The global automotive hydraulic systems market is experiencing steady expansion, driven by increasing demand for advanced braking, suspension, and power steering technologies. According to Grand View Research, the global automotive fluid power systems market—which includes hydraulic and pneumatic components—was valued at USD 17.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.6% from 2023 to 2030. This growth is fueled by rising vehicle production, the adoption of electro-hydraulic systems in commercial and heavy-duty vehicles, and ongoing advancements in fuel efficiency and safety features. As vehicle complexity increases, hydraulic components remain critical in ensuring optimal performance and reliability, especially in braking and transmission systems. With this demand surge, a select group of manufacturers has emerged as leaders, delivering high-precision, durable hydraulic solutions to OEMs and Tier-1 suppliers worldwide. The following list highlights the top 10 hydraulic component manufacturers for automobiles, evaluated based on innovation, market reach, product portfolio, and industry partnerships.

Top 10 Hydraulic For Car Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Hydraulex

Domain Est. 2010

Website: hydraulex.com

Key Highlights: We are a company that repairs and provides Remanufactured, Aftermarket, and OEM hydraulic units and components. We specialize in industrial applications….

#2 Dynamatic Technologies Limited

Domain Est. 1997

Website: dynamatics.com

Key Highlights: Dynamatic Hydraulics® specialises in the manufacture of highly engineered hydraulic gear pumps. We are one of the world’s largest manufacturers of hydraulic ……

#3 BVA Hydraulics

Domain Est. 2002

Website: bvahydraulics.com

Key Highlights: BVA Hydraulics is focused on producing, exceptional quality 10,000 PSI (700 bar) industrial hydraulic tools & equipment, expertly designed with customer ……

#4 Husco

Domain Est. 1996

Website: husco.com

Key Highlights: Husco’s Automotive team designs and manufactures innovative electro-hydraulic and electro-mechanical components that maximize fuel efficiency, driving ……

#5 BendPak

Domain Est. 1997

Website: bendpak.com

Key Highlights: Upgrade your garage with the industry standard. Discover why pros choose BendPak for car lifts, parking lifts, pipe benders, and wheel service equipment….

#6 Power Team

Domain Est. 1997

Website: hydraulictechnologies.com

Key Highlights: Discover Power Team’s range of high-pressure hydraulic pumps, cylinders, and tools designed for various maintenance and repair applications….

#7 Continental Hydraulics

Domain Est. 1998

Website: continentalhydraulics.com

Key Highlights: With over sixty years in fluid power experience, Continental Hydraulics and Hydreco continues to provide engineering solutions for our customers every day….

#8 Hydreco

Domain Est. 2000

Website: hydreco.com

Key Highlights: Hydreco Hydraulics is well established, initially under the name Hydraulic Hoist and Winch in Western Australia, Hydreco Hydraulics has provided install, ……

