The global high-speed buffing equipment market is experiencing robust growth, driven by increasing demand across automotive, aerospace, metal fabrication, and consumer electronics industries. According to a 2023 report by Mordor Intelligence, the industrial polishing and buffing equipment market is projected to grow at a CAGR of over 6.2% from 2023 to 2028, fueled by advancements in automation and rising requirements for high-precision surface finishing. Similarly, Grand View Research estimates that the global surface finishing equipment market, a broader segment encompassing buffing technologies, was valued at USD 24.8 billion in 2022 and is expected to expand at a CAGR of 5.9% through 2030. With manufacturers increasingly prioritizing efficiency, consistency, and energy savings, investment in high-speed buffing systems has become a strategic imperative. This surge in demand has led to the emergence of innovative manufacturers specializing in high-performance, durable, and intelligent buffing solutions. The following list highlights the top 10 high-speed buffing manufacturers shaping this evolving landscape through technological leadership, global reach, and strong customer adoption.

Top 10 High Speed Buffing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SpeedFam

Domain Est. 1995

Website: speedfam.com

Key Highlights: SpeedFam is the comprehensive manufacturer of grinding, lapping and polishing equipment and the consumables with process support for various electronic and ……

#2 ULTRA TEC Manufacturing, Inc.

Domain Est. 1996

Website: ultratecusa.com

Key Highlights: ULTRA TEC designs, manufactures and provides advanced surface & sample prep equipment and consumables for both routine and custom applications….

#3 Mirka

Domain Est. 1997

Website: mirka.com

Key Highlights: Mirka Ltd is a world leader in surface finishing technology and offers a broad range of ground-breaking sanding solutions including abrasives, sandpaper,……

#4 Dico Products

Domain Est. 1997

Website: dicoproducts.com

Key Highlights: Shop Dico Products for USA-made buffing wheels, compounds, and abrasives. Trusted since 1892 for quality power tool accessories and surface finishing tools….

#5 Buff and Shine Mfg

Domain Est. 1998

Website: buffandshine.com

Key Highlights: Buff and Shine is a premier manufacturer, importer and exporter of car buffing pads, backing plates, carpet film, clay bars, drying cloths, and more!Missing: high speed…

#6 Lapping Polishing Grinding Machines Products Services

Domain Est. 2014

Website: lapmaster-wolters.com

Key Highlights: LAPMASTER WOLTERS provides industrial lapping machines, ultrasonic cleaners diamond powder and abrasive compounds for grinding and polishing equipment….

#7 Mercury Floor Machines

Domain Est. 1999

Website: mercuryfloormachines.com

Key Highlights: For over 50 years, the Mercury Floor Machines division of Ultimate Solutions has crafted high durability, high performance floor maintenance machines to ……

#8 Hawk Enterprises

Domain Est. 2002 | Founded: 1995

Website: hawkenterprises.com

Key Highlights: HAWK ENTERPRISES has been designing and building high quality floor machines and specialty equipment in Elkhart, IN, in since 1995….

#9 Zephyr Polishes

Domain Est. 2004

Website: zephyrpro40.com

Key Highlights: Zephyr has the top-tier premium brand in the metal polishing industry. DIY Metal Polishing Everything you need from our kits to get going on your own shiny ……

#10 Floor Buffers & Burnishing Machines

Domain Est. 2009

Website: xtremepolishingsystems.com

Key Highlights: 3-day delivery 15-day returnsDiscover the best floor buffing machine and floor polisher options to make your floors shine. Learn tips and benefits of using floor buffers….

Expert Sourcing Insights for High Speed Buffing

H2: High-Speed Buffing Market Trends Forecast for 2026

The high-speed buffing market is poised for significant transformation by 2026, driven by technological innovation, evolving industrial demands, and a growing emphasis on automation and sustainability. As industries from automotive to consumer electronics continue to prioritize surface finishing quality and production efficiency, high-speed buffing technologies are adapting to meet these challenges. Below are key trends expected to shape the market by 2026:

