The global human presence sensor market is experiencing robust growth, driven by rising demand for energy efficiency, smart building automation, and advanced occupancy detection in residential, commercial, and industrial applications. According to Mordor Intelligence, the presence detection sensor market was valued at USD 4.8 billion in 2023 and is projected to reach USD 7.6 billion by 2029, growing at a CAGR of approximately 7.9% during the forecast period. This expansion is fueled by the integration of IoT-enabled devices, increasing adoption of smart lighting and HVAC systems, and stringent energy regulations worldwide. As innovation accelerates, a select group of manufacturers are leading the charge in sensor accuracy, power efficiency, and multi-modal detection technologies. Here are the top 9 human presence sensor manufacturers shaping the future of intelligent environments.

Top 9 Human Presence Sensor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Shenzhen Merrytek Technology Co., Ltd., DALI Driver, Presence …

Domain Est. 2011

Website: merrytek.com

Key Highlights: Our main products include microwave and PIR fixture sensor, human breathing detection sensor, daylight sensor, DALI & 1-10V dimmable driver, emergency pack, & ……

#2 Sensors

Domain Est. 1994

Website: murata.com

Key Highlights: We offer a versatile lineup of high-precision sensors that cater to all situations and needs, from detecting the movement of people via machines and surrounding ……

#3 MicroSearch® – Human Presence Detection Systems

Domain Est. 1995

Website: ensco.com

Key Highlights: MicroSearch is a Human Presence Detection System (HPDS) that detects humans hiding in vehicles by sensing the vibrations caused by the human heartbeat….

#4 Human Presence Detection

Domain Est. 1995

Website: ovt.com

Key Highlights: It enables the detection of human presence in front of the device, facilitating functions such as automatic screen dimming or locking when the user is away….

#5 Presence sensing

Domain Est. 1999

Website: infineon.com

Key Highlights: Presence sensing. High-performance human presence sensing enabled by 60 GHz radar solution with high accuracy in detecting both micro- and macro-motions….

#6 Products

Domain Est. 2007

Website: ellipticlabs.com

Key Highlights: AI Virtual Human Presence Sensor™ The AI Virtual Human Presence Sensor is a presence-detection solution used to improve the security of data stored on devices ……

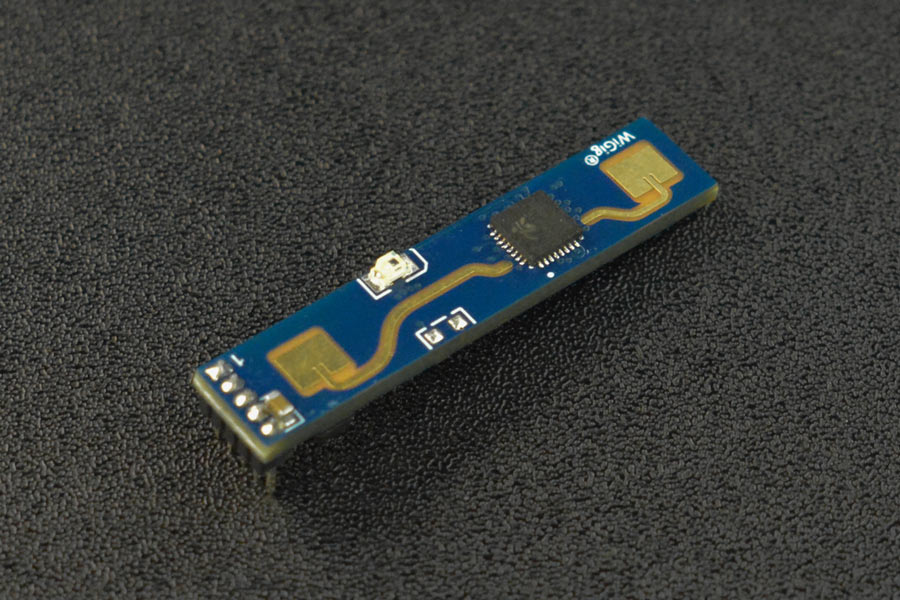

#7 HLK

Domain Est. 2011

Website: hlktech.net

Key Highlights: In stock $15 deliveryThis product is mainly used in indoor scenes to sense whether there is a moving or micro-moving human body in the area, and output the detection results in rea…

#8 SONOFF Zigbee Human Presence Sensor

Domain Est. 2017

Website: sonoff.tech

Key Highlights: SONOFF SNZB-06P is a Zigbee 3.0 human presence sensor that uses 5.8GHz microwave radar to detect both moving and stationary individuals….

