The global high pressure air compressors market is experiencing steady growth, driven by increasing demand across industries such as oil & gas, manufacturing, construction, and automotive. According to Grand View Research, the global air compressor market size was valued at USD 35.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. High pressure models, in particular, are gaining traction due to their critical role in specialized applications like compressed air energy storage, diving, and industrial gas processing. Mordor Intelligence forecasts a similar upward trajectory, projecting a CAGR of over 4% during the 2024–2029 period, underpinned by technological advancements and rising automation in production facilities worldwide. As reliability and energy efficiency become key differentiators, leading manufacturers are investing heavily in R&D to meet stringent performance standards and sustainability goals. In this competitive landscape, the following ten companies have emerged as top high pressure air compressor manufacturers, combining innovation, global reach, and robust product portfolios to meet the evolving needs of industrial and commercial end-users.

Top 10 High Pressure Air Compressors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Chicago Pneumatic Homepage

Domain Est. 1994

Website: cp.com

Key Highlights: We are a global manufacturer of high-performance power tools, air compressors, generators, light towers, and hydraulic equipment for professional and industrial ……

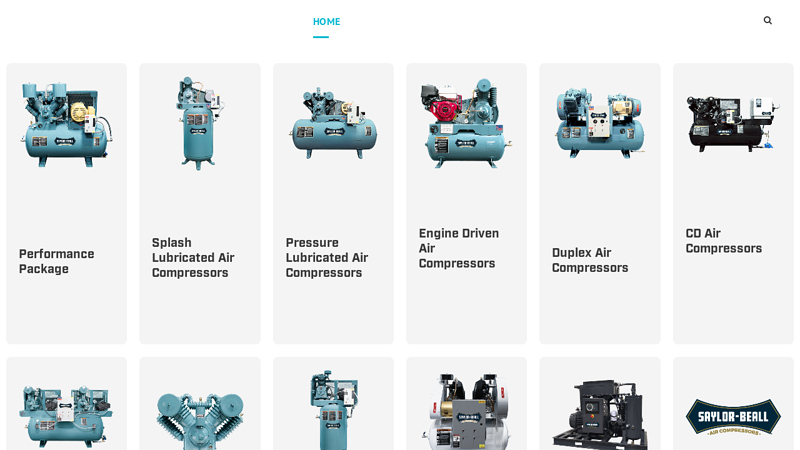

#2 Saylor

Domain Est. 1997

Website: saylor-beall.com

Key Highlights: Specialized manufacturers of two stage air compressors for commercial and industrial application….

#3 Bauer Compressors: High

Domain Est. 1997

Website: bauercomp.com

Key Highlights: Bauer Compressors manufactures a broad range of compressor systems for various breathing-air and industrial applications….

#4 ELGi Industrial Air Compressors

Domain Est. 1997

Website: elgi.com

Key Highlights: ELGi Compressor in USA offers a wide range of portable air compressors that are environmentally friendly and adhere to most of the international standards….

#5 Ingersoll Rand Air Compressors, Power Tools, Lifting and Fluid …

Domain Est. 2001

Website: ingersollrand.com

Key Highlights: Air Compressors & Systems Ingersoll Rand is a worldwide manufacturer and distributor of unrivalled compressed air solutions, parts and accessories and services ……

#6 BOGE

Domain Est. 1998

#7 Oasis Manufacturing

Domain Est. 2003

Website: oasismfg.com

Key Highlights: Oasis Off-Road manufacturing offers a comprehensive line of air compressors and air system components. Learn more, and request a quote….

