The global styrene plastic market continues to expand at a steady pace, driven by rising demand across packaging, consumer goods, automotive, and construction industries. According to Grand View Research, the global polystyrene market was valued at USD 35.4 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This growth is fueled by the material’s versatility, cost-efficiency, and favorable mechanical properties. As sustainability and high-performance materials gain prominence, leading manufacturers are investing in innovation, recycling technologies, and scalable production to capture emerging opportunities. Against this backdrop, a select group of companies are emerging as high-impact players—shaping industry standards, advancing material science, and driving supply chain resilience. The following list identifies the top 10 styrene plastic manufacturers making significant contributions to market evolution and technological advancement.

Top 10 High Impact Styrene Plastic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Polystyrol Portal

Domain Est. 1995

Website: polystyrol.basf.com

Key Highlights: General Purpose PolyStyrene (GPPS), a product from the BASF plastics range, is a crystal-clear, high-performance polymer that is very easy to process….

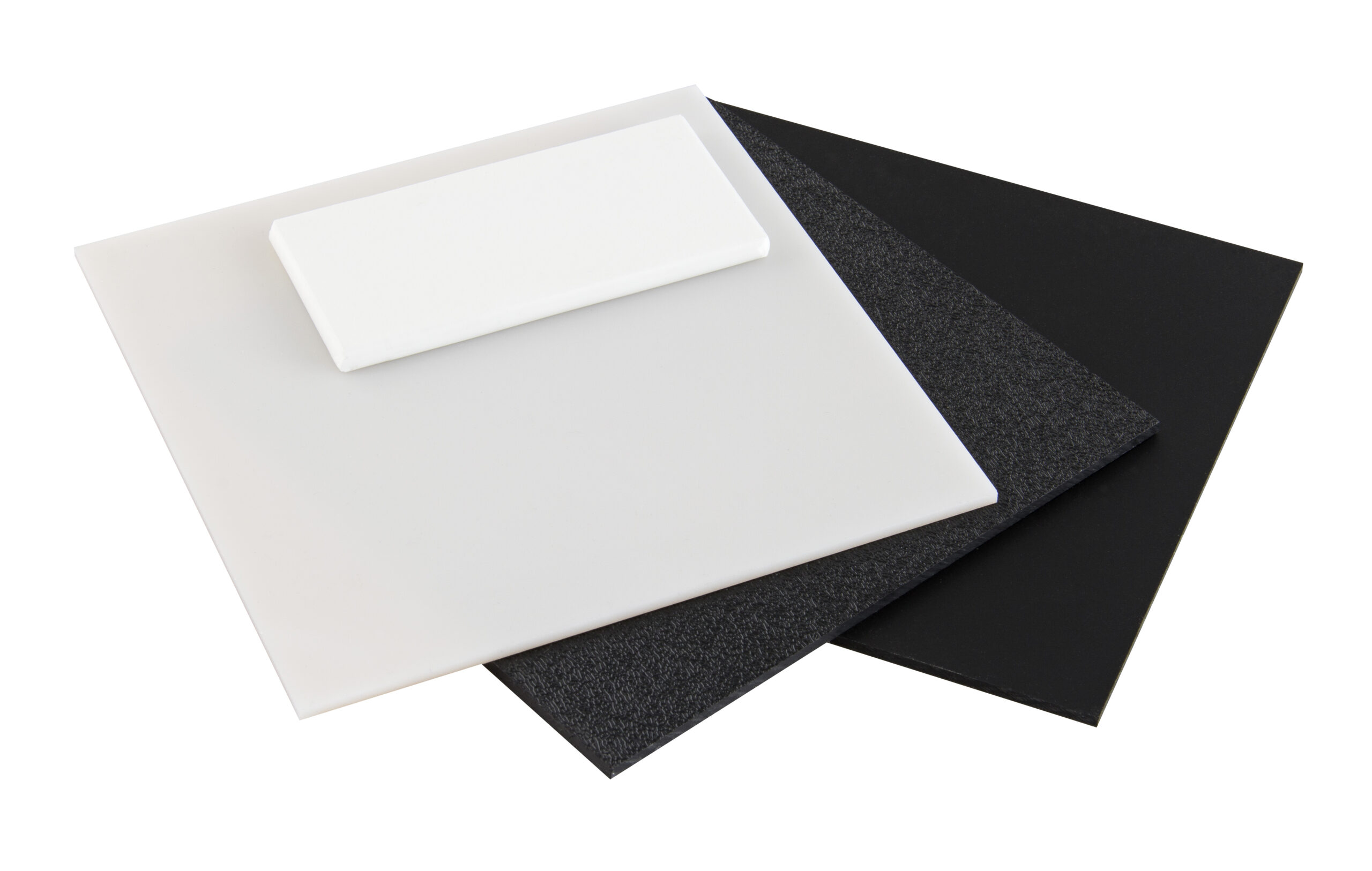

#2 HIPS

Domain Est. 1997

Website: meyerplastics.com

Key Highlights: High Impact Polystyrene (HIPS), commonly known as HIPS, is a rubber-modified version of General-Purpose Polystyrene….

#3 Industrial and Performance Plastic Sheet

Domain Est. 2010

Website: iplasticsupply.com

Key Highlights: Specializing in Wholesale Engineering Plastics, Mechanical Plastics and High Performance Plastics For Industry….

