The global hematology equipment market is experiencing robust growth, driven by rising prevalence of blood disorders, increasing demand for early disease diagnosis, and advancements in automation and digital pathology. According to a report by Mordor Intelligence, the hematology analyzers market was valued at USD 4.65 billion in 2023 and is projected to grow at a CAGR of 6.8% during the forecast period (2024–2029). Similarly, Grand View Research estimates that the global hematology market size reached USD 9.5 billion in 2022 and is expected to expand at a CAGR of 6.3% from 2023 to 2030, fueled by technological innovations and expanding healthcare infrastructure in emerging economies. As demand for accurate, high-throughput blood testing rises—particularly in clinical laboratories, hospitals, and point-of-care settings—leading manufacturers are investing heavily in R&D to enhance diagnostic precision, workflow efficiency, and integration with laboratory information systems. In this evolving landscape, nine key players have emerged as pioneers in Hema equipment innovation, shaping the future of hematological diagnostics worldwide.

Top 9 Hema Equipment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 The HEMA Shop –

Domain Est. 2012

Website: thehemashop.com

Key Highlights: The HEMA Shop is part of The Knight Shop International Ltd, manufacturers and distributors for many of the products shown on this site….

#2 Hema Driveline and Hydraulics Inc.: Hema Usa

Domain Est. 2019

Website: hema-usa.com

Key Highlights: Hema Usa, Explore the reliable gear pump, gear motors, orbital motor from Hema Driveline and Hydraulics Inc. for smooth hydraulic operations….

#3 Historical European Martial Arts (HEMA) Equipment and Gear

Domain Est. 2000

Website: woodenswords.com

Key Highlights: We offer the largest selection of Historical European Martial Arts (HEMA) equipment in the United States. From gloves to fencing masks, SPES to PBT, we can meet ……

#4 HEMA Alliance

Domain Est. 2009

Website: hemaalliance.com

Key Highlights: The HEMA Alliance supports the Historical European Martial Arts community across the world….

#5 HEMA Supplies

Domain Est. 2012

Website: hemasupplies.com

Key Highlights: We provide quality imported equipment for the practice of Historical European Martial Arts so whether you are looking for protective gear, training swords,…

#6 FAITS D’ARMES

Domain Est. 2013

Website: faitsdarmes.com

Key Highlights: Swords, weapons & protective gear for HEMA and historical fencing · Training Swords for HEMA · Fencing Masks 350N and 1600N for HEMA · Protective Gloves for HEMA….

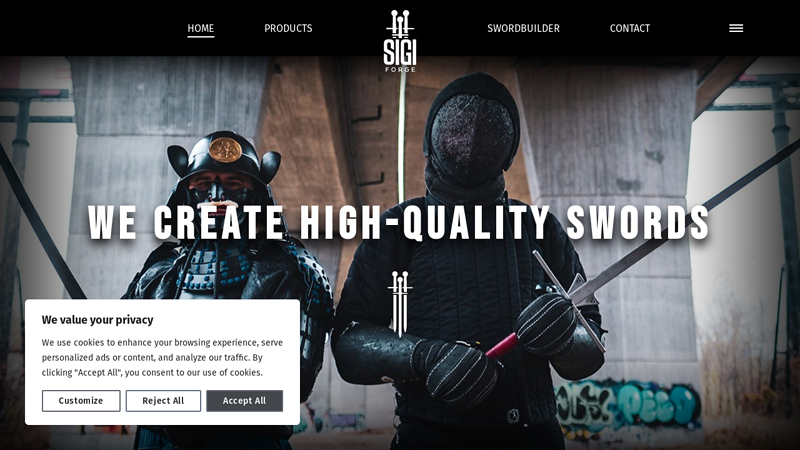

#7

Domain Est. 2020

Website: sigiforge.com

Key Highlights: Welcome to SIGI Forge website! SIGI Forge is a company which creates feders and other gear for the practice of Historical European Martial Arts (HEMA)…

#8 HEMA Resources

Domain Est. 2020

Website: historicaleuropeanmartialarts.com

Key Highlights: Welcome to the best HEMA website to learn and find information resources for starting your journey into historical fencing and medieval swordsmanship….