#8 ABAC USA

Domain Est. 2009

Website: abacaircompressors.com

Key Highlights: Welcome to the USA ABAC Air Compressors website. ABAC is a leading compressed air solutions company committed to delivering superior air compressors, tools, ……

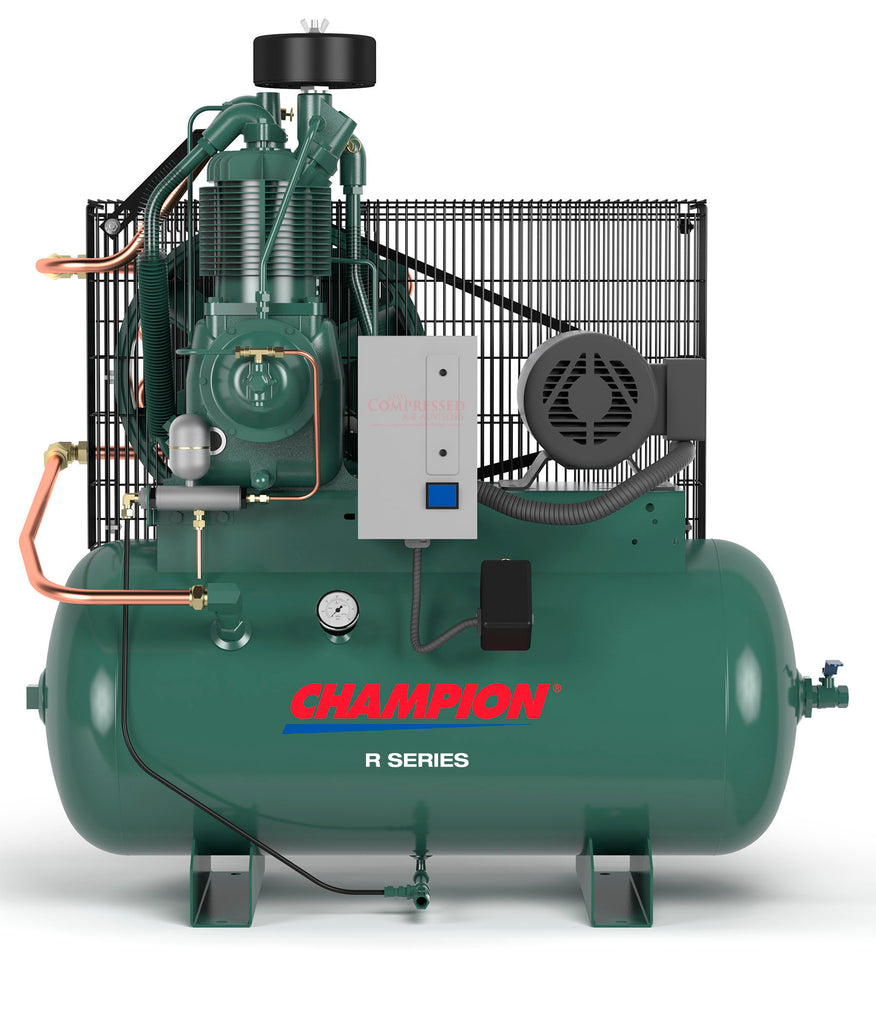

#9 Champion Compressors

Domain Est. 2017

Website: championcompressor.net

Key Highlights: We specialize in the sales, installation, service and repair of Champion air compressors and air dryers, as well as having a large inventory of parts and ……

#10

Domain Est. 2021

Website: kobelco-compressors.com

Key Highlights: KOBELCO COMPRESSORS is a global compressed air solution provider from Japan, having over 100 years history….

Expert Sourcing Insights for High Pressure Air Compressors

H2: 2026 Market Trends for High-Pressure Air Compressors

The global high-pressure air compressor (HPAC) market is projected to experience significant transformation by 2026, driven by technological innovation, increasing industrial automation, and rising demand across critical end-use sectors. This analysis outlines key market trends expected to shape the industry landscape through 2026, with a focus on technological advancements, regional dynamics, regulatory influences, and emerging applications.

