The global check valve market is experiencing robust growth, driven by increasing demand across industries such as oil & gas, water and wastewater treatment, chemical processing, and power generation. According to Mordor Intelligence, the check valve market was valued at USD 8.5 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2029. This expansion is fueled by rising infrastructure development, stricter environmental regulations, and the need for reliable fluid control systems to prevent backflow and ensure operational safety. Within this growing market, hose check valves—valves specifically designed for integration into flexible hose systems—are gaining traction due to their versatility in mobile, industrial, and marine applications. As demand intensifies, manufacturers are focusing on innovation in materials, sealing technology, and compact design to meet performance and durability requirements. This list highlights the top 10 hose check valve manufacturers leading this space through proven product quality, global reach, and technical expertise.

Top 10 Hose Check Valve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial Pinch Valves & Check Valves

Domain Est. 1995

Website: redvalve.com

Key Highlights: Red Valve is the largest manufacturer and supplier of pinch and check valves, and is the preferred supplier for municipalities and industrial plants worldwide….

#2 Powell Valves: Industrial Valve Manufacturer

Domain Est. 1998

Website: powellvalves.com

Key Highlights: Powell Valves has been a leading industrial manufacturer, providing high-quality gate, globe, check, bellow-seal & non-return valves. Contact a valve expert ……

#3 Legend Valve

Domain Est. 1996

Website: legendvalve.com

Key Highlights: Legend provides high quality valves and fittings for plumbing, industrial, commercial and residential markets….

#4 Kennedy Valve

Domain Est. 1997

Website: kennedyvalve.com

Key Highlights: Kennedy Valve Company, located in Elmira, New York, is an established manufacturer of fire hydrants, valves and fire protection products….

#5 Check Valves, Ball Valves, & Low Pressure Valve Manufacturer …

Domain Est. 1999

Website: usvalve.com

Key Highlights: US Valve is a New Jersey Corporation with headquarters in New Jersey and valve manufacturing locations in Maryland–USA, Europe and Asia….

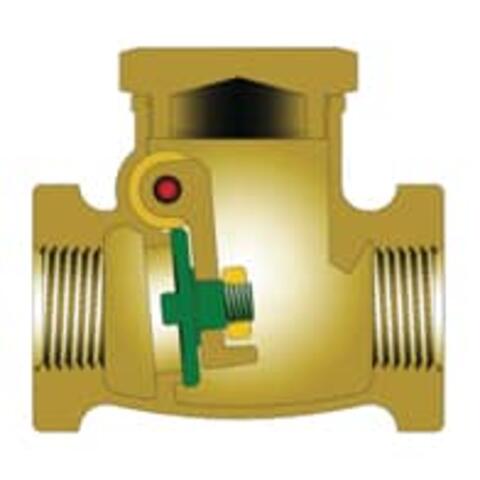

#6 RED-WHITE VALVE CORP.

Domain Est. 2008

Website: redwhitevalvecorp.com

Key Highlights: RED-WHITE VALVE CORP. manufactures an extensive line of coil kit components including fixed orifice manual balancing valves, automatic balancing valves, ……

#7 Parth Valve

Domain Est. 2018

Website: parthvalve.com

Key Highlights: The PARTH VALVES AND HOSES LLP offers a variety of HYGIENE VALVES, FDA HOSES DAMPERS that are made with premium materials in a hygienic setting and have….

#8 Flomatic Valves

Domain Est. 1996 | Founded: 1933

Website: flomatic.com

Key Highlights: Since 1933, Flomatic Valves has focused on the design, development, and manufacturing of high-quality valve products for the water and wastewater industries….

#9 Check & Foot Valves

Domain Est. 1996

Website: merrillmfg.com

Key Highlights: Free delivery over $50Merrill 500 Series No-Lead Malleable Iron Check Valve – No-Spin Poppet, High Strength & Corrosion-Resistant | CVI. SKU CVI100. Starting at $39.00….

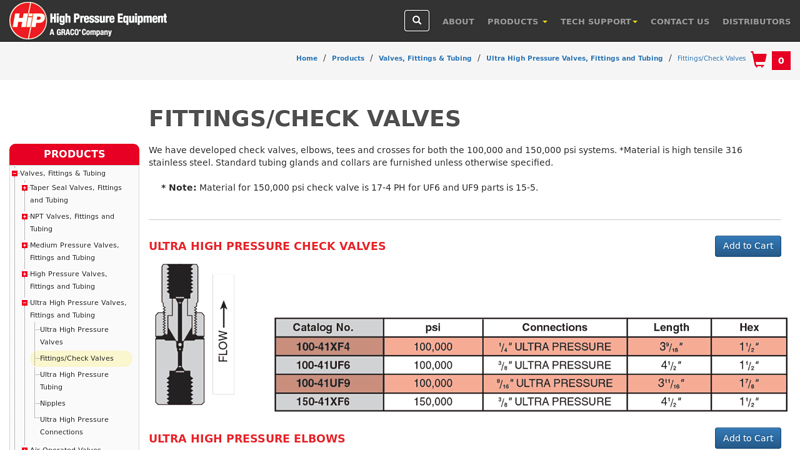

#10 Fittings/Check Valves

Domain Est. 1997

Website: highpressure.com

Key Highlights: We have developed check valves, elbows, tees and crosses for both the 100,000 and 150,000 psi systems. *Material is high tensile 316 stainless steel….

