The global hydraulic pressure pump market is experiencing robust growth, driven by rising demand across industrial, construction, agricultural, and manufacturing sectors. According to Grand View Research, the global hydraulic pumps market was valued at USD 9.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. This expansion is fueled by increasing automation, advancements in mobile and industrial machinery, and the need for energy-efficient fluid power systems. Additionally, Mordor Intelligence forecasts continued market momentum, citing infrastructure development and heightened adoption of hydraulic systems in emerging economies as key growth accelerators. In this competitive landscape, a select group of manufacturers have emerged as leaders, combining innovation, reliability, and global reach to dominate the industry. The following list highlights the top 9 hydraulic pressure pump manufacturers shaping the future of fluid power technology.

Top 9 Hydraulic Pressure Pump Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High

Domain Est. 1995

Website: oilgear.com

Key Highlights: Oilgear is a leading manufacturer of high-performance pumps, valves, and rotary actuators, offering comprehensive services, training, and test equipment….

#2 Pumps

Domain Est. 1995

Website: danfoss.com

Key Highlights: Danfoss Power Solutions offers a wide range of hydraulic pumps for mobile and industrial applications including hydrostatic, gear, piston, vane and digital ……

#3 Grundfos USA

Domain Est. 1995

Website: grundfos.com

Key Highlights: The full range supplier of pumps and pump solutions. As a renowned pump manufacturer, Grundfos delivers efficient, reliable, and sustainable solutions all ……

#4 BVA Hydraulics

Domain Est. 2002

Website: bvahydraulics.com

Key Highlights: BVA Hydraulics is focused on producing, exceptional quality 10,000 PSI (700 bar) industrial hydraulic tools & equipment, expertly designed with customer ……

#5 HiP

Domain Est. 1997

Website: highpressure.com

Key Highlights: High pressure valves, fittings and tubing manufactured to the highest quality standards, delivered with the shortest lead times, and priced to make you money….

