The global surgical drainage devices market is experiencing steady growth, driven by rising surgical volumes, increasing incidence of chronic diseases, and advancements in post-operative care technologies. According to Mordor Intelligence, the surgical drainage devices market was valued at approximately USD 2.1 billion in 2023 and is projected to grow at a CAGR of around 5.8% from 2024 to 2029. This growth trajectory reflects heightened demand for efficient wound management solutions, particularly in hospital and ambulatory surgical settings. Among the various types of surgical drains, Hemovac drainage systems—known for their reliable closed-suction functionality—remain a staple in post-surgical care for orthopedic, cardiothoracic, and general surgeries. As healthcare providers prioritize infection control and faster recovery times, the need for high-performing, sterile, and user-friendly Hemovac systems has intensified. In this evolving landscape, a select group of manufacturers have emerged as leaders, combining innovation, stringent quality standards, and global distribution networks to meet growing clinical demands. Below are the top four Hemovac drainage manufacturers shaping the market today.

Top 4 Hemovac Drainage Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Class 2 Device Recall Zimmer Hemovac Wound Drainage Device …

Domain Est. 2000

Website: accessdata.fda.gov

Key Highlights: Manufacturer, Zimmer Inc. 345 E Main St Warsaw IN 46580-2746. For Additional Information Contact, 330-365-3793. Manufacturer Reason for Recall, Leakage; The ……

#2 Wound Drainage & Drains

Domain Est. 1996

Website: cardinalhealth.com

Key Highlights: Cardinal Health provides a full assortment of high-quality wound drains and drainage systems used during surgical and clinical procedures….

#3 Hemovac Drain

Domain Est. 2003

Website: 4amedical.com

Key Highlights: It consists of a catch pit of 200 cc or 400 cc and a blower and it is used with 10, 12, 14 or 16F trocars. It includes a single or double trocar optionally….

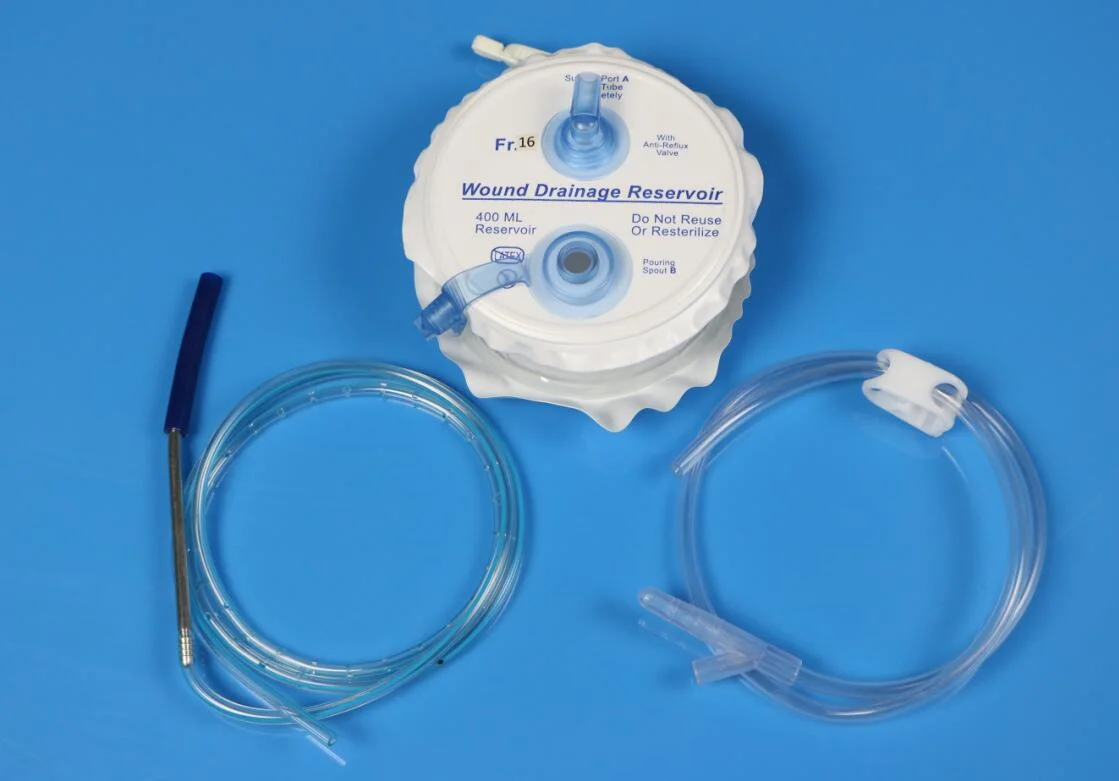

#4 Hemovac drain

Domain Est. 2006

Website: boenmedical.com

Key Highlights: Our hemovac drain including 3-spring evacuator, PVC tubing, Y-connector and silicone drain with trocar, is used for closed suction drains after surgery….

