The global high voltage controller market is experiencing robust growth, driven by rising demand for efficient power management systems across industrial automation, renewable energy, and electric vehicle (EV) infrastructure. According to Grand View Research, the global power electronics market—of which high voltage controllers are a critical component—was valued at USD 28.5 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2024 to 2030. Similarly, Mordor Intelligence projects that the high voltage power controller market will grow steadily, fueled by increasing investments in smart grid technologies and the proliferation of high-voltage DC (HVDC) transmission systems. As industries prioritize energy efficiency and system reliability, the role of advanced high voltage controllers has become increasingly pivotal. In this evolving landscape, a select group of manufacturers are leading innovation, scale, and performance—setting the benchmark for quality and technological advancement. Here’s a look at the top 9 high voltage controller manufacturers shaping the future of power control.

Top 9 High Voltage Controller Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HVM Technology, Inc.

Domain Est. 2005

Website: hvmtech.com

Key Highlights: HVM Technology specializes in high voltage DC-DC converters and amplifiers with a wide range of high voltage components, measurement devices, and accessories….

#2 HV TECHNOLOGIES, Inc.

Domain Est. 1998

Website: hvtechnologies.com

Key Highlights: HV TECHNOLOGIES, Inc. is a prominent supplier of High Voltage and EMC test equipment. Distributor of EMC Partner, HAEFELY and BAUR equipment….

#3 XP Power

Domain Est. 2000

Website: xppower.com

Key Highlights: Looking for the leading manufacturer of AC-DC power supplies, DC-DC converters, high voltage, RF & custom power products? Discover our extensive range….

#4 Trench Group

Domain Est. 2004

Website: trench-group.com

Key Highlights: Trench is a hidden champion in the energy sector and is one of the global leaders of high voltage component manufacturers: Nearly all grid operators ……

#5 High Voltage Power Supply Products

Domain Est. 1995

Website: spellmanhv.com

Key Highlights: Spellman high voltage power supplies are complex power conversion circuits that convert a lower voltage potential to a higher voltage potential….

#6 Power Supplies

Domain Est. 1997

Website: dbcontrol.com

Key Highlights: High Voltage and Low Voltage Power Supplies, High Voltage Assemblies. Custom designed to your specifications; CAN-BUS to interface options for high voltage ……

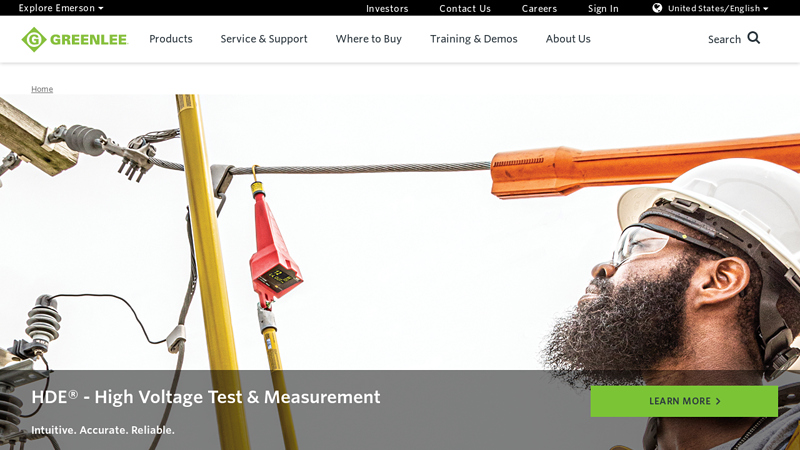

#7 HDE

Domain Est. 1997

Website: greenlee.com

Key Highlights: Find product features, specifications and where to buy information for the Greenlee’s HDE line of High Voltage Test & Measurement tools….

#8 High Voltage Power Supply (HVPS)

Domain Est. 1999

Website: iseg-hv.com

Key Highlights: The iseg company group specialises in the development and production of High Voltage Power Supplies for Industry and Research. Our business goal is to provide ……

#9 b2 electronics

Domain Est. 2009 | Founded: 2001

Website: b2hv.com

Key Highlights: Founded in 2001, b2 electronics is an internationally acting company with the goal to innovate high voltage testing….

