The global CNC milling machine market is experiencing robust growth, driven by rising demand for precision engineering across aerospace, automotive, and medical device manufacturing. According to Grand View Research, the market was valued at USD 63.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 7.2% through 2030. This growth is fueled by increasing automation, advancements in Industry 4.0 technologies, and the integration of AI-driven predictive maintenance and IoT-enabled machine monitoring. As engineering manufacturers seek higher accuracy, faster cycle times, and seamless digital connectivity, investment in high-tech milling solutions has become a strategic imperative. In this evolving landscape, selecting the right milling machine is critical—not just for competitive advantage, but for long-term operational scalability and innovation. Based on performance metrics, technological sophistication, and industry adoption, here are the top 10 high-tech milling machines shaping modern manufacturing in 2024.

Top 10 High-Tech Milling Machines For Engineering Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Milling machine manufacturer & technology leader from Gos

Website: hermle.de

Key Highlights: In the CNC milling machine sector, HERMLE AG is a leading manufacturer of portal milling machines, machine tools and CNC special machines….

#2 Makino

Domain Est. 1996

Website: makino.com

Key Highlights: Achieve superior results with Makino’s CNC machining. Makino machines and engineering services provide precision and reliability across applications….

#3 UNITED MACHINING

Domain Est. 1999

Website: gfms.com

Key Highlights: LIECHTI milling machines reduce machining times more than 30 percent as a result of specific profile machining technology and specialized CAD/CAM software….

#4 EMCO lathes & milling machines manufacturer, CNC training …

Domain Est. 2007

Website: emco-world.com

Key Highlights: EMCO has been a leading manufacturer of lathes and milling machines for over 75 years and offers a wide range of development opportunities….

#5 Technology leader in machine tools & systems

Domain Est. 2017

Website: ffg-ea.com

Key Highlights: Milling machines for high-speed, high-performance and heavy duty machining of large parts, universal milling machines and milling/drilling machines from ……

#6 DATRON High

Domain Est. 1995

Website: datron.com

Key Highlights: DATRON CNC milling machines are rigid and durable high-speed machining centers that improve the quality of your parts while reducing cycle times and operating ……

#7 Metal Fabrication Machinery

Domain Est. 1998

Website: mcmachinery.com

Key Highlights: MC Machinery Systems, a supplier of metal fabrication machines, provides EDM, milling, laser, press brake, finishing, and automation solutions….

#8 Fadal

Domain Est. 1998

Website: fadal.com

Key Highlights: Fadal offers CNC machining centers, boring machines, and milling machines through an extensive network of North American dealers….

#9 High Precision Machines

Domain Est. 2007

Website: fivesgroup.com

Key Highlights: Fives is recognized as the leading supplier of high-precision machine-tooling solutions, used in both hi-tech industries and traditional manufacturing….

