The global HVAC fans and blowers market is experiencing robust growth, driven by increasing demand for energy-efficient climate control systems across residential, commercial, and industrial sectors. According to a report by Mordor Intelligence, the global HVAC market was valued at USD 136.5 billion in 2022 and is projected to grow at a CAGR of over 7.5% from 2023 to 2028, with fans and blowers representing a critical component segment. Similarly, Grand View Research estimates that the global HVAC equipment market will expand at a CAGR of 6.8% from 2023 to 2030, citing rising urbanization, stricter energy regulations, and the adoption of smart building technologies as key growth catalysts. As sustainability and indoor air quality become central priorities, manufacturers of HVAC fans and blowers are innovating to meet performance and efficiency demands. In this evolving landscape, a select group of manufacturers have emerged as market leaders through advanced engineering, global reach, and consistent product innovation—shaping the future of airflow technology.

Top 10 Hvac Fans And Blowers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 New York Blower Company

Domain Est. 1996

Website: nyb.com

Key Highlights: Since 1889, The New York Blower Company (nyb) has been the industry leader and your comprehensive source for catalog and OEM fans, blowers, ventilation systems ……

#2 Aerovent

Domain Est. 1996

Website: aerovent.com

Key Highlights: As a leading designer and manufacturer of high-quality industrial air moving equipment, Aerovent sets the industry standard….

#3 Twin City Fan & Blower

Domain Est. 1997

Website: tcf.com

Key Highlights: Twin City Fan & Blower is an industry-leading designer and manufacturer of high-quality custom, semi-custom and standard fans ranging from heavy-duty industrial ……

#4 Industrial Centrifugal Fans & Blowers Manufacturer

Domain Est. 2002

Website: airprofan.com

Key Highlights: Explore industry-leading industrial fans and blowers—engineered for performance, built to spec, and backed by fast lead times and expert support….

#5 Orion Fans

Domain Est. 1997

Website: orionfans.com

Key Highlights: Orion Fans is a global manufacturer and JIT supplier of AC fans, DC fans, Fan trays, blowers, motorized impellers, specialty fans, and fan accessories….

#6 ebm

Domain Est. 1998

Website: ebmpapst.com

Key Highlights: Fans from a premium manufacturer – our products · Electronics · Compact fans · Axial fans · Centrifugal fans · Blowers · Tangential blowers · Valves · Electronics….

#7 Industrial Fans, Air Knife Systems, Cooling Fans, Blowers, Ventilation

Domain Est. 2003

Website: aircontrolindustries.com

Key Highlights: Explore our wide range of industrial solutions – from fans and air knife blower systems to centrifugal fans. Enhance your operations with ACI….

#8 Greenheck

Domain Est. 1995

Website: greenheck.com

Key Highlights: Greenheck is the leading supplier of air movement, air control and air conditioning equipment. Delivering reliable air comfort, safety and energy ……

#9 Loren Cook Company: Air Moving Experts

Domain Est. 1996

Website: lorencook.com

Key Highlights: Air Moving Experts – Fans, Blowers, Lab Exhaust, & Energy Recovery – Loren Cook Company. is here. Make fast fan selections and export schedules in seconds with ……

#10 Fans & Blowers

Domain Est. 2021

Website: fairbanksmorsedefense.com

Key Highlights: Durable, high-efficiency air movement solutions for demanding marine environments. Browse FMD’s trusted range of fans and blowers….

Expert Sourcing Insights for Hvac Fans And Blowers

2026 Market Trends for HVAC Fans and Blowers

The global HVAC (Heating, Ventilation, and Air Conditioning) fans and blowers market is poised for significant transformation by 2026, driven by technological innovation, regulatory shifts, and evolving consumer demands. As energy efficiency and environmental sustainability become central themes across industries, the HVAC sector is adapting with smarter, more efficient air movement solutions. This analysis explores key trends expected to shape the HVAC fans and blowers market in 2026.

Growing Demand for Energy-Efficient Solutions

Energy efficiency remains a primary driver in the HVAC fans and blowers market. With rising energy costs and stringent government regulations—such as updated building energy codes and efficiency standards like the U.S. Department of Energy (DOE) and EU Ecodesign Directive—manufacturers are prioritizing high-efficiency motors and aerodynamic designs. By 2026, adoption of Electronically Commutated Motors (ECMs) and variable speed drives is expected to accelerate, allowing fans and blowers to adjust output based on real-time demand, reducing energy consumption by up to 30–50% compared to traditional AC motors.

Integration of Smart Technologies

The proliferation of smart buildings and the Internet of Things (IoT) is pushing HVAC components toward greater connectivity. In 2026, intelligent fans and blowers equipped with sensors and embedded controls will enable predictive maintenance, remote monitoring, and integration with building management systems (BMS). These smart systems optimize airflow based on occupancy, air quality, and temperature, enhancing both comfort and efficiency. Market demand is increasingly favoring HVAC solutions that support automation and data analytics, especially in commercial and industrial applications.

