, KTL, or manufacturer certifications)

- Palletization: Use standard EUR/ISO pallets. Secure loads with stretch wrap and corner boards. Include a packing slip and shipping manifest with each shipment.

Regulatory Compliance

Hyundai Oil Filters must comply with both international and local regulatory frameworks.

- Environmental Regulations:

- REACH (EU): Compliant with SVHC (Substances of Very High Concern) guidelines. No restricted substances above threshold limits.

- RoHS (EU/UK): Free of lead, mercury, cadmium, and other hazardous substances.

- EPA (USA): Compliant with TSCA; no intentionally added PFAS unless declared.

- Waste Management: Filters are classified as automotive waste post-use. Follow local regulations for used oil filter disposal (e.g., draining oil before recycling in accordance with RCRA in the U.S.).

- Country-Specific Requirements:

- USA: DOT and EPA regulations apply during transport and disposal.

- EU: Must comply with End-of-Life Vehicles (ELV) Directive and proper WEEE labeling if applicable.

- South Korea: KTL or KC certification may be required for domestic distribution.

Import/Export Documentation

Ensure smooth cross-border movement with accurate documentation.

- Required documents include:

- Commercial Invoice (with HS Code: 8421.23.00 – Oil Filters for Internal Combustion Engines)

- Packing List

- Certificate of Origin (preferably Form EUR.1 or ATR for EU trade)

- Bill of Lading or Air Waybill

- Material Safety Data Sheet (MSDS), if requested (due to trace oil content)

- Customs Clearance: Declare filters under correct tariff classification. Provide proof of compliance with destination country’s automotive part standards (e.g., SAE, DIN, or KSM specifications).

Quality Assurance and Traceability

Maintain product integrity through rigorous tracking and quality control.

- Batch Traceability: Each filter is marked with a unique batch/lot number. Records must be retained for a minimum of 7 years for warranty and recall purposes.

- Quality Audits: Conduct regular audits of logistics partners for compliance with handling and storage standards.

- Recall Preparedness: Establish a product recall protocol aligned with Hyundai Motor Group’s global standards in case of non-conformity.

Sustainability and Reverse Logistics

Support environmental responsibility throughout the product lifecycle.

- Recycling Programs: Partner with certified recyclers for used oil filters. Promote take-back programs where feasible.

- Packaging Sustainability: Use recyclable cardboard and minimal plastic. Encourage returnable packaging solutions for high-volume distributors.

- Carbon Footprint: Optimize shipping routes and consolidate loads to reduce emissions. Monitor via logistics KPIs.

By adhering to this guide, stakeholders ensure the safe, compliant, and efficient distribution of Hyundai Oil Filters, maintaining brand integrity and customer trust.

Conclusion on Sourcing Hyundai Oil Filters

In conclusion, sourcing genuine or high-quality Hyundai oil filters is essential for maintaining the performance, reliability, and longevity of Hyundai vehicles. While original equipment manufacturer (OEM) filters from authorized Hyundai dealers ensure optimal compatibility and adherence to manufacturer standards, aftermarket alternatives from reputable brands can also provide cost-effective and reliable options when they meet OEM specifications.

Key considerations when sourcing Hyundai oil filters include ensuring proper fitment, verifying filtration efficiency, checking for compliance with industry standards (such as ISO 4548), and evaluating warranty and availability. Purchasing from trusted suppliers—whether online or in-store—helps avoid counterfeit products and supports vehicle warranty requirements.

Ultimately, balancing cost, quality, and authenticity will lead to informed sourcing decisions, contributing to better engine health and reduced maintenance costs over time. For optimal results, always refer to the vehicle’s owner manual and consult with certified technicians when in doubt.