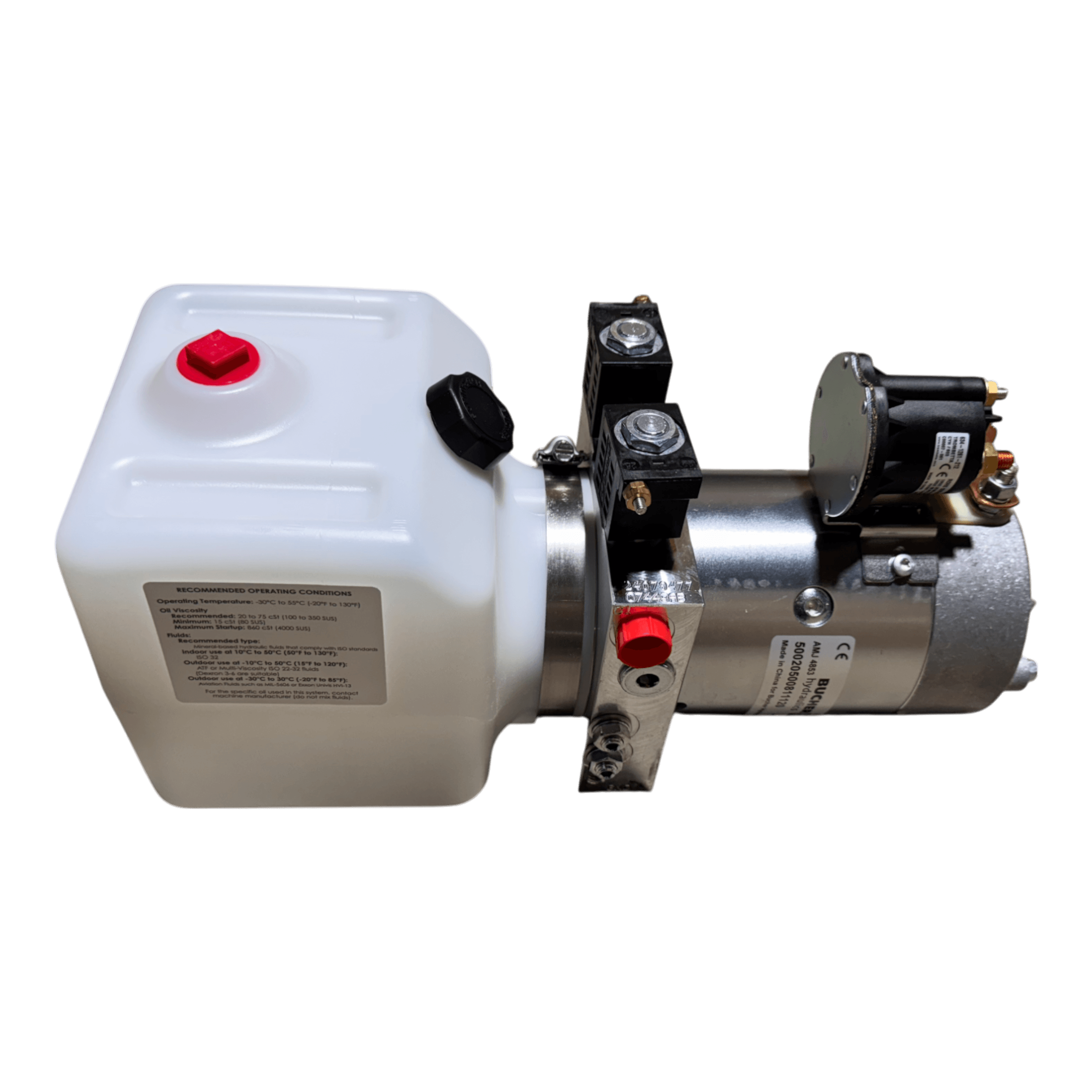

#6 Bucher Hydraulics

Domain Est. 1998

Website: bucherhydraulics.com

Key Highlights: Pumps, motors, valves, cylinders, power units and control systems as standard products, system solutions and custom solutions….

#7 Pumps

Domain Est. 1999

Website: global.kawasaki.com

Key Highlights: Kawasaki offers variety of variable displacement axial piston pumps that have high performance, reliability and ease of maintenance….

#8 Yuken Hydraulic Valves, Pumps, Motors

Domain Est. 2004

Website: yuken-usa.com

Key Highlights: Vane Pumps. These pumps are of high pressure and high performance. They have been developed for low noise operation and have a wide range for output flow….

#9 Hydraulic Cylinders, Valves, Pumps and Components from Bailey …

Domain Est. 2013

Website: baileyhydraulics.com

Key Highlights: Free delivery over $35 45-day returnsBailey International has been a leader in the mobile hydraulics industry for over 40 years, offering fast and free shipping on the highest qual…

Expert Sourcing Insights for Hydraulic Pressure Pump

2026 Market Trends for Hydraulic Pressure Pumps

The global hydraulic pressure pump market is poised for significant transformation by 2026, driven by technological advancements, increasing industrial automation, and a growing emphasis on energy efficiency. This analysis explores key trends shaping the industry in the coming years.

Technological Innovation and Smart Hydraulics

A major trend influencing the hydraulic pressure pump market is the integration of smart technologies and the Internet of Things (IoT). By 2026, manufacturers are expected to increasingly adopt condition monitoring systems, predictive maintenance algorithms, and digital twin technologies. These innovations enhance pump reliability, reduce downtime, and improve operational efficiency. Hydraulic pumps equipped with embedded sensors enable real-time data transmission, allowing for remote diagnostics and performance optimization.

Rising Demand in Industrial Automation and Manufacturing

The continued expansion of industrial automation across sectors such as automotive, aerospace, and general manufacturing is fueling demand for high-performance hydraulic pressure pumps. As factories implement advanced machinery requiring precise motion control and high-force operations, the need for reliable and efficient hydraulic systems grows. By 2026, this trend is projected to accelerate, particularly in emerging economies investing in smart manufacturing infrastructure.

Energy Efficiency and Sustainability Focus

Environmental regulations and sustainability goals are pushing manufacturers to develop energy-efficient hydraulic pumps. Variable displacement pumps, load-sensing systems, and electro-hydraulic servo pumps are gaining traction due to their ability to reduce energy consumption and lower carbon emissions. By 2026, compliance with global energy standards such as ISO 13779 and the EU Ecodesign Directive will be a key driver in product development and market competitiveness.

Growth in Construction and Infrastructure Spending

Infrastructure development projects worldwide—especially in Asia-Pacific, the Middle East, and parts of Africa—are expected to propel demand for hydraulic equipment, including pressure pumps. Hydraulic pumps are essential in heavy construction machinery like excavators, cranes, and loaders. Government-led infrastructure initiatives and urbanization trends will sustain market growth through 2026.

Regional Market Dynamics

Asia-Pacific is anticipated to remain the largest and fastest-growing market for hydraulic pressure pumps by 2026, driven by industrialization in China, India, and Southeast Asian countries. North America and Europe will see steady growth, supported by modernization of aging equipment and adoption of advanced hydraulic systems in defense and renewable energy applications.