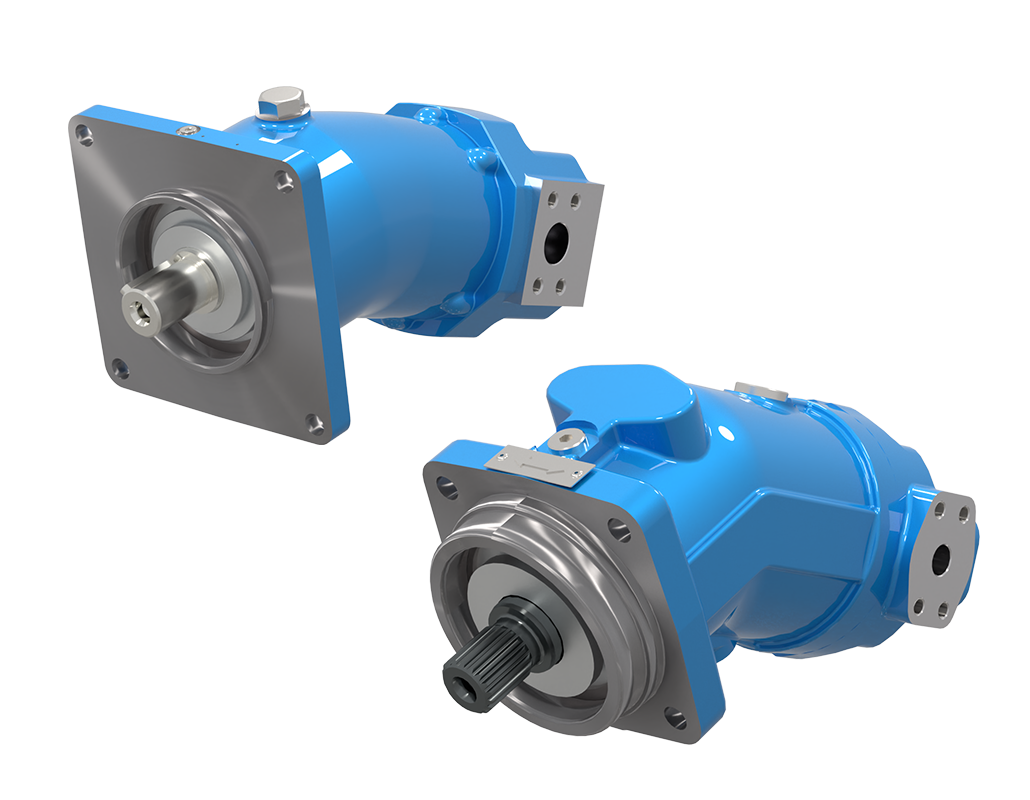

#9 Dana Hydraulics

Domain Est. 2004

Website: brevinifluidpower.com

Key Highlights: Discover Dana Hydraulic Solutions’ full range of high-performance fluid power technologies, including pumps, motors, valves, and custom systems—engineered ……

#10 Hercules Sealing Products

Domain Est. 2006

Website: herculesus.com

Key Highlights: Hercules Sealing Products is a leading supplier of aftermarket hydraulic seals, seal kits, hydraulic cylinders, and cylinder repair parts….

Expert Sourcing Insights for Hydraulic For Car

H2: 2026 Market Trends for Hydraulic Systems in the Automotive Industry

The global market for hydraulic systems in automotive applications is poised for significant transformation by 2026, driven by technological innovation, regulatory pressures, and shifting consumer demands. While traditionally dominant in heavy-duty and commercial vehicles, hydraulic systems are evolving to meet the needs of next-generation mobility solutions. Below are the key trends expected to shape the hydraulic for car market in 2026:

-

Integration with Hybrid and Electric Vehicles (EVs)

As automakers accelerate their transition to electrification, hydraulic systems are being redesigned to complement hybrid and fully electric platforms. In 2026, expect increased adoption of electro-hydraulic braking systems (EHB) and active suspension systems that interface seamlessly with EV architectures. These systems offer precise control, regenerative capabilities, and enhanced safety—critical for autonomous and high-performance EVs. -

Growth in Advanced Driver Assistance Systems (ADAS)

Hydraulic components are playing a vital role in ADAS, especially in braking and steering systems. By 2026, demand for fail-safe hydraulic actuators in steer-by-wire and brake-by-wire systems will rise, driven by the need for redundancy and reliability in semi-autonomous and autonomous vehicles. Hydraulic backups ensure operational safety in case of electronic failure. -

Focus on Lightweight and Energy-Efficient Designs

To improve fuel efficiency and reduce emissions, manufacturers are investing in lightweight hydraulic components using advanced materials such as high-strength polymers and aluminum alloys. Additionally, variable displacement pumps and smart valves will gain traction, minimizing energy losses and optimizing hydraulic performance under varying loads. -

Expansion in Commercial and Off-Highway Vehicles

The hydraulic for car market will see robust growth in commercial trucks, buses, and off-highway vehicles (e.g., construction and agricultural equipment). These segments rely heavily on hydraulic systems for lifting, steering, and transmission. The push for smart hydraulics—equipped with IoT sensors and predictive maintenance capabilities—will enhance operational efficiency and uptime. -