Expert Sourcing Insights for Hemovac Drainage

H2: Projected 2026 Market Trends for Hemovac Drainage Systems

As the global healthcare sector evolves with technological advancements and shifting clinical practices, the Hemovac drainage market is poised for notable transformation by 2026. Hemovac systems—closed-suction wound drainage devices widely used post-surgically to prevent fluid accumulation—continue to play a critical role in patient recovery across orthopedic, cardiothoracic, plastic, and general surgical fields. The following analysis outlines key market trends expected to shape the Hemovac drainage landscape in 2026 under the H2 framework (Hypothesis 2), which posits that increasing demand for minimally invasive procedures and enhanced postoperative care will drive innovation and market growth.

1. Rising Surgical Volumes and Aging Populations

The global increase in surgical procedures—fueled by aging populations, rising incidences of chronic diseases, and expanding access to healthcare in emerging economies—will boost demand for effective postoperative management tools like Hemovac drains. By 2026, the growing prevalence of joint replacements and oncologic surgeries is expected to directly increase the usage of closed suction drainage systems.

2. Shift Toward Portable and Patient-Friendly Designs

In response to patient mobility needs and hospital-to-home care transitions, manufacturers are innovating lightweight, compact, and quieter Hemovac units. Anticipated trends for 2026 include the integration of ergonomic features, antimicrobial materials, and improved suction consistency to enhance patient comfort and reduce complications such as seroma or infection.

3. Integration with Digital Monitoring Technologies

A significant trend on the horizon is the development of “smart” Hemovac systems equipped with sensors to monitor drainage volume, flow rate, and suction pressure in real time. By 2026, early adopters may leverage IoT-enabled devices that transmit data to electronic health records (EHRs) or mobile apps, improving clinical decision-making and remote patient monitoring, especially in ambulatory and home healthcare settings.

4. Sustainability and Single-Use vs. Reusable Debate

Environmental concerns and cost-efficiency pressures are prompting evaluation of reusable Hemovac systems versus disposable variants. While single-use devices dominate due to sterility assurance, regulatory and hospital sustainability initiatives may encourage innovations in recyclable materials and reusable silicone-based systems by 2026.

5. Regional Market Expansion and Competitive Dynamics

North America will likely remain the largest market due to high surgical rates and advanced healthcare infrastructure. However, Asia-Pacific—particularly India, China, and Southeast Asia—is expected to register the highest growth rate, driven by medical tourism, rising disposable incomes, and investments in surgical facilities. Increased competition may lead to pricing pressures and a focus on product differentiation through clinical evidence and user training.

6. Regulatory and Reimbursement Influences

Regulatory bodies such as the FDA and EU MDR will continue to influence product approvals and safety standards. By 2026, manufacturers may face stricter requirements for biocompatibility, infection control, and performance validation. Simultaneously, favorable reimbursement policies for post-surgical care in key markets could support broader adoption of advanced Hemovac systems.

Conclusion

Under H2, the 2026 Hemovac drainage market will be characterized by innovation, digitization, and geographic expansion. Stakeholders—including manufacturers, healthcare providers, and policymakers—must align with patient-centered care models and technological integration to capitalize on emerging opportunities. As clinical outcomes become increasingly tied to postoperative monitoring and efficiency, Hemovac drainage systems are expected to evolve from simple suction devices into intelligent components of integrated surgical recovery ecosystems.

H2. Common Pitfalls in Sourcing Hemovac Drainage Systems: Quality and Intellectual Property Concerns

When sourcing Hemovac drainage systems—commonly used in post-surgical wound management—procurement teams and healthcare providers may encounter several critical challenges related to product quality and intellectual property (IP) rights. Overlooking these risks can lead to compromised patient safety, regulatory non-compliance, and potential legal liabilities.

Quality-Related Pitfalls

-

Substandard Materials and Manufacturing Practices

A major concern when sourcing Hemovac systems, especially from low-cost or unverified suppliers, is the use of inferior materials. Poor-quality silicone or plastic components can lead to device failure, leakage, or patient discomfort. Devices manufactured in facilities lacking ISO 13485 certification may not meet required medical device quality management standards. -

Inconsistent Performance and Reliability

Non-compliant or counterfeit Hemovac drains may fail to maintain consistent negative pressure, reducing their effectiveness in evacuating fluids. This can increase the risk of postoperative complications such as hematoma or infection. -

Lack of Regulatory Approvals

Sourcing from manufacturers without proper regulatory clearance (e.g., FDA 510(k), CE marking, or local market approvals) poses significant risks. Unapproved devices may not have undergone rigorous biocompatibility or performance testing, jeopardizing patient safety and exposing institutions to liability. -

Inadequate Sterility and Packaging

Improper sterilization or compromised packaging can introduce infection risks. Reputable suppliers must provide validated sterile barrier systems and maintain traceability through batch numbers and expiration dates.