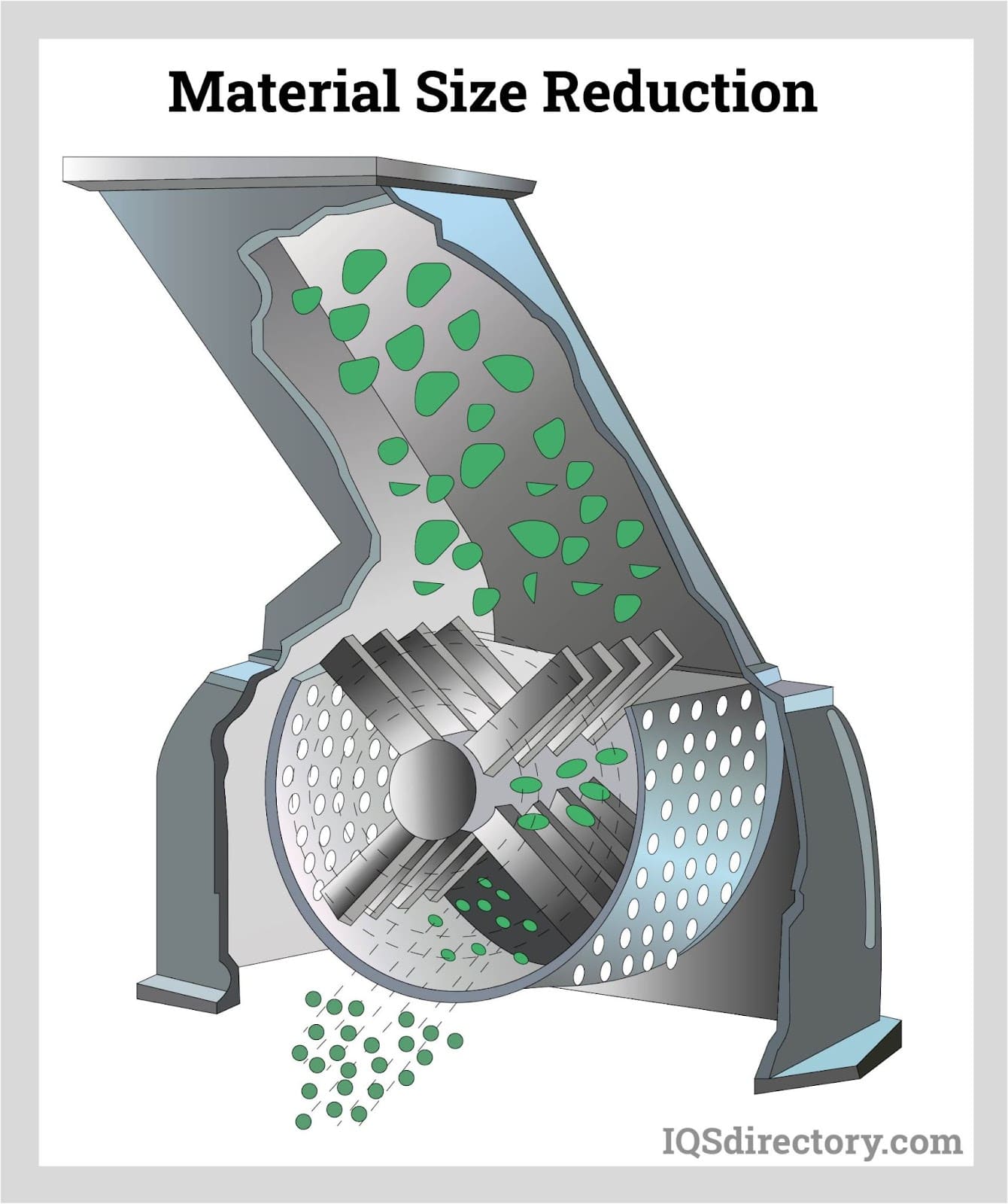

#10 Milling Machines & Solid Particle Size Reduction Equipment

Domain Est. 2019

Website: quadro-mpt.com

Key Highlights: Quadro Engineering is a Global Industry Leader in Powder Milling Machines and Particle Processing & Size Reduction Equipment….

Expert Sourcing Insights for High-Tech Milling Machines For Engineering

H2: 2026 Market Trends for High-Tech Milling Machines in Engineering

The global market for high-tech milling machines in engineering is poised for significant transformation by 2026, driven by advancements in automation, digitalization, and evolving industrial demands. Key trends shaping this sector include:

-

Integration of AI and Machine Learning

By 2026, artificial intelligence (AI) and machine learning (ML) will be deeply embedded in high-tech milling machines. These technologies enable predictive maintenance, real-time process optimization, and adaptive machining. Smart algorithms analyze cutting parameters, tool wear, and material behavior to enhance precision and reduce downtime, particularly in aerospace, automotive, and medical device manufacturing. -

Growth of Industry 4.0 and IoT Connectivity

The proliferation of the Industrial Internet of Things (IIoT) fosters seamless connectivity between milling machines, enterprise resource planning (ERP) systems, and cloud platforms. High-tech mills will increasingly feature digital twins—virtual replicas that simulate performance under various conditions—allowing engineers to optimize workflows and improve quality control before physical production begins. -

Demand for Multi-Tasking and 5-Axis Milling Machines

As engineering components grow more complex, demand for 5-axis and multi-tasking milling centers will rise. These machines offer greater flexibility, reduced setup time, and improved accuracy for intricate geometries. The aerospace and energy sectors are expected to be primary drivers, with growing investment in turbine blades, engine components, and lightweight structural parts. -

Sustainability and Energy Efficiency

Environmental regulations and corporate sustainability goals are pushing manufacturers to adopt energy-efficient milling solutions. By 2026, high-tech mills will increasingly feature regenerative drives, optimized cooling systems, and reduced material waste through precision machining. Machine tool builders are also focusing on recyclable components and modular designs to extend product life cycles. -