Expert Sourcing Insights for High Voltage Controller

H2: 2026 Market Trends for High Voltage Controllers

The global market for high voltage controllers is poised for significant transformation by 2026, driven by accelerating electrification, renewable energy integration, and advancements in smart grid infrastructure. As industries and utilities adapt to rising energy demands and decarbonization goals, high voltage controllers—critical components for managing and regulating power flow in transmission and distribution systems—are experiencing evolving technological, regulatory, and demand-side dynamics.

1. Growth in Renewable Energy Integration

A primary driver of the 2026 high voltage controller market is the global expansion of renewable energy sources, particularly solar and wind. These intermittent energy sources require sophisticated voltage regulation to maintain grid stability. High voltage controllers are increasingly deployed in substations and renewable power plants to ensure consistent voltage levels and prevent overloads. Countries investing heavily in offshore wind and large-scale solar farms—such as China, the U.S., Germany, and India—are expected to account for a significant share of new installations.

2. Smart Grid Expansion and Digitalization

Utilities are modernizing aging grid infrastructure with smart grid technologies, which rely on intelligent high voltage controllers equipped with IoT connectivity, remote monitoring, and real-time analytics. By 2026, the integration of AI-driven predictive maintenance and self-healing grid capabilities will elevate demand for digital high voltage controllers. These smart systems enhance grid resilience, reduce downtime, and improve energy efficiency—key priorities for utility providers navigating climate pressures and regulatory mandates.

3. Electrification of Transportation and Industry

The surge in electric vehicle (EV) adoption and industrial electrification is increasing load demands on high voltage networks. Fast-charging stations, EV fleet depots, and electric heavy machinery require robust voltage control to manage sudden load fluctuations. High voltage controllers are being redesigned to support dynamic load balancing and peak shaving, particularly in urban and industrial zones. This trend is expected to boost market growth, especially in regions with aggressive EV adoption targets.

4. Regional Market Divergence

While North America and Europe lead in adopting advanced controller technologies due to strong regulatory frameworks and grid modernization funding, the Asia-Pacific region is anticipated to witness the highest compound annual growth rate (CAGR). Rapid urbanization, expanding manufacturing sectors, and government initiatives like China’s “Dual Carbon” goals are accelerating investments in high voltage infrastructure. Emerging markets in Southeast Asia and Africa are also beginning large-scale grid upgrades, creating new opportunities for cost-effective, modular controller solutions.

5. Technological Innovation and Product Development

By 2026, high voltage controllers are expected to feature enhanced capabilities such as adaptive voltage regulation, fault current limitation, and compatibility with hybrid AC/DC systems. Solid-state technologies and wide-bandgap semiconductors (e.g., SiC and GaN) are enabling smaller, more efficient controllers with faster response times. Additionally, cybersecurity is becoming a critical design consideration, as connected controllers become potential targets for cyber threats.

6. Regulatory and Sustainability Pressures

Stringent energy efficiency standards and sustainability regulations are pushing manufacturers to develop eco-friendly, low-loss controllers. The European Union’s Green Deal and similar initiatives worldwide are incentivizing utilities to upgrade to energy-efficient equipment. In response, vendors are focusing on recyclable materials, reduced SF6 (sulfur hexafluoride) usage, and lifecycle carbon footprint assessments.

Conclusion

The 2026 high voltage controller market will be defined by innovation, digital integration, and a strong alignment with global energy transition goals. Stakeholders—including manufacturers, utilities, and policymakers—must collaborate to scale advanced controller technologies that support a reliable, resilient, and sustainable power ecosystem. With the market projected to grow at a CAGR of approximately 6–8% through 2026, strategic investments in R&D, interoperability, and cybersecurity will be essential for long-term competitiveness.

Common Pitfalls Sourcing a High Voltage Controller (Quality, IP)

Sourcing a high voltage controller involves significant technical and legal considerations, particularly concerning quality and intellectual property (IP). Overlooking these aspects can lead to safety hazards, product failures, legal disputes, and reputational damage. Below are common pitfalls to avoid:

Poor Quality Control and Reliability

One of the most critical risks when sourcing high voltage controllers is inadequate quality assurance. High-voltage systems demand rigorous standards due to safety and performance implications.

-

Insufficient Testing and Certification: Many suppliers, especially from less-regulated markets, may not conduct thorough high-voltage testing (e.g., dielectric withstand, partial discharge, thermal cycling). Always verify that the controller meets international standards such as IEC 61800, UL 61800, or ISO 26262 (for automotive).