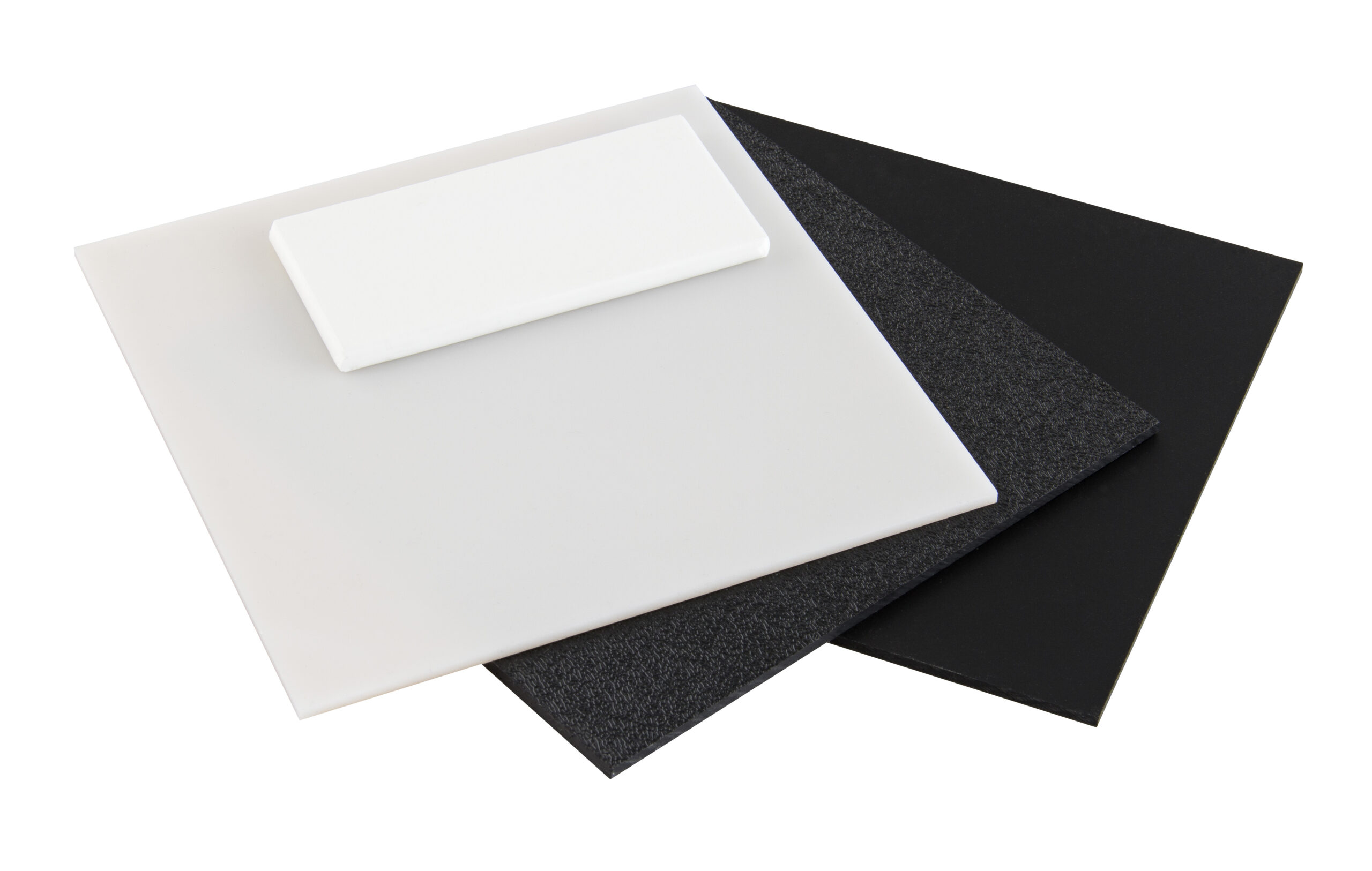

#4 HIPS (High Impact Polystyrene)

Domain Est. 1996

Website: totalplastics.com

Key Highlights: Explore our high-quality HIPS (High Impact Polystyrene) products, ideal for a variety of applications. Secure the best deals on Total Plastics now!…

#5 High Impact Polystyrene (HIPS)

Domain Est. 1996

Website: piedmontplastics.com

Key Highlights: High impact polystyrene (HIPS) sheet is a lightweight, rigid plastic material known for its outstanding impact resistance and easy fabrication….

#6 High Impact Styrene Sheets

Domain Est. 1997

Website: acmeplastics.com

Key Highlights: Free delivery 15-day returnsAcme Plastics has high impact styrene sheets in stock and ready to ship. High impact styrene is nontoxic, odorless & dimensionally stable, ideal for vac…

#7 High Impact Polystyrene Properties

Domain Est. 2000

Website: curbellplastics.com

Key Highlights: High Impact Polystyrene (HIPS) is a low cost, tough plastic that is easy to thermoform and fabricate. HIPS plastic material is often used for countertop point ……

#8 High Impact Polystyrene Suppliers

Domain Est. 2000

Website: polymershapes.com

Key Highlights: Polymershapes is a leader among High Impact Polystyrene suppliers. With over 70 locations across the United States, Canada, and Mexico, ……

#9 Performance Optimizing Polystyrene Rollstock

Domain Est. 2019

Website: impactplastics.co

Key Highlights: Formulated to achieve the optimal balance between protection and strength, our High Impact Polystyrene Solutions (HIPS) are produced with targeted expertise….

#10 High Impact Polystyrene (HIPS) & Styrene Sheet

Domain Est. 2022

Website: interstateam.com

Key Highlights: Impact resistant and cost-effective plastic for signage, prototypes, displays, and more. · High impact strength · Easy to paint, print, and adhere with adhesives ……

Expert Sourcing Insights for High Impact Styrene Plastic

H2: 2026 Market Trends for High Impact Styrene (HIPS) Plastic

The global High Impact Styrene (HIPS) plastic market is poised for moderate but steady growth through 2026, driven by evolving industrial demands, technological advancements, and shifting regulatory landscapes. HIPS, a cost-effective and versatile thermoplastic known for its excellent impact resistance and ease of processing, continues to maintain a strong presence in packaging, consumer goods, electronics, and healthcare sectors. The following outlines the key market trends anticipated in 2026:

-

Steady Demand from the Packaging Industry

HIPS remains a preferred material for rigid packaging, particularly in food containers, disposable cutlery, and clamshell packaging. In 2026, demand is expected to grow, especially in emerging markets where urbanization and consumerism are rising. The material’s clarity, printability, and compatibility with modified atmosphere packaging (MAP) reinforce its utility. However, sustainability concerns may limit growth in regions with stringent plastic regulations. -

Sustainability and Regulatory Pressures

Environmental regulations targeting single-use plastics are influencing HIPS consumption, particularly in the European Union and parts of North America. The introduction of extended producer responsibility (EPR) schemes and bans on certain disposable items may reduce HIPS use in short-life applications. In response, manufacturers are investing in recyclable HIPS grades and integrating post-consumer recycled (PCR) content into production processes. By 2026, companies adopting circular economy models are expected to gain market share. -

Growth in Medical and Healthcare Applications

HIPS is increasingly utilized in medical packaging, diagnostic devices, and laboratory equipment due to its sterility, dimensional stability, and cost efficiency. The expansion of healthcare infrastructure in developing economies and the ongoing need for single-use medical components will support HIPS demand. Regulatory compliance with ISO 10993 and USP Class VI standards enhances its credibility in this high-value sector. -

Technological Innovations and Material Enhancements

Ongoing R&D is focused on improving HIPS performance through additives and polymer blending. Innovations such as bio-based modifiers and impact modifiers designed for lower temperatures are expanding HIPS applications into more demanding environments. Additionally, advancements in compounding technology are enabling better control over mechanical properties, opening new opportunities in electronics housings and appliance components. -

Regional Market Dynamics

Asia-Pacific, particularly China and India, will remain the largest consumer and producer of HIPS in 2026, driven by robust manufacturing activity and domestic demand. North America and Europe will focus on high-value, specialty HIPS grades, including recyclable and flame-retardant variants. Latin America and the Middle East are expected to see moderate growth, supported by investments in packaging and construction industries. -

Supply Chain Resilience and Feedstock Volatility

HIPS is derived from styrene monomer, which is sensitive to crude oil price fluctuations. In 2026, geopolitical tensions and energy transitions could lead to feedstock volatility. As a result, producers are diversifying supply chains and exploring backward integration into styrene production to ensure stability. Strategic partnerships and regional production hubs will become increasingly important. -

Competition from Alternative Plastics

HIPS faces competition from materials like polypropylene (PP), polyethylene terephthalate (PET), and bioplastics, especially in packaging. However, HIPS maintains a competitive edge in applications requiring rigidity, dimensional stability, and ease of thermoforming. Market players are countering substitution threats by highlighting HIPS’s cost-performance balance and recyclability in closed-loop systems.

In conclusion, the 2026 HIPS market will be shaped by a balance between traditional demand drivers and sustainability imperatives. While regulatory challenges persist, innovation and regional growth opportunities are expected to sustain HIPS relevance in key industrial and consumer applications. Companies that prioritize eco-design, recycling integration, and application-specific solutions will be best positioned for long-term success.

Common Pitfalls When Sourcing High Impact Styrene (HIPS) Plastic: Quality and Intellectual Property Concerns

Sourcing High Impact Polystyrene (HIPS) requires careful attention to both material quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to production delays, compromised product performance, legal disputes, and reputational damage. Below are the key pitfalls to avoid:

Quality-Related Pitfalls

-

Inconsistent Material Properties

- Pitfall: Variability in impact strength, melt flow index (MFI), tensile strength, and color batch-to-batch. This inconsistency can lead to part failure, poor mold filling, or aesthetic defects.

- Cause: Sourcing from suppliers with inadequate quality control, using recycled/regrind content without specification, or inconsistent feedstock.