Expert Sourcing Insights for Hose Check Valve

H2: Projected Market Trends for Hose Check Valves in 2026

The global hose check valve market is poised for steady growth by 2026, driven by increasing demand across key industrial sectors, technological advancements, and a heightened focus on system efficiency and safety. Several defining trends are expected to shape the market landscape in the coming years.

1. Rising Industrial Automation and Infrastructure Development

The expansion of industrial automation, particularly in manufacturing, chemical processing, and water treatment, is fueling demand for reliable fluid control components like hose check valves. Emerging economies in Asia-Pacific and Latin America are investing heavily in infrastructure and industrial projects, directly boosting the need for durable and efficient valve solutions. These valves prevent backflow in fluid systems, ensuring operational safety and reducing maintenance costs—critical factors in automated environments.

2. Growth in Oil & Gas and Petrochemical Sectors

Despite the global shift toward renewable energy, the oil and gas industry continues to modernize its infrastructure, especially in midstream and downstream operations. Hose check valves are essential in pipelines, transfer systems, and offshore platforms to prevent reverse flow and fluid contamination. The anticipated increase in LNG (liquefied natural gas) projects and refinery upgrades will further stimulate market demand through 2026.

3. Advancements in Material Science and Valve Design

Manufacturers are focusing on developing hose check valves made from corrosion-resistant materials such as stainless steel, PTFE-lined components, and advanced polymers. These enhancements improve valve longevity and performance in aggressive environments (e.g., high pressure, extreme temperatures, or chemically active fluids). Compact, lightweight, and modular designs are also becoming popular, enabling easier integration into complex hydraulic and pneumatic systems.

4. Emphasis on Sustainability and Leak Prevention

Environmental regulations are becoming stricter worldwide, pushing industries to adopt leak-proof, low-emission components. Hose check valves play a vital role in minimizing fluid loss and preventing contamination. Companies are increasingly opting for valves that comply with ISO and API standards, which support sustainability goals and reduce environmental liability.

5. Regional Market Dynamics

North America and Europe will remain significant markets due to stringent safety regulations and ongoing industrial upgrades. However, the Asia-Pacific region—led by China, India, and Southeast Asian countries—is expected to witness the highest growth rate. Rapid urbanization, government investments in water management, and the expansion of the automotive and manufacturing sectors are key drivers in this region.

6. Digital Integration and Smart Valve Technologies

Although still in early stages for hose check valves, the integration of IoT-enabled sensors and predictive maintenance systems is an emerging trend. Smart monitoring systems can detect valve performance anomalies, predict failures, and optimize system efficiency. While primarily seen in larger industrial valves, this technology is expected to trickle down to auxiliary components like hose check valves by 2026.

7. Supply Chain Resilience and Localization

Post-pandemic supply chain disruptions have prompted manufacturers to reevaluate sourcing and production strategies. There is a growing trend toward regional manufacturing and inventory localization to mitigate risks. This shift supports faster delivery times and reduces dependency on single-source suppliers, particularly for mission-critical components like check valves.

In conclusion, the hose check valve market in 2026 will be characterized by innovation, regulatory compliance, and expanding applications across diverse industries. Companies that invest in advanced materials, sustainability, and digital readiness are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing Hose Check Valves (Quality and IP)

Sourcing the right hose check valve is critical for ensuring system reliability, safety, and performance—especially in industrial, chemical, or high-pressure applications. However, several common pitfalls related to quality and Ingress Protection (IP) ratings can lead to premature failure, leaks, safety hazards, or system downtime. Being aware of these issues helps avoid costly mistakes.

Poor Material Quality and Compatibility

One of the most frequent pitfalls is selecting a hose check valve made from substandard or incompatible materials. Low-quality elastomers, plastics, or metals may degrade when exposed to certain fluids, temperatures, or environmental conditions. For example, using a valve with NBR seals in an ozone-rich environment can lead to rapid cracking and failure. Always verify chemical compatibility with the media being handled and ensure materials meet relevant industry standards.

Inadequate Ingress Protection (IP) Rating

The IP rating indicates the level of protection against solid objects and liquids. A common mistake is assuming all hose check valves are suitable for outdoor or washdown environments. Using a valve with a low IP rating (e.g., IP44) in a high-moisture or dusty setting can result in internal contamination, corrosion, or mechanical failure. For harsh environments, opt for valves with higher IP ratings such as IP65, IP67, or IP69K, especially if the valve is exposed to direct water jets or high-pressure cleaning.

Lack of Third-Party Certification

Many suppliers offer valves that claim to meet certain standards but lack actual certification. Relying on unverified claims can lead to non-compliant or unsafe components. Always request documentation such as CE marking, ISO certification, or test reports from accredited laboratories. Certifications provide assurance that the product has been tested for quality, durability, and safety.

