The global hydrographic water transfer printing market is experiencing robust growth, driven by rising demand for customized surface finishes across automotive, consumer electronics, and industrial design sectors. According to a 2023 report by Mordor Intelligence, the market is projected to grow at a CAGR of over 8.5% from 2023 to 2028, reaching an estimated value of USD 550 million by the end of the forecast period. This expansion is fueled by advancements in activator chemistry, increasing adoption of decorative films, and growing consumer preference for unique, high-quality finishes. As a critical component in the hydrographic printing process, water transfer activators play a pivotal role in film dissolution, pattern adhesion, and finish durability—making the manufacturers of these formulations key enablers of innovation and scalability. With market competition intensifying, a select group of producers are leading the charge through superior product performance, environmental compliance, and technical support. Below is a data-driven overview of the top 8 hydrographic water transfer activator manufacturers shaping the industry’s future.

Top 8 Hydrographic Water Transfer Activator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Water Transfer Printing Solutions & Hydro Dip Films

Domain Est. 2000

Website: yht.com.tw

Key Highlights: YHT is a leading Water Transfer Printing manufacturer offering complete solutions: 1000+ hydro dip films, dipping machines, and global support….

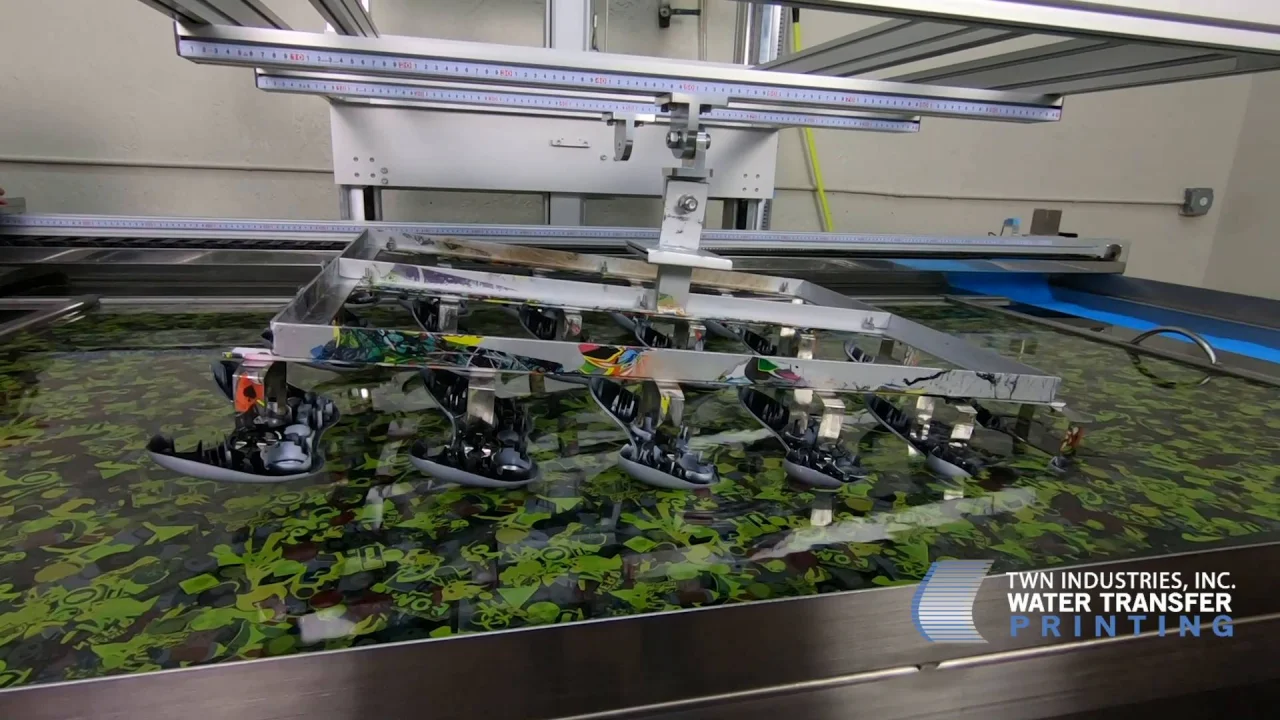

#2 Technology Process Videos

Domain Est. 2018

Website: sage1988.com

Key Highlights: Technology Process · Hydro Dipping Tank – Spray Activator after Putting the Film on the Water Surface. Technology Process. 2024-07-17. Hydro Dipping Tank – Spray ……

#3 Hydrographics Activator – Hydro Dipping Activators for Pros

Domain Est. 2002

Website: watertransferprinting.com

Key Highlights: 4-day deliveryTWN’s hydrographics activators create flawless film activation and improve color retention and ink elasticity. Trusted by industry professionals….

