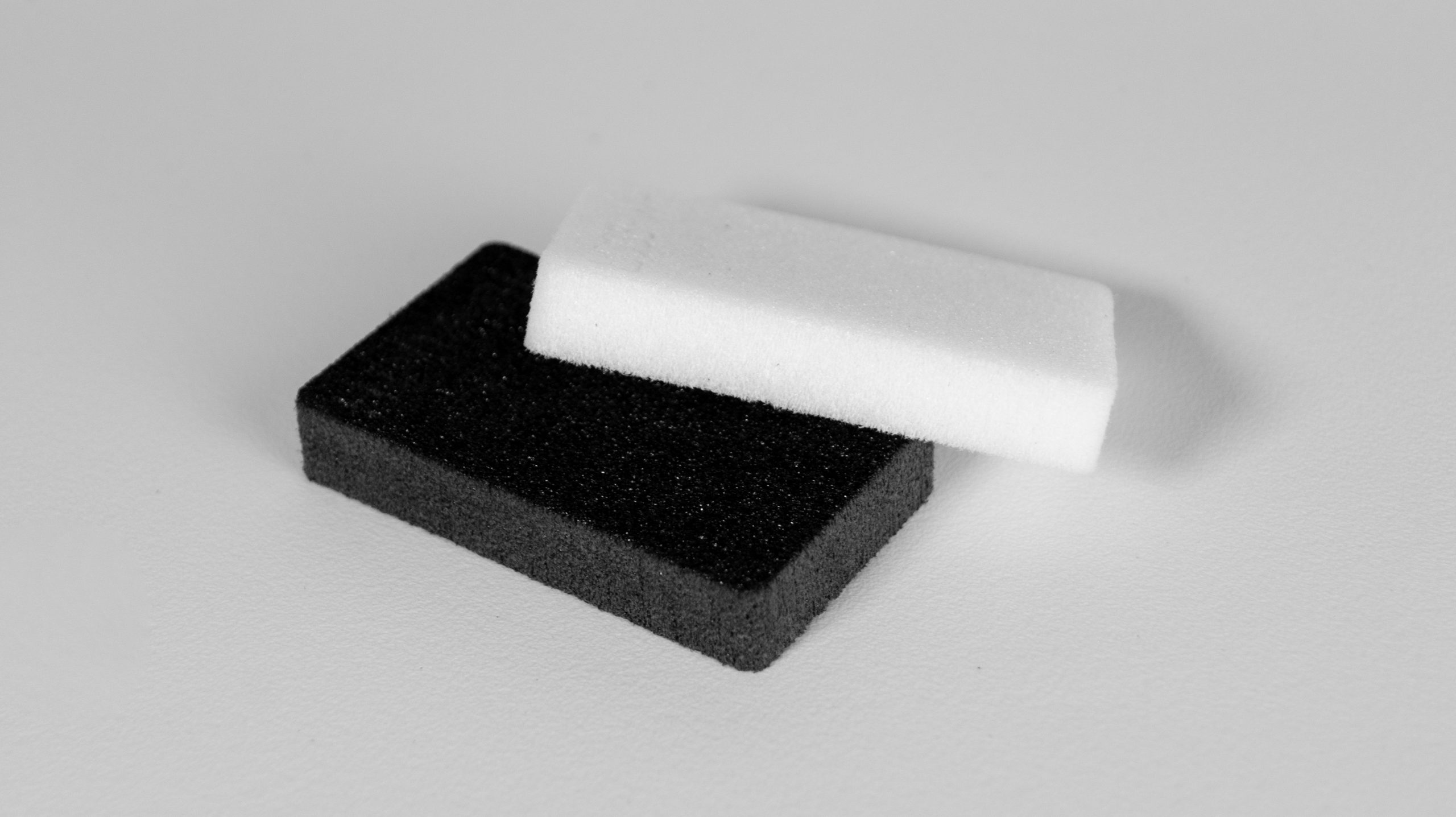

The global polyurethane (PU) foam market is experiencing robust expansion, driven by rising demand across furniture, automotive, construction, and packaging industries. According to a 2023 report by Grand View Research, the global PU foam market size was valued at USD 66.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. High density PU foam, in particular, is gaining traction due to its superior load-bearing capacity, durability, and thermal insulation properties, making it a preferred choice for performance-critical applications. This surge in demand has catalyzed innovation and competition among manufacturers, with a concentration of key players in Asia-Pacific, North America, and Europe scaling production and enhancing formulation technologies. As industries prioritize lightweight, energy-efficient, and long-lasting materials, the market for high density PU foam continues to evolve—setting the stage for the top manufacturers shaping the sector’s future.