-

Growing Demand from Energy and Industrial Gases

By 2026, the energy sector—particularly hydrogen production and carbon capture, utilization, and storage (CCUS)—is anticipated to become a major growth driver for HPACs. High-pressure compressors are essential in hydrogen refueling stations and gas storage systems, where pressures often exceed 350 bar. With global investments in green hydrogen infrastructure accelerating, especially in Europe, North America, and parts of Asia-Pacific, demand for oil-free and high-efficiency compressors will rise significantly. -

Technological Advancements and Digital Integration

Manufacturers are increasingly integrating IoT-enabled monitoring, predictive maintenance systems, and energy optimization software into HPACs. By 2026, smart compressors equipped with real-time analytics and remote diagnostics are expected to dominate new installations in manufacturing, pharmaceuticals, and food processing. These technologies not only reduce operational downtime but also improve energy efficiency—addressing rising energy costs and sustainability mandates. -

Shift Toward Oil-Free and Sustainable Solutions

Environmental regulations and end-user demand for contamination-free air are propelling the adoption of oil-free HPACs, particularly in sensitive industries like semiconductor manufacturing, medical gas supply, and electronics. By 2026, oil-free compressors are projected to capture over 35% of the global HPAC market, with innovations in materials and cooling systems enhancing their reliability and efficiency. -

Regional Market Expansion

Asia-Pacific is expected to lead market growth by 2026, fueled by rapid industrialization in China, India, and Southeast Asia. Infrastructure development, expansion of manufacturing hubs, and government support for clean energy projects are increasing HPAC demand. Meanwhile, North America and Europe will see steady growth due to stringent emissions standards and investments in advanced manufacturing and clean energy technologies. -

Supply Chain Resilience and Localization

Geopolitical uncertainties and post-pandemic supply chain disruptions have prompted compressor manufacturers to reevaluate sourcing and production strategies. By 2026, localized manufacturing and regional supply chains are expected to become more prevalent, reducing lead times and enhancing responsiveness to market demands. -

Regulatory Pressure and Energy Efficiency Standards

Stricter global energy efficiency regulations, such as the EU’s Ecodesign Directive and U.S. DOE standards, will continue to influence HPAC design and performance. Manufacturers are focusing on developing compressors that meet Tier 4 and upcoming Tier 5 efficiency benchmarks. Compliance will be a key differentiator in competitive markets. -

Emerging Applications in Defense and Aerospace

The defense and aerospace sectors are increasingly utilizing HPACs for testing, propulsion systems, and life support equipment. With growing defense budgets in countries like the U.S., India, and South Korea, demand for rugged, high-reliability compressors is expected to rise through 2026.

Conclusion

By 2026, the high-pressure air compressor market will be defined by innovation, sustainability, and digital integration. Companies that prioritize energy efficiency, adapt to evolving regulatory landscapes, and expand into emerging applications—particularly in hydrogen and clean tech—will be best positioned to capitalize on growth opportunities. The market is forecasted to grow at a CAGR of 5.8% from 2023 to 2026, reaching an estimated value of USD 7.2 billion.

Common Pitfalls When Sourcing High Pressure Air Compressors (Quality & IP)

Sourcing high-pressure air compressors (HPACs) requires careful consideration beyond basic specifications. Overlooking critical quality and Intellectual Property (IP) aspects can lead to significant operational, financial, and legal risks. Here are key pitfalls to avoid:

1. Prioritizing Low Initial Cost Over Total Cost of Ownership (TCO)

- Pitfall: Selecting the cheapest option without evaluating long-term costs like energy consumption, maintenance frequency, spare parts pricing, and downtime impact.

- Consequence: Higher energy bills, frequent breakdowns, expensive repairs, and reduced equipment lifespan, negating any initial savings.

- Solution: Conduct a thorough TCO analysis, including energy efficiency ratings (e.g., kW per m³/min), estimated maintenance schedules, and availability/cost of critical spares.

2. Inadequate Verification of Manufacturer Quality & Certifications

- Pitfall: Assuming advertised specifications (pressure, flow, purity) are accurate without verifying manufacturing standards, testing procedures, or relevant certifications (e.g., ASME, PED, ISO 8573 for air quality, ATEX for explosive atmospheres).

- Consequence: Receiving underperforming, unsafe, or non-compliant equipment. Risk of contamination (critical for breathing air, medical, or semiconductor applications), safety incidents, or failure to meet regulatory requirements.