#4 Hydro Dip Film Activator

Domain Est. 2007

Website: hydrodip.com

Key Highlights: 2–3 day delivery 14-day returnsEnhance your water transfer printing projects with our hydrographic film activator. Explore a range of activators for hydro-dipping at Hydro-Dip….

#5 Liquid Print: Hydrographic film

Domain Est. 2008

Website: liquidprintone.com

Key Highlights: Liquid Print provides hydrographic films and activators for manual, semi-automatic and fully automatic water transfer printing systems….

#6 AquaGraphix

Domain Est. 2012

Website: aquagraphix.co.uk

Key Highlights: The UK’s Leading Hydrographics Company – Film & Activator Supplies – Water Transfer Printing – Hydrographics Services…

#7 Hydrographic Activator

Domain Est. 2013

Website: tsautop.com

Key Highlights: Tsautop can supply hydrographic activator for all starter of hydro dipping,we have two types activator A and B,activator A for blank hydrographic film, ……

#8 Dip Pros Hydrographic Film Paint Tank Supply Company

Domain Est. 2017

Website: dippros.com

Key Highlights: Hydrographic Dip Tanks , Hydrographic Films by True Timber Camo / Vail Camo and US Paint and Dip Bite also Dip Demon Dip Wizard Dip Kits….

Expert Sourcing Insights for Hydrographic Water Transfer Activator

H2: Emerging Market Trends for Hydrographic Water Transfer Activator (2026 Outlook)

As the global market for hydrographic (or water transfer) printing continues to expand, the demand for high-performance hydrographic water transfer activators is expected to grow significantly by 2026. These activators—specialized solvents that dissolve the film’s base layer, enabling precise pattern transfer onto 3D substrates—are critical to the success of the immersion printing process. Several key trends are shaping the market landscape for these activators in the lead-up to 2026:

-

Increased Industrial Adoption Across Automotive and Consumer Goods Sectors

The automotive industry remains a dominant driver, with rising demand for custom interior and exterior components such as dashboards, trim pieces, and wheel covers. By 2026, hydrographic printing is projected to gain further traction in electric vehicle (EV) production, where customizable, lightweight, and aesthetically appealing surfaces are prioritized. Similarly, consumer electronics (e.g., gaming peripherals, smartphone accessories) and home appliances are adopting hydrographic printing for product differentiation, directly increasing demand for reliable activators. -

Shift Toward Environmentally Sustainable and Low-VOC Formulations

Environmental regulations, particularly in North America and the European Union, are pushing manufacturers to reformulate activators with lower volatile organic compound (VOC) content. By 2026, water-based or bio-solvent activators are expected to capture a growing market share as companies seek compliance with REACH, EPA standards, and green manufacturing certifications. This trend is also being driven by corporate sustainability goals and consumer preference for eco-friendly products. -

Advancements in Activator Performance and Application Efficiency

Innovations in activator chemistry are enhancing transfer accuracy, reducing film wrinkling, and improving adhesion on complex geometries. Next-generation activators with optimized evaporation rates and broader compatibility with diverse film types (e.g., camouflage, carbon fiber, wood grain) are being developed. Automated spray systems and precision dispensing technologies are also being integrated into production lines, improving consistency and reducing waste—key factors in large-scale industrial applications. -

Growth in Emerging Markets and Regional Manufacturing Hubs

Asia-Pacific, particularly China, India, and Southeast Asia, is expected to lead market growth due to expanding manufacturing capabilities and rising disposable incomes. Localized production of activators is increasing to reduce import dependencies and logistical costs. Latin America and parts of Africa are also witnessing growing adoption in automotive aftermarket and artisanal manufacturing, creating new distribution opportunities. -

Consolidation and Strategic Partnerships Among Suppliers

The activator market is seeing consolidation as major chemical companies acquire niche hydrographic solution providers to expand their specialty coatings portfolios. Strategic partnerships between activator manufacturers and film producers are enabling bundled product offerings, technical support, and training programs—enhancing customer retention and market penetration. -

Digitalization and Customization Driving Demand

The rise of digital design tools and on-demand manufacturing platforms enables rapid prototyping and small-batch customization. This trend supports the use of hydrographic printing for personalized products, from sports equipment to luxury goods. High-quality activators that ensure flawless transfers are essential in maintaining print fidelity, thereby reinforcing their value in the supply chain.