Rise of Additive-Hybrid Manufacturing

Hybrid milling machines that combine subtractive machining with additive manufacturing (e.g., laser metal deposition) are gaining traction. This convergence allows for rapid prototyping, repair of high-value components, and creation of complex internal features. The aerospace and defense industries are leading adopters, leveraging hybrid systems to reduce lead times and material costs. -

Regional Market Dynamics

Asia-Pacific, particularly China, Japan, and South Korea, will remain the largest market due to strong industrial automation initiatives and expanding electronics and automotive sectors. North America and Europe will see steady growth driven by reshoring efforts, advanced R&D, and government support for smart manufacturing. -

Workforce Upskilling and Remote Operation

As machines become more sophisticated, demand for skilled operators and programmers will increase. Training programs in CNC programming, AI-assisted diagnostics, and digital twin management will be critical. Remote monitoring and operation capabilities—accelerated by the pandemic—will become standard, enabling global teams to manage milling operations from anywhere.

In conclusion, the 2026 landscape for high-tech milling machines in engineering will be defined by intelligent automation, connectivity, and sustainability. Companies that embrace digital transformation and invest in integrated, flexible machining solutions will gain a competitive edge in an increasingly high-precision, high-efficiency global market.

Common Pitfalls When Sourcing High-Tech Milling Machines for Engineering

Sourcing high-precision milling machines for advanced engineering applications involves significant investment and technical complexity. Overlooking key factors can lead to performance issues, intellectual property (IP) exposure, and long-term operational inefficiencies. Below are critical pitfalls to avoid:

Poor Quality Assurance and Inadequate Machine Specifications

One of the most common pitfalls is selecting a machine based solely on price or marketing claims without verifying actual build quality and performance metrics. High-tech milling machines require tight tolerances, thermal stability, and long-term reliability. Buyers may fall into the trap of insufficient due diligence—failing to review third-party certifications, conduct factory acceptance tests (FAT), or assess component quality (e.g., spindles, linear guides, and CNC controls). This can result in machines that underperform, require frequent maintenance, or fail to meet production standards.

Insufficient Verification of Technical Support and After-Sales Service

Advanced milling systems often require specialized knowledge for setup, calibration, and troubleshooting. A major oversight is underestimating the importance of local technical support, spare parts availability, and software updates. Sourcing from overseas suppliers without established service networks can lead to extended machine downtime and lost productivity. Ensure suppliers offer comprehensive training, remote diagnostics, and responsive field service before finalizing procurement.

Overlooking Intellectual Property (IP) Risks in Software and Automation

High-tech milling machines often integrate proprietary control software, automation interfaces, and digital twins. A critical but frequently ignored pitfall is the potential IP exposure when using vendor-specific programming environments or cloud-connected systems. Some suppliers may retain rights to process data, toolpath algorithms, or machine learning models used in optimization. This can compromise competitive advantage and create legal vulnerabilities, especially in industries like aerospace or medical devices where IP protection is paramount.

Incompatible Integration with Existing Manufacturing Ecosystems

Modern engineering facilities rely on seamless integration between CAD/CAM systems, MES platforms, and machine tools. Sourcing a milling machine with proprietary or outdated communication protocols (e.g., lack of MTConnect or OPC UA support) can hinder interoperability and data flow. This pitfall leads to isolated islands of automation, reduced traceability, and increased engineering effort to develop custom interfaces.

Inadequate Cybersecurity Measures

As milling machines become increasingly connected to factory networks and cloud platforms, they present potential attack surfaces. Buyers often overlook cybersecurity features such as encrypted communications, role-based access control, and secure firmware updates. A compromised machine can lead to production sabotage, theft of sensitive design data, or disruption of entire manufacturing lines.

Failure to Evaluate Total Cost of Ownership (TCO)

Focusing only on the initial purchase price is a common error. TCO includes energy consumption, tooling costs, maintenance frequency, software licensing, and potential downtime. High-tech machines with superior efficiency and reliability may have a higher upfront cost but deliver substantial savings over time. Neglecting TCO analysis can result in suboptimal long-term value.

Underestimating Skill Gaps and Training Requirements

Operating and programming advanced milling machines demands specialized skills. Organizations may fail to assess whether their workforce is prepared to leverage the full capabilities of new equipment. Without proper training programs and change management, even the most sophisticated machine may not reach its performance potential.

Avoiding these pitfalls requires a structured sourcing strategy that balances technical evaluation, IP protection, integration readiness, and long-term operational support. Engaging cross-functional teams—including engineering, IT, legal, and procurement—ensures a holistic assessment and reduces risks associated with high-stakes capital investments.