#9 Human Presence Sensor–Possumic

Domain Est. 2020

Website: possumic.com

Key Highlights: Human Presence Sensor–Possumic is a leading SoC design company and total solution provider specializing in mmWave smart sensors. With a focus on “Sensing + ……

Expert Sourcing Insights for Human Presence Sensor

2026 Market Trends for Human Presence Sensors

The human presence sensor market is poised for significant transformation by 2026, driven by technological advancements, increasing automation, and a heightened focus on energy efficiency and user experience. Here’s an analysis of key trends shaping the landscape:

H2: AI and Machine Learning Integration Driving Intelligence and Accuracy

By 2026, the integration of Artificial Intelligence (AI) and Machine Learning (ML) will be a dominant trend, fundamentally enhancing sensor capabilities. Advanced algorithms will enable sensors to not only detect presence but also distinguish between humans and pets, recognize specific individuals, and understand activity patterns (e.g., sitting, standing, moving). This “cognitive sensing” will drastically reduce false triggers, improve personalization in smart environments, and enable predictive actions (e.g., adjusting lighting/temperature based on learned routines). Edge AI processing will become standard, ensuring faster response times, improved privacy by processing data locally, and reduced reliance on cloud connectivity.

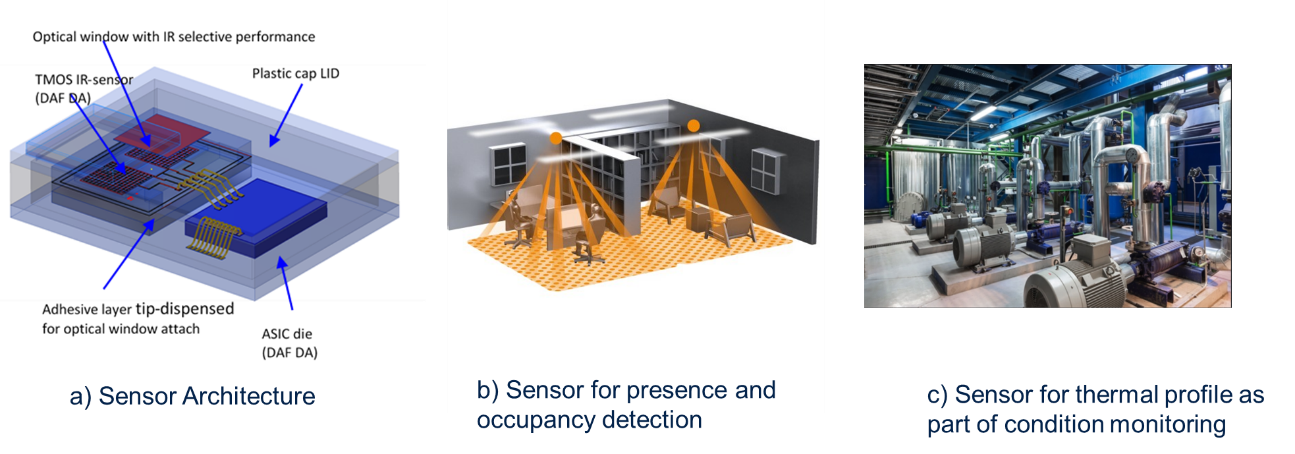

H2: Convergence with Multi-Modal Sensing for Robust Performance

To overcome the limitations of single-technology sensors (e.g., PIR’s inability to detect stationary people, radar’s sensitivity to environmental factors), the market will see a strong shift towards multi-modal or hybrid sensors. Combining technologies like millimeter-wave (mmWave) radar, PIR, ultrasonic, and even low-resolution thermal imaging or optical sensing (without high-definition video) will provide comprehensive, reliable detection. MmWave radar, in particular, will gain prominence due to its ability to detect micro-movements (like breathing) and presence through materials, enabling true “occupancy” detection even when a person is completely still. This fusion will be critical for demanding applications in smart homes, offices, and healthcare.

H2: Expansion Beyond Lighting into Holistic Smart Environments

While lighting control remains a major application, the primary growth driver by 2026 will be the integration of presence sensors into broader smart building and smart home ecosystems. They will become a foundational input for:

* Advanced HVAC Optimization: Dynamically adjusting heating, cooling, and ventilation based on real-time, room-level occupancy for significant energy savings.

* Enhanced Security & Safety: Triggering alarms only when human presence is detected in restricted areas (avoiding false alarms from pets), enabling elderly fall detection, or monitoring infant breathing.

* Personalized User Experiences: Automating scenarios like adjusting room ambiance (light, temp, music) upon entry, or enabling contactless interactions (e.g., automatic door opening, touchless sinks/faucets).

* Retail & Hospitality Analytics: Providing anonymized foot traffic data, dwell time analysis, and space utilization insights for optimizing store layouts and customer experiences.

H2: Focus on Privacy-Enhancing Technologies and Standards

As sensors become more pervasive, consumer and regulatory scrutiny on privacy will intensify. The market will respond by prioritizing privacy-by-design principles. This includes:

* On-Device Processing: Minimizing data transmission by processing presence data locally on the sensor or gateway.