In summary, by 2026, the hydrographic water transfer activator market is poised for robust growth, driven by industrial innovation, regulatory shifts, and expanding applications. Success will depend on suppliers’ ability to deliver environmentally compliant, high-performance products while adapting to regional demand dynamics and technological advancements in the broader hydrographic printing ecosystem.

H2: Common Pitfalls When Sourcing Hydrographic Water Transfer Activator (Quality and Intellectual Property Risks)

Sourcing Hydrographic Water Transfer Activator—a specialized chemical solution used in hydrographic (or water transfer) printing to dissolve film binders and activate ink for adhesion to substrates—can be fraught with quality and intellectual property (IP) challenges. Organizations must navigate these pitfalls carefully to ensure process reliability, product performance, and legal compliance.

1. Inconsistent Chemical Composition and Performance (Quality Pitfall)

Many suppliers, especially low-cost manufacturers, offer activators with variable formulations. These inconsistencies can lead to:

– Incomplete film activation, resulting in ink smudging or poor adhesion.

– Over-activation, causing ink to disperse or blur on the water surface.

– Short pot life or sensitivity to environmental conditions (temperature, humidity).

Impact: Poor-quality activators compromise print fidelity, increase rework rates, and reduce throughput in production environments.

2. Lack of Technical Documentation and Traceability

Reputable activators are backed by technical data sheets (TDS), safety data sheets (SDS), batch traceability, and performance testing. Many generic or unbranded suppliers fail to provide these, leaving buyers without critical information for process control or regulatory compliance.

Impact: Inability to troubleshoot issues, validate repeatability, or meet industry standards (e.g., ISO, REACH, RoHS).

3. Counterfeit or Misbranded Products (IP Infringement)

The hydrographic printing market sees widespread counterfeiting of well-known branded activators (e.g.,假冒品牌). These knock-offs often mimic packaging and labeling but use inferior or altered formulas.

IP Risks:

– Purchasers may inadvertently support trademark infringement.

– Use of counterfeit chemicals can void equipment warranties or violate compliance agreements.

– Legal exposure if IP-infringing products are distributed further.

4. Unverified Supplier Claims and Specifications

Some suppliers advertise “compatible with Brand X” or “meets OEM specifications” without independent verification. Without third-party testing or certification, such claims may be misleading.

Impact: False expectations about performance lead to production failures and wasted resources.

5. Absence of IP Protection in Custom Formulations

Companies developing proprietary activator blends risk IP theft when sourcing from contract manufacturers without robust legal safeguards (e.g., NDAs, IP assignment clauses, restricted access to formulations).

IP Risks:

– Formulation theft or reverse engineering by suppliers.

– Loss of competitive advantage if the activator is a differentiating factor in the printing process.

6. Regulatory Non-Compliance

Activators often contain volatile organic compounds (VOCs), solvents (e.g., toluene, butanone), or other regulated substances. Suppliers in less-regulated regions may not comply with environmental or safety regulations (e.g., EPA, EU REACH, OSHA).

Impact: Import restrictions, customs delays, workplace safety hazards, and liability exposure.

Best Practices to Mitigate Risks:

– Source from reputable, certified suppliers with verifiable quality management systems (e.g., ISO 9001).

– Require batch-specific testing reports and full SDS/TDS documentation.

– Conduct side-by-side performance testing before full-scale adoption.

– Use legal agreements to protect proprietary formulations and ensure IP ownership.

– Verify supplier compliance with international chemical regulations.

– Avoid suppliers offering unusually low prices—often a red flag for substandard or counterfeit products.

By proactively addressing quality and IP concerns, companies can ensure reliable hydrographic printing operations and protect their innovation and brand integrity.

H2: Logistics & Compliance Guide for Hydrographic Water Transfer Activator

Overview

The Hydrographic Water Transfer Activator is a chemical solution used in hydrographic (or immersion) printing to liquefy film ink and activate its bonding properties, enabling the transfer of printed patterns onto 3D surfaces. Due to its chemical composition—typically containing solvents such as toluene, methanol, or acetone—this product is subject to specific logistics and regulatory compliance requirements.