Logistics & Compliance Guide for High-Tech Milling Machines for Engineering

Product Classification and Regulatory Framework

High-tech milling machines for engineering applications typically fall under industrial machinery regulations, including harmonized systems (HS) codes such as 8459.10 or 8459.21, depending on automation level and specifications. These machines may be subject to export control regimes like the Wassenaar Arrangement due to their precision and potential dual-use (civilian and military) applications. Compliance with ITAR (International Traffic in Arms Regulations) is generally not required unless the machine exceeds specific tolerance thresholds (e.g., positioning accuracy under 1 micron or multi-axis capabilities exceeding five axes with certain performance levels). Always verify technical specifications against national and international control lists prior to shipment.

Export Documentation and Licensing

Accurate documentation is critical for international shipments. Required documents include a commercial invoice, packing list, bill of lading or air waybill, and a certificate of origin. For controlled items, an export license from the relevant authority (e.g., Bureau of Industry and Security in the U.S. or equivalent bodies in the EU or Asia) may be necessary. Technology-specific end-user statements or consignment declarations might also be required to confirm that the equipment will not be used for unauthorized purposes. Automated export systems (e.g., AES in the U.S.) must be used to file Electronic Export Information (EEI) when the value exceeds $2,500 per destination or when a license is required.

Packaging, Handling, and Transportation Requirements

High-tech milling machines are sensitive to shock, vibration, and moisture. Units must be crated in custom-engineered wooden or metal enclosures with internal bracing and vibration-dampening materials. Desiccants should be included to prevent condensation during transit. Crates must meet ISPM-15 standards for international wood packaging. Labeling should include “Fragile,” “This Side Up,” and handling instructions per ISO 780. Due to weight and dimensions, transport typically requires specialized freight handling—either FCL (Full Container Load) sea freight or heavy-lift air cargo. Ensure proper securing via blocking and bracing within containers or trailers.

Customs Clearance and Import Compliance

Importing countries may impose duties, taxes, and conformity assessments. Pre-arrival submission of documentation is strongly advised to avoid delays. Many jurisdictions require proof of compliance with local safety and electromagnetic compatibility (EMC) standards (e.g., CE in Europe, CCC in China, or UL/cTUVus in North America). Some countries mandate factory inspections or certification by national bodies. Importers should provide a valid import license if required and be prepared for customs valuation audits. Misdeclaration of value or technical specs can lead to fines, seizure, or blacklisting.

Installation, Servicing, and After-Sales Logistics

Due to complexity, these machines often require on-site installation by certified engineers. Plan for logistics of spare parts, tooling kits, and diagnostic equipment. Service contracts should define response times and technician qualifications. When shipping parts or returning machines for repair, comply with temporary import/export regimes (e.g., ATA Carnet) to avoid customs duties on re-export. Maintain records of all service interventions for compliance with warranty and regulatory traceability requirements.

Environmental and End-of-Life Compliance

Milling machines contain electronic components, lubricants, and metals subject to environmental regulations such as the EU’s WEEE (Waste Electrical and Electronic Equipment) Directive and RoHS (Restriction of Hazardous Substances). Manufacturers and importers may be responsible for take-back and recycling programs. Proper documentation of materials used and end-of-life disposal procedures must be maintained. Exporting used machines to certain countries may be restricted under the Basel Convention if classified as electronic waste.

Cybersecurity and Data Compliance

Modern milling machines often include networked control systems (CNC) with embedded software. Ensure compliance with data protection laws (e.g., GDPR) if machines collect or transmit operational data. Secure firmware updates and restrict remote access to prevent unauthorized control. Export of certain encryption technologies may require additional licensing under dual-use regulations. Document cybersecurity measures taken as part of compliance reporting.

In conclusion, sourcing high-tech milling machines for engineering applications requires a strategic approach that balances advanced capabilities, precision, reliability, and long-term value. As engineering demands continue to evolve, investing in state-of-the-art CNC milling technology—featuring multi-axis functionality, automation integration, and smart manufacturing compatibility—ensures enhanced productivity, superior part quality, and competitive advantage. Key considerations such as machine accuracy, build quality, software compatibility, vendor support, and total cost of ownership should guide procurement decisions. Ultimately, selecting the right high-tech milling machine aligns not only with current project requirements but also supports future innovation, scalability, and operational excellence in advanced engineering environments.