Competitive Landscape and Strategic Alliances

The market is witnessing increased consolidation, with leading players engaging in mergers, acquisitions, and R&D collaborations to expand their product portfolios and geographic reach. Companies such as Bosch Rexroth, Parker Hannifin, Danfoss, and Kawasaki Heavy Industries are investing heavily in next-generation hydraulic solutions, including hybrid and electro-hydraulic systems.

Conclusion

By 2026, the hydraulic pressure pump market will be shaped by digitalization, sustainability imperatives, and robust industrial demand. Manufacturers that prioritize innovation, energy efficiency, and smart integration will be best positioned to capitalize on emerging opportunities across global industries.

Common Pitfalls When Sourcing Hydraulic Pressure Pumps: Quality and Intellectual Property (IP) Risks

Sourcing hydraulic pressure pumps, especially from new or international suppliers, involves several critical risks related to quality and intellectual property. Overlooking these pitfalls can lead to operational failures, safety hazards, legal disputes, and reputational damage.

Poor Quality Control and Substandard Components

One of the most frequent issues in hydraulic pump sourcing is inconsistent quality control. Suppliers—particularly low-cost or unverified manufacturers—may use inferior materials (e.g., low-grade castings, subpar seals, or inadequate coatings) that compromise pump durability and performance. This can result in premature wear, internal leakage, reduced efficiency, or catastrophic failure under pressure. Without rigorous inspection protocols or third-party certification (e.g., ISO 9001), buyers risk receiving pumps that don’t meet performance specifications or industry standards (e.g., ISO 4409 for hydraulic pump testing).

Lack of Traceability and Documentation

Reputable hydraulic pump suppliers provide comprehensive documentation, including material certifications, test reports, and traceability records (e.g., heat numbers, batch codes). A common pitfall is sourcing from vendors who cannot or will not provide this information, making it difficult to verify compliance with safety and performance standards. In regulated industries like aerospace or heavy machinery, missing documentation can lead to non-compliance and liability issues.

Counterfeit or Imitation Products

The hydraulic components market is vulnerable to counterfeit or cloned products that mimic well-known brands. These imitations often lack proper engineering validation and may infringe on original designs or trademarks. Buyers might unknowingly receive pumps labeled as genuine OEM parts but manufactured without authorization. These counterfeit pumps frequently fail under load or cause system-wide damage due to poor tolerances and untested designs.

Intellectual Property Infringement Risks

Sourcing pumps from manufacturers that reverse-engineer patented designs poses serious IP risks. Even if the supplier appears legitimate, using a pump that violates an existing patent can expose the buyer to legal action, especially in jurisdictions with strong IP enforcement. This is particularly true when sourcing from regions with lax IP protection. Purchasing such components may result in cease-and-desist orders, product recalls, or financial penalties.

Inadequate Testing and Validation Procedures

Some suppliers claim compliance with industry standards but lack the in-house testing capabilities to verify performance under real-world conditions. Without evidence of functional testing (e.g., pressure cycling, efficiency mapping, noise/vibration analysis), buyers cannot be confident in the pump’s reliability. Relying solely on datasheet claims without independent validation is a significant oversight.

Hidden Supply Chain Risks

The final pump may be assembled by one company but contain critical components (e.g., swashplates, valve plates, shaft seals) sourced from unvetted subcontractors. Without transparency into the full supply chain, buyers face hidden quality and IP risks. A seemingly reputable supplier might unknowingly incorporate infringing or low-quality parts, undermining the entire system’s integrity.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough supplier audits and request quality certifications.

– Require full traceability and performance test documentation.

– Use authorized distributors or direct OEM channels when possible.

– Perform independent product validation or third-party testing.

– Include IP indemnification clauses in procurement contracts.

Proactive due diligence is essential to ensure that sourced hydraulic pressure pumps meet both performance expectations and legal requirements.

Logistics & Compliance Guide for Hydraulic Pressure Pump

Product Classification and Regulatory Overview

Hydraulic pressure pumps are mechanical devices used to generate, control, and transmit power using pressurized fluid. Their classification for logistics and compliance purposes depends on design, application, and components. Typically, they fall under industrial machinery (HS Code 8413.60 or 8413.70 internationally). Compliance requirements vary based on destination country and may include electrical safety, pressure equipment directives, and environmental standards.