This guide outlines key considerations for the safe and compliant handling, storage, transportation, and disposal of Hydrographic Water Transfer Activator.

H2.1 Regulatory Classification & Documentation

-

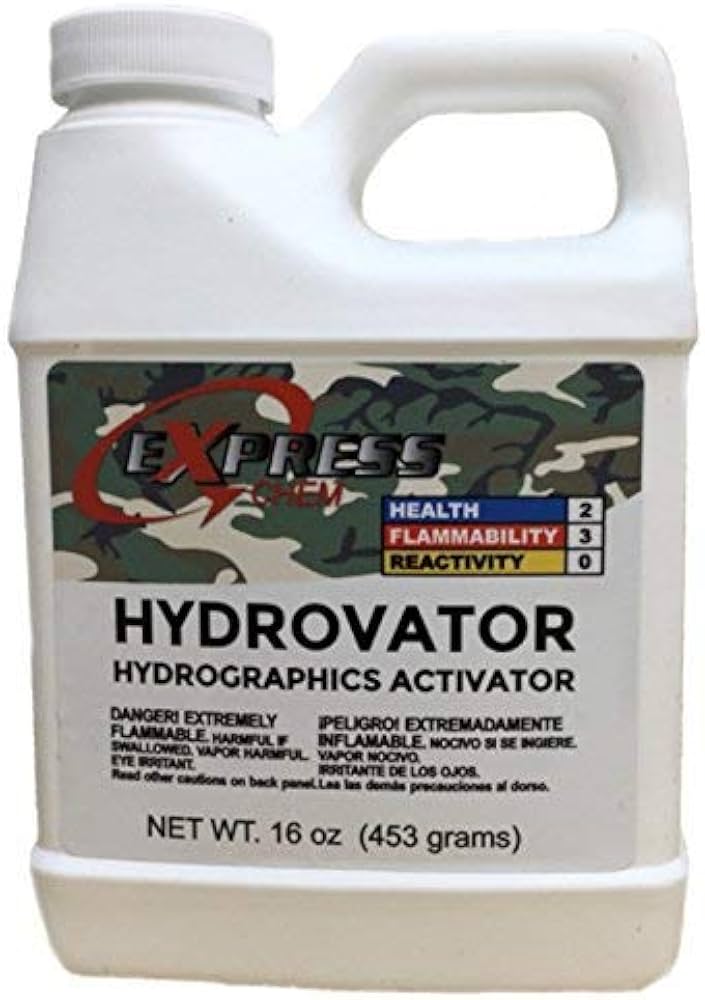

Hazard Classification:

Most activators are classified as flammable liquids (UN 1133, Class 3) under the Globally Harmonized System (GHS) and may also carry health hazard warnings due to volatile organic compounds (VOCs). -

Safety Data Sheet (SDS):

A current, GHS-compliant SDS must be available and accessible for all personnel handling the activator. The SDS provides critical information on: - Chemical composition

- Physical and health hazards

- First-aid and firefighting measures

- Handling and storage instructions

-

Regulatory requirements

-

Transport Documentation:

For domestic and international shipments, proper shipping names, UN numbers, hazard class, and packing group must be included on transport documents (e.g., Bill of Lading, Dangerous Goods Declaration).

H2.2 Packaging & Labeling

- Packaging Requirements:

- Use only UN-certified, leak-proof containers suitable for flammable liquids.

- Ensure containers are tightly sealed and protected from physical damage.

-

Inner packaging (e.g., HDPE bottles) must be placed in robust outer packaging with absorbent material.

-

Labeling:

All packages must display: - Proper shipping name and UN number (e.g., “FLAMMABLE LIQUID, N.O.S. (Hydrographic Activator), UN1993, Class 3, PG II”)

- GHS pictograms (flammable, health hazard, environmental hazard if applicable)

- Hazard statements (e.g., H225: Highly flammable liquid and vapor)

- Precautionary statements (e.g., P210: Keep away from heat/sparks/open flames)

- Supplier information and emergency contact

H2.3 Transportation & Shipping

- Domestic (e.g., U.S. DOT Regulations):

- Comply with 49 CFR for hazardous materials transportation.

- Shipments must be classified, packaged, marked, labeled, and documented accordingly.