Top 10 High Density Pu Foam Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Foam Factory, Inc.

Domain Est. 2000

Website: foambymail.com

Key Highlights: We proudly offer traditional foam products like cushions, insulation, and packaging materials, as well as memory foam and latex mattresses, toppers, and even ……

#2 General Plastics

Domain Est. 1996

Website: generalplastics.com

Key Highlights: General Plastics is certified and equipped to offer polyurethane foam solutions, providing part design support and design production from start to finish….

#3 Flexible Foams

Domain Est. 1999

Website: americanexcelsior.com

Key Highlights: Viscool Foams’ air flow testing indicates an improvement of 35-90 times more air flow than other leading manufacturers of high density viscoelastic foams….

#4 Grand Rapids Foam Technologies

Domain Est. 2004

Website: grft.com

Key Highlights: GRFT is a family-owned polyurethane foam manufacturer that provides personalized services to each and every one of our valued customers….

#5 Polyurethane Foam

Domain Est. 1993

Website: carpenter.com

Key Highlights: Carpenter produces our own polyol, and offers polyurethane foam in blocks, rolls, and custom specifications….

#6 Henry ResinTech HD High Density Rigid Foams

Domain Est. 1994

Website: henry.com

Key Highlights: Henry ResinTech’s High Density Foam, or ResinTech HD, ranges from 6 PCF to 15 PCF. The smooth reactivity characteristics and superb demold times, distinguishes ……

#7 Construction Foams

Domain Est. 1995

Website: sika.com

Key Highlights: Sika provides a complete range of high-quality construction foams in the Sika Boom® range, with products and systems for all different application fields….

#8 Zotefoams

Domain Est. 1996

Website: zotefoams.com

Key Highlights: Zotefoams offers lightweight, high-performance AZOTE and ZOTEK foam solutions for aerospace, automotive, and construction industries….

#9 Huntsman Polyurethanes

Domain Est. 1997

Website: huntsman.com

Key Highlights: Huntsman Polyurethanes is a global leader in MDI-based polyurethanes, serving over 3,000 customers in more than 90 countries….

#10 PU Foam

Domain Est. 2023

Website: faujifoam.com

Key Highlights: With over 10.0 years of experience in the industry, we have perfected the art of producing high-quality PU Foam that is peerless in its performance….

Expert Sourcing Insights for High Density Pu Foam

H2: 2026 Market Trends for High-Density Polyurethane (PU) Foam

As we approach 2026, the global market for high-density polyurethane (PU) foam is poised for significant transformation, driven by evolving industrial demands, regulatory shifts, and advancements in material science. High-density PU foam, known for its superior mechanical strength, thermal insulation, and durability, is increasingly being adopted across key sectors such as construction, automotive, furniture, and renewable energy. Below is an analysis of the primary market trends shaping the high-density PU foam industry in 2026:

-

Growth in Construction and Insulation Applications

The construction sector remains the largest consumer of high-density PU foam, particularly for insulation in residential and commercial buildings. With global emphasis on energy efficiency and net-zero carbon buildings, demand for high-performance insulation materials is rising. In 2026, stringent building energy codes—especially in North America, Europe, and parts of Asia-Pacific—are expected to accelerate adoption. High-density PU foam’s excellent R-value per inch and air-sealing properties make it a preferred choice for green building certifications like LEED and BREEAM. -