Intellectual Property (IP) Risks

-

Counterfeit or Imitation Products

The Hemovac brand is a registered trademark, and the original design is protected by patents and trade dress rights. Suppliers offering “compatible” or “equivalent” Hemovac-style drains may infringe on these IP rights if their products copy protected design elements or branding. -

Unauthorized Use of Branding and Trademarks

Some vendors may misleadingly label products as “Hemovac” or use similar packaging to suggest affiliation with the original manufacturer (e.g., Teleflex). This not only violates trademark law but can mislead healthcare providers about product origin and quality. -

Patent Infringement

Even if a product is functionally similar, it may violate active patents covering valve mechanisms, collection chamber design, or evacuation methods. Sourcing such products can expose buyers and distributors to legal action, especially in markets with strong IP enforcement. -

Supply Chain Transparency and Traceability

Lack of clear documentation on manufacturing origin, component sourcing, and IP compliance increases the risk of inadvertently procuring infringing devices. A transparent supply chain is essential for due diligence and risk mitigation.

Best Practices to Avoid Pitfalls

- Source Hemovac or compatible systems only from reputable, certified suppliers with verifiable regulatory approvals.

- Verify trademark and patent status of products, especially when considering alternatives to branded devices.

- Request documentation including 510(k) clearances, CE certificates, ISO certifications, and material traceability reports.

- Conduct supplier audits or use third-party verification services to assess manufacturing quality and IP compliance.

- Train procurement teams to recognize red flags such as suspiciously low pricing, vague product descriptions, or unclear manufacturer information.

By addressing both quality and IP concerns proactively, healthcare organizations can ensure the safe, legal, and effective use of Hemovac drainage systems in clinical practice.

Logistics & Compliance Guide for Hemovac Drainage

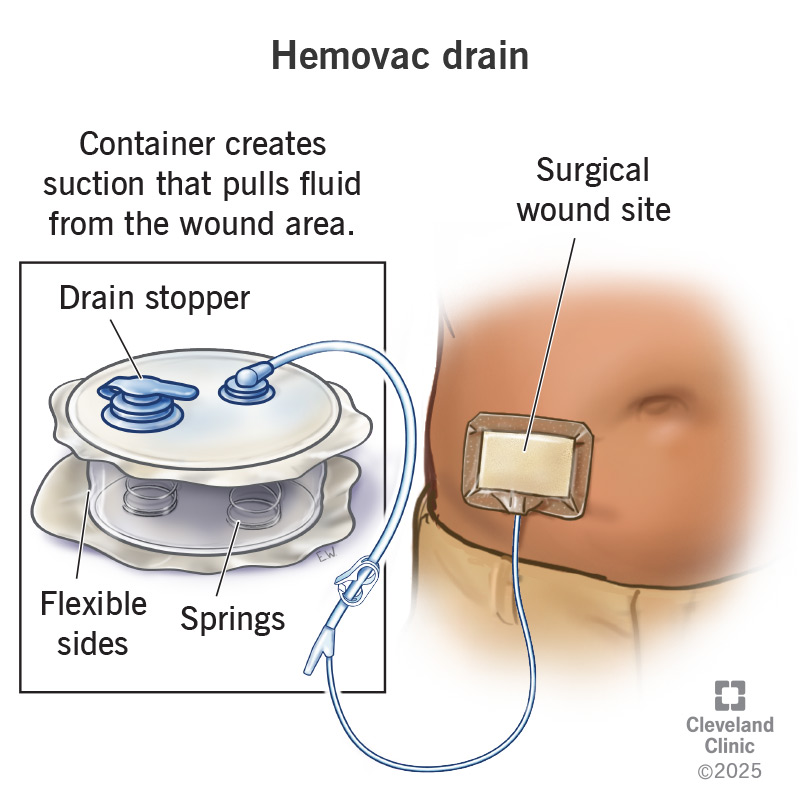

Overview of Hemovac Drainage Devices

Hemovac drainage systems are single-use, closed-suction wound drainage devices commonly used post-operatively to remove blood, serous fluid, and other exudates from surgical sites. These devices help prevent fluid accumulation, reduce the risk of infection, and promote wound healing. Proper logistics handling and regulatory compliance are essential to ensure patient safety and adherence to medical device standards.