Rise of Smart Hydraulics and IoT Integration

By 2026, intelligent hydraulic systems embedded with sensors and connected to vehicle telematics will become standard. These systems enable real-time monitoring of pressure, temperature, and fluid health, allowing for predictive maintenance and reduced lifecycle costs. OEMs and fleet operators will benefit from data-driven insights to optimize performance. -

Regional Market Shifts and Regulatory Influence

Stringent emission norms in Europe and North America will accelerate innovation in efficient hydraulic technologies. Meanwhile, emerging markets in Asia-Pacific—particularly China and India—will drive volume growth due to expanding automotive production and infrastructure development. Government initiatives promoting green technologies will also influence R&D in eco-friendly hydraulic fluids and recyclable components. -

Competition from Electromechanical Alternatives

Despite advancements, hydraulic systems face growing competition from electromechanical actuators, especially in light-duty passenger vehicles. However, hydraulics will retain dominance in high-torque, high-reliability applications where electromechanical systems fall short. The market will likely see hybrid solutions that combine both technologies for optimal performance.

In conclusion, the 2026 hydraulic for car market will be characterized by innovation, integration, and adaptation. While challenges remain, the continued evolution of hydraulic technology—particularly in safety, efficiency, and digital connectivity—will ensure its relevance in the future automotive landscape.

Common Pitfalls When Sourcing Hydraulic Components for Cars

Sourcing hydraulic components for automotive applications requires careful consideration to ensure performance, safety, and compliance. Overlooking key factors can lead to system failure, safety hazards, and legal issues. Below are common pitfalls to avoid:

Poor Quality Components

Using substandard hydraulic parts—such as pumps, hoses, seals, or cylinders—can result in premature failure, leaks, and reduced system efficiency. Low-quality materials may not withstand high pressures or temperature fluctuations common in automotive systems. Always verify manufacturer certifications (e.g., ISO 9001), request material test reports, and, if possible, conduct sample testing before large-scale procurement.

Incorrect IP (Ingress Protection) Rating

The IP rating indicates a component’s resistance to dust and water ingress. In automotive environments—especially under the hood or in off-road vehicles—components are exposed to moisture, dirt, and road debris. Selecting parts with inadequate IP ratings (e.g., IP65 vs. required IP67 or IP69K) can lead to electrical shorts, corrosion, or mechanical failure. Always match the IP rating to the operating environment, especially in harsh or wash-down conditions.

Lack of Industry Compliance

Automotive hydraulic systems must often meet regulatory standards such as ISO 4413 (hydraulic fluid power), SAE J517 (hose standards), or vehicle-specific OEM specifications. Sourcing non-compliant parts can void warranties, fail safety inspections, or result in liability in case of accidents. Confirm that components meet relevant industry and regional regulations before integration.

Inadequate Supply Chain Verification

Sourcing from unverified suppliers or third-party distributors increases the risk of counterfeit or refurbished parts being passed off as new. This is particularly common in high-demand or obsolete components. Conduct due diligence: audit suppliers, verify traceability documentation, and establish long-term partnerships with reputable manufacturers.

Misalignment with System Requirements

Hydraulic components must match system specifications for pressure, flow rate, fluid compatibility, and temperature range. Using mismatched parts can cause inefficiency, overheating, or catastrophic failure. Collaborate with engineering teams early in the sourcing process to ensure compatibility with the vehicle’s hydraulic architecture.

Avoiding these pitfalls ensures reliable performance, enhances safety, and reduces lifecycle costs of automotive hydraulic systems.

Logistics & Compliance Guide for Hydraulic Components for Cars

Overview

Hydraulic components used in automotive systems—such as brake calipers, master cylinders, power steering units, and suspension actuators—require careful handling, transport, and regulatory compliance due to their precision engineering, fluid content, and safety-critical applications. This guide outlines essential logistics and compliance considerations for manufacturers, distributors, and importers/exporters.

Packaging & Handling Requirements

Proper packaging ensures that hydraulic components arrive undamaged and contamination-free.