- Solution: Demand certification documentation, request test reports (e.g., performance curves, oil content analysis), and audit the manufacturer’s quality management system (e.g., ISO 9001). Verify compliance with your specific application’s safety and purity standards.

3. Overlooking After-Sales Support & Spare Parts Availability

- Pitfall: Failing to assess the supplier’s global service network, technical expertise, spare parts inventory, and lead times before purchase.

- Consequence: Prolonged downtime during breakdowns, difficulty obtaining critical components, reliance on expensive third-party parts, or forced equipment replacement.

- Solution: Evaluate the supplier’s service footprint, request parts lists and pricing, confirm availability of local technicians, and understand warranty terms and service level agreements (SLAs).

4. Neglecting Intellectual Property (IP) Rights & Technology Transfer

- Pitfall: Sourcing from suppliers who use or potentially infringe on patented technologies (e.g., specific compression stages, cooling systems, control algorithms) without clarity on ownership or licensing. Also, assuming proprietary designs can be freely modified or replicated.

- Consequence: Legal liability for patent infringement, potential lawsuits, injunctions halting operations, reputational damage, and restrictions on modifying or maintaining the equipment.

- Solution: Conduct due diligence on the supplier’s IP portfolio and freedom to operate. Ensure contracts explicitly state warranty against IP infringement by the supplier. Avoid reverse engineering or unauthorized modifications.

5. Underestimating the Importance of Application-Specific Design

- Pitfall: Treating HPACs as generic commodities and not ensuring the design (materials, lubrication, filtration, controls) is optimized for the specific application (e.g., breathing air requires oil-free or Class 0, diving needs specific safety features, industrial processes need specific pressure stability).

- Consequence: Equipment failure, unsafe conditions, product contamination, or inability to meet process requirements.

- Solution: Clearly define all application requirements (pressure, flow, air quality class, duty cycle, environment, safety standards) and ensure the chosen compressor is explicitly designed and certified for that use case.

6. Ignoring the Supply Chain & Component Quality

- Pitfall: Focusing only on the final assembly brand without understanding the quality and origin of critical components (e.g., motors, valves, seals, sensors, control systems).

- Consequence: Increased failure rates due to substandard components, difficulty sourcing replacements, and hidden quality issues not covered by the main warranty.

- Solution: Inquire about key component suppliers, their reputation, and quality control processes. Request information on component warranties and availability.

By proactively addressing these pitfalls related to quality assurance and intellectual property, organizations can significantly reduce risks, ensure reliable operation, protect their legal standing, and achieve better long-term value when sourcing high-pressure air compressors.

Logistics & Compliance Guide for High Pressure Air Compressors

H2: Handling, Storage, and Transportation Requirements

Proper handling, storage, and transportation of high pressure air compressors (HPACs) are critical to ensuring safety, regulatory compliance, and equipment integrity. These units operate at pressures typically ranging from 3,000 to 5,000 psi (200–350 bar) and may be used in diving, firefighting, aerospace, and industrial applications. Below are key guidelines for logistics and compliance.

H2.1: Pre-Transportation Inspection

Before any movement of a high pressure air compressor, conduct a thorough pre-transport inspection:

- Verify system depressurization: Ensure all air storage cylinders and internal lines are fully depressurized and purged.

- Inspect for damage: Check for visible damage to the frame, hoses, filters, gauges, and electrical components.

- Confirm secure mounting: Units must be properly mounted on skids or in enclosures to prevent shifting during transit.

- Document condition: Photograph and log the condition of the unit prior to shipment to support liability tracking.

H2.2: Packaging and Securing for Transport

High pressure air compressors must be packaged to prevent mechanical shock, vibration, and environmental exposure:

- Use protective crating: Wooden crates or custom shipping containers with foam or foam-in-place cushioning are recommended.

- Weatherproofing: Seal units in moisture-resistant wraps or enclosures, especially for sea or outdoor transport.

- Secure internal components: Lock moving parts (e.g., belts, fans) and cover intakes/exhausts to prevent debris ingress.

- Label all sides: Use standardized labels indicating “Fragile,” “This Side Up,” and “Do Not Stack.”