Automotive Industry Shift Toward Lightweighting

The automotive sector is increasingly utilizing high-density PU foam for structural components, interior padding, and noise, vibration, and harshness (NVH) reduction. As automakers strive to meet fuel efficiency and electric vehicle (EV) range targets, lightweight yet strong materials are critical. High-density PU foams offer a favorable strength-to-weight ratio and can be engineered for crash absorption. By 2026, integration of PU foam in EV battery enclosures and seating systems is expected to grow significantly. -

Sustainability and Bio-Based PU Foam Development

Environmental regulations and consumer pressure are pushing manufacturers to develop more sustainable alternatives. In 2026, the market will see increased R&D and commercialization of bio-based and recycled-content high-density PU foams. Companies are investing in formulations using renewable raw materials (e.g., castor oil, soy polyols) and closed-loop recycling technologies. Regulatory frameworks such as the EU Green Deal and U.S. EPA guidelines are incentivizing low-VOC (volatile organic compound) and non-toxic foams. -

Expansion in Asia-Pacific and Emerging Markets

Asia-Pacific is projected to be the fastest-growing regional market for high-density PU foam, led by China, India, and Southeast Asia. Rapid urbanization, infrastructure development, and rising disposable incomes are fueling demand in construction and consumer goods. Local production capacity is expanding, reducing dependency on imports and enabling cost-competitive solutions tailored to regional needs. -

Technological Innovation and Customization

Advances in foam formulation and processing technologies—such as nano-reinforcement, 3D printing of PU foam structures, and smart foams with responsive properties—are enabling highly customized solutions. By 2026, manufacturers are expected to offer application-specific high-density PU foams with enhanced fire resistance, improved thermal stability, and better adhesion properties. -

Supply Chain Resilience and Raw Material Volatility

The market continues to face challenges from fluctuating prices of key raw materials like diisocyanates and polyols, influenced by crude oil markets and geopolitical factors. In response, leading producers are diversifying supply chains, investing in vertical integration, and forming strategic partnerships to ensure stability. Adoption of digital supply chain tools for inventory and demand forecasting is becoming standard practice. -

Increased M&A and Consolidation

The competitive landscape is witnessing consolidation, with major chemical companies acquiring niche PU foam innovators to expand product portfolios and geographic reach. This trend is expected to continue into 2026, enhancing economies of scale and accelerating innovation cycles.

In conclusion, the 2026 market for high-density PU foam will be defined by sustainability, performance optimization, and regional diversification. Stakeholders who invest in eco-friendly formulations, advanced manufacturing, and strategic market positioning will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing High-Density Polyurethane (PU) Foam: Quality and Intellectual Property Risks

Sourcing high-density polyurethane (PU) foam requires careful attention to both material performance and legal considerations. Overlooking key pitfalls can result in product failure, supply chain disruption, or legal exposure. Below are critical challenges related to quality and intellectual property (IP) when procuring this specialized material.

Quality-Related Pitfalls

-

Inconsistent Physical Properties

High-density PU foam performance hinges on precise control of density, compressive strength, tensile strength, and cell structure. Suppliers may offer foams that meet nominal specifications on paper but vary significantly between batches due to poor process control. This inconsistency can compromise structural integrity in applications like automotive seating, aerospace components, or industrial insulation. -

Poor Resilience and Compression Set

A common quality issue is inadequate long-term resilience. Low-quality foams may initially meet load-bearing requirements but degrade rapidly under repeated stress, leading to permanent deformation (high compression set). This results in reduced product lifespan and customer dissatisfaction. -

Substandard Raw Materials

Some suppliers cut costs by using inferior polyols, isocyanates, or additives. These lower-grade inputs can impair foam stability, flame retardancy, and resistance to environmental factors (e.g., UV exposure, temperature fluctuations, humidity), especially in outdoor or demanding industrial environments. -

Inadequate Testing and Certification

Reputable suppliers provide test reports (e.g., ASTM D3574, ISO 17249) verifying foam performance. Sourcing without access to certified test data increases the risk of receiving non-compliant material. Lack of traceability and batch-specific documentation further complicates quality assurance. -

Inaccurate or Misleading Specifications

Some suppliers may exaggerate foam density or performance metrics. For example, claiming “high-density” without specifying exact values or testing methods can mislead buyers. Always validate claims through third-party testing or material data sheets with detailed test conditions.