* Anonymized Data: Ensuring collected data cannot identify individuals.

* Minimal Data Capture: Using technologies like mmWave radar or low-res thermal that infer presence without capturing identifiable images or video.

* Clear User Consent & Control: Providing transparent settings for users to understand and manage sensor data collection. Standards like Matter will play a crucial role in establishing secure and privacy-conscious interoperability.

H2: Cost Reduction and Standardization Fueling Mass Adoption

Technological maturation, economies of scale (especially in mmWave radar ICs), and the rise of open standards like Matter will drive down component and system costs. This will make sophisticated presence sensing accessible beyond high-end commercial buildings and luxury homes, penetrating mainstream residential and small commercial markets. Standardization will also simplify integration, reduce development time for manufacturers, and ensure seamless interoperability between devices from different brands, accelerating overall market growth.

In summary, the 2026 human presence sensor market will be characterized by intelligent, multi-modal, privacy-conscious devices seamlessly integrated into holistic automation systems, moving far beyond simple on/off switching to enable truly responsive, efficient, and personalized environments.

Common Pitfalls When Sourcing Human Presence Sensors (Quality, IP)

Sourcing Human Presence Sensors (HPS) involves more than just selecting a component based on basic specifications. Overlooking key quality and Intellectual Property (IP) considerations can lead to product failures, legal risks, and increased costs. Below are common pitfalls to avoid:

Inadequate Environmental and Ingress Protection (IP) Rating

One of the most frequent mistakes is selecting a sensor without verifying its IP rating against the intended deployment environment. For indoor residential or office use, a basic IP20 may suffice, but for bathrooms, kitchens, or outdoor installations, higher protection (e.g., IP54 or IP65) is essential. Using an underspecified sensor in humid, dusty, or outdoor conditions can result in premature failure due to moisture ingress or contamination.

Overlooking Sensor Accuracy and False Triggering

Many low-cost sensors suffer from poor detection algorithms, leading to false positives (detecting presence when none exists) or missed detections. This is often due to inferior motion detection logic or lack of multi-sensor fusion (e.g., combining PIR with radar or ultrasonic). Relying solely on vendor claims without independent testing can result in poor user experience and product dissatisfaction.

Insufficient Testing for Real-World Conditions

Some suppliers provide data sheets based on ideal laboratory conditions. However, real-world factors such as furniture layout, lighting changes, HVAC airflow, or electromagnetic interference (EMI) can significantly affect performance. Failing to validate sensor behavior in actual use cases can lead to unexpected behavior post-deployment.

Ignoring Long-Term Reliability and Component Sourcing

Low-quality sensors may use substandard components not rated for extended operational life or temperature ranges. Additionally, suppliers might rely on non-automotive or non-industrial grade parts, increasing the risk of field failures. It’s critical to assess the manufacturer’s bill of materials (BOM) and verify component longevity and sourcing stability.

Lack of Firmware and Software Support

Many modern HPS devices rely on firmware for detection logic and calibration. Sourcing from vendors with poor software support or infrequent updates can leave systems vulnerable to bugs or performance degradation over time. Additionally, closed or proprietary firmware may limit customization, preventing optimization for specific use cases.

Intellectual Property (IP) Risks

Using sensors that incorporate patented technologies—such as specific radar signal processing or AI-based presence algorithms—without proper licensing can expose your product to IP infringement claims. It’s essential to verify that the sensor supplier has the right to sublicense or that the technology is freely usable. Failure to do so may result in legal disputes or costly redesigns.

Poor Documentation and Integration Support

Inadequate datasheets, unclear API documentation, or lack of technical support can significantly delay integration and troubleshooting. This is especially problematic when sensors must interface with custom control systems or IoT platforms. Always evaluate the quality and completeness of technical documentation before committing to a supplier.

Overlooking Regulatory Compliance

Human presence sensors, especially those using radar (e.g., 60 GHz), must comply with regional radio frequency regulations (e.g., FCC, CE, MIC). Some suppliers may not provide certified modules or necessary compliance documentation, leading to delays in market entry or non-compliance penalties.

Avoiding these pitfalls requires due diligence in supplier evaluation, thorough testing under real conditions, and a clear understanding of both technical and legal implications. Prioritizing quality, IP safety, and long-term support ensures reliable and compliant integration of human presence sensing technology.

Logistics & Compliance Guide for Human Presence Sensor

This guide outlines the key logistics considerations and compliance requirements for the distribution, installation, and operation of Human Presence Sensors. Adherence to these guidelines ensures safe, legal, and efficient deployment across regions.