-

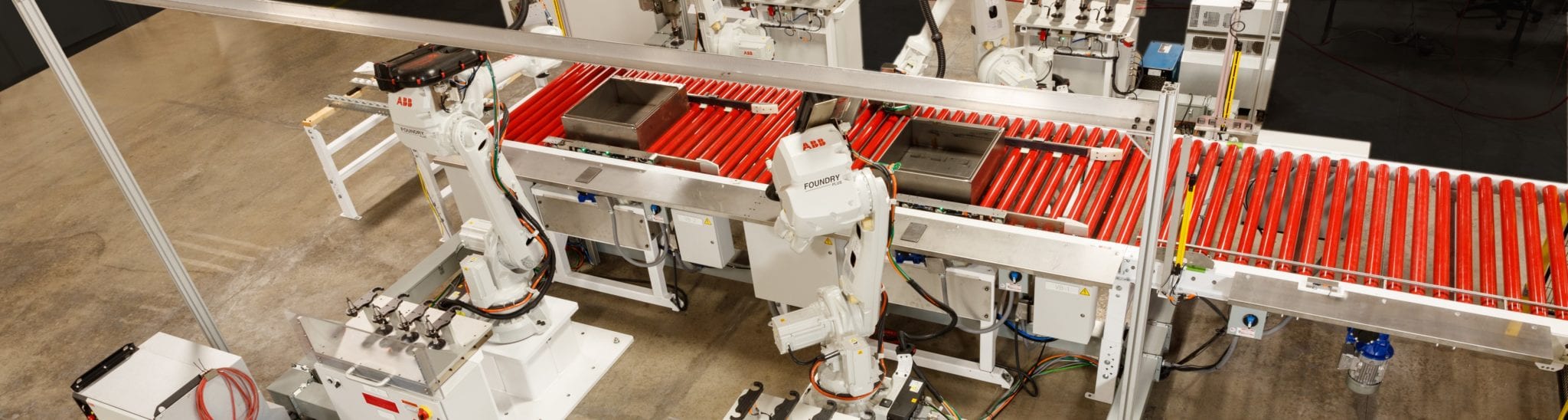

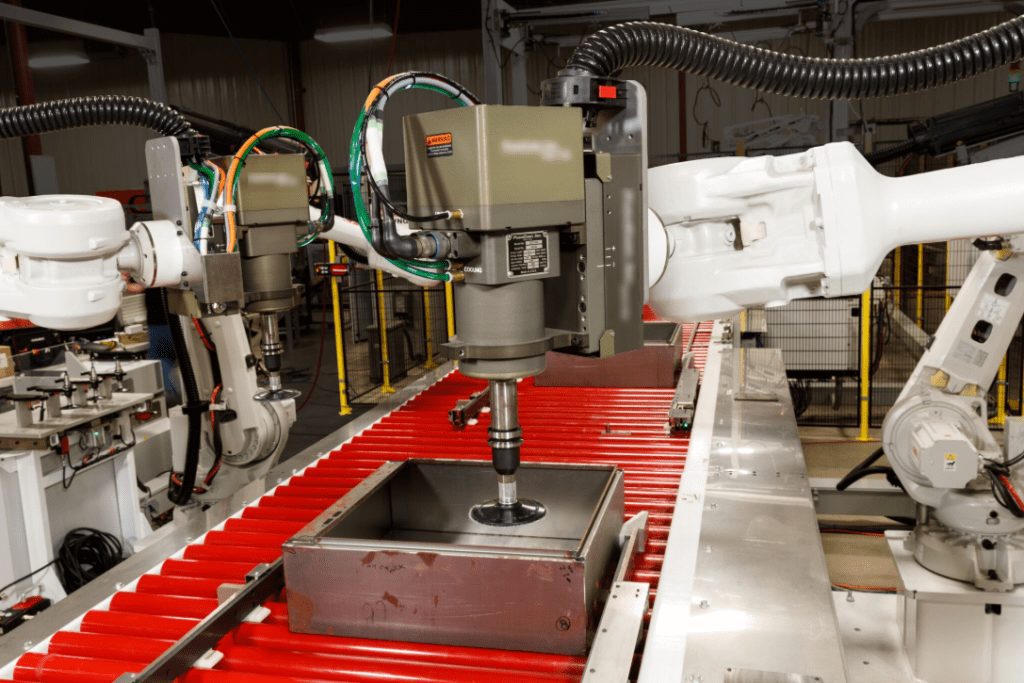

Increased Adoption of Automation and Robotics

By 2026, the integration of high-speed buffing systems with robotic automation is expected to accelerate. Automated buffing cells equipped with AI-driven path planning and force control will enhance precision, reduce labor costs, and improve repeatability. This trend is especially prominent in automotive manufacturing and aerospace, where consistent surface finishes are critical. -