- Mitigation: Require detailed technical data sheets (TDS) and certificates of analysis (CoA) for every shipment. Implement incoming material inspection protocols and consider long-term supply agreements with performance guarantees.

-

Poor Color Consistency and Additive Stability

- Pitfall: Unacceptable color shifts or fading, especially in pigmented or flame-retardant grades. Additives (like impact modifiers) may not be uniformly dispersed.

- Cause: Inadequate dispersion during compounding, use of low-quality or unstable pigments/additives, or exposure to UV/heat during storage.

- Mitigation: Specify color tolerances (e.g., Delta E values), require UV stability testing data, and audit supplier compounding processes. Control storage conditions rigorously.

-

Contamination and Impurities

- Pitfall: Presence of foreign particles, gels, or cross-contamination from other polymers, leading to defects in finished products (e.g., weak spots, visual flaws).

- Cause: Poor housekeeping at the supplier, shared production lines without proper purging, or contaminated raw materials.

- Mitigation: Audit supplier manufacturing facilities. Require particle count specifications and filtration standards. Implement visual and microscopic inspection upon receipt.

-

Inadequate Documentation and Traceability

- Pitfall: Lack of full material disclosure (e.g., exact composition, additives, recycled content), making regulatory compliance (REACH, RoHS) difficult and hindering root cause analysis for failures.

- Cause: Suppliers reluctant to share formulations, poor documentation practices, or complex supply chains.

- Mitigation: Demand full material disclosure statements (MDS) and conflict minerals reporting. Establish traceability requirements back to resin origin.

Intellectual Property (IP)-Related Pitfalls

-

Unauthorized Use of Proprietary Grades or Formulations

- Pitfall: Sourcing a material that mimics a patented or proprietary HIPS grade (e.g., a specific impact-modified or flame-retardant formulation) without authorization, exposing the buyer to infringement claims.

- Cause: Suppliers offering “equivalent” or “generic” versions of branded materials, or buyers specifying a grade without verifying its IP status.

- Mitigation: Clearly define required performance specs instead of naming proprietary grades. Conduct IP due diligence on suppliers and materials. Obtain written warranties from suppliers regarding non-infringement.

-

Lack of Clear IP Ownership in Custom Compounds

- Pitfall: Ambiguity over who owns the IP (formulation, process) when developing a custom HIPS compound with a supplier. This can lead to disputes over usage rights, exclusivity, and future sourcing.

- Cause: Absence of a formal development agreement defining IP ownership, licensing terms, and confidentiality.

- Mitigation: Establish a clear contractual agreement before development begins, specifying that all resulting IP related to the custom formulation belongs to the buyer or is licensed exclusively.

-

Confidentiality Breaches

- Pitfall: The supplier discloses sensitive information about your product design, application, or target market to competitors, potentially enabling them to develop competing materials or target your customers.

- Cause: Weak or unsigned Non-Disclosure Agreements (NDAs), or suppliers with lax information security.

- Mitigation: Implement robust, legally binding NDAs covering all discussions and data exchange. Vet suppliers’ data security practices.

-

Reverse Engineering and “Copycat” Materials

- Pitfall: A supplier uses material samples provided for testing to reverse-engineer and create a competing product sold to your competitors.

- Cause: Providing large quantities of material without safeguards or clear agreements prohibiting reverse engineering.

- Mitigation: Limit sample quantities. Include explicit clauses in agreements forbidding reverse engineering and requiring secure handling of samples. Use material with unique, hard-to-replicate markers if feasible.

By proactively addressing these quality and IP pitfalls through rigorous supplier qualification, clear contractual agreements, detailed specifications, and ongoing monitoring, companies can ensure a reliable supply of HIPS that meets performance requirements while protecting their intellectual property and minimizing legal and operational risks.