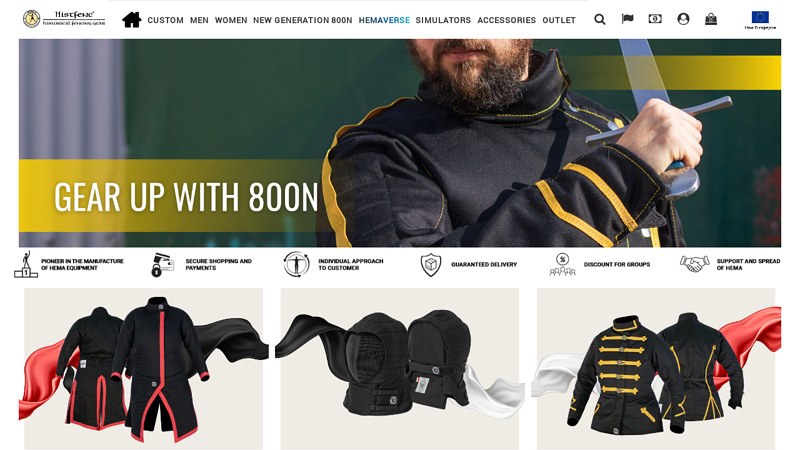

#9 Histfenc

Website: histfenc.eu

Key Highlights: Store information. Histfenc – HEMA Gear Wapienna 46 87-100 Toruń Poland. Call us: 0048 690 012 692. WhatsApp: ……

Expert Sourcing Insights for Hema Equipment

H2 2026 Market Trends Analysis for Hema Equipment

Hema Equipment, a leading provider of high-performance hydraulic and mechanical components used across industrial, construction, agriculture, and energy sectors, is positioned to navigate a dynamic market landscape in the second half of 2026. Driven by global macroeconomic shifts, technological advancements, and evolving regulatory pressures, H2 2026 presents significant opportunities and challenges. Here is a detailed analysis of the key market trends shaping Hema Equipment’s trajectory:

1. Accelerated Demand for Electrification & Energy Transition Solutions (Strong Upside)

* Trend: Global momentum behind decarbonization, particularly in transportation (EVs, rail), renewable energy (wind turbine hydraulics, solar tracking), and industrial machinery (electric forklifts, port equipment), will intensify in H2 2026. Governments are enforcing stricter emissions regulations (e.g., EU’s “Fit for 55,” US IRA implementation), and corporations are accelerating net-zero commitments.

* Impact on Hema: This creates substantial demand for Hema’s specialized electro-hydraulic systems, energy recovery units, and high-efficiency, low-leakage components designed for hybrid and fully electric applications. Hema’s R&D investments in compact, high-power-density solutions will be crucial. Partnerships with EV battery manufacturers, wind turbine OEMs, and green hydrogen producers will be key growth avenues. Opportunity: High. Risk: Moderate (requires continued R&D investment).

2. Supply Chain Resilience & Regionalization (Ongoing Challenge & Opportunity)

* Trend: Geopolitical instability (e.g., continued tensions in key regions) and lessons learned from past disruptions will drive OEMs and end-users to prioritize supply chain redundancy, near-shoring, and inventory optimization. “Just-in-time” models will be supplemented by “just-in-case” strategies.

* Impact on Hema: Hema’s established manufacturing footprint in North America, Europe, and Asia positions it well to serve regional markets. However, competition for critical raw materials (rare earths for motors, specific alloys) and components (advanced electronics) will remain fierce. Hema must leverage its local production capabilities, long-term supplier contracts, and digital supply chain tools (IoT, blockchain for traceability) to ensure reliability and gain a competitive edge. Opportunity: Moderate-High (if execution is strong). Risk: High (logistical complexity, cost inflation).

3. Proliferation of AI, IoT, and Predictive Maintenance (Transformative Shift)

* Trend: Industrial IoT (IIoT) and AI-driven analytics are moving from pilot projects to mainstream adoption in H2 2026. Customers increasingly demand “smart” components that provide real-time performance data, enable predictive maintenance, and integrate seamlessly into digital factory ecosystems.

* Impact on Hema: This is a critical inflection point. Hema must rapidly scale its smart component offerings (e.g., hydraulic pumps and motors with embedded sensors, condition monitoring systems). Success hinges on developing robust, secure data platforms, offering actionable analytics services, and creating a compelling value proposition for ROI (reduced downtime, extended asset life). Failure to innovate here risks commoditization of core products. Opportunity: Very High (new revenue streams, service models). Risk: Very High (technological leap, cybersecurity, integration complexity).

4. Sustained Focus on Efficiency, Sustainability, and Circular Economy (Regulatory & Customer Driver)

* Trend: Beyond electrification, regulations (e.g., EU Ecodesign, stricter fluid leak standards) and customer ESG (Environmental, Social, Governance) reporting requirements will push demand for ultra-high efficiency components, reduced lifecycle environmental impact, and circular solutions (recycling, remanufacturing).

