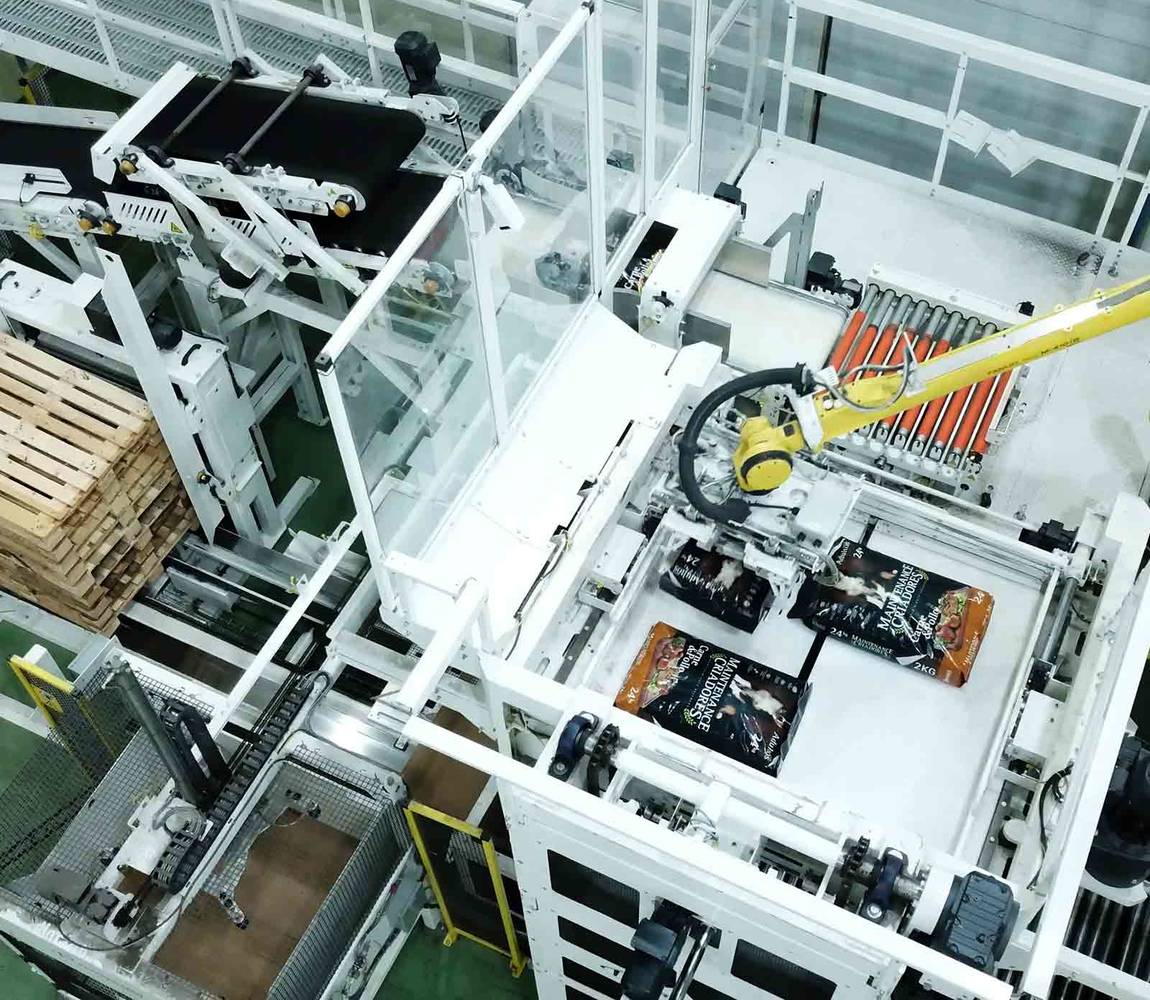

The global palletizing equipment market is undergoing a transformative shift, driven by rising demand for automation in logistics, manufacturing, and distribution centers. With labor shortages, increasing e-commerce fulfillment needs, and the push for operational efficiency, hybrid palletizing systems—combining the flexibility of robotic arms with the reliability of conventional layer-forming technology—are gaining significant traction. According to Grand View Research, the global palletizing equipment market was valued at USD 2.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This growth is further amplified by the adoption of Industry 4.0 technologies and the integration of AI-driven robotics in material handling. Hybrid systems, in particular, are emerging as a cost-effective, scalable solution for facilities handling diverse product formats and variable throughput demands. As the market evolves, several manufacturers are leading the charge in innovation, offering intelligent, modular, and energy-efficient hybrid palletizing solutions that meet today’s dynamic supply chain challenges.