Expansion in Residential and Commercial Construction

Urbanization and infrastructure development, particularly in Asia-Pacific, Latin America, and the Middle East, are fueling growth in residential and commercial construction. As new buildings incorporate advanced HVAC systems to meet comfort and regulatory standards, the demand for reliable and efficient fans and blowers is rising. In developed markets, building retrofitting initiatives aimed at improving energy performance will further drive replacements and upgrades of outdated fan systems.

Focus on Indoor Air Quality (IAQ)

Heightened awareness of indoor air quality, intensified by the post-pandemic health landscape, continues to influence HVAC design. By 2026, demand for fans and blowers capable of supporting high air exchange rates and integration with air purification systems (e.g., HEPA filters, UV-C) will grow. Residential, healthcare, and educational facilities are prioritizing ventilation solutions that reduce airborne contaminants, increasing the need for advanced blower technologies that ensure consistent, clean airflow.

Sustainability and Regulatory Compliance

Environmental regulations targeting greenhouse gas emissions and refrigerants are indirectly influencing fan and blower design. As HVAC systems shift toward low-GWP (Global Warming Potential) refrigerants and net-zero energy buildings, fans and blowers must complement these goals through reduced power consumption and lifecycle sustainability. Manufacturers are increasingly using recyclable materials and designing for longer product lifespans, aligning with circular economy principles.

Advancements in DC and Hybrid Fan Technologies

Direct Current (DC) fans and hybrid systems are gaining traction due to their compact size, quiet operation, and high efficiency. By 2026, DC-powered blowers are expected to capture a larger market share, especially in residential HVAC and compact commercial units. Innovations in motor design and power electronics are making these systems more cost-competitive, overcoming earlier barriers related to upfront costs.

Regional Market Dynamics

Regionally, North America and Europe will continue to lead in adopting advanced HVAC technologies due to strict energy codes and mature building infrastructure. However, the Asia-Pacific region—particularly China, India, and Southeast Asia—is expected to witness the highest growth rate, driven by rapid urbanization, industrial expansion, and government initiatives promoting energy-efficient buildings.

Conclusion

By 2026, the HVAC fans and blowers market will be defined by innovation, intelligence, and sustainability. Energy efficiency, digital integration, and improved indoor air quality will remain central themes, supported by regulatory frameworks and evolving consumer expectations. Manufacturers who invest in smart, eco-friendly technologies and expand into emerging markets are likely to gain a competitive edge in this dynamic landscape.

Common Pitfalls Sourcing HVAC Fans and Blowers (Quality, IP)

Poor Quality Components

One of the most frequent issues when sourcing HVAC fans and blowers is selecting products with substandard materials and construction. Low-quality motors, bearings, and housings can lead to premature failure, increased maintenance costs, and reduced system efficiency. Buyers may be tempted by lower upfront prices, but inferior components often result in higher lifecycle costs due to downtime and replacements.

Inadequate Ingress Protection (IP) Rating

Choosing fans and blowers with an inappropriate IP rating for the operating environment is a critical oversight. For example, using an IP44-rated fan in a dusty or outdoor setting where IP55 or higher is required can lead to contamination, electrical faults, and reduced lifespan. It’s essential to match the IP rating to environmental conditions such as moisture, dust, and exposure to weather.

Misalignment with Application Requirements

HVAC systems vary widely in pressure, airflow, and duty cycles. Selecting a fan or blower not engineered for the specific application—such as using a light-duty residential fan in an industrial setting—can compromise performance and safety. Failure to verify static pressure requirements, duty cycle, and airflow (CFM) leads to inefficient operation and potential system overload.

Lack of Certifications and Compliance

Sourcing components without proper certifications (e.g., CE, UL, AMCA) can result in non-compliance with safety and performance standards. This not only poses risks to end-users but may also lead to legal liabilities and voided warranties. Always verify that the fan or blower meets regional and industry-specific regulatory requirements.

Insufficient Supplier Verification

Procuring from unverified or unreliable suppliers increases the risk of counterfeit products, inconsistent quality, and lack of technical support. Without thorough supplier vetting—including audits, sample testing, and reference checks—buyers may face supply chain disruptions and quality inconsistencies.

Overlooking Noise Levels and Vibration

Fans and blowers contribute significantly to system noise and vibration. Ignoring sound pressure levels (dB) and vibration specifications can result in occupant discomfort, especially in commercial or residential environments. Selecting units without proper acoustic testing or damping features leads to costly retrofits or complaints.