-

Substandard Components: Low-cost suppliers may use inferior capacitors, MOSFETs, or insulation materials that degrade under high-stress conditions, leading to premature failure or safety issues like arcing or thermal runaway.

-

Lack of Traceability: Without proper component traceability (e.g., batch numbers, supplier certifications), it becomes difficult to manage recalls or root cause analysis in case of failure.

-

Inadequate Environmental Protection: High voltage controllers often operate in harsh environments. Sourcing units without proper encapsulation, conformal coating, or ingress protection (IP67, etc.) can result in corrosion, moisture ingress, and short circuits.

Intellectual Property (IP) Risks

IP infringement is a serious concern, especially when sourcing from regions with weak IP enforcement.

-

Counterfeit or Cloned Designs: Some suppliers offer “compatible” controllers that closely mimic proprietary designs. These may infringe on patents, copyrights, or trade secrets, exposing your company to legal liability.

-

Unclear IP Ownership in Custom Designs: When working with contract manufacturers or OEMs on custom controllers, failure to define IP ownership in contracts can result in shared or lost rights. Ensure that design specifications, firmware, and PCB layouts are explicitly assigned to your company.

-

Use of Open-Source Firmware Without Compliance: Some controllers use open-source software (e.g., under GPL licenses). If not properly licensed or attributed, this can trigger license obligations or expose your product to unwanted open-source requirements.

-

Reverse-Engineered Components: Some suppliers may incorporate reverse-engineered ICs or proprietary algorithms without licensing, leading to potential litigation from original IP holders.

Mitigation Strategies

To avoid these pitfalls:

– Conduct thorough supplier audits, including factory visits and quality system reviews (e.g., ISO 9001).

– Require full compliance documentation (test reports, safety certifications, RoHS, REACH).

– Perform independent third-party testing on sample units.

– Include strong IP clauses in procurement contracts specifying ownership, non-infringement warranties, and indemnification.

– Use NDA agreements when sharing technical specifications.

– Work with legal counsel to perform freedom-to-operate (FTO) analyses before finalizing designs.

By proactively addressing quality and IP concerns, companies can reduce risk and ensure reliable, legally sound integration of high voltage controllers into their systems.

Logistics & Compliance Guide for High Voltage Controller

This guide outlines essential logistics considerations and compliance requirements for the safe and legal handling, transportation, storage, and installation of High Voltage Controllers. Adherence to these guidelines is critical to ensure personnel safety, equipment integrity, and regulatory compliance.

Regulatory Compliance

High Voltage Controllers are subject to stringent international, national, and regional regulations due to the inherent risks associated with high voltage equipment. Compliance is mandatory at all stages of the product lifecycle.

- Electrical Safety Standards: Devices must comply with recognized safety standards such as IEC 61800-5-1 (Adjustable speed electrical power drive systems), IEC 60204-1 (Safety of machinery – Electrical equipment of machines), and UL 60730 or UL 508C where applicable.

- Electromagnetic Compatibility (EMC): Compliance with EMC directives (e.g., EU EMC Directive 2014/30/EU, FCC Part 15 in the U.S.) is required to prevent interference with other electronic systems.

- RoHS and REACH Compliance: Ensure the product meets the Restriction of Hazardous Substances (RoHS) and Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulations, especially for shipments into the European Union.

- CE, UKCA, and UL Markings: Affix appropriate conformity markings based on destination market requirements. CE marking is required for EU markets; UKCA for the United Kingdom; UL certification is often required for North America.

- Low Voltage Directive (LVD): In the EU, high voltage controllers may fall under the LVD (2014/35/EU) if operating between 50–1000 V AC or 75–1500 V DC. Confirm voltage classification and conformity.

Packaging and Handling

Proper packaging and handling are essential to prevent damage and maintain safety integrity during transit and storage.

- ESD-Safe Packaging: Use electrostatic discharge (ESD)-protective materials to shield sensitive electronic components.

- Robust Enclosure: Package the controller in a rigid, shock-absorbent container with internal bracing to prevent movement. Include moisture barrier bags where necessary.

- Labeling Requirements:

- Clearly mark “Fragile,” “This Side Up,” and “Do Not Stack” as appropriate.

- Include high voltage warning labels (e.g., “Danger – High Voltage”).

- Attach compliance labels (CE, UL, etc.) and product identification (model, serial number, voltage ratings).