Top 10 Hybrid Palletizing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 EVS Robot

Domain Est. 2020

Website: evsint.com

Key Highlights: EVS Robot is a leading supplier of industrial robotic arms, SCARA robots, and CNC robots for sale in China. Visit our website to learn more!…

#2 Robot|History of the business

Domain Est. 1999

Website: global.kawasaki.com

Key Highlights: We completed Japan’s first domestically produced industrial robot, the Kawasaki-Unimate 2000, becoming the pioneer in developing the Japanese robot industry….

#3 Industrial Manipulators and Material Handling Solution

Domain Est. 2003

Website: indevagroup.com

Key Highlights: Scaglia Indeva is a leader in Industrial Manipulators and Material Handling Solutions market thanks to its experience and know-how….

#4 Automatic Palletizer Machine

Domain Est. 2004

Website: dgtsolutions.ca

Key Highlights: The automatic palletizing machine is built to perform automatic handling and stacking of boxes, drums, barrels, pails, jug-in-box, large volume containers, ……

#5 Technica

Domain Est. 2000

Website: technicaintl.com

Key Highlights: Palletizers · Semi Automatic Palletizer · Robotic Crate Palletizer · Pantograph Palletizer · Hybrid Palletizer · Robotic Palletizer · Depalletizers · Robotic ……

#6 Assembly Lines & Manufacturing Automation Systems

Domain Est. 2000

Website: primetest.com

Key Highlights: PrimeTest Automation is a custom manufacturing automation system designer and builder for assembly lines and other manufacturing facilities….

#7 Packaging Machinery Manufacturing

Domain Est. 2008

Website: alligatorautomations.com

Key Highlights: Alligator Automations specializes in providing Palletizing Solutions. These involve stacking various items like boxes, bags, shrink packs… Read More ……

#8 Megadyne Group

Domain Est. 2012

Website: megadynegroup.com

Key Highlights: Megadyne offers a wide variety of rubber and urethane standard items and special products designed to satisfy specific customer requirements….

#9 How Much Does a Robotic Palletizer Cost?

Domain Est. 2023

Website: tomarobots.com

Key Highlights: Explore robotic palletizer costs, key pricing factors, and how to estimate ROI for the right palletizing solution for your facility….

#10 News

Domain Est. 2020

Website: close-r.com

Key Highlights: We have refreshed our logo! We have officially established our company as “Closer Inc.” We have been selected as a finalist in the Elevator Pitch Competition ( ……

Expert Sourcing Insights for Hybrid Palletizing

H2: 2026 Market Trends for Hybrid Palletizing

The hybrid palletizing market is poised for significant transformation by 2026, driven by converging technological advancements, evolving industrial demands, and a heightened focus on operational resilience. Hybrid systems—combining robotic arms with traditional, high-speed gantry or layer-handling palletizers—offer a strategic balance of flexibility, speed, and cost-efficiency, positioning them at the forefront of material handling innovation. Key trends shaping the market include:

-

Accelerated Demand for Flexibility & Agility:

- Driver: The rise of e-commerce, direct-to-consumer models, and mass customization is forcing manufacturers and distributors to handle smaller batch sizes, more frequent changeovers, and a wider variety of SKUs (including odd-sized, unstable, or fragile items).

- Impact: Pure high-speed gantry systems struggle with this variability, while pure robotic systems may lack throughput for core SKUs. Hybrid solutions excel by using the gantry for high-volume, stable products and the robot for complex, low-volume, or mixed-SKU pallet patterns, offering unmatched operational agility.

- 2026 Outlook: Flexibility will be the primary purchasing criterion. Systems will increasingly feature intuitive, no-code/low-code programming interfaces and AI-driven pattern optimization to minimize changeover time.