Inconsistent Manufacturing Standards

Valves sourced from unreliable manufacturers may suffer from inconsistent spring tension, sealing surfaces, or dimensional tolerances. These variations can result in inconsistent performance, leakage, or failure to reseat properly. Partner with suppliers who adhere to strict quality control processes and offer batch traceability.

Misunderstanding Pressure and Flow Requirements

Selecting a valve that cannot handle the system’s maximum pressure or flow rate leads to premature wear or catastrophic failure. Always confirm the valve’s maximum operating pressure, burst pressure, and flow characteristics match or exceed system demands. Overlooking backpressure requirements is another frequent oversight that impacts valve functionality.

Ignoring Environmental and Installation Conditions

Environmental factors such as UV exposure, temperature extremes, and vibration can degrade valve performance. Similarly, improper installation—like incorrect orientation or over-tightening—can damage seals or housing. Choose valves designed for the specific installation environment and follow manufacturer guidelines rigorously.

By addressing these common pitfalls related to quality and IP ratings, you can ensure reliable, long-term performance of hose check valves in your application.

H2: Logistics & Compliance Guide for Hose Check Valves

Ensuring the smooth transportation and regulatory compliance of Hose Check Valves is critical for operational efficiency, safety, and legal adherence. This guide outlines key considerations for logistics planning and compliance across the product lifecycle.

H3: Transportation & Handling

-

Packaging Requirements

Hose Check Valves must be securely packaged to prevent physical damage during transit. Use cushioned, sealed containers that protect against moisture, dust, and impact. Valves with elastomeric seals should be protected from ozone, UV exposure, and extreme temperatures. -

Labeling & Documentation

Each shipment must include clear labeling with: - Product name and model number

- Batch/lot number

- Net weight and dimensions

- Handling symbols (e.g., “Fragile,” “This Way Up”)

- Country of origin

-

Safety warnings (if applicable)

-

Storage Conditions

Store in a dry, temperature-controlled environment (typically 5°C to 40°C). Avoid direct sunlight and sources of heat or vibration. Valves with rubber or plastic components should not be stored near solvents or corrosive chemicals. -

Transport Modes

Suitable for road, rail, air, and sea freight. For international shipping, ensure compliance with IATA (air) or IMDG (sea) regulations if transporting with associated hazardous materials.

H3: Regulatory Compliance

- Material Compliance

Confirm that materials used (e.g., stainless steel, brass, EPDM, NBR) meet relevant standards: - FDA 21 CFR for food and beverage applications

- NSF/ANSI 61 for potable water systems

-

REACH and RoHS for EU markets (restriction of hazardous substances)

-

Pressure Equipment Directive (PED) – EU

If the valve is used in pressurized systems in the European Union, it may fall under the scope of the PED (2014/68/EU). Verify CE marking requirements based on fluid group, pressure, and volume. -

ASME & ANSI Standards – North America

Ensure design and testing adhere to applicable standards such as ASME B16.34 or ANSI B16.34 for valve construction and pressure ratings. -

ATEX / IECEx (Hazardous Areas)

For use in explosive atmospheres, verify compliance with ATEX (EU) or IECEx standards if the valve is intended for such environments. -

Customs & Import Regulations

Prepare commercial invoices, packing lists, and certificates of origin. Classify under correct HS Code (e.g., 8481.80 for check valves). Be aware of import duties, anti-dumping rules, and country-specific certifications.

H3: Quality & Traceability

-

Batch Traceability

Maintain full traceability of materials and production batches. Each valve or shipment should include a unique identifier for quality control and recall readiness. -

Testing & Certification

Provide test certificates (e.g., material test reports, pressure test reports) upon request. Some industries require third-party certification (e.g., API, CRN in Canada). -

Documentation Retention

Retain logistics and compliance records for a minimum of 5–10 years, depending on regional and industry requirements.

H3: Environmental & Sustainability Considerations

-

Waste & Recycling

Follow local regulations for disposal of packaging and non-functional valves. Metals and elastomers should be recycled where possible. -

Carbon Footprint

Optimize shipping routes and consolidate shipments to reduce emissions. Consider suppliers with ISO 14001 environmental management certification.

Adhering to this logistics and compliance framework ensures that Hose Check Valves are delivered safely, meet regulatory expectations, and support sustainable operations globally.

Conclusion on Sourcing Hose Check Valves

In conclusion, sourcing hose check valves requires a strategic approach that balances quality, cost, availability, and application-specific requirements. These essential components play a critical role in preventing backflow and ensuring the efficient and safe operation of fluid handling systems across industries such as agriculture, manufacturing, water treatment, and chemical processing.

When selecting suppliers, it is important to evaluate factors such as material compatibility, pressure and temperature ratings, regulatory compliance (e.g., FDA, NSF, or CE), and certifications. Additionally, establishing relationships with reliable suppliers—whether domestic or international—can enhance supply chain resilience and reduce lead times.

Investing time in vetting manufacturers, requesting samples, and conducting performance testing ensures that the selected hose check valves meet operational demands and longevity expectations. Ultimately, a well-informed sourcing decision contributes to improved system reliability, reduced maintenance costs, and enhanced safety, making it a vital component of effective fluid system management.