International Shipping and Packaging Requirements

Ensure pumps are securely packaged to prevent damage during transit. Use wooden crates or heavy-duty pallets with cushioning material to protect ports, seals, and drive components. Label packages with “Fragile,” “This Side Up,” and handling instructions. For international shipments, include a commercial invoice, packing list, bill of lading, and certificate of origin. Confirm whether the pump contains oils or hydraulic fluid—these may be subject to dangerous goods regulations (e.g., IATA/IMDG) if present in significant quantities.

Export Controls and Licensing

Determine if the hydraulic pressure pump is subject to export control regulations such as the U.S. Export Administration Regulations (EAR) or the International Traffic in Arms Regulations (ITAR). High-pressure pumps used in aerospace, defense, or subsea applications may require export licenses. Review the Commerce Control List (CCL) to identify ECCN (Export Control Classification Number). If no ECCN applies, shipment may proceed under NLR (No License Required), provided end-use and end-user restrictions are satisfied.

Pressure Equipment Safety Compliance

In the European Union, hydraulic pumps used in systems operating above 0.5 bar may fall under the Pressure Equipment Directive (PED) 2014/68/EU. Compliance requires CE marking, technical file documentation, and conformity assessment based on fluid group, volume, and pressure (PS x V). In the U.S., adherence to ASME B31.3 (Process Piping) and ANSI safety standards is recommended. Manufacturers must provide a Declaration of Conformity and equipment data sheets.

Electrical and Electromagnetic Compliance

If the pump includes an electric motor or control system, it must comply with regional electrical safety and EMC regulations. In the EU, this includes Low Voltage Directive (LVD) 2014/35/EU and Electromagnetic Compatibility (EMC) Directive 2014/30/EU. In North America, UL/CSA certification (e.g., UL 508A for industrial control panels) is typically required. Ensure all electrical components bear appropriate certification marks.

Environmental and Chemical Regulations

Confirm that hydraulic pumps do not contain restricted substances under RoHS (EU) or similar regulations (e.g., China RoHS). If the pump ships with hydraulic fluid, verify compliance with REACH (EU) for chemical registration. Used or surplus pumps may be subject to WEEE (Waste Electrical and Electronic Equipment) rules if they contain electronic components. Proper disposal documentation may be required.

Import Compliance and Duties

Importers must provide accurate Harmonized System (HS) codes for customs clearance. Duties and taxes vary by country—consult local customs authorities or a licensed customs broker. Some countries require proof of conformity (SASO in Saudi Arabia, SONCAP in Nigeria) or local representative registration. Ensure documentation includes pump specifications, materials, voltage, and pressure ratings.

Transportation of Hazardous Materials (if applicable)

If the pump contains or is shipped with hydraulic oil classified as flammable or environmentally hazardous (e.g., mineral oil with flash point below 60°C), it may be regulated under ADR (road), IATA (air), or IMDG (sea) as Class 3 flammable liquid or UN3082 (environmentally hazardous substance). Proper labeling, packaging, and shipping papers are mandatory. Pumps shipped empty and cleaned are generally exempt.

Maintenance of Compliance Documentation

Retain all compliance documentation for a minimum of 10 years, including:

– CE Declaration of Conformity (for EU)

– Test reports (pressure, electrical safety)

– Risk assessment and technical construction file

– Export license (if applicable)

– Material safety data sheets (MSDS/SDS) for fluids

– Calibration and quality certificates

Training and End-User Responsibilities

Provide end users with installation, operation, and maintenance manuals in the local language. Ensure training on safe operation, pressure testing procedures, and emergency shutdown. Inform users of periodic inspection requirements, especially for high-pressure systems, to remain compliant with local safety regulations.

Summary and Best Practices

To ensure smooth logistics and regulatory compliance:

– Classify the pump correctly under HS and ECCN systems.

– Secure appropriate certifications (CE, UL, CSA, etc.).

– Package and label shipments according to international standards.

– Verify fluid content and apply dangerous goods rules if needed.

– Maintain comprehensive documentation for audits and customs.

– Consult legal or compliance experts when entering new markets.

In conclusion, sourcing hydraulic pressure pump manufacturers requires a strategic and thorough approach to ensure reliability, performance, and long-term value. Key factors to consider include the manufacturer’s reputation, quality certifications, engineering expertise, production capabilities, and after-sales support. Conducting due diligence through site visits, reference checks, and product testing can significantly mitigate risks and ensure compatibility with specific application requirements. Additionally, evaluating cost-effectiveness, lead times, and geographic proximity helps optimize the supply chain and reduce downtime. By partnering with reputable and experienced manufacturers, businesses can secure high-quality hydraulic components that enhance system efficiency, durability, and overall operational success in demanding industrial environments.