* Impact on Hema: Hema’s core competency in high-efficiency hydraulics becomes even more valuable. There’s a growing market for Hema Remanufactured (HemaReman) programs offering certified, like-new performance with significant cost and environmental savings. Investment in sustainable materials (bio-based seals, recycled content), lifecycle assessment (LCA) tools, and end-of-life take-back schemes will be essential for maintaining brand reputation and meeting tender requirements. Opportunity: High (premium pricing, customer loyalty). Risk: Low-Moderate (cost of new initiatives).

5. Infrastructure Investment & Construction Cycles (Cautiously Optimistic)

* Trend: Major government infrastructure programs (e.g., US IIJA, EU Recovery and Resilience Facility) will continue to fund projects, but momentum might plateau slightly in H2 2026 compared to earlier years. Construction activity will remain solid, particularly in renewable energy infrastructure (transmission, offshore wind ports) and urban development.

* Impact on Hema: Steady demand for robust, durable hydraulic systems in excavators, cranes, pavers, and tunnel boring machines. Hema’s reputation for reliability in harsh environments is key. Focus should be on new machine builds and fleet upgrades incorporating the efficiency and smart features mentioned above. Opportunity: Moderate-Stable. Risk: Moderate (potential project delays, interest rate sensitivity).

Conclusion & Strategic Implications for Hema (H2 2026):

H2 2026 presents a highly dynamic environment where Hema Equipment’s success will depend on its ability to innovate rapidly (especially in electrification and digitalization), strengthen supply chain resilience, and embed sustainability throughout its operations and offerings.

- Priority 1: Accelerate Digital & Electrification: Double down on smart component development and AI/analytics platforms. Expand partnerships in the EV and renewable energy value chains.

- Priority 2: Enhance Supply Chain Agility: Leverage regional manufacturing, invest in digital supply chain visibility, and secure critical material supplies.

- Priority 3: Champion Sustainability: Scale the HemaReman program, achieve verifiable sustainability certifications, and market the environmental and economic benefits of Hema’s efficient technology.

- Priority 4: Strengthen Customer-Centricity: Move beyond selling components to offering performance-based solutions and lifecycle services enabled by data.

Hema’s strong brand and technological foundation provide a solid platform. By proactively addressing these H2 2026 trends, Hema Equipment can capture significant market share and solidify its position as a leader in next-generation industrial motion control. Failure to adapt, particularly in digitalization, could see it lose ground to more agile competitors.

Common Pitfalls Sourcing HEMA Equipment: Quality and Intellectual Property Concerns

Sourcing Historical European Martial Arts (HEMA) equipment involves navigating a specialized market where both quality consistency and intellectual property (IP) issues can pose significant challenges. Being aware of these pitfalls is crucial for clubs, instructors, and individual practitioners aiming to acquire safe, durable, and ethically produced gear.

Quality Inconsistencies and Safety Risks

One of the most prevalent issues when sourcing HEMA gear is the wide variance in quality, particularly with manufacturers outside established Western European or North American markets. Lower-cost suppliers may use substandard materials—such as brittle steel in feder swords, weak stitching in jackets, or inadequate foam in sparring gloves—leading to premature failure during training. Poor heat treatment in steel weapons can result in dangerous snapping or excessive flex, increasing injury risk. Additionally, inconsistent sizing and ergonomic design across brands make it difficult to assemble a fully compatible and protective kit. Buyers may also encounter misleading product descriptions or inflated safety claims, especially when third-party testing data isn’t provided. To mitigate these risks, it’s essential to rely on community-reviewed brands, seek out independent durability tests, and prioritize vendors who adhere to recognized safety standards like those from HEMA Alliance or national federations.

Intellectual Property and Design Infringement

The HEMA equipment market has seen growing concerns over intellectual property (IP) violations, particularly in the replication of patented or trademarked designs. Several reputable manufacturers invest heavily in research and development to create innovative protective gear—such as specialized gorget designs, articulated sparring masks, or unique blade geometries—and hold legal protections for these inventions. However, some suppliers, particularly in regions with lax IP enforcement, produce near-identical copies of these designs without licensing or attribution. This not only undermines the original creators financially but may also result in inferior reproductions that compromise safety. Purchasing counterfeit or cloned gear can inadvertently support unethical manufacturing practices and discourage future innovation in the HEMA community. To avoid IP pitfalls, buyers should verify the authenticity of products, support original designers, and be cautious of suspiciously low prices that may indicate unauthorized replication.