Intellectual Property (IP) Pitfalls

-

Use of Proprietary Formulations Without Licensing

High-performance PU foams often rely on patented formulations or catalyst systems. Sourcing from manufacturers who replicate branded foams (e.g., imitations of Bayer’s Bayflex® or BASF’s Infinergy®) without proper licensing exposes the buyer to IP infringement claims, even if unintentional. -

Lack of IP Indemnification in Contracts

Many supply agreements fail to include clauses that protect the buyer from third-party IP disputes. Without indemnification, your company may be liable for legal costs or damages if the foam infringes on existing patents or trade secrets. -

Reverse-Engineered or Clone Materials

Some suppliers offer “equivalent” high-density foams at lower prices by reverse-engineering premium products. These clones may infringe on formulation or process patents, placing the end-user at legal risk, particularly in regulated industries like transportation or medical devices. -

Unclear Ownership of Custom Formulations

When developing a custom high-density foam formulation collaboratively, unclear IP agreements can lead to disputes over ownership. Suppliers may claim rights to the formulation, restricting your ability to source from alternative vendors or use the material in future products. -

Insufficient Due Diligence on Supplier IP Practices

Failing to audit a supplier’s IP compliance—such as reviewing their patent licenses, R&D documentation, or history of litigation—can result in unknowingly sourcing infringing materials. This may lead to supply chain interruptions, product recalls, or reputational damage.

Best Practices to Avoid Pitfalls:

– Require detailed technical data sheets and batch-specific test reports.

– Conduct on-site audits of supplier facilities to assess quality control processes.

– Include IP warranties and indemnification clauses in procurement contracts.

– Work with legally vetted suppliers who hold valid licenses for proprietary technologies.

– Consult legal counsel when sourcing custom or high-performance foam formulations.

By proactively addressing these quality and IP risks, organizations can ensure reliable performance and legal compliance in their high-density PU foam supply chain.

H2: Logistics & Compliance Guide for High-Density Polyurethane (PU) Foam

High-density polyurethane (PU) foam is widely used in industrial, automotive, construction, and packaging applications due to its durability, insulation properties, and shock absorption. Proper logistics handling and regulatory compliance are critical to ensure safety, environmental protection, and adherence to international and local standards. This guide outlines key considerations for the transportation, storage, labeling, and regulatory compliance of high-density PU foam.

H2.1: Transportation and Packaging

- Packaging Requirements:

- High-density PU foam should be wrapped in moisture-resistant materials (e.g., polyethylene film) to prevent water absorption and degradation.

- Use robust pallets and secure strapping to prevent shifting during transit.

-

For bulk shipments, foam blocks or sheets should be stacked uniformly and protected from sharp objects that may cause tearing.

-

Modes of Transport:

- Road: Ensure vehicles are dry and covered; protect from extreme temperatures.

- Sea: Use sealed containers to avoid exposure to humidity and salt air. Desiccants are recommended.

-

Air: Comply with IATA regulations; PU foam is generally non-restricted, but check for treated or fire-retardant variants.

-

Temperature Considerations:

- Avoid prolonged exposure to temperatures above 80°C (176°F) to prevent deformation or off-gassing.

- Do not store or transport below freezing if moisture is present; this may lead to structural damage upon thawing.

H2.2: Storage Conditions

- Environment:

- Store in a dry, well-ventilated area away from direct sunlight and heat sources.

- Ideal storage temperature: 10–30°C (50–86°F).

-

Relative humidity: below 70% to minimize moisture uptake.

-

Shelf Life:

- High-density PU foam typically has a shelf life of 3–5 years when stored properly.

-

Monitor for discoloration, brittleness, or loss of resilience as signs of degradation.

-

Segregation:

- Keep away from oxidizing agents, solvents, and strong acids/bases.

- Do not store near flammable materials unless fire-rated barriers are in place.