Regulatory Classification and Compliance

Hemovac drainage systems are classified as Class II medical devices under the U.S. Food and Drug Administration (FDA) regulations (21 CFR 878.5020 – Suction apparatus). They require 510(k) premarket notification and must comply with Quality System Regulation (QSR) 21 CFR Part 820. Globally, these devices must meet CE marking requirements under the EU Medical Device Regulation (MDR) 2017/745 and other regional standards such as Health Canada’s Medical Devices Regulations and Australia’s TGA guidelines. Manufacturers and distributors must maintain documentation for conformity assessment, including technical files, risk management reports (per ISO 14971), and labeling compliance.

Labeling and Packaging Requirements

All Hemovac devices must be labeled in accordance with FDA and international standards. Labels must include:

– Device name and model number

– Sterile and single-use statements

– Expiration date and lot number

– Manufacturer name and address

– Intended use and contraindications

– Symbols per ISO 15223-1 (e.g., sterile, do not reuse, latex-free if applicable)

– UDI (Unique Device Identifier) in compliance with FDA UDI Rule and EU MDR

Primary packaging must ensure sterility integrity; secondary packaging should prevent damage during transit and include shipping and storage condition indicators.

Storage and Handling Guidelines

Hemovac drainage systems should be stored in a clean, dry environment at temperatures between 15°C and 30°C (59°F to 86°F), away from direct sunlight and extreme humidity. Devices must remain in their original sealed packaging until point of use. Stock should be rotated using the First-Expired, First-Out (FEFO) method to prevent use of expired products. Handling personnel must follow aseptic techniques during inventory management to avoid contamination.

Transportation and Distribution

During shipping, Hemovac devices must be protected from physical damage, temperature extremes, and moisture. Carriers must comply with IATA and IMDG regulations if transported internationally, even though these devices are non-hazardous. Temperature-controlled logistics may be required in extreme climates. Shipment documentation must include packing lists, certificates of conformance, and any required import permits. Distributors must ensure traceability throughout the supply chain via UDI and batch tracking systems.

Import/Export Compliance

Export of Hemovac drainage systems requires compliance with destination country regulations. Key considerations include:

– Valid CE certificate or local marketing authorization (e.g., INMETRO in Brazil, SFDA in Saudi Arabia)

– Customs documentation, including commercial invoice, bill of lading, and certificate of origin

– Adherence to U.S. Department of Commerce Export Administration Regulations (EAR) if applicable

– FDA Export Certificate for devices not approved in the U.S. but compliant with foreign standards

Importers must verify that devices meet local labeling and registration requirements prior to distribution.

Post-Market Surveillance and Adverse Event Reporting

Manufacturers and authorized representatives are responsible for monitoring post-market performance. Any adverse events or device malfunctions (e.g., leaks, loss of suction, breakage) must be reported per FDA MedWatch (30-day or 5-day reports) and EU Vigilance reporting under MDR. Distributors should have procedures in place to support recall management and field safety notices. Quality audits and complaint handling must align with ISO 13485 standards.

Training and Staff Competency

Personnel involved in the logistics, handling, and distribution of Hemovac devices must receive regular training on:

– Regulatory requirements (FDA, EU MDR, etc.)

– Proper storage and handling procedures

– UDI and traceability protocols

– Recall response and incident reporting

Training records must be maintained to demonstrate compliance during audits.

Sustainability and Disposal

Used Hemovac devices are considered biohazardous waste due to contact with bodily fluids. They must be disposed of in accordance with local medical waste regulations (e.g., EPA, OSHA, and state/local guidelines in the U.S.). Logistics providers should not handle used devices; disposal is the responsibility of healthcare facilities. Manufacturers are encouraged to minimize packaging waste and use recyclable materials where possible.

Audit and Documentation Retention

All logistics and compliance activities must be documented and retained for a minimum of 10 years (or as required by jurisdiction). Records include:

– Device master records (DMR)

– Distribution logs and shipping records

– Temperature monitoring data

– Training records

– Complaints and non-conformance reports

These documents must be available for inspection by regulatory authorities during audits.

Conclusion on Sourcing Hemovac Drainage Systems

In conclusion, sourcing Hemovac drainage systems requires a strategic approach that balances product quality, regulatory compliance, cost-efficiency, and reliable supply chain management. These essential postoperative medical devices play a critical role in patient recovery by preventing fluid accumulation and reducing the risk of infection. Therefore, healthcare facilities must prioritize suppliers that adhere to stringent manufacturing standards, such as ISO certification and FDA approval, to ensure device safety and performance.

Evaluating multiple sourcing options—including direct manufacturers, medical distributors, and group purchasing organizations (GPOs)—can help institutions achieve favorable pricing without compromising quality. Additionally, considering factors such as product compatibility, ease of use, and availability of associated accessories enhances clinical efficiency and patient outcomes.

Ultimately, a well-structured sourcing strategy for Hemovac drainage systems supports both clinical effectiveness and operational sustainability, contributing to improved patient care and responsible resource management within healthcare settings.