-

Convergence of Robotics, AI, and Machine Learning:

- Driver: Maturation of AI/ML algorithms, computer vision, and sensor fusion technologies.

- Impact: Hybrid systems will leverage AI for:

- Intelligent SKU Recognition & Grasping: Advanced vision systems will automatically identify and locate diverse, non-uniform, or poorly labeled products on the infeed, enabling reliable robotic handling.

- Dynamic Pallet Pattern Optimization: AI will analyze product mix, stability requirements, warehouse space constraints, and transport logistics in real-time to generate optimal pallet patterns, maximizing load stability and cube utilization.

- Predictive Maintenance: ML algorithms will analyze sensor data (vibration, temperature, cycle counts) from both robotic and gantry components to predict failures before they occur, minimizing unplanned downtime.

- 2026 Outlook: “Cognitive palletizing” will become a key differentiator. Hybrid systems will move beyond pre-programmed routines to adapt intelligently to real-world variations.

-

Enhanced Connectivity and Integration within Industry 4.0:

- Driver: The push for fully integrated, data-driven factories and warehouses (Digital Twins, MES, WMS).

- Impact: Hybrid palletizers will become seamless nodes in the IIoT (Industrial Internet of Things) ecosystem:

- Real-time Data Flow: Systems will provide granular data on OEE (Overall Equipment Effectiveness), cycle times, error rates, material usage, and energy consumption directly to central platforms.

- Closed-Loop Control: Integration with upstream (packing, case erectors) and downstream (stretch wrapping, labeling, conveyance) processes will enable dynamic line balancing and autonomous adjustment based on real-time demand signals.

- Remote Monitoring & Support: Cloud-based platforms will allow OEMs and integrators to monitor system health, perform diagnostics, and provide remote support globally.

- 2026 Outlook: Interoperability (OPC UA, MQTT) and standardized data models will be non-negotiable. Hybrid palletizers will be key data sources for operational intelligence.

-

Focus on Sustainability and Total Cost of Ownership (TCO):

- Driver: Increasing regulatory pressure, corporate ESG goals, and volatile energy costs.

- Impact:

- Energy Efficiency: Hybrid systems will incorporate regenerative braking (especially in robots), optimized motion paths, and energy-efficient motors to reduce power consumption.

- Material Optimization: AI-driven pattern planning will minimize void space, reducing the need for excessive dunnage, stretch film, and ultimately, transportation emissions.

- Right-Sizing: The hybrid approach allows companies to invest in the optimal capacity mix, avoiding over-capex on pure robotic lines for high-volume tasks or inflexible gantry lines for complex needs, improving overall TCO.

- 2026 Outlook: Sustainability metrics (energy/kWh, film usage per pallet, CO2e reduction) will be prominent in ROI calculations and marketing.

-

Expansion Beyond Traditional Industries:

- Driver: Proven reliability and falling technology costs.

- Impact: While Food & Beverage, Consumer Goods, and Chemicals remain core markets, hybrid palletizing will see significant growth in:

- Pharma & Medical Devices: Handling diverse, often fragile packaging with stringent hygiene and traceability needs.

- E-commerce Fulfillment Centers: Managing extreme SKU variety and high throughput demands.

- Building Materials: Handling heavy, awkward, or irregularly shaped items (e.g., pipes, tiles, lumber).

- Recycling & Waste Management: Dealing with highly variable, non-standard bales or containers.

- 2026 Outlook: Niche applications with specific handling challenges will increasingly adopt hybrid solutions as customization becomes easier.

-

Evolution of Human-Robot Collaboration (HRC):

- Driver: Need for safe interaction in dynamic environments and addressing labor shortages.

- Impact: While full cages may still be used for high-speed gantry sections, robotic work cells within hybrid systems will increasingly utilize:

- Advanced Safety Systems: LiDAR, 3D vision, and power-and-force limiting robots enabling safer operation near human workers for tasks like pallet staging, film roll changes, or quality checks.

- Cobots for Specific Tasks: Collaborative robots might be integrated for loading/unloading specific zones or handling very delicate items within the hybrid workflow.