H2.3: Safety and Handling

- Personal Protective Equipment (PPE):

- Wear gloves and safety glasses when cutting or machining foam to avoid skin irritation or eye contact with dust.

-

Use respiratory protection (e.g., N95 mask) if sanding or processing generates fine particles.

-

Dust Control:

- Use local exhaust ventilation when cutting, grinding, or routing PU foam.

-

Collect and dispose of PU dust in accordance with local waste regulations—do not incinerate without proper emissions controls.

-

Fire Safety:

- PU foam is combustible. Store away from ignition sources.

- Use fire-retardant (FR) treated foam where required by building or transportation codes.

- Keep appropriate fire extinguishers (Class A, B, or C, depending on formulation) on site.

H2.4: Regulatory Compliance

- Global Regulations:

- REACH (EU): Ensure no restricted substances (e.g., certain amines or catalysts) are present above threshold levels.

- RoHS (EU): Applicable if foam is part of an electrical/electronic device—verify absence of lead, cadmium, etc.

-

TSCA (USA): Confirm compliance with EPA’s Toxic Substances Control Act for chemical substances used in production.

-

Transportation Regulations:

- IATA/ICAO: Non-hazardous for air transport under normal conditions; verify if flame-retardant additives change classification.

- IMDG Code: Generally not classified as dangerous goods, but document any treated variants.

-

ADR (Europe): PU foam is not typically regulated as hazardous in solid form.

-

SDS (Safety Data Sheet):

- Maintain an up-to-date SDS compliant with GHS (Globally Harmonized System).

- Include information on composition, fire hazards, first aid, and disposal.

H2.5: Environmental and Disposal Considerations

- Recycling:

- PU foam can be mechanically recycled into rebonded foam or used as filler.

-

Chemical recycling (glycolysis) is emerging but not yet widespread.

-

Waste Disposal:

- Dispose of waste foam in accordance with local municipal and environmental regulations.

- Landfilling may be permitted but is discouraged due to non-biodegradability.

-

Incineration should be conducted in permitted facilities equipped with emissions controls to prevent release of isocyanates or nitrogen oxides.

-

Sustainability:

- Consider bio-based PU foams or products with recycled content to improve environmental profile.

- Report carbon footprint if required under corporate sustainability programs (e.g., EPD, LCA).

H2.6: Labeling and Documentation

- Product Labeling:

- Include product name, density, dimensions, batch number, and manufacturer details.

- Add safety warnings if flame-retardant chemicals are present (e.g., “May emit hazardous fumes when burned”).

-

Indicate compliance with relevant standards (e.g., UL 94, ASTM D3574).

-

Required Documentation:

- Commercial invoice and packing list for international shipments.

- Certificate of Conformance (CoC) upon request.

- SDS provided to all downstream users.

By following this logistics and compliance guide, businesses can ensure safe, efficient, and legally compliant handling of high-density PU foam throughout the supply chain. Regular audits and staff training are recommended to maintain adherence to evolving regulations.

Conclusion for Sourcing High-Density PU Foam

Sourcing high-density polyurethane (PU) foam requires a strategic approach that balances quality, cost, performance requirements, and sustainability. High-density PU foam is widely valued for its durability, load-bearing capacity, insulation properties, and versatility across industries such as furniture, automotive, bedding, and construction. When sourcing this material, it is essential to partner with reliable suppliers who adhere to consistent manufacturing standards and can provide certification for fire resistance, environmental compliance (e.g., VOC emissions, REACH, or CAL 117), and material consistency.

Evaluating foam specifications—such as density (typically 2.5 lb/ft³ and above), load-bearing strength (ILD or IFD), compression set, and resilience—is critical to ensuring the foam meets the intended application’s functional demands. Additionally, considering eco-friendly options, such as bio-based or recyclable PU foams, can support sustainability goals and enhance brand reputation.

In conclusion, successful sourcing of high-density PU foam involves thorough supplier vetting, clear communication of technical requirements, and ongoing quality control. By prioritizing performance, reliability, and environmental responsibility, businesses can secure a high-quality material that enhances product durability and customer satisfaction while maintaining competitive advantage in the market.