- Handling Instructions: Only trained personnel should handle the unit. Use appropriate lifting equipment for heavy models. Avoid dropping or impacting the controller.

Transportation

Transportation of high voltage equipment must comply with dangerous goods regulations when applicable, particularly if batteries or capacitors are integrated.

- Air Freight (IATA): If the controller contains energy storage components exceeding specified thresholds, it may be classified under UN 3481 (Lithium-ion batteries) or similar. Consult IATA Dangerous Goods Regulations and perform a hazard assessment.

- Ground and Sea Freight (ADR/RID/IMDG): Ensure compliance with regional transport regulations. Declare any hazardous components accurately.

- Temperature Control: Avoid exposure to extreme temperatures during transit. Maintain storage within the manufacturer’s specified range (typically -25°C to +70°C for storage).

- Insurance and Documentation: Provide detailed shipping documentation, including commercial invoice, packing list, safety data sheet (if applicable), and certificates of conformity.

Import and Export Compliance

Cross-border shipments require careful attention to customs and trade regulations.

- Export Controls: Verify if the controller is subject to export control regulations such as ITAR (International Traffic in Arms Regulations) or EAR (Export Administration Regulations) in the U.S., or similar regimes in other countries.

- Customs Classification: Use the correct HS (Harmonized System) code (e.g., 8537.10 for boards with voltage control functions) to ensure accurate duty assessment.

- Documentation: Provide a Certificate of Origin, Export Declaration, and any required permits or licenses.

- Duty and Tax Optimization: Leverage free trade agreements or bonded warehouse programs where applicable to reduce costs.

On-Site Storage and Installation

Prior to commissioning, proper storage and installation protocols must be followed.

- Storage Conditions: Store in a clean, dry, temperature-controlled environment with low humidity. Avoid condensation and corrosive atmospheres.

- Pre-Installation Inspection: Check for shipping damage, verify contents against packing list, and confirm compliance labels are intact.

- Qualified Personnel Only: Installation and electrical connections must be performed by certified electricians or engineers familiar with high voltage systems.

- Lockout/Tagout (LOTO): Follow LOTO procedures during installation and maintenance to prevent accidental energization.

- Grounding and Bonding: Ensure proper grounding in accordance with local electrical codes (e.g., NEC Article 250 in the U.S., IEC 60364 internationally).

Environmental and End-of-Life Management

Compliance extends beyond operational use to include environmental responsibility.

- WEEE Compliance: In the EU, adhere to the Waste Electrical and Electronic Equipment (WEEE) Directive for proper end-of-life disposal and recycling.

- Take-Back Programs: Offer or participate in manufacturer take-back or recycling programs.

- Hazardous Waste Disposal: Follow local regulations for disposal of any components classified as hazardous waste (e.g., capacitors with PCBs, though rare in modern designs).

Training and Documentation

Ensure all stakeholders have access to critical information.

- User Manuals: Provide comprehensive installation, operation, and maintenance manuals in the local language(s) of the destination market.

- Safety Training: Conduct training for handlers, installers, and maintenance personnel on high voltage risks and emergency procedures.

- Record Keeping: Maintain logs of compliance certifications, shipping documents, inspections, and maintenance activities.

Adherence to this guide ensures safe, legal, and efficient logistics management of High Voltage Controllers across global supply chains. Always consult the manufacturer’s specifications and local regulations for site-specific requirements.

Conclusion: Sourcing a High-Voltage Controller

In conclusion, sourcing a high-voltage controller requires a thorough evaluation of technical specifications, safety standards, reliability, and supplier credibility. The controller must meet the required voltage and current ratings, offer robust protection features (such as overvoltage, overcurrent, and thermal shutdown), and be compatible with the overall system architecture. Compliance with international regulations (e.g., UL, CE, IEC) is essential to ensure safe and legal operation.

Cost, lead time, and scalability should also be balanced with performance and durability, especially for applications in electric vehicles, renewable energy systems, or industrial automation where failure can lead to significant consequences. Engaging with reputable suppliers, conducting rigorous testing, and considering long-term support and warranty options are critical to ensuring a successful integration.

Ultimately, selecting the right high-voltage controller is not just about meeting current needs, but also about ensuring scalability, safety, and reliability for future operations. A well-informed sourcing decision will contribute significantly to the efficiency, safety, and longevity of the entire high-voltage system.