Logistics & Compliance Guide for Hema Equipment

This guide outlines the essential logistics and compliance procedures to ensure the safe, efficient, and legally compliant handling, transportation, storage, and use of Hema Equipment. Adherence to these guidelines is mandatory for all personnel involved in the lifecycle of Hema products.

Equipment Handling & Transportation

All Hema Equipment must be handled and transported in accordance with manufacturer specifications and international logistics standards. Use appropriate lifting equipment and protective packaging to prevent damage during movement. Secure loads properly on vehicles using straps or restraints suitable for the weight and dimensions of the equipment. Avoid exposure to extreme temperatures, moisture, and corrosive environments during transit. Documentation, including packing lists, bills of lading, and certificates of conformity, must accompany each shipment.

Storage Requirements

Store Hema Equipment in a clean, dry, and well-ventilated environment with controlled temperature and humidity levels as specified in the product documentation. Equipment should be kept off the ground on pallets or shelves and protected from dust, direct sunlight, and physical impact. Clearly label storage areas and maintain organized inventory records. Conduct regular inspections to ensure stored equipment remains in optimal condition and has not been compromised.

Regulatory Compliance

Hema Equipment must comply with all applicable regional and international regulations, including but not limited to CE marking (EU), FCC (USA), RoHS, REACH, and ISO standards. Ensure that all equipment is certified and accompanied by valid declarations of conformity. Maintain up-to-date compliance documentation and conduct periodic audits to verify adherence. Any modifications or repairs must be performed in accordance with regulatory guidelines and documented accordingly.

Import & Export Procedures

All international shipments of Hema Equipment must comply with customs regulations in both origin and destination countries. Accurate classification under the Harmonized System (HS) codes, proper valuation, and completion of export declarations are required. Obtain necessary export licenses or permits for controlled goods. Ensure that import documentation, including commercial invoices, packing lists, and certificates of origin, meets local regulatory requirements. Partner with licensed freight forwarders experienced in handling industrial equipment.

Safety & Risk Management

Implement a comprehensive safety program for all logistics and handling operations involving Hema Equipment. Provide personnel with proper training on equipment handling, emergency procedures, and use of personal protective equipment (PPE). Perform risk assessments for high-value or hazardous shipments and implement mitigation strategies. Maintain incident reporting protocols and investigate all accidents or non-conformances promptly to prevent recurrence.

Documentation & Record Keeping

Maintain complete and accurate records for all logistics and compliance activities. Required documentation includes equipment specifications, test reports, compliance certificates, shipping logs, customs filings, maintenance records, and training records. Store all documents securely—digitally and/or physically—for a minimum of seven years or as required by local law. Ensure easy retrieval for audits, inspections, or customer inquiries.

Environmental Responsibility

Hema Equipment logistics operations must align with environmental sustainability goals. Minimize packaging waste through reusable or recyclable materials. Optimize transportation routes to reduce carbon emissions. Properly dispose of or recycle damaged or end-of-life equipment in accordance with WEEE and local environmental regulations. Report environmental performance metrics regularly and seek continuous improvement opportunities.

Conclusion for Sourcing HEMA Equipment

Sourcing HEMA (Historical European Martial Arts) equipment requires a thoughtful and informed approach that balances safety, historical accuracy, durability, and cost. As the practice of HEMA continues to grow globally, the availability and quality of gear have improved significantly, offering practitioners a wide range of options. However, selecting appropriate equipment involves careful consideration of training intensity, weapon discipline, and personal fit.

Key factors in the sourcing process include prioritizing protective gear such as masks, jackets, gloves, and rigid protection that meet recognized safety standards (e.g.,350N or higher puncture resistance). Training weapons should accurately reflect the weight, balance, and dimensions of historical originals while being made from safe, durable materials like nylon or steel, depending on the level of contact.

Purchasing decisions should be guided by reputable manufacturers and vendors known for quality craftsmanship and adherence to community safety norms. While price is a consideration, investing in high-quality, well-tested gear ultimately enhances safety and training effectiveness. Additionally, connecting with the HEMA community—through clubs, forums, or events—can provide valuable insights and recommendations for sourcing reliable equipment.

In conclusion, responsible sourcing of HEMA equipment is essential for safe, authentic, and sustainable practice. By making informed choices, practitioners contribute to a safer training environment, preserve historical integrity, and support the continued growth and professionalism of the HEMA community worldwide.