H2: Logistics & Compliance Guide for High Impact Styrene (HIPS) Plastic

High Impact Styrene (HIPS) is a widely used thermoplastic known for its toughness, ease of processing, and cost-effectiveness in applications like packaging, consumer goods, and appliances. Efficient logistics and strict adherence to compliance requirements are essential for its safe and legal handling throughout the supply chain.

H2: Storage & Handling

- Environmental Conditions:

- Temperature: Store HIPS in a cool, dry, and well-ventilated area. Avoid prolonged exposure to temperatures above 50°C (122°F) to prevent softening, warping, or degradation. Protect from direct sunlight and heat sources (radiators, boilers).

- Humidity: Maintain low humidity. While HIPS has low moisture absorption, excessive humidity can lead to surface fogging or affect downstream processing (e.g., printing, bonding).

- Fire Safety: HIPS is combustible. Store away from ignition sources. Use appropriate fire extinguishing media (water spray, foam, dry chemical, CO2). Ensure storage areas comply with local fire codes for plastics.

- Physical Handling:

- Protection: Protect material from physical damage (dents, scratches, crushing) during handling and storage. Use appropriate pallets and stacking methods.

- Packaging: Keep original packaging (e.g., sealed bags, boxes on pallets) intact until ready for use to prevent contamination and dust accumulation.

- Stacking: Stack pallets securely according to manufacturer recommendations and warehouse safety guidelines to prevent collapse. Do not exceed safe stacking heights.

- Static Control: HIPS can generate static electricity. Implement grounding procedures when handling large quantities or in low-humidity environments, especially near flammable vapors or dusts.

- Contamination Control:

- Keep HIPS separate from incompatible materials (strong oxidizing agents, certain solvents). Prevent contamination from dirt, oils, or other plastics.

H2: Transportation

- Packaging for Transit:

- Use robust, undamaged packaging (corrugated boxes, shrink-wrapped pallets) capable of withstanding normal transit conditions (vibration, compression, minor impacts).

- Securely unitize loads on pallets to prevent shifting.

- Protect from moisture during transit (use waterproof covers for open trucks; ensure container integrity for intermodal).

- Regulatory Classifications (Typical – Verify with SDS):

- UN Number: HIPS is generally not classified as a Dangerous Good for transport under major regulations (IMDG Code, IATA DGR, ADR, 49 CFR) in its solid form (pellets, sheets, finished goods). Always verify the specific classification using the current Safety Data Sheet (SDS) for the exact product.

- Hazard Class: Typically Non-Hazardous for transport as a solid plastic.

- Exceptions: Dust generation during handling large quantities of pellets might pose a combustible dust hazard under specific conditions (concentration, ignition source, confinement). Dust control measures are recommended. Molten HIPS is a different hazard.

- Documentation:

- Bill of Lading (BOL): Clearly describe the material as “High Impact Styrene (HIPS) Pellets” or “HIPS Sheets” as applicable. Include quantity, weight, packaging type, and any specific handling instructions.

- Safety Data Sheet (SDS): Provide the current, manufacturer-specific SDS to the carrier and recipient upon request. This is crucial for emergency response.

- Carrier Requirements: Communicate any specific handling instructions (e.g., avoid extreme heat, protect from moisture) to the carrier. Ensure the carrier is aware of the material type.

H2: Regulatory Compliance & Safety

- Safety Data Sheet (SDS):

- Mandatory: Possess and readily accessible the current SDS for the specific HIPS grade being handled (provided by the supplier).

- Key Sections: Pay close attention to:

- Section 2 (Hazard Identification): Confirms classification (typically non-hazardous solid, combustible dust potential).

- Section 7 (Handling and Storage): Specific safe practices.

- Section 8 (Exposure Controls/Personal Protection): PPE requirements (see below).

- Section 9 (Physical and Chemical Properties): Melting point, flash point (if applicable), dust explosion parameters.

- Section 10 (Stability and Reactivity): Incompatibilities.

- Section 13 (Disposal Considerations): Waste disposal guidelines.