Inadequate Thermal and Electrical Protection

Some lower-tier fans lack built-in thermal overload protection or fail to meet insulation class standards (e.g., Class F or H). This increases the risk of motor burnout under high-temperature conditions or voltage fluctuations. Always confirm thermal protection features and insulation ratings for reliability in demanding environments.

Conclusion

Avoiding these common pitfalls requires due diligence in component selection, supplier evaluation, and application analysis. Prioritizing quality, appropriate IP ratings, and compliance ensures long-term performance, safety, and cost-efficiency in HVAC system operations.

Logistics & Compliance Guide for HVAC Fans and Blowers

Product Classification and HS Codes

HVAC fans and blowers are typically classified under specific Harmonized System (HS) codes for international trade. Common classifications include:

– 8414.59: Fans and recirculating hoods with filters, electric motor-driven, with or without filters.

– 8414.60: Ventilating or recycling hoods incorporating a fan and a filter.

– 8501.31 / 8501.32: Electric motors (if shipped separately or as components).

Accurate HS code classification ensures proper tariff application, customs clearance, and compliance with import/export regulations. Consult local customs authorities or a licensed customs broker for country-specific classifications.

Import/Export Regulations

Compliance with international trade laws is essential when shipping HVAC fans and blowers. Key considerations include:

– Export Controls: Verify if products contain dual-use technologies or components subject to export restrictions (e.g., under EAR in the U.S. or EU Dual-Use Regulation).

– Import Permits: Some countries require import licenses for electrical machinery or energy-consuming products.

– Documentation: Prepare commercial invoices, packing lists, bills of lading/air waybills, and certificates of origin.

– Restricted Destinations: Screen buyers and end-users against denied parties lists (e.g., OFAC, BIS Entity List).

Energy Efficiency and Environmental Standards

HVAC fans and blowers must comply with energy performance regulations in target markets:

– United States: Comply with DOE (Department of Energy) efficiency standards under 10 CFR Part 431.

– European Union: Meet Ecodesign Directive (EU) 2015/1097 and ErP (Energy-related Products) requirements.

– Canada: Adhere to NRCan efficiency regulations (SOR/2016-199).

– Labeling: Provide energy efficiency labels where required (e.g., EU Energy Label).

Electrical Safety and Certification

Electrical components must meet regional safety standards:

– North America: UL 507 (Standard for Electric Fans) and CSA C22.2 No. 113.

– European Union: CE marking per Low Voltage Directive (LVD 2014/35/EU) and EN 60335-1/60335-2-80.

– Other Regions: Include certifications such as UKCA (UK), RCM (Australia), or CCC (China) as applicable.

Testing by accredited labs and proper technical documentation (e.g., EU Declaration of Conformity) are mandatory.

Packaging and Shipping Requirements

Proper packaging ensures product integrity during transit:

– Use moisture-resistant, shock-absorbent materials to protect motors and blades.

– Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”).

– Securely anchor units in containers to prevent shifting.

– Include serialized tracking labels and barcodes for inventory management.

– Comply with ISPM 15 for wooden packaging materials in international shipments.

RoHS and Environmental Compliance

Electronic components in fans and blowers must meet substance restrictions:

– EU RoHS Directive (2011/65/EU): Limits lead, mercury, cadmium, and other hazardous substances.

– China RoHS: Requires labeling and compliance for electronic products sold in China.

– REACH (EU): Regulates the use of SVHCs (Substances of Very High Concern).

Suppliers must provide material declarations and compliance certificates.

Warranty, Labeling, and User Documentation

Ensure all products include:

– Multilingual user manuals with installation, operation, and maintenance instructions.

– Safety warnings in accordance with local regulations.

– Permanent labels indicating voltage, frequency, power, model number, and manufacturer details.

– Warranty information compliant with local consumer protection laws (e.g., EU Consumer Rights Directive).

After-Sales and Reverse Logistics

Plan for end-of-life and repair logistics:

– Establish return procedures for defective units (RMA process).

– Comply with WEEE (Waste Electrical and Electronic Equipment) Directive in the EU for recycling.

– Offer spare parts support and repair services to extend product life and meet sustainability goals.

Summary

Successful logistics and compliance for HVAC fans and blowers require attention to classification, regulatory standards, safety certifications, packaging, and environmental directives. Proactive planning and documentation ensure smooth global distribution and market access.

Conclusion: Sourcing HVAC Fans and Blowers

Sourcing HVAC fans and blowers is a critical decision that directly impacts the efficiency, reliability, and performance of heating, ventilation, and air conditioning systems. A successful sourcing strategy requires a comprehensive approach that balances technical specifications, energy efficiency, durability, and total cost of ownership.