Advancements in Abrasive Materials and Tooling

Next-generation abrasive compounds and coated buffing wheels are being developed to withstand higher rotational speeds while maintaining surface integrity. Nanomaterial-enhanced buffing pads and smart abrasives with real-time wear monitoring will gain traction, enabling longer tool life and reduced downtime. -

Growth in Electric Vehicle (EV) Production

The surge in EV manufacturing will fuel demand for high-speed buffing in component finishing, particularly for aluminum and composite materials used in lightweight vehicle bodies and battery enclosures. High-speed buffing ensures smooth, oxidation-free surfaces essential for both performance and aesthetics. -

Focus on Sustainable and Eco-Friendly Processes

Environmental regulations and corporate sustainability goals will drive the development of dry buffing systems and water-based lubricants to replace traditional oil-based compounds. Energy-efficient motors and regenerative drive systems will also be integrated to minimize the carbon footprint of high-speed buffing operations. -

Expansion in Emerging Markets

Industrial growth in Southeast Asia, India, and Latin America will expand the addressable market for high-speed buffing equipment. Local manufacturing hubs in electronics, metal fabrication, and appliance production will adopt advanced buffing solutions to meet global quality standards. -

Digital Integration and Predictive Maintenance

IoT-enabled buffing machines with embedded sensors will allow real-time monitoring of speed, temperature, pressure, and vibration. Predictive analytics will anticipate maintenance needs, reduce unplanned downtime, and optimize process parameters—enhancing overall equipment effectiveness (OEE). -

Customization and Modular System Design

Equipment manufacturers will increasingly offer modular high-speed buffing systems that can be tailored to specific applications—ranging from fine polishing of surgical instruments to coarse deburring of cast metal parts. This flexibility supports agile manufacturing and quick changeovers.

In conclusion, the high-speed buffing market in 2026 will be defined by smarter, faster, and more sustainable solutions. Companies that invest in automation, digitalization, and eco-conscious innovation will lead the industry, meeting the rising demand for high-quality surface finishing across diverse sectors.

Common Pitfalls in Sourcing High Speed Buffing (Quality, IP)

Sourcing high-speed buffing equipment or services—especially when involving proprietary technology or performance-critical applications—can present significant challenges. Without careful due diligence, companies risk compromising on quality, performance, and intellectual property (IP) protection. Below are common pitfalls to avoid:

Quality Inconsistencies and Performance Gaps

- Inadequate Material Specifications: Suppliers may use substandard abrasives, polishing compounds, or backing materials that degrade performance or shorten tool life under high-speed conditions, leading to inconsistent finishes or premature failure.

- Lack of Precision Engineering: High-speed buffing demands precisely balanced tools and components. Poor manufacturing tolerances can cause vibration, excessive heat, or tool disintegration, posing safety risks and damaging workpieces.

- Insufficient Testing and Validation: Some suppliers may not conduct real-world performance testing at operational speeds, resulting in equipment that fails under actual use conditions.

- Inconsistent Batch Quality: Especially with offshore manufacturing, quality control may vary between production runs, leading to unpredictable results and increased rework costs.

Intellectual Property (IP) Risks

- Unprotected Design and Technology Transfer: Sharing detailed specifications or custom tool designs with suppliers without proper non-disclosure agreements (NDAs) or IP clauses can expose proprietary processes to misuse or reverse engineering.

- Lack of IP Ownership Clarity: Contracts may fail to clearly assign ownership of custom-developed tools, software, or processes, leading to disputes or restricted usage rights.

- Third-Party Component Infringement: Suppliers may incorporate patented technologies (e.g., motor designs, control systems) without proper licensing, exposing the buyer to infringement claims.

- Data and Process Security Gaps: Digital models, CAD files, or operational data shared during sourcing may be stored or transmitted insecurely, increasing the risk of IP theft.

Mitigation Strategies

To avoid these pitfalls, implement rigorous supplier qualification processes, demand third-party certifications (e.g., ISO, balancing standards), insist on comprehensive IP agreements, and conduct ongoing quality audits. Pilot testing and clear contractual terms are essential to ensure both performance reliability and IP protection.