- Personal Protective Equipment (PPE):

- Respiratory Protection: Generally not required for handling solid HIPS under normal conditions. Essential when handling large quantities of pellets where significant dust generation is possible (e.g., pouring, grinding). Use NIOSH-approved dust masks (N95 or higher) or respiratory protection as determined by a risk assessment.

- Eye Protection: Safety glasses with side shields are recommended to protect against dust or flying particles during cutting, grinding, or handling.

- Skin Protection: Wear gloves (e.g., nitrile) when handling to prevent skin irritation from dust or potential additives. Wear protective clothing to prevent contamination of personal clothing.

- Hearing Protection: May be required in high-noise processing environments (e.g., granulators).

- Workplace Safety:

- Dust Control: Implement engineering controls (local exhaust ventilation, dust collection systems) when generating dust (processing, handling bulk pellets). Minimize dust accumulation on surfaces.

- Fire Prevention: Eliminate ignition sources near storage and handling areas. Have appropriate fire extinguishers readily available. Train personnel on fire response.

- Ventilation: Ensure adequate general ventilation in storage and processing areas.

- Training: Train employees on the hazards of HIPS (primarily dust and fire), safe handling procedures, PPE use, emergency procedures, and SDS information.

- Environmental Compliance:

- Waste Disposal: Dispose of HIPS waste (scrap, off-cuts, contaminated material) according to local, state/provincial, and national regulations. Options include recycling (preferred), incineration in permitted facilities with energy recovery, or landfill disposal (least preferred, check local restrictions). Never dispose of in regular trash if recyclable. Consult the SDS (Section 13) and local waste authorities.

- Spill Response: Small spills of pellets can usually be swept up. For significant dust spills, use vacuum equipment designed for combustible dust (never dry sweep). Prevent dust clouds. Contain and dispose of as solid waste. Refer to SDS Section 6.

- Labeling:

- Ensure shipping containers and intermediate storage containers are clearly labeled with the contents (“HIPS Pellets,” “HIPS Sheet – Grade XYZ”).

- Follow any GHS labeling requirements if the specific HIPS formulation has hazardous components (e.g., certain additives). Most virgin HIPS pellets are not GHS-labeled.

Critical Reminders:

- Always Consult the SDS: The specific Safety Data Sheet provided by your HIPS supplier is the definitive source for hazard information, handling, storage, PPE, and disposal for that particular product. Regulations and formulations vary.

- Verify Transport Classification: Never assume. Confirm the UN number and hazard class for your specific shipment with the supplier and/or a dangerous goods safety advisor, especially for large volumes or unusual forms.

- Local Regulations Prevail: This guide covers common principles. Always comply with all applicable local, state/provincial, national, and international regulations (e.g., OSHA, EPA, REACH, RoHS).

- Combustible Dust: While HIPS dust is generally considered less sensitive than some other polymer dusts, treat it seriously. Implement dust control and housekeeping to prevent accumulations.

In conclusion, sourcing high-impact styrene plastic requires a strategic approach that balances material performance, cost-effectiveness, supplier reliability, and sustainability considerations. High-impact polystyrene (HIPS) offers excellent versatility, ease of processing, and impact resistance, making it ideal for applications in packaging, consumer goods, electronics, and medical devices. When selecting a supplier, key factors such as material quality, compliance with industry standards (e.g., FDA, RoHS), consistent supply chain, and technical support should be prioritized.

Additionally, evaluating regional sourcing options, negotiating favorable terms, and fostering long-term partnerships can enhance supply stability and reduce costs. As environmental concerns grow, incorporating recycled HIPS or exploring more sustainable alternatives without compromising performance is increasingly important for responsible sourcing.

Ultimately, a well-informed sourcing strategy for high-impact styrene plastic not only ensures product quality and operational efficiency but also supports sustainability goals and strengthens competitive advantage in the marketplace.