H2.3: Transportation Regulations and Classifications

HPACs may contain compressed gas systems, electrical components, and oil-lubricated mechanisms, which can trigger regulatory requirements:

- DOT (U.S. Department of Transportation):

- If transporting with attached high-pressure cylinders, ensure cylinders are DOT/TC certified and within requalification date.

- Cylinders must be secured upright, valves protected, and labeled with content (e.g., “AIR, COMPRESSED – NON-FLAMMABLE GAS, UN1002”).

- IATA (Air Transport):

- Compressed air cylinders are generally allowed as cargo under Class 2.2 (Non-Flammable, Non-Toxic Gas).

- Maximum pressure and quantity limits apply; consult IATA Dangerous Goods Regulations (DGR) Section 2.6.

- IMDG (Maritime Transport):

- Follow IMDG Code guidelines for compressed gases; UN1002 applies.

- Ensure proper stowage away from heat sources and flammable materials.

⚠️ Note: Even if the compressor itself is not classified as hazardous, attached cylinders or residual pressure may require compliance with dangerous goods regulations.

H2.4: Storage Guidelines

When storing high pressure air compressors, follow these best practices:

- Indoor, dry environment: Store in a clean, temperature-controlled area with low humidity to prevent corrosion.

- Ventilation: Ensure adequate airflow to prevent accumulation of any residual gases or oil fumes.

- Elevation: Keep units off the floor (on pallets or stands) to avoid moisture contact and facilitate inspections.

- Security: Restrict unauthorized access; lock storage areas if cylinders are attached.

- Periodic maintenance: Even in storage, conduct monthly visual checks and quarterly operational tests (if safe and feasible).

H2.5: International Compliance and Documentation

For cross-border shipments:

- Export Controls: Verify if the compressor contains dual-use technologies subject to ITAR or EAR (U.S. regulations).

- CE Marking (EU): Ensure compliance with Machinery Directive 2006/42/EC and Pressure Equipment Directive 2014/68/EU.

- Customs Documentation: Include commercial invoice, packing list, certificate of origin, and any hazardous materials declarations.

- Local Standards: Research country-specific requirements (e.g., INMETRO in Brazil, CCC in China).

H2.6: Training and Personnel Safety

- Certified handlers: Only trained personnel should load, secure, or unload HPACs.

- PPE requirements: Use gloves, safety glasses, and steel-toed boots during handling.

- Lifting equipment: Employ forklifts or cranes with appropriate slings — never lift by hoses, controls, or gauges.

Adhering to H2-level logistics and compliance protocols ensures the safe and legal movement of high pressure air compressors across all stages of the supply chain. Regular audits and documentation help maintain accountability and readiness for inspections.

Conclusion for Sourcing High-Pressure Air Compressors

Sourcing high-pressure air compressors requires a strategic and well-informed approach that balances performance, reliability, cost, and long-term operational needs. These critical pieces of equipment serve vital roles across industries such as oil and gas, manufacturing, diving, firefighting, aerospace, and energy, where consistent and reliable compressed air supply is essential.

When selecting a high-pressure air compressor, it is crucial to assess specific application requirements—including pressure and flow rates, duty cycle, portability, and regulatory compliance. Additionally, evaluating energy efficiency, maintenance demands, and lifecycle costs ensures sustainable and cost-effective operations. The choice between oil-lubricated and oil-free models should align with air purity standards, especially in sensitive environments like medical or breathing air applications.

Supplier selection plays a key role in long-term success. Partnering with reputable manufacturers or distributors that offer strong technical support, warranty coverage, and spare parts availability can significantly reduce downtime and operational risks. Conducting thorough market research, obtaining competitive quotes, and considering total cost of ownership—rather than just upfront price—are essential steps in making a sound investment.

Ultimately, sourcing the right high-pressure air compressor is not just about acquiring equipment, but about ensuring safety, efficiency, and reliability in mission-critical operations. A well-considered procurement strategy will lead to improved performance, reduced maintenance costs, and enhanced operational continuity over the compressor’s lifespan.