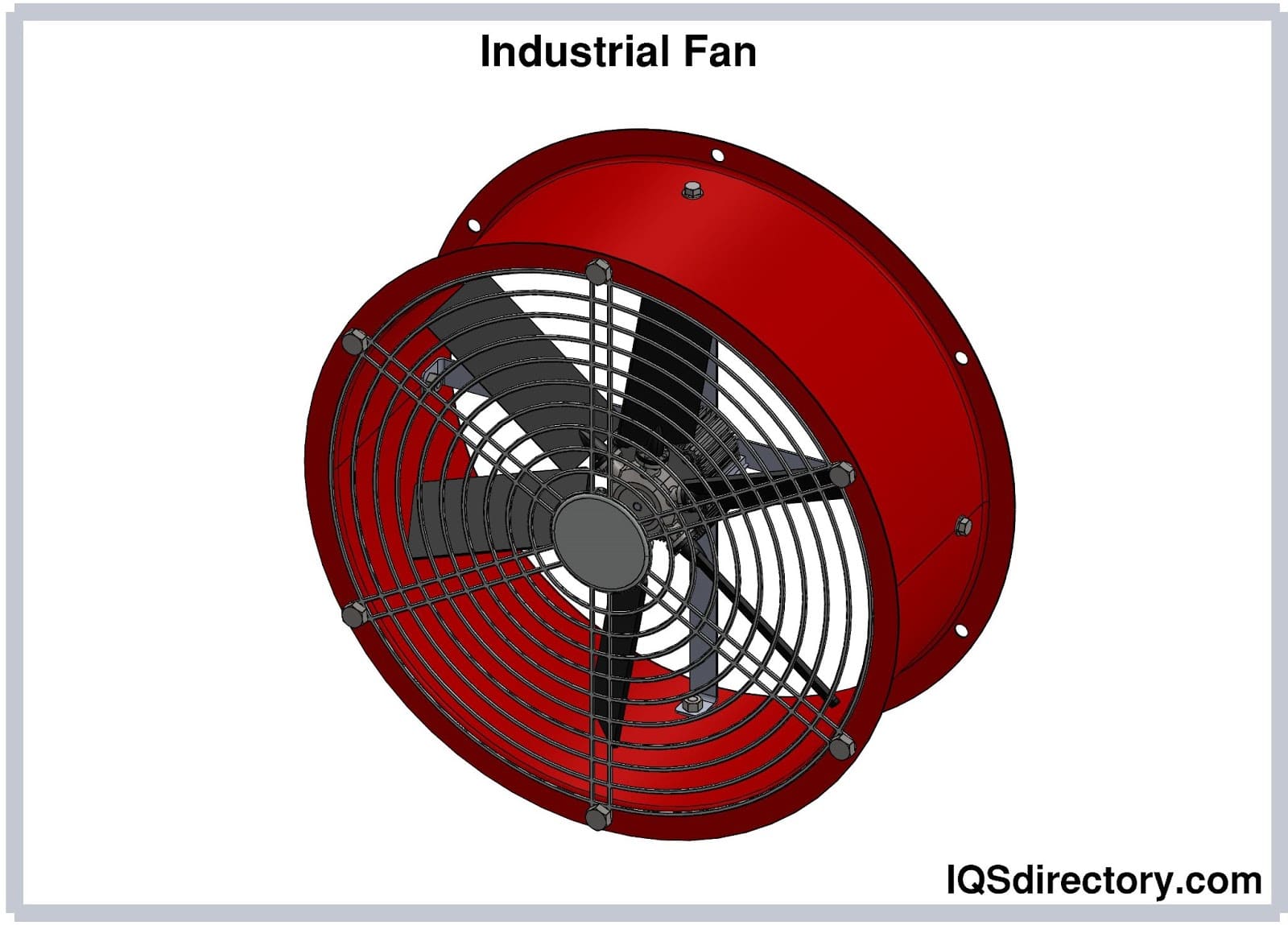

Key considerations include understanding the specific application requirements—such as airflow volume, pressure needs, noise constraints, and environmental conditions—and selecting appropriate fan types (e.g., centrifugal, axial, or mixed-flow) and motor configurations (e.g., AC, EC, variable speed). Partnering with reputable suppliers who offer proven product quality, compliance with industry standards (such as AMCA, ISO, and energy efficiency regulations), and responsive technical support is essential.

Additionally, evaluating long-term operational costs—not just upfront purchase price—is vital. Energy-efficient models, especially those with electronically commutated (EC) motors or variable frequency drives (VFDs), offer significant savings over time and contribute to sustainability goals.

In conclusion, effective sourcing of HVAC fans and blowers involves a strategic blend of technical expertise, supplier evaluation, and lifecycle cost analysis. By prioritizing performance, efficiency, and reliability, organizations can ensure optimal system operation, reduce maintenance requirements, and enhance overall indoor environmental quality.