- 2026 Outlook: “Hybrid” will extend to include safer human interaction, blurring the lines between automation and manual assistance.

Conclusion for 2026:

By 2026, the hybrid palletizing market will be defined by intelligent, connected, and highly flexible systems. The “hybrid” advantage—leveraging the best of both robotic and gantry technologies—will be amplified by AI, IIoT, and advanced software. Success will depend on vendors offering not just hardware, but comprehensive solutions focused on maximizing OEE, minimizing TCO, ensuring sustainability, and enabling seamless integration into the broader digital supply chain. Companies that fail to adopt this level of adaptability and intelligence will struggle to compete in an increasingly volatile and demanding market.

Common Pitfalls in Sourcing Hybrid Palletizing Systems: Quality and Intellectual Property Risks

Poor Component Quality and Integration Issues

One major pitfall when sourcing hybrid palletizing solutions—combining robotic arms with conventional automation—is inconsistent component quality. Suppliers may use substandard motors, sensors, or control systems to cut costs, leading to unreliable performance, frequent downtime, and accelerated wear. Additionally, integrating third-party robotic systems with existing conveyor or software platforms can result in compatibility issues if the supplier lacks proven integration expertise, undermining system efficiency and scalability.

Inadequate Verification of Intellectual Property Rights

Sourcing hybrid palletizing systems from offshore or less-established vendors increases the risk of unintentionally acquiring solutions that infringe on third-party intellectual property (IP). Some suppliers may use cloned firmware, unlicensed software, or patented mechanical designs without authorization. This exposes the buyer to legal liabilities, shipment seizures, or forced system modifications. Always verify that the supplier owns or has legitimate rights to all core technologies, including control algorithms, user interfaces, and proprietary motion sequences.

Lack of Transparency in Software and Firmware Ownership

Hybrid systems often rely on proprietary software for coordination between robotic and conventional elements. A common pitfall is unclear ownership or licensing terms for this software. Suppliers might restrict access to source code, block updates, or impose recurring license fees. Without clear IP documentation and rights to modify or maintain the software, buyers face long-term operational dependencies and increased total cost of ownership.

Insufficient Validation of Design and Performance Claims

Suppliers may overstate a hybrid system’s throughput, flexibility, or uptime based on idealized conditions. Without independent testing or detailed performance guarantees, buyers risk deploying a system that fails to meet production demands. Request real-world case studies, third-party certifications, and opportunities for factory acceptance testing to validate both quality and performance before finalizing procurement.

Supply Chain and Support Vulnerabilities

Hybrid palletizing systems depend on specialized components, some of which may be single-sourced. If the supplier lacks robust supply chain management or fails to secure IP rights for critical subsystems, future maintenance, spare parts, or upgrades can become unfeasible. Ensure long-term support agreements and clarify IP escrow provisions to protect against vendor lock-in or business discontinuation.

Logistics & Compliance Guide for Hybrid Palletizing

Hybrid palletizing, which combines manual labor with automated systems (such as robotic arms, palletizing cells, or semi-automated conveyors), offers increased efficiency and flexibility in warehouse and distribution operations. However, integrating human and machine workflows requires careful planning around logistics and compliance to ensure safety, regulatory adherence, and operational effectiveness. This guide outlines key considerations and best practices.

Safety Standards and Workplace Regulations

Ensuring worker safety is paramount in hybrid palletizing environments. Employers must comply with occupational health and safety regulations, such as those from OSHA (U.S.), HSE (UK), or equivalent bodies globally.

- Risk Assessment: Conduct a thorough hazard analysis of all palletizing zones, identifying pinch points, falling loads, and robot interaction areas.

- Machine Safeguarding: Install safety interlocks, light curtains, and emergency stop systems to protect workers near automated equipment.

- Lockout/Tagout (LOTO): Implement LOTO procedures during maintenance to prevent accidental machine activation.

- Training: Provide comprehensive training for operators on safe interaction with automated systems, including emergency response.

- Collaborative Robot (Cobot) Compliance: If cobots are used, ensure they meet ISO/TS 15066 standards for human-robot collaboration, including force and speed limitations.