-

Training required for personnel involved in shipping (DOT Hazmat certification).

-

International (e.g., IATA/IMDG):

- Air shipments: Follow IATA Dangerous Goods Regulations (DGR).

- Sea shipments: Comply with IMDG Code.

-

Road/rail in Europe: ADR/RID regulations apply.

-

Quantity Limits:

- Small quantities may qualify for limited quantity or excepted quantity exemptions (e.g., 1L per inner package under IATA), reducing labeling and documentation burden.

H2.4 Storage Requirements

- Storage Environment:

- Store in a well-ventilated, cool, dry area away from direct sunlight and heat sources.

- Maintain temperatures below 30°C (86°F); avoid freezing if specified by manufacturer.

-

Use flammable storage cabinets if quantities exceed local thresholds.

-

Segregation:

- Keep away from oxidizers, acids, and incompatible materials.

-

Do not store near ignition sources or electrical equipment.

-

Secondary Containment:

- Use spill trays or containment pallets to prevent environmental release in case of leakage.

H2.5 Handling & Worker Safety

- Personal Protective Equipment (PPE):

Required PPE includes: - Chemical-resistant gloves (nitrile or neoprene)

- Safety goggles or face shield

- Lab coat or apron

-

Respiratory protection (organic vapor cartridge) if ventilation is inadequate

-

Ventilation:

- Use local exhaust ventilation or fume hoods when dispensing or applying activator.

-

Ensure adequate room air exchange (minimum 10 air changes per hour).

-

Spill Response:

- Contain spill with inert absorbent material (e.g., vermiculite, spill pads).

- Do not allow entry into drains or waterways.

- Collect waste and dispose of as hazardous waste.

- Evacuate area if vapor concentration is high.

H2.6 Environmental & Disposal Compliance

- Waste Disposal:

- Spent or expired activator is typically classified as hazardous waste (e.g., D001 for ignitability).

-

Dispose through licensed hazardous waste handlers in accordance with RCRA (U.S.) or equivalent national regulations (e.g., Waste Electrical and Electronic Equipment (WEEE) or national hazardous waste codes in EU).

-

Environmental Precautions:

- Prevent release to soil, water, or sewer systems.

- Report significant spills to environmental authorities as required by law.

H2.7 Training & Emergency Preparedness

- Employee Training:

- Conduct regular training on:

- SDS review

- Safe handling and storage

- Spill response and fire safety

- Use of PPE

-

Maintain records of training completion.

-

Emergency Procedures:

- Post emergency contact numbers and spill response instructions.

- Maintain accessible spill kits and fire extinguishers (Class B rated).

- Conduct periodic drills for chemical release scenarios.

H2.8 Regulatory Compliance by Region (Summary)

| Region | Key Regulations | Notes |

|——–|——————|——-|

| United States | OSHA HazCom, EPA RCRA, DOT 49 CFR | State-specific rules may apply (e.g., CA Prop 65) |

| European Union | CLP, REACH, ADR, Seveso III | SDS must be in local language; ECHA registration may apply |

| Canada | WHMIS 2015, TDG Regulations | French/English bilingual labeling required |

| International Air | IATA DGR | Quantity limits and packaging rules strictly enforced |

H2.9 Recordkeeping & Audits

- Maintain records of:

- SDS files

- Training logs

- Shipping manifests and hazardous waste disposal receipts

- Spill/incident reports

- Conduct annual audits to ensure ongoing compliance with applicable regulations.

Conclusion

Proper logistics and compliance management for Hydrographic Water Transfer Activator minimizes risk to personnel, ensures regulatory adherence, and supports environmental protection. Always consult the product-specific SDS and local regulatory authorities for the most accurate requirements.

Conclusion:

Sourcing a hydrographic water transfer activator requires careful consideration of several key factors, including chemical composition, activation performance, environmental and safety compliance, and supplier reliability. A high-quality activator is essential for achieving precise film dissolution, optimal ink transfer, and durable finishes in hydrographic immersion printing processes. Evaluating activators based on evaporation rate, compatibility with various inks and substrates, and consistency in performance ensures superior end results.

Additionally, selecting a responsible supplier that adheres to regulatory standards (such as VOC compliance and safe handling practices) supports both operational efficiency and environmental sustainability. In conclusion, a well-researched sourcing strategy focusing on product quality, technical support, and regulatory compliance will significantly enhance the success and scalability of hydrographic printing operations.