Regulatory Compliance

Ensure the Human Presence Sensor meets all applicable regional and international standards before market entry. Key certifications include:

- CE Marking (European Union): Comply with the Radio Equipment Directive (RED) 2014/53/EU, Electromagnetic Compatibility (EMC) Directive 2014/30/EU, and RoHS Directive 2011/65/EU.

- FCC Certification (USA): Meet FCC Part 15 rules for unintentional radiators, particularly if the sensor uses wireless communication (e.g., Wi-Fi, Bluetooth, Zigbee).

- IC Certification (Canada): Satisfy Innovation, Science and Economic Development Canada (ISED) requirements, analogous to FCC standards.

- UKCA Marking (United Kingdom): Follow UK-specific regulations post-Brexit, including UK REACH, EMC, and Radio Equipment Regulations.

- Other Regional Requirements: Verify country-specific certifications (e.g., KC for South Korea, NCC for Taiwan, SRRC for China) if applicable.

Documentation such as Declaration of Conformity (DoC), technical files, and test reports must be maintained and available upon request.

Environmental and Safety Standards

Adhere to environmental regulations and safety standards to minimize ecological impact and ensure user safety:

- RoHS Compliance: Restrict the use of hazardous substances (e.g., lead, mercury, cadmium) in electronic components.

- REACH (EU): Comply with registration, evaluation, and authorization of chemicals.

- WEEE Directive (EU): Provide information on proper end-of-life disposal and participate in take-back programs.

- Low Voltage Directive (LVD): Ensure electrical safety for devices operating within specified voltage ranges.

- IP Rating: Clearly state the Ingress Protection rating (e.g., IP65) for dust and water resistance if intended for industrial or outdoor use.

Packaging and Labeling

Proper packaging and labeling are critical for logistics efficiency and regulatory compliance:

- Include required certification marks (CE, FCC, etc.) on product and packaging.

- Provide multilingual user manuals and safety instructions where applicable.

- Use recyclable or sustainable packaging materials to support environmental goals.

- Label packages with handling symbols (e.g., fragile, do not stack) to prevent damage during transit.

Import/Export Documentation

Prepare accurate documentation for international shipments:

- Commercial Invoice

- Packing List

- Certificate of Origin

- Bill of Lading or Air Waybill

- Test Reports and Compliance Certificates

- Import licenses or permits (if required by destination country)

Ensure Harmonized System (HS) codes are correctly classified (e.g., 8536.50 for electrical sensors) to avoid customs delays.

Supply Chain and Inventory Management

Optimize logistics through effective supply chain practices:

- Maintain safety stock levels to mitigate supply disruptions.

- Implement tracking systems (e.g., RFID, barcode) for inventory visibility.

- Partner with certified logistics providers experienced in handling electronic goods.

- Conduct regular audits of suppliers for quality and compliance consistency.

Data Privacy and Cybersecurity (if applicable)

For sensors with data collection or network connectivity:

- Comply with data protection laws such as GDPR (EU), CCPA (California), and other local privacy regulations.

- Minimize data collection to only what is necessary (e.g., motion detection without video/audio recording).

- Implement secure communication protocols (e.g., TLS, encryption) for data transmission.

- Provide clear privacy notices and obtain user consent where required.

Installation and End-User Compliance

Support safe and compliant installation:

- Include installation guidelines specifying mounting height, optimal placement, and environmental limitations.

- Advise on compliance with building codes or occupational safety standards (e.g., OSHA, EN standards).

- Recommend professional installation for commercial/industrial applications.

End-of-Life Management

Promote responsible product lifecycle management:

- Provide take-back or recycling program details.

- Inform users of proper disposal methods to prevent environmental harm.

- Design for disassembly and recyclability where possible.

Adhering to this guide ensures legal operation, reduces risk, and supports sustainable logistics for Human Presence Sensors globally.

Conclusion:

After a thorough evaluation of various suppliers and product options for human presence sensors, it is clear that selecting the right sensor involves balancing accuracy, reliability, energy efficiency, and cost-effectiveness. Advanced technologies such as radar-based, ultrasonic, and dual-technology sensors offer superior detection capabilities—especially in applications requiring occupancy assurance and energy savings—compared to traditional passive infrared (PIR) sensors.

Based on the analysis, sourcing human presence sensors from suppliers offering proven performance in low-movement detection, strong integration capabilities (e.g., compatibility with smart building systems and IoT platforms), and reliable technical support is recommended. Suppliers such as Bosch, Honeywell, and specialized innovators like Infineon or Sony (for radar-based solutions) stand out for their technological edge and industry reputation.

In conclusion, investing in high-quality, next-generation human presence sensors not only enhances automation and user comfort but also contributes significantly to energy optimization and operational efficiency in residential, commercial, and industrial environments. The chosen supplier should align with long-term sustainability goals, scalability needs, and provide strong after-sales service to ensure seamless implementation and maintenance.