Logistics & Compliance Guide for High Speed Buffing

This guide outlines the essential logistics and compliance considerations for implementing and managing high-speed buffing operations in industrial or manufacturing environments. Adherence to these guidelines ensures operational efficiency, regulatory compliance, and worker safety.

Equipment Procurement and Installation

Source high-speed buffing machines from certified suppliers compliant with ISO and ANSI standards. Ensure all equipment includes CE marking or equivalent regional certifications. Coordinate delivery schedules with facility downtime to minimize production disruption. Verify electrical requirements (voltage, phase, amperage) match site infrastructure prior to installation. Conduct a site assessment to confirm adequate space, ventilation, and access for maintenance.

Transportation and Handling

Transport buffing equipment using secure, climate-controlled freight services to prevent damage. Use appropriate lifting gear (e.g., forklifts, cranes) during offloading, following load capacity guidelines. Store machines indoors in a dry, dust-free area until installation. Label all components clearly and maintain a packing list for inventory reconciliation.

Regulatory Compliance

Adhere to OSHA 29 CFR 1910 regulations for machine guarding, lockout/tagout (LOTO), and worker exposure limits. Comply with NFPA 70 (National Electrical Code) for electrical installations. Ensure buffing wheels and compounds meet REACH and RoHS directives where applicable. Maintain documentation of equipment conformity assessments, safety data sheets (SDS) for consumables, and compliance audits.

Worker Safety and Training

Provide mandatory training on high-speed buffing hazards, including flying debris, entanglement, and noise exposure. Implement hearing conservation programs where noise levels exceed 85 dBA. Require personnel to wear PPE: safety glasses with side shields, face shields, hearing protection, gloves, and flame-resistant apparel. Train staff on emergency shutdown procedures and LOTO protocols. Document all training sessions and maintain records for at least three years.

Environmental Controls

Install local exhaust ventilation (LEV) systems to capture buffing dust and fumes at the source. Conduct regular LEV performance testing and certification. Use dust collection systems with HEPA filtration to prevent particulate release. Dispose of spent buffing compounds and waste materials in accordance with EPA and local hazardous waste regulations. Label waste containers appropriately and maintain disposal manifests.

Maintenance and Operational Procedures

Develop and enforce a preventive maintenance schedule for motors, spindles, and guards. Inspect buffing wheels for cracks or imbalance before each use. Balance wheels regularly to prevent vibration and ensure operator safety. Keep detailed maintenance logs accessible for compliance audits. Prohibit modifications to safety interlocks or guards.

Quality Assurance and Documentation

Validate buffing process parameters (RPM, pressure, dwell time) during initial setup and after maintenance. Conduct periodic quality checks on finished parts to ensure consistency. Maintain a log of equipment calibration, process validation, and non-conformance reports. Retain all compliance and operational records for a minimum of five years.

Emergency Preparedness

Post emergency contact numbers and evacuation routes near buffing stations. Equip areas with fire extinguishers rated for electrical and combustible metal fires (Class D). Train personnel in fire response and first aid. Conduct quarterly emergency drills and document outcomes.

Conclusion on Sourcing High-Speed Buffing Equipment and Services:

Sourcing high-speed buffing solutions requires a strategic approach that balances performance, cost, durability, and technical support. High-speed buffing is critical in industries demanding precision surface finishes—such as aerospace, automotive, and medical device manufacturing—where efficiency and consistency are paramount. After evaluating available suppliers, technologies, and materials, it is evident that investing in advanced buffing systems with variable speed controls, durable abrasive components, and integrated cooling mechanisms significantly enhances productivity and finish quality.

Key considerations when sourcing include the supplier’s reputation for innovation and reliability, the compatibility of equipment with existing production workflows, availability of technical training and after-sales service, and compliance with safety and environmental standards. Additionally, forming partnerships with suppliers who offer customization options and continuous support ensures long-term operational success.

In conclusion, sourcing high-speed buffing equipment should not be based solely on initial cost, but on total value—including performance, maintenance requirements, uptime, and technical expertise. A well-informed sourcing strategy will lead to improved surface finishing outcomes, reduced cycle times, and greater competitiveness in high-precision manufacturing environments.