Equipment and System Integration

Seamless integration between manual and automated components is critical for efficient hybrid operations.

- Compatibility: Ensure conveyors, lift tables, and robotic arms are compatible with existing warehouse systems (e.g., WMS, ERP).

- Modular Design: Use modular palletizing systems that allow for easy reconfiguration as product mixes or volumes change.

- Load Stability: Verify that both manual and automated processes adhere to consistent stacking patterns and weight distribution standards to prevent collapse during transport.

- Pallet and Load Standards: Use standardized pallet types (e.g., ISO, EUR, GMA) and ensure load dimensions comply with storage and transport requirements.

Regulatory Compliance for Transportation

Properly palletized loads must meet shipping and transportation regulations to avoid fines and delays.

- Load Securing: Comply with transportation regulations such as the U.S. FMCSA’s cargo securement rules (49 CFR Part 393) or EU Directive 2014/47/EU.

- Weight Distribution: Ensure pallet loads are within axle weight limits and do not exceed vehicle capacity.

- Labeling and Documentation: Accurately label pallets with content descriptions, handling instructions (e.g., “Fragile,” “This Way Up”), and barcodes for traceability.

- Hazardous Materials: If handling hazardous goods, comply with IMDG, IATA, or ADR regulations, including proper segregation, labeling, and documentation.

Quality Control and Traceability

Maintaining product integrity and traceability is essential in hybrid environments.

- Inspection Points: Implement visual or automated inspection stations post-palletizing to verify correct stacking, labeling, and load integrity.

- Batch Tracking: Integrate barcode or RFID scanning to link each pallet to specific batches, enabling full traceability through the supply chain.

- Audit Readiness: Maintain records of palletizing operations, equipment maintenance, and operator training for compliance audits.

Environmental and Sustainability Considerations

Hybrid palletizing offers opportunities to enhance sustainability.

- Energy Efficiency: Optimize robotic cycles and conveyor usage to reduce energy consumption.

- Reusable Packaging: Where possible, use returnable or recyclable pallets and dunnage.

- Waste Reduction: Monitor and minimize damaged goods due to improper stacking or handling.

Training and Workforce Management

Effective workforce management ensures smooth hybrid operations.

- Cross-Training: Train staff to operate both manual and automated systems, increasing operational flexibility.

- Ergonomics: Design workstations to reduce strain (e.g., adjustable height platforms, powered assist tools).

- Performance Monitoring: Use key performance indicators (KPIs) such as pallets per hour, error rates, and downtime to assess efficiency and support continuous improvement.

Documentation and Recordkeeping

Maintain comprehensive records to demonstrate compliance and support troubleshooting.

- Standard Operating Procedures (SOPs): Document procedures for palletizing, equipment use, and emergency response.

- Maintenance Logs: Keep detailed logs of robotic and conveyor maintenance to ensure reliability and compliance.

- Incident Reports: Record all safety incidents or near-misses and conduct root cause analyses.

By addressing these logistics and compliance aspects, organizations can safely and efficiently implement hybrid palletizing solutions that enhance productivity while meeting regulatory requirements.

Conclusion on Sourcing Hybrid Palletizing Solutions

Sourcing hybrid palletizing solutions offers a strategic balance between automation and flexibility, making it an ideal choice for businesses navigating diverse production needs, fluctuating order volumes, and limited space or capital budgets. By combining robotic palletizers with semi-automated or manual components, hybrid systems provide scalability, improved efficiency, and faster return on investment compared to fully automated setups.

When sourcing such systems, it is crucial to evaluate specific operational requirements, product characteristics, throughput demands, and future growth plans. Partnering with experienced suppliers who offer modular, easily reconfigurable solutions ensures adaptability to changing market conditions. Additionally, considerations such as integration with existing systems, training, maintenance support, and total cost of ownership play a vital role in long-term success.

Ultimately, hybrid palletizing represents a pragmatic and cost-effective step toward automation, enabling companies to enhance productivity, reduce labor strain, and maintain competitiveness in an increasingly dynamic supply chain environment. Careful planning and vendor selection will maximize the benefits of hybrid solutions, paving the way for future automation advancements.