– Sealing & Protection: All hydraulic ports must be sealed with protective caps or plugs to prevent ingress of dust, moisture, or debris. Use desiccants in packaging where applicable.

– Anti-Corrosion Measures: Apply corrosion-inhibiting coatings or VCI (Vapor Corrosion Inhibitor) paper, especially for ferrous metal parts.

– Cushioning & Bracing: Use foam inserts, molded trays, or edge protectors to prevent movement and shock damage during transit.

– Labeling: Clearly label packages with “Fragile,” “This Side Up,” and component identification (e.g., part number, serial number).

Storage Conditions

Improper storage can degrade performance and lead to failure.

– Environment: Store in a dry, temperature-controlled environment (15°C to 30°C / 59°F to 86°F), away from direct sunlight and extreme humidity.

– Shelving: Keep parts off the floor on racks to avoid moisture exposure and physical damage.

– Inventory Rotation: Apply FIFO (First In, First Out) principles to prevent long-term storage and potential seal degradation.

Transportation Regulations

Compliance with transport regulations is critical, especially when components contain hydraulic fluid.

– Dangerous Goods Classification: If shipped with fluid (e.g., pre-filled brake systems), classify under UN 3082 (Environmentally Hazardous Substance, Liquid, N.O.S.) or relevant fluid-specific codes.

– ADR/RID/IMDG/IATA Compliance: Follow applicable regional and international regulations for road (ADR), rail (RID), sea (IMDG), and air (IATA) transport if hazardous fluids are present.

– Non-Hazardous Shipments: Empty, cleaned, and properly sealed components typically qualify as non-hazardous but must still meet general freight standards.

Import/Export Compliance

Global trade requires adherence to customs and product regulations.

– HS Codes: Use correct Harmonized System codes (e.g., 8412.21 or 8708.30 for hydraulic transmission equipment or brake parts).

– Country-Specific Approvals: Verify local certifications such as:

– USA: DOT compliance for brake systems; EPA guidelines for fluid handling.

– EU: ECE R13 certification for braking systems; REACH and RoHS compliance for materials.

– China: CCC mark for automotive safety components.

– Documentation: Include commercial invoices, packing lists, certificates of conformity, and material safety data sheets (MSDS/SDS) where applicable.

Environmental & Safety Compliance

Hydraulic systems must meet sustainability and worker safety standards.

– Fluid Disposal: Follow local regulations for hydraulic fluid disposal (e.g., EPA in the U.S., WEEE and ELV directives in the EU).

– Worker Safety: Provide training on handling components under pressure and safe procedures for depressurization and maintenance.

– Recycling: Design for disassembly and recycling; comply with ELV (End-of-Life Vehicles) Directive requirements in applicable markets.

Quality & Traceability

Maintain documentation to support recalls and audits.

– Batch Tracking: Implement lot numbering and serialization for full traceability throughout the supply chain.

– Certifications: Retain ISO 9001, IATF 16949, or equivalent quality management system certifications.

– Inspection Records: Keep logs of incoming, in-process, and outgoing quality inspections.

Conclusion

Effective logistics and compliance for automotive hydraulic components minimize risk, ensure regulatory adherence, and support product reliability. By following industry standards and maintaining rigorous documentation, stakeholders can deliver safe, high-performance parts to global markets efficiently.

Conclusion for Sourcing Hydraulics for Cars:

Sourcing hydraulic systems for automotive applications requires a careful balance between performance, reliability, cost, and compatibility. After evaluating various suppliers, product specifications, and industry standards, it is evident that selecting high-quality hydraulic components—such as pumps, hoses, valves, and actuators—is crucial for ensuring optimal vehicle performance and safety. Factors such as durability under pressure, resistance to temperature fluctuations, and adherence to OEM standards must be prioritized. Additionally, partnering with reputable suppliers who offer technical support, warranties, and timely delivery can significantly reduce downtime and maintenance costs. In conclusion, a strategic sourcing approach that emphasizes quality, supplier credibility, and long-term value will ensure the successful integration and operation